In his groundbreaking work Sources of Innovation, Eric von Hippel discussed from where in (and out of) the value-chain innovations came in different industries: the customer, the manufacturer, the supplier, or third-party innovator (universities, research laboratories, etc.).

The world has changed, and new phenomena have become apparent. This article is a conceptual paper that discusses these new phenomena and presents a tentative updated pheno-typology of the sources of innovation, adding six to von Hippel's original four. To build these phenotypes it draws heavily on Kaulio (1998), Borrus and Zysman (1997) and Hart & Kim (2002).

As principal take-away, the consequences for knowledge production and transfer are discussed for each of the 10 phenotypes, in comparison to the in-house, non-open innovation, default phenotype.

During the 1970s and 1980s, the Schumpeterian entrepreneurship researcher Eric Von Hippel pioneered research on the sources of innovation. Von Hippel conducted many studies and wrote many articles, eventually summarized in a book – The Sources of Innovation – in 1988. Von Hippel identified four sources of innovation, three of which stemming from outside the firm: the customers, the suppliers, and third parties (universities, consultants, etc.). Strategy researcher Henry Chesbrough later arrived, independently, at the same conclusions, published in his 2003 book – Open Innovation: The new imperative for creating and profiting from technology.

Most researchers in business administration consider Chesbrough (Chesbrough, 2003; Enkel, Gassmann, & Chesbrough, 2009) the first and foremost researcher of “open innovation”. Few are familiar with Von Hippel's work on the same phenomenon, dating back to the mid-1970s and early 1980s, and hence almost 50 years ago now. Von Hippel pursued many research streams on open innovation, such as monopoly rent,1 the “stickiness” of customer needs information,2 users as the source of innovation,3 lead users as the sources of innovation,4 users as innovators,5 “open source” (Baldwin & Von Hippel, 2011; Lakhani & Von Hippel, 2003; Von Hippel & Von Krogh, 2003; Von Krogh & Von Hippel, 2006), “co-opetition” (Morrison, Roberts, & Von Hippel, 2000; Von Hippel, 1987), and the innovation process (Thomke, Von Hippel, & Franke, 1998; Tyre & Von Hippel, 1997; Von Hippel & Tyre, 1995; Von Hippel, 1990). Despite this extensive body of research (37 articles and 2 books, with more than 58,000 citations), all published in top journals (14 in Research Policy, 9 in Management Science, and a combined total of 10 in Organization Science, MIT Sloan Management Review, Journal of Product Innovation Management, Harvard Business Review, and the Journal of Marketing), Von Hippel's research is not well-known outside the field of entrepreneurship.

The world has changed substantially since then, however, and we are now experiencing a full-blown globalization (Feenstra & Hanson, 1996; Krugman & Venables, 1995; Mathews, 2006), higher volatility of capitalism, and supply chains, the strategic importance of which has increased. That capitalism is volatile is acknowledged by both classical economists, such as Marx (1894/1974), and neo-classical economists, such as Keynes (Dillard, 1981:1087). This increasing volatility is the result of shorter life cycles and increased risk, the combined effects increasing fixed costs per unit of production (see below). Companies compete embedded in networks, engage in strategic co-operation, and even co-operate with competitors (Frohlich & Westbrook, 2001:186; Stonebraker & Afifi, 2004:1132).

While neo-classical economists have argued that perfect competition is the natural state of a capitalist economy, the main objective of the fields of business administration and entrepreneurship has been to show how firms are able to differentiate themselves to reap temporary monopoly rent by establishing monopolistic competition and using a unique value or price to carve out a place in the market.6

The question is – have the changes described above fundamentally changed the sources of innovation? This paper aims to provide an answer to this question. We begin by looking at some of the forces driving the change: shorter life cycles, lower variable production costs, intellectual property, network economics, and knowledge production and transfer.

The forces behind the changeWe propose that the forces behind the increased complexity of innovation are: shorter life cycles, lower direct production costs, intellectual property, knowledge transfer, and network economics.

