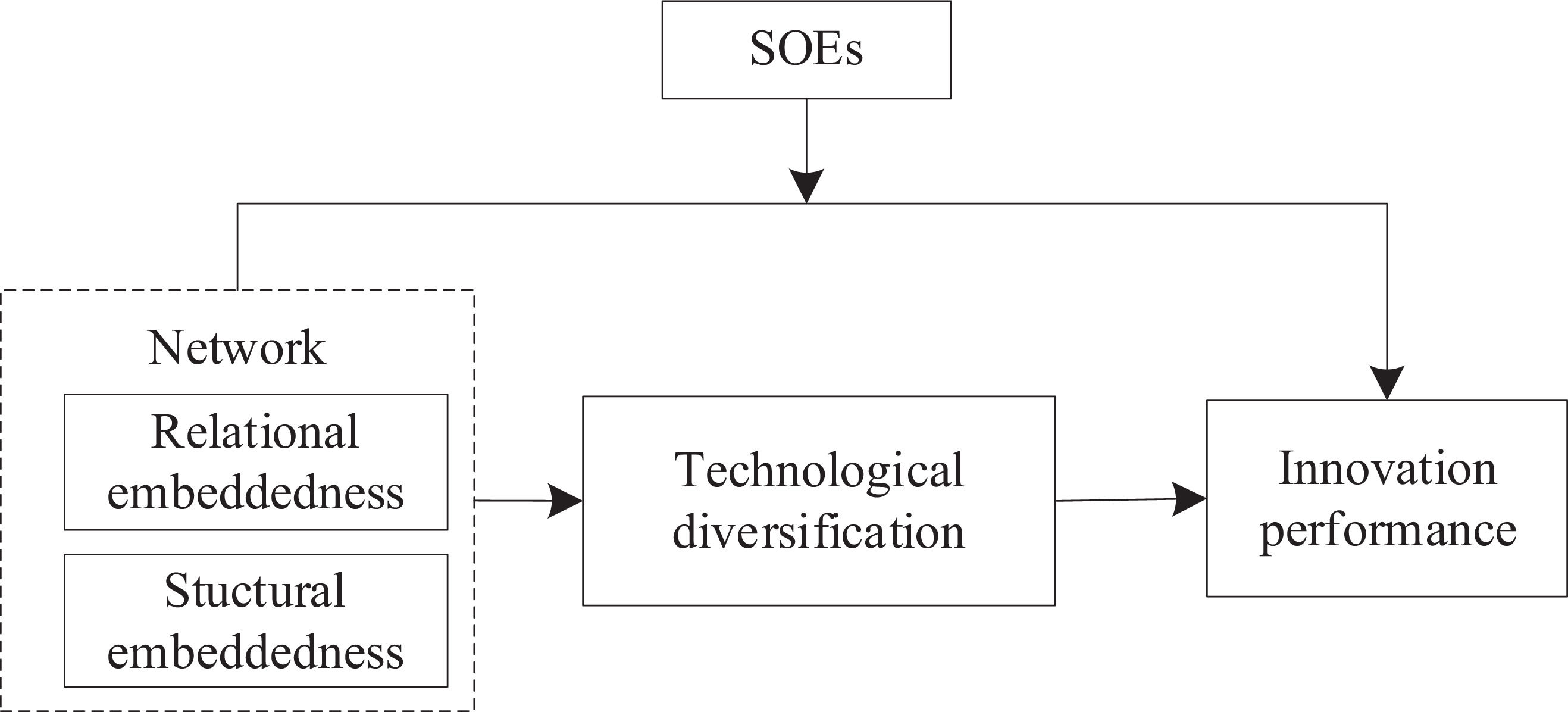

Network embeddedness is an essential determinant of enterprise innovation, but the mechanism of its impact on innovation performance remains unclear. Based on resource dependence theory, this study analyzes the influence of structural embeddedness and relational embeddedness on innovation performance and introduces technological diversification and state ownership to discuss the mediation and moderation mechanism. Using the patent and financial data of China's listed companies from 2007 to 2016, we tested the theoretical model by panel regression analysis. The results show that there is an inverted U-shaped relationship between relational embeddedness and innovation performance and structural embeddedness exerts a significant positive effect on innovation performance. Technology diversification plays a mediating role between relational embeddedness, structural embeddedness and innovation performance. Compared with nonstate-owned companies, state-owned enterprises are less dependent on network resources. Although the inverted U-shaped relationship between network embedding and innovation performance is weaker, the positive influence of structural embeddedness on innovation performance is stronger.

The rapid development and broad application of digital technologies have triggered significant changes in the technological environment. With the increasing complexity of technology and the shortening of the technology cycle, cross-organization cooperative innovation has become an important approach to technology innovation. Collaboration networks between enterprises are increasingly complex and play multiple roles in corporate governance and strategic decisions (Banalieva & Dhanaraj, 2019). Network embeddedness is also considered as a vital source of enterprises’ resources and knowledge (Lee, Lee, & Pennings, 2001; Öberg, 2019; Salavisa, Sousa, & Fontes, 2012).

Scholars have conducted a series of studies on the relationship between networks and innovation performance (Schilling & Phelps, 2007; Wang, Rodan, Fruin, & Xu, 2014). However, most previous studies focus on the direct impact of network embeddedness on innovation performance. According to resource dependence theory, organizations may create external dependencies in transactions with other actors and organizations, and implement strategies to enhance their power in resource-related transactions (Pfeffer & Salancik, 1978; Xia, Wang, Lin, Yang, & Li, 2016). Because enterprise network embeddedness belongs to external dependence (Bäck & Kohtamäki, 2015), organizations can only transform their advantages and resources brought by relationship and structural embeddedness into their unique competitiveness and achieve control of external resources and power. Then, enterprises are able to improve their innovation performance through network embeddedness. Technological diversification stands for the degree of diversification of the knowledge and technology base (Chen, Shih, & Chang, 2012; Miller, 2004) and provides enterprises with more cross-domain knowledge and resources (Leten, Belderbos, & Van Looy, 2007) to improve their absorptive capacity and integration ability (Kim, Lee, & Cho, 2016). With the help of technological diversification, enterprises transform network embeddedness resources into capabilities, improve their competitiveness, and carry out innovative activities. Therefore, technological diversification may generate a mediation mechanism between network embeddedness and innovation performance (Zhang & Tang, 2018) .

In addition, ownership is an important factor in enterprise resource dependence. In transition economies, and especially in China, state-owned enterprises (SOEs) are not only providers of public services, as in some industrial countries, but also the main contributors to economic growth and social sustainability (Kroll & Kou, 2019). During its economic transformation, China formed a pattern of coexistence of diverse forms of enterprises with state and private ownership. Besides shareholding ties, Chinese SOEs are embedded in a network composed of complex institutional links with the state. From the perspective of the network concept, the actors of SOEs’ network include government organs such as SASAC (State-owned Assets Supervision and Administration Commission of the State Council) that supervises and manages the SOEs under the supervision of the central government, ministries, in which there exists regular high-level personnel exchanges between governments and SOEs as well as financial institutions. Relational ties consist of ownership, strategic alliance, personnel and supervisory connections (Lin, 2017), for that reason, SOEs possess more social capital and political resources than private firms, so that they occupy higher opportunity to obtain national policy support (Lazzarini, Mesquita, Monteiro, & Musacchio, 2020; Lin, Cai, & Li, 1998). This connecting activity could be understood as “network hierarchy”, which presents the top-down governance features between Chinese SOEs and state institutions, and “institutional bridging”, which interprets vertically systematized fasteners combining separate components of the system (Lin & Milhaupt, 2013). Especially in the context of economic transition, embeddedness with political resources could reduce uncertainty by developing relationships with state institutions, helping firms learn how the governments operate and engender trust with bureaucrats, which increases corporate performance (Haveman, Jia, Shi, & Wang, 2017). While private entrepreneurs pursue profit maximization as the prominent objective, SOEs need to take their social responsibilities and political goals into account (Lazzarini, Mesquita, Monteiro, & Musacchio, 2020). The institutional arrangements between SOEs and political organs require the leaders of SOEs, both as managers and government officials, to ascertain the security of state assets and fulfill administrative targets (Li & Xia, 2008). For those reasons political resources may also decrease the incentive of SOEs to attempt high-risk cooperate strategies to chase long-term returns such as innovation activities. This discrepancy of the previous studies makes it necessary to investigate the network embeddedness of SOEs in more dimensions.

