Entrepreneurial ecosystems create a conductive environment for innovation and advancing sustainable development. They stimulate national innovation and economic development; however, empirical examination, especially in emerging economies, remains limited. Using longitudinal data on 89 countries for 2018–2021, this study empirically tests three pillars of entrepreneurial ecosystems—resource supply, resource demand, and allocation and accumulation—through a gendered lens to explore their effect on national innovation and entrepreneurship. We estimate regional effects with a three-dimensional fixed effects regression model. Our results suggest that knowledge capital of female researchers and domestic economy size are the central drivers of national innovation and entrepreneurship, respectively. Furthermore, this effect is more critical for emerging economies and disappears as countries develop. We present a gendered empirical examination of Audretsch et al.’s (2022) framework and elucidate the contributions of women in driving national innovation through ecosystems in emerging economies.

The roles of entrepreneurship and innovation as central drivers of development and economic growth were established almost a century ago (Schumpeter, 1934, 1942). However, recently, the locus of innovation has shifted from an individualist perspectives to a community one, with a special focus on infrastructure and the external environment (Granstrand & Holgersson, 2020; Spigel et al., 2020). Scholars and policymakers have come to perceive entrepreneurship and innovation to be embedded into larger ecosystems consisting of a variety of “interdependent actors and factors that enable and constrain entrepreneurship within a particular territory” (Stam & Van de Ven, 2021, p. 1). Although entrepreneurial ecosystems are gaining increasing attention, few studies have validated their characteristics and effectiveness in emerging economies through a gendered lens.

The rise in popularity of ecosystems research is driven by policymakers and the focus on the positive outcomes generated by ecosystems in terms of productive entrepreneurship and innovation. However, the concept continues to be “highly undertheorized, and not yet adequately measured” (Stam, 2018, p. 1). So what are entrepreneurial ecosystems and how do their components come together to produce innovation and entrepreneurship? To answer these questions, Audretsch et al. (2022) proposed a framework explaining the development of innovation and entrepreneurship through three pillars: resource supply, resource demand, and allocation and accumulation barriers.

In this study, the entrepreneurial ecosystem is defined according to Audretsch et al. (2022) conceptualization, as “a set of factors required to start a business with the potential to scale up and innovate in a particular geographic space” (n.p.). No existing study has tested these three pillars empirically together and through a gendered lens. This is the objective of our study. Building on Audretsch et al. (2022) novel framework of entrepreneurship and national innovation systems, we tested the characteristics and effectiveness of ecosystems and demonstrate how they are operationalized by women to create national value. In doing so, this study offers an important empirical validation of a new and emerging framework. Furthermore, it sheds light on the important, less-understood role of women in ecosystems (Brush et al., 2022) by placing them at the heart and center of inquiry. While extant research has examined the barriers that women face in entrepreneurship and innovation in relation to ecosystems, this study bridges an important gap between these topics, to focus on the nexus of ecosystems, gender, and innovation, and sheds light on the invisible role that women play within national innovation systems.

Theory and hypotheses developmentEntrepreneurial ecosystemsThe ecosystem metaphor, derived from biology, was introduced by Tansley (1935) as an interactive system of living organisms that emphasizes the interdependencies between organisms and the environment (Cavallo et al. 2019). It was later carried into the management literature by Moore (1993) to capture the idea that business ecosystems arise from a “swirl of capital, customer interest, and talent generated by a new innovation, just as successful species spring from the natural resources of sunlight, water, and soil nutrients” (p. 76). A network of individuals, knowledge, and human capital is perceived as the heart of an entrepreneurial ecosystem, and the external environment that creates regulations and extends access to resources is the social context that enables or constrains action (Stam & Spigel, 2016).

Other management scholars defined ecosystems as “the evolving set of actors, activities, and artifacts, and the institutions and relations […] that are important for the innovative performance of an actor” (Granstrand & Holgersson, 2020, p. 1) or “an interdependent network of self-interested actors jointly creating value” (Bogers et al., 2019). In the social sciences, the term ecosystems broadly denotes “a set of interacting autonomous organizations and individuals united around a focal value proposition” (Baldwin et al., 2024, p. 3). The underlying premise is that the value generated by an entire ecosystem is greater than that generated by the individual parts of the ecosystem alone, leading to a complementary surplus (Baldwin et al., 2024). Members of an ecosystem participate in capturing a portion of the created value.

Entrepreneurial ecosystems have emerged as a special subset representing regional ecosystems and innovation clusters where entrepreneurs, funders, research organizations, accelerators, knowledge, resources, and institutions interact to generate productive entrepreneurship, innovation, and thus, economic growth. Spigel et al. (2020)) define entrepreneurial ecosystems as “the regional collection of actors (such as entrepreneurs, advisors, mentors, and workers) and factors (cultural outlooks, policies, R&D systems, and networks) that all contribute to the creation and survival of high-growth ventures” (p. 484). Entrepreneurial ecosystem research emphasizes the external conditions of a specific region and the interactions of multiple constituents as key to innovation and the emergence and growth of new ventures (Locke, 1996; Stam, 2015; Acs et al., 2017).

Examples include technopoles—centers of high-tech manufacturing that are dedicated to innovation and entrepreneurship (Scott, 1990); science parks—areas in close proximity to research universities that are dedicated to the formation of new technology-based firms and industries (Phan et al., 2005); and industrial clusters—comprising people and firms in natural and historically bound areas with strong networks for subcontracting and shared labor for specialization and efficiency (Krugman, 1991; Markusen, 1996; Porter, 1998; Pyke & Sengenberger, 1992).

Entrepreneurial ecosystems and genderThere is evidence that entrepreneurial ecosystems differentially impact men and women; however, theories explaining how and when variations by gender occur remain underdeveloped (Brush et al., 2019).

Gender is socially constructed through geography, historical and political contexts, cultural norms, and institutional practices and policies in educational institutions, legal systems, and religious organizations (Foss et al., 2019). It intersects with other aspects of identity such as race, ethnicity, and class. Thus, individuals have multiple identities that intersect based on race, religion, ethnicity, socioeconomic status, geographic location, and educational level (Crewnshaw, 1989). These intersecting identities shape the knowledge and intellectual resources that women bring to the innovation process. They may also clash with existing macrostructures and ecosystems, creating multiple barriers to women's full participation in innovation activities. For example, contexts that privilege the roles of women as wives and mothers over other roles may prevent or discourage them from engaging in business ownership and innovation activities (Roomi, 2013).

The “soft” components of an ecosystem, such as education, training, mentors, and access to markets (Foss et al., 2019), can be shaped to address the gaps that exist in conventional institutional structures and ecosystems arising from one or multiple identities. For example, based on studies revealing women's managerial experience (Mukhtar, 2002), programs specifically targeting this issue are particularly valuable for women who have not had the opportunity to hold managerial positions. The “hard” components of an ecosystem, such as access to funding and physical facilities including incubators, laboratories, and equipment (Foss et al., 2019), can also be aligned to address gaps in conventional institutional structures and ecosystems. There is extensive evidence that women face more challenges than men in acquiring startup and growth capital, especially with regard to venture capital (Brush et al., 2014). In addition, the science, technology, engineering, and mathematics (STEM) sectors, as well as high-technology sectors have fewer women (Anna et al., 2000; Brush et al., 2019; Foss & Gibson, 2015). The hard components of ecosystems can be designed with greater consideration and depth to address these challenges and boost the development and growth of female innovators.

