This paper offers a theoretical model which focuses on cultural bargaining behavior. It is based on an intercultural negotiation framework of activity-based cultural types (Ott, 2011). The complexities of international negotiations are analyzed from a multi-active bargaining perspective which considers negotiation-is-an-art model. The results show the multi-active bargaining types from a seller and a buyer perspective. The differences in international negotiation behavior show the problems of cultural collisions. The possibility to circumvent these clashes is at the core of this article. The analysis proves useful as the different time perceptions, cultural activity levels and the resulting strategic behavior are clearly related to the deadlocks, stalemates, break-ups and agreements experienced in real-life scenarios. The application of the model to UK-Malaysian negotiation experiments is an example of the robustness of the theoretical results. This paper offers solutions to negotiations in an intercultural context and opens the black box of the uncertainty about cultural incompatibilities.

Este estudio ofrece un modelo teórico que se centra en el comportamiento negociador cultural basado en una negociación intercultural sobre actividades culturales (Ott, 2011). Las complejidades de las negociaciones internacionales se analizan desde una perspectiva de negociación múltiple que considera un modelo de “la negociación es un arte.” Los resultados muestran los tipos de negociación multi-activa desde el punto de vista de un comprador y un vendedor. Las diferencias de comportamiento en la negociación intercultural demuestran los problemas de los choques culturales. Este artículo se centra en la posibilidad de evitar esos choques. La validez del análisis se ve reflejada en cómo las diferencias de percepción temporal, niveles de actividad cultural y el comportamiento estratégico resultante están claramente relacionados con los puntos muertos, acuerdos y rotura de las negociaciones que se dan en situaciones reales. La aplicación del modelo a experimentos de negociación entre el Reino Unido y Malasia pone de manifiesto la solidez de los resultados teóricos. Este artículo ofrece soluciones a las negociaciones interculturales y revela el problema de la incertidumbre en cuanto a incompatibilidades culturales.

‘Consider first a Bazaar: a buyer would arrive at a shop, bargain with the seller and might after a while indicate that he is about to leave and look for another shop. It is commonplace for the seller to shout after the leaving customer and make a last price offer. Indeed, no self-respecting seller would allow a customer to leave without making a last offer (Shaked, 1994, p. 421/422)’.

Modeling a bazaar is one way of showing interactions at the marketplace which reaches from such immediate levels of co-operation and conflict to more sophisticated negotiations of virtual high-tech bargaining scenarios. Contrary to Shaked (1994) who moved away from bazaar to model high-tech market bargaining, Rapoport, Erev, and Zwick (1995) used a model of a ‘Tunisian Bazaar’ mechanism. As these papers show a similarity in the bargaining procedures of haggling bargainers, we use this as a starting point to show differences in the first offer, acceptance and rejection between different groups of cultures. In a bazaar the incompatibilities of different cultural bargaining types are most obvious between cultures with a haggling approach, on the one hand, and those with a short-term or those with a more patient approach, on the other hand.

One thing which is common to all modes of negotiating is a cultural cognitive program, which accompanies interaction and procedures in a globalized business world. The outcome of international and intercultural negotiations for managerial purposes is strongly determined by an inherent set of different values, beliefs, attitudes and norms which is often difficult to detect and about which it is difficult to be certain. The necessary evidence for strengthening the cultural negotiation types came from empirical investigations (Adair & Brett, 2004, 2005; Chaney & Martin, 2004; Graham, 1985; Graham & Mintu-Wimsat, 1997; Graham, Mintu, & Rodgers, 1994; Salacuse, 1999). These studies pointed to different bargaining strategies of US, Japanese and Brazilian cultures.

In a recent publication Ott (2011) introduced an intercultural negotiation framework which considers the clash between linear-active, multi-active and reactive bargaining strategies. This paper develops the concept presented in the cultural activity framework (Ott, 2011) further and assumes a one-sided incomplete information scenario for sellers and buyers with a multi-active approach. The characteristics of a haggling approach can generally be seen in a high offer, frequent rejection of offers and a longer bargaining horizon (Ott, 2011). Ott (2011) provides a basis for further research. The cooperation/conflict scenarios are not considered in an incomplete information setting, which can be very likely in import/export negotiations or any other foreign direct investment cases when a host culture is unsure about the expat managers or MNE HQ relationship with their subsidiary.

This paper contributes to the literature of international negotiations in several ways. First, we try to emphasize the multi-active bargaining behavior in buyer–seller negotiations. Second, we integrate these cultural activity types with bargaining games of one-sided incomplete information. Third, we apply our theoretical analysis to a UK-Malaysian experiment. Though the paper uses a formal analysis, the propositions are followed by the intuition to show the practical relevance.

International negotiationsIn this article, we continue in the tradition of Raiffa (1982, with Raiffa, Richarson, & Metcalfe, 2002) and Sebenius (1992, 2009) who called for negotiation analysis which integrates theoretical bargaining models with real-life negotiation scenarios. Co-operation and conflict are the essence of negotiations and are also the point of tension in game theoretical reasoning. We need to consider a dynamic perspective with the respective solution concept to combine the descriptive and prescriptive negotiation perspectives.

The literature review deals with the theoretical underpinning of international negotiation styles and bargaining models of one-sided incomplete information. It therefore combines both streams of literature with an empirical negotiation background and a theoretical bargaining approach.

International negotiation stylesThe literature of international negotiations is replete with examples of negotiation styles (Graham, 1985; Gelfand & Brett, 2004; Ghauri & Usunier, 2003; Thompson, Neale, & Sinaceur, 2004, inter alia) of different distinct cultural patterns such as US, Japanese and Brazilians. The scope of literature considers the art and science of negotiations, the psychology of negotiations and the international business and international relations perspectives on negotiations. A variety of negotiation models and frameworks deal with negotiation behavior which can be found in the international business literature (Fayerweather & Kapoor, 1976; Graham, 1987; Ghauri & Usunier, 2003; Ott, 2011; Tung, 1982; Weiss, 1993), game theory literature (Raiffa, 1982; Schelling, 1960) and social psychology literature (Deutsch, 1973; Gelfand & Brett, 2004; Pruitt, 1981). Combining culture, negotiation and game theory is the focus of this paper. We consider first the theoretical underpinning for culture and negotiation styles in that respect.

Understanding cultural behavior and co-operation (Chen, Chen, & Meindl, 1998; Fang, 2006; Hall, 1976; Hofstede, 1991, 2001) explains differences in negotiation styles and outcomes have been explicated for many decades. Whether cooperative or non-cooperative strategies are used in negotiation is determined by cultural evolution and schemes (Calabuig & Olcina, 2009; Chuah, Hoffmann, Jones, & Williams, 2007; Cordes, Richerson, McElreath, & Strimling, 2008; Hennig-Schmidt, Li, & Yang, 2008). The negotiation process belonging to the most basic cultural programs has been analyzed in experiments and it can be considered as a dynamic concept. We therefore use a time lens to show the differences and more importantly its implications for intercultural negotiations.