Shorter life cyclesEarlier studies viewed shorter life cycles (Young 1964; cited by Qualls, Olshavsky, & Michaels, 1981; Olshavsky 1980, cited by Qualls et al., 1981) as the result of increased competition. Back in the 19th century; it was not unusual for a product to exist for 100 years. Magnier, Kalaitzandonakes, and Miller (2010), on the other hand, provide such empirical evidence from a 12-year period in the US corn-hybrid industry. …corn hybrids with more advanced biotech features tend to have shorter product life cycles. (Magnier et al. (2010:33)

If we look at industry experience, rather than empirical research, the typical life cycle of a new product after World War II (WWII) was about 20 years. By the 1980s, they had dropped to 7–8 years. Today, in early 2019, product life cycles are typically 3–5 years, and for some individual products (e.g. mobile phones) as little as 3–6 months. These products may often reside within technologies with longer life cycles (7–10 years for 4G mobile networks, for example), however, and the very concept of a technology as such (e.g. the mobile phone is now 73 years old). The latter correspond to “Kondratieff cycles”, or Schumpeter's (1950) “destructive innovation cycles” (Abernathy & Clark, 1985; Pisano, 1990).

In Schumpeter's theory, entrepreneurs and innovations come in swarms, which explains why different cycles can be observed in the economic development. The Kondratieff-cycle of 60-year duration is differentiated from the shorter cycles in that it does not involve merely specific innovations, but the whole industrial and commercial structure. (Edvinsson, 2005:50)

Lower variable production costs.Variable costs, c, are the per-unit cost of making an item, including materials, labour, marketing, transportation, administration, management. Capital costs, C, are the upfront costs of making the item, including plant and equipment, inventory, trade credit, plus investments in branding, marketing, and process R&D. Labour-intensive production technologies (like fibreglass hand lay.up) have high variable costs and low capital costs, while automated, machine-intensive technologies (like plastic injection moulding) have low variable costs and high capital costs. (Baldwin, Hienerth, & Von Hippel, 2006:1300–1301).

In early capitalism, the variable cost of production of a product or a service was 80–90% of its price. Since WWII, supply has typically been higher than demand. Resources have hence been allocated to product development, adaptation, and marketing. As a consequence, the variable cost of production feel to close to 50% of the total price. This is, to a large extent, the effect of automation (Parker & Wirth, 1999:435), or what Marx (1894/1974) called the “organic composition of capital” – the ratio of constant capital to variable capital.

Today the variable costs of production are, in many industries, less than 15%. This statement would seem to contradict traditional production costs economics, which tends to say that fixed costs fall as volume increases. In reality, however, innovation has meant that more and more risks have to be taken upfront. Today's risks include not only investments in machines and buildings, but also conceptualization of the product architecture, organizing of the value chain, as well as the lion's share of marketing costs (Philipson, Johansson, & Schley, 2016).

Due to the short life cycles, direct variable production costs, for an Apple iPhone, for example (i.e. its innovation, operating system and key applications, and organizing the value chain and preparing global marketing for a window of, at most, 3 years) are anywhere from 25% (MarketWatch, 2018-01-19) to 35% (Fortune, 2018-01-19) of the price paid by the consumer. As Magnier et al. (2010:34) explain: …because of the increased demand uncertainty they must carry larger safety inventories to avoid stock-outs for the successful products and larger excess inventories for the unsuccessful ones, all at significantly higher operating costs.

The lowering of variable costs is also the result of continuous efforts to reduce costs in order to remain competitive. As various costs have been beaten down by these efforts, new costs have come into focus. The focus of management has changed in keeping with the changed cost structure: from direct labour in the 1950s and direct material in the mid-1960s, to overhead costs in the mid-1980s. We propose that the most important costs today are product development (in a broad sense) and marketing aimed at increasingly smaller global target groups.

Intellectual propertyAt the time when Von Hippel wrote The Sources of Innovation, he had the opinion that, in most cases, intellectual property offered limited opportunity to exploit monopoly rent: …the observations presented above provide a very reasonable explanation for the typical ineffectiveness of the patent grant. (Von Hippel, 1988)

As a result of militant action in the WTO by the US and due to many industries having learned how to use intellectual property rights to defend their innovations, these rights have since been strengthened (Glass & Saggi, 2002, see also Bogers, Bekkers, & Granstrand, 2012:38; Candelin-Palmqvist, Sandberg, & Mylly, 2012:502; Griffith, Miller, & O’Connell, 2014:12; Hargreaves 2018-09-07:45; Pham, 2010:53). In many industries, however, this has forced co-opetition solutions of the type described for the mobile telephone equipment industry (see below), where no single competitor holds the intellectual property rights needed to realize the new technology.