There are three lines of research that relate to this study: ecosystems, innovation, and gender. One line of research explores national innovation ecosystems and their outcomes in general but not as they relate to gender (Cirera & Maloney, 2017; Granstrand & Holgersson, 2020). Another line examines gender and entrepreneurial ecosystems in relation to the rate of entrepreneurship (Hechavarría & Ingram, 2019), network connectivity and distribution of social capital (McAdam et al., 2019; Neumeyer et al., 2019), federal procurement policies (Orser et al., 2019), startup activities (Sperber & Linder, 2019), and business failure (Simmons et al., 2019). The third stream examines women's innovation in relation to differences in peer review for innovation financing (Belz et al., 2022), small and medium enterprises in emerging markets (Madison et al., 2022), and the disadvantage of monetizing their inventions (McGrath et al., 2022). While these lines of research explain some of the barriers that women face in entrepreneurship and innovation in relation to ecosystems, this study bridges an important gap between these topics by focusing on the nexus of ecosystems, gender, and innovation.

Resource supply pillarOne of the main underlying forces that enables or constrains entrepreneurship and innovation is resource supply, which includes physical capital and infrastructure, knowledge capital, and human capital. Knowledge spillovers from human capital, knowledge capital, and infrastructure create positive externalities that add value to ecosystems. Human capital, knowledge capital and infrastructure work together to transform ideas into goods and services.

Physical infrastructureInnovation in the 20th century relied heavily on a region's underlying technological infrastructure (Chen & Guo, 2023; Feldman & Florida, 1994). An infrastructure's capacity to organize and deliver knowledge and technical resources is key to the innovation process (Feldman & Florida, 1994). Reliable and widespread communication networks, such as high-speed broadband Internet, allow for the rapid dissemination of information and collaboration among firms, individuals, and researchers. Additionally, they facilitate the development of digital technologies and new businesses (Cheng et al., 2017; Eng, 2004). Access to communication networks and other forms of digital infrastructure lowers the barriers for startups and entrepreneurs (Alderete, 2017; Audretsch et al., 2015). This allows them to reach wider audiences and market their products and services through various channels. Communication networks can facilitate global connectivity, promote the exchange of ideas and knowledge across borders, and contribute to cross-cultural innovation (Uzuegbunam, 2021). The democratization of access sparks innovation in unexpected locations. The movement of information, goods, services, and even people is facilitated by a connected and reliable infrastructure. Reliable information and telecommunication technology systems promote knowledge transfer and innovation diffusion (Eisenhardt & Santos, 2000), allowing individuals to stay abreast with current research, market trends, and technological advances at the click of a button, which can further fuel innovation and entrepreneurial activity (Eng, 2004). Thus, we hypothesize:

H1a Physical telecommunication infrastructure is positively associated with the likelihood of innovation.

H1b Physical telecommunication infrastructure is positively associated with the likelihood of entrepreneurship.

The skills and experience of the workforce in an ecosystem can act as a catalyst for entrepreneurship and innovation. Human capital refers to the stock of skills and other personal characteristics that support individual productivity (OECD, n.d.). Women continue to face barriers to employment (Avolio et al., 2020; Ferragina, 2020; Jayachandran, 2021) in part due to cultural norms (Jayachandran, 2021) and policies that hinder their full participation (Del Rey et al., 2021; Ferragina, 2020). The increase in women joining the labor market and the growth of human capital strongly contribute to GDP growth (Han & Lee, 2020; Sever, 2023). Their contributions reflect the effective utilization of human capital. It has also been correlated with social and economic development as well as global competitiveness (WEF, 2024).

In addition, based on the way women's experiences are shaped differently in society through cultural and historical contexts, socialization, and gender roles, women can bring diverse perspectives and unique insights to the market (Blair-Loy, 2001; García-Sánchez et al., 2023; Syed, 2008b; Syed & Pio, 2010). These unique experiences may help them generate new approaches to problem-solving and identify needs, gaps, or underserved segments in the market. This may also serve as the foundation for new ventures, products, or services.

Even further, women who are actively involved in the workforce can serve as mentors and provide guidance to other women, contributing to the growth and collaboration of professional networks that provide opportunities, knowledge, and idea exchange conducive to innovation and entrepreneurial initiatives (Sealy & Singh, 2010; Byrne et al., 2019). Their participation can drive change, in work practices and policies, advancing a more flexible and inclusive work environment (Kirton, 2020) and innovative work structures that benefit men and women (Hussain et al., 2014). As women gain economic independence by joining the workforce, they obtain greater access to financial resources to start their own ventures and contribute unique perspectives that drive innovation. Thus, we hypothesize:

H1c Human capital (women labor force) is positively associated with the likelihood of innovation.

H1d Human capital (women labor force) is positively associated with the likelihood of entrepreneurship.

Knowledge capital refers to information and knowledge, often in scientific and technical areas, produced for productive purposes (Laperche, 2013). Throughout history, women have been instrumental in advancing education, literacy rates, and intellectual capital in society, despite barriers to early schooling and higher education (Estler, 1975; Aleman & Renn, 2002). Their roles as educators, caregivers, and community builders are monumental in building and preserving knowledge capital (Estler, 1975; Aleman & Renn, 2002; Cooper, 2013). Educated women often become agents of change in their families and communities (Sperling & Winthrop, 2015; Bertini & Ceretti, 2020). In developed and developing regions, women continue to have a transformative impact on the field of education and the process of retaining, passing, and shaping knowledge capital across generations (Cooper, 2013; Cui et al., 2019). One way that women researchers contribute to innovation is through helping others develop. By training the next generation of academics, scientists, engineers, entrepreneurs, and innovators, they can share quality skills and knowledge with the workforce that drives innovation (Chandler, 1996; Varkey et al., 2012; Thomas et al., 2015). According to Bozeman (2011), female researchers are more likely to collaborate. By sharing knowledge through publications, conferences, and collaborations, they disseminate new knowledge and encourage further research and innovation. In their role as researchers, they contribute to the creation of new knowledge through scientific investigation and experimentation, which forms the basis for the development of new technologies, processes, and products. Innovation is embedded in context, race, and gender (Pecis & Berglund, 2021; Vunibola & Scobie, 2022). Many start-ups and groundbreaking innovations stem from the breakthroughs achieved by researchers. Thus, we hypothesize:

H1e Knowledge capital (women researchers) is positively associated with the likelihood of innovation.

H1f Knowledge capital (women researchers) is positively associated with the likelihood of entrepreneurship.

Another underlying force that enables or constrains entrepreneurship and innovation is the allocation and accumulation pillar, which include access to finance, regulations, and social capital. Quality institutions, policies, and intermediary organizations play important roles in addressing market failures to improve the quantity, conditions, and allocation of resources available to entrepreneurs. Through policy interventions, the regulatory environment can influence the incentives and costs of entry, availability of resources, and overall competitive landscape for entrepreneurship and innovation to flourish.

Access to financeAccess to finance is critical for innovation and entrepreneurship. Research suggests that access to finance drives innovation in developing nations (Fombank & Adjasi, 2018). Such resources allow businesses to allocate funds for scientific research, implement new technologies, and develop new products and services. For entrepreneurs, access to finance is key to taking action and implementing ideas in the market. Access to loans, seed funding, and venture capital enables entrepreneurs to develop prototypes, conduct market research, and launch new products or services (O'Sullivan, 2006; Mazzucato, 2013). Innovation often involves risk taking and experimentation (O'Sullivan, 2006; Coad & Rao, 2008; Mazzucato, 2013). Access to financial resources provides a safety net for entrepreneurs to take risks, support continuous iterative development, explore unconventional ideas, and learn from failure (Coad & Rao, 2008). This is especially important for start-ups in emerging industries that require significant upfront investment in research and technology development (Coad & Rao, 2008). Access to finance also lowers barriers for aspiring entrepreneurs, contributing to a more inclusive entrepreneurial landscape (Canepa & Stoneman, 2008; Revest & Sapio, 2012), as more people from diverse backgrounds and demographics are able to pursue business development. Thus, we hypothesize:

H2a Access to finance is positively associated with the likelihood of innovation.

