China's digital economy has made amazing achievements, which brings deep impacts on enterprise innovation. Based on unbalance panel dataset covering more than two thousand manufacturing listed companies in A-stock market of China during the 2011 to 2018 period, this paper employs two-way fixed effects (TWFE) model to examine the effects of attention to digital economy on enterprise innovation. The primary explanatory variable in this research is attention degree that enterprises pay to the digital economy measured by Python technology and text analysis. Additionally, the intermediate effect model is adopted to check the underlying mechanisms of cost control in enterprises, which is also impacted by the digital economy. Several novel findings emerge. First, the number of patent applications increase as enterprises pay more attention to the digital economy. Digital economy has positive impacts on different innovation processes, not only promotes invention, but also promotes appearance design. Second, digital technology and business model as two aspects of digital economy have different effects on innovation. The attention to digital technology has positive impacts on invention patents and design patents, while business model only has a positive impact on design patents. Third, enterprises that pay attention to the digital economy are more likely to increase their R&D expenditure and decrease their sales and finance expenses, which encourages the innovation output. This paper explains these findings in the context of China and makes some specific suggestions for enterprises to promote digital transformation and innovation.

The digital economy has recently attracted much attention from enterprises worldwide. More specifically, the digital economy is fostered and booming with the positive promotion of the manufacturing industry and network. The Digital Economy Report 2021 published by UNCTAD (2021) explained that the data-driven digital economy is core to all fast-evolving digital technologies, such as data analytics, artificial intelligence (AI), blockchain, Internet of Things (IoT), cloud computing and other Internet-based services. The gradual interrelation between digital technology and business operations has led to the convergence of management disciplines, equipment, and applications. The Internet, big data, AI, and other new information and communication technologies have been applied to the real economy on a broader and more profound level. Consequently, the pace of digital transformation and intelligent upgrading of the manufacturing industry is accelerating.

On the one hand, the digital economy has become an important part of the Chinese national economy. The digitalization of China's manufacturing industry has achieved remarkable results. Its scale of added value has grown from 17.4 trillion Yuan in 2016 to 28.7 trillion Yuan in 2019, accounting for 29% of GDP (CAICT, 2021). According to the statistics published by China's Ministry of Industry and Information Technology, the scale of China's digital economy reached 45.5 trillion Yuan in 2021, accounting for 39.8% of the GDP and ranking second in the world. With the escalating growth of the digital economy, it has become significant to China's manufacturing industry to promote technological innovations by integrating digital technology (Wu, 1996; Zhao, Zhang & Liang, 2020). In preventing and controlling the COVID-19 pandemic in China, the digital economy has contributed significantly to the resumption of the manufacturing industry and stimulated the vitality of enterprise innovativeness.

On the other hand, the digital economy and industry development have increasingly become the academic hotspot. The research on the digital transformation of enterprises can be traced back to the "Solow paradox" or "productivity paradox," discovered by Solow (1987). Some scholars have regarded information technology investment as an unimportant variable that other factors can replace, especially in banking, non-agricultural sectors, and other industries (Gordon, 2003; Parsons, Gotlieb & Denny, 1993). Some researchers have theoretically explained the reasons for the "Solow Paradox," including the problem of measurement, the lag effect of information technology, the lack of other complementary factors, and so on (e.g., Brynjolfsson & Hitt, 2003; David, 1990; Griliches, 2009). In the mid-1990s, information superhighway construction in the United States created a significant impact, and as a result, the total factor productivity of the non-agricultural business sector improved substantially (Oliner & Sichel, 2000). Consequently, many studies published in the early 2000s have demonstrated that much of the contribution comes from information technology-related investment (Oliner & Sichel, 2000; Oliner, Sichel & Stiroh, 2008).

The extant literature has continued the discussion on the "Solow paradox" by examining the effect of the innovation-driven digital economy on firm productivity (Hartmann, Waubke & Gebhardt, 2021; Pan, Xie, Wang & Ma, 2022). Most scholars have studied the impact of digitization on regional innovation from a macro level (Baslandze, 2016; Thomas, 2020). The findings indicate that widespread Internet and digital infrastructure use have increased regional innovation (Han, Song & Li, 2019; Thomas, 2020). Many quantitative research studies have used traditional research tools and methodologies to measure the impact of the digital economy from national or regional perspectives (Curran, 2018; Huang, Yu & Zhang, 2019; Li, Chen, Chen & He, 2022). Some qualitative research studies have also argued the micro-level influence of digital technology on enterprise technological innovations (Baslandze, 2016; Boland, Lyytinen & Yoo, 2007; Brynjolfsson & Saunders, 2009; Cui, Ye, Teo & Li, 2015; Han et al., 2019; Paunov & Rollo, 2016). Further, the literature reveals that digital transformation efforts will have an impact on enterprise product innovation (Ghasemaghaei & Calic, 2020), process innovation (Nambisan, 2017), organizational innovation (Ciriello, Richter & Schwabe, 2018), and business model innovation (Autio, Nambisan, Thomas & Wright, 2018). Integrating digital systems is one of the most preferred ways to promote effective workflows and business processes (Thomas, 2020). Further, Verhoef et al. (2021) emphasized that resultant business model innovation has challenged existing firms, disrupted several sectors, and radically changed customer expectations and behavior.

Although it has been noted that the digital transformation efforts of an enterprise can contribute to enterprise technological innovation, there are still some research gaps concerning investigating the relationship between the digital economy and enterprise innovativeness. First, although the digital economy is booming, empirical research on examining the effect of an enterprise's degree of attention to the digital economy on its innovativeness in the context of Chinese enterprises is insufficient. In most instances, the existing literature is focused on measuring the effect of the digital economy. Most studies have measured the digital economy index from a macro-level perspective (e.g., Pan et al., 2022; Wang, Chen & Li, 2022). More specifically, some have focused more on the macro digital economy than the internal application of digital technology within enterprises (Bertani, Ponta, Raberto, Teglio & Cincotti, 2021; Watanabe, Tou & Neittaanmäki, 2018). Such studies cannot deeply reflect how micro-enterprises can foster technological innovations in the digital economy (Ayres & Williams, 2004).

To address this void in prior literature, this study measures how much attention enterprises give to the digital economy using data mining and text analysis methods. By doing so, it broadens the attempts made by the previous literature on measuring the indicators of the digital economy.

Second, the digital economy includes many aspects, while innovation can be divided into different processes. However, both the digital economy and enterprise innovativeness have heterogeneity. Some studies have discussed the impacts of various digital technologies, such as information technology (Gordon, 2003; Parsons et al., 1993), the Internet, blockchain, and big data on enterprise innovativeness (Claster et al., 2013; Javaid et al., 2021). Nevertheless, existing studies have not considered all digital technologies and business models in understanding how enterprise's degree of attention to the digital economy influences its innovativeness. This paper examines the impacts of two aspects of the digital economy on different innovation processes of enterprises, including the innovation of invention, utility model, and appearance design, to address this gap in the existing literature.

Third, the internal changes of enterprises under the influence of the digital economy have not been adequately researched yet. The existing research has mainly demonstrated a positive impact of the digital economy on firm productivity. The digital economy's influence on enterprises' innovation activities and the internal mechanism is a new topic worthy of in-depth study, as transaction costs have been greatly reduced with the emergence of the digital economy. Further, the model of operation and source competitive advantage of enterprises have also changed. Consequently, the impact of cost control decisions on innovation activities must be further studied.

This paper contributes to the existing literature in the following vital ways. The first is measuring the degree of firm-level attention to the digital economy by applying Python technology. Using listed manufacturing enterprises in China's A-stock market and collating firm-level data from 2011 to 2018 as the research sample, this paper conducts data mining and text analysis on the annual reports. By doing so, this study makes a descriptive analysis of the trends and sectoral differences in enterprises' attention to the digital economy. The second contribution is testing the effects of Chinese enterprises’ attention to the digital economy on innovation with heterogeneity. Employing the two-way fixed effects (TWFE) model indicates that the more enterprises pay attention to the digital economy, the more patents are applied. The attention to the digital economy has a significantly positive relationship with invention patents and design patent applications. Both effects of digital technology deployment and business models on different innovation processes are comprehensively considered. The findings reveal that digital technology brings a complementary perspective to enterprise innovativeness, while business model brings design innovation to create customer value. The third contribution is uncovering that the digital economy helps enterprises effectively control costs and save money in business activities. The research shows that attention to the digital economy increases expenditure on R&D while reducing sales expenses and finance expenses.

The rest of this research is outlined as follows: Section II presents the related literature and hypotheses development. Section III describes the empirical model and data. Section IV presents empirical results about the effects of an enterprise's degree of attention to the digital economy on its innovativeness. Section V discusses the underlying mechanisms of cost control that could explain the estimated effects. Section VI is the conclusion.

Related literature and hypotheses developmentThis section reviews and summarizes previous literature on the relationship between an enterprise's degree of attention to the digital economy and its innovativeness. It concludes with the hypotheses developed.

Theoretical backgroundThis paper employs the theories of attention-based view (ABV) (Ocasio, 1997) and digital innovation (Nambisan, 2017) in developing the theoretical framework to investigate the link between an enterprise's degree of attention to the digital economy and its innovativeness.

Attention-based view (ABV)Ocasio introduced the attention-based view (ABV) theory in 1997 (Ocasio, 1997). "Attention" refers to the process through which an organization's management allocates a finite amount of time and energy to pay attention, code, explain, and concentrate on queries and replies (Andrews, Fainshmidt, Ambos & Haensel, 2022). It contends that organizational structure and executive cognition constrain and influence the issues and solutions they may focus on (Andrews et al., 2022). ABV is an important theoretical perspective in studying organizational behavior and management science (Alshahrani, Dennehy & Mäntymäki, 2022). According to the ABV theory, enterprise management's focus is a crucial resource for a firm (Essuman, Bruce, Ataburo, Asiedu-Appiah & Boso, 2022). Managers' choice is based on where they pay attention under restricted rationality (Li et al., 2022).

Attention allocation influences the amount of innovative information available and strategic decisions made by decision-makers (Alshahrani et al., 2022). Many studies have shown that attention allocation has become an important factor affecting economic performance. This logic has been widely applied in various economic fields (Gabaix, 2019; Mackowiak, Matejka & Wiederholt, 2018). However, economic agents cannot deal with all of the information in the economic system because their attention is limited. The attention paid by economic agents has become a scarce resource (Sims, 2003, 2006). From the standpoint of attention allocation, one of the difficulties enterprises must deal with is logically assigning limited attention resources to various components of the innovation process. The amount of information obtained is determined by the degree of attention allocated to external information (Matejka & McKay, 2015). There is a specific limit to the individual's ability to process the information. Consequently, enterprises' attention can influence the focus of decision-making on a specific field. According to the ABV theory, the outcome of innovative decisions depends on which issues the decision-makers devote more attention to. Thus, enterprises must concentrate managers' attention on the area conducive to innovation to implement innovation successfully. Consequently, this research uses the ABV theory as the theoretical underpinning to analyze the link between attention to the digital economy and enterprise innovation.

Digital innovationDigital innovation refers to the application of digital technology during the innovation process of an enterprise (Nambisan, 2017). Digital technology has altered the fundamental nature of original products, the new product development process, business models, and organization types, and even subverted the primary hypotheses of many innovation theories. Ciriello et al. (2018) have defined that innovating digitally means innovating products, processes, or business models using digital technology platforms as a means or end within and across organizations. Digital technology both results from and serves as the foundation for digital innovation. It has excellent scalability and low entry barriers, encouraging widespread participation and democratizing invention (Yoo, Henfridsson & Lyytinen, 2010; Tajeddini, 2016). The existing literature has reached a consensus and believes digital innovation has the following two characteristics.

Convergence: Digital technologies combine previously separate components. Industry barriers, organizational boundaries, departmental boundaries, and even product boundaries are dissolved by digital innovation, which promotes new business models.