Network economicsNetwork theory was preceded by mathematical graph theory and topology. Network theory focuses on social networks, but the theory is related to neural networks, used in neuroscience to explain some of the fundamentals of associations in the human brain. Knowledge theory and network theory can be viewed as similar, but on different scientific levels. Kaufmann (1967:312–315) demonstrated the importance of delimiting complexity, by dissociating networks into “network islands”, between which couplings are loose. Around the same time, Thompson (1967) brought this thought to organization theory, by explicitly referring to Von Neumann and Morgenstern (1944/2007) and Luce and Raiffa (1957). Network economy is also the basis for Wintelism, a phenomenon whereby, because of loosely coupled product architecture, components can be outsourced based on an explicit limited set (called a “brief”) of knowledge.

Knowledge production and transferCompared to neurobiological and psychological theory of knowledge and creation, knowledge creation and knowledge transfer theory in business administration are rather mechanistic. Creativity is the result of associative synapses in the brain, built on the internalization7 of past experiences and how these experiences have been interpreted and given meaning. The child is essentially born autistic, with an information overload, overwhelming the small capacity of the brain. Through experience, associations are built into a grid of pre-understanding that filters sensory information considered redundant. Only once the grid is fine enough can the brain begin to process higher mental functions, built on a meta-understanding of the child itself (Vygotsky, 1987, 1993, 1994, 1997a, 1997b, 1998, 1999).

Human experience is diverse and individual and, hence, these associations are not the same from one individual to another. Tacit knowing could be said to be the mass of these associations (Polanyi, 1961, 1962, 1968). With a rich network of unique, loosely linked associations, an individual is considered creative by those who do not have the same associations. And although explicit knowledge is also harboured in the brain, it is associated with tacit knowing, making even explicit knowledge intrinsically tacit.

Tacit knowing can be transformed into explicit knowledge through externalization. Externalization, in turn, occurs through written or oral language, visualization, and behaviour, as well as through odour, fragrance, scent, and aroma. Externalization (the objectifying of the subjective) makes it possible for the subject to “look at” her tacit knowing and reflect on it. The “looking at” aspect is evident, as visualization is a very powerful instrument for the designer, architect, and product developer. Externalized knowledge is not necessarily immediately understandable to others, however, and may require interpretation, a transformation into more explicit knowledge, based on a more common frame of reference, a more explicit knowledge. This transformation is the basic problem of knowledge transfer (Philipson, forthcoming).

Von Hippel (1994) differentiates between the knowledge regarding needs and knowledge regarding solutions. We would add to this also transformational knowledge, when the solutions knowledge is used to satisfy the needs. It could be argued that this is the essence of solutions knowledge, but we maintain that it is necessary to differentiate between the mere competence to find solutions to a needs problem in general, and actually producing innovative knowledge that satisfies needs in radically new ways.

MethodologyThis paper is conceptual but, as in Zineldin and Philipson (2007) where we tested the actual use of relationship marketing, we have also investigated the actual use of customer involvement by conducting telephone interviews with 84 international companies out of a sample of 485, a response rate of 17%.

Based on an earlier version of this paper, Khan and Lodhi (2010) studied the sources of innovation in the wind-turbine industry. They identified 231 wind-turbine companies across the world and selected a convenience sample of 31 companies attending the 2010 European Wind Energy Conference and Exhibition in Warsaw, Poland. Hence, their sample represented 13.4% of the identified global wind-turbine industry. Khan and Lodhi interviewed representatives of 25 of these 31 companies in person, and the remaining 6 by way of an email questionnaire.

PhenotypesAs used here, the word phenotype is based on a biological analogy8: …there often is no clear analogy in cultural evolution to the mechanisms involving fitness of phenotypes in biological evolution. (Nelson, 2006:501) …there is a clear analogy between business practice and genes and business firms and phenotypes (see Nelson and Winter 1982). (Nelson, 2006:502)

That is, I use phenotype here to denote the strategic repertoire of innovation sources available to a firm. In The Sources of Innovation, Von Hippel (1988) showed that, in different industries, innovation comes primarily from a company's customers, from within the industry itself, from the company's suppliers, or from third parties (independent inventors, research laboratories, universities, etc.), all depending on who is most likely to earn and retain the temporary monopoly rent that an innovation permits the innovator to reap. Von Hippel proposed that the sources of innovation are dependent on the possibility of displacing this rent in the value chain, at the same time as preventing others from doing so, or of licensing the use of the innovation-related knowledge to others for a fee.

Phenotype 0: Innovation from within the firmVon Hippel (1988) writes- that the firm itself is often also the source of its own innovation. This is the trivial default. For reasons explained here (above and below), this default is becoming less viable. In this default phenotype, the firm must produce the knowledge regarding needs and solutions, and with solutions knowledge transform the needs knowledge into products that satisfy the needs. There is no knowledge transfer involved.