H2b Access to finance is positively associated with the likelihood of entrepreneurship.

The regulatory environment of a country can develop conductive structures that encourage innovation and entrepreneurial activities or create barriers that impede and increase the cost of organizing a firm and innovating (Baumol, 1990; Sobol, 2008; Van Waarden, 2001; Xin & Park, 2024). Simplified regulations and capital market rules that reduce administrative hurdles make it easier for startups to navigate legal requirements and create a more favorable environment for startups and innovation (Blind, 2012). Indicators related to the quality of the regulatory environment include a variety of factors, such as the ease of starting a business, competitive landscape, property and intellectual property rights, degree of capital market failure, and enforcement of contracts (Chowdhury et al., 2019; Amorós, 2011). Strong intellectual property rights are critical for encouraging innovation (Pisano, 2006; Hudson & Minea, 2013). Clear and enforceable regulations related to patents, copyrights, and trademarks that ensure intellectual assets are protected incentivize creativity, brand building, and investments in R&D (Pisano, 2006; Hudson & Minea, 2013). Antitrust and competition laws that promote a fair and competitive environment and encourage a level playing field for businesses foster innovation and provide companies with space to differentiate themselves through improvements in goods and services (Jorde & Teece, 1990). Government procurement policies can influence the development of start-ups by creating competition in bidding and promoting the inclusion of innovative processes that improve quality or reduce the cost of securing government contracts (Edquist & Zabala-Iturriagagoitia, 2012). Thus, we hypothesize:

H2c Favorable regulations are positively associated with the likelihood of innovation.

H2d Favorable regulations are positively associated with the likelihood of entrepreneurship.

The third main underlying force that enables or constrains entrepreneurship and innovation is the resource demand pillar, which includes access to markets, firm capabilities, and entrepreneurs’ characteristics. The structure of output markets includes consumers who buy and use products, shaping the demand for the final goods and services produced, and the collective capabilities of firms. Consumer preferences and buying power are linked to improvements in firms’ output quality, productivity, and overall capabilities.

Access to marketsLarger markets advance innovation through open trade, a larger variety of goods, and increased competition (Desmet & Parente, 2010). Larger markets, often characterized by higher GDP levels, attract more investment (Blomström, 2002) and provide startups and innovators with more access to resources. This facilitates the start-up process and R&D activities, enabling businesses to invest in product development, innovation, and technology. Greater open market accessibility often means working with diverse consumer demands and behaviors, creating a business environment that fosters different ideas and continuous improvement (Malerba et al., 2007). Furthermore, joining these markets can serve as a stepping-stone for businesses, enhancing their competitiveness and enabling them to scale beyond national borders (Arora & Gambardella, 1997). This level of competitiveness stimulates innovation and encourages entrepreneurs to find unique value propositions, niche opportunities, and creative solutions to distinguish themselves (Malerba et al., 2007). Thus, we hypothesize:

H3a Access to markets is positively associated with the likelihood of innovation.

H3b Access to markets is positively associated with the likelihood of entrepreneurship.

Firms’ capabilities play a crucial role in driving a country's innovation and entrepreneurship levels. Firms engaged in outward foreign direct investment are predominantly motivated by the pursuit of strategic resources and capabilities (Deng, 2007). Those with higher levels of capabilities are more likely to engage in outward foreign direct investment to access or acquire new technologies and knowledge as well as to grow their existing firms beyond their current markets (Kaya & Erden, 2008). The ability to successfully expand abroad and become globally competitive requires dynamic capabilities (Luo, 2000), especially with respect to productivity and technology (Wei et al., 2014). This facilitates the generation of knowledge and expertise that can spill over to other firms and industries, driving national innovation (Knoerich, 2017).

Established firms create new independent companies that emerge from existing parent companies as spin-offs to leverage their existing capabilities and expertise in new markets (Cui et al., 2024). Based on their existing capabilities, this international expansion demonstrates their competence in home markets and their ability to recognize and capitalize on growth opportunities beyond domestic markets. Additionally, international expansion requires significant financial resources. This demonstrates the strength their financial capabilities to make substantial investments abroad (Haapanen et al., 2016).

Managing multiple operations across countries entails managerial and strategic capabilities (Tasheva & Nielsen, 2022). Firms must be able to navigate the geographic and cultural differences, market conditions, and multiple business environments. Thus, outward foreign direct investment showcases a firm's ability to manage, strategize, and execute business strategies across borders. Furthermore, operating in foreign markets involves inherent risks, and effectively managing these risks is a sign of resilience and adaptability (Qiao et al., 2022).

Thus, foeign direct investment serves as a sign of firms’ capabilities, as it reflects not only the firms’ existing knowledge, technology, and parent capabilities in its home market but also its financial strengths, managerial and strategic capabilities, and pursuit of strategic resources, capabilities, and new knowledge in a different market. The existing research suggests that outward foreign direct investment contributes to economic development (Knoerich, 2017). Firms’ outward direct investment can facilitate innovation transfer (Xu et al., 2022) and best practices as well as access to unique resources, such as skilled labor and strategic assets (Keller, 2021). Thus, we hypothesize:

H3c Firms’ capabilities are positively associated with the likelihood of innovation.

H3d Firms’ capabilities are positively associated with the likelihood of entrepreneurship.

The data used in this study were collected from the World Bank Group (WBG), United Nations Educational Scientific and Cultural Organization (UNESCO), and International Telecommunication Union (ITU). The collected data cover more than 100 countries for the years 2018–2021. Specifically, the key datasets for our two main dependent variables of interest, entrepreneurship and innovation, are the World Bank Entrepreneurship Database and United Nations Industrial Development Organization (UNIDO), respectively. The World Bank Entrepreneurship Database is a source of comparable cross-country data on business registration created to advance awareness of the business creation process and private enterprise. UNIDO is a source of comparable cross-country data for industrial production and growth that aims to advance the knowledge of industrial development in developing countries and transition economies. UNIDO focuses on the ninth Sustainable Development Goal (SDG 9): Industry, innovation, and infrastructure. The UNESCO Institute for Statistics was used to collect data on one of the main independent variables: female researchers in public and private sectors. One of the objectives of the UNESCO Institute for Statistics is to further the understanding of the gender gap faced by women in STEM by measuring the number of women in research across countries. The ITU is a source of internationally comparable data for information and communication technologies (ICT) aimed at tracking digital transformation globally. The ITU was used to collect data on one of the main independent physical telecommunications infrastructures. All other independent variables were collected from the WBG.

MeasuresDependent variablesInnovationInnovation is the process by which new products, services, and processes are introduced (Drucker, 1985). The Global Innovation Index project, created by the World Intellectual Property Organization (WIPO), was launched to create metrics and approaches that capture innovation in society beyond the common measures of R&D expenditure and number of research articles (Dutta, 2011). WIPO offers a variety of measures to capture national innovation, including technology exports. Following the Global Innovation Index project, medium-to-high technology exports were used to measure innovation. This is in line with the general definition offered by the Oslo Manual (OECD, 2005), which describes innovation as “a new or significantly improved product (good or service), or process, a new marketing method, or a new organizational method in business practices, workplace organization, or external relations” (p. 46).

