Despite Nigeria's huge population, huge consumer market and the vast number of mobile money operators (MMOs), the uptake of mobile money services has been the lowest in Africa. The introduction of mobile money services into the market after an elaborate licensing and regulatory process by the Central Bank of Nigeria was expected to accelerate financial inclusion and increase the overall number of transactions in the country. This was however not the case as the expected result of increased financial inclusion was not achieved. Although various reasons have been suggested as the cause of this, the paper argues that the lack of sustainable business models for the creation of mobile money services has been one of the greatest hindrances. Existing business models for mobile money services have proven to be unsustainable and unprofitable. Through case studies of existing mobile money operators, this paper investigates the reasons for unsuccessful deployment of mobile money services by MMOs in Nigeria and proceeds to develop a framework for sustainable business models for this market. Results of this study suggest that MMOs should pay close attention to all aspects of the business models they deploy in the creation of mobile money services with particular emphasis on the value proposition, customer segments and scale.

A pesar de la enorme población de Nigeria, el enorme mercado de consumo y la gran cantidad de Operadores de Dinero Móvil (MMO), la aceptación de los Servicios de Dinero Móvil ha sido la más baja de África. Se esperaba que la introducción de servicios de dinero móvil en el mercado después de un elaborado proceso de licencias y regulación por parte del Banco Central de Nigeria acelerara la inclusión financiera y aumentara el número total de transacciones en el país. Sin embargo, esté no fue el caso, ya que no se logró el resultado esperado de una mayor inclusión financiera. Aunque se han sugerido varias razones como la causa de esto, pero este documento sostiene que la falta de modelos de negocios sostenibles para la creación de servicios de Dinero Móvil ha sido uno de los mayores obstáculos. Los Modelos de Negocio Existentes para los Servicios de Dinero Móvil han demostrado ser insostenibles y no rentables. A través de estudios de casos de operadores de dinero móvil existentes, este documento investiga las razones del despliegue fallido de los Servicios de Dinero Móvil por parte de los OPM en Nigeria y procede a desarrollar un marco para modelos de negocios sostenibles para este mercado. Los resultados de este estudio sugieren que los OPM deben prestar mucha atención a todos los aspectos de los modelos de negocios que implementan en la creación de servicios de dinero móvil, con especial énfasis en la propuesta de valor, los segmentos de clientes y la escala.

Delivering financial services to unbanked and underbanked segments of a population could be costly for both financial services providers and consumers. The unbanked segments of a population comprise those individuals who do not have any type of commercial bank account such as a transaction or savings account (Grimes, Rogers, & Smith, 2010). On the hand, the underbanked population refers to individuals who do not have an account at a commercial bank but use informal financial services such as thrifts, rotation savings or lending schemes, cooperatives, and the like. Although the banked population has been defined as individuals who have accounts domiciled with a commercial bank, this definition excludes several individuals who are active members of the formal financial system via ownership of accounts as well as relationships with other non-commercial bank institutions. To cater to this group of individuals, the banked population can be described as consisting of individuals who have transactional accounts with commercial banks, microfinance banks, mobile money operators, mortgage banks or other regulated financial institutions. David-West et al. (2016) and Demirguc-Kunt, Klapper, Singer, and Van Oudheusden (2015) report that other than being vastly rural, these population segments are characterized by low income, unemployment, low literacy levels, and limited digital capabilities. This implies that financial service providers must adopt low-cost channels to serve customers in these segments who may otherwise be unwilling to bear the additional cost of accessing financial services. Traditional commercial bank branch models have proven to be unprofitable amongst this market segment and hence unsustainable for financial service providers given the high cost of operating bank branches especially in areas that have low economic activity. Other exogenous factors that make this model unviable and costly for both the provider and consumer include poor infrastructure and security. Managing these constraints would require the use of alternative and effective, yet low-cost alternatives and channels, including but not limited to mobile financial services, digital banking and agency banking. The viability of these channels is further supported by high mobile phone penetration levels in the rural areas that are also characterized by low income and poor-quality physical infrastructure.

Mobile financial services (MFS) are accessible to customers on the go irrespective of time and location. Mobile financial services refer to a range of financial services delivered and accessible via mobile technologies such as point of sales (POS) terminals, debit and credit cards, mobile money, mobile applications, and the like. MFS is a subset of digital financial services (DFS) which encompasses all financial services that are provisioned digitally using mobile technologies, internet, computers, and other digitally supported channels. On the other hand, DFS is defined as a leverage of information and communication technologies for cost-efficient delivery channels and includes electronic payments systems (retail and wholesale) and electronic banking products or services’ (David-West, 2016a). MFS has been considered the most viable and cost-effective channel for delivering financial services to consumers at the bottom of the pyramid. Mobile money or mobile money services refer to financial services that offer electronic accounts (e-wallets) in which customers can deposit, withdraw cash and manage electronic money (Peruta, 2015). It is a financial service provided by financial services institutions that operate as either bank or as non-bank independent entities (also known as third-party providers) through the use of mobile phones and cellular networks. Jenkins (2008) simply defines it as money that can be accessed and used via mobile phone. According to Donovan (2012), these services are enabled via small pieces of software embedded on a SIM card or available over a mobile network. On their part, Micheni, Lule, and Muketha (2013) define mobile money as a technology that leverages wireless network infrastructure to facilitate the exchange of monetary value between various actors involved in the transaction. David-West, Umukoro, and Muritala (2017) argue that mobile money differs from the broad term digital financial services in the sense that the former is provisioned through mobile devices and cellular networks while the latter is an umbrella term for all financial services provided through electronic platforms such as mobile phones, electronic cards, and the internet. The introduction of mobile money services attempts to address the financial inclusion problem which is considered to be a setback to economic growth and social inclusion (David-West, Ajai, et al., 2017; David-West et al., 2016; Demirguc-Kunt et al., 2015).

David-West, Ajai, et al. (2017) define financial inclusion as a state in which all bankable members of an economy can easily access and use available formal financial services at an affordable cost. Sarma (2008) defines financial inclusion as a process that ensures ease of access, availability and use of formal financial systems by all members of an economy. Similarly, Kasprowicz and Rhyne (2013) note that financial inclusion is a state in which everyone who can use financial services (including disabled, poor, and rural populations), has access to quality financial services at affordable prices, in a convenient manner, and with dignity for the clients. Although the authors highlight an individual's ability in the use of financial services, the deployment of mobile money services through the use of agents (over-the-counter services) makes it possible for individuals who lack basic and/or digital literacy to access financial services provisioned at the agent locations.

David-West, Umukoro, et al. (2017) report that a common thread in the definitions of financial inclusion is its link to ownership of an account with a formal financial institution. However, the inadequate distribution of bank branches and other financial access points makes access to formal financial services difficult for unbanked and underbanked individuals in the society, especially those living in remote geographical locations. The deployment of mobile money as a tool for financial access is further supported by the ubiquity of the mobile phone given its immense impact in transforming the way people use and access financial services (David-West, Umukoro, et al., 2017). While more than a billion people are unbanked globally, they do own cellular telephones and this provides an opportunity to expand financial access to poor people for the achievement of financial inclusion (CGAP, 2009a, 2009b).

Providing easy and affordable access to financial services to disadvantaged segments requires low-cost channels such as those offered by cellular networks. As such, mobile money services close the financial access gap between the banked and un(der)banked as evident in markets such as Kenya, Bangladesh, Pakistan, India, Ghana and Tanzania. Mobile money is reported to have grown account ownership by 700 million between 2011 and 2014, leaving global account ownership across the adult population at 62 per cent, up from 51 per cent in 2011 (Demirguc-Kunt et al., 2015). By leveraging mobile money services to reach the rural poor and under-served, countries in Sub-Saharan Africa (SSA) drove up account ownership by a third – to 34 per cent. Overall, 12 per cent of adults in the region has a mobile money account, which is four times the developing world average (Demirguc-Kunt et al., 2015). The potential of mobile money services thus remains promising for service providers and national economies hoping to solve the challenge of financial exclusion.

