We analyze the effects of digitalization and the knowledge acquired through vertical and institutional cooperation across the value chain on the introduction of patents and technological, namely, product and process, innovations in large, and small and medium-sized enterprises (SMEs). We study the case of Spain as a digitally competitive economy displaying a relatively low innovation score, a feature reversing the trend observed in most European Union countries. Three empirical scenarios, one for each innovation output, are defined and analyzed following a random-effects probit panel model separately estimated for large firms and SMEs. The sample used in the empirical analysis comprises 1,369 manufacturing firms, out of which 508 are large and 862 SMEs. The empirical results confirmed the importance of digitalization and collaboration across the value chain for all firms, regardless of size. We also observe that the performance of internal R&D activities fosters the introduction of patents and technological innovations across all firms. The main theoretical implications of the empirical results are discussed, and different policy recommendations suggested.

The literature on digitalization and its effects on the incentives and technological innovations developed by firms across different industrial sectors is extensive and has continued gathering momentum in recent years. Digital transformation has been given various definitions (Reis et al., 2018). One of the first and most direct ones corresponds to Westerman et al. (2011), who defined digital transformation as the use of technology to radically improve the performance or reach of enterprises. The competitive advantages that may arise from introducing patents and new products, designing novel production processes, and generating new markets constitute one of the main objectives of digital transformation (Fitzgerald et al., 2014; Ross et al., 2016). Exploiting emerging digital technologies requires transforming the organizational structure of firms, leading to modifications in products and processes (Matt et al., 2015).

The development of digital technologies has fostered the transformation of industries within the digital environment (Kraus et al., 2022). The digital transformation of firms and innovation management has led to the emergence of business ecosystems conditioning the subsequent innovation incentives and processes (Huesig & Endres, 2019; Elia et al., 2021). For instance, the creation of high-speed networks allows for decision-making processes to be based on real-time information, increasing the response capacity of firms to external shocks and supply chain interactions (Kergroach, 2021). Recent research has focused on the consequences of digital technologies for sustainable entrepreneurship (Holzmann & Gregori, 2023), particularly the integration of digital technologies and sustainability within business models (Pan et al., 2022; Nishant et al., 2020).

Digital transformation in SMEsThe implementation of Industry 4.0 practices in small and medium-sized enterprises (SMEs) has taken place through a variety of channels (Meindl et al., 2021), among which cloud computing remains the most prominent one (Harvey Nash, 2022; Moeuf et al., 2017). Digital transformation aims to trigger improvements in the competitiveness of SMEs through innovations implemented at different firm levels (Teoh et al., 2022). In this regard, adopting digital technologies requires substantial investment by firms, which, if absent, would decrease their capacity to address potential competitive challenges arising in the market (Oliveira et al., 2022; Cambrea et al., 2021).

Digital technologies are strengthened during the internationalization process of firms (Chen & Kamal, 2016), with Müller et al. (2021) emphasizing the importance that the capacity of SMEs to assimilate and apply environmental information has for their innovation strategies. Similarly, Ojha et al. (2023) studied the dynamic strategic benefits of virtual integration as a performance improver for SMEs. The literature has also ventured into the efficiency branch of operations research. Gao et al. (2023) applied a hybrid model consisting of the super-efficiency version of data envelopment analysis within a Malmquist framework to study the effects of digitalization on the servitization level of manufacturing SMEs.

The increase in the productivity of SMEs triggered by digital transformation has been constantly validated in the literature. The analyses performed encompass developed regions such as the US and Europe (Van Ark et al., 2021), as well as developing countries (Aly, 2020), with particular emphasis placed on Africa (Gaglio et al., 2022), China (Du & Jiang, 2022) and Russia (Romanova & Ponomareva, 2022). On the other hand, Radicic & Petković (2023) highlighted the fact that the literature has not generally considered the effect of digital transformation on innovation in SMEs.

There are plenty of potential channels through which digital technologies may affect the functioning of SMEs, ranging from the reduction of transaction costs and new product and process developments to improvements in logistics and communication within and across firms (Grover et al., 2022; Alcácer et al., 2016). In this regard, digital transformation has also had significant effects on the competitive behavior of European SMEs (Garzoni et al., 2020). The activities undertaken by European SMEs are indeed significantly conditioned by digital technologies, including their interactions with customers and suppliers (Matarazzo et al., 2021) and the development of new products and services (Khin & Ho, 2019). Skare et al. (2023) illustrated how the transformation induced by digital technologies conditions the main competences of European firms and their networks. These authors analyzed the effects of digitalization – measured via the Digital Economy and Society Index (DESI) index computed by the European Commission – on different activities of European SMEs, including customer access, competition, access to finance, input costs, skilled labor, exogenous shocks, global crises, and regulatory issues.