This definition not only captures Schumpeterian entrepreneurial endeavors but also stresses the actual implementation of innovation through products, processes, and organizational and marketing models or techniques from public and private enterprise (European Commission, 2002). The Schumpeterian literature stresses the potential of technological opportunities for productivity growth (Schumpeter, 1934). The high-tech exports in industrialized economies that underlie economic growth and social development (OECD, 2005) are key components of innovation.

EntrepreneurshipAccording to Schumpeter (1934), an entrepreneur is one who develops new products, processes, inputs, markets, and organizations. For Gartner (1985), an entrepreneur is one who creates new ventures. For Audretsch et al. (2022), an entrepreneur “combines resources that are available in the ecosystem to produce goods and services to the market, which will involve interactions with workers, other entrepreneurs, and other firms” (p. 17). Following these conceptualizations, entrepreneurship in this study was measured by the number of new businesses registered. This measure captures the number of new limited liability corporations registered in a calendar year in each country.

Key explanatory variablesPhysical infrastructureKnowledge spillovers stem from the positive externalities of physical infrastructure (Audretsch et al., 2022). Telecommunications infrastructure can reduce transaction costs, improve decision making between firms and households, and reduce search and production costs (Hardy, 1980). It is central to every country's information systems and economy (World Bank, 1994). Thus, this study uses annual investments in telecommunications (USD) every calendar year to measure physical infrastructure.

Knowledge capitalKnowledge spillovers from research institutions, industry producers, and suppliers are spatially localized in the geographic proximity of the knowledge source (Audretsch et al., 2022). They decrease the costs of learning and innovation for entrepreneurs in specific locations (Audretsch et al., 2022). As the goal of this research is to explore the role of women in driving national innovation and entrepreneurship, we measure knowledge capital by the number of female researchers as a percentage of the total full-time-equivalent researchers in the government (UNESCO, 2019). A minority of the world's researchers are women (UNESCO, 2019). Researchers contribute to the creation of new knowledge through scientific investigation and the dissemination of their findings in publications, conferences, and teaching. These are integral components of the development and enhancement of knowledge capital.

Human capitalHuman capital is the building block of every economy. The distribution of skills and technological transformation of human capital are primitives of entrepreneurial ecosystems (Audretsch et al., 2022). Examining women's roles can help us understand their contributions in ecosystems and assist in unlocking the full potential of an economy for sustainable development (Dollar & Gatti, 1999). To investigate the impact of women on national innovation and entrepreneurship, we measured human capital using the female labor force participation rate. This measure captures the proportion of the population aged 15–64 that is economically active and female, expressed as a percentage of the total female population.

Access to financeEntrepreneurship selection depends on capital constraints (Audretsch et al., 2022). If entrepreneurs perceive an opportunity in the market, they may be constrained from undertaking the opportunity because of a lack of capital or access to capital markets (Elston & Audretsch, 2011). Individuals with lower net worth will be credit-constrained and, therefore, have a greater dependency on developed financial markets to become self-employed (Audretsch et al., 2022). Access to finance includes venture capital, loans, small business grants, and other types of credit. Thus, we measure banks’ access to finance through domestic credit to the private sector. This captures the resources provided to the private sector by other depository corporations (deposit-taking corporations other than central banks), such as through loans, purchases of non-equity securities, trade credits, and other accounts receivable that establish a claim for repayment. This encompasses credit allocation, which is a key purpose of financial intermediaries (Beck et al., 2009).

RegulationsThe environment, characterized by different laws and regulations (formal institutions), impacts the costs and choices for self-employment (North, 1990; Audretsch et al., 2022). Regulations distort relative prices and resource allocation, which can, in turn, distort the choice to pursue entrepreneurial opportunities (Audretsch et al., 2022). Using the Worldwide Governance Indicators from the World Bank Group, regulatory quality was used to measure regulations, which reflects perceptions of the government's ability to formulate and implement sound policies and regulations that foster private sector development.

Access to marketsMany entrepreneurs choose to start ventures in the area they live and choose the type of business they want to start in their specific product market (Audretsch et al., 2022). The structure of output markets and whether they have demand, are easily accessible, and are competitive differs vastly from one economy to another. Thus, the structure of output markets shapes the allocation of resources to firms and ultimately impacts entrepreneurial talent distribution and who will become an entrepreneur (Audretsch et al., 2022). Access to markets is measured by the domestic economy size through GDP, expressed in current international dollars and converted by purchasing power parity (PPP).

Firm capabilitiesFirms’ capabilities in terms of the technology employed, productivity, and managerial talent affect the level of entrepreneurship and innovation in an economy (Audretsch et al., 2022). Firm capabilities are measured by net foreign direct investment outflows as a percentage of GDP. This measure involves net outflows of investment from one economy to the rest of the world divided by GDP. The measure captures cross-border investment in one economy by a resident from another economy who has ownership of 10 percent or more ordinary shares of voting stock. Residents significantly influence the management of enterprises in other economies, demonstrating their capabilities and local competitiveness by extending into new markets and accessing additional knowledge (Kaya & Erden, 2008).

OECDThe Organization for Economic Co-operation and Development (OECD) is an international organization that classifies countries according to levels of development. It works with governments and policymakers to establish international standards for governance, taxation, and economic performance. The goal of the OECD is to advance ways to improve social, economic, and environmental outcomes through data and evidence-based research. “OECD” is a binary variable used to interact with variables of interest to capture differences in development levels; it is coded 1 if countries are non-OECD members and 0 otherwise.

Empirical analysisFixed-effects regressionA fixed-effects regression is used to test these hypotheses. The estimation approach is in line with time- and country-level data availability and design (Siepel & Dejardin, 2020) and is robust to both time- and country-level unobserved heterogeneity. Among panel analysis approaches, this technique relies on a strict exogeneity assumption for unbiased identification (Wooldridge, 2010). We estimate two fixed-effects regression models, one for each dependent variable. While the data were collected for <100 countries, the fixed effects model included 89 countries as the first dependent variable (innovation) and 79 countries as the second dependent variable (entrepreneurship) based on the data availability for each variable per year and country. Standard errors are clustered to account for autocorrelation and heteroskedasticity.

We use a three-step estimation strategy to examine the predictors of innovation and entrepreneurship. First, we estimate a reduced version without controlling for time and country effects. Second, we estimate a model with only country-fixed effects, and third, we estimate a full model with both country- and time-fixed effects. We observe a significant variance among the three models and provide support for choosing the third model. In the second part of our analysis, we use a high-dimensional multi-varied fixed-effects model (Correia, 2017) to understand whether our original results vary by region. Based on our original two-way fixed effects model, we advance our analysis one step further to include regional interactions with significant variables and a three-way fixed effects model to account for country, time, and level of development.

By including fixed effects for time, country, and level of development in our analysis, we minimize bias that could result from unobserved heterogeneity across multiple entities and improve the efficiency, accuracy, and reliability of our causal inferences. This is particularly relevant for our context, given that we conduct panel data analysis in which multiple countries at different levels of development are examined over time, as the traditional approach to fixed effects would not be feasible when there are multiple sets of fixed effects with many categories (Correia, 2017). To overcome these shortcomings, we utilize the most recent advances in econometric methods and apply a high-dimensional fixed-effects model that accounts for the multiple dimensions in our panel (Correia, 2017).