Generativity: Digital technologies are inherently dynamic, extensible, and malleable. So digital innovation can be continuously improved and self-growth (Yoo, Boland, Lyytinen & Majchrzak, 2012). The most typical example is that digital products such as APP can innovate iteratively in time according to user feedback and various problems in the operation process.

These two features enable digital technology to serve as both the foundation for and the outcome of digital innovations (Yoo et al., 2010). It can be said that digital technology and its derived business model have caused "creative destruction" to enterprises (Ciriello et al., 2018). Traditionally, innovation has often been characterized as a discrete, linear, sequential process with distinct, logically ordered stages (Tajeddini, 2016). The traditional innovation process comprises idea creation, advocacy and screening, experimentation, commercialization, dissemination, and execution (Fichman, Dos Santos & Zheng, 2014). There are distinctions between traditional and digital innovations, and in most instances, traditional innovation processes are subverted by digital innovation. Thus, this paper focuses on investigating the impact of digital technology on digital innovation and business models, which are two aspects of the digital economy. The digital innovation process considered in this paper is divided into three parts: invention patents, utility model patents, and design patents, to depict the influence of digital technology comprehensively.

Hypotheses developmentThe relationship between an enterprise's degree of attention to the digital economy and innovationThe prosperity and development of the digital economy have made many enterprises focus on it. The ABV theory holds that executives' attention is a valuable resource in an enterprise. Executives' attention is selective, meaning they only pay attention to particular queries and replies while ignoring others. The digital economy makes technical knowledge explicit (Varian, 2010), which can increase enterprises’ attention to innovation. Moreover, the influence of the digital economy on enterprise innovation is heterogeneous. Some researchers discuss various aspects of the digital economy's influences on different types of innovation, including technological invention, product innovation, process innovation, business model innovation, and service innovation.

The digital economy can inspire invention and the creation of new technology. The widespread use of network communication accelerates knowledge codification (Yadav, 2014). Digital technology stores and replicates knowledge in the form of information and data and can also use diversified storage methods such as audio, video, images, and so on. Large-capacity cloud storage can preserve knowledge in colossal quantity in various categories and forms (Arthur, 2007). The digital economy promotes the flow and collection of information resources across time and space. According to the theory of information economics, the flow and transmission of information are often limited by space and other factors. Digital technology can accelerate the flow of information across time and space and break down the barriers of information asymmetry. The digital environment connects physical and virtual space, realizing "spatiotemporal stagger and synchronous parallel connection." Enterprises can quickly obtain more distant information and extend the existing innovation networks (He, 2018; Lyytinen, Yoo & Boland Jr, 2016). The digital economy improves the efficiency of knowledge acquisition. The emergence of the Internet further reduces the cost of acquiring technical knowledge for users (replication cost is zero) (Katz & Shapiro, 1985; Liebowitz & Margolis, 1994). Consequently, the transmission of knowledge is enhanced, and the spread of innovation resources worldwide accelerates, promoting innovation spillover.

The digital economy also significantly impacts product innovation, enabling enterprises to create or improve existing products by integrating digital technologies into product design, development, and production processes (Rammer, Fernández & Czarnitzki, 2022;). Enterprises can create more user-friendly and practical products by involving users in the design process. Many new business models based on digital technologies improve enterprise competitiveness to match supply and demand (Sanasi, Ghezzi, Cavallo & Rangone, 2020). The adoption of big data analytics has helped enterprises gain insights into customers’ demands and create personalized products that reach new customers (Chen, Chiang & Storey, 2012). By analyzing user data, enterprises can identify patterns and preferences and design products that better meet customer needs. Other digital technologies, such as AI and cloud computing, can optimize enterprises’ business processes and organizational performance (Khin & Ho, 2020; Gamage, Tajeddini & Tajeddini, 2022), supporting their innovation activities. The relationship between enterprises' attachment to the digital economy and innovation capabilities can be characterized as a two-way causality. On the one hand, enterprises that attach importance to the digital economy are more likely to innovate, as they are better equipped with the necessary resources, capabilities, and knowledge. On the other hand, enterprises that invest in innovation are also more likely to attach importance to the digital economy, as they find the value of digital technology in improving their innovation capabilities and competitiveness.

The Resource-Based View (RBV) suggests that a firm's resources and capabilities are vital to its competitive advantage. In the context of the digital economy, firms that invest in digital resources and capabilities are better positioned to innovate, as they have the necessary tools to collect and analyze data, improve their operations, and develop new products and services. At the same time, innovation can also be a source of digital resources and capabilities that can be applied to the digital economy. Therefore, it is necessary to solve the problem of reverse causality in empirical research.

As discussed above, digital technologies have facilitated innovation by enabling enterprises to invent new technology, create new products, optimize their business processes, develop innovative business models, and offer improved customer service. Thus, a positive correlation exists between the digital economy and enterprise innovativeness. Therefore, the first hypothesis is put forward as follows:

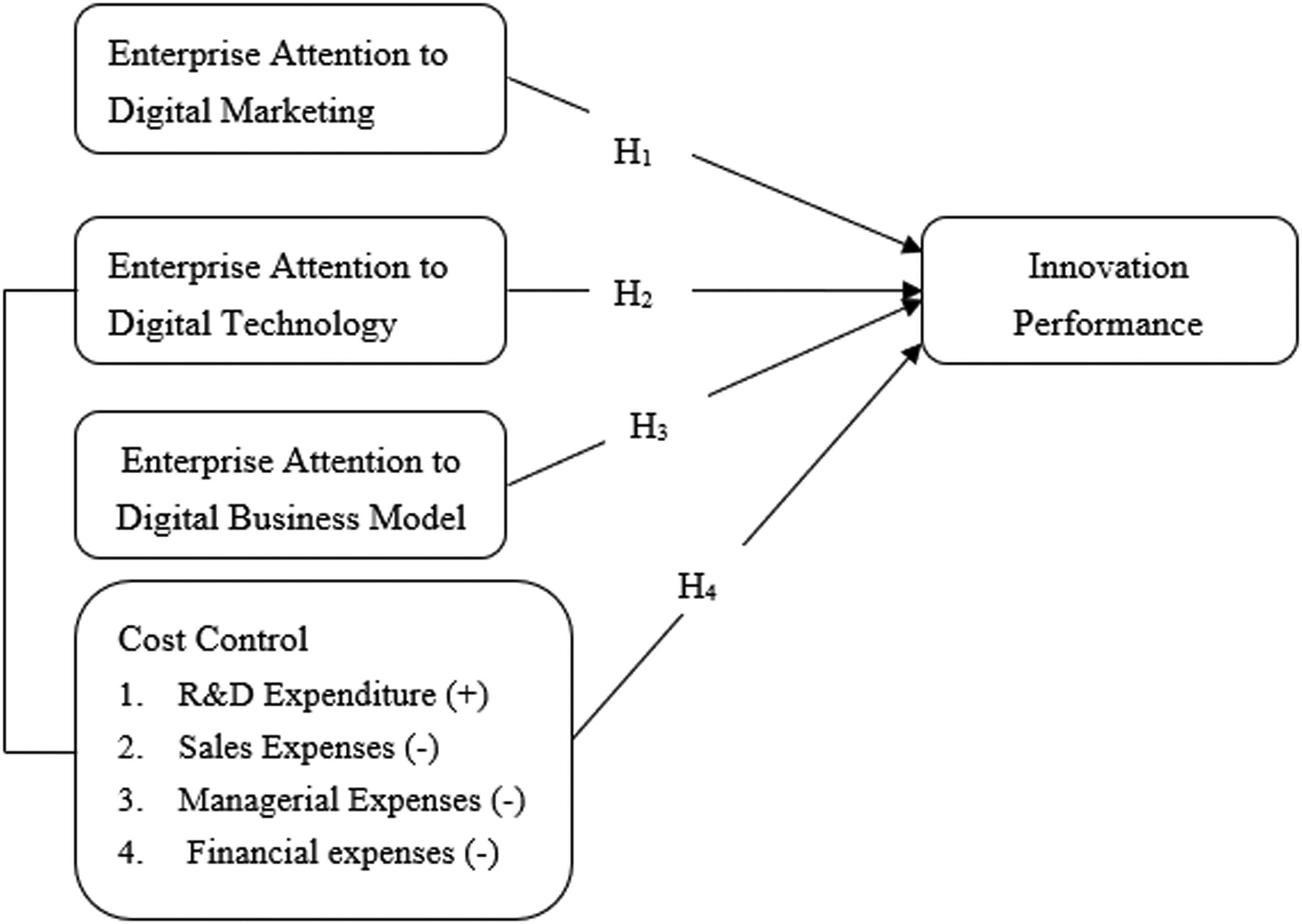

H1:An enterprise's degree of attention to the digital economy is positively related to its innovation performance.

Two aspects of the digital economy that enterprises pay attention toThe digital economy involves many aspects, including technology, business model, and new industry. Enterprises' degree of attention to specific fields in the digital economy reflects the direction of digital transformation, which will affect innovation strategy.

According to the theory of digital innovation, digital technology is fundamental for the innovation of products, production processes, business models, and organization types. Digital technology has characteristics of general purpose technology (GPT) (Harris, 1997), which includes AI, machine learning, cloud computing, big data analytics, and the Internet of things. The potential continuous improvement and the positive feedback loop of GPT will further produce innovation spillover effects (Helpman & Trajtenberg, 1996). One of the important features of GPT is innovation complementarity. Digital technologies, such as GPT, can enhance the effectiveness of innovation in various application fields through technology integration. Digital technology enables enterprises to obtain the knowledge and information needed for innovation quickly. Consequently, digital technology allows enterprises to create new and innovative products and services that were not possible before.

However, the digital economy is not purely digital technology but leads to the creation of new business models. Business models are critical for enterprises because they determine how enterprises create and capture value from their products and services. In the digital economy, new business models focus on data-driven decision-making, connected platform-based models, and value co-creation with customers for innovation (Saarijärvi, Kannan & Kuusela, 2013). The digital economy has enabled new business models disrupting traditional industries, such as the sharing economy and subscription-based services. Numerous enterprises must respond to the disruption of traditional business models by digitization. Digital transformation enables enterprises and customers to co-create new products based on platforms (Genzorova, Corejova & Stalmasekova, 2019). For example, companies such as Facebook and Google have developed business models that rely on advertising revenue generated from user data.

Digital technology and business models are interdependent and must work together to create value. By integrating digital technologies with business models, enterprises can achieve the accuracy of demand analysis, the intensification of R&D resources, and the efficiency of the innovation process. For example, the success of platform-based business models such as Uber and Airbnb relies on digital technology to create and manage the platform. The digital economy constantly evolves as new digital technologies emerge and companies develop new business models. Enterprises that are successful in the digital economy need to adapt and evolve to keep up with these frequent changes. Therefore, the second hypothesis is put forward as follows:

H2:Enterprises paying attention to the degree of digital technology will improve their innovation performance.

H3:Enterprises paying attention to the degree of digital business model improve their innovation performance.

The link between enterprises' attention to the degree of the digital economy and cost controlThe expenditure on attention resources has become a vital part of enterprises’ operating costs. Therefore, improving the efficiency of attention resources has become a business goal that enterprises must attach great importance to. Porter and Heppelmann (2016) proposed that cost leadership, differentiation, and centralization are the three primary strategies for enterprises to gain competitiveness. Cost control is the key to achieving cost leadership. Digital technology can both increase and decrease the operational costs of enterprises, depending on how it is utilized and implemented within the organization.

On the one hand, digital technology can increase costs for enterprises in the short term. In the early stage, enterprises must invest a lot in purchasing hardware, software, and IT infrastructure to apply digital technology. In particular, small and medium-sized enterprises must invest much money to transform existing systems to incorporate new digital technologies. Maintaining and upgrading digital systems can also be expensive, especially for businesses with complex systems or large amounts of data (Khin & Ho, 2020; Nambisan, 2017). Furthermore, digital technology can also create new risks and costs for businesses, such as the potential for cyber-attacks or data breaches, which can result in significant financial losses and damage to reputation (Li & Liu, 2021).