Usunier's (2003a, 2003b) contrasts time models between the Western (linear, economic time) and Eastern Asian time patterns (cyclical-integrated time). In general, the time horizon directly or indirectly plays a crucial role in international negotiations – especially the contrast between the long-term orientation of Asian, Arab and African cultures influence negotiations versus the short-term perspectives of Western Societies. Ellingsen and Johannesson (2009) contrasted the short-termist ‘Time is money’ perspective with the one of anthropologists who insisted that the ‘convertibility of time and money is circumscribed by norms and values’ (p. 96). Their results with Swedish participants in an experiment showed that subjects are more prone to make non-monetary sacrifices than to make monetary ones. Further there are different degrees of long-term and short-term orientation. Uncertainty about these types is a characteristic of international bargaining. Compared to the literature on negotiation styles of US Americans, Japanese and Chinese, the way cultural behavior affects negotiation strategies of multi-active players has not been analyzed extensively so far. Robinson, Lewicki, and Donahue (2000) found clear differences in the bargaining tactics between Asian, Latin American, USA and Western European groups on the five factor scales. The five factors comprised competitive bargaining, attacking opponent's network, false promises, misrepresentation and inappropriate info gathering which showed clear differences in cultural patterns. It becomes clear that using a multi-active bargaining perspective in contrast to the Western and Far Eastern behavior would open the black box of cultural clashes in negotiations.

Whereas Francis (1991), Olekalns and Weingart (2008) and Adair, Taylor, and Tinsley (2009) stress the tendency to adapt and overcompensate when negotiating with cultures of different negotiation schemes. This paper suggests that there is a cognitive part in the core of a bargaining game which will tend to lead to intercultural clashes even with the best intentions to find a cooperative solution. This is particularly clear in a bazaar when buyer–seller negotiations clash due to different concepts and styles. Building on an activity type focus for intercultural cognitive perspective together with a bargaining model, this paper stresses the multi-active section of the conceptual framework of intercultural negotiations (Ott, 2011). It articulates two levels of analysis (seller and buyer perspective) and comprises three distinct types of cultural strategic behavior (linear-active/US, multi-active/Brazil, reactive/Japan). We use Ott (2011) to further develop a model for multi-active bargainers colliding with other cultural activity types.

Bargaining literatureThe classical literature of bargaining games with one-sided incomplete information comprises articles by Rubinstein (1982, 1985), Ausubel and Deneckere (1989a, 1989b), Admati and Perry (1987), Myerson and Satterthwaite (1983), Crampton (1985, Chap. 8), Chatterjee and Samuelson (1983), Fudenberg, Levine, and Tirole (1985, Chap. 5), Myerson (1985, Chap. 7). Admati and Perry (1987, p. 321) pointed out that in the standard bargaining game a fixed time between offers is specified exogenously whereas in real bargaining situations bargainers may employ a number of strategies to affect the length of time between offers. It could be that the bargainers do not face each other throughout the bargaining process (communication by phone, etc.), a player can disappear for some time for various reasons or could close communication channels when it is his turn to make, receive or respond to an offer. Gul and Sonnenschein (1985, p. 5) stated ‘delay to agreement can only be explained by the time between offers’. Endogenous time between offers can be an important strategic variable in bargaining with incomplete information which was analyzed in Rubinstein (1985) and Admati and Perry (1987). Each player can delay her response as long as she wishes (beyond an exogenously fixed minimum time unit) when it is her turn to respond to an offer. There is the assumption that until an offer has been made by the relevant player, the other player must remain passive and cannot revise previous offers. Using Ott (2011) and applying her framework to a situation in which the seller is multi-active and delay is short in order to reverse Admati and Perry's (1987) delay assumption. There will be uncertainty about the buyer who might react with long-term or short-term valuation of the bargaining process. A bargaining game with haggling is therefore the theoretical underpinning for a bazaar setting.

Theoretically haggling has been rarely investigated, but there are a few experiments which analyze haggling in experiments (Cason, Friedman, & Milam, 2003; Milam, 2006). The outcome is that there are inefficiencies. The insights gained are derived from Rapoport et al. (1995) and Balakrishnan and Eliashberg (1995) which combine bargaining models with an experimental design. As their results show similarities to this article the next step is a formal model for the cultural types of bargaining. The proposition of a new way of analyzing international negotiations enables the study of the clash of cultural types. A framework of a one-sided incomplete information setting enlarges Ott (2011) to the degree that a multi-active seller (in a bazaar) meets a buyer whose cultural profile is uncertain and vice versa.

Multi-active bargaining behavior – values and costsThe following bargaining games show the outcomes when the seller or the buyer offers first. These scenarios are dealt with from a formal approach bundling a multi-active seller moving first and similarly for the multi-active buyer moving first. Hence, we aim to show the dynamics in international negotiations considering the different cultural activity types.