Types of customer involvement. Von Hippel identified customer involvement as a key issue in successful innovation, due to the stickiness of customer information (Von Hippel, 1994). Following Von Hippel (1988), Kaulio (1998) categorized customer innovation into three types: innovation for the customer, innovation with the customer and innovation by the customer. Kaulio (1998) further classified 7 methods of product development: quality function deployment (QFD), user-oriented product development, concept testing, beta testing, consumer idealized design, lead user method, and participatory ergonomics involving the customer, according to whether the product development was carried out for, with or by the consumer (see below).

Phenotype 1: For the customerInnovation for the customer refers to cases where the firm does not actually involve the customer in any active way. The firm maintains that it can appropriate the required knowledge regarding customer needs through market analysis, in a classic rationalistic Kotlerian sense. It is naturally also possible to do this in a less rationalistic way, by gut feeling. For example, a Swedish furniture manufacturer gives designers the task of designing a new chair, then demos ten chairs in its showroom and sees which one most customers take a liking to. Another example is that, although Apple probably does do market research, Steve Jobs is also alleged to have said that: “Apple is a company of nerds, creating things they want themselves.” That is, the firm is confident that there are many other nerds out there, and Apple nerds (so to speak) can therefore be considered part of their own target market or their own lead users, in a Von Hippelian sense (Herstatt & Von Hippel, 1992). This is essentially the same as the default, Phenotype 0.

Phenotype 2: With the customerInnovation carried out with the customer can be the typical approach of a small engineering firm, for example, that designs special solutions for an individual industrial customer, or “standard-special” solutions produced by a mid-sized engineering firm that competes with products whose architecture is made up of standardized components that can be combined to offer customers semi-unique solutions, which are much less expensive than the individually tailored solutions and price-worthy compared to the leaders standardized products. These standard-specials were the strength of the Swedish engineering industry, such as ASEA (now part of ABB), Volvo (i.e. Volvo Trucks, the lorry manufacturer, not Volvo Cars), Kalmar Industries, and others, and their way of competing with large US competitors whose large inner market enabled them to produce standard products in large series. As competition has increased, the target groups have become smaller and standard-special offerings have become the calling card of all engineering industry.

In the case of this phenotype, the co-operation with the customer involves a reciprocal transfer of knowledge. The customer transfers needs knowledge to the firm and the firm transfers solutions knowledge back to the customer, working together to produce transformational knowledge.

Phenotype 3: By the customerInnovation by the customer, is as identified by Von Hippel (1988), when the customer is the inventor and either proceeds as an industry start-up or licenses its innovation to a supplier. The former is interesting from a societal perspective, but less so for the firm, which is our perspective here. The latter can be the trivial case, where one engineering company orders a special product from another (often smaller) company, or if it is recurrent, traditional outsourcing (see Phenotype 5, below). A more interesting case is when the firm provides advanced users with toolkits to help them innovate (Von Hippel, 2005:147ff.), nurturing user innovation. This is Phenotype 3, where the needs knowledge is not transferred to the firm, which merely packages its solutions knowledge and transfers it to the customers in the form of a toolkit and lets the customer provide the transformational knowledge.

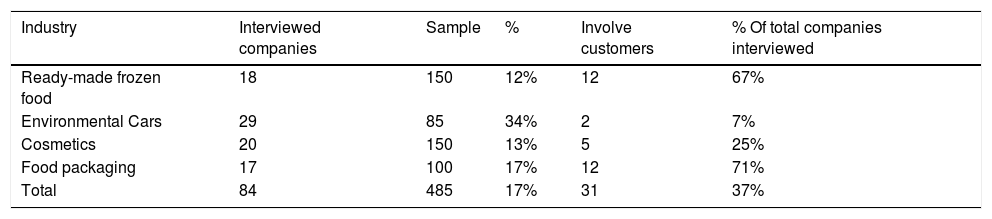

Zineldin and Philipson (2007) showed that, in many cases, business leaders only pay lip service to the adoption of relationship management. None of the five Scandinavian firms studied used the relationship marketing approach exclusively, yet still used the transaction-oriented methods of Kotler and Borden. Since Von Hippel's lead-user method (Herstatt & Von Hippel, 1992; Urban & Von Hippel, 1988; Von Hippel, 1986), business leaders have also paid lip service to customer involvement in product development. In 2010, 20 of my master students conducted 84 telephone interviews with 84 companies world-wide (17.5% of 480 companies of a convenience sample) in four industry clusters. Only 37% of the companies interviewed involved customers in their product development (Table 1).