Thus, based on resource dependence theory, this study introduces technological diversification as a mediating variable and establishes a mediating model of “network embeddedness—diversified technology—innovation performance”. Additionally, considering the influence of enterprise ownership on enterprise resource dependence, this study explores the moderating role of ownership in the relationship between network embeddedness and innovation performance.

Our paper makes several contributions to the literature. First, we analyze the inverted U-shaped relationship between relational embeddedness and innovation performance and deepen the relationship between network embeddedness and innovation. Relational embeddedness is an essential channel through which companies obtain resources, and the negative effects of excessive embeddedness should also be considered (Andersen, 2013; Uzzi, 1997). Second, using resource dependence theory, we explore the mediating path of technological diversification and expand the research of network embeddedness on the mediation mechanism of innovation performance. Most existing studies, which concentrate on the direct effect between network embeddedness and innovation performance, regard the relationship mechanism as a black box (Zhang & Tang, 2018). This research introduces technological diversification as a mediating variable and considers it a key way to reduce network dependence. It is helpful to further understand the relationship between network embeddedness and innovation performance. Third, regarding the resource dependence of SOEs, this paper explores the moderating effect of enterprise ownership by expanding the application scope of resource dependence theory. In China, SOEs have obvious advantages in resource acquisition and possession, which gives them more substantial power in resources (Lin et al., 1998) and makes them less dependent on network embeddedness in relation to innovation performance.

Conceptual background and research hypothesisNetwork embeddedness and innovation performanceEmbeddedness theory provides a theoretical basis and analytical framework for social network analysis. It combines the indicators of social networks with embeddedness and establishes a connection between economics and organizational strategy. Granovetter (1985) proposed a basic analytical framework for embeddedness, including relational embeddedness and structural embeddedness. Relational embeddedness focuses on the strength and continuity of the relationship between social actors and emphasizes the social capital created by network relationships (Coleman, 1988), while structural embeddedness gives more attention to the subject in the network concentrating on network information transmission and bridging relationships (Burt, 1992; Granovetter, 1973).

① Relational embeddedness and innovation performance

According to resource-based theory, relational embeddedness is essential social capital of an enterprise (Coleman, 1988) and is conducive to the enterprise's acquisition of innovative information and resources. It is mainly manifested in three aspects. First, the channels for enterprise resource acquisition should be improved (Laursen & Salter, 2014). A higher level of relationship embeddedness is represented by more corporate connections. Enterprises obtain more innovation resources through these connections and complementary assets from different connections (Teece, 1986). Second, relational embeddedness reduces enterprises’ search cost and helps them obtain the approach to innovation from a variety of channels, which expands the search radius and reduces the transaction cost in the search process (Koka & Prescott, 2008). Third, relational embeddedness can reduce the information asymmetry among enterprises which will be inevitably confronted with various opportunistic risks and "free-riding" phenomena in the network (Williamson, 1971). Higher relational embeddedness increases corporate information sources and generates trust and reciprocity (Gouldner, 1960), which will help enterprises improve their innovation performance.

However, the “over-embeddedness” of relational embeddedness also hurts innovation performance (Andersen, 2013; Uzzi, 1997). First, relational over-embeddedness raises the costs of information screening for companies (Andersen, 2013), because relational embeddedness brings a variety of mixed information to enterprises, so that they have to invest a considerable amount to choose the information that is useful for their innovation. The investment in information filtering exerts a crowding-out effect on innovation. Second, relational over-embeddedness may lead to corporate information leakage (Poppo, Zheng Zhou, & Zenger, 2003). The prerequisite for network embeddedness to provide resources for enterprises is seen as reciprocal behavior between enterprises, which exchange resources and share information with related counterparts. At the same time, relational over-embeddedness exposes various information and resources of the enterprise itself. Third, relational over-embeddedness results in the homogenization of knowledge, which causes path dependence (Andersen, 2013). Enterprises tend to cooperate and communicate with similar firms. For that reason, an enterprise's relational over-embeddedness leads to the homogeneity of enterprise network knowledge (Andersen, 2013) and enterprises would likely seek solutions in their network. The homogenization of knowledge caused by over-embeddedness will lock the company onto a particular technological track (Leonard-Barton, 1992) and hinder the company's innovation.

Accordingly, there is a nonlinear relationship between relational embeddedness and innovation performance. This study proposes the following hypothesis:

H1a: There is an inverted U-shaped relationship between network relational embeddedness and innovation performance.

② Structural embeddedness and innovation performance

Structural embeddedness reflects the positional and "bridge role" of enterprises in the network (Burt, 1992; Goduscheit, Khanin, Mahto, & McDowell, 2021; Tiwana, 2008). The structural hole theory proposed by Burt provides an essential theoretical basis for studying structural embeddedness. According to this theory, enterprises that occupy structural holes play a bridging role between two network players that are not directly connected and have more information advantages and resource benefits (Burt, 1992; Guan & Liu, 2016). First, enterprises with structural embeddedness enjoy more information advantages and thus obtain more heterogeneous knowledge to acquire information, which is helpful to improve innovation performance. Second, structural embeddedness helps companies obtain diverse resources (Goduscheit et al., 2021; Tiwana, 2008). Innovation is a complex process that involves technological invention and commercialization. Complementary technologies and knowledge are needed at different stages of innovation (Teece, 1986). Enterprises with structural embeddedness rely on their advantageous positions to integrate various heterogeneous resources and transform them into productivity to promote innovation performance. Third, structural holes are present in nonredundant cooperative relationships between enterprises (Burt, 1992; Phelps, Heidl, & Wadhwa, 2012). Because enterprises occupying structural holes obtain more effective relationships, it helps to reduce the management costs of social networks and ascertain investment in innovation. Therefore, we believe that the structural embeddedness of enterprises has a positive effect on the innovation performance, and the hypothesis can be formulated as:

H1b: When the embedded network has more structural holes, the innovation performance is better.

Mediating role of technological diversificationTechnological diversification is viewed as a manifestation of enterprise technology and knowledge breadth and a vital determinant for improving enterprise absorptive capacity (Lin & Chang, 2015) and reducing enterprise R&D costs (Chen et al., 2012). From the perspective of resource dependence theory, enterprises internalize network resources into their own capabilities through technological diversification to enhance their competitiveness and power in the network, which decreases the external dependence. Related research also shows that technological diversification can be utilized as a mediating variable between corporate strategy and performance (Zhang & Tang, 2018). Using patent data in the emerging nanobiopharmaceutical field, Zhang & Tang (2018) suggest that partners’ organizational diversity and geographical diversity may affect their innovation performance due to technological diversification. Thus, an enterprise's network embeddedness is likely to influence its innovation performance through technological diversification.