On the other hand, digital technology can also decrease the cost of enterprises by enabling greater efficiency, automation, and collaboration. As a GPT, digital technology has the characteristic of decreasing marginal costs. Digital technology enables the creation of products and services that can be replicated and distributed virtually at no cost (Katz & Shapiro, 1985) once the initial fixed costs of developing the technology have been incurred. According to Transaction Cost Economics (TCE), enterprises’ costs are impacted by the costs of transacting with other firms or individuals. Transaction cost consists of information search cost. Once the information search cost occurs, it will become the precipitating cost (Streit & Wegner, 1992). Enterprises often remain competitive mainly by saving transaction costs, including coordination costs with suppliers and customers. In the context of digital technology, information can be transmitted across time and space, while the cost of obtaining information is meager. Knowledge resources within enterprises are mostly spread in the form of information. Enterprise innovation activities thus improve efficiency because of the low cost of obtaining information. Digital technology can also reduce costs for search, replication, logistics, transportation, production, and enterprise management (Afuah, 2003; Goldfarb & Tucker, 2019; Venables, 2001). Reducing the search cost improves the efficiency of information matching, communication, and organization (Agrawal & Goldfarb, 2008; Dana & Orlov, 2014), which helps enterprises focus on the needed information. When considering the e-commerce trading platform as an example, the cost of consumer information search and the price discrimination of sellers can be reduced, thus promoting the allocation of market resources (Bakos, 1997; Pee, 2016).

The digital economy can help enterprises reduce production and finance costs by optimizing the management mode. It also broadens the cooperation circle and promotes enterprises to participate in the specialized division of labor (Malone, Yates & Benjamin, 1987). Due to utilizing ICT more effectively, the unit cost of coordinating owners of diverse expertise and property has been reduced over the past 100 years. Big data, cloud computing, the Internet of things, AI, and other digital technologies have the effects of virtual market and data analysis, which can help enterprises to acquire external knowledge at low cost and high efficiency. The supply of knowledge or experience of public goods is improved (Lerner, Pathak & Tirole, 2006). AI technology improves the supply chain's efficiency, saves costs, and increases enterprises' profitability. Enterprises can be encouraged to release more resources for independent research and development (Thompson, Williams & Thomas, 2013) to introduce new products and innovations (Brynjolfsson & Saunders, 2009). The basic unit of the traditional economy is the atom with high production costs. While the basic unit of the digital economy is the bit, the information and digital resources are replicable.

As discussed, overall, digital technology has both positive and negative impacts on the costs of enterprises. While there are short-term costs associated with implementing these technologies, the long-term benefits of increased productivity, efficiency, and scalability can be significant. Therefore, the third hypothesis is put forward as follows:

H4:An enterprise's attention to the degree of the digital economy can change cost control that affects its innovation performance indirectly.

According to the above theoretical derivation and hypotheses, this paper develops the following research framework, as shown in Fig. 1.

Empirical modelEstimating equationThe following benchmark model is established to identify the digital economy's effects on enterprise innovation. The study adopted the two-way fixed effects (TWFE) model and regressed Innoit on ADEit at the manufacturing firm level.

In order to judge whether this study is suitable for linear or nonlinear regression, this paper tested the model form with Link Test. The results show that the fitting value of the nonlinear term is not significant, so this paper is suitable for linear regression.

In the benchmark model, the dependent variable (Innoit) is measured by a log of the number of patent applications to reflect the innovation output of enterprises. The study considers different innovation processes, adding the number of applications of invention patents, utility models, and appearance design patents in regression. The independent variable (ADEit) reflects an enterprise's degree of attention to the digital economy. The study uses Python technology and makes text analyses of listed companies’ annual reports, referring to Yang and Liu (2018), Qi and Cai (2020), and Wu, Hu, Lin and Ren (2021). Derived from this method, the number of keywords disclosure of the digital economy is used to reflect manufacturing enterprises’ degree of attention to the digital economy. The independent variable includes two parts, which are attention to digital technology (ADT) and attention to digital business (ADB). The benchmark model includes a vector of time-varying firm controls (Xit), both firm-fixed effects (λi) and year-fixed effects (νt). Among them, i means firms and t means years. α0 is a constant. εit is the residual term. α1 reflects the direct effect of the degree of attention to the digital economy on innovation. If α1> 0, the degree of attention to the digital economy is considered to promote enterprise innovation.

According to the Hausman test results, the p-value is 0. It is demonstrated that the panel fixed effect model is better than the random effect model. So two-way fixed effects model is selected for regression. The study mainly reports the results of TWFE models, uses Robust analysis to adjust the standard errors, and clusters them into the industry level to control the potential heteroscedasticity and sequence-related problems. To ensure the robustness of the research conclusions, this paper also establishes a dynamic panel model (2) and uses the System GMM (SYS-GMM) to test the endogeneity. As patent applications take a long time to be approved, one and two-period lag of patent applications are added to the control variables.

The study constructs an intermediate effect model to test whether an enterprise's degree of attention to the digital economy promotes its innovativeness through cost control. The set econometric model is:

Costit indicates enterprise costs, measured by the proportion of expenditure on R&D, sales, management, and finance. The significance of b1 can examine the indirect effect of enterprises’ attention to the digital economy on cost control. By doing so, this study makes theoretical analyses of the comprehensive influence of an enterprise's attention to the digital economy and cost control on innovation.

DataConsidering the availability and reliability of the data, the study selected Chinese manufacturing companies listed in Shanghai and Shenzhen A-stock markets as the research sample. The main reasons for choosing the listed manufacturing companies as the research sample are: (1) Listed manufacturing companies must issue annual reports regularly, disclosing rich information about the degree of attention allocation to the digital economy. (2) The disclosure information is subject to public supervision, and the data are relatively reliable. (3) Listed manufacturing enterprises are generally high-quality and represent technological innovations in China's manufacturing industry. The sample is selected according to the following criteria: (1) Based on the objective of this paper, only the listed companies with industry code C (which means manufacturing industry) are retained. (2) ST and ST* listed companies are excluded. (3) The companies with missing, incomplete, or inaccurate data are removed; the companies with the number of assets and equity that are negative or zero are also removed. (4) The continuous variables at the firm level are winsorized 1% to eliminate the influence of extreme values.

After completing the above selection criteria, the final dataset comprised an unbalanced panel with 8422 observations from 2011 to 2018. The number of firms increased from 1828 in 2011 to 2367 in 2018. As the data related to some firms were missing in some years, and some new firms were added to the sample later, the number of observations considered each year is different.

The data about the selected manufacturing firms is collected through Wind and CSMAR databases. The information about enterprises’ degree of attention to the digital economy is obtained using Python technology from annual reports of listed companies. The data on patents and R&D expenditure comes from the CSMAR database, and some details were obtained from the State Intellectual Property Office (SIPO).

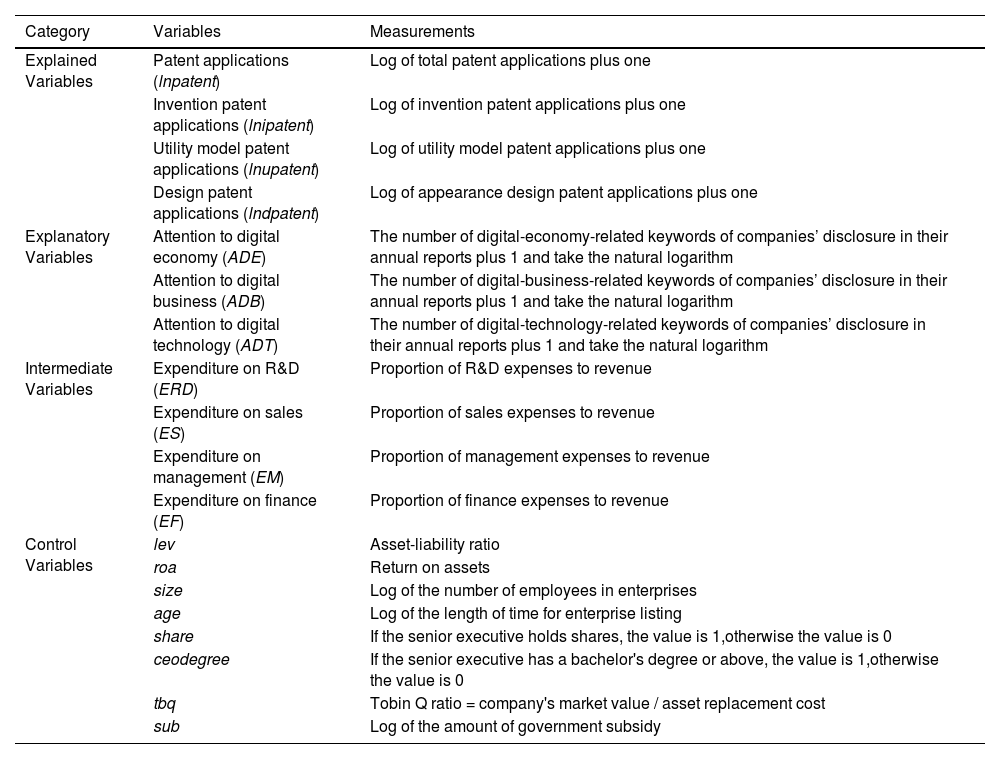

Variables description and measurementsThe definitions and measurements of variables used in this study are presented in Table 1.

Variables and measurements.

| Category | Variables | Measurements |

|---|---|---|

| Explained Variables | Patent applications (lnpatent) | Log of total patent applications plus one |

| Invention patent applications (lnipatent) | Log of invention patent applications plus one | |

| Utility model patent applications (lnupatent) | Log of utility model patent applications plus one | |

| Design patent applications (lndpatent) | Log of appearance design patent applications plus one | |

| Explanatory Variables | Attention to digital economy (ADE) | The number of digital-economy-related keywords of companies’ disclosure in their annual reports plus 1 and take the natural logarithm |

| Attention to digital business (ADB) | The number of digital-business-related keywords of companies’ disclosure in their annual reports plus 1 and take the natural logarithm | |

| Attention to digital technology (ADT) | The number of digital-technology-related keywords of companies’ disclosure in their annual reports plus 1 and take the natural logarithm | |

| Intermediate Variables | Expenditure on R&D (ERD) | Proportion of R&D expenses to revenue |

| Expenditure on sales (ES) | Proportion of sales expenses to revenue | |

| Expenditure on management (EM) | Proportion of management expenses to revenue | |

| Expenditure on finance (EF) | Proportion of finance expenses to revenue | |

| Control Variables | lev | Asset-liability ratio |

| roa | Return on assets | |

| size | Log of the number of employees in enterprises | |

| age | Log of the length of time for enterprise listing | |

| share | If the senior executive holds shares, the value is 1,otherwise the value is 0 | |

| ceodegree | If the senior executive has a bachelor's degree or above, the value is 1,otherwise the value is 0 | |

| tbq | Tobin Q ratio = company's market value / asset replacement cost | |

| sub | Log of the amount of government subsidy |

Enterprise innovation includes the invention of new technologies and the design of new products and services. Considering the process used in innovations, this study focuses only on technological invention and product design innovation of enterprises. The study uses the number of patent applications to reflect the level of technological innovation. As discussed in the extant literature (Dosi, Marengo & Pasquali, 2006; Frakes & Wasserman, 2017; Krammer, 2009), the innovation level of an enterprise is usually calculated by making a log of the number of patent applications. Compared with patent authorization, the number of patent applications can avoid the time lag due to the approval process and political connection (Haeussler, Harhoff & Mueller, 2014). According to China's patent law, patents are divided into three main types invention, utility model, and design. These patent types differ in innovation level and quality (Cai, Chen & Wang, 2018). For instance, the technical content of the invention patent is higher compared to the other two types. Consequently, this study uses the number of invention patent applications to measure the invention level and "substantial innovation" of enterprises (Li & Zheng, 2016). Utility model and appearance design patents are also included in the study to reflect the market-oriented application of innovative achievements.