Customer involvement in four industries; own.

| Industry | Interviewed companies | Sample | % | Involve customers | % Of total companies interviewed |

|---|---|---|---|---|---|

| Ready-made frozen food | 18 | 150 | 12% | 12 | 67% |

| Environmental Cars | 29 | 85 | 34% | 2 | 7% |

| Cosmetics | 20 | 150 | 13% | 5 | 25% |

| Food packaging | 17 | 100 | 17% | 12 | 71% |

| Total | 84 | 485 | 17% | 31 | 37% |

As with relationship marketing, the results of this study shows that customer involvement in product development is not a dominating reality.

Phenotype 4: By third partiesVon Hippel (1988) identified third parties – inventors, universities, and independent research laboratories – as sources of innovation in some industries. An interesting development in this respect is that many big pharmaceutical companies no longer seem to be able to provide the creative environment necessary for innovation. In many cases, this work has been outsourced to independent research laboratories. These companies (the third parties), owned by leading researchers or their employees at large, invent new substances and patent them. Pharmaceutical companies then buy the patents and, take them through the US Federal Drug Authority testing process and market them.

This phenotype requires that the firm have needs knowledge to evaluate the proposals of third parties, but does not require solutions knowledge or transformational knowledge. Knowledge transfer is thus limited to the final product, the embodiment of others’ knowledge.

Phenotype 5: To the supplierIn this phenotype, the firm does the inventing but outsources the production to a supplier. This is traditional outsourcing and I include it here as an innovation phenotype because of its knowledge management implications (and as a contrast to Phenotype 8, below). Here, the firm designs the product or component in every detail. To get quotes, it must transfer all of the knowledge needed to produce the new design to the supplier and then analyze the quotes received in similar detail. This heavy load of knowledge transfer limits the number of suppliers the firm can invite to tender. One consequence of this is limited variation between the quotes: everything is given, and the quotes offer only marginal differences in price. Hence, Phenotype 5 yields the firm just as heavy a knowledge-production load as the default, Phenotype 0, in addition to a heavy knowledge-transfer workload. This phenotype has therefore been increasingly abandoned in favour of other phenotypes as companies learn.

Phenotype 6: With the supplierThis phenotype is equivalent to Phenotype 2, but in this case the co-operation is initiating by the firm, not the customer. By asking the supplier for a special or standard-special component, the firm increases the value of its own product. The great advantage of this phenotype compared to the default is that the supplier provides genuine solutions knowledge. Apart from this, however, as with Phenotype 7 (below), it still entails a heavy workload of knowledge transfer (Fig. 1, left part).

Phenotype 7: By the supplier/for the firmThis phenotype was one of Von Hippel's (1988) original sources of innovation, where a materials manufacturer typically invents new characteristics for a material, which it then presents to an important customer firm as a means to enhance the value of that firm's products. This means that, for the firm, the knowledge production and transfer, in this case embodied in the component or material, is small. This is typical of innovative clusters, where the firm uses cutting-edge suppliers, including machine suppliers and designers, and other knowledge workers, to their advantage (Porter, 1990).