Contribution: the case of SpainWe analyze whether digital transformation fosters innovation among Spanish firms, focusing particularly on the behavior of SMEs. As highlighted by Radicic & Petković (2023), this relationship has received less attention from the literature than the effect of digitalization on productivity. The intuition describing the expected relationship between both variables is direct and appealing; namely, the implementation of digital technologies is expected to enhance the capacity of firms to introduce patents as well as product and process innovations.

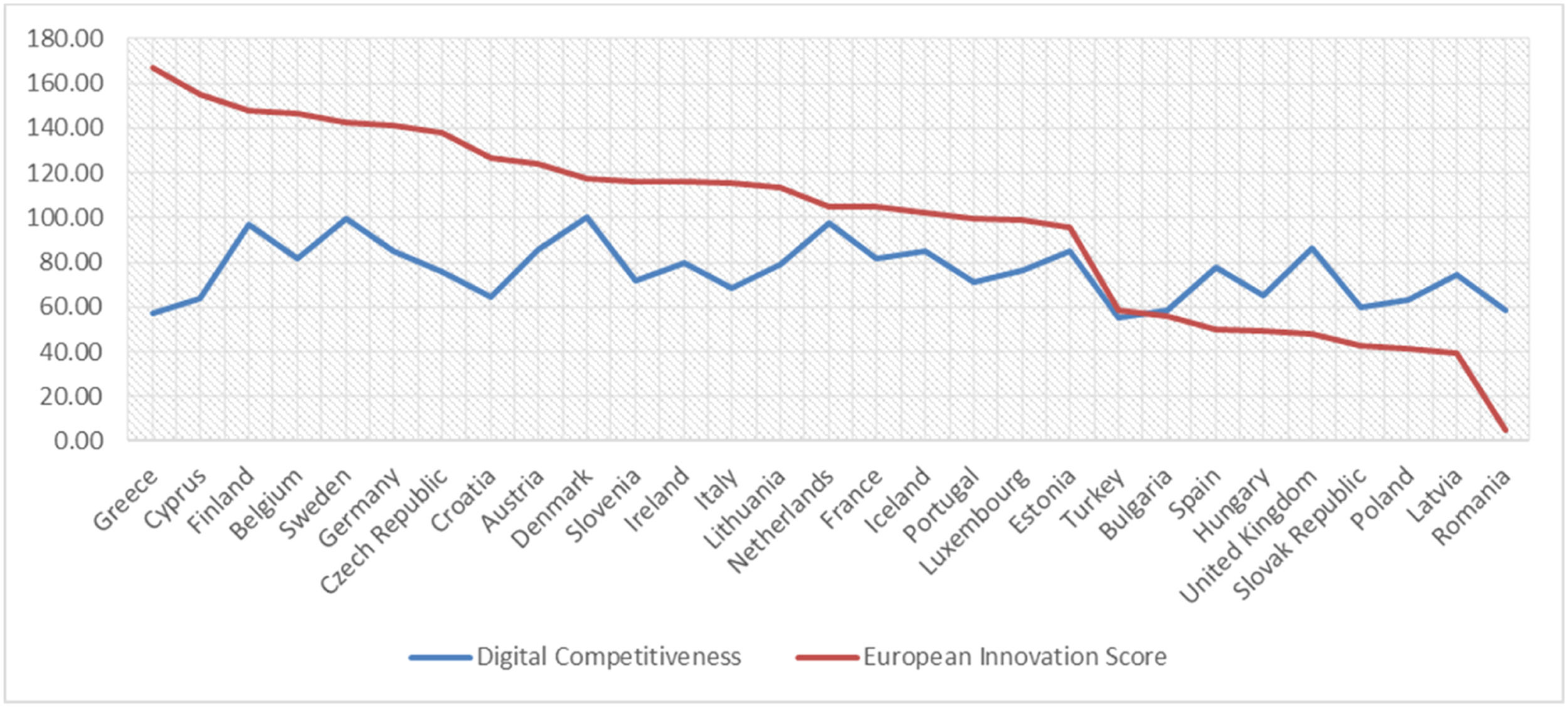

However, some doubts may arise if one has a look at the main macroeconomic indicators. Fig. 1 illustrates the innovation scores for SMEs together with the World Digital Competitiveness index across most European countries in 2022. This figure does not represent a clear relationship between both variables, whose correlation equals 0.38. It is particularly interesting how the relationship is inverted for a subset of countries, including Spain, whose digital competitiveness is larger than its innovation score. On the opposite side, Greece and Cyprus display high innovation scores but much lower competitiveness.