Degree of attention to the digital economyIn recent years, text analysis of annual reports of listed companies has become a new econometric method to measure firm initiatives. Following the prior research (Qi & Cai, 2020; Yang & Liu, 2018), the study uses the number of digital-economy-related keywords disclosure to reflect enterprises’ degree of attention to the digital economy. With Python and machine learning, the indicators can be obtained. The indicators related to an enterprise's degree of attention to the digital economy are divided into two categories: digital business model and digital technology.

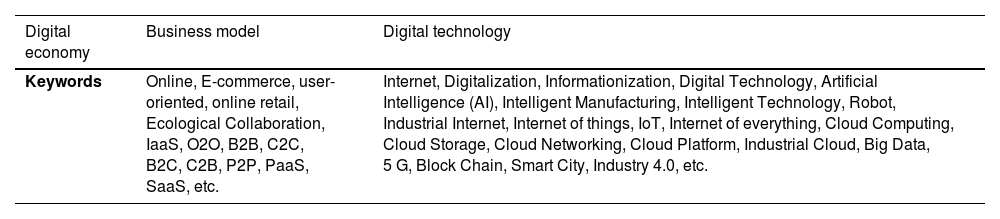

The data processing is conducted as follows: (1) Creating a keywords dictionary for retrieval. As Table 2 shows, the study selects the relevant keywords related to the digital transformation efforts of enterprises from Chinese policy documents. The keywords are divided into two categories: business model and digital technology. (2) Use Python technology to capture the sentences containing keywords in the annual reports of listed manufacturing companies in the A-stock market from 2011 to 2018. (3) Read the sentences related to keywords one by one and clean the data to eliminate the statements that have no substantial relationship with digital transformation. For example, similar expressions such as "the Internet website designated by the CSRC", "Internet Co., Ltd.", "Online Technology Co., Ltd." and "Electronic Commerce Co., Ltd." et al. (4) Count the disclosure times of keywords after data cleaning.

Keywords related to the digital economy.

| Digital economy | Business model | Digital technology |

|---|---|---|

| Keywords | Online, E-commerce, user-oriented, online retail, Ecological Collaboration, IaaS, O2O, B2B, C2C, B2C, C2B, P2P, PaaS, SaaS, etc. | Internet, Digitalization, Informationization, Digital Technology, Artificial Intelligence (AI), Intelligent Manufacturing, Intelligent Technology, Robot, Industrial Internet, Internet of things, IoT, Internet of everything, Cloud Computing, Cloud Storage, Cloud Networking, Cloud Platform, Industrial Cloud, Big Data, 5 G, Block Chain, Smart City, Industry 4.0, etc. |

The study employs two ways to prevent potential mistakes in the above quantization process: (1) Based on a series of papers that build a digital transformation thesaurus, this paper improves the text processing method and extracts all keyword-related text data from the Java PDFbox database, examines and filters the keywords. (2) Three researchers check each keyword text of the firm. Further, the keyword text was thoroughly assessed and eliminated if there was a false keyword or wrong information.

Intermediate variablesCost is the total outflow of economic benefits that will result in losing owners' rights and the corresponding loss of economic interests The cost used for an enterprise's innovation investment will determine its innovation output level. Expenditure for sales, management, R&D, and finance makes up most of the enterprise's costs. Enterprises perform cost control following the combination of proportional control and event audit. This paper considers cost control as an intermediate variable. Referring to the research of Patatoukas (2011), Falk (2012), and Shi, Li and Liu (2020), expenditure for R&D, sales, management, and finance are used as the variables of transaction cost to reflect the indirect effect of cost saving. Accordingly, four intermediate variables are generated by calculating the proportion of expenses to revenue.

Control variablesControl variables are added to reduce the estimation distortion caused by possible omitted variables. The elements that influence innovation are first included. According to the Schumpeter hypothesis, the larger the enterprise is, the more efficient the technological innovation will be. However, old enterprises easily fall into path dependence without innovative vitality. Thus, enterprises’ size and age are controlled. The primary force behind innovation is entrepreneurship. Both Drucker and Schumpeter emphasized the value of entrepreneurship in fostering innovations. Thus, entrepreneurs' education level is added as a control variable. The existing literature has focused on the influence of government subsidies on enterprise innovation, including the effects of incentives, crowding out, and substitution (Becker, 2015; Dimos & Pugh, 2016). This research controls the variable of government subsidy since Chinese governments actively implement fiscal policy and encourage innovation activities at all levels. The operation-level influencing variables of the company that affects innovation ability are also kept under control, as prior research usually did (Bentley, Omer & Sharp, 2013; Bérubé & Mohnen, 2009; Dechow & Dichev, 2002; McGuire, Omer & Sharp, 2011; Tong, He, He & Lu, 2014). The enterprise characteristic values such as return on assets, asset-liability ratio, and Tobin Q reflect the operating conditions and profitability, which will determine whether the enterprise has the ability to carry out innovative activities. The ownership structure of major shareholders has a positive or negative impact on the intensity of R&D innovation (Hosono, Tomiyama & Miyagawa, 2004; Yafeh & Yosha, 2002). If the shareholding is concentrated among significant shareholders, firms will invest in innovation based on the motive of shareholders' interests. Therefore, this paper controls whether the senior executive holds shares. In addition, this paper also controls the time effect and individual effect.

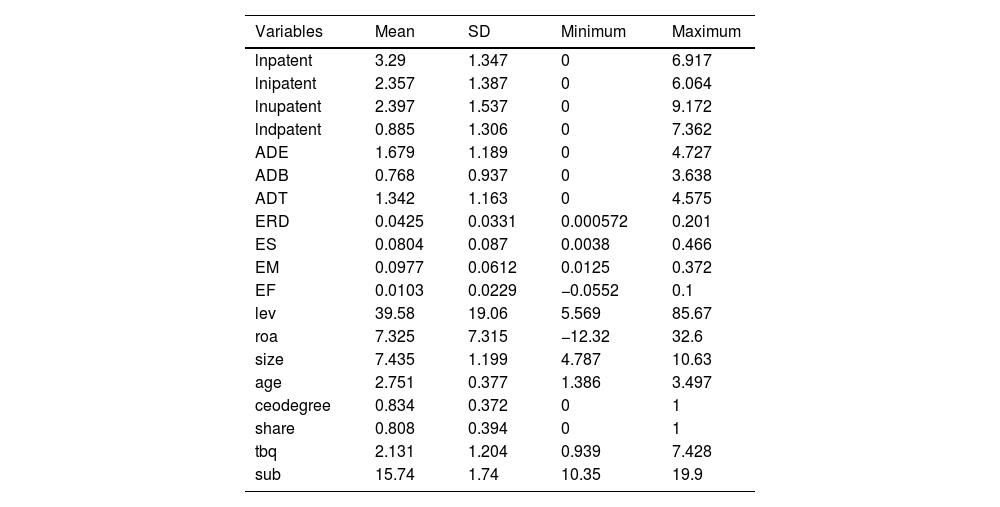

Descriptive statisticsTable 3 illustrates the broad description of the panel data of listed manufacturing enterprises from 2011 to 2018. Regarding enterprises’ innovation output, the mean log of total patent applications is 3.29. The number of invention and utility model patents accounts for a large proportion. Comparing maximum and minimum values shows significant differences in all kinds of patent applications. Regarding the digital economy, the mean of an enterprise's degree of attention to the digital economy is 1.679, and the maximum is 4.727. These values indicate that most listed companies pay attention to the digital economy, but there is a big difference in the degree of attention. By comparing two aspects of the digital economy, the degree of attention to digital technology occupies the dominant position. Regarding cost control, the proportion of expenditure on management is the largest, and then successively are expenditures on sales, R&D, and finance. This means that listed manufacturing companies in China spend more money on management and sales.

Descriptive statistics.