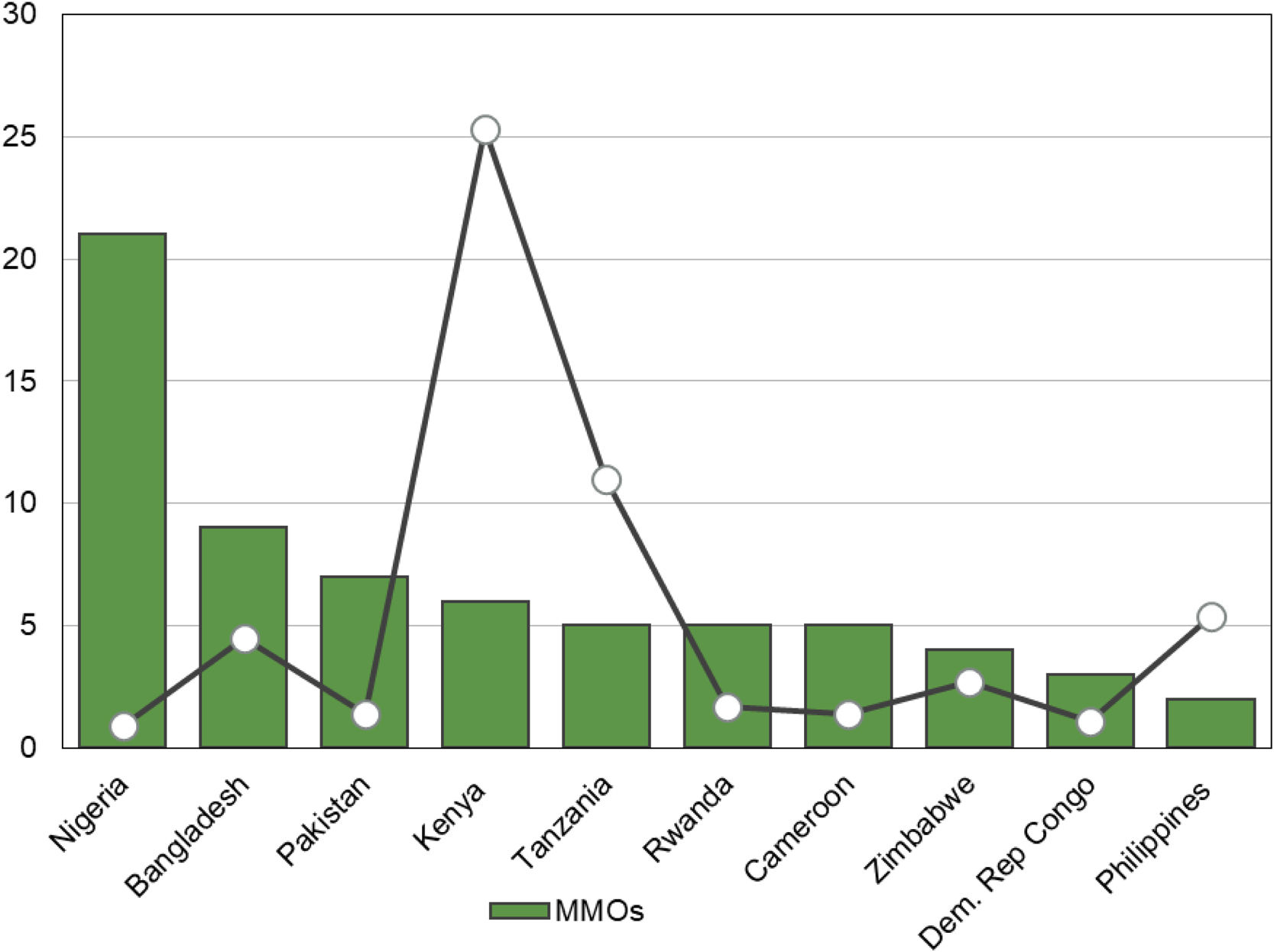

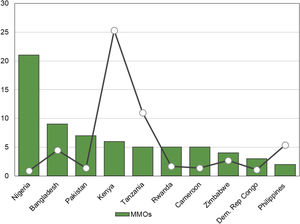

Despite Nigeria's population, sizeable consumer market and relatively high number of MMOs when compared to other emerging markets (see Fig. 1 below highlighting number of mobile money operators versus active mobile money accounts in some emerging economies in the year 2016), the uptake of mobile money services remains very low with no promise of reaching the critical mass needed for business growth and sustainability. Although David-West et al. (2016) in an industry-wide report understudied what assets, resources and capabilities are needed by mobile money operators in Nigeria, there was a minimal emphasis on business model re-conceptualization and innovation for scaling and sustaining digital financial services. While various factors have been identified as the causes of low adoption, there is little evidence of sustainable business models for the creation and delivery of mobile money services. According to Osterwalder,Pigneur et. al (2005), a business model serves as a conceptual tool for understanding how firms do business and could be used for analysis, comparison and performance assessment, management, communication, and innovation. With the right business model, MMOs and other financial service providers (FSPs) can develop appropriate strategies to drive their profitability and sustainability, ultimately resulting in increased financial inclusion for Nigerians. It is therefore important to understand the existing business models deployed for the creation and delivery of mobile money services in light of current market dynamics that require low cost-to-serve models. Also important is the necessity for increased emphasis on the diverse needs of different customer segments in the different regions of the country in order to attain critical mass and business sustainability.

Graph showing the number of MMOs versus active mobile money accounts in some emerging economies in 2016 (source: David-West, 2016b).

This study seeks to:

- •

Identify the current dynamics and trends in the creation and deployment of mobile money services by MMOs in Nigeria as well as their business models of MMOs;

- •

Explain why attempts at scaling and expanding mobile money services in Nigeria have failed to reduce the financial exclusion gap in the country; and

- •

Propose a framework for sustainable business models for mobile money service creation and delivery by MMOs in Nigeria and other emerging economies.

The under-listed research questions guiding the study and the accomplishment of the objectives are:

- 1.

What business models currently exist for the deployment of mobile money services in Nigeria?

- 2.

Are the current business models sustainable for the creation and delivery of mobile money services in Nigeria?

- 3.

What factors account for the low uptake of mobile money services in Nigeria?

- 4.

What sustainable business model should be deployed by MMOs for mobile money services in Nigeria?

Through the case study analyses of eight leading MMOs in Nigeria, we investigate whether there are any sustainable business models in the Nigerian digital financial services space that could be deployed to address financial inclusion. We attempt to identify factors that have inhibited the adoption and deployment of mobile money services, and then proceed to suggest business model re-configuration recommendations that would enhance financial inclusion, alongside other unintended benefits such as growth in gross domestic product, increased number of transactions, faster access to credit and job creation, to mention a few.

The cases help to establish the need for sustainable business models in a market characterized by a high number of operators, vast market potential and miniscule transaction volumes. They also offer grounds to suggest that existing business models are unprofitable and consequently unsustainable.

Literature reviewMobile money deployment efforts in NigeriaFinancial inclusion remains low in Nigeria and without the desired results despite the efforts made towards closing this gap (David-West, Umukoro, et al., 2017). National aggregate data shows that only 41.1 per cent of adult Nigerians have access to formal financial services while 11.6 per cent transact within the informal sector; leaving a staggering 48.4 per cent without access to financial services (David-West, Umukoro, et al., 2017). The Central Bank of Nigeria (CBN) in 2011 issued operational licenses to MMOs in order to deliver mobile money services as a complementary effort to services provided by 25 licensed deposit money (commercial) banks, and over 1000 microfinance banks amongst other formal financial services providers. Despite having the highest number globally – 21 MMOs as at 2016 (David-West, Ajai, et al., 2017), the Nigerian adult population using mobile money services remains at 1.1 per cent of which about 1 per cent own both a bank account and mobile money account. The implication is that in reality, only 0.1 per cent of Nigeria's adult population rely on mobile money services as a means of financial intermediation. This low adoption percentage shows the large gap that exists in attempting to attain the broad financial inclusion goals the country has set.1

With about 25 active mobile money operators at the close of the year 2017 (David-West, Umukoro, et al., 2017), achieving a critical mass of users from the Nigerian adult population remains a mirage for MMOs. David-West, Umukoro, et al. (2017) further report that ownership of mobile phones through which mobile money is accessed also witnessed a decline from 91.2 per cent to 59.4 per cent between 2013 and 2016 across the adult population. These statistics cast doubts on the existence of a business case for mobile money services in Nigeria. While high financial exclusion rates suggest opportunities for MMOs, their inability to attain critical mass remains worrisome and calls for an in-depth understanding of the underlying business models deployed in the creation and delivery of DFS. In view of the key characterizations of Nigeria's unbanked and underbanked population segments as having low income, low literacy levels, low digital capabilities and high youth unemployment (which further leads to high youth dependency rate) (David-West et al., 2016; David-West, Ajai, et al., 2017; David-West, Umukoro, et al., 2017), serving these population segments using mobile money services requires a deeper understanding of their needs and aspirations of the different segments. Although this has culminated into different national access to finance (A2F) studies conducted bi-annually which have been running since 2008, Nigeria's financial inclusion progress remains low when juxtaposed alongside other emerging markets with similar characteristics.