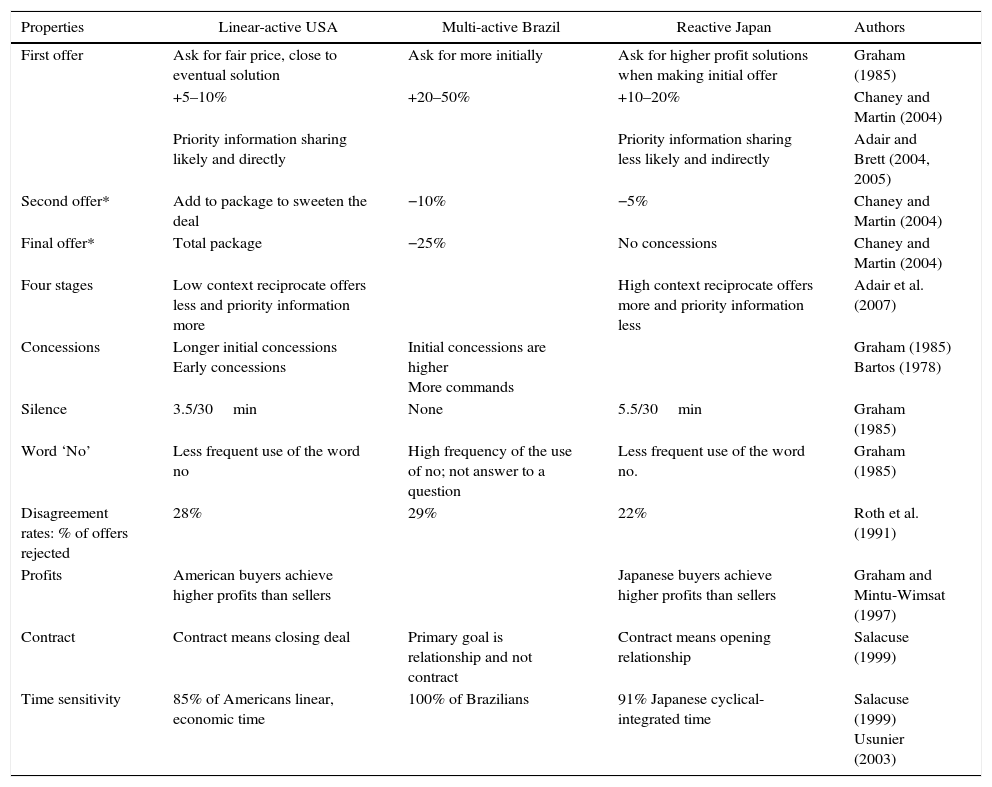

Ott (2011) draws on Lewis (2006) categories of linear-active, multi-active and reactive cultures and created an intercultural negotiation framework. Three main cultural activity groups are distinguished: task-oriented, highly organized planners (linear-active culture); people-oriented, loquacious ‘inter-relators’ (multi-active culture); introvert, respect-oriented listeners (reactive culture). Ott (2011) related these cultural activity types with the empirical evidence to design a bargaining framework. Table 1 outlines the empirical evidence regarding the key properties of the three types.

Empirical evidence of cultural activity types.

| Properties | Linear-active USA | Multi-active Brazil | Reactive Japan | Authors |

|---|---|---|---|---|

| First offer | Ask for fair price, close to eventual solution | Ask for more initially | Ask for higher profit solutions when making initial offer | Graham (1985) |

| +5–10% | +20–50% | +10–20% | Chaney and Martin (2004) | |

| Priority information sharing likely and directly | Priority information sharing less likely and indirectly | Adair and Brett (2004, 2005) | ||

| Second offer* | Add to package to sweeten the deal | −10% | −5% | Chaney and Martin (2004) |

| Final offer* | Total package | −25% | No concessions | Chaney and Martin (2004) |

| Four stages | Low context reciprocate offers less and priority information more | High context reciprocate offers more and priority information less | Adair et al. (2007) | |

| Concessions | Longer initial concessions Early concessions | Initial concessions are higher More commands | Graham (1985) Bartos (1978) | |

| Silence | 3.5/30min | None | 5.5/30min | Graham (1985) |

| Word ‘No’ | Less frequent use of the word no | High frequency of the use of no; not answer to a question | Less frequent use of the word no. | Graham (1985) |

| Disagreement rates: % of offers rejected | 28% | 29% | 22% | Roth et al. (1991) |

| Profits | American buyers achieve higher profits than sellers | Japanese buyers achieve higher profits than sellers | Graham and Mintu-Wimsat (1997) | |

| Contract | Contract means closing deal | Primary goal is relationship and not contract | Contract means opening relationship | Salacuse (1999) |

| Time sensitivity | 85% of Americans linear, economic time | 100% of Brazilians | 91% Japanese cyclical-integrated time | Salacuse (1999) Usunier (2003) |

This paper examines the clashes of pure types (such as US-Americans, Japanese and Brazilians) analyzed in the international business literature and emphasizes the differences between the respective bargaining behaviors. Consistent with the choice of pure types, empirical studies in international negotiations focus strongly on distinctive US and Japanese negotiations (Adair & Brett, 2004, 2005; Adair, Weingart, & Brett, 2007) and more recently on US and Chinese (Lee, Guang, & Graham, 2006) negotiations. Other cultures such as Brazilian, Spanish and Israeli are also often included to show US and Japanese bargaining (Adair & Brett, 2004, 2005; Brett & Okumura, 1998; Chaney & Martin, 2004; Graham, 1985; Graham & Mintu-Wimsat, 1997; Graham et al., 1994; Roth, Prasnikar, Okuno-Fujiwara, & Zamir, 1991; Salacuse, 1999). Adler, Graham, and Schwarz Gehrke (1987) distinguish between the US, Canadian and Mexican negotiation style. Using the cultural activity typology the difference between the bargaining patterns of linear-active (US, Canada) and multi-active (Mexican) behavior early on is striking. Volkema (1999) emphasizes similarly the difference between US and Brazilian negotiations, which can as well classify as linear-active versus multi-active negotiations. In 2004, Volkema (2004) stresses his results with an even larger dataset, but we can still classify the linear-active, multi-active and reactive negotiators of his nine-country analysis.

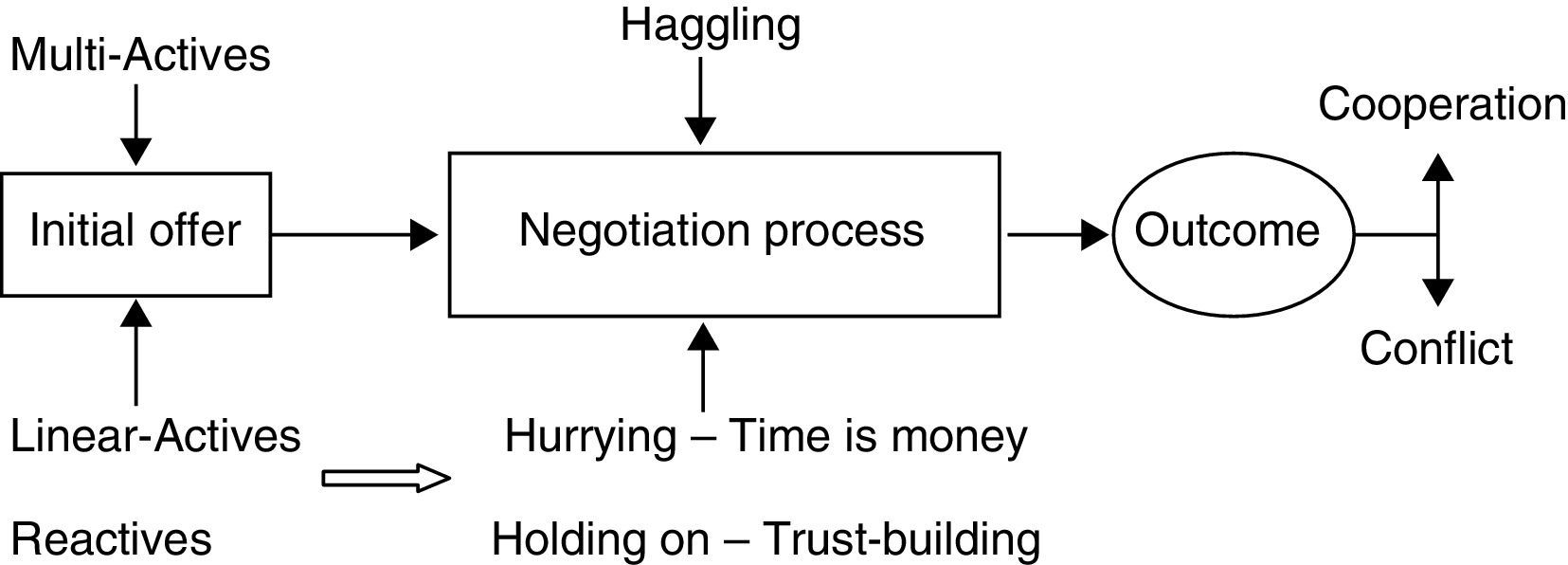

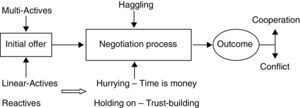

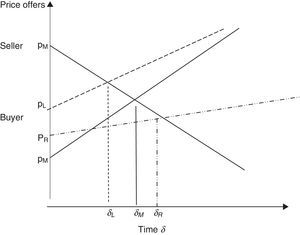

In the intercultural negotiation framework, cultural differences in bargaining behavior are connected to the range of the initial offer, the frequency of rejection, strategies of concession-making and the valuation of time. Fig. 1 shows the conceptual approach.