| Variables | Mean | SD | Minimum | Maximum |

|---|---|---|---|---|

| lnpatent | 3.29 | 1.347 | 0 | 6.917 |

| lnipatent | 2.357 | 1.387 | 0 | 6.064 |

| lnupatent | 2.397 | 1.537 | 0 | 9.172 |

| lndpatent | 0.885 | 1.306 | 0 | 7.362 |

| ADE | 1.679 | 1.189 | 0 | 4.727 |

| ADB | 0.768 | 0.937 | 0 | 3.638 |

| ADT | 1.342 | 1.163 | 0 | 4.575 |

| ERD | 0.0425 | 0.0331 | 0.000572 | 0.201 |

| ES | 0.0804 | 0.087 | 0.0038 | 0.466 |

| EM | 0.0977 | 0.0612 | 0.0125 | 0.372 |

| EF | 0.0103 | 0.0229 | −0.0552 | 0.1 |

| lev | 39.58 | 19.06 | 5.569 | 85.67 |

| roa | 7.325 | 7.315 | −12.32 | 32.6 |

| size | 7.435 | 1.199 | 4.787 | 10.63 |

| age | 2.751 | 0.377 | 1.386 | 3.497 |

| ceodegree | 0.834 | 0.372 | 0 | 1 |

| share | 0.808 | 0.394 | 0 | 1 |

| tbq | 2.131 | 1.204 | 0.939 | 7.428 |

| sub | 15.74 | 1.74 | 10.35 | 19.9 |

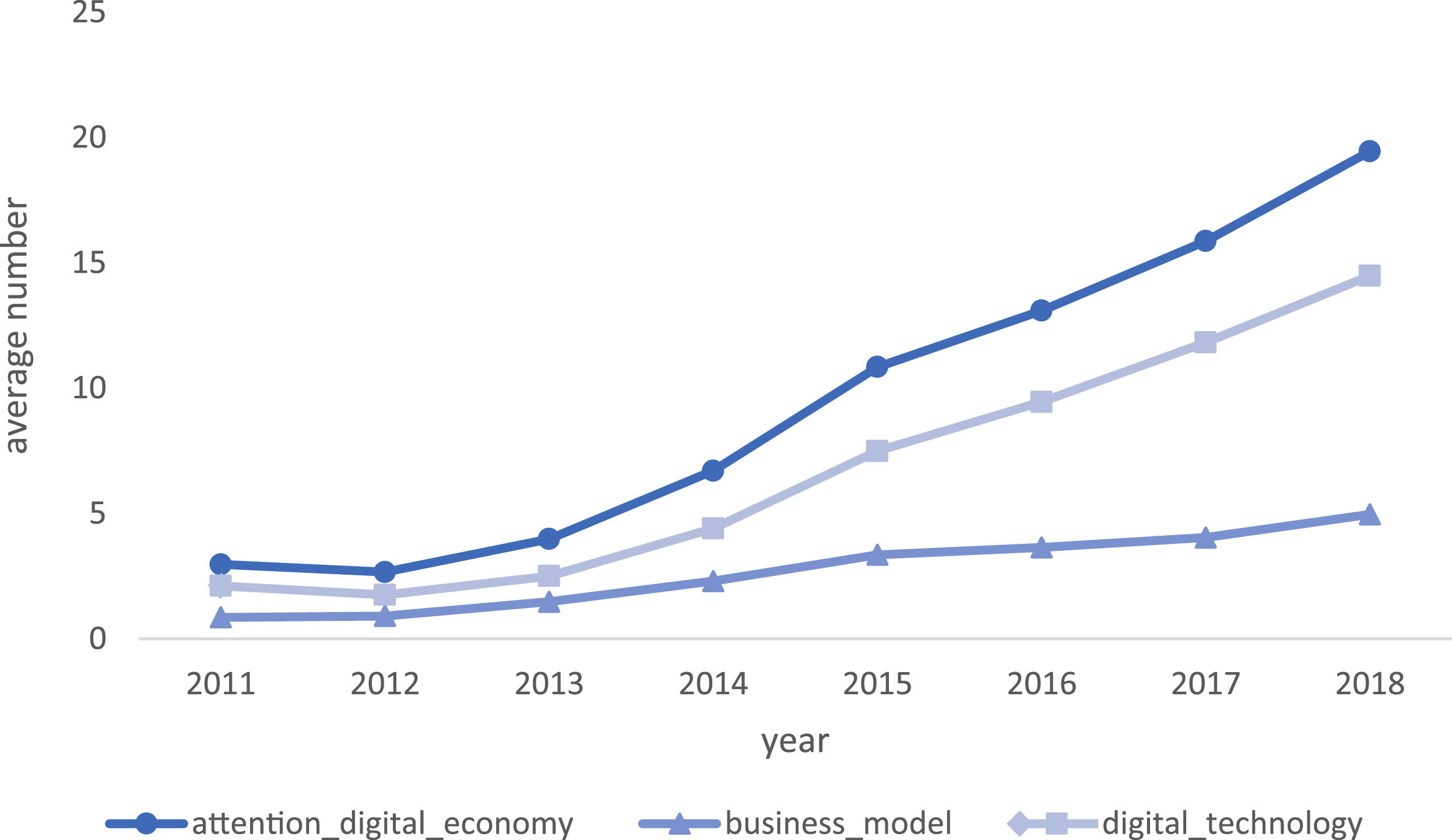

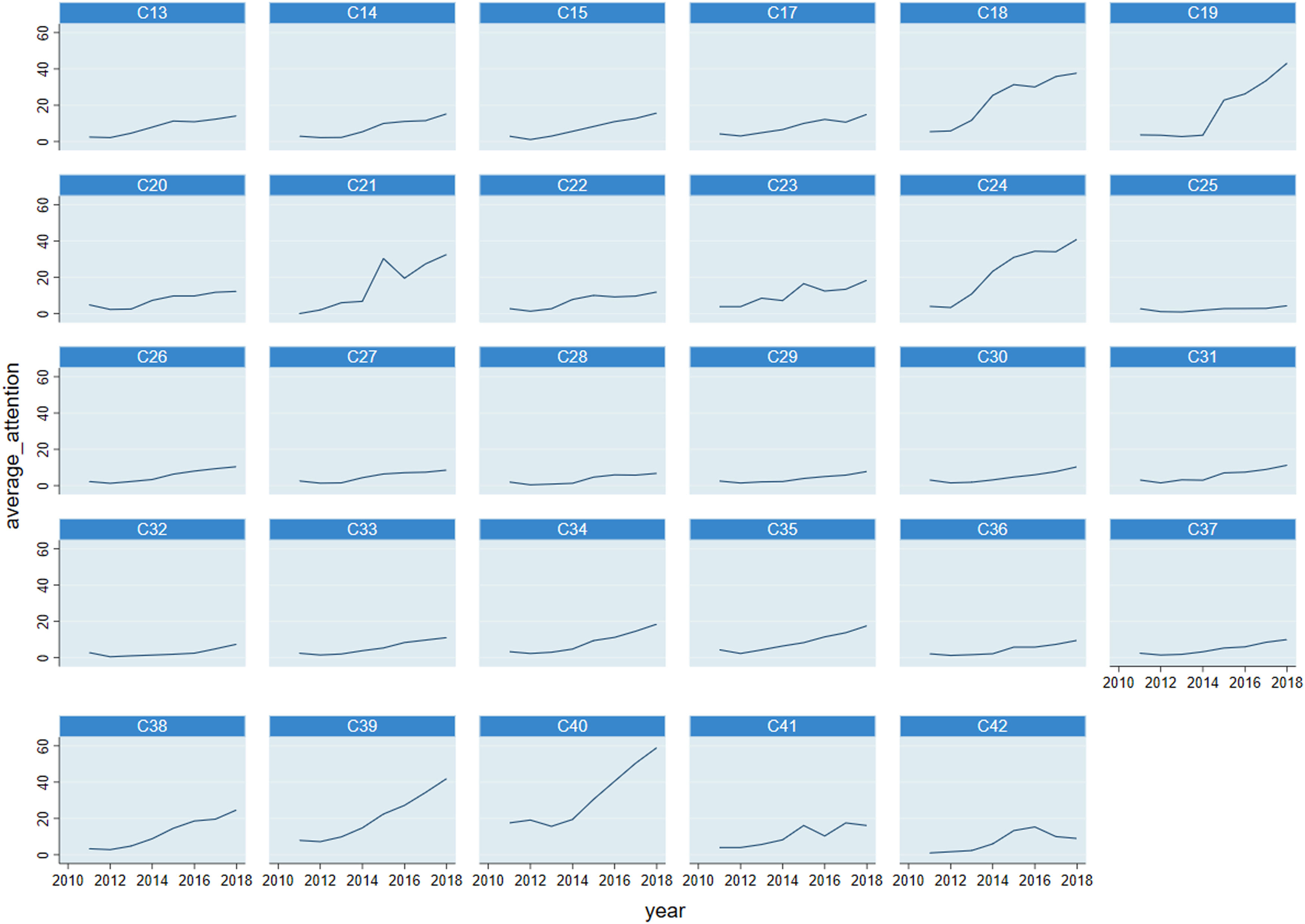

In order to understand the characteristics of the data more deeply, the study makes a horizontal and vertical comparative analysis of the sample. The time trend charts of the annual average of the degree of attention to the digital economy and different industrial sectors are shown in Fig. 2 and Fig. 3. As shown in Fig. 3, the degree of enterprises’ attention to the digital economy is increasing year by year. The attention to digital technology grows faster than the business model, showing significant differences among industrial sectors.

In Fig. 3, this study classifies the sectors according to the Guidelines on Industry Classification of Listed Companies and draws the changing trend. The degree of attention to the digital economy of manufacturing sectors related to consumer goods (sector codes are C18, C19, C21, and C24) has grown highly. The digital economy has opened online markets and provided more resources for these sectors. Therefore, enterprises in these sectors pay more attention to the emerging trends related to the digital economy. Manufacturing computers, communications, and other electronic equipment (C39) also pay much attention to the digital economy, as enterprises in these sectors rely on digital technology and produce related products. The instrument manufacturing industry (C40) sector also relies on digital technology deployment. The main function of this sector is to provide industrial equipment condition monitoring and fault diagnosis systems. Related enterprises need digital technology to make the collection, screening, transmission, and data analysis of the physical parameters of the equipment.

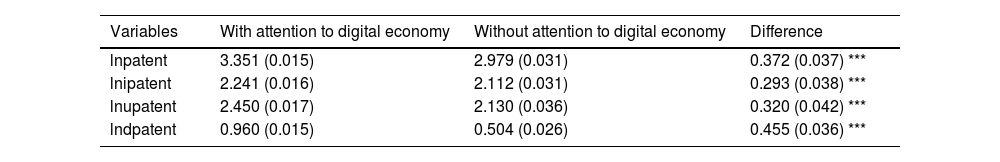

In Table 4, the sample is divided into two parts with attention to the digital economy and without attention to the digital economy. Compared with enterprises that do not pay attention to the digital economy, enterprises that pay attention to the digital economy have significantly higher innovation output. The average values of lnpatent, lnipatent, lnupatent, and lndpatent of the sample of enterprises that pay attention to the digital economy are higher than their counterparts. The study makes the Mean and Wilcoxon tests to check the significance of differences between the two samples. The differences between the two samples are significant at a 1% confidence level. The findings indicate that the digital economy significantly changes the elements, subjects, processes, and methods of enterprise innovation activities and processes.

A simple comparison of attention to the digital economy: with Mean test and Wilcoxon test.

| Variables | With attention to digital economy | Without attention to digital economy | Difference |

|---|---|---|---|

| lnpatent | 3.351 (0.015) | 2.979 (0.031) | 0.372 (0.037) *** |

| lnipatent | 2.241 (0.016) | 2.112 (0.031) | 0.293 (0.038) *** |

| lnupatent | 2.450 (0.017) | 2.130 (0.036) | 0.320 (0.042) *** |

| lndpatent | 0.960 (0.015) | 0.504 (0.026) | 0.455 (0.036) *** |

Note: Standard errors are in parentheses. *** Indicate p < 0.001 and significance at the 1% level.

Regarding innovation elements, enterprises have changed from relying on talents, capital, technology, and other elements to being more dependent on information and data. In terms of innovation subjects, the R&D design of enterprises has changed from internal R&D departments to internal and external multi-agent cooperation. Thus, the cost and innovation risk of innovation can be reduced. Regarding the innovation process, the enterprises have changed from the linear one-way process of "R&D-production-application" to the innovation closed-loop process of "R&D-production-application-feedback-iteration." Regarding innovation methods, enterprises can change from physical experiments to digital simulations. This shows that the hypothesis of more innovation output of enterprises with attention to the digital economy is basically verified.

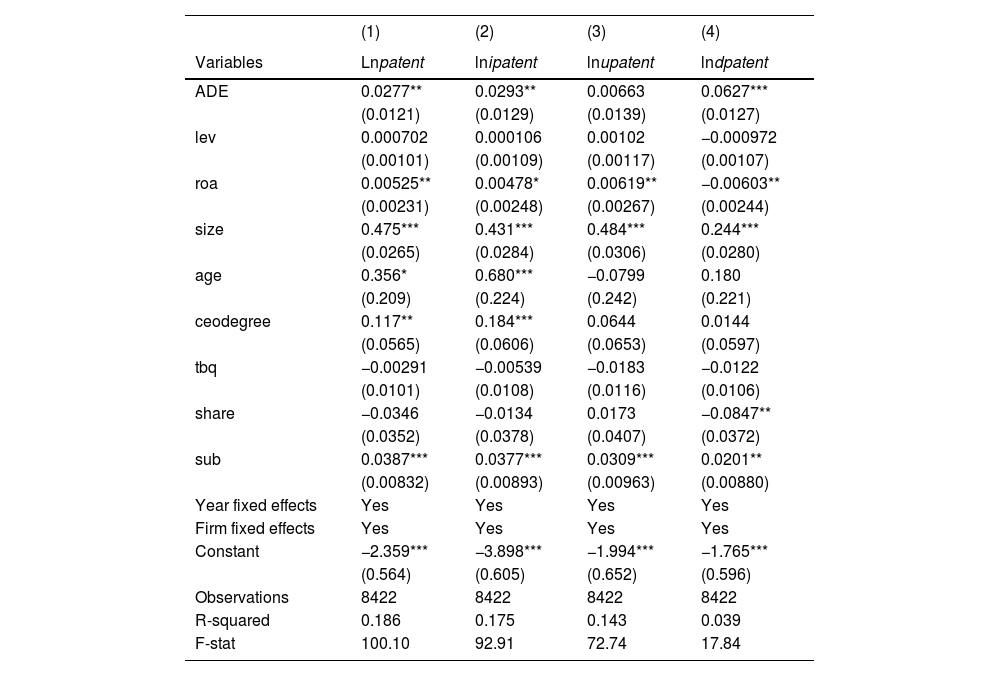

Empirical resultsBenchmark regression resultsTable 5 lists the benchmark regression results of the degree of enterprises’ attention to the digital economy on innovation, including control variables and year-firm two-way fixed effects. Among them, column (1) reflects the effect of an enterprise's degree of attention to the digital economy on the number of total patent applications. The result shows that the coefficient is significantly positive at the confidence level of 5%. Every one-unit increase in enterprises’ attention to the digital economy will lead to an increase of 0.0277 percentage points in the number of patent applications. Column (2) reflects the effect of attention to the digital economy on the number of invention patent applications. The result is also significantly positive at the confidence level of 5%. Every one-unit increase in enterprises’ attention to the digital economy will increase 0.0293 percentage points in the number of invention patent applications. The digital economy has an innovation-driven effect and positively impacts the "substantive innovation" represented by invention patents. However, the effect on the number of utility model patent applications is insignificant. In column (4), the effect on the number of enterprise design patent applications is significantly positive at the confidence level of 1%. Every one-unit increase in enterprises’ attention to the digital economy increases the number of enterprise design patent applications by 0.0627 percentage points. The above results reflect that the effect on the number of design patent applications is the most substantial. This may be because the digital economy has formed an online market environment where customers and enterprises interact frequently. It is convenient for enterprises to advertise and promote products online. In order to get more attention from customers, enterprises are more inclined to optimize the style of industrial products and make more esthetic and suitable designs. Consequently, hypothesis 1 is verified.