Mobile money: Nigeria vs other emerging marketsThe uptake of mobile money services in Nigeria remains lowest when compared to markets with similar characteristics (see Fig. 1). Despite the regulator's efforts towards liberalizing the DFS space and the emergence of financial technology firms in the delivery of digital financial services, the sizeable number of service providers has not produced the desired adoption levels. The 2016 InterMedia report shows that across select emerging markets, awareness of mobile money services in Nigeria among the adult population stands at 12 per cent when compared to Kenya (99 per cent), Tanzania (95 per cent), Bangladesh (92 per cent), Uganda (91 per cent), Pakistan (72 per cent), India (10 per cent) and Indonesia (8 per cent). In addition, the registered user statistics report Nigeria with 0.6 per cent when compared to Kenya (67 per cent), Tanzania (61 per cent), Uganda (35 per cent), Bangladesh (9 per cent), Pakistan (1 per cent), India (0.4 per cent) and Indonesia (0.3 per cent).

The use of mobile money services including third-party use shows that Nigeria (0.9 per cent) is only ahead of India and Indonesia with 0.6 per cent and 0.4 per cent respectively. Kenya (79 per cent), Tanzania (63 per cent), Uganda (47 per cent) and Pakistan (9 per cent) all have higher mobile money utilization rates in spite of Nigeria's active mobile money operators’ base. Although India with 13 MMOs ranks lower than Nigeria by mobile money utility, Nigeria's financial inclusion rate of 41.9 per cent2 is lower. India, with an adult population size of 931.4 million boasts a financial inclusion rate of 63 per cent. While other markets have higher conversion rates, Nigeria's 0.07 per cent is only better than Indonesia and India, converting at 0.06 per cent and 0.05 per cent respectively. Kenya leads the conversion race with 0.8 per cent, followed by Tanzania (0.66 per cent), Uganda (0.52 per cent), Bangladesh (0.36 per cent) and Pakistan (0.13 per cent).3 The statistics presented above highlight the need for mobile money operators to match supply and demand-side factors and examine and re-innovate their existing business models if they are to remain profitable and sustainable.

Business models and sustainable business modelsA business model (BM) in describing how an organization approaches value creation and value capture, helps in highlighting the organization's approach to product development, deployment and pricing (Osterwalder and Pigneur, 2005; Osterwalder & Pigneur, 2010). Amit and Zott (2001) suggest that a business model is a representation of the transaction content, structure and governance designed to create value through the exploitation of business opportunities. They refer to transaction content as the goods and/or information exchanged as well as the resources and capabilities needed to enable the exchange; while transaction structure refers to all parties involved in the exchange, how these parties are linked and how exchange structures take place. Teece (2010) adds that a BM is primarily the organizational and financial ‘architecture’ of a business and includes implicit assumptions about customers, their needs, and the behaviour of revenues, costs and competitors and the articulation of how the firm converts resources and capabilities into economic value.

According to Shafer, Smith, and Linder (2005), a BM represents a firm's underlying core logic and strategic choices for creating and capturing value within a value network. Demil and Lecocq (2010) opine that it is an articulation between the various areas of a firm's activity designed to produce customers’ value proposition. McNally (2013) adds that BMs help organizations look internally (at their infrastructure and processes of creating efficiencies) and externally (at the customers and processes of value creation). Rasmussen (2007) asserts that a BM is important for a firm to develop a competitive strategy, revenue and cost structure, identify customer segments, product differentiation, identify the right infrastructure (partners, activities and resources), channels and relationships that can help deliver the business’ value proposition and how the firm integrates its own value chain with those of other firms in a value network. It thus reflects management's hypothesis about customers’ needs, how they want the needs met, and how the firm can organize to best meet those needs, and get value for its offering (Teece, 2010). Zott, Amit, and Massa (2011) submit that the BM can be conceptualized as an archetype (such as for e-business specifically), or as an activity system (for strategic analysis of network activity), or as a cost/revenue architecture (for economic analysis).

On the other hand, sustainable business models (SBM) incorporate a triple bottom line approach and consider a wide range of stakeholder interests, including environment and society; and are important in driving and implementing corporate innovation for sustainability, helping to embed sustainability into business purposes and processes, and serving as key drivers of competitive advantage (Bocken, Short, Rana, & Evans, 2014). The concept of a sustainable business model presupposes that existing business models might not have yielded the desired organizational impact either in the short, mid or long term. Given this, the need to constantly evaluate, re-conceptualize, and innovate new or adapt current business models has become a priority for firms. Consequently, Bocken et al. (2014) submit that business model innovation (BMl) offers a potential approach to deliver the required change through re-conceptualizing the purpose of the firm and its value creating logic, and re-imagining perceptions of the value proposition. This is, however, dependent on a firm's available assets, resources and capabilities (ARCs) required for delivering customers’ value proposition (Beltramello, Haie-Fayle, & Pilat, 2013; David-West et al., 2016).

According to Schaltegger, Lüdeke-Freund, and Hansen (2012), business model innovations can support a systematic and on-going creation of cases for business sustainability. Kramer and Porter (2011) add that careful BM redesign makes it realistic for mainstream businesses to more readily integrate sustainability into their business and for new start-ups to design and pursue sustainable business from the outset. Demil and Lecocq (2010) state that a business model reconceptualization or redesign must consider a fine-tuning process involving voluntary and emergent changes in and between permanently linked core components; hence, a firm's sustainability depends on anticipating and reacting to sequences of voluntary and emerging change. Such dynamic consistency forms the firm's capability to build and sustain its performance while changing its business model (Demil & Lecocq, 2010; Doz & Kosonen, 2010; Muzellec, Ronteau, & Lambkin, 2015).

Despite the need for business model reconceptualization as variously submitted by different scholars and its resultant effect on attaining scale and business sustainability, active MMOs in Nigeria are yet to apply this approach in the description of their businesses. While favourable market dynamics may have been beneficial to operators in other emerging markets such as Kenya, Peru and Brazil, a firm's understanding of its market is needed for the business model adaptation to be sustainable. This is because business activities such as mobile money have the potential to create new revenue streams, mostly through entrepreneurial start-ups and corporate ventures and can transform the rules of competition for incumbents in unprecedented ways (Amit & Zott, 2001). Consequently, business model innovation or the process of building a sustainable business model should not only change a firm's value proposition but also how it does business, rather than merely what it does; and must also go beyond processes and products (Amit & Zott, 2012; Bocken et al., 2014).

Chen et al. (2013) posit that a firm's value chain is enhanced when the business model provides value (whether social or economic) to all entities involved. A major setback to business model adaptation is the inability to innovate or reconceptualize the business model. Chesbrough (2010) posits that firms can commercialize new ideas and technologies through their BMs and although they may have extensive investments and processes for exploring new ideas and technologies, there is also little to no ability to innovate the business models through which these inputs will pass. BM innovation becomes necessary when an idea or technology taken to market using different business models will yield different commercial outcomes (Chesbrough, 2010). Consequently, there is a need for a firm to develop, either internally or externally, the capability needed to innovate their BMs.

The creation and delivery, otherwise known as commercialization of mobile money services require sustainable business models that can help meet market needs at low costs. There is a recognition of the fact that existing and dominant BMs transplanted from developed markets will prove ineffective in serving the BOP of emerging markets; thus, there is need for firms to adapt their BMs to their local market's cultural, economic, institutional and geographic features and to reflect an understanding of the local business environment and prevailing circumstances (Dahan, Doh, Oetzel, & Yaziji, 2010; Rohatynskyj, 2011). Bocken et al. (2014) posit that research on SBMs will continue to receive more attention given that firms will need to alter existing business models to remain competitive. Williamson (2010) adds that if incumbent firms are to survive competition, they will require new types of responses which are driven by shifts in their BMs that consider the fundamental changes in global market structure as well as the local markets where the firm is focused.