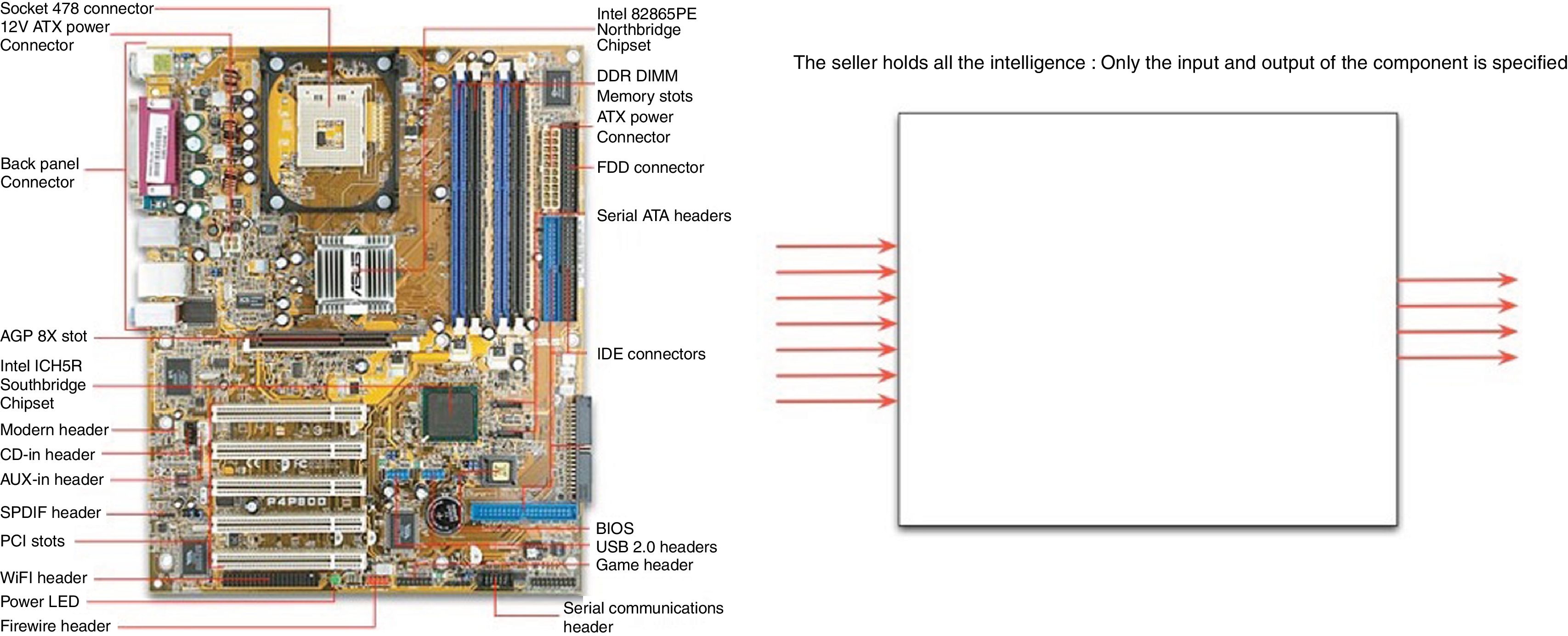

Phenotype 8: By the supplier/Wintelism.Borrus and Zysman (1997) introduced the concept of Wintelism to describe a new phenomenon that emerged after an antitrust decision against IBM in 1980. The 1980 decision forced IBM to outsource its component manufacturing, with the hope of creating future competition. Instead of employing traditional outsourcing, IBM chose to specify only the functional input and output of the component, leaving suppliers to decide on the necessary transformations (Fig. 1, right part). Though studies concerning Wintelism are scarce in most Western journals (see Bach, Newman, & Weber, 2005; Hart & Kim, 2002; Kim, 2002; Lüthje, 2002; Tan, 2002; Zysman & Schwartz, 1998), a Google Scholar search reveals that several hundred articles can be found in Chinese journals. However, all of these are locked, in Chinese, and require a password.

Less design work, faster design. Consequently, the buying firm does not need to design (innovate, develop, construct) every detail of a product, only the product architecture at a higher level of the product structure. This makes it is possible to shorten development times, a vital capability with in an era of shorter product life cycles.

Increased competition between suppliers. Since a firm only has to specify the function of the component (inputs and outputs), the information can easily and inexpensively be transferred, e.g. via a website, to many suppliers, thus increasing competition between suppliers. As opposed to in the past, when only ten or so suppliers could be invited to tender, thousands of suppliers can now submit tenders. It also lowers the cost of evaluating the offerings of the suppliers. The firm does not need to transfer detailed knowledge to the supplier that has won the bid – the supplier knows best how the component should be produced.

The unleashing of creativity. Prospective suppliers can use their creativity to invent radically new solutions that yield much lower prices or higher performance or new features (cf. the development in the computer industry since 1980).

To summarize, Phenotype 8 is neutral in relation to the default phenotype's knowledge production regarding needs, taps heavily into supplier solutions and transformational knowledge, and is much leaner with respect to knowledge transfer than Phenotype 6. It has thus become the preferred innovation model in the consumer electronics and mobile phone terminal industries, as well as other industries that use electronic components and software content.

Phenotype 9: Virtual enterprise with complementorsWhen a company does not have the competence to produce a product demanded by the market, one alternative can be to develop the offering with a company that has complementary competence. Simple combinations to develop new offerings are discussed in the extensive literature on co-branding (Lindgreen, Hingley, Grant, & Morgan, 2012). But more substantial co-operation, where the new knowledge is developed using the existing knowledge and skill sets of the individual partners, is also possible.