Different bargaining strategies occur because of setting a reasonable high price in order to get the desired price due to the duration of the negotiation period and to the resulting discounted value. For instance, a straight-forward approach and the anticipation of a short bargaining period may result in a lower initial offer and lower costs of time.

The negotiation rules include the range of price p and costs of time as a discount factor δ, which will be introduced in combination into this model. For our multi-active bargaining analysis, the properties of the model, thus, comprise the linear-active, multi-active and reactive type of player created in the framework (Ott, 2011):Assumption and Property 1Multi-active Players Multi-active players consider bargaining as art and a have long-term perspective in bargaining. Emotional bargaining means a high frequency of ‘Nos’ or rejection of offers. The multi-active player has a medium-term orientation δ→1, the time between offers and concessions is short 0<Δ≤1, the bargaining costs are high cH(t) and the length of negotiations covers a long period t={0, ∞}. Linear-active players have high costs of bargaining and time is costly which leads to a short-term perspective. The linear-active player has a short-term perspective δ→0, the offers and concessions are posed with a short delay Δ→0, the costs of bargaining are cL(t) low due to the short time horizon and finally the length of negotiations covers a short period t={0, N}. Acceptance leads to the end of the game and rejection to a small number of counter-offer and sometimes as well to the end of the game. Reactive players have a long-term perspective in bargaining and opting out after a long period of bargaining is possible. The reactive bargaining type has a long-term perspective δ→1, however the delay between offers can be long Δ→1, the bargaining costs are high cH(t), outside options are relevant and even possible after acceptance and the end of the game can be t={0, ∞}.

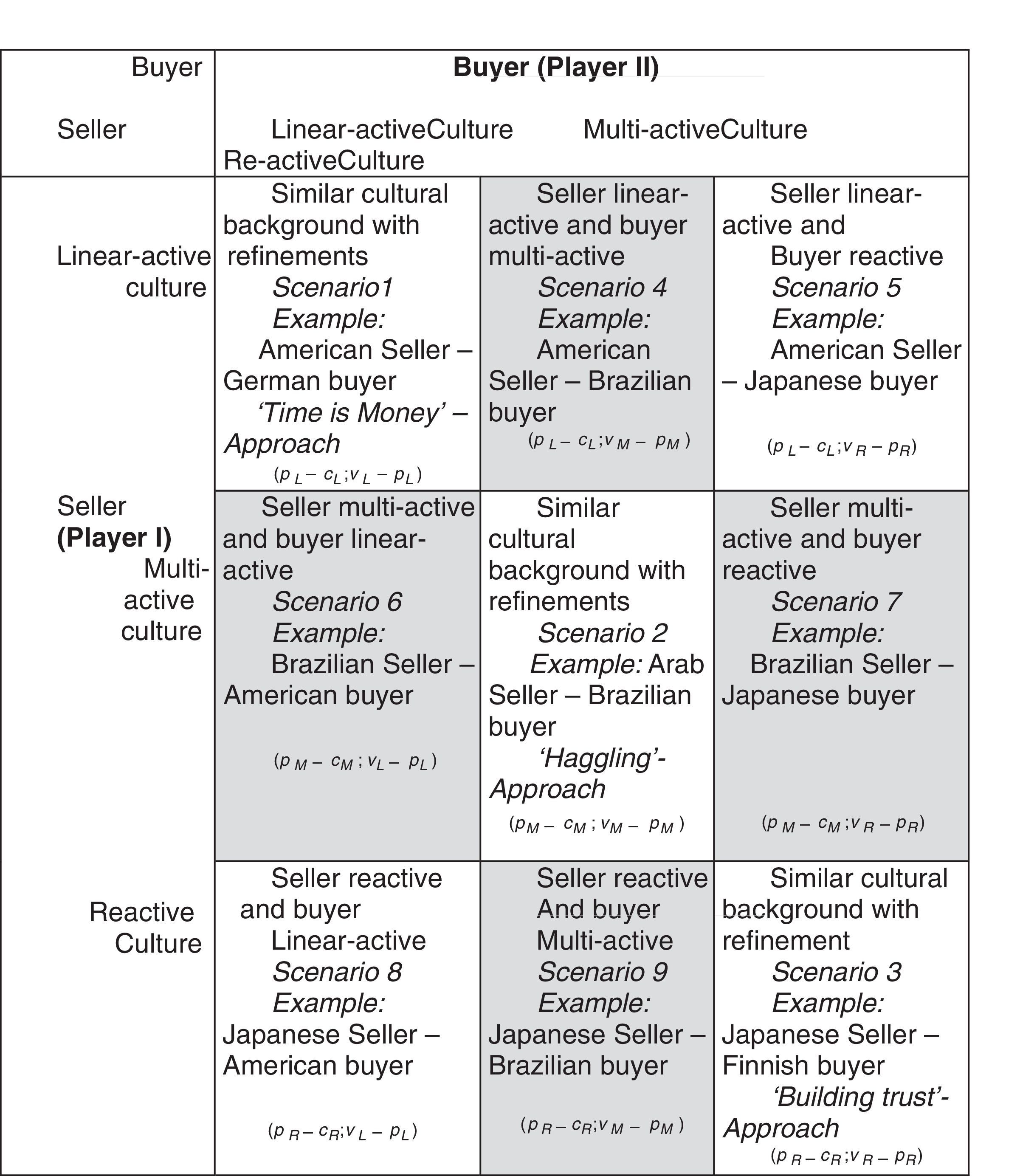

As we can now see it is important to distinguish between the multi-active and the reactive type due to their different strategic concept of delay regarding counter-offers and concessions. This means that we can capture the role of ‘No’ and the proneness to rejection in mathematical terms. The conceptualization of the clashes between these pure types can be seen in the following table. For the purpose of this paper, the main focus is on multi-active bargaining behavior and the clashes with linear-active and reactive types which are highlighted in the grey-shaded area from Table 2 in Ott (2011).

Buyer–seller model for different cultures in intercultural negotiations.