Schaltegger et al. (2012) identified three typologies of business models that could prove sustainable to firms: (1) defensive adjustment strategy which is an incremental business model aimed at protecting current business models that focus on risk and cost reduction, often driven by the need for compliance; (2) accommodative (improvement, integration) model which focuses on modifying a firm's internal processes with consideration for environmental or social objectives; and (3) proactive (full integration) strategy that focuses on redesigning a firm's core business logic. Although all business model innovations that deliver sustainability are important to a firm's competitiveness, proactive innovation strategies appear to be the most impactful given that they are flexible and can be completely modified. Sinkovics, Sinkovics, and Yamin (2014) posit that in order to gain better insight into SBMs, it is important to understand how value creation actually takes place in the market segments at the BOP. This is key for mobile money operators since the majority of their market segments are in the BOP.

The dynamic nature of business modelsLiterature presents two prominent debates regarding business models (Demil & Lecocq, 2010; Shafer et al., 2005; Sinkovics et al., 2014). The first is that there is a lack of a generally accepted definition regarding the number and nature of business model components (Hamari, 2009; Shafer et al., 2005). This is reflected in the various business models identified earlier. The second debate is one identified by Demil and Lecocq (2010), on the question of whether BMs should be considered as static or dynamic. While literature suggests that there seem to be some commonalities in the definition of a business model, at least in terms of purpose, what constitutes a BM depends on the objective, vision and mission statement of a firm and the prevailing market dynamics which may force a firm to alter or adapt its business model in order to remain competitive, and sustainable. However, the static or dynamic nature of the business model structure is another debate that does not have a common viewpoint. Notwithstanding, Zott et al. (2011) submit that business model conceptualization is now shifting from value capture to value creation.

Given the dynamism of the business environment that calls for experimentation, reinvention, innovation, and adaptation, Linder and Cantrell (2000) and Sinkovics et al. (2014) contend that there is a need for flexible business models that accommodate changes in business offerings or strategy which in turn require an adaptation or complete redesign of one or more of the business model components. In the light of this, Sinkovics et al. (2014) and Baden-Fuller and Morgan (2010) criticized Osterwalder's BMC as appearing too rigid without provision for changes in strategy or model evolution. Sinkovics et al. (2014) further state that given the consequences of the dynamic changes that occur internally or externally, a BM case analysis is required to map the current business model and also capture the changes that occurred over time, alongside reasons for those changes. Wirtz, Schilke, and Ullrich (2010) posit that firms must constantly develop and alter their existing business models from the evidence gotten of customers’ responses to their value proposition, to a proof of the commercial viability of the business. In spite of the different criticisms of Osterwalder's BM canvas, we are of the view that it still presents the most robust and comprehensive view of a firm's value creation and delivery activities as aligned with the company's view of its customer's needs and aspirations.

Elements of a business modelThere are different elements of a business model however, variation occurs across models. For instance, Shafer et al. (2005) identify four key elements of a business model vis-a-vis strategic choices, value creation, value capture, and the value network. On the other hand, Osterwalder and Pigneur (2010) identified nine elements or components of a business model namely customer segments, value proposition, customer relationships, channels, key resources, key activities, key partners, cost structure, and revenue streams. For Richardson (2008), a business model comprises the value proposition (i.e. the offer and the target customer segment), the value creation and delivery system, and the value capture system. Hamel (2000) proposed a business model framework that identifies customer benefits which is the link between strategy and customer needs; configuration that highlights firm-specific combination of resources, skills and procedures deployed in driving a given strategy; and company frontiers that encompass decisions regarding activity, which require recourse to the added value of an external network. Amit and Zott (2001) identified four elements of a business model namely efficiency, complementarities, lock-in and novelty which are interdependent sources for value creation. Muzellec et al. (2015) and Chesbrough (2010) opine that the customer segment, value proposition, revenue generating mechanism, cost structure and profit potential of the business are key elements of the business model.

Theoretical frameworkThe business model canvas (BMC) developed by Osterwalder and Pigneur, guided this study. The framework highlights the basic considerations for designing a business model that helps a firm to realize its objectives and further identifies the various elements that a firm must consider in creating and capturing value for a target market, as well as the key activities, assets, resources and capabilities that are needed to deliver on the value proposition. The nine elements of the business model canvas are explained below:

Customer segments: This refers to the target market segment for whom the business value is created. Muzellec et al. (2015) report that well-articulated business models must identify one or more customer segments for which the business value is tailored. The customer segments of the business model must thus classify or profile the customers in terms of their identity (who they are) and functions (what they need). Firms must also carefully distinguish between the needs and aspirations of the paying customer for a product or service and the final consumer. The needs and aspirations of the customers and consumers may differ markedly. Although one entity may purchase the service, the benefit of the service may reach beyond the customer to a separate consumer (Chen, Cheng and Mehta, 2013).

Value proposition: This relates to the economic and social value offered by service providers for attracting and retaining customers. Good value propositions are a consequence of an in-depth understanding of customers’ profiles (needs and characteristics). Chen et al. (2013) argue that the value proposition is the main focus of the business canvas upon which other elements of the model revolve. The value propositions must thus contain elements of value innovation which make them distinct from those offered by their competition. This means that value is raised for customers with reduced cost. Teece (2010) adds that a BM is key in defining the manner by which a firm delivers value to customers, entices customers to pay for value, and converts those payments to profit. This makes the value proposition element one of the most important features of the business model.

Channels: These refer to the mechanisms of delivery through which customers are served. Zeleti, Ojo, and Curry (2016) submit that the channel component describes how a firm communicates with and reaches its customer segments to deliver its value proposition. Channels serve as the conduits through which a firm relates with customers (service-oriented) or delivers goods to customers (product-oriented). Understanding market segments help identify the channels that are most appropriate in serving the customers.

Customer relationships: These are relationships directly or indirectly maintained with customers (Chen et al., 2013). The nature of the relationship between the firm and customers is important as it impacts customer acquisition and retention. A BM must thus identify activities and mechanisms through which excellent customer relationships are developed. Jenkins (2008) notes that for mobile money businesses, a formidable link between customers and the MMOs will be a well-established network of agents through whom mobile money services are offered over the counter (OTC) to customers. Once an MMO is able to build a strong and effective agent network, customers can be better served using these agents as they represent the MMOs on behalf of the providers.

Revenue structures: McNally (2013) identified a key question which every firm must ask: What are customers really willing to pay for? Once the right customer needs have been identified, the revenue sources must then be factored into the business model. The achievement of financial value not only allows the firm to be self-sustaining but also provides opportunities for reinvestment and/or cross-subsidization (Sinkovics et al., 2014).

Key activities: These are several activities that a firm undertakes to deliver on its value proposition (Chen et al., 2013). Zeleti et al. (2016) add that these activities describe the most important things that a firm must do to make its business model work. They form the operations carried out by the firm for creating, capturing and delivering value.

Key resources: Understanding and identifying the key resources needed to deliver on the value propositions form a critical element of a business model. Key resources could be technology, infrastructure, or human resources, and other financial or non-financials that are vital in executing the key activities (Chen et al., 2013; McNally, 2013) towards delivering the customer value proposition. Zeleti et al. (2016) further posit that key resources are needed if the business model must work.

Key partners: These are elements of the business model that extend beyond the firm's entity, its customers and shareholders, and also include value captured for key stakeholders which require a broader value network perspective for innovating and transforming the business model (Beattie & Smith, 2013; Sommer, 2012; Zott et al., 2011). Key partners also describe the network of suppliers and partners needed to make the business model feasible (Jenkins, 2008; Zeleti et al., 2016), by their providing key resources or conducting key activities. Where the needed resources or knowledge for navigating the complexities of the target market are lacking, firms may consider collaborating with partners to help facilitate new modes of value creation (Dahan et al., 2010) as well as alternative routes to market. This suggests that strategic partnerships remain key to achieving efficiency gains and business continuity. The evolving platform and sharing economy phenomenon also suggest that shared infrastructure and assets can be leveraged for greater efficiencies and economies of scales. As such, a viable business model must identify key partners with the relevant assets, resources and capabilities needed to deliver customer value propositions (David-West et al., 2016).

Cost structures: The efficiency of any business largely depends on how costs are structured. Costs such as capital expenditure (CAPEX) and operating expenditure (OPEX) significantly impact how well an organization is positioned and able to compete in a given market. The cost element of the BM must be able to answer questions such as what the most important costs inherent in the business are and what the avenues are through which those costs would be offset.