Innovation scores versus digital competitiveness across European countries in 2022. Sources: European innovation scores for SME innovation in European countries 2022 (EU=100). Retrieved from the European Innovation Scoreboard available at https://research-and-innovation.ec.europa.eu/statistics/performance-indicators/european-innovation-scoreboard_en. World Digital Competitiveness ranking computed by the International Institute for Management Development. Available at https://www.imd.org/centers/wcc/world-competitiveness-center/rankings/world-digital-competitiveness-ranking/.

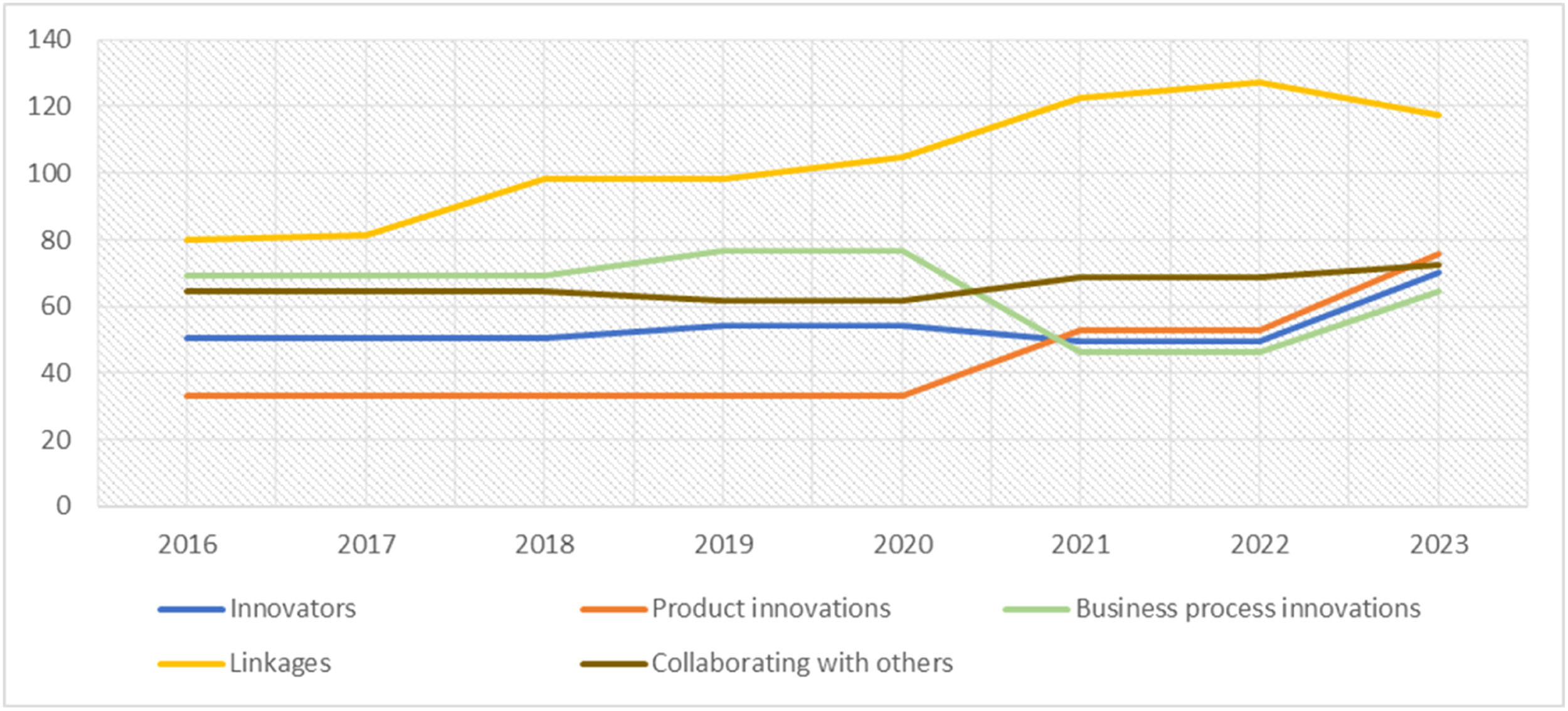

Fig. 2 provides additional intuition by describing the evolution of different innovation and linkage scores for Spanish SMEs from 2016. Clearly, firms are increasing their linkages and opening to external collaboration, displaying a recent increase in innovators. Note also how the tendency of product and process innovations has been inverted in the last three years, with products gaining relevance over the process while further evolving almost identically. That is, Spanish SMEs were focused on enhancing their production capacities, a process that has given place to a sustained increase in product innovations.

Evolution of innovation and linkages scores for Spanish SMEs. sources: Performance relative to EU in 2014 = 100. Retrieved from the European Innovation Scoreboard available at https://ec.europa.eu/research-and-innovation/en/statistics/performance-indicators/european-innovation-scoreboard/eis.