Let us now consider the standard buyer–seller model to show how the reservation price of the seller and buyer influences the agreed price or contracted price (Raiffa, 1982). In the standard buyer–seller negotiation literature (Raiffa, 1982; Raiffa et al., 2002; Rapoport et al., 1995; Sebenius, 1992, 2009) there is no distinction between different cultural ways of bargaining and using differences in initial offers and bargaining horizon. Our model adds to the standard model the differences in the value of time v (‘time is money’, ‘negotiation is an art’, ‘patience is a virtue’) and the differences of the costs c of the bargaining process which correlate with the differences in cultural patterns of negotiating.

The initial offer of a linear-active bargainer is smaller than the one of the multi-active and reactive players pR>pM>pL. The counter-offer of a linear-active, multi-active and reactive player shows the relationship pR*>pM*>pL*; pR*=max{vR,cR}pM*=max{vM,cM}pL*=max{vL,cL} which maximizes the time and costs of bargaining. The value of the time horizon v considers the value v∈[0,1] as a function of bargaining horizon v(δi) in which the discount factor δi symbolizes patience and impatience: v(δR)>v(δM)>v(δL). The costs of bargaining for a certain amount of time can be written as c(δR)>c(δM)>c(δL).

Bargaining modelsThe bargaining game starts at time zero, when it is the seller's turn to make an offer. Players make alternating offers until they reach an agreement. A response to an offer involves either an acceptance or a counteroffer, and it is made within no shorter than a given length of time. The response can be made at any time afterwards. The other player remains passive until an acceptance or counteroffer has been announced. The original offer cannot be revised after it has been made. The first offer in the game can be made at any time t≥0. Since the acceptance of an offer ends the game, a relevant history for the game is a sequence of unacceptable offers and a sequence of time between offers.

As this paper draws upon Rapoport et al. (1995) and Balakrishnan and Eliashberg (1995), the trading rules are used and reshaped for the purpose of creating a model for understanding multi-active buyer–seller bargaining games. This paper's bargaining rules are also adopted from Fudenberg et al. (1985), Crampton (1985), Fudenberg et al. (1985), Rubinstein (1985), Gul and Sonnenschein (1985), Admati and Perry (1987), and Ausubel and Deneckere (1989a, 1989b).

The following scenarios are applications of the bargaining games. Propositions and corollaries are adapted to the activity-based types of bargaining with one-sided uncertainty about the reservation values, such as the bargaining costs and the value of time, and about the strategic delay. Using the sequential equilibrium situation, we move to the incomplete information situation by using the dynamic approach by introducing ‘Nature’ as a dummy player for the one-sided incomplete information scenarios below. We consider the bargaining power derived from the first move of offering a price or making a proposal (either as a seller or as a buyer). This means that we can use, as well, uncertainty about the type of the first mover and suggest how to move as a multi-active player in a response scenario, which leads to a seller-offer game and buyer-offer game. We adapt Rapoport et al. (1995) to our situation by stating our trading rules: (1) private information on one side; (2) no communication is allowed except price proposal, acceptance and rejection; (3) the parties can be patient and impatient to enjoy the fruits of agreement, (note this is a deviation from Rapoport et al. (1995)). In addition, we consider what might happen when both the informed and uninformed party make offers. We emphasize Rapoport et al.’s proposition of impatience as ‘costs of bargaining’ is considered for our linear-active bargainers. Furthermore, an important feature is that the influence of time on bargaining could take on different forms. It can be reflected in the discounting function if the players discount future benefits. Secondly, the utility of agreement may change with the date. Finally, there is usually fixed cost of bargaining that recurs at each stage of the negotiation. In the present paper we study the variable costs of bargaining in terms of uncertainty regarding the time horizon. Our discount value is the factor of time and δ=[1−(1−r)1/2]/r.

We add to Rapoport et al.’s work the idea that there are different activity types of sellers and buyers and the clash of culture of these differences has an impact on the length of bargaining, and on the likelihood of break-ups, stalemates and success. Therefore, we can see the agreement zone is influenced by the height of the first offer, the concessions, the costs and the value of bargaining as an indication of the differences of time horizons. As an additional step to capture the differences of activity types, we choose to analyze the cultural clashes with the notation and logic of a process-oriented negotiation analysis.

Let us, therefore, represent each player's problem as choosing the maximum (minimum) level to demand (offer), subject to the constraints. We can therefore add what we have come up with in the section above relating to Characterization of Types and develop our models, respectively. This would mean that the seller will maximize the demand (price minus costs (p−c)) and the buyer will minimize the offer (v−p). The height of initial prices, the length of bargaining and the costs and value functions will all differ according to the cultural types.

Multi-active seller gamesLet there be a multi-active seller with payoff UMS=pM−cM, the index M refers to the price margin given which is between 20 and 50% and uncertainty about the buyer's value of the bargaining process with payoff ULMRB=v(δi)−p.Proposition 1 If a multi-active seller makes the initial offer in a seller-offer-game, then the uncertainty about the type of the buyer will lead to a bargaining game with incomplete information. (1) The multi-active seller makes an initial offer pM. The first situation occurs when a multi-active seller sets pM and expects the buyer to negotiate over this price by rejecting or making a counter-offer. (2) Nature chooses type of buyer to be either linear-active, multi-active or reactive v(δi)=v(δL,δM,δR). (3) The buyer accepts or rejects the offer. (4) Acceptance ends the game. In general, we have the following relationship of reservation values to show acceptance of an offer v(δi)≥p. (5) Rejection leads to another offer by the multi-active seller which will occur in a very short period of time. This is in a seller-offer game. The multi-active seller will continue with the game by offering again. The payoffs will be (UMS=pM−cM, ULMRB=v(δi)−p).□