One example in which the co-operation is limited is cases where the basic product architecture and standardized interfaces between product components can be developed independently of each other, as long as the product is complying to the architecture and the interface requirements. One such example is the open source software called “middleware”. Middleware makes it possible to develop small software components, each of limited interest as stand-alone programmes. Standardized middleware enables these components to connect to a multitude of complementary components, in order to execute more complex tasks for users. CommerceNet, a collaborative innovation network of complementary businesses in the same industry, operates as a virtual enterprise, and was at the forefront of such development. This phenoptype limits the firm's own knowledge production for needs knowledge, solutions knowledge, as well as transformational knowledge (CommerceNet, 2018-01-19; Wikipedia, 2018-01-19). The knowledge transfer can sometimes be intensive but, on other occasions, it may be possible to apply a Wintelism-like architectural knowledge transfer with limited knowledge transfer at the component level. To date, it would appear that this phenotype has been used only sparingly.

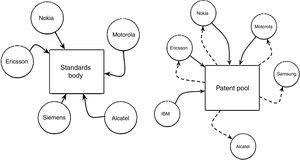

Phenotype 10: Virtual enterprise with competitorsThis phenotype is based on co-opetition, where competitors may sometimes co-operate (Gnyawali & Park, 2011; Liu, 2013; Mention, 2011; Nalebuff & Brandenburger, 1997; Quintana-Garcia & Benavides-Velasco, 2004; Schiavone & Simoni, 2011; Wu & Wu, 2016; Zineldin, 2004). In most legal jurisdictions antitrust laws prevent this, though society has in some situations permitted this type of cooperation when it comes to building network economies (Westland, 2008). This is necessary because network economies build on standardized interfaces that enable the interconnection of networks. Society also has an interest in having such open interfaces; which are although not necessarily in public domain. A third justification for this phenotype is that, in today's complex technological environment, a single supplier is often unable to realize new complex technology because it does not possess the elements needed to build the technology. The supplier must therefore co-operate with others that do have these elements. “Standard setting organizations (“SSOs”) are of growing importance as an institution for coordinating and facilitating the economic activities of intellectual property rights holders” (Tsai & Wright, 2014:1).

A typical and perhaps best example of this is mobile phone technology. To build a new generation of mobile transmission systems, the interested parties come together in Geneva under the auspices of the International Standardization Organization (ISO), a United Nation's body. Adhering to ISO rules regarding open standards and the open licensability of the resulting technology, these parties are protected from antitrust prosecution. The signatories of the standard work together to develop the specifications of the new standard, e.g. the fourth generation (4G) cellular network standard (Fig. 2, left side).

The owners of the intellectual property required to realize the new standard form a “patent pool”, a virtual enterprise that licenses patents from the patent owners and sub-licenses them as a patent bundle to companies wanting to compete in the market for this technology (Fig. 2, right side). Because the standard is developed under the ISO treaty, even firms that do not own patents can acquire a license for the bundle to produce products for the new market. Companies, such as IBM, with no primary interest in the market can thereby also earn royalties on their technology.

Companies participating in the marketplace must have a good common understanding, at the platform level, of the needs of the customers and also, at an architectural level, of the solutions and transformational knowledge. Hence, the knowledge transfer at this level is intense, whereas at the component level it is limited to evaluating existent embodiments, in patents, software, etc.

This phenotype can be said to be equivalent to Phenotype 8 Wintelism, where technology has become so complex that it is no longer possible to produce a sustainable competitive position at the architectural level.

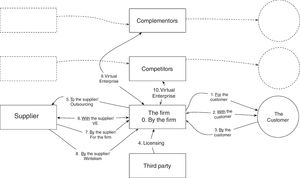

The 10 PhenotypesThe default phenotype discussed above, Phenotype 0, and the other 10 phenotypes that present alternative strategies for a firm are summarized in Fig. 3. The figure shows the ten strategic options, phenotypes 1–10, available as sources of innovation. The rectangles represent companies and the circles customers, with the arrows indicating the phenotype relationships.

Empirical exampleKhan and Lodhi (2010) studied the sources of innovation in the global wind-turbine industry based on an early version of the phenotypes. They found the following sources of innovation (multiple sources) (Table 2).