Regarding the analyses performed in the literature, Radicic & Petković (2023) obtained a positive relationship between digital transformation and innovation for German SMEs, requiring the mediating role of intramural R&D. Radicic & Pinto (2019) considered the persistent behavior displayed by technological innovations when validating this relationship through a set of Spanish manufacturing firms. These authors concluded that cooperation with suppliers and universities positively affected product and process innovations.

The current paper analyzes the relationship existing between the digitalization of the value chain and the incentives of large firms and SMEs to develop patents and technological innovations. The analysis will focus on the capacity of the knowledge acquired through digital transformation, vertical interactions with customers and suppliers, and institutional cooperation across the value chain to foster the introduction of patents as well as products and process innovations. These features are particularly relevant among SMEs, for which the adoption and implementation of digital technologies can be a source of competitive advantage. We will also evaluate the contribution of R&D activities to the development of technological innovations across firms conditioned by their relative size.

Given the facts presented in Figs. 1 and 2, we focus our analysis on Spain, which can be defined as a digitally competitive economy displaying a relatively low innovation score. The sample used in the empirical research comprises 1,369 manufacturing firms, out of which 508 are large (more than 250 employees) and 862 SMEs (between 10 and 250 employees), evaluated over the period 2000-2017.

The econometric model applied takes the form of a knowledge production function that determines to what extent different knowledge sources affect innovation outputs. Three empirical scenarios, one for each innovation output, are estimated using a random-effects probit panel model, which will be evaluated separately for large firms and SMEs. The main theoretical implications derived from the results obtained are then discussed, and different policy recommendations are provided.

The rest of the paper proceeds as follows. The next section provides a basic literature review and defines the hypotheses tested. Section 4 describes the variables selected for the empirical analysis performed in Section 5. Sections 6 and 7 present and discuss the results obtained, respectively. Section 8 concludes and suggests potential extensions.

Literature reviewIndustry 4.0 is characterized by the implementation of Information and Communication Technologies (ICTs) in manufacturing and through the different elements composing production and distribution processes (Sarbu, 2022; Culot et al., 2020). These technologies extend traditional value chains into network systems, fostering the emergence of innovation ecosystems (Gebhardt et al., 2022; Xu, 2020). The latter arise from the interactions triggered by digital technologies among stakeholders and organizations, leading to the introduction of new products and services (Chae, 2019; Suseno et al., 2018). That is, digital transformation is expected to foster innovation and enhance the competitive advantage of firms (Appio et al., 2021; Steiber et al., 2021).

The emergence of Industry 4.0 has led to an increase in firm competition by modifying the existing business models via changes in the value chain, interactions with suppliers and customers, and the introduction of new products and services (Benitez et al., 2020; Müller et al., 2018). Firms are, therefore, required to develop new products and processes to survive market competition (Neumeyer et al., 2020; De Guimarães et al., 2020). In this regard, digital transformation may foster the introduction of new products and processes (Li et al., 2023; Usai et al., 2021). However, its main objectives focus on addressing the evolution of demand and market transformations triggered by the introduction of digital technologies (Heredia et al., 2022; Gobble, 2018). As a result, the assimilation of digital technologies has become an essential component of the innovation capacity and growth of firms (Soto Setzke et al., 2023; Scoutto et al., 2021; Hess et al., 2020).

Gaglio et al. (2022) illustrated how innovation positively affects labor productivity, conditional on the use of digital technologies. These authors analyzed the effect sequentially, focusing first on the impact of digitalization on innovation and then on the influence of the latter on productivity. Inter-firm cooperation should therefore foster the access of firms to the knowledge required to improve their innovation performance (Beynon et al., 2021; Doran et al., 2019). As stated above, the knowledge acquired through digitalization processes can lead to the introduction of novel products and processes, a feature recently used to emphasize their potential sustainable applications (Luo et al., 2023; Martínez et al., 2022; Nambisan and Lyytinen, 2020).

Conceptual frameworkOur analysis focuses on the evolution of digital value chains and their effect on the innovation performance of SMEs in terms of patents, product, and process innovations. Value chains have been substantially affected by digital technologies, both via supply chain modifications (Hahn, 2020) and customer interactions (Frederico et al., 2020). The introduction of patents, new products, and processes is determined by the innovation strategy designed by the firms and the acquisition of internal and external knowledge (Guckenbiehl et al., 2021). In this regard, the limited capacity of SMEs to generate and invest in internal knowledge leads to external interactions as alternative sources of knowledge (Obradović et al., 2021). This latter strategy is enhanced by their digitalization processes, with SMEs displaying heterogeneous resource capacities (Eller et al., 2020).