First, network embeddedness enhances enterprises’ absorptive capacity by improving technological diversification (Zhang & Tang, 2018). Absorptive capacity plays a crucial mediating role in the creation of knowledge and technological innovation by enterprises (Julien, Andriambeloson, & Ramangalahy, 2004). Enterprises can only increase their innovation performance after being embedded in the network by obtaining resources for digestion and absorption, because network embeddedness advantages help them engage in self-learning of prior knowledge and cross-breeding of different technologies through technological diversification (Chen et al., 2012) and build stronger absorptive capacity (Alonso-Borrego & Forcadell, 2010; Cohen & Levinthal, 1990). Second, technology diversification reduces R&D costs and R&D risks. Enterprises that integrate network resources to innovate in different fields through technological diversification can balance R&D capabilities through scope effects and reduce innovation costs and R&D risks (Chen et al., 2012), thereby improving R&D efficiency and shortening the R&D cycle. Third, companies continue to exchange resources with the environment, and if companies want to survive for a long time, they need to reduce their dependence on external resources (Pfeffer & Salancik, 1978). Network embeddedness is the main way for enterprises to exchange resources with the external environment, while technological diversification is seen as a critical way to reduce their dependence on external resources. In summary, by integrating network embedded resources, enterprises carry out technological diversification, extend their product chain, reduce dependence on external resources, and improve enterprise innovation performance.

Based on the above analysis, the following hypotheses are proposed:

H2a: Technological diversification has a mediating effect on the relationship between relational embeddedness and innovation performance.

H2b: Technological diversification has a mediating effect on the relationship between structural embeddedness and innovation performance.

Moderating role of state ownershipAccording to resource dependence theory, cooperation as an open system depends on external environment, which influences organizational behavior. In order to reduce environmental dependence and uncertainty, organizations could act to diminish others’ power over them, which is characterized by the control over essential resources (Hillman, Withers, & Collins, 2009; Pfeffer & Salancik, 1978; Ulrich & Barney, 1984). The relationship between organization and government has been a central field of resource dependence theory. Because organizations can hardly reduce interdependence on the social system including state organs, they attempt to use political means to change the condition of the external economic environment, such as engaging in cooperate political action (Pfeffer & Salancik, 1978).

① Relational embeddedness of SOEs

The relational embeddedness of enterprises provides various innovative resources for enterprises and increases their social capital. Based on resource dependent theory, the focal organization is not particularly dependent on the external environment, regardless of how important the resource is (Pfeffer & Salancik, 1978). SOEs are less dependent than non-SOEs on relational embeddedness resources. The reasons are as follows: First, due to their special status and the political influence, SOEs can obtain not only more R&D investment funds but also bank loans at a lower cost to support enterprise innovation (Chen, Li, & Tillmann, 2019; Wei & Wang, 1997), which reduces their dependence on network embeddedness. The state has a greater policy inclination toward SOEs (Lazzarini et al., 2020; Tõnurist, 2015), which also means that private enterprises cannot compete fairly with public ones in the market and are in a disadvantaged position. Therefore, non-SOEs rely more on external networks to improve their innovation performance through network embeddedness.

Second, the political status of SOE managers reduces the efficiency of network resource allocation. Conflicts of interest between principals and agents in SOEs (Lazzarini et al., 2020) could lead to the deviation of the managers’ target and abuse the network embeddedness resources of SOEs to carry out rent-seeking behaviors (Shaheer, Yi, Li, & Chen, 2019), such as transferring benefits through cooperative relationships, which diminishes the efficiency of SOE network resource allocation and weakens the influence of network embeddedness on the innovation output of enterprises.

Third, unlike in private and foreign firms, the leaders of SOEs are not only managers but also government officials who tend to pursue social responsibilities and administrative tasks instead of profit maximization (Lin, Cai, & Li, 1998). Considering the balance between corporate benefits and corporate responsibilities, state ownership has a crowding-out effect on enterprises’ innovation performance when they fulfill their social responsibilities. In addition, SOEs’ strategic decision-making is directly or indirectly interfered with by the government, and they often undertake basic strategic research with higher risks and lower economic profits in innovation and R&D investment, which weakens the impact of relational embeddedness.

Accordingly, we believe that SOEs mitigate the impact of relational embeddedness on innovation performance due to the particularity of their property rights, and we propose the following hypothesis:

H3a: The inverted U-shaped relationship between relational embeddedness and innovation performance is weaker in SOEs than in non-SOEs.

③ Structural embeddedness of SOEs

SOEs have more information and resource advantages due to their close connection with the government, as a result of which they enjoy preferential treatment in national policies and make prompt corresponding adjustments to their innovation and R&D strategies. At the same time, SOEs’ soft budget constraints ensure that they receive timely assistance from the state in the face of financial crises and effectively guarantee the implementation of their innovative strategies (Lin & Tan, 1999; Woo, 2019). Moreover, the state ownership and the political background of the managers strengthen the role of structural embeddedness in promoting innovation performance. Unlike the privatized nature of private enterprises, SOEs have the “guarantee” and “endorsement” of the government. Consequently, SOEs can take advantage of information and resources from structural embeddedness and integrate heterogeneous network resources to improve innovation performance.

Therefore, we argue that the ownership of SOEs strengthens the positive impact of structural embeddedness on innovation performance and suggest the following hypothesis:

H3b: The network structural embeddedness of SOEs has a stronger role in promoting innovation performance than that of non-SOEs.

Research designSamples and dataThis research conducted an empirical analysis by merging the following two databases: (1) patent data from the Chinese State Intellectual Property Office, which contains all patent application information from 1985 to 2017, including the patent number, application time, patentee, and International Patent Classification (IPC); and (2) the financial data of listed companies from the China Stock Market & Accounting Research Database (CSMAR), including basic information from 2004 to 2016. We established a dataset containing the patent and the financial data of 1193 listed companies with 239,632 invention patents. Following the methods in literature, based on the joint patent application, a five-year time window was used to build a collaboration innovation network among research institution, universities and enterprises. Considering the hysteresis and possible endogeneity, this paper utilized a longitudinal analysis to test the hypothesis (Guan & Liu, 2016; Wang et al., 2014), namely using the first five years (t-5 years to t-1 year) of the data network to explain the technological diverfication and innovation performance in the year t. This process required that a company has at least one patent during the previous five years and in the subsequent observation year. The final sample consists of 5780 patents from 942 enterprises.

VariablesDependent variableAlthough some scholars use new product sales to measure innovation (Griliches, 1979; Liu & Buck, 2007), from the perspective of technology, patent-based variables could reflect the innovation performance of enterprises more accurately in developing countries such as China. New product sales may be overrecorded by firms to gain more subsidies from local authorities, while patents focus on the technological improvement and creation, so patent-based variables have a strong correlation with R&D. Besides, the patent-based variables are reliable and accurate proxy for innovation activities (Acs, Anselin, & Varga, 2002; Ning, Wang, & Li, 2016), such as patentees, application times, IPCs, and other information over time (Nagaoka, Motohashi, & Goto, 2010). The empirical study in the context of China suggests that controlling for subsidies and other variables, patents can still stand for innovation activities in China (Dang & Motohashi, 2015).

In addition, we argue that patent application data may be more suitable for our study than patent grants: First, patent application data include complete innovation information. Because of strict examination procedures for patent grants, some patents cannot meet the standards for format and content, which leads to the loss of information in patent grant data. Second, patent application data provide timelier information on performance, while patent grants require several processes, such as a preliminary examination, a substantive examination and grants, which take several years to finally be granted (Li, 2015).

In conclusion, we use the number of patent applications in logarithmic form to measure innovation performance. Considering the zero patent applications, we add one to the patent applications and then take the logarithmic form.