MethodologyThe study adopted a qualitative approach that considered multiple cases in investigating the business models deployed by MMOs in the creation and delivery of mobile money services in Nigeria. The multiple case approach allowed for a comparative analysis of the business models deployed by operators and provided insight into establishing how sustainable these models are for creating and delivering mobile money services. Berkowitz (1997) states that case studies provide very rich explorations of a subject or phenomenon as it develops in a real-world setting. The study further uses a cross-case analysis given its robustness in analysing and synthesizing data across multiple cases unlike the individual or intra-case analysis approach that restricts the analysis to a single case (Berkowitz, 1997; Cruzes, Dybå, Runeson, & Höst, 2015; Mahoney, 1997; Miles, Huberman, & Saldana, 2013).

Case selection of the population of twenty-one licensed MMOs, eight active MMOs were purposefully selected for the study. Each MMO selected was a licensed operator with the apex financial services regulator (Central Bank of Nigeria) and has been in operation for over 5 years – either operating as an independent organization (non-bank led) or as a spin-off entity of a larger deposit money bank (bank-led). The sample selection was done using purposive sampling in order to focus on particular attributes of interest to the MMOs that could be used to answer the research questions. The selection of MMOs was further based on certain criteria including company access, operating location and operating model (bank-led vs non-bank led). Of the eight MMOs purposively sampled, three were bank-led and five were non-bank led. The instrument employed was designed to elicit information on supply-side strategic and organizational assets, resources and capabilities required for effective mobile money deployment.

Semi-structured interviews with C-level executives of the selected MMOs were conducted. The research design was based on multiple cases and the interviews were carried out by two independent field teams who adopted the same interview protocol which consisted of over 80 open-ended leading questions. The interviews provided a better understanding of the nature of the MMO business, their operating models, risk mitigation approaches, technologies deployed, cost structures, strategies, motives and specific focus on the assets, resources, capabilities and components of their operating business models deployed in the creation and delivery of mobile money services. Some of the questions revolve around the components of business models as described in (Osterwalder & Pigneur, 2009) and are aimed at addressing the research aims as indicated above. In accordance with research protocols, each recorded interview lasted about 80minutes. Transcripts of the voice recordings from the interviews as well as debrief notes were thematically coded into one or multiple nodes guided by a list of a priori codes identified from the related literature and analyzed using a qualitative data analysis (QDA) application, Nvivo. Coding was done in multiple cycles and two iteration tests to ascertain the consistency and sufficiency of themes and their classifications. Inter-coder reliability was used to determine the reliability of the themes. This was achieved by subjecting the transcripts to coding by four independent coders after which the themes were compared and harmonized.

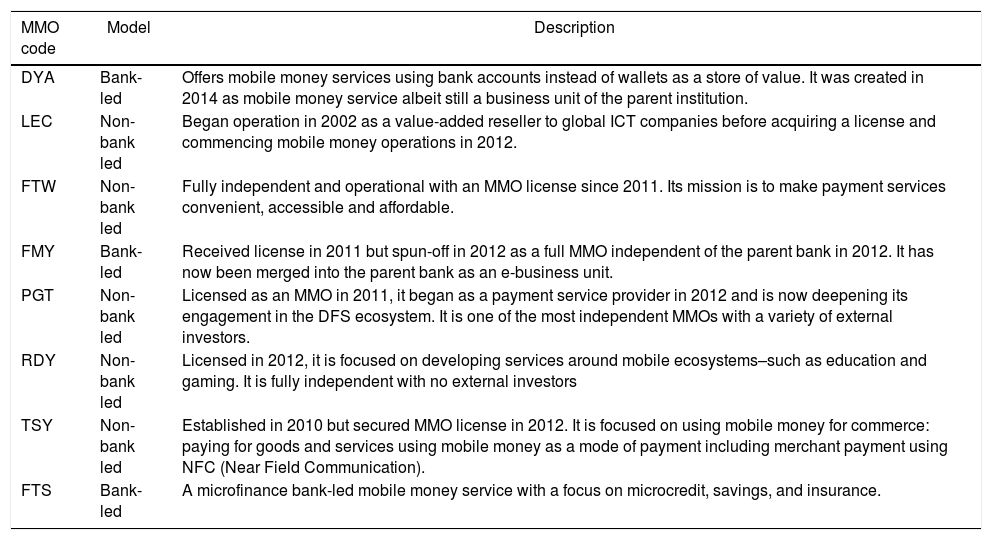

ResultsThis paper has attempted to ascertain the availability or lack of sustainable business models for the creation and delivery of mobile money services in Nigeria with a view of proposing new business models for the delivery of mobile money services to the bottom of the pyramid. The result of the study is presented as follows (Table 1).

Operating model descriptions of the eight sampled MMOs.

| MMO code | Model | Description |

|---|---|---|

| DYA | Bank-led | Offers mobile money services using bank accounts instead of wallets as a store of value. It was created in 2014 as mobile money service albeit still a business unit of the parent institution. |

| LEC | Non-bank led | Began operation in 2002 as a value-added reseller to global ICT companies before acquiring a license and commencing mobile money operations in 2012. |

| FTW | Non-bank led | Fully independent and operational with an MMO license since 2011. Its mission is to make payment services convenient, accessible and affordable. |

| FMY | Bank-led | Received license in 2011 but spun-off in 2012 as a full MMO independent of the parent bank in 2012. It has now been merged into the parent bank as an e-business unit. |

| PGT | Non-bank led | Licensed as an MMO in 2011, it began as a payment service provider in 2012 and is now deepening its engagement in the DFS ecosystem. It is one of the most independent MMOs with a variety of external investors. |

| RDY | Non-bank led | Licensed in 2012, it is focused on developing services around mobile ecosystems–such as education and gaming. It is fully independent with no external investors |

| TSY | Non-bank led | Established in 2010 but secured MMO license in 2012. It is focused on using mobile money for commerce: paying for goods and services using mobile money as a mode of payment including merchant payment using NFC (Near Field Communication). |

| FTS | Bank-led | A microfinance bank-led mobile money service with a focus on microcredit, savings, and insurance. |

Broad descriptions of the operating models of each of the sampled MMOs in the study. We keep the names of the MMOs anonymous and used pseudonyms to represent them.