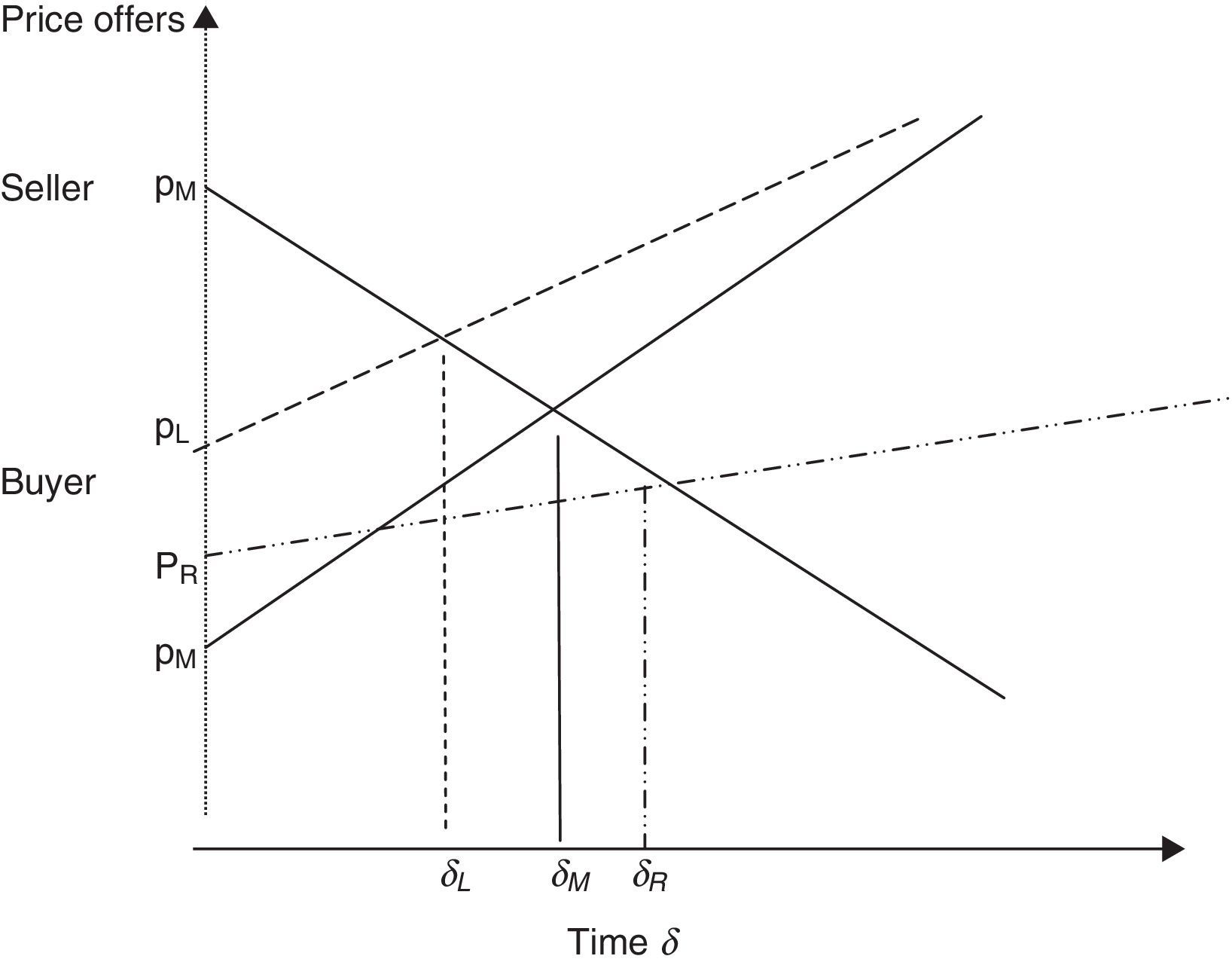

When a multi-active seller offers price pM, then the uncertainty about the buyer leads in cultural terms to differences in the valuation of the bargaining process with the initial offer. This means that, for linear-active and reactive types, the initial price offer does not fit to their private values. Therefore, rejection of the offer from the linear-active buyer will lead to another offer by the multi-active seller in the way that haggling lowers the initial price offer over time. However, the reactive player will not reject to due to losing face, but will delay the process – thus going counter to the strategic process of bargaining of multi-active players. Differences in the valuation lead to stalemates and break-ups. Fig. 2 shows the results of Corollaries 1a, b and c.Corollary 1aBrazilian Seller – American Buyer If a multi-active seller and a linear-active buyer bargain over the price of a good they want to trade, there will be a conflict due to the low frequency of offers/counteroffers and a high probability of acceptance of a high price without further bargaining. v(δL)≥pM and the value of the bargaining process is short for the linear-active player; therefore the costs are lower for the linear-active buyer to negotiate for a short period, whereas pM has a higher margin for the bargaining process. If the linear-active accepts, then she pays a higher price than necessary. If a multi-active seller offers to a multi-active buyer, then rejection by a multi-active buyer will lead to a counter-offer in a very short period of time. v(δM)≥pM and the cultural costs of bargaining are equal. This is the benchmark case for all other cultural models. If a multi-active seller and a reactive buyer bargain over the price of a good they want to trade, there will a long period of bargaining. v(δR)≥pM and the value of the bargaining process is longer than the offered price pM can cover. The multi-active seller will accept earlier than culturally perceived by the reactive player. It will be too costly to hold out for the multi-active.

Let there be the payoff function of a multi-active buyer UMB=vM−pM and a randomized seller with ULMRS=p−c(δi). There is uncertainty about the seller's bargaining horizon and cost of bargaining.Proposition 2 If a multi-active buyer makes the initial offer in a buyer-offer game, then the uncertainty about the type of the seller will lead to a sequential equilibrium. (1) The multi-active buyer makes an initial offer pM. (2) Nature chooses the type of the buyer being either linear-active, multi-active or reactive c(δi)=c(δL,δM,δR). (3) The linear-active, multi-active or reactive seller will either accept or reject. (4) Acceptance will end the game. In general, we can write p≥c(δi) to reach an agreement. It is very unlikely that the multi-active seller will accept the offer. (5) Rejection will lead to another offer by the buyer in a buyer-offer game or a counter-offer in an alternating offer game. Rejection by the seller will lead to a quick succession of another buyer offer in case of the buyer-offer game. The game continues. The payoffs will be (UMB=vM−pM,ULMRS=p−c(δi)).□