Independent variables① Relational embeddedness stands for the strength of the relationship between enterprises and other innovation subjects. It is measured by the network centrality of the enterprises. It is formulated as follows:

where i stands for a target node, and j is the node other than i. If i is related to j, then Xji is equal to 1, otherwise Xji is 0.② Structural embeddedness is measured by the number of enterprises’ structural holes in the network. This study uses network efficiency to measure structural holes. The formula is written as follows:

where i is the target node, j represents the node except i, q represents the third node other than i and j, and Piq stands for the proportional strength between i and q.Mediating variablesWe measure technological diversification using the entropy index of the firm's technical fields. Considering the different types of technologies, this paper categorizes their technical fields at the four-digit level (IPC-4). The model is formulated as the following equation:

where Pi represents the share of the company's IPC-4 patents (namely i). N is the number of IPC-4 patents. There is a positive correlation between the entropy value and technology diversification.Moderating variablesTo explore the moderation effect of state ownership, following existing studies (Luo, Zhang, & Zhu, 2011) we adopt the proportion of state-owned shares among the top ten shareholders, who have a profound influence on decision-making.

Control variablesThis study also controls several other variables that may impact innovation performance, including profitability, equity concentration, and firm size. Since a company's profitability determines its ability to carry out R&D activities to an extent, ROE is used to measure the profitability of a business (Qian & Li, 2003). Ownership concentration represents the ability of major shareholders to control the company. For instance, in an enterprise where the ownership concentration stays at a high level, major shareholders may adjust R&D investment to affect corporate innovation performance to increase their interests (Lee & O'Neill, 2003). In order to quantify this factor, we measure the ownership concentration by the proportion of the largest shareholder's equity. As to the firm size, large companies tend to contribute more to innovation because of their better access to social capital, resources and funds. In the previous research there is also evidence that firm size is positively associated with patent applications (Fischer & Henkel, 2012). In our paper, we utilize the logarithm of the number of employees and the logarithm of the total assets of the company. The meanings and symbolic representations of the main variables are shown in Table 1.

Main variable names, symbols and meanings.

| variable | name | symbol | meaning |

|---|---|---|---|

| Dependent variable | Innovation performance | Inn | The number of patent applications (in logarithm scale) |

| Independent variable | Relational embeddedness | RE | Centrality in the network |

| Structure embeddedness | SH | Structural holes occupied by enterprise | |

| Mediating variable | Technology diversification | TD | The entropy index of IPC-4 involved in the patent |

| Moderator | Nature of property rights | SOE | the proportion of state-owned share among the top 10 shareholders. |

| Control variable | Profitability | ROE | Return on equity |

| Equity concentration | shrcr | Proportion of the largest shareholder | |

| Enterprise size | Emp | number of employees (in logarithm scale) | |

| Toass | Total assets at the end of the year (in logarithm scale) |

To test the influence of enterprise network embeddedness on innovation performance, the mediating role of technological diversification, and the moderating role of ownership, the following econometric model is constructed:

where Innitrepresents the innovation performance of a company; Netitstands for its network embeddedness, including relational embeddedness and structural embeddedness; TDitis the company's technological diversification level; and Zitrepresents a vector of the control variables, including the return on net assets, equity concentration, and corporate size. μit stands for the unobserved effect, and εitis the random disturbance.Formula 4 is used to test the impact of network embeddedness on innovation performance. Formula 5 tests the effect of network embeddedness on technological diversification, and Formula 6 tests the mediating effects of technological diversification based on the step-by-step test method (Brockman, Khurana, & Zhong, 2018). Formula 7 tests the moderating role of ownership by introducing ownership and its interactive terms with network embeddedness.

This paper uses a panel regression to test the hypotheses. We conduct a Hausman test at first. The results show a significant correlation between the explanatory variables and unobservable variables (P < 0.05); thus, the fixed effects model is adopted. In addition, this study further controls the year and estimates the dual fixed utility model.

Empirical analysisDescriptive statistics and correlation analysisTable 2 summarizes the descriptive statistical analysis results such as the mean, standard deviation, correlation coefficient matrix, and variance inflation factor (VIF) of the variables. The VIF value of each variable is less than 5, which proves that there is no serious multicollinearity.

Descriptive statistics and correlation analysis.

| variable | Mean | SD | Inn | RE | SH | TD | ROE | Toass | Shrcr | Emp |

|---|---|---|---|---|---|---|---|---|---|---|

| INN | 34.93 | 2337 | —— | |||||||

| RE | 2.92 | 10.69 | 0.43*** | 1.36 | ||||||

| SH | 0.50 | 0.47 | 0.29*** | 0.23*** | 1.10 | |||||

| TD | 1.43 | 1.22 | 0.72*** | 0.41*** | 0.18*** | 1.30 | ||||

| SOE | 0.21 | 0.24 | 0.11*** | 0.19*** | 0.17*** | 0.13*** | 1.44 | |||

| ROE | 0.00 | 0.01 | 0.01 | 0.00 | 0.02 | 0.03 | 1.00 | |||

| Toass | 3.66 | 1.49 | 0.41*** | 0.33*** | 0.21*** | 0.32*** | −0.02 | 3.50 | ||

| Shrcr | 35.55 | 15.11 | 0.10*** | 0.19*** | 0.06*** | 0.09*** | −0.01 | 0.27*** | 1.27 | |

| Emp | 8.03 | 1.29 | 0.42*** | 0.31*** | 0.20*** | 0.32*** | −0.04** | 0.84*** | 0.27*** | 3.37 |

Note: *, **, *** mean P<0.1, P<0.05, P<0.01, respectively. The diagonal line represents the VIF value of the variable.

Table 3 reports the results regarding the effect of network embeddedness on innovation performance. Model 1 contains only the control variables. Model 2 includes relational embeddedness. Model 3 includes structural embeddedness. Model 4 is the full model, which contains relational embeddedness and structural embeddedness. We use a three-step procedure to test the inverse-U relationship between relational embeddedness and innovation performance (Lind & Mehlum, 2010).

Results of hypothesis test.

| Model | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| RE | 0.547*** | 0.507*** | 0.472*** | 0.445*** | ||||

| (0.05) | (0.05) | (0.05) | (0.05) | |||||

| RE2 | −0.017*** | −0.016*** | −0.015*** | −0.014*** | ||||

| (0.00) | (0.00) | (0.00) | (0.00) | |||||

| S H | 0.306*** | 0.234*** | 0.242*** | 0.194*** | ||||

| (0.04) | (0.04) | (0.04) | (0.04) | |||||

| ROE | 2.290** | 2.214** | 2.140** | 2.105** | 1.940** | 1.938** | 1.843* | 1.861* |

| (1.00) | (0.97) | (0.99) | (0.97) | (0.98) | (0.96) | (0.98) | (0.96) | |

| Toass | 0.385*** | 0.277*** | 0.352*** | 0.259*** | 0.174*** | 0.135*** | 0.170*** | 0.134*** |

| (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | |

| Shrcr | −0.048* | −0.057** | −0.032 | −0.044 | −0.007 | −0.029 | −0.000 | −0.022 |

| (0.03) | (0.03) | (0.03) | (0.03) | (0.03) | (0.03) | (0.03) | (0.03) | |

| Emp | 0.153*** | 0.149*** | 0.139*** | 0.139*** | 0.130*** | 0.131*** | 0.121*** | 0.124*** |

| (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | |

| constant | −0.380 | −0.056 | −0.356 | −0.061 | −0.057 | 0.120 | −0.083 | 0.088 |

| (0.30) | (0.29) | (0.30) | (0.29) | (0.30) | (0.30) | (0.30) | (0.30) | |

| N | 3641 | 3641 | 3641 | 3641 | 3641 | 3641 | 3641 | 3641 |

| R2 | 0.114 | 0.162 | 0.130 | 0.171 | 0.153 | 0.187 | 0.163 | 0.193 |

| Year | N | N | N | N | Y | Y | Y | Y |

Note: *, **, *** mean p<0.1, p<0.05 and p<0.01, respectively.