More specifically, country-fixed effects control for the unobserved heterogeneity constant within each country, such as cultural differences, but these vary within each country. This is important for isolating the impact of the outcome variables, innovation and entrepreneurship. Similarly, regional fixed effects account for unobserved heterogeneity that is constant over time within each group of countries that share the same levels of development, such as well-established infrastructure and political systems with elections. Time fixed effects capture trends and shocks that impact all countries simultaneously but vary over time, such as the COVID-19 pandemic and its significant effect on global financial markets. This can also include technological advancements and policy changes that affect the entire panel. By controlling for these temporal effects, this study ensures that the estimated effects are not confounded by time-related trends.

Given that this study uses panel data with multiple dimensions, high-dimensional fixed effects are particularly useful to account for each layer. This is particularly crucial in complex datasets, in which multiple sources of variation can obscure the true relationship between variables. By including fixed effects for each dimension, the model reduces the risk of omitted variable bias. Additionally, isolation provides a clearer understanding of the relationship between the three pillars and the outcomes, innovation and entrepreneurship, minimizing biases from unobserved heterogeneity across these dimensions.

ResultsTable 1 presents summary statistics. Summary statistics provide an overview of the central tendencies and dispersions within a dataset. Specifically, they demonstrate the significant variability among the observed countries. There is considerable variability in medium-to-high technology exports, indicating that some countries are leading exports while others are minimally involved. Similarly, while, on average, about 36,000 new businesses are registered across the countries observed, the high standard deviation relative to the mean indicates that there is significant variability in new business registration.

We expect this variability given the wide coverage of the countries included and their substantial variations in levels of development, gross domestic product, political systems, culture, and institutional characteristics. Given this significant variability, robust statistical techniques are necessary to manage these wide-ranging variations and ensure that the estimates capture the actual underlying patterns. Thus, high-dimensional fixed effects are especially useful in this context to isolate the impact of time-invariant unobserved heterogeneity and adjust for within-cluster heteroskedasticity and autocorrelation from a wide range of values.

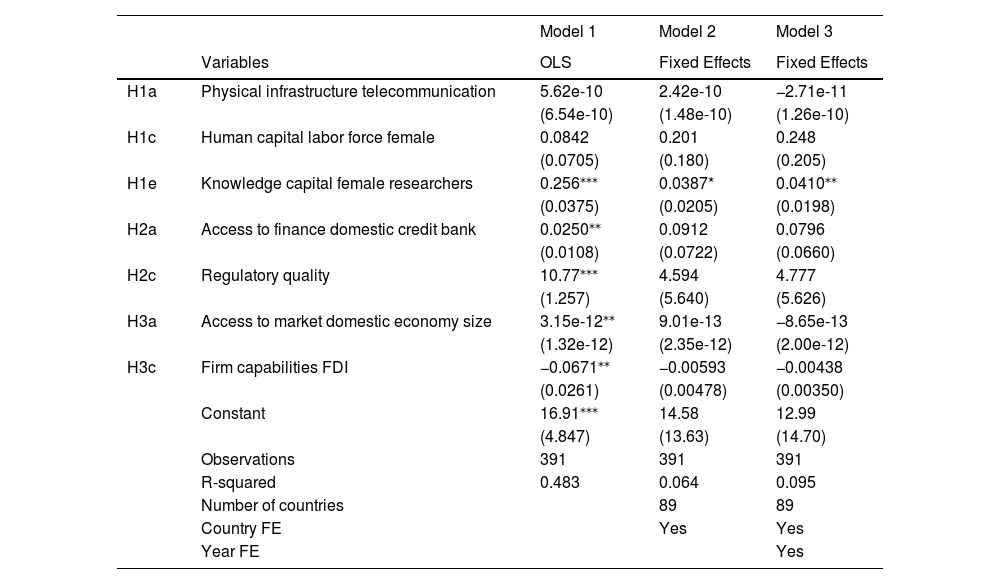

Tables 2 and 3 summarize the fixed-effects model estimates used to test the hypotheses. Table 2 shows the relationship between innovation and the three pillars of entrepreneurial ecosystem. Hypothesis 1 investigates the resource supply pillar and predicts that physical infrastructure (H1a), human capital (H1c), and knowledge capital (H1e) are positively associated with national innovation outcomes. After controlling for time- and country-unobserved heterogeneity, we find a significant positive relationship between knowledge capital and national innovation (Table 2: β = 0.041, p < 0.05). Among Hypotheses 1a, 1c, and 1e, the results support only Hypothesis 1e.

Hypothesis 2 examines the allocation and accumulation pillar and predicts that access to finance (H2a) and favorable regulations (H2c) are positively associated with national innovation outcomes. In the simple reduced model, access to finance and favorable regulations are significant, indicating a positive relationship with innovation. However, these effects become insignificant after controlling for unobserved country- and time-invariant heterogeneity. Thus, Hypotheses 2a and 2c were not supported.

Hypothesis 3 tests the resource demand pillar and predicts that access to markets (H3a) and firm capabilities (H3c) are positively associated with innovation. As in hypothesis 2, the reduced model shows that access to markets and firm capabilities are significant predictors of innovation. However, these effects disappear once country- and time-invariant unobserved heterogeneity are controlled for. Thus, Hypotheses 3a and 3c were not supported.

Table 3 illustrates the relationship between entrepreneurship and the three pillars of the entrepreneurial ecosystem. Hypothesis 1 examines the resource supply pillar and predicts that physical infrastructure (H1b), human capital (H1d), and knowledge capital (H1f) increase the likelihood of entrepreneurial activity. However, these hypotheses were not supported. Hypothesis 2 examines the allocation and accumulation pillar and predicts that access to finance (H2b) and favorable regulations (H2d) will be positively associated with entrepreneurial activity. However, these hypotheses were not supported. Hypothesis 3 tests the resource demand pillar and predicts that access to markets (H3b) and firm capabilities (H3d) increase the likelihood of entrepreneurial activity. We found a significant positive relationship between access to markets and entrepreneurial activity (Table 3: β = 1.79e-08, p < 0.05). Thus, Hypothesis 3b was supported.

The three models demonstrate the effectiveness of utilizing longitudinal data and fixed effects over OLS in our experiment to reduce bias and test our hypotheses more rigorously in regions with scarce data. Based on the results from each model, we proceed to test the regional interactions for each significant independent variable to understand whether this effect varies by the level of development. From Table 2, based on the impact of knowledge capital by female researchers on innovation, we proceed to examine whether the impact varies by country development, as identified by the OECD. From Table 3, based on the impact of domestic economy size on entrepreneurship, we proceed to examine whether the impact varies by country development, as identified by the OECD.