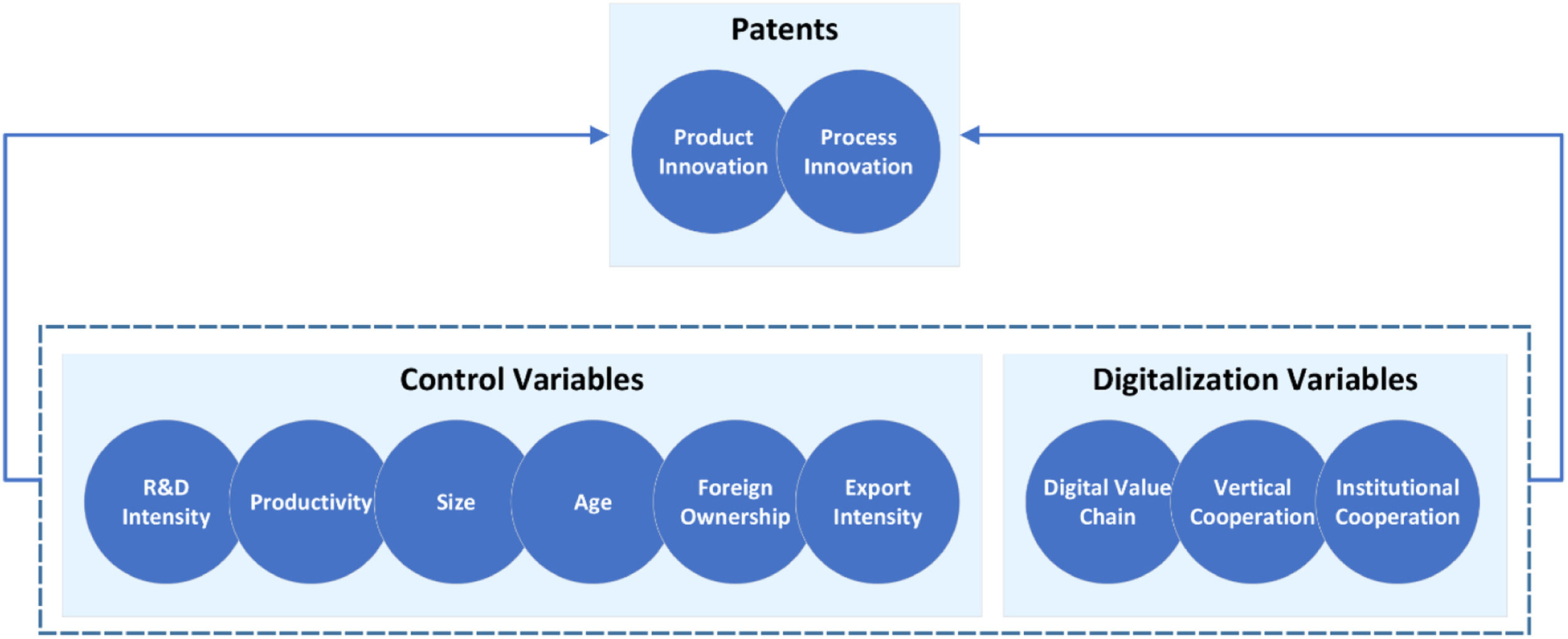

Given these premises, we will define three main hypotheses suggesting positive effects from digital value chains, vertical and institutional cooperation on the innovation capacities and outcomes of SMEs. In a nutshell, we will test the potential positive impact of these digitalization variables on the capacity of firms to develop and introduce patents and technological innovations. The intuition describing the interactions analyzed empirically is presented in Fig. 3, where the main digitalization variables and controls used in the econometric regressions are listed. A detailed description of each variable and the corresponding references justifying their choice and describing their expected effect on the innovation outcomes of firms is presented in the next section. We conclude by noting that these hypotheses will be tested for large firms and SMEs as a whole and separately so that general and specific size effects can be identified and analyzed.

Variables and hypothesesWe consider the effects of digitalization on the patent output of firms together with the introduction of product and process innovations. A complete description of the variables and the literature supporting their respective choices follows.

Dependent variablesPatent analysis constitutes a well-known standard measure of technological competitiveness (Zhu et al., 2023; Ahn, 2020). Radicic & Petković (2023) analyzed the impact of digitalization on product and process innovations, namely, technological innovations. These authors highlighted the fact that this potentially positive relationship has not been properly analyzed in the literature, which contrasts with the significant number of analyses performed regarding the effects of digital transformation on the productivity and efficiency of firms (Kádárová et al., 2023; Schuh et al., 2014).