We test the inverted U-shaped relationship between network relational embeddedness and innovation performance in three steps (Haans, Pieters, & He, 2016). First, the linear term of relational embeddedness affects innovation performance positively and significantly, and its quadratic term has a negative and significant impact on innovation performance in Model 2. Second, the slopes of the upper and lower bounds are 0.55 and −0.35, respectively, and both are significant. Third, the turning point is 15.64, which is located well within the data range. Therefore, we believe that there is an inverted U-shaped relationship between network relational embeddedness and innovation performance. H1a is supported. The coefficient of structural embeddedness is positive and significant at the 5% level (p <0.05) in Model 3, which indicates that structural embeddedness has a significant positive impact on innovation performance. H1b is supported. In the full model (Model 4), the above results are robust. Besides, we control the year with a dummy variable (Model 5-Model 8) to test the disturbance terms that may vary over time. The results also remain robust.

Mediation testTable 4 reports the results of the mediation test. We test the mediating effect of technological diversification with the step-by-step test method.

The results of mediation test.

| Variable | Model1 | Model2 | Model3 | Model4 | Model5 |

|---|---|---|---|---|---|

| TD | INN | TD | INN | INN | |

| RE | 0.158*** | 0.375*** | 0.349*** | ||

| (0.02) | (0.04) | (0.04) | |||

| RE2 | −0.005*** | −0.012*** | −0.011*** | ||

| (0.00) | (0.00) | (0.00) | |||

| SH | 0.086*** | 0.210*** | 0.165*** | ||

| (0.02) | (0.04) | (0.04) | |||

| TD | 1.085*** | 1.120*** | 1.075*** | ||

| (0.04) | (0.04) | (0.04) | |||

| ROE | 0.932** | 1.203 | 0.912** | 1.118 | 1.135 |

| (0.45) | (0.84) | (0.46) | (0.85) | (0.84) | |

| Toass | 0.054*** | 0.218*** | 0.076*** | 0.267*** | 0.206*** |

| (0.02) | (0.03) | (0.02) | (0.03) | (0.03) | |

| Shrcr | −0.008 | −0.049** | −0.001 | −0.031 | −0.040 |

| (0.01) | (0.02) | (0.01) | (0.02) | (0.02) | |

| Emp | 0.036* | 0.110*** | 0.033* | 0.102*** | 0.104*** |

| (0.02) | (0.03) | (0.02) | (0.04) | (0.03) | |

| _cons | −0.165 | 0.122 | −0.251* | −0.074 | 0.117 |

| (0.14) | (0.25) | (0.14) | (0.25) | (0.25) | |

| N | 3641 | 3641 | 3641 | 3641 | 3641 |

| r2 | 0.051 | 0.376 | 0.036 | 0.362 | 0.381 |

Note: *, **, *** indicate p<0.1, p<0.05 and p<0.01, respectively.

As for Hypothesis 2, the results in Model 1 demonstrate that linear term of relational embeddedness positive and significant impact technological diversification and its quadratic term has a negative and significant influence on technological diversification. The three-step procedure supports the inverse U-shaped relationship. Then, we introduce both network embeddedness and technology diversification into the Model 2. The results show that there is an inverted U-shaped relationship between network relational embeddedness and innovation performance. The effect of technological diversification on innovation performance is significantly positive. Accordingly, technological diversification has a mediating effect on the relationship between relational embeddedness and innovation performance. H2a is supported. Similarly, we test the mediating effect between structural embeddedness and innovation performance. In Model 3, structural embeddedness has a positive and significant impact on technological diversification. In Model 4, both structural embeddedness and technological diversification have positive and significant impact on innovation performance. Therefore, technological diversification has a mediating effect on the relationship between structural embeddedness and innovation performance. H2b can be confirmed. The results of the full model (Model 5) also support H2a and H2b.