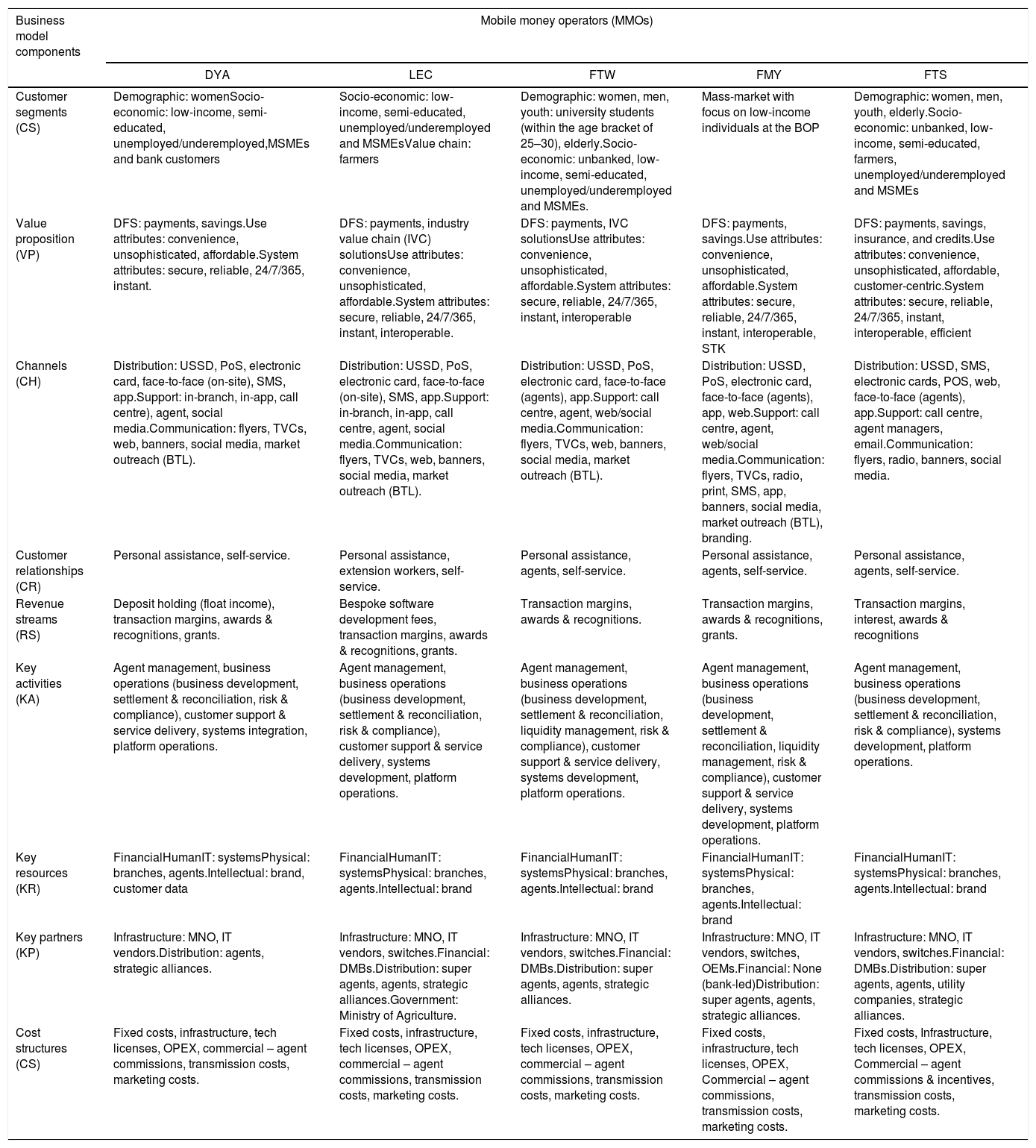

The analysis of the business models of five out of the eight cases is summarized in Table 2 using elements from the Business Model Canvas developed by Osterwalder and Pigneur (2009), and based on responses provided by the key informants from the sampled cases.

Business model components of five of eight sampled MMOs.

| Business model components | Mobile money operators (MMOs) | ||||

|---|---|---|---|---|---|

| DYA | LEC | FTW | FMY | FTS | |

| Customer segments (CS) | Demographic: womenSocio-economic: low-income, semi-educated, unemployed/underemployed,MSMEs and bank customers | Socio-economic: low-income, semi-educated, unemployed/underemployed and MSMEsValue chain: farmers | Demographic: women, men, youth: university students (within the age bracket of 25–30), elderly.Socio-economic: unbanked, low-income, semi-educated, unemployed/underemployed and MSMEs. | Mass-market with focus on low-income individuals at the BOP | Demographic: women, men, youth, elderly.Socio-economic: unbanked, low-income, semi-educated, farmers, unemployed/underemployed and MSMEs |

| Value proposition (VP) | DFS: payments, savings.Use attributes: convenience, unsophisticated, affordable.System attributes: secure, reliable, 24/7/365, instant. | DFS: payments, industry value chain (IVC) solutionsUse attributes: convenience, unsophisticated, affordable.System attributes: secure, reliable, 24/7/365, instant, interoperable. | DFS: payments, IVC solutionsUse attributes: convenience, unsophisticated, affordable.System attributes: secure, reliable, 24/7/365, instant, interoperable | DFS: payments, savings.Use attributes: convenience, unsophisticated, affordable.System attributes: secure, reliable, 24/7/365, instant, interoperable, STK | DFS: payments, savings, insurance, and credits.Use attributes: convenience, unsophisticated, affordable, customer-centric.System attributes: secure, reliable, 24/7/365, instant, interoperable, efficient |

| Channels (CH) | Distribution: USSD, PoS, electronic card, face-to-face (on-site), SMS, app.Support: in-branch, in-app, call centre), agent, social media.Communication: flyers, TVCs, web, banners, social media, market outreach (BTL). | Distribution: USSD, PoS, electronic card, face-to-face (on-site), SMS, app.Support: in-branch, in-app, call centre, agent, social media.Communication: flyers, TVCs, web, banners, social media, market outreach (BTL). | Distribution: USSD, PoS, electronic card, face-to-face (agents), app.Support: call centre, agent, web/social media.Communication: flyers, TVCs, web, banners, social media, market outreach (BTL). | Distribution: USSD, PoS, electronic card, face-to-face (agents), app, web.Support: call centre, agent, web/social media.Communication: flyers, TVCs, radio, print, SMS, app, banners, social media, market outreach (BTL), branding. | Distribution: USSD, SMS, electronic cards, POS, web, face-to-face (agents), app.Support: call centre, agent managers, email.Communication: flyers, radio, banners, social media. |

| Customer relationships (CR) | Personal assistance, self-service. | Personal assistance, extension workers, self-service. | Personal assistance, agents, self-service. | Personal assistance, agents, self-service. | Personal assistance, agents, self-service. |

| Revenue streams (RS) | Deposit holding (float income), transaction margins, awards & recognitions, grants. | Bespoke software development fees, transaction margins, awards & recognitions, grants. | Transaction margins, awards & recognitions. | Transaction margins, awards & recognitions, grants. | Transaction margins, interest, awards & recognitions |

| Key activities (KA) | Agent management, business operations (business development, settlement & reconciliation, risk & compliance), customer support & service delivery, systems integration, platform operations. | Agent management, business operations (business development, settlement & reconciliation, risk & compliance), customer support & service delivery, systems development, platform operations. | Agent management, business operations (business development, settlement & reconciliation, liquidity management, risk & compliance), customer support & service delivery, systems development, platform operations. | Agent management, business operations (business development, settlement & reconciliation, liquidity management, risk & compliance), customer support & service delivery, systems development, platform operations. | Agent management, business operations (business development, settlement & reconciliation, risk & compliance), systems development, platform operations. |

| Key resources (KR) | FinancialHumanIT: systemsPhysical: branches, agents.Intellectual: brand, customer data | FinancialHumanIT: systemsPhysical: branches, agents.Intellectual: brand | FinancialHumanIT: systemsPhysical: branches, agents.Intellectual: brand | FinancialHumanIT: systemsPhysical: branches, agents.Intellectual: brand | FinancialHumanIT: systemsPhysical: branches, agents.Intellectual: brand |

| Key partners (KP) | Infrastructure: MNO, IT vendors.Distribution: agents, strategic alliances. | Infrastructure: MNO, IT vendors, switches.Financial: DMBs.Distribution: super agents, agents, strategic alliances.Government: Ministry of Agriculture. | Infrastructure: MNO, IT vendors, switches.Financial: DMBs.Distribution: super agents, agents, strategic alliances. | Infrastructure: MNO, IT vendors, switches, OEMs.Financial: None (bank-led)Distribution: super agents, agents, strategic alliances. | Infrastructure: MNO, IT vendors, switches.Financial: DMBs.Distribution: super agents, agents, utility companies, strategic alliances. |

| Cost structures (CS) | Fixed costs, infrastructure, tech licenses, OPEX, commercial – agent commissions, transmission costs, marketing costs. | Fixed costs, infrastructure, tech licenses, OPEX, commercial – agent commissions, transmission costs, marketing costs. | Fixed costs, infrastructure, tech licenses, OPEX, commercial – agent commissions, transmission costs, marketing costs. | Fixed costs, infrastructure, tech licenses, OPEX, Commercial – agent commissions, transmission costs, marketing costs. | Fixed costs, Infrastructure, tech licenses, OPEX, Commercial – agent commissions & incentives, transmission costs, marketing costs. |

We keep the names of the MMOs anonymous and used pseudonyms to represent them.

The results of the study highlight some important themes in better understanding the current BMs deployed by the MMOs and we shall approach the discussion by exploring customer segments, value propositions, channels, customer relationships, revenues streams, and cost structures.

Customer segmentsResults from the discussions with the key informants reveal that few providers are able to address demographic segments like women or youth as well as actors and participants in industry value chains such as agriculture. Mobile money operators address a fairly homogeneous customer group based on socio-economic status. The addressable market appears to be largely drawn from the broad customer segments that traditional commercial banks target. The Nigerian market, however, is significantly saturated with over 25 MMOs. The approach of serving a homogeneous customer segment is unlikely to drive business growth and sustainability as the unbanked and underbanked Nigerians from each of the six geopolitical zones of the country have significantly different financial service needs predicated on their locations, trades, and unique circumstances. Greater knowledge of the needs of the different market segments based on their geographies and unique circumstances should drive DFS products development and deployment.