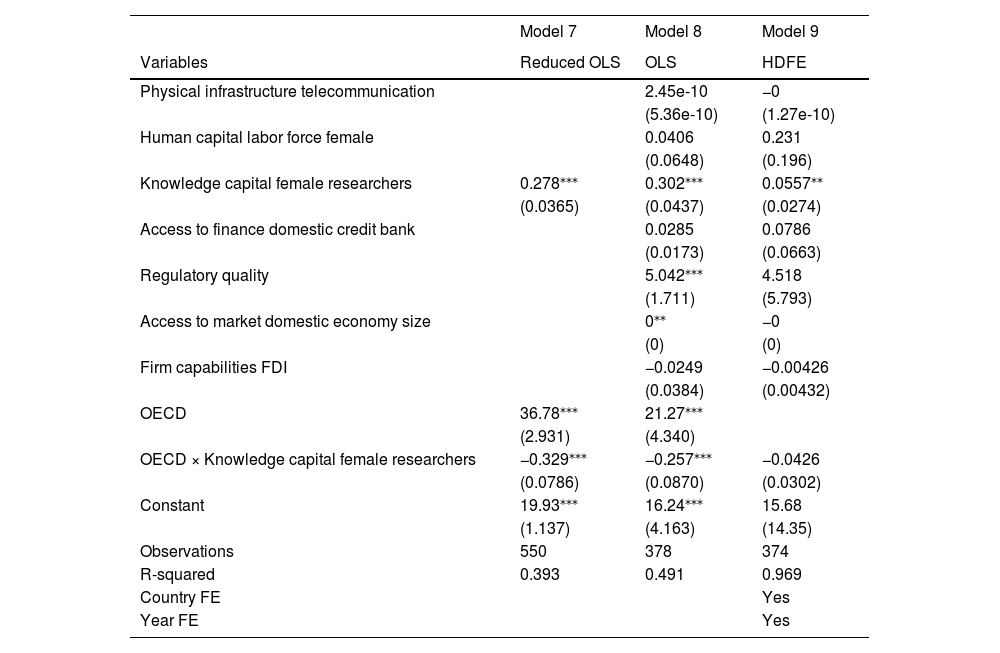

Table 4 presents the results for the impact of knowledge capital on innovation across varying development levels. Through the interaction between knowledge capital and OECD countries, we test whether the effect of knowledge capital on innovation differs between OECD and non-OECD countries. Model 9 presents the results for the high-dimensional fixed effects, accounting for the three dimensions of unobserved interactive fixed effects: time, country, and region. We found a significant positive relationship between knowledge capital and innovation (Table 4: β = 0.0557, p < 0.05). This finding indicates that the effect of knowledge capital on innovation differs between the groups. Innovation increases to different degrees in OECD versus non-OECD countries based on the knowledge capital of women researchers. Knowledge capital positively impacts innovation in non-OECD countries to a greater degree. As countries develop and reach a certain level of innovation, this difference in effect disappears, and the impact of knowledge capital on innovation becomes similar between the two groups. Fig. 1 presents the marginal effects and predictions to visualize the relationship between different levels of development in OECD and non-OECD countries.

Table 5 presents the results for the impact of the domestic market on entrepreneurship across varying development levels. Through the interaction between the domestic economy size and the OECD, we test the degree to which the impact of the domestic economy on entrepreneurship varies between OECD and non-OECD countries. Model 12 presents the results for high-dimensional fixed effects to account for the three dimensions and to include regional effects. We find a significant positive relationship between the size of the domestic economy and entrepreneurship (Table 5: β = 1.43e-08, p < 0.05). This suggests that the impact of the domestic economy size on entrepreneurship is different for the two groups. Entrepreneurs’ access to a larger domestic economy is predicted to increase entrepreneurship at different levels in both OECD and non-OECD countries. As the economies of countries grow beyond a certain threshold, this effect is expected to disappear. Thus, non-OECD countries must gain more from growing knowledge capital and domestic economy size to boost their national innovation and entrepreneurship levels, respectively. Table 6 presents the average innovation and entrepreneurship by country.

DiscussionInterpretations of findingsOur results tell an interesting story about ecosystems, innovation, and entrepreneurship in emerging economies. With respect to innovation, the reduced model (Model 1), which excludes fixed effects for countries, years, and levels of development, indicates that all three pillars significantly influence innovation. The resource supply pillar via knowledge capital, the allocation pillar via regulatory quality and access to finance, and resource demand pillar via access to markets and firms’ FDI capabilities all show significance. However, once we control for differences across countries, years, and levels of development, these effects disappear, and we are left only with the influence of the resource supply pillar through knowledge capital. This suggests that there are individual characteristics unique to the countries examined, such as their history, geography, form of government, level of development, infrastructure, and social structure, which may initially account for the significant results of the other pillars in our reduced model.

It could also be that a global condition that affected all countries within the same calendar year, such as a pandemic, an economic crisis, or geopolitical tension with widespread economic implications, influenced the results observed in our initial model regarding these effects on innovation. Thus, by controlling for year fixed effects, we account for global shocks that affect all countries in the same calendar year, thereby minimizing the influence of other external forces and isolating the changes attributable to the three pillars on innovation. Once the impact is isolated and the effects of knowledge capital are differentiated by the level of development, we find that the influence of knowledge capital on innovation remains significant in non-OECD countries, albeit up to a certain threshold, as shown in Fig. 1. Moreover, it diminishes as knowledge capital increases and countries achieve higher levels of development.

With respect to entrepreneurship, the reduced model (Model 4), which excludes the fixed effects for countries, years, and levels of development, indicates that only the resource demand pillar, via access to markets, is significant. Once we controlled for differences across countries, years, and levels of development, we obtained similar results. However, once the effects of market access are differentiated by the level of development, we find that the influence of market access on entrepreneurship remains significant in non-OECD countries. This suggests that access to markets is more important for entrepreneurship in non-OECD countries and diminishes as access to markets increases and countries obtain higher levels of development. Given these findings, we suggest further research avenues to explore Audretsch et al. (2022) framework from a different perspective.

Implications for theory and literatureThis study empirically tested Audretsch et al. (2022) entrepreneurial ecosystem framework using a gendered lens. Using longitudinal data, we empirically tested the three pillars of the entrepreneurial ecosystem–resource supply, allocation and accumulation, and resource demand–and their effects on the likelihood of innovation and entrepreneurship. In doing so, we elaborate on the developing conceptualization of the entrepreneurial ecosystem and advance several insights into innovation and entrepreneurship processes. We empirically validate the framework and apply it through a gendered lens in data-scarce regions to uncover new insight into the fundamental role of women in advancing developing regions.

We find that across non-OECD countries, the knowledge capital generated by women researchers serves as the chief driving force for national innovation. With respect to entrepreneurship, we find that across non-OECD countries, the domestic economy size is the primary driving factor for new businesses. Our results support the importance of the resource supply pillar in advancing innovation and the resource demand pillar in facilitating entrepreneurship. This study aligns with current findings on entrepreneurship and innovation (Acs et al., 2017; Audretsch et al., 2022; Spigel et al., 2020; Stam & Van de Ven, 2021).

This study contributes to existing literature in several ways. First, it validates the original tenants of Audretsch et al. (2022) framework. Our findings strongly support the importance of the resource supply and demand pillars. The validation of this new and upcoming framework suggests that innovation and entrepreneurship rely on a combination of specific tangible dimensions. By empirically validating the theoretical framework through a longitudinal study, we confirm the accuracy and reliability of the phenomena represented in the theoretical framework, thereby contributing to the body of entrepreneurship literature that prompts the study of ecosystems. Entrepreneurship ecosystem assessments are plentiful, but are rarely embedded in solid economic theory and are informed by data representative of multiple dimensions in developing countries (Cruz & Zhu, 2023). These shortcomings are especially relevant in technology-intensive start-ups (Cruz & Zhu, 2023), which our measure of innovation captures. Although it may be challenging to identify high-potential start-ups ex ante, they are more likely to emerge in ecosystems with complementary factors that facilitate innovation, technological upgrades, and higher market entry rates at higher quality (Cruz et al., 2022). These findings bring understanding one step closer to uncovering the untapped potential of entrepreneurial ecosystems (Kuckertz, 2019) and national innovation systems (Van Waarden, 2001).