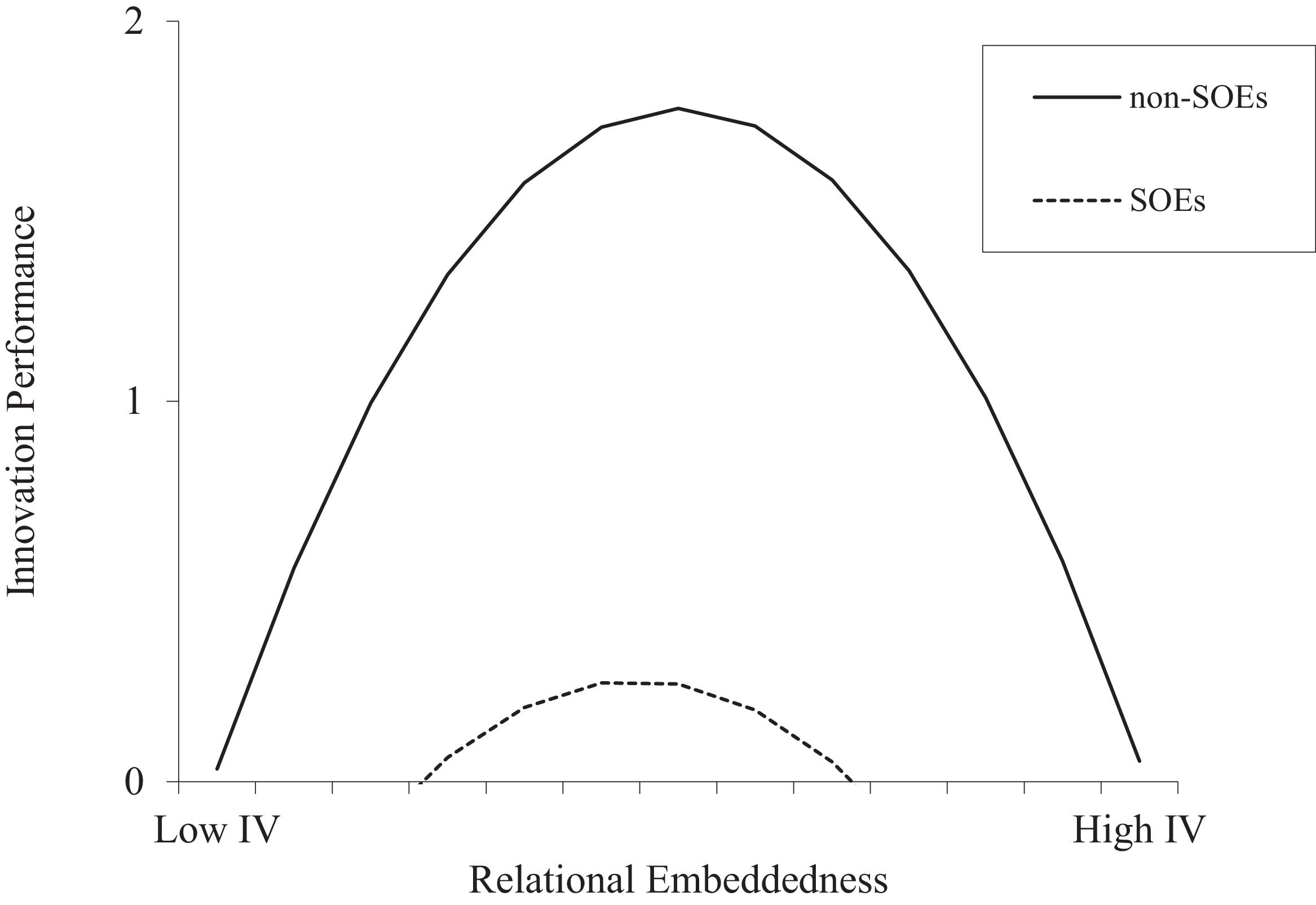

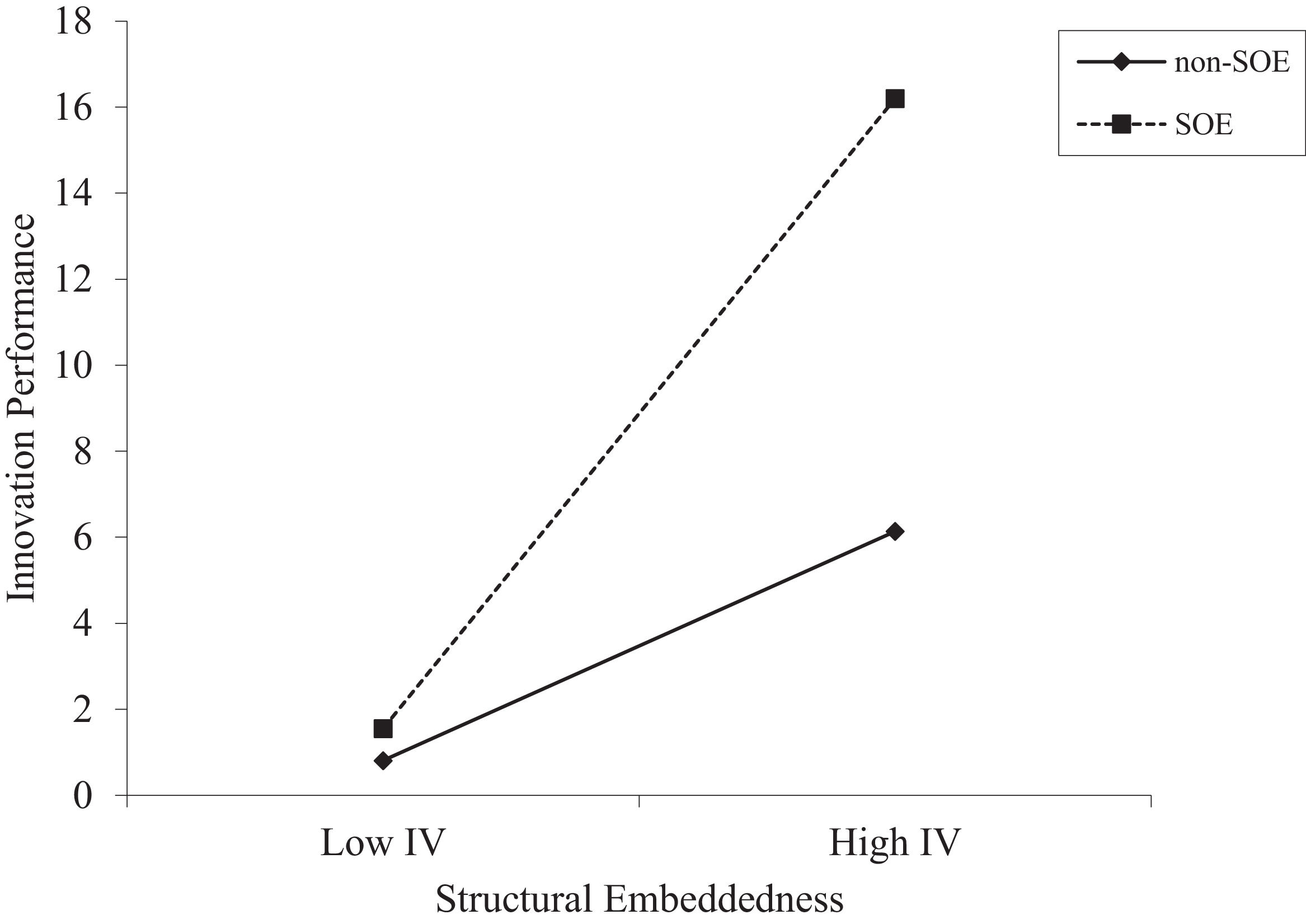

Moderation testTable 5 illustrates the results of the moderation test. In the Model 1, the interaction term (SRE) between the proportion of state-owned share and the linear term of relational embeddedness has significant and positive effect on innovation performance, while the interaction term (SRE2) between the proportion of state factor and the its quadratic term has a significant and negative effect on innovation, which indicates that the inverted U-shaped relationship between relational embeddedness and innovation performance is weaker for SOEs than for non-SOEs. H3a is supported. In Model 2, the interaction term (SSH) between state-owned factor and structural embeddedness is associated positively with innovation performance. For SOEs, structural embeddedness has a stronger impact on innovation performance. H3b is confirmed.

Results of Moderation Test.

| Variable | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| RE | 1.026*** | 1.954 | |

| (0.10) | (0.31) | ||

| RE2 | −0.156 | −0.143 | |

| (0.02) | (0.02) | ||

| SH | 0.213*** | 0.130 | |

| (0.06) | (0.16) | ||

| SOE | −1.648 | −1.123*** | −2.764 |

| (0.73) | (0.38) | (1.55) | |

| SRE | −0.825*** | −0.815*** | |

| (0.17) | (0.23) | ||

| SRE2 | 0.090*** | 0.083*** | |

| (0.02) | (0.02) | ||

| SSH | 2.182** | 2.147** | 2.095*** |

| (0.97) | (0.99) | (0.64) | |

| ROE | 0.259*** | 0.358*** | 0.248*** |

| (0.04) | (0.04) | (0.05) | |

| Toass | −0.019 | −0.008 | −0.015 |

| (0.03) | (0.03) | (0.05) | |

| Shrcr | 0.151*** | 0.144*** | 0.138** |

| (0.04) | (0.04) | (0.07) | |

| Emp | 0.373** | 0.498** | |

| (0.17) | (0.23) | ||

| _cons | 0.003 | −0.255 | 0.072 |

| (0.29) | (0.30) | (0.57) | |

| N | 3641 | 3641 | 3641 |

| r2 | 0.175 | 0.134 | 0.183 |

Note: *, **, *** indicate p<0.1, p<0.05 and p<0.01, respectively. SRE, SRE2, SSH indicate the interact term between network embeddedness and SOE.

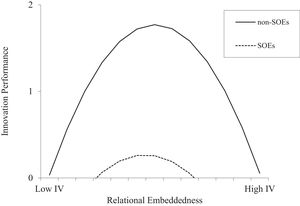

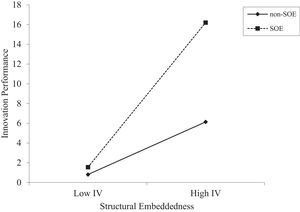

In addition, we draw schematic diagrams of the moderating variable for a better demonstration of the moderating effect of state ownership. Fig. 2 shows the relationship between the relational embeddedness and innovation performance of SOEs and non-SOEs. It is found that the inverted U-shaped curve of SOEs is gentler than that of non-SOEs. Fig. 3 presents the relationship between the structural embeddedness and innovation performance of SOEs and non-SOEs. The SOEs have an even greater slope than non-SOEs.

Robustness testResidual regressionThis study may have measurement errors of relational embeddedness, structure embeddedness and technology diversification. Therefore, we use a two-stage error regression (2SRI) to check the robustness of our results (Terza, 2017). First, we define relational embeddedness, structure embeddedness and technology diversification as the dependent variables and then take the control variables as the independent variables. Regression is performed to control the related variables’ interference and save the residuals. Second, we repeat the hypothesis tests by using the residuals to replace the three independent variables (Table 6).

Results of Residual Regression.