The interdependencies between both types of innovation have been consistently highlighted in the literature. Product innovation aims at increasing the profitability of firms, emphasizing the interactions between firms and consumers (Pesch et al., 2021; López-Cabarcos et al., 2020). Innovations are introduced in production processes to reduce costs and improve quality, enhancing interactions across the value chain (Domnich, 2022; Gogokhia & Berulava, 2021; Mohnen & Hall, 2013).

Independent variablesThree main variables are used to describe the digitalization capacity and implementation of SMEs.

Digital value chainThe consequences derived from the implementation of digital technologies within the supply chains of manufacturing firms have gained momentum as a research topic (Rad et al., 2022; Büyüközkan & Göçer, 2018). These technologies allow firms to interact with suppliers, as well as customers, in the development of new products and processes. The resulting interactions can improve the performance of innovations, particularly when considering the potential for collaboration enhancement throughout the supply chain (Belhadi et al., 2021; Hahn, 2020). The subsequent generation of digital value chains and their relevance in defining the Industry 4.0 phenomenon have been consistently analyzed and validated in the literature (Papadopoulos et al., 2022; Vadana et al., 2020). This evidence – together with the subsequent intuition – leads to our first hypothesis:

H1:Digital Value Chains positively affect patents, product, and process innovations.

Digital technologies allow for larger and faster information flows within the firm but also with external elements of the value chain (Zekhnini et al., 2020; Chavez et al., 2017). These technologies allow firms to integrate suppliers and users into the design of digital value chains (Fatorachian & Kazemi, 2021; Kamble & Gunasekaran, 2020). Technological cooperation with customers and suppliers along the digital value chain may foster innovations through two specific channels; namely, the production process may benefit from the feedback of suppliers, while interactions with customers may lead to the introduction of new products (Malacina & Teplov, 2022; Shen et al., 2021; Lee & Schmidt, 2017). The resulting hypothesis stemming from this evidence states:

H2:Vertical Cooperation positively affects patents, product, and process innovations.

The specific knowledge required to develop technological innovations is generally costly and the result of R&D processes internal to relatively large firms. Thus, R&D activities performed by SMEs may not foster innovation outcomes. On the other hand, the knowledge inherent to digital technologies tends to be standardized (Guckenbiehl et al., 2021; Hervas-Oliver et al., 2021). As a result, SMEs may develop innovations without relying on R&D but focusing on collaborations with other economic actors or the application of different management tools (Zahoor & Al-Tabbaa, 2020; Tsay et al., 2018). Digitalization widens the potential for SMEs to develop innovation linkages with various components of the supply chain, including competitors and other types of institutions, such as universities and R&D labs (Yang et al., 2021; Vahter et al., 2014). The final hypothesis tested is therefore defined as follows:

H3:Institutional Cooperation positively affects patents, product, and process innovations.

Control variables are introduced to capture the main characteristics of markets and firms. We list the variables below together with the expected effects from their respective inclusion. Our approach differs from that of the recent paper by Radicic & Petković (2023), who used the internal R&D performed by SMEs as a moderating variable when considering the relation between the digitalization of firms and their technological innovations.

R&D intensityThe internal R&D of firms constitutes a source of knowledge that drives their innovation processes (Hammar & Belarbi, 2021; Roper & Turner, 2020; Santos-Arteaga et al., 2019). The limited innovation and financial capacities of SMEs condition their investment in R&D activities. As a result, SMEs shift their focus to networking with different types of partners – which range from suppliers and customers to public research institutes and universities – to enhance their innovation capacities (Kim and Kim, 2022; Rammer et al., 2009). In addition, the ability of SMEs to use the knowledge inherent to digital technologies conditions the innovation capacity improvements derived from their R&D activities. Given these constraints, SMEs usually innovate while lacking an R&D department or absent specific R&D expenditures (Alhusen & Bennat, 2021; Thomä & Zimmermann, 2020).

ProductivityThe literature analyzing the factors that affect productivity in SMEs remains quite fragmented (Owalla et al., 2022). This quality follows from the literature on R&D and knowledge spillovers within firms and their positive effect on productivity and innovation (Audretsch & Belitski, 2020). The same intuition arises when considering the complementarities existing between the internal knowledge generated through R&D and external knowledge spillovers (Audretsch et al., 2021; Battke et al., 2016). In a related paper, Radicic & Petković (2023) observed a slight increase in labor productivity as the size of German SMEs increases.

SizeSmaller firms tend to be less innovative than larger ones (Fang et al., 2021; Masood & Sonntag, 2020). The innovation and financial capacities of Multinational Enterprises (MNEs) allow them to overcome different barriers generally faced by SMEs (Estensoro et al., 2022; Horváth & Szabó, 2019). This is particularly true when considering product and process innovations (Müller et al., 2021). However, despite the limits SMEs face in terms of human and financial capital (Abou-Foul et al., 2021), they are able to adapt faster than larger firms to market changes (Radicic & Pugh, 2017).