Second, by critically reimagining the framework to apply a gendered lens, we contribute to furthering understanding of women's roles in innovation. A gendered lens allows us to untangle the effects that men and women have on national development to shed light on women's contributions, especially in understudied regions with limited data. Unlike entrepreneurship, innovation research has paid little attention to gender (Brush et al., 2022). This study highlights blind spots (Pecis & Berglund, 2021) to reveal the gaps that exist when women are excluded from developmental processes. By applying a gendered lens to the framework and placing women at the core of inquiry, we provide empirical evidence of their role in driving innovation and advance the understanding of gender dynamics in national innovation, theoretically, including the important and lesser understood role of women in driving innovation.

Third, this study adds to the literature that examines the differences across countries at different developmental levels, as measured by OECD and non-OECD countries. Not all countries benefit similarly from the same ecosystem dimensions. Some ecosystems, namely non-OECD economies, are more heavily dependent on knowledge capital for national innovation and market size for entrepreneurship. However, in developed economies, these dimensions are not as relevant in driving innovation and entrepreneurship. This theoretically demonstrates the differences in the macro-level processes of innovation and entrepreneurship according to varying levels of development.

In sum, we contribute to the literature by supporting an emerging conceptualization of ecosystems through a longitudinal study to verify two dimensions. Additionally, we extend the extant conceptualizations of innovation through a model that places women at the center to showcase their contributions to national innovation. Third, we extend the extant conceptualizations of ecosystem inputs and outcomes to countries with different levels of economic development to advance our knowledge of the varying macro-level processes that lead to innovation and entrepreneurship.

Implications for policy and practiceThe analysis builds on the United Nations Development Program (UNDP) Sustainable Development Goals and the World Bank's expenditure review for science, technology, and innovation in developing nations (Cirera & Maloney, 2017; Li et al., 2020). This study is particularly important because policies have counterintuitive outcomes when they do not account for the contribution and inclusion of all members of society or when the differences in contextual elements, such as levels of development, are not considered in the treatment. Women researchers generate knowledge capital that shapes the macro environment and catalyzes societal changes. This is more relevant to the outcomes for non-OECD countries. Based on these findings, advancing theory to account for underserved areas in ecosystem development could better predict innovation and entrepreneurship in different regions.

The empirical validation and extension of this framework can assist analysts, practitioners, and policymakers in conducting entrepreneurial ecosystem assessments and diagnostics that best ignite entrepreneurship, innovation, and economic development. Governments and development agencies can use this data-driven evidence to identify policy outcomes and strategies conducive to national innovation, particularly in countries where data are not widely available to undertake such diagnostics (Audretsch et al., 2022).

Study limitations and future researchOur study has some limitations. Although the longitudinal analysis used in this study empirically tests Audretsch et al. (2022) framework explaining innovation and entrepreneurship over time, it has several constraints inherent to panel data modeling. We are cognizant that entrepreneurs’ characteristics and culture are vital in the assessment of this framework. However, this analysis tests only variables that are dynamic and changing over time to fully utilize panel data and represent time and country unobserved heterogeneity in modeling. Thus, we cannot estimate how culture and individual characteristics impact the outcomes of interest over time owing to the causal nature of our experiment and static data that are often used to measure culture and individual characteristics. Our model excludes all static variables, such as entrepreneurs’ characteristics and culture but controls for their variations through fixed effects. This presents a promising avenue for future research, as future scholars may examine their impact through cross-sectional studies.

Another limitation is that our study does not perfectly control for other external factors within the model to prevent overfitting. We limit our independent variables to those dynamic variables suggested by Audretsch et al. (2022) without further controls and interactions, excluding the interaction to measure the differences in varying development levels, to avoid overfitting the model and ensure the reliability and robustness of our estimates.

Some potential biases and limitations in our dataset include coverage and quality. Table 6 shows that our data represent all countries or regions uniformly. Developing countries typically have limited data compared to developed regions due to challenges in collection or reporting. This limits the scope and comprehensiveness of our analysis. While the dataset includes a wide variety of countries, there are still missing countries which represent an important portion of the world that remain unexamined. Without these countries, the sample cannot fully capture the range of global diversity. The sample in this study has more countries from certain regions than others based on data availability. Specifically, Oceania is absent. There is more representation from Europe than from any other region, followed by Africa. South American, Asia, and North America are less represented. Therefore, our findings and the generalizability of the results are limited by this sample.

In addition, the quality of data varies depending on its source and collection method. Variations in collection methods and definitions across countries and over time affect the accuracy and comparability. We aggregate our data from multiple sources with careful consideration to minimize the effects of coverage and quality. To build on this in the extant literature, future scholars should collect primary data in developing regions to overcome these limitations and control the quality and coverage.

ConclusionUsing longitudinal data across developed and developing nations, this study applies a gendered lens to empirically test the effects of the three pillars of entrepreneurial ecosystems, namely the resource supply, allocation and accumulation, and resource demand pillars, on national innovation and entrepreneurship. Our findings suggest that the resource supply and resource demand pillars are necessary for innovation and entrepreneurship in developing countries, respectively. The role of women knowledge workers, incorporated through the resource supply pillar, is essential for driving national innovation. The role of markets, incorporated through the resource demand pillar, is key to driving entrepreneurship. We provide a different perspective to understand ecosystems through the role that women play across varying levels of economic development.

There are three strands of research that relate to our study: ecosystems, innovation, and gender. Although these strands of research explain some of the barriers that women face in entrepreneurship and innovation in relation to ecosystems, our research bridges an important gap between these topics, focusing on the nexus of ecosystems, gender, and innovation. Despite the importance of this inquiry for advancing knowledge and creating sustainable and equitable economic development, few studies have explored this aspect (Arora et al., 2019; Bührer et al., 2020; Cukier et al., 2022). While previous research has examined innovation ecosystems, the role of women has not been analyzed (Brush et al., 2019; Granstrand & Holgersson, 2020). Our study connects these three strands of literature (ecosystems, innovation, and gender) and places the role of women at the heart of ecosystem analysis.

Even further, our research provides a novel approach to gender and innovation research using state-of-the-art methods of applied econometric modeling (Sarafidis & Wansbeek, 2021) to advance evidence-based knowledge in this area. By employing a high-dimensional fixed effects, our analysis is based on a causal inference that can better isolate the impact and control for time-specific trends and shocks that may affect innovation and entrepreneurship. This allows us to control for interactions across three dimensions, reducing the bias that may arise from unobserved heterogeneity across these dimensions, and enhancing the robustness of estimates against omitted variables. The literature primarily considers a static view of the concept, analyzing it at a single point in time, or at national or regional levels. We extend the analysis of ecosystems through space and time, adding temporal and national and regional dimensions, answering calls for empirical rigor (Granstrand & Holgersson, 2020; Ritala & Almpanopoulou, 2017).

The novel framework developed by Audretsch et al. (2022) has influenced research and practice on entrepreneurial ecosystems. In addition to being adopted by the World Bank as a diagnostic toolkit for developmental policy and international development practice, it offers research scholars an essential conceptual framework to anchor their analysis. Our study adds to the ecosystem literature through an empirical examination of the framework from a gendered lens in contexts at varying levels of development.

CRediT authorship contribution statementNaeimah Alkharafi: Writing – review & editing, Writing – original draft, Software, Methodology, Investigation, Formal analysis, Data curation, Conceptualization.

Summary statistics.

Notes:.

a Denoted in percent.

b Denoted in absolute count.

c Denoted in millions.