The effects of enterprises’ degree of attention to the digital economy on innovation: with TWEF model.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | Lnpatent | lnipatent | lnupatent | lndpatent |

| ADE | 0.0277** | 0.0293** | 0.00663 | 0.0627*** |

| (0.0121) | (0.0129) | (0.0139) | (0.0127) | |

| lev | 0.000702 | 0.000106 | 0.00102 | −0.000972 |

| (0.00101) | (0.00109) | (0.00117) | (0.00107) | |

| roa | 0.00525** | 0.00478* | 0.00619** | −0.00603** |

| (0.00231) | (0.00248) | (0.00267) | (0.00244) | |

| size | 0.475*** | 0.431*** | 0.484*** | 0.244*** |

| (0.0265) | (0.0284) | (0.0306) | (0.0280) | |

| age | 0.356* | 0.680*** | −0.0799 | 0.180 |

| (0.209) | (0.224) | (0.242) | (0.221) | |

| ceodegree | 0.117** | 0.184*** | 0.0644 | 0.0144 |

| (0.0565) | (0.0606) | (0.0653) | (0.0597) | |

| tbq | −0.00291 | −0.00539 | −0.0183 | −0.0122 |

| (0.0101) | (0.0108) | (0.0116) | (0.0106) | |

| share | −0.0346 | −0.0134 | 0.0173 | −0.0847** |

| (0.0352) | (0.0378) | (0.0407) | (0.0372) | |

| sub | 0.0387*** | 0.0377*** | 0.0309*** | 0.0201** |

| (0.00832) | (0.00893) | (0.00963) | (0.00880) | |

| Year fixed effects | Yes | Yes | Yes | Yes |

| Firm fixed effects | Yes | Yes | Yes | Yes |

| Constant | −2.359*** | −3.898*** | −1.994*** | −1.765*** |

| (0.564) | (0.605) | (0.652) | (0.596) | |

| Observations | 8422 | 8422 | 8422 | 8422 |

| R-squared | 0.186 | 0.175 | 0.143 | 0.039 |

| F-stat | 100.10 | 92.91 | 72.74 | 17.84 |

Note: Standard errors are in parentheses. ∗ p < 0.05, ∗∗ p < 0.01, ∗∗∗ p < 0.001.

Other control variables also have effects on enterprise innovativeness. From the perspective of internal innovation factors, enterprise size positively affects the number of total patent applications, invention patents, utility model patents, and design patent applications. This is consistent with the Schumpeter hypothesis that large-scale enterprises tend to have a higher innovation level. The improvement of ROA is conducive to the increase in the total number of patent applications, invention patents, and utility model applications. However, it has a negative impact on the number of design patent applications. The main reason may be that enterprises with higher profitability focus on the inherent quality of technology and products. In contrast, enterprises with lower profitability tend to increase revenue through eye-catching designs. The results also show that older enterprises have more invention patent applications. The education degree of entrepreneurs also has a significant positive impact on technological innovation. It further validates Schumpeter's theoretical view about entrepreneurial spirit. From the perspective of external innovation factors, government subsidies positively impact all types of patent applications. This indicates that the technological innovation of Chinese manufacturing enterprises is inseparable from the strong policy support of the government.

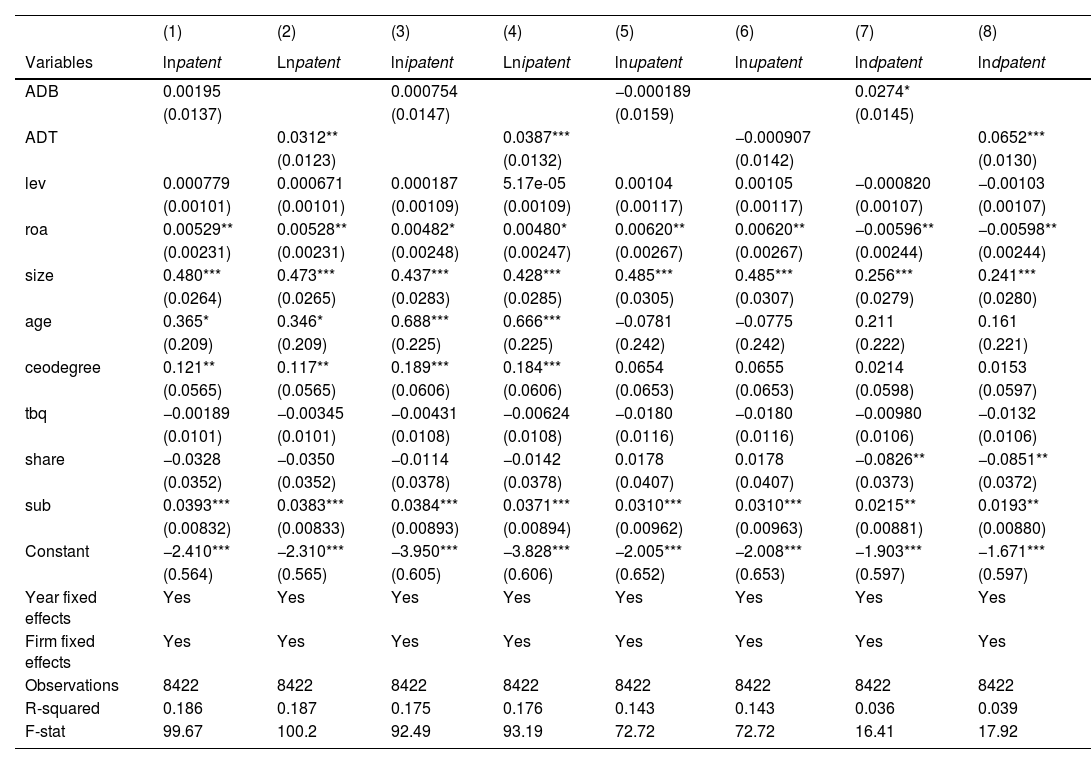

As the digital economy contains a variety of new technologies and business models, the study further examines the effects of an enterprise's degree of attention to the digital economy on innovation by considering its two aspects. As shown in Table 6, an enterprise's attention to digital technology significantly impacts patent applications, while the attention to the business model has no significant impact. The results further verify the complementary innovation between GPT and other technologies. Among them, the effect coefficient of the degree of attention to digital technologies on the number of total patent applications is 0.0312, which is significant at a 5% confidence level. The coefficients on the number of invention and design patent applications are 0.0387 and 0.0652, respectively. Both of them are significant at a 1% confidence level. It shows that an enterprise's attention to digital technology positively impacts innovation of invention and design patents. The effect on the number of utility model patent applications is still insignificant. An additional finding is in column (7). It indicates that an enterprise's degree of attention to the business model positively impacts design patent applications, which is significant at a 10% confidence level. It further shows that the digital economy makes focus a priority when designing the appearance of products. The digital business model constructs connected platforms for the value co-creation between enterprises and customers, so new products and technologies can better match market demand. Enterprises can make better design innovation and market promotion by applying the digital business model. Consequently, hypotheses 2 and 3 are verified.

The effects of digital business model and technology on innovation: with TWEF model.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| Variables | lnpatent | Lnpatent | lnipatent | Lnipatent | lnupatent | lnupatent | lndpatent | lndpatent |

| ADB | 0.00195 | 0.000754 | −0.000189 | 0.0274* | ||||

| (0.0137) | (0.0147) | (0.0159) | (0.0145) | |||||

| ADT | 0.0312** | 0.0387*** | −0.000907 | 0.0652*** | ||||

| (0.0123) | (0.0132) | (0.0142) | (0.0130) | |||||

| lev | 0.000779 | 0.000671 | 0.000187 | 5.17e-05 | 0.00104 | 0.00105 | −0.000820 | −0.00103 |

| (0.00101) | (0.00101) | (0.00109) | (0.00109) | (0.00117) | (0.00117) | (0.00107) | (0.00107) | |

| roa | 0.00529** | 0.00528** | 0.00482* | 0.00480* | 0.00620** | 0.00620** | −0.00596** | −0.00598** |

| (0.00231) | (0.00231) | (0.00248) | (0.00247) | (0.00267) | (0.00267) | (0.00244) | (0.00244) | |

| size | 0.480*** | 0.473*** | 0.437*** | 0.428*** | 0.485*** | 0.485*** | 0.256*** | 0.241*** |

| (0.0264) | (0.0265) | (0.0283) | (0.0285) | (0.0305) | (0.0307) | (0.0279) | (0.0280) | |

| age | 0.365* | 0.346* | 0.688*** | 0.666*** | −0.0781 | −0.0775 | 0.211 | 0.161 |

| (0.209) | (0.209) | (0.225) | (0.225) | (0.242) | (0.242) | (0.222) | (0.221) | |

| ceodegree | 0.121** | 0.117** | 0.189*** | 0.184*** | 0.0654 | 0.0655 | 0.0214 | 0.0153 |

| (0.0565) | (0.0565) | (0.0606) | (0.0606) | (0.0653) | (0.0653) | (0.0598) | (0.0597) | |

| tbq | −0.00189 | −0.00345 | −0.00431 | −0.00624 | −0.0180 | −0.0180 | −0.00980 | −0.0132 |

| (0.0101) | (0.0101) | (0.0108) | (0.0108) | (0.0116) | (0.0116) | (0.0106) | (0.0106) | |

| share | −0.0328 | −0.0350 | −0.0114 | −0.0142 | 0.0178 | 0.0178 | −0.0826** | −0.0851** |

| (0.0352) | (0.0352) | (0.0378) | (0.0378) | (0.0407) | (0.0407) | (0.0373) | (0.0372) | |

| sub | 0.0393*** | 0.0383*** | 0.0384*** | 0.0371*** | 0.0310*** | 0.0310*** | 0.0215** | 0.0193** |

| (0.00832) | (0.00833) | (0.00893) | (0.00894) | (0.00962) | (0.00963) | (0.00881) | (0.00880) | |

| Constant | −2.410*** | −2.310*** | −3.950*** | −3.828*** | −2.005*** | −2.008*** | −1.903*** | −1.671*** |

| (0.564) | (0.565) | (0.605) | (0.606) | (0.652) | (0.653) | (0.597) | (0.597) | |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 8422 | 8422 | 8422 | 8422 | 8422 | 8422 | 8422 | 8422 |

| R-squared | 0.186 | 0.187 | 0.175 | 0.176 | 0.143 | 0.143 | 0.036 | 0.039 |

| F-stat | 99.67 | 100.2 | 92.49 | 93.19 | 72.72 | 72.72 | 16.41 | 17.92 |

Note: Standard errors are in parentheses. ∗ p < 0.05, ∗∗ p < 0.01, ∗∗∗ p < 0.001.

An enterprise's degree of attention to the digital economy may not be enough to reflect an enterprise's accurate digital transformation level. Thus, the stability of the regression result remains to be verified. This study complements other empirical methods, such as changing the explanatory variable and model and introducing the variable of digital transformation, in order to ensure the consistency and stability of the evaluation results.