Sources of innovation in the wind-turbine industry, Kahn and Lodhi (2010).

| Sources of innovation phenotypes | Number of companies |

|---|---|

| 0. By the firm/in-house | 25 |

| 1. For the customer | 19 |

| 2. With the customer | |

| 3. By the customer | |

| 4. Licensing from third party | 10 |

| 5. To the supplier/outsourcing | 19 |

| 6. With the supplier/virtual enterprise | 17 |

| 7. By the supplier/for the firm | 14 |

| 8. By the supplier/wintelism | 9 |

| 9. With complementors/virtual enterprise | 0 |

| 10. With competitors/virtual enterprise | 2 |

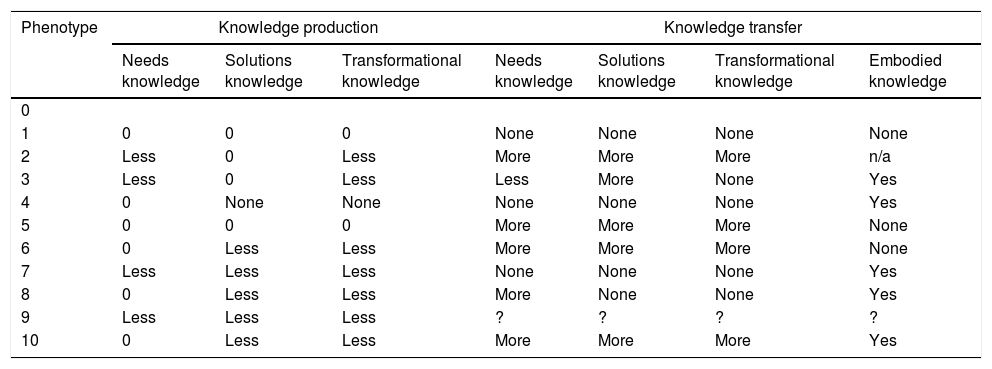

The discussion above under each phenotype shows that, when it comes to knowledge production, and transfer (see above), the consequences for a firm are heavily affected by the firm's choice of innovation phenotype. These consequences are summarized in Table 3. Rectangles, circles, and arrows with dashed lines in the figure are parts of the value-chains, not directly concerned by the phenotypes.

The knowledge production and transfer in the phenotypes; own.

| Phenotype | Knowledge production | Knowledge transfer | |||||

|---|---|---|---|---|---|---|---|

| Needs knowledge | Solutions knowledge | Transformational knowledge | Needs knowledge | Solutions knowledge | Transformational knowledge | Embodied knowledge | |

| 0 | |||||||

| 1 | 0 | 0 | 0 | None | None | None | None |

| 2 | Less | 0 | Less | More | More | More | n/a |

| 3 | Less | 0 | Less | Less | More | None | Yes |

| 4 | 0 | None | None | None | None | None | Yes |

| 5 | 0 | 0 | 0 | More | More | More | None |

| 6 | 0 | Less | Less | More | More | More | None |

| 7 | Less | Less | Less | None | None | None | Yes |

| 8 | 0 | Less | Less | More | None | None | Yes |

| 9 | Less | Less | Less | ? | ? | ? | ? |

| 10 | 0 | Less | Less | More | More | More | Yes |

Von Hippel (1976), Von Hippel (1977), Von Hippel (1978), Von Hippel (1998), Thomke and Von Hippel (2002), Baldwin et al. (2006); Baldwin and Von Hippel (2011), Reiman et al. (1998).

Von Hippel (1986), Von Hippel (1989); Urban and Von Hippel (1988); Herstatt and Von Hippel (1992); Von Hippel et al. (1999); Lilien, Morrison, Searls, Sonnack, & Von Hippel (2002); Franke et al. (2006), Von Hippel et al. (2009).

Von Hippel and Katz (2002), Franke and Von Hippel (2003), Harhoff et al. (2003), Henkel and Von Hippel (2004), Lüthje et al. (2005), Von Hippel (2005), Von Hippel (2007), Oliveira and Von Hippel (2011), Von Hippel et al. (2011).

Although many business administration researchers are unaware of this, the underpinning for this is Schumpeter's (1950) discussion of monopoly rent, which in turn can be traced to the classical discussions of Malthus (1798/1970), Ricardo (1817/1971), Marx (1867/1976, 1885/1978, 1894/1974), Marx (1857/1973), Marx (1921/1969, 1969, 1972), and Sraffa (1960).

Vygotsky is sometimes seen as a forerunner of social constructivism in that the child is formed by internalization of the cultural constructs embedded in language. We argue that this is not correct. Similarly to Freud, Vigotsky did not see the child as a mere social construct; he viewed the internalization process (the superego) as moulding the inner potentials of the biologic “sprout” (the id). While criticizing earlier primitive attempts to build a dialectical materialist psychology, Vygotsky was himself a dialectical materialist.

“A unit of cultural inheritance, hypothesized as analogous to the particulate gene, and as naturally selected by virtue of its ‘phenotypic’ consequences on its own survival and replication in the cultural environment” (Dawkins, 1976).