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| INN. | INN | TD | INN. | TD | INN | INN | INN | |

| r_RE | 0.308*** | 0.099*** | 0.259*** | 1.082*** | ||||

| (0.05) | (0.02) | (0.05) | (0.10) | |||||

| r_RE2 | −0.008*** | −0.003** | −0.007*** | −0.079*** | ||||

| (0.00) | (0.00) | (0.00) | (0.01) | |||||

| r_SE | 0.272*** | 0.048 | 0.205** | 0.257*** | ||||

| (0.10) | (0.05) | (0.10) | (0.06) | |||||

| r_TD | 4.091*** | 4.524*** | ||||||

| (0.60) | (0.60) | |||||||

| SOE | −1.862 | −1.002*** | ||||||

| (0.73) | (0.38) | |||||||

| r_SRE | −0.967*** | |||||||

| (0.17) | ||||||||

| r_SRE2 | 0.095*** | |||||||

| (0.02) | ||||||||

| r_SSE | 0.192 | |||||||

| (0.18) | ||||||||

| ROE | 2.765*** | 2.644*** | 0.994** | −1.349 | 0.978** | −1.871 | 2.217** | 2.318** |

| (1.00) | (1.01) | (0.49) | (1.16) | (0.49) | (1.16) | (0.97) | (0.99) | |

| Toass | 0.266*** | 0.316*** | 0.062*** | −0.078 | 0.082*** | −0.070 | 0.385*** | 0.390*** |

| (0.04) | (0.04) | (0.02) | (0.07) | (0.02) | (0.07) | (0.04) | (0.04) | |

| Shrcr | −0.039 | −0.014 | 0.010 | −0.089*** | 0.015 | −0.075** | −0.012 | −0.020 |

| (0.03) | (0.03) | (0.02) | (0.03) | (0.02) | (0.04) | (0.03) | (0.03) | |

| Emp | 0.183*** | 0.167*** | 0.034 | 0.047 | 0.031 | 0.020 | 0.176*** | 0.160*** |

| (0.05) | (0.05) | (0.02) | (0.05) | (0.02) | (0.05) | (0.04) | (0.04) | |

| _cons | −0.151 | −0.212 | −0.193 | 0.885** | −0.235 | 0.932** | −0.491* | −0.325 |

| (0.34) | (0.35) | (0.17) | (0.37) | (0.17) | (0.38) | (0.29) | (0.30) | |

| N | 2826 | 2826 | 2826 | 2826 | 2826 | 2826 | 3641 | 3641 |

| r2 | 0.117 | 0.099 | 0.033 | 0.137 | 0.023 | 0.124 | 0.176 | 0.133 |

Moreover, in order to check the possible endogeneity, we run an instrumental regression, in which the lagged terms of the independent variables and mediating variables are applied as instrumental variables. Table 7 shows the results of the instrumental variable regression with two-stage least square method.

Results of IV Regression.

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

|---|---|---|---|---|---|---|---|---|

| Dependent variable | INN. | INN | TD | INN. | TD | INN | INN | INN |

| iv_RE | 0.308*** | 0.099*** | 0.259*** | 0.486*** | ||||

| (0.05) | (0.02) | (0.05) | (0.11) | |||||

| iv_RE2 | −0.008*** | −0.003** | −0.007*** | −0.033*** | ||||

| (0.00) | (0.00) | (0.00) | (0.01) | |||||

| iv_SE | 0.272*** | 0.048 | 0.205** | −0.012 | ||||

| (0.10) | (0.05) | (0.10) | (0.13) | |||||

| iv_TD | 4.091*** | 4.524*** | ||||||

| (0.60) | (0.60) | |||||||

| SOE | −1.074 | −0.439 | ||||||

| (0.94) | (0.48) | |||||||

| iv SRE | −0.273 | |||||||

| (0.18) | ||||||||

| iv_SRE2 | 0.037** | |||||||

| (0.01) | ||||||||

| iv_SSE | 1.217*** | |||||||

| (0.37) | ||||||||

| ROE | 2.765*** | 2.644*** | 0.994** | −1.349 | 0.978** | −1.871 | 2.733*** | 2.542** |

| (1.00) | (1.01) | (0.49) | (1.16) | (0.49) | (1.16) | (1.00) | (1.01) | |

| Toass | 0.266*** | 0.316*** | 0.062*** | −0.078 | 0.082*** | −0.070 | 0.261*** | 0.322*** |

| (0.04) | (0.04) | (0.02) | (0.07) | (0.02) | (0.07) | (0.04) | (0.04) | |

| Shrcr | −0.039 | −0.014 | 0.010 | −0.089*** | 0.015 | −0.075** | −0.017 | −0.011 |

| (0.03) | (0.03) | (0.02) | (0.03) | (0.02) | (0.04) | (0.04) | (0.04) | |

| Emp | 0.183*** | 0.167*** | 0.034 | 0.047 | 0.031 | 0.020 | 0.183*** | 0.164*** |

| (0.05) | (0.05) | (0.02) | (0.05) | (0.02) | (0.05) | (0.05) | (0.05) | |

| _cons | −0.151 | −0.212 | −0.193 | 0.885** | −0.235 | 0.932** | −0.110 | −0.143 |

| (0.34) | (0.35) | (0.17) | (0.37) | (0.17) | (0.38) | (0.34) | (0.35) | |

| F | 44.66*** | 44.44*** | 11.54*** | 45.70*** | 9.66*** | 47.48*** | 30.72*** | 33.66*** |

| R2 | 0.117 | 0.099 | 0.033 | 0.137 | 0.023 | 0.124 | 0.121 | 0.105 |

| N | 2826 | 2826 | 2826 | 2826 | 2826 | 2826 | 2826 | 2826 |

We change the method of hypothesis testing to test the robustness of the results. We have utilized the number patent applicants in log to test the hypotheses. Because the number of patent applications is a nonnegative integer, and the variance of the sample is much larger than the mean, this paper re-tests the hypotheses with the negative binomial regression method (Table 8).

Results of Negative Binomial Regression.

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

|---|---|---|---|---|---|---|---|---|

| Dependent variable | INN. | INN | TD | INN. | TD | INN | INN | INN |

| RE | 0.321*** | 0.219*** | 0.160*** | 0.818*** | ||||

| (0.02) | (0.02) | (0.01) | (0.06) | |||||

| RE2 | −0.008*** | −0.006*** | −0.003*** | −0.052*** | ||||

| (0.00) | (0.00) | (0.00) | (0.01) | |||||

| SE | 0.390*** | 0.100*** | 0.278*** | 0.295*** | ||||

| (0.04) | (0.02) | (0.03) | (0.05) | |||||

| TD | 0.961*** | 0.921*** | ||||||

| (0.03) | (0.03) | |||||||

| SOE | −0.265 | −0.550*** | ||||||

| (0.22) | (0.13) | |||||||

| SRE | −0.769*** | |||||||

| (0.09) | ||||||||

| SRE2 | 0.063*** | |||||||

| (0.01) | ||||||||

| SSE | 0.433*** | |||||||

| (0.15) | ||||||||

| ROE | 1.396* | 1.213 | 0.951** | 0.502 | 0.927** | 0.395 | 1.437* | 1.258* |

| (0.76) | (0.74) | (0.45) | (0.61) | (0.45) | (0.62) | (0.77) | (0.74) | |

| Toass | 0.073*** | 0.104*** | 0.033*** | 0.080*** | 0.057*** | 0.102*** | 0.072*** | 0.115*** |

| (0.02) | (0.02) | (0.01) | (0.02) | (0.01) | (0.02) | (0.02) | (0.02) | |

| Shrcr | −0.022 | −0.017 | −0.012* | −0.033*** | −0.004 | −0.046*** | 0.010 | −0.001 |

| (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | (0.02) | |

| Emp | 0.023 | 0.004 | 0.033*** | 0.018 | 0.035*** | −0.023 | 0.012 | 0.011 |

| (0.03) | (0.03) | (0.01) | (0.02) | (0.01) | (0.02) | (0.03) | (0.03) | |

| _cons | 0.378** | 0.264* | −0.086 | 0.336** | −0.224*** | 0.505*** | 0.355** | 0.227 |

| (0.16) | (0.16) | (0.07) | (0.15) | (0.07) | (0.14) | (0.16) | (0.16) | |

| Wald | 761.48*** | 203.24*** | 475.86*** | 2929.55*** | 231.27*** | 1740.07*** | 806.11*** | 219.30*** |

| N | 3641 | 3641 | 3641 | 3641 | 3641 | 3641 | 3641 | 3641 |

Considering the endogeneity that may be caused by independent and mediating variables, this paper used innovation performance with a one-period lag as the dependent variable to confirm whether our results remain robust. Specifically, we use the network embeddedness data from t-6 to t-2 year to interpret technological diversification in t-1 year and innovation performance in t year (Table 9).