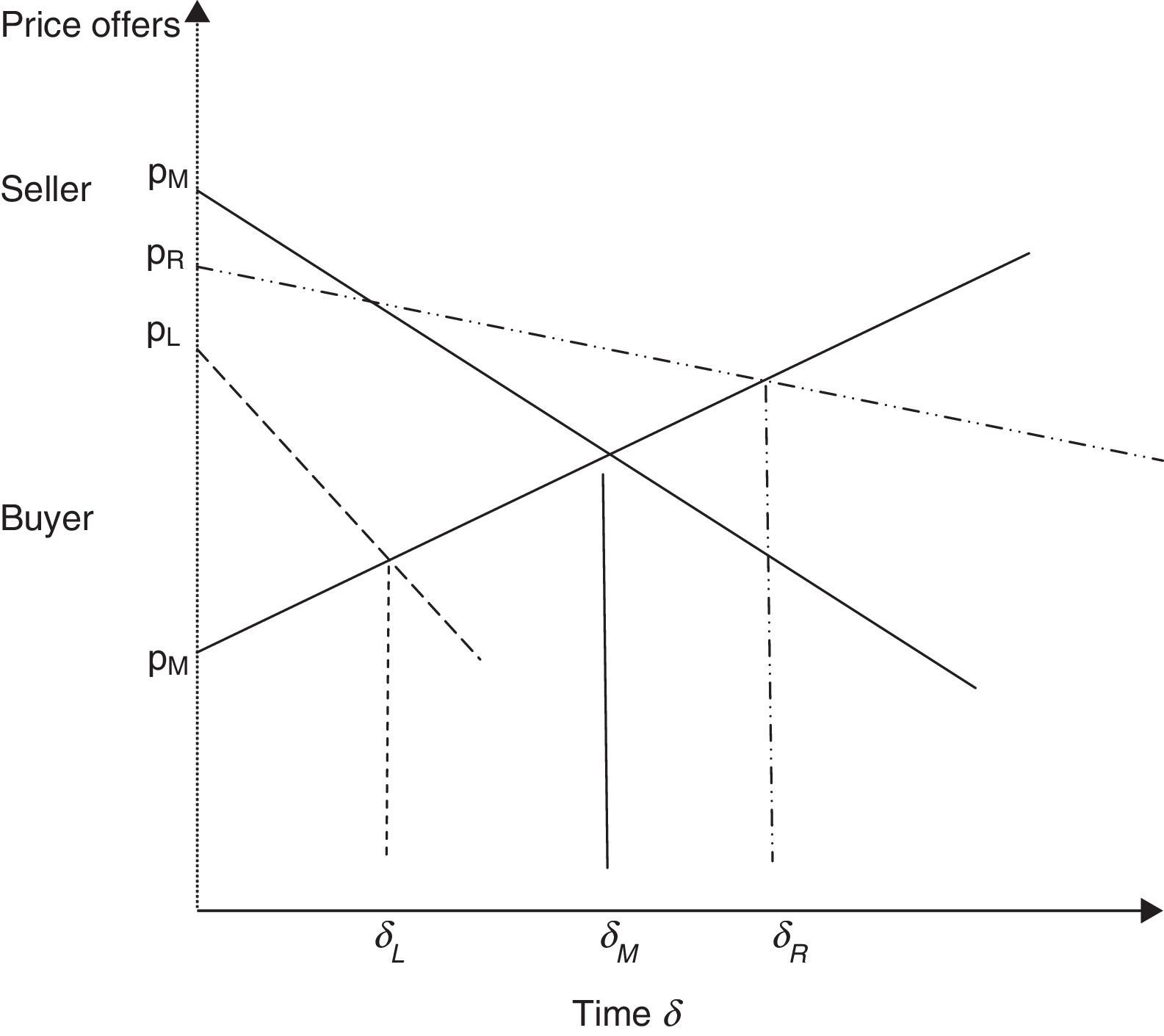

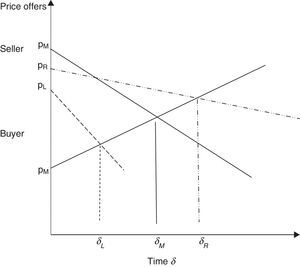

If the buyer moves first and offers pM, uncertainty about costs of bargaining for the seller is relevant and determines the outcome. This means that the initial price offer is higher with respect to the costs of the bargaining horizon and its coverage. This means that the linear-active seller has lower costs of bargaining and the reactive seller has higher costs and a longer horizon to cover. There is again a high probability of dissatisfaction with the bargaining procedure for the multi-active and linear-active partners and a high probability of failure for the multi-active and reactive due to incompatibilities (Fig. 3).Corollary 2aBrazilian Buyer – American Seller If a multi-active buyer offers price pM, the linear-active seller either accepts or rejects in a short period of time. pM≥c(δL) and higher costs of bargaining of the multi-active seller due to longer time horizon will clash with a shorter horizon of the linear-active buyer who will accept or reject in a shorter time period. Acceptance and rejection of the buyer will end the game. If a multi-active buyer offers price pM, the multi-active seller will reject in a short period of time and it leads to a quick offer-counter-offer sequence with the intention to continue in an alternating offer game of haggling.

pM≥c(δM) and same time horizon of multi-active sellers and buyers will have similar costs of bargaining.

Corollary 2cBrazilian Buyer – Japanese SellerIf a multi-active buyer offers price pM, and rejection by the reactive seller (if it happens) will lead to a counter-offer within a long period of time or a sequence of offers by the buyer.

ResultpM≥c(δR) and longer time horizon of reactive players will lead to higher costs of bargaining, but they are covered partially by the price of the multi-active buyer.

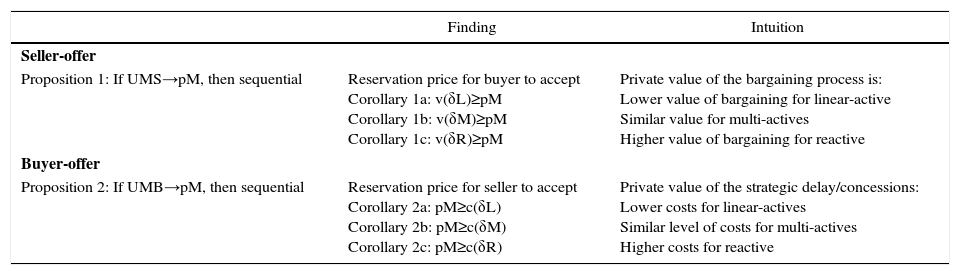

In summary, the results of multi-active bargaining in Table 3 show the differences between different time horizons, values and costs in international negotiations.

Summary of multi-active bargaining behavior.

| Finding | Intuition | |

|---|---|---|

| Seller-offer | ||

| Proposition 1: If UMS→pM, then sequential | Reservation price for buyer to accept Corollary 1a: v(δL)≥pM Corollary 1b: v(δM)≥pM Corollary 1c: v(δR)≥pM | Private value of the bargaining process is: Lower value of bargaining for linear-active Similar value for multi-actives Higher value of bargaining for reactive |

| Buyer-offer | ||

| Proposition 2: If UMB→pM, then sequential | Reservation price for seller to accept Corollary 2a: pM≥c(δL) Corollary 2b: pM≥c(δM) Corollary 2c: pM≥c(δR) | Private value of the strategic delay/concessions: Lower costs for linear-actives Similar level of costs for multi-actives Higher costs for reactive |