Value propositionThe value propositions of mobile money offerings by the various providers are somewhat similar, irrespective of customer segments, specific needs or geography. The value propositions identified are classified into three unique components – digital financial services (DFS) offered, usage attributes, and system attributes. Due to licensing restrictions, non-bank providers are only able to provide deposit and payments services, whilst bank-led operators can provide credit (loans). Insurance protection may also be available for credit products. One of the executives interviewed reiterated thus:

“I am just saying that the mobile money as it is today is a digital financial service, but then there are so many other things that falls [sic] under [that heading]. And that is the way to solve financial inclusion problems: It is through innovative ideas by capture [sic] a segment and get them engage [sic].”

Value propositions should address utility and adoption with features that foster convenience, affordability, simplicity (unsophisticated) and customer centricity. System-related attributes should address confidence building features of the technology and virtual transaction environment. These include operations beyond banking hours, 24/7/365 access, systems security, reliability, instantaneous transactions and interoperability. To enhance data security, user interfaces and value-added services support, a SIM Toolkit (STK) application is deployed.

We recommend that a more detailed articulation of the different value propositions for the different segments based on their needs, circumstances, occupations and income levels should be adopted as against the practice of deploying homogeneous value propositions which, in most instances, still target the banked consumer. Non-bank led operators should also engage the regulator in the area of creating enabling laws and regulations that facilitate the creation of products that do not only facilitate payment, but also enable the consumers earn interest on savings held by non-bank led operators in mobile wallets.

ChannelsMobile money operators employ channels for service distribution, support and communication. Other than physical financial access points (branches or agents), the digital nature of the services suggests digital-enabled channels. However, depending on the market segment, technology, and deployment costs, a variety of digital distribution channels are operational. The most popular and intuitive are mobile channels such as short message service (SMS), universal supplementary service data (USSD), mobile applications and point of sale (POS) terminals. These channels, however, have their challenges as one of the respondents said:

“Alert notifications from receiving banks to customers is very poor which makes customers disturb agents for non-receipt of funds transferred to them”

Bank-led MMOs leverage existing support channels – in-branch, email, call centre, web chat and social media for attending to customer queries. Notwithstanding the absence of branches, agents assist non-bank providers with face-to-face customer support alongside digital support channels. Even though above-the-line (ATL) communication techniques are more dominant, the nascent nature of mobile money justifies the use of below-the-line (BTL) methods such as direct consumer outreaches. The ATL techniques range from flyer distribution, TV and radio commercials, print media adverts, web banners, and so on. A respondent said:

“Actually, we have not done so much in terms of advertising. So [we have] flyers, handbills, banners at the agent locations. In the early days, we did a few radio jingles…”

Another responded that:

“We use the 3 local languages. Pidgin… I can’t remember if we’ve done any advert in Pidgin.”

Given the ubiquity of feature phones as against smartphones and high teledensity in Nigeria at over 100 per cent, MMOs should deploy more efforts in the creation of ATL and BTL communication activities that pass-through feature phones as a channel. We also observed that MMOs do not employ channels such as informal groups or community/occupational based associations in reaching their potential customers. This neglected channel is believed to hold strong promise.

Customer relationshipsIn the area of customer relationships, the mechanisms that exist for building and maintaining customer relationships remain direct personal assistance (using face-to-face channels) and self-service through the diverse digital channels provided. Where mobile money services are deployed in the agriculture sector, MMOs leverage the existence of extension workers to form part of the relationship building channels. The development and maintenance of relationships also extend to key partners where, depending on the nature of the relationship, these may require additional resources and frequent reporting.

MMOs should more deliberately cultivate new customer relationships and adopt an approach that demonstrates an understanding of the segments and locations of the customers. More efforts should also be deployed in strengthening existing relationships.

Revenue streamsThe primary revenue stream of mobile money remains the transaction margins. One of our key respondents confirmed this by saying:

“Indeed, transaction fees [are] really our revenue. In the case of collections, like government or hospital, it's still transactions, it's the commission.”

Deposit money banks that hold the aggregate pool funds have the advantage of earning interest income on the float balances, unlike the independent (non-bank) MMOs that do not hold their deposits. One of the respondents representing an independent MMO reiterated:

“…So, the physical cash would always sit in a bank, virtual funds will be with the mobile payment operators”

While this is different for non-bank led MMOs that are required to partner with a deposit holding bank, they may have to source for additional revenue streams other than commissions earned on transactions. Such supplementary revenue streams as revealed from our analysis include interest income for providers of credit services and bespoke software development fees for non-bank led providers with established systems development capabilities. Innovation grants that support product build-outs and deployments also form part of the revenue sources for mobile money operators, while awards and recognitions are avenues for non-monetary revenue.

Key activitiesMobile money development and operational activities are homogeneous across all cases. These can be summarized in three broad categories of activities – product design, agent management, and operations (reconciliations). One of the respondents remarked:

“…the agent development team recruits the agents, go through all the vetting process but the day-to-day management of the agents is within trade and distribution across Nigeria.”

In terms of reconciliation activities, another executive responded:

“Now, obviously if I was sending money from my wallet to yours, it would debit my wallet and credit your wallet. In the case of this gentleman, he sent from himself to himself. Unfortunately, the system/platform was not configured to recognize that kind of thing. What happened was that it credited him but didn’t debit him. You see, thank God we do daily reconciliation, there was an imbalance; that is a one-legged transaction. There was an imbalance and we could track it thorough[ly]. And like I said, thank God the operations team does it daily.”

MMOs should build and manage the route-to-market (service distribution) channels, operate the business, serve and support customers, conduct back office services such as settlement and reconciliation, fulfil regulatory risk and compliance mandates and deliver the service. As a result of the dependence on technology-, IT management activities as they relate to building and managing IT services, systems development and integration were also found to be critical.

Key resourcesThe key resources component of the different business models examined showed that the key resources deployed for the delivery of mobile money services revolve around four conventional areas – physical, human, financial and technology. One of the executives responded:

“People (IT) - We have our technology (IT). Because all our technology products are proprietary to us. So, it's a separate entity but it is part of us. The developers and all of them they’re core to us.”

Another said:

“We have two data centres.”

In terms of people resources, one of the executives interviewed said:

“XXX agents need to be handy to receive and resolve customer problems as soon as possible.”

In addition to these, intellectual resources such as established and known bank brands and existing customer data are noteworthy. The establishment, age and physical presence of banks provide them more leverage than their newer (independent) counterparts in the mobile money ecosystem. MMOs should spend more time deepening their resource pools especially for technological resources that can be a source of competitive advantage.

Key partnersWhile partners can be employed to deliver some key activities or provide key resources, in the case of mobile money services, partnerships with technology vendors (suppliers) that provide the hardware systems, software applications as well as communications networks, especially mobile network operators (MNOs) that own the rails for transaction processing are considered mandatory and were observed across all cases analyzed. This further strengthens the submission of Jenkins (2008) and Donovan (2012) that the provision of mobile money services exists at the intersection of finance and technology and as such, a myriad of partnerships and collaboration is needed to effectively deliver on the value proposition of mobile money operators. Internet service providers (ISPs) are alternative communications providers when financial or agent services are web-based. Non-bank operators also require partnerships with financial institutions to hold and manage the deposit pools, as well as provide rebalance services for agents to top-up e-float balances at bank branches. Interoperability, a system attribute of the value proposition, is facilitated through partnerships with switches and other financial services providers, including MMOs. However, in Nigeria, interoperability is simply a technical functionality that is not being offered to the customers. Supported by the Agent Banking Guidelines, the limited number of bank branches in Nigeria warrants alternative distribution channels through independent agents and as such requires partnerships either with individual agents or with established licensed super-agents. Where POS integration is supported as a channel, partnerships with existing merchant acquirers are essential. Mobile money operators servicing industry value chain activities like agriculture, gaming, and the like also require alliances with key actors in the industry ecosystems. Finally, another category of partners identified are non-governmental and other development agencies conducting interventions that require processing consumer payments. This group was identified as having huge potential for growth and expansion of the market.