AgeThe literature has traditionally found an inverse relationship between innovation and the age of firms (Balasubramanian & Lee, 2008; Hansen, 1992). At the same time, digital transformation must be complemented with investment in human capital to exploit the resulting innovation systems properly. This process requires time and a flexible labor force (Prodi et al., 2022). Bouncken et al. (2021) found that forming knowledge alliances helps reduce the limitations older firms face when creating innovation value. Recently, Kim (2022) highlighted the moderating role of firm size and age as features smoothing the assimilation of the negative effects derived from innovation failures.

Foreign ownershipThe digitization of data spanning the activities of firms allows for the integration of value chains across all levels, increasing the dependence of firms on their external networks (Järvi & Kortelainen, 2017). The evidence regarding foreign ownership and innovation is mixed. For instance, advanced foreign subsidiaries in Sub-Saharan Africa do not cooperate with local firms to innovate (Adu-Danso & Abbey, 2022). When considering emerging economies facing informal competition, Cuervo-Cazurra et al. (2019) found out that majority-owned foreign subsidiaries aim for radical innovation activities while minority-owned ones focus on incremental innovations. Foreign-owned subsidiaries in Spain are less likely to introduce product innovations, absent any significant effect on process innovations (García-Sánchez & Rama, 2020).

Export intensityExport intensity, namely, the ratio of total export to sales, is generally used as a control variable since the innovation performance of firms can be affected by their position in global markets (Fosfuri & Tribó, 2008). The effects are heterogeneous and depend on the country and industrial sector considered (Xie & Li, 2017). SMEs are generally less export-oriented than larger firms (World Trade Organization, 2016). In this regard, the incentives of exporters to innovate are higher due to the competition faced in international markets (Rachinger et al., 2018). On the other hand, Radicic & Djalilov (2019) found that technological innovations positively affect the export intensity of SMEs.

MethodologyWe describe below the sample used to validate the hypotheses empirically and the econometric model applied to analyze the data.

SampleThe data on manufacturing firms used to perform the empirical analysis has been retrieved from a database named Survey on Business Strategies (Encuesta sobre Estrategias Empresariales – ESEE).1 This survey has been conducted periodically since 1990 under the auspices of the Spanish Ministry of Finance and Public Function and encompasses manufacturing firms in Spain with more than 10 employees. ESEE collects annual data on firms from 20 manufacturing industries, covering the total number of firms with more than 200 employees and a representative sample of firms employing between 10 and 200 workers evaluated through a random stratified sampling scheme.

This data source provides a large amount of information at the micro level on the productive activities of firms, their business strategies and performance, while offering specialized information regarding their technological activities. As a result, ESEE has been used in a variety of contributions analyzing the determinants and sources of innovative capabilities across firms (Radicic & Pinto, 2019; Barge-Gil et al., 2011; Cassiman et al., 2010; Salomon & Jin, 2008; Huergo, 2006; Álvarez & Molero, 2005).

Since 2000, ESEE includes a set of variables related to the firm's use of internet-based digital communication technologies, such as e-commerce transactions within the supply value chain. These variables will allow us to analyze how much the digitalization of the value chain contributes to the innovative performance of firms. The sample used in the empirical analysis covers the period 2000-2017 and comprises 1,369 firms, out of which 862 are SMEs (between 10 and 250 employees) and 508 are large firms (more than 250 employees). Note that despite the availability of information regarding the digitalization of firms, its consequences for their technological activities remain mainly unexplored.

Econometric modelTo test whether digitalization contributes to the innovative performance of firms, the econometric model applied takes the form of a knowledge production function that allows us to explore to what extent different knowledge sources, beyond formal R&D activities, affect innovation outputs (Griliches, 1979). More precisely, the empirical model is defined as follows:

where yit* is a latent dependent variable that captures the effectiveness of the factors determining the generation of new knowledge. The subscripts refer to firm i in period t; xit represents the set of explanatory factors, β are the coefficients of the independent variables to be estimated, αi represents firm-specific time-invariant effects and εit is the error term. Firms obtain the innovation output yit if yit* is positive.We define three empirical models, one for each innovation output, as follows:

where y1, y2, and y3 are binary dependent variables assigned to patents granted, product innovations, and process innovations, respectively.Each dependent variable is regressed against the explanatory factors discussed in the previous section. The main independent variable capturing the effect of digitalization on the innovative performance of firms is the digitalization of the value chain (Digital value chain). This variable takes the value 1 if the firm sells to customers or purchases from suppliers through Internet-based channels that require sophisticated electronic data interchange processes.