Regression estimates on the likelihood of innovation.

| Model 1 | Model 2 | Model 3 | ||

|---|---|---|---|---|

| Variables | OLS | Fixed Effects | Fixed Effects | |

| H1a | Physical infrastructure telecommunication | 5.62e-10 | 2.42e-10 | −2.71e-11 |

| (6.54e-10) | (1.48e-10) | (1.26e-10) | ||

| H1c | Human capital labor force female | 0.0842 | 0.201 | 0.248 |

| (0.0705) | (0.180) | (0.205) | ||

| H1e | Knowledge capital female researchers | 0.256⁎⁎⁎ | 0.0387* | 0.0410⁎⁎ |

| (0.0375) | (0.0205) | (0.0198) | ||

| H2a | Access to finance domestic credit bank | 0.0250⁎⁎ | 0.0912 | 0.0796 |

| (0.0108) | (0.0722) | (0.0660) | ||

| H2c | Regulatory quality | 10.77⁎⁎⁎ | 4.594 | 4.777 |

| (1.257) | (5.640) | (5.626) | ||

| H3a | Access to market domestic economy size | 3.15e-12⁎⁎ | 9.01e-13 | −8.65e-13 |

| (1.32e-12) | (2.35e-12) | (2.00e-12) | ||

| H3c | Firm capabilities FDI | −0.0671⁎⁎ | −0.00593 | −0.00438 |

| (0.0261) | (0.00478) | (0.00350) | ||

| Constant | 16.91⁎⁎⁎ | 14.58 | 12.99 | |

| (4.847) | (13.63) | (14.70) | ||

| Observations | 391 | 391 | 391 | |

| R-squared | 0.483 | 0.064 | 0.095 | |

| Number of countries | 89 | 89 | ||

| Country FE | Yes | Yes | ||

| Year FE | Yes |

Notes: Estimated coefficients presented with clustered standard errors in fixed effects models. Model 3 includes country and year fixed effects.

Regression estimates on the likelihood of entrepreneurship.

| Model 4 | Model 5 | Model 6 | ||

|---|---|---|---|---|

| Variables | OLS | Fixed Effects | Fixed Effects | |

| H1b | Physical infrastructure telecommunication | 2.46e-06 | −4.09e-08 | −1.37e-07 |

| (2.33e-06) | (1.66e-07) | (1.51e-07) | ||

| H1d | Human capital labor force female | −70.12 | −779.7 | −861.9* |

| (153.1) | (517.3) | (507.4) | ||

| H1f | Knowledge capital female researchers | 220.3 | 5.069 | 0.459 |

| (135.8) | (15.81) | (20.01) | ||

| H2b | Access to finance domestic credit bank | 29.44 | 64.45 | 62.45 |

| (32.54) | (42.91) | (43.46) | ||

| H2d | Regulatory quality | 602.0 | 5017 | 4738 |

| (3525) | (8787) | (8400) | ||

| H3b | Access to market domestic economy size | 1.00e-08⁎⁎⁎ | 2.40e-08⁎⁎⁎ | 1.79e-08⁎⁎⁎ |

| (3.85e-09) | (5.59e-09) | (4.17e-09) | ||

| H3d | Firm capabilities FDI | −36.54 | 5.628* | 9.268 |

| (61.43) | (3.330) | (5.576) | ||

| Constant | 17,394* | 55,706* | 63,304⁎⁎ | |

| (9564) | (30,565) | (30,314) | ||

| Observations | 271 | 271 | 271 | |

| R-squared | 0.194 | 0.120 | 0.158 | |

| Number of countries | 79 | 79 | ||

| Country FE | Yes | Yes | ||

| Year FE | Yes |

Notes: Estimated coefficients presented with clustered standard errors in fixed effects models. Model 6 includes country and year fixed effects.

Regional differences of knowledge capital for innovation.

| Model 7 | Model 8 | Model 9 | |

|---|---|---|---|

| Variables | Reduced OLS | OLS | HDFE |

| Physical infrastructure telecommunication | 2.45e-10 | −0 | |

| (5.36e-10) | (1.27e-10) | ||

| Human capital labor force female | 0.0406 | 0.231 | |

| (0.0648) | (0.196) | ||

| Knowledge capital female researchers | 0.278⁎⁎⁎ | 0.302⁎⁎⁎ | 0.0557⁎⁎ |

| (0.0365) | (0.0437) | (0.0274) | |

| Access to finance domestic credit bank | 0.0285 | 0.0786 | |

| (0.0173) | (0.0663) | ||

| Regulatory quality | 5.042⁎⁎⁎ | 4.518 | |

| (1.711) | (5.793) | ||

| Access to market domestic economy size | 0⁎⁎ | −0 | |

| (0) | (0) | ||

| Firm capabilities FDI | −0.0249 | −0.00426 | |

| (0.0384) | (0.00432) | ||

| OECD | 36.78⁎⁎⁎ | 21.27⁎⁎⁎ | |

| (2.931) | (4.340) | ||

| OECD × Knowledge capital female researchers | −0.329⁎⁎⁎ | −0.257⁎⁎⁎ | −0.0426 |

| (0.0786) | (0.0870) | (0.0302) | |

| Constant | 19.93⁎⁎⁎ | 16.24⁎⁎⁎ | 15.68 |

| (1.137) | (4.163) | (14.35) | |

| Observations | 550 | 378 | 374 |

| R-squared | 0.393 | 0.491 | 0.969 |

| Country FE | Yes | ||

| Year FE | Yes |

Notes: Estimated coefficients presented with clustered standard errors in fixed effects models. Model 9 includes regional development, country, and year fixed effects.

Regional differences of access to markets for entrepreneurship.

| Model 10 | Model 11 | Model 12 | |

|---|---|---|---|

| Variables | OLS reduced | OLS | HDFE |

| Physical infrastructure telecommunication | 2.49e-06 | −2.63e-07* | |

| (2.10e-06) | (1.47e-07) | ||

| Human capital labor force female | −111.0 | −880.8* | |

| (244.0) | (514.8) | ||

| Knowledge capital female researchers | 198.8 | 6.660 | |

| (129.4) | (21.60) | ||

| Access to finance domestic credit bank | 37.74 | 63.16 | |

| (58.27) | (44.21) | ||

| Regulatory quality | −2938 | 4220 | |

| (5838) | (8809) | ||

| Access to market domestic economy size | 1.31e-08⁎⁎⁎ | 9.66e-09* | 1.43e-08⁎⁎⁎ |

| (1.47e-09) | (4.94e-09) | (3.45e-09) | |

| Firm capabilities FDI | −8.388 | 5.105 | |

| (177.4) | (5.599) | ||

| OECD | 8475 | 9005 | |

| (8746) | (10,100) | ||

| OECD × Access to market domestic economy size | 2.55e-08⁎⁎⁎ | −4.50e-10 | 1.32e-08 |

| (4.90e-09) | (4.61e-09) | 1.37e-08 | |

| Constant | 17,950⁎⁎⁎ | 18,334 | 64,239⁎⁎ |

| (3705) | (15,239) | (30,910) | |

| Observations | 531 | 265 | 260 |

| R-squared | 0.256 | 0.192 | 0.991 |

| Country FE | Yes | ||

| Year FE | Yes |

Notes: Estimated coefficients presented with clustered standard errors in fixed effects models. Model 12 includes regional development, country, and year fixed effects.

Averages for innovation and entrepreneurship by country.

Notes: OECD, organization for Economic Co-operation and Development.

OECD members are marked with x.