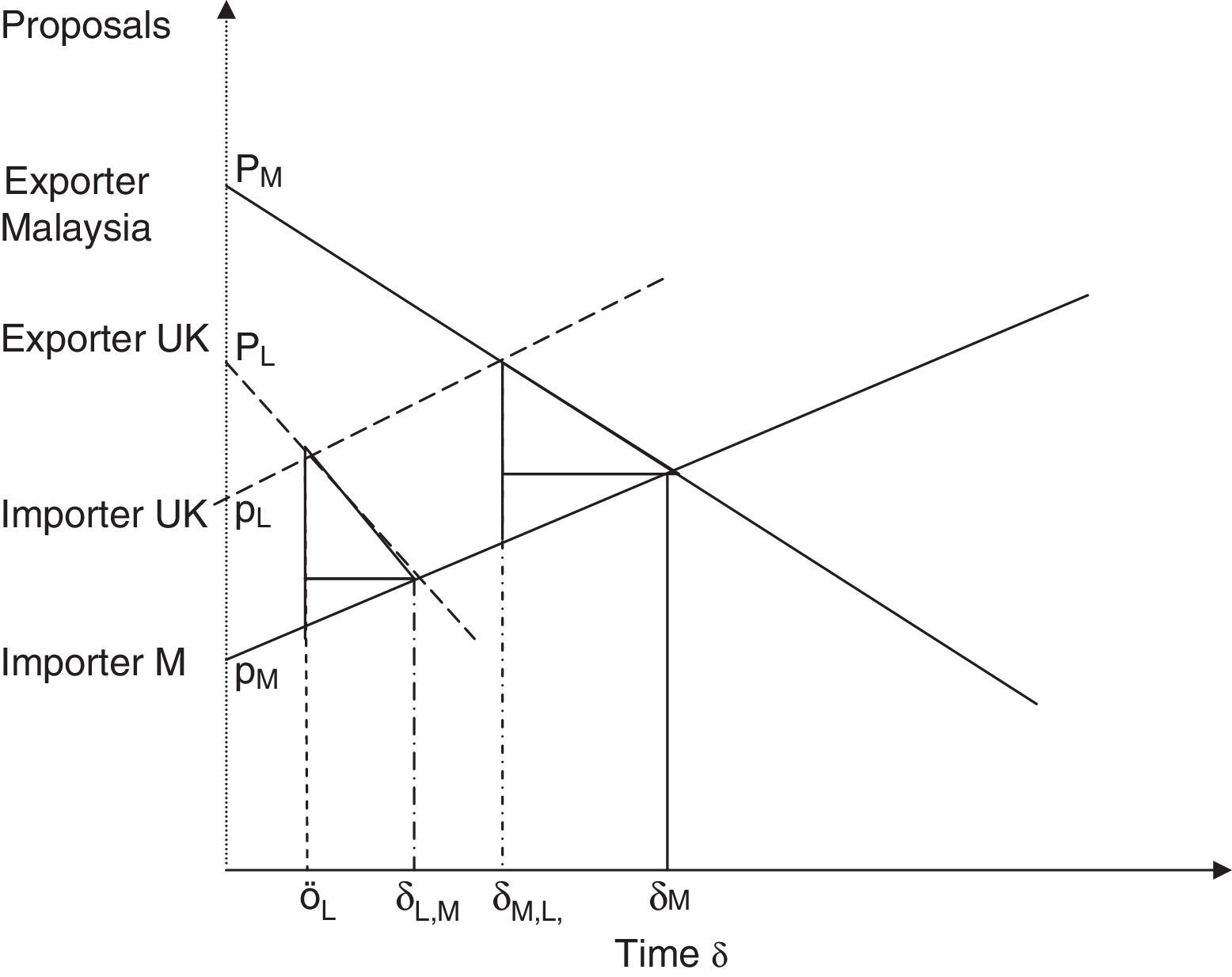

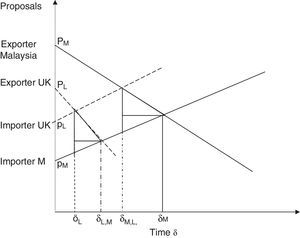

As another application of our model to export-import negotiations, we show how negotiators from the UK and Malaysia would behave in such a negotiation game.

Fig. 4 shows the application of the differences in negotiating to a UK-Malaysian negotiation (Chuah et al., 2007; Chuah, Hoffmann, Jones, & Williams, 2009) only over several periods instead of an ultimatum game. It shows that the UK importer–exporter relationship is clearly a short-termist (linear-active) approach and the Malaysian importer–exporter relationship is situated in the multi-active negotiation approach. Bringing together UK and Malaysian importers and exporters, this will clearly explain what we have found in the Corollaries and proofs (1a, 1b, 2a and 2b) from the seller and buyer sections as a good example of the differences in costs and values.

Globalization has led to many phenomena which have an impact on managerial decision-making and strategic reasoning in a business context. Among the uncertainties of business transactions across borders are risks with regards to international negotiations. There are menus of how to deal with people from or doing business in particular countries which cannot prevent misunderstandings. The break-up of negotiations and deals, which might have been successful in one's own culture, shows that the explanation comes from a much deeper cognitive level than any menu would suggest. The simple case of a short-term and long-term perspectives of exporters and importers showed that the cultural behavioral patterns are linked to initial price offers, counter-offers, concessions, frequency of offer rejections and the costs of bargaining. The signaling effect of the initial price is a very powerful mechanism to prevent failure.

Discussion and conclusionThis paper analyzes the bargaining procedures of multi-active sellers and buyers in one-sided incomplete information games. The paper was structured into the literature review, the description of international negotiation styles, the game trees (time lines), the models of uncertainty and multi-active bargaining in international negotiation analysis. The results of the games showed equilibrium types and a possibility to circumvent problems in international business negotiations which are related to different time perceptions and strategic behavior in this respect. It is important to anticipate the deadlocks, stalemates and even break-ups when bargaining with culturally programmed types.

In order to capture the specific characteristics of the multi-active types, we split the scenarios in seller-dominated situations either in which we know the first movers as multi-active or in which we had to randomize as LMR due to uncertainty, but in this case the second mover was a multi-active player. In the same way, we analyzed a buyer dominated perspective. This offers us the possibility to see the multi-active way of bargaining from various angles. Furthermore, we solved the problem of bargaining between the three types in an elegant way using corollaries to show the strategies of each type. We are now able to predict the culturally determined ways of moving in an international setting. The intuition behind the results shows that cultural patterns of offering, accepting and rejecting as well as counter-offering can lead to the anticipation of moves. Most importantly, we are able to see the value and costs of the bargaining process for the strategic moves of the players and their influence on the way proposals and counter-proposals are used.

This paper's analysis offers an opportunity to see that multi-active types will continue bargaining when there is a linear-active bargainer who considers rejection as the end of the game or will accept at an earlier stage than the multi-active player. We can call this ‘costs of cultural bargaining’. This is the case when the private values of the bargaining process are lower than the price offered. This occurs particularly when the multi-active seller offers first. Additionally, the multi-active bargaining horizon looks shorter in comparison with the reactive time perspective. In this case, the high frequency of rejection of the multi-active player will collide with a more patient approach and a lower concession rate of the reactive player. The bargaining strategies will, here, be leading to a deadlock, a break-up of negotiations or a relationship building process. The latter shows a more stable solution and an equilibrium in the long run.

Our model was applied to bargaining in a Bazaar which featured all three types and the outcome is in favor of a long-term approach. The limitations of the analysis are that we were using a field study example to analyze our theoretical outcomes. Future research can use this research design to investigate multi-active bargaining behavior in experiments.

Our results are not only useful for export and import negotiations, but also for negotiations in MNEs and international collaborations. The applicability to negotiations between MNEs with headquarters in multi-active European countries (i.e. Italy, Spain) and their hosts in the USA, Japan and China can lead to a better understanding between multi-active types in the HQs and linear and/or reactive subsidiaries/hosts and vice versa for HQs based in linear-active or reactive cultures (USA, Japan, China) with subsidiaries in multi-active cultures (Southern Europe, Middle East, Latin America).