Results of Lagged Variables Test.

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| INN. | INN | TD | INN. | TD | INN | INN | INN | |

| L.RE | 0.577*** | 0.164*** | 0.526*** | 1.074*** | ||||

| (0.05) | (0.02) | (0.05) | (0.11) | |||||

| L.RE2 | −0.018*** | −0.005*** | −0.016*** | −0.077*** | ||||

| (0.00) | (0.00) | (0.00) | (0.01) | |||||

| L.SE | 0.300*** | 0.062** | 0.263*** | 0.169** | ||||

| (0.05) | (0.02) | (0.05) | (0.07) | |||||

| L.TD | 0.368*** | 0.422*** | ||||||

| (0.05) | (0.05) | |||||||

| SOE | −0.749 | −0.785 | ||||||

| (0.94) | (0.49) | |||||||

| SRE | −0.830*** | |||||||

| (0.18) | ||||||||

| SRE2 | 0.088*** | |||||||

| (0.02) | ||||||||

| SSE | 0.548*** | |||||||

| (0.21) | ||||||||

| ROE | 1.551 | 1.443 | −0.305 | 1.186 | −0.321 | 1.040 | 1.482 | 1.435 |

| (1.00) | (1.03) | (0.48) | (0.99) | (0.49) | (1.01) | (0.99) | (1.03) | |

| Toass | 0.325*** | 0.434*** | 0.069*** | 0.305*** | 0.103*** | 0.401*** | 0.304*** | 0.440*** |

| (0.04) | (0.04) | (0.02) | (0.04) | (0.02) | (0.04) | (0.04) | (0.04) | |

| Shrcr | −0.073** | −0.038 | −0.013 | −0.076** | −0.004 | −0.046 | −0.045 | −0.028 |

| (0.03) | (0.03) | (0.02) | (0.03) | (0.02) | (0.03) | (0.04) | (0.04) | |

| Emp | 0.141*** | 0.123** | 0.027 | 0.128*** | 0.023 | 0.111** | 0.134*** | 0.121** |

| (0.05) | (0.05) | (0.02) | (0.05) | (0.02) | (0.05) | (0.05) | (0.05) | |

| _cons | −0.092 | −0.474 | −0.127 | −0.031 | −0.236 | −0.366 | −0.029 | −0.349 |

| (0.34) | (0.35) | (0.17) | (0.34) | (0.17) | (0.34) | (0.34) | (0.35) | |

| N | 2826 | 2826 | 2826 | 2826 | 2826 | 2826 | 2826 | 2826 |

| r2 | 0.191 | 0.142 | 0.060 | 0.217 | 0.036 | 0.177 | 0.204 | 0.146 |

In summary, the results in Tables 6–9 confirm that our findings are robust. We also test the year lag of dependent variable, such as 2, 3 or 4. The results show that direct and mediating effects remain robust, but moderating effects become insignificant after a lag of 3 years. The possible reason lies in that the ownership structure is not stable and changes greatly in a certain period of time.

Conclusion and discussionMain research conclusionsThis paper builds a theoretical model of network embeddedness and innovation performance that contains the mediating role of technological diversification and that of ownership. Using financial and patent data of Chinese listed companies from 2007 to 2016, this paper empirically analyzed the influencing mechanism of network embeddedness on innovation performance. The conclusions are as follows.

Firstly, there is an inverted U-shaped relationship between relational embeddedness and innovation performance, and structural embeddedness has a significant positive impact on innovation. The relational embeddedness of enterprises in the network mainly reflects the frequency of cooperation between enterprises and other innovative entities. As suggested by prior literature (Andersen, 2013; Uzzi, 1997), this study supports the nonlinear relationship between relational embeddedness and innovation. Appropriate relational embeddedness is conducive to the improvement of corporate innovation performance, while excessive relational embeddedness could produce a "resource curse" effect, which is not conducive to innovation output. As earlier literature has demonstrated, structural embeddedness focuses on the position of the enterprise in the network, which is a nonredundant cooperative relationship between enterprises (Burt, 1992), higher structural embeddedness brings information and resource advantages to enterprises and promotes their innovation performance.

Secondly, technological diversification is an important way for enterprises to reduce their external dependence on network embeddedness and formed a moderation mechanism between relational embeddedness and innovation, and in line with Zhang and Tang (2018), we found that technological diversification mediates the positive impact of structural embeddedness on innovation performance. While acquiring resources through network embeddedness, enterprises also depend on the external environment. Enterprises are able to internalize external resources into their capabilities and enhance the power of network embeddedness through technological diversification, which reduces external dependence and improves corporate innovation capability.

Thirdly, the inverted U-shaped relationship between relational embeddedness and innovation performance is weaker in SOEs than in non-SOEs. In contrast, the positive impact of structural embeddedness on innovation performance is stronger. The advantages of SOEs’ resource acquisition afford them stronger control over resources in network embeddedness (Lazzarini et al., 2020; Lin et al., 1998). Their ability to control resources not only help them mitigate the dependence on the network, which weakens their relationship between relational embeddedness and innovation performance but also enhances their information and position advantages in the network, which strengthens the positive impact of structural embeddedness.

Management significanceThis research has some implications for management practice. First, companies should devote attention to the heterogeneous impacts of different methods of network embeddedness on innovation performance. When establishing connections with other institutions, they shall focus on the effectiveness of the relationships to avoid excessive redundant relationships that increase management costs and the inertia of network embeddedness. Moreover, it is reasonable for enterprises to attach importance to their position in the network, establish bridge relationships with the other enterprises, and enhance their position and information advantage. Second, social network resources can be used to carry out technological diversification and reduce the reliance on network embeddedness. While enterprises use network embeddedness to improve organizational innovation, they can quickly transform network embeddedness resources into their technological diversification capabilities. Third, it is suggested that the government further optimizes the allocation of innovative resources and improve SOEs’ operational efficiency by reforms.

Limitations and future researchAlthough this study makes some contributions in theory and practice, it has limitations in resources and space. First, this research starts from the perspective of resources by considering that knowledge network construction and technology diversification calculations involve IPC numbers, which may lead to a strong correlation between the two elements. Therefore, the analysis is mainly focused on the network embeddedness of enterprises and the research framework does not include the knowledge network. In future research, we will further analyze the influencing path of knowledge network embeddedness on innovation performance. Second, as to dependent variables, due to the lack of data of the innovation investment and new product sales of listed companies, this study used the number of patents to measure innovation performance, which might bring certain deviations in the research. It is also reasonable to expand the research view from innovation activities to a broader dimension of economic performance such as revenue and profit. Third, with regard to technological diversification as a mediating variable based on resource dependence theory, there might exist multiple mediating paths between network embeddedness and innovation performance. It is necessary to extend research approach by introducing additional variables such as dynamic and core capabilities in the follow-up studies.