Cost structuresThe costs required for the operation of a mobile money business range from fixed costs which include technology, infrastructure and licensing costs, operating costs such as marketing (ATL and BTL) and technology maintenance fees which are also quite significant. The final category comprising other commercial-oriented costs like agent commissions, transmission charges and insurance (where offered) cannot be ignored. Our analysis of this business model component further shows that the cost structure of these MMOs is so high that profitability may take longer than anticipated. A respondent noted thus:

“The annual cost to maintain this company today is about

600 million; and this is just not just salary[sic] because there is like [sic] the bandwidth, and this does not even include agents’ commissions.”Given such huge cost structures, especially in emerging markets where the cost of doing business is relatively high, MMOs must explore avenues for cost management and reduction to ensure that their low-cost orientations are maintained.

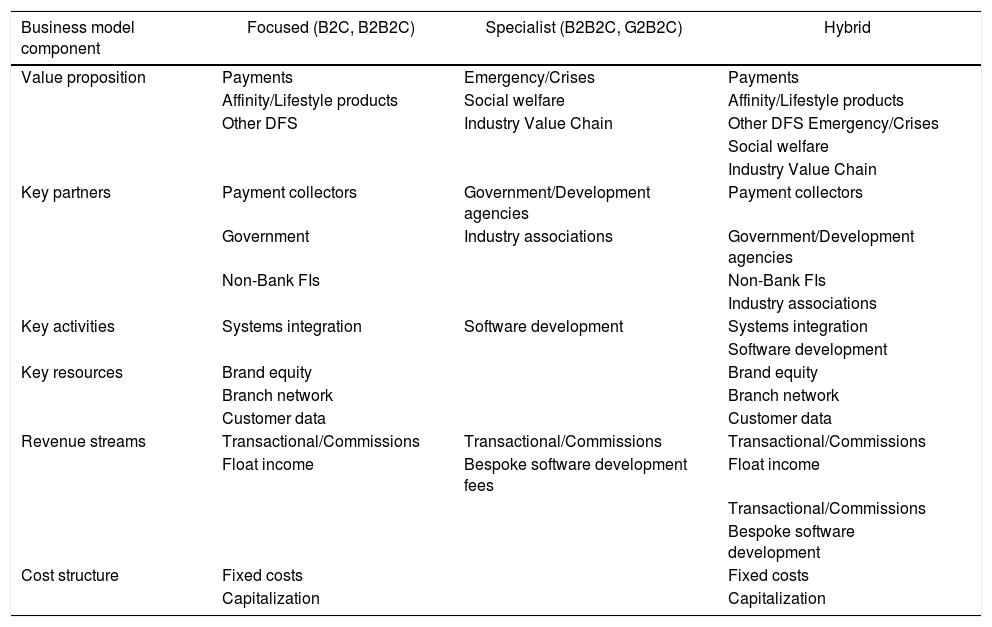

Sustainable business models for mobile financial servicesFollowing our analysis of the current business models deployed by the operators, we propose three business model configurations for the delivery of sustainable mobile financial services in Nigeria (see Table 3). The first is the focused model that targets the efficient delivery of financial services to a customer segment, demographic group or lifestyle/affinity groups. Operators that run focused business models usually facilitate payments, collections and other financial services seamlessly. The value proposition of these MMOs includes efficiency and reliability while systems integration to core banking systems and other third-party systems is critical. The specific elements of the value proposition, key partners, key activities, key resources, revenue streams and cost structures recommended in the business model are indicated in Table 3.

Proposed sustainable business models (SBMs).

| Business model component | Focused (B2C, B2B2C) | Specialist (B2B2C, G2B2C) | Hybrid |

|---|---|---|---|

| Value proposition | Payments | Emergency/Crises | Payments |

| Affinity/Lifestyle products | Social welfare | Affinity/Lifestyle products | |

| Other DFS | Industry Value Chain | Other DFS Emergency/Crises | |

| Social welfare | |||

| Industry Value Chain | |||

| Key partners | Payment collectors | Government/Development agencies | Payment collectors |

| Government | Industry associations | Government/Development agencies | |

| Non-Bank FIs | Non-Bank FIs | ||

| Industry associations | |||

| Key activities | Systems integration | Software development | Systems integration |

| Software development | |||

| Key resources | Brand equity | Brand equity | |

| Branch network | Branch network | ||

| Customer data | Customer data | ||

| Revenue streams | Transactional/Commissions | Transactional/Commissions | Transactional/Commissions |

| Float income | Bespoke software development fees | Float income | |

| Transactional/Commissions | |||

| Bespoke software development | |||

| Cost structure | Fixed costs | Fixed costs | |

| Capitalization | Capitalization |

Key: B2C (business to consumer); B2B2C (business to business to consumer); G2B2C (government to business to consumer).

The second business model is labelled the specialist model. Unlike focused models that banks are better positioned to lead, specialist business models are more synonymous with non-bank led MMOs. Specialist models aim to reduce tensions in industry value chains whilst facilitating payments and other commercial activities. Thus, specialist models are more complex and require a deep understanding of industry business rules, processes and software development capabilities. Specialist models can also be deployed to support government social welfare schemes and other emergency interventions such as payments to displaced persons. The specific elements of the value proposition, key partners, key activities, key resources, revenue streams and cost structures recommended in the business model are indicated in Table 3.

Finally, the third model is a blended or hybrid model, combining elements of both the focused and specialist models. The specific elements of the value proposition, key partners, key activities, key resources, revenue streams and cost structures are also indicated in Table 3.

Implications for theory and practiceThe theoretical discourse around business models (BMs) and sustainable business models (SBMs) has raised two key questions as highlighted by Sinkovics et al. (2014) and Demil and Lecocq (2010) on the nature and dynamism of business models – static or dynamic. If firms must remain competitive and sustainable, then our findings present a case for the dynamism in the conceptualization and design of business models. This school of thought is supported by (1) the changing nature of customer segments over time as a consequence of changing consumer profiles and needs; (2) the volatility of the business environment which impacts how firms create and deliver value propositions for customers; (3) the increasing role of technology in business and society. Business models must, therefore, make provision for evaluation and re-invention to meet these needs. Firms must, therefore, develop the assets, resources and capabilities (ARCs) needed for flexible business model re-generation that identify changes in consumer needs as well as accommodate the corresponding changes in their offerings or strategy (David-West et al., 2016; Linder and Cantrell, 2000; Sinkovics et al., 2014). These require an adaptation or complete redesign in one or more elements of a firm's original business model as well as devising new strategies that will effectively implement the business model.

ConclusionThe paper sought to ascertain the nature of business models deployed by MMOs in the creation and delivery of mobile money services in Nigeria, and also to propose sustainable business models that can help MMOs and other financial services providers effectively deliver mobile money services to the bottom of the pyramid market segments. Our analyses of the various business models across the different cases show that the BMs deployed are generic in nature despite having some variations in the customer segments served by these operators. In light of this, the business models adopted by the operators may not be sustainable especially given that these models are not designed to reduce tensions in industry value chains as they are more focused on general payments. We argue that for different customer segments (demographic – age groups, gender, education level, location; and socio-economic – income, employment, industry value chains participants such as farmers and MSMEs), the value propositions may not be generic and as such must match the different needs of the customer segments. Consequently, mobile money providers must constantly re-evaluate, re-conceptualize, re-innovate or adapt their BMs to reflect customer profiles, their needs and the dynamism of the business environment (Dahan et al., 2010; Linder and Cantrell, 2000; Sinkovics et al., 2014; Williamson, 2010; Wirtz et al., 2010; Zott et al., 2011).

Directions for future researchAlthough this study reviewed several business models, our analysis was guided by the Osterwalder's BMC. Other opportunities for further research include a study that considers the triangulation of alternate business model conceptualisation frameworks will benefit business literature as it will help create more viable business models that can help firms to be more competitive and sustainable. In addition, further understanding of the outcomes of currently deployed business models in terms of the MMO's number of employees, income level, overall profitability, earnings before interest, tax, depreciation and amortization, shareholders’ funds, return on capital employed, and leverage will be beneficial. This knowledge will increase overall understanding of the business performance of the current business models over and beyond low customer and transaction volumes observed in the study. Finally, analyses of the impact of the current policy environment, as well as actions of the different regulatory institutions, influences the business model choices and business outcomes of the MMOs will help in extending the overall understanding of how policy and business models impact the performance of the MMOs. This study may come up with policy recommendations that will result in more cohesive and effective business models. Future research can also explore economic modelling to show the costs of each of the proposed business models and establish the exact cost-effectiveness of each of the proposed business models.