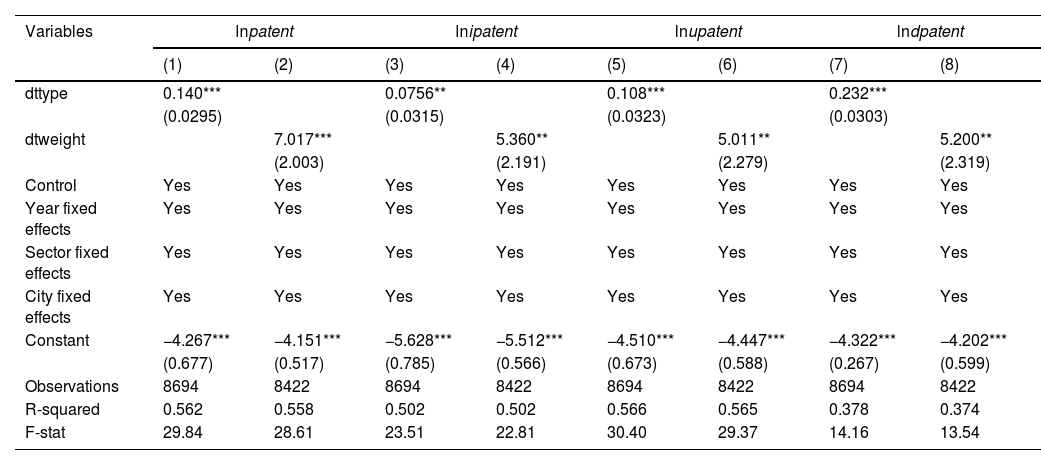

Changing variables and modelConcerning the practice of Qi and Cai (2020), two new explanatory variables are selected to regress again. One is a dummy variable dttype to measure whether the enterprise discloses the keywords of the digital economy. The other variable is a continuous variable dtweight to measure the extent of enterprises’ attention to the digital economy among sectors. Table 7 shows the regression results with the replacement of new explanatory variables. The control variables of regressions are the same as the benchmark regression. Considering that enterprises would be affected by city and industry-level factors, a multi-dimensional fixed effect model is used in this part, adding sector and city-fixed effects into regressions. The effect coefficients of new explanatory variables are significant at a 5% or 1% confidence level. The results show that the two explanatory variables significantly positively impact the number of total and other kinds of patent applications. Enterprises that disclose digital economy keywords have a higher level of innovation than those that do not. The higher proportion of digital economy keywords in sectors leads to higher innovation. It is further verified that the previous empirical conclusion is robust.

The result of robustness checks.

| Variables | lnpatent | lnipatent | lnupatent | lndpatent | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| dttype | 0.140*** | 0.0756** | 0.108*** | 0.232*** | ||||

| (0.0295) | (0.0315) | (0.0323) | (0.0303) | |||||

| dtweight | 7.017*** | 5.360** | 5.011** | 5.200** | ||||

| (2.003) | (2.191) | (2.279) | (2.319) | |||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Sector fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| City fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −4.267*** | −4.151*** | −5.628*** | −5.512*** | −4.510*** | −4.447*** | −4.322*** | −4.202*** |

| (0.677) | (0.517) | (0.785) | (0.566) | (0.673) | (0.588) | (0.267) | (0.599) | |

| Observations | 8694 | 8422 | 8694 | 8422 | 8694 | 8422 | 8694 | 8422 |

| R-squared | 0.562 | 0.558 | 0.502 | 0.502 | 0.566 | 0.565 | 0.378 | 0.374 |

| F-stat | 29.84 | 28.61 | 23.51 | 22.81 | 30.40 | 29.37 | 14.16 | 13.54 |

Note: Standard errors are in parentheses. ∗ p < 0.05, ∗∗ p < 0.01, ∗∗∗ p < 0.001.

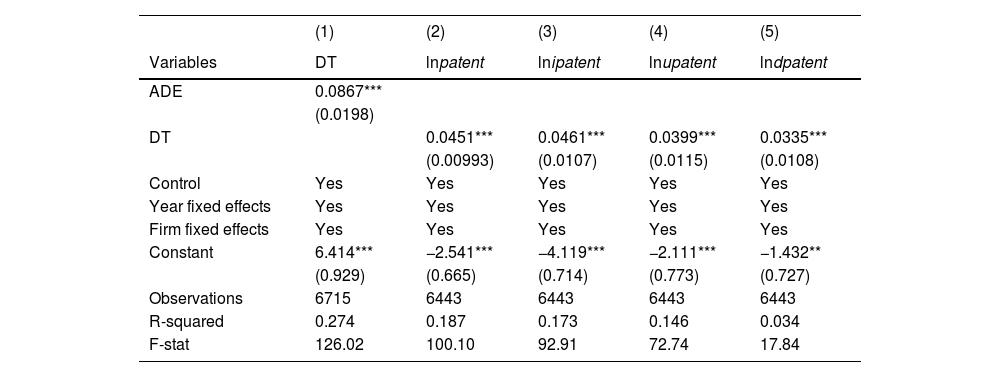

The focus may not accurately reflect the digital transformation efforts of the enterprises operating in the digital economy. This study uses the logarithm of the value of software assets in intangible assets as a proxy variable for digital transformation (DT) to solve the problem. According to the empirical findings in Table 8, enterprises that pay more attention to the digital economy have higher levels of digital transformation. Moreover, enterprises with reasonable digital transformation efforts have more patent applications, invention patents, utility model patents, and design patents.

The effects of digital transformation on innovation: with TWEF model.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | DT | lnpatent | lnipatent | lnupatent | lndpatent |

| ADE | 0.0867*** | ||||

| (0.0198) | |||||

| DT | 0.0451*** | 0.0461*** | 0.0399*** | 0.0335*** | |

| (0.00993) | (0.0107) | (0.0115) | (0.0108) | ||

| Control | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes |

| Firm fixed effects | Yes | Yes | Yes | Yes | Yes |

| Constant | 6.414*** | −2.541*** | −4.119*** | −2.111*** | −1.432** |

| (0.929) | (0.665) | (0.714) | (0.773) | (0.727) | |

| Observations | 6715 | 6443 | 6443 | 6443 | 6443 |

| R-squared | 0.274 | 0.187 | 0.173 | 0.146 | 0.034 |

| F-stat | 126.02 | 100.10 | 92.91 | 72.74 | 17.84 |

Note: Standard errors are in parentheses. ∗ p < 0.05, ∗∗ p < 0.01, ∗∗∗ p < 0.001.

The endogenous problems in the model, such as missing variables, measurement errors, reverse causality, and sample selection, must also be eliminated.

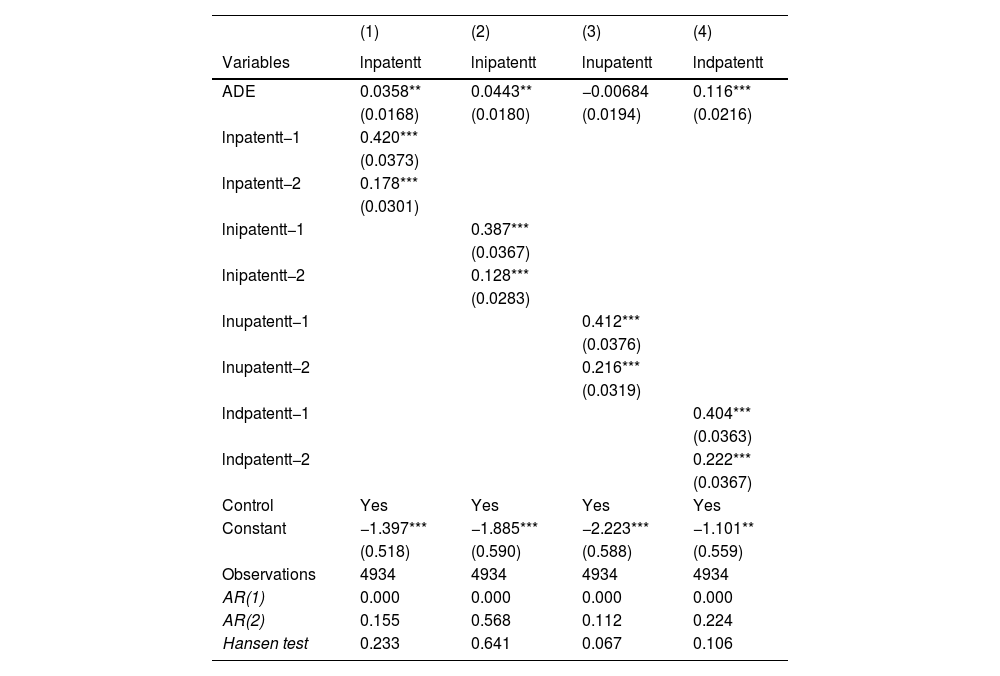

Using dynamic panel data (DPD)Since the number of patent applications in the past may impact the present circumstances, the number of patent applications can be considered an endogenous variable. Thus, this study employs the SYS-GMM model to test the endogeneity while lags one and two types of patent applications are introduced as control variables for dynamic panel data. In Table 9, enterprise innovation is still impacted by an enterprise's attention to the digital economy even after controlling explained variables with a lag of two periods. There is no significant difference in the coefficient of each variable between static fixed panel model and dynamic panel data. It shows that the degree of attention to the digital economy still significantly affects the total number of patent applications, invention patent applications, and design patent applications. However, an enterprise's degree of attention to the digital economy has no significant impact on utility model patent applications. The random interference terms and instrumental variables all passed the validity tests. In the Arellano-Bond test, the p-value of the first-order autocorrelation test AR (1) test is 0, which significantly rejects the null hypothesis. The p-value of the second-order autocorrelation test AR (2) test is greater than 0.1, indicating that there is no second-order or higher-order autocorrelation in the random interference term of the model. The over-identified Hansen test does not reject the null hypothesis (p > 0.1), indicating that the instrumental variables are valid and the model setting is reasonable. In summary, the estimation results of SYS-GMM are valid, and the benchmark regression results are robust.

The regression results of SYS-GMM.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | lnpatentt | lnipatentt | lnupatentt | lndpatentt |

| ADE | 0.0358** | 0.0443** | −0.00684 | 0.116*** |

| (0.0168) | (0.0180) | (0.0194) | (0.0216) | |

| lnpatentt−1 | 0.420*** | |||

| (0.0373) | ||||

| lnpatentt−2 | 0.178*** | |||

| (0.0301) | ||||

| lnipatentt−1 | 0.387*** | |||

| (0.0367) | ||||

| lnipatentt−2 | 0.128*** | |||

| (0.0283) | ||||

| lnupatentt−1 | 0.412*** | |||

| (0.0376) | ||||

| lnupatentt−2 | 0.216*** | |||

| (0.0319) | ||||

| lndpatentt−1 | 0.404*** | |||

| (0.0363) | ||||

| lndpatentt−2 | 0.222*** | |||

| (0.0367) | ||||

| Control | Yes | Yes | Yes | Yes |

| Constant | −1.397*** | −1.885*** | −2.223*** | −1.101** |

| (0.518) | (0.590) | (0.588) | (0.559) | |

| Observations | 4934 | 4934 | 4934 | 4934 |

| AR(1) | 0.000 | 0.000 | 0.000 | 0.000 |

| AR(2) | 0.155 | 0.568 | 0.112 | 0.224 |

| Hansen test | 0.233 | 0.641 | 0.067 | 0.106 |

Note: Standard errors are in parentheses. ∗ p < 0.05, ∗∗ p < 0.01, ∗∗∗ p < 0.001.

The result of Arellano-Bond test and Hansen test is p-value.

Enterprises with high levels of innovation may be more focused on digital technology and more capable or motivated to carry out digital transformation, which could lead to the reverse causality problem in empirical estimation. This study mitigates the potential endogeneity problem by constructing instrumental variables, following the approach of Zhang, Lu and Li (2021). The "Mount Everest Plan" was initiated by multiple departments in China in 2009 and was dedicated to promoting the development of science and engineering. Seventeen pilot universities officially launching the "Mount Everest Plan" around 2010 were selected as the baseline. The instrumental variable ADE was constructed by multiplying the geographical distance between the listed enterprises and the 17 pilot universities and the interaction term of the experimental period. Specifically, Eq. (4) is used to construct the instrumental variable, wherei represents a listed enterprise, k represents the first batch of pilot universities, and n represents the number of the first batch of pilot universities (n = 17). Distance represents the straight-line distance between the enterprise's office location, calculated based on longitude and latitude, and the main campus of university k. Post is a time dummy variable. Since the first batch of universities mostly started implementing the "Mount Everest Plan" in 2010, the first batch of students affected by the "Mount Everest Plan" graduated in 2014. Therefore, Post takes 0 before 2014 and 1 afterward.

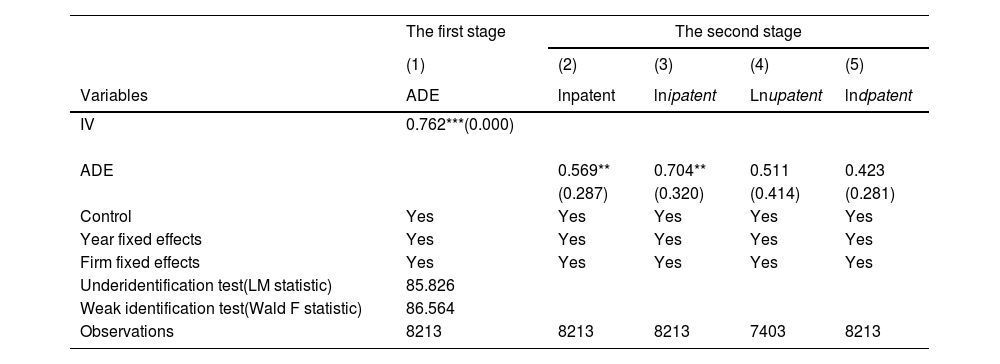

STEM (science, technology, engineering, and mathematics) education cultivates data analytical skills, programming skills, and engineering design thinking closely related to digital technology applications, making STEM professionals play a crucial role in digital technology application development. Previous industry experience and academic research have confirmed that the shortage of STEM professionals is a bottleneck for enterprises adopting digital technologies such as big data and AI (Tambe, 2014). Many new digital economy formats are incubated in universities, and enterprises closely associated with universities are more likely to pay more attention to and actively participate in the digital economy. For example, many founders of Internet companies in Silicon Valley, such as Google and Yahoo, graduated from Stanford University. In China, many Internet companies such as JD.com and Didi were incubated and grew in Zhongguancun Science Park, benefiting from the influence of the university town in the Haidian District. Similarly, the University of Science and Technology of China in Hefei has incubated excellent AI enterprises such as iFLYTEK. According to the design of the instrumental variable, the closer the distance between the listed enterprise and the pilot university, the greater the enterprise's exposure to policy radiation, and the more likely the enterprise is to pay attention to the digital economy. At the same time, this instrumental variable is unlikely to affect innovation at the firm level through other channels only by arousing attention to the digital economy, firstly, theoretically satisfying the requirement of exclusivity. In column (1) of Table 10, the regression results of the first stage, where the core variable ADE is regressed on the instrumental variable, show that the coefficient of the instrumental variable is significantly positive. This indicates that listed enterprises closer to the pilot universities have a higher degree of attention to the digital economy, which aligns with expectations. The Cragg-Donald F statistic for the first stage is 86.564, and the Kleibergen-Paap rk F statistic is 85.826, far exceeding the critical value of 16.38 for the 10% level of the weak instrumental variable test proposed by Stock and Yogo, indicating that the instrumental variable satisfies the relevance assumption. In the second stage regression, the coefficient assessing the impact of attention to the digital economy on the number of patent and invention patent applications is significant at the 5% confidence level. However, the coefficient assessing the impact on utility and design patents is insignificant. This suggests that the pilot universities mainly influence enterprises’ technological innovation rather than affecting utility or design innovation.

The result of endogeneity checks.

| The first stage | The second stage | ||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Variables | ADE | lnpatent | lnipatent | Lnupatent | lndpatent |

| IV | 0.762***(0.000) | ||||

| ADE | 0.569** | 0.704** | 0.511 | 0.423 | |

| (0.287) | (0.320) | (0.414) | (0.281) | ||

| Control | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes |

| Firm fixed effects | Yes | Yes | Yes | Yes | Yes |

| Underidentification test(LM statistic) | 85.826 | ||||

| Weak identification test(Wald F statistic) | 86.564 | ||||

| Observations | 8213 | 8213 | 8213 | 7403 | 8213 |

Note: Standard errors are in parentheses. ∗ p < 0.05, ∗∗ p < 0.01, ∗∗∗ p < 0.001.

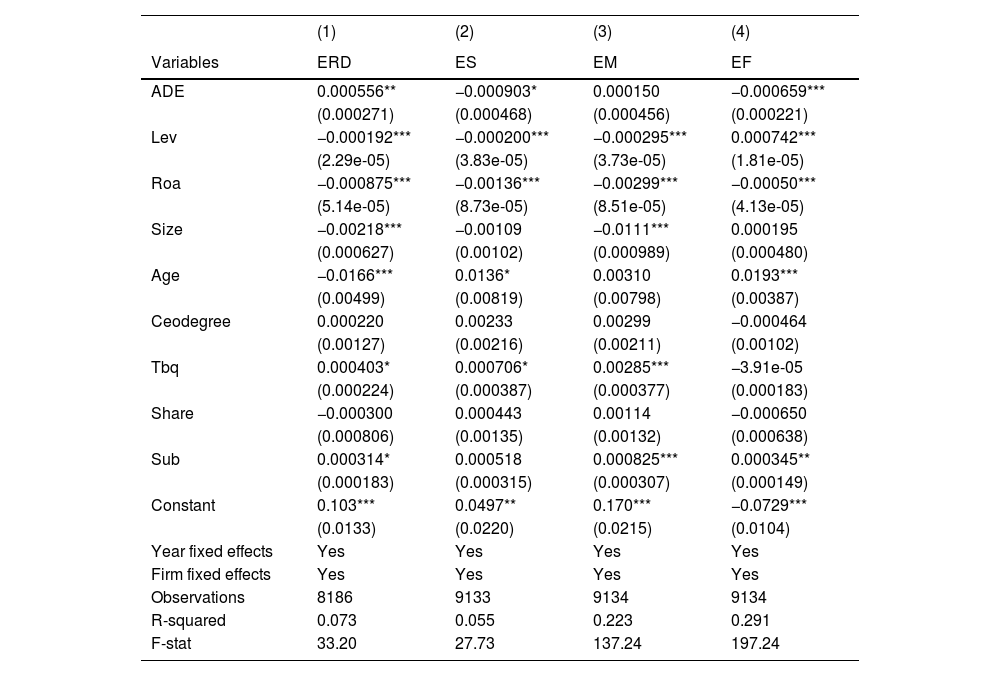

To test the third hypothesis, this section verifies cost control as the mechanism of assessing the impact of an enterprise's degree of attention to the digital economy on innovation. Based on the theoretical review in Section 2, the impact of an enterprise's degree of attention to the digital economy on innovation can be achieved through cost control, which includes R&D expenditure, sales expenses, management expenses, and finance expenses. Table 11 examines the results of the mechanism with the intermediate effect model.

Mechanism analysis: with intermediate effect test.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | ERD | ES | EM | EF |

| ADE | 0.000556** | −0.000903* | 0.000150 | −0.000659*** |

| (0.000271) | (0.000468) | (0.000456) | (0.000221) | |

| Lev | −0.000192*** | −0.000200*** | −0.000295*** | 0.000742*** |

| (2.29e-05) | (3.83e-05) | (3.73e-05) | (1.81e-05) | |

| Roa | −0.000875*** | −0.00136*** | −0.00299*** | −0.00050*** |

| (5.14e-05) | (8.73e-05) | (8.51e-05) | (4.13e-05) | |

| Size | −0.00218*** | −0.00109 | −0.0111*** | 0.000195 |

| (0.000627) | (0.00102) | (0.000989) | (0.000480) | |

| Age | −0.0166*** | 0.0136* | 0.00310 | 0.0193*** |

| (0.00499) | (0.00819) | (0.00798) | (0.00387) | |

| Ceodegree | 0.000220 | 0.00233 | 0.00299 | −0.000464 |

| (0.00127) | (0.00216) | (0.00211) | (0.00102) | |

| Tbq | 0.000403* | 0.000706* | 0.00285*** | −3.91e-05 |

| (0.000224) | (0.000387) | (0.000377) | (0.000183) | |

| Share | −0.000300 | 0.000443 | 0.00114 | −0.000650 |

| (0.000806) | (0.00135) | (0.00132) | (0.000638) | |

| Sub | 0.000314* | 0.000518 | 0.000825*** | 0.000345** |

| (0.000183) | (0.000315) | (0.000307) | (0.000149) | |

| Constant | 0.103*** | 0.0497** | 0.170*** | −0.0729*** |

| (0.0133) | (0.0220) | (0.0215) | (0.0104) | |

| Year fixed effects | Yes | Yes | Yes | Yes |

| Firm fixed effects | Yes | Yes | Yes | Yes |

| Observations | 8186 | 9133 | 9134 | 9134 |

| R-squared | 0.073 | 0.055 | 0.223 | 0.291 |

| F-stat | 33.20 | 27.73 | 137.24 | 197.24 |

Note: Standard errors are in parentheses. ∗ p < 0.05, ∗∗ p < 0.01, ∗∗∗ p < 0.001.

More attention to the digital economy stimulates enthusiasm for innovation investment in new products, technologies, and projects. Under the focus on the digital economy, the proportion of R&D expenditure to operational revenue is further raised, increasing innovation production. Table 11, column (1) reflects that as an enterprise's degree of attention to the digital economy increases, the proportion of its R&D expenditure will increase. The coefficient is 0.000556. It means that when an enterprise's degree of attention to the digital economy increases by a unit, the proportion of its R&D expenditure will increase by 0.0556 percentage points. Consistent with Chen, Gu and Luo (2022) and Griliches (1981), this study reveals that an enterprise's R&D expenditure significantly and strongly impacts the number of patent applications. It indicates that an enterprise's attention to the digital economy can increase R&D expenditure and produce more innovation output, supporting an R&D expenditure channel.

Sales expensesThe digital economy promotes the booming of online sales. Digital transformation will save sales expenses for enterprise innovation. Column (2) of Table 11 reflects that the degree of attention to the digital economy has a negative effect on sales expenses, with an impact coefficient of −0.000903. This indicates that sales expenses decrease under the influence of digital transformation. The main reason for decreased sales expenses is that online sales can save costs. The digital economy broadens online sales channels, thus reducing sales expenses for enterprises and market search costs for consumers. Enterprises can strengthen the market promotion of new products at low cost. Moreover, innovative activities can accurately track the market demand trend and match customer needs on a larger scale. Meanwhile, reducing sales expenses can further save money for R&D investment, which strongly and indirectly affects invention patents.

Management expensesAs indicated in column (3) of Table 11, the effect of enterprises’ degree of attention to the digital economy on the proportion of management expenses is not significant. Although the average expenses of management are the highest for listed manufacturing companies in China, as shown in Table 3, management cost is still difficult to be reduced in the digital economy. Management is strongly related to managers' subjective will and enterprise regulations; thus, it is difficult to change. Enterprises' digital transformation efforts will increase the workforce and material expenses when adopting new technologies, equipment, and management models. Advanced management models can be an important driving force for technological innovation.

Finance expensesFinance expenses are the costs incurred by enterprises in order to raise funds in the process of production and operation. Column (4) of Table 11 reflects the negative effect of digital transformation efforts on finance expenses, which is significant at a 5% confidence level. It shows that finance expenses will decrease with increasing attention to the digital economy. Reducing finance expenses will help enterprises save more for R&D and stimulate innovation output. The relationship between debit and credit is becoming more evident in the digital environment. Digital technologies produce more finance software for enterprises to reduce finance expenses and processing time. Consequently, business efficiency is improved, encouraging enterprises’ innovative efforts to be better.