The second set of independent variables accounts for the role of innovation networks in the success of innovation processes. The insertion of firms into innovation networks is operationalized through their technological cooperation with customers and/or suppliers (Vertical cooperation) as well as universities and R&D centers (Institutional cooperation). These two regressors are dummy variables that adopt the value 1 if the firm cooperates with other agents or 0 if not, representing the mean effect of knowledge networks on its innovation capabilities.

As control variables, we include the R&D intensity of firms, measured as the percentage of R&D investments over sales, since R&D is considered one of the main factors determining technological innovation (Acs and Audretsch, 1988; Hall et al., 1986). We also include the following control variables related to the characteristics of firms that the literature on economics of innovation highlights as positively associated with technological performance: Productivity –measured in terms of value added by employee –, size – measured by the number of employees – and firm age.

A dummy variable capturing the Foreign ownership2 of firms is also included to control for the innovative activities that subsidiaries carry out in host countries, which are conditioned by the competence creating or competence exploiting mandates of the multinational enterprise subunit (Cantwell & Piscitello, 2015; Cantwell & Mudambi, 2005). Finally, we also include the Export intensity of the firm – measured by the export volume as a share of sales – to capture the learning process that takes place by exporting, characterized by the exchange of knowledge in foreign markets (Salomon & Shaver, 2005).

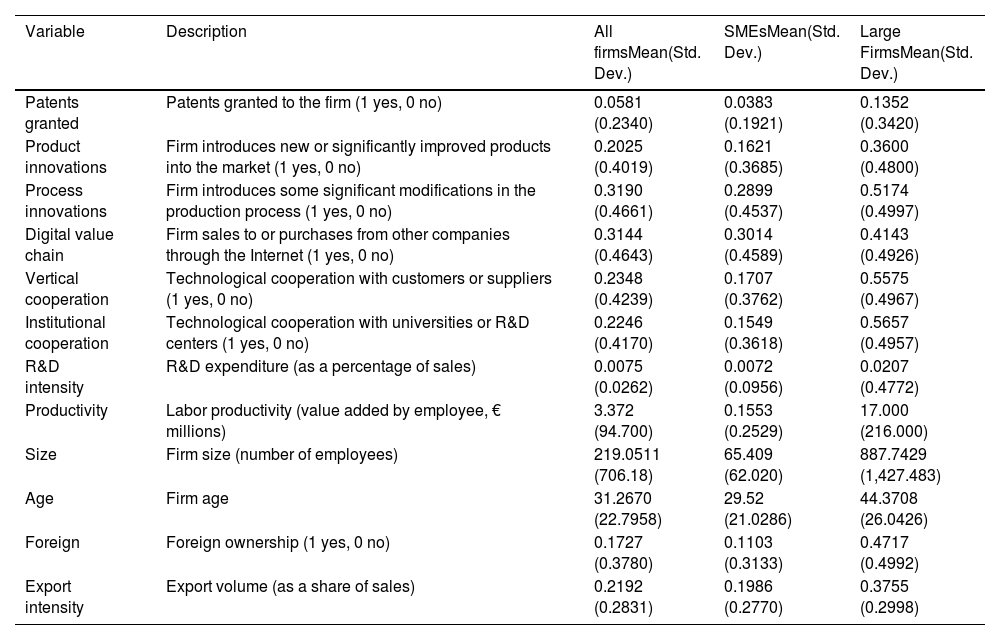

Table 1 summarizes the variables used in the analysis and presents some descriptive statistics. It can be observed that large firms are more innovative than SMEs. In the case of patents granted, the frequency of innovation within large firms is 13.52 %, almost four times higher than for SMEs. These percentages increase for both groups of firms when considering product and process innovations. Even though substantial differences remain between both groups, the technological gap that separates them decreases. For instance, 36 % of large firms introduced product innovations relative to 16.21 % of SMEs. Note that SMEs and large firms are more engaged in process innovations than in the rest of technological activities, validating the trend observed in Fig. 2.

Variable definition and descriptive statistics

| Variable | Description | All firmsMean(Std. Dev.) | SMEsMean(Std. Dev.) | Large FirmsMean(Std. Dev.) |

|---|---|---|---|---|

| Patents granted | Patents granted to the firm (1 yes, 0 no) | 0.0581 (0.2340) | 0.0383 (0.1921) | 0.1352 (0.3420) |

| Product innovations | Firm introduces new or significantly improved products into the market (1 yes, 0 no) | 0.2025 (0.4019) | 0.1621 (0.3685) | 0.3600 (0.4800) |

| Process innovations | Firm introduces some significant modifications in the production process (1 yes, 0 no) | 0.3190 (0.4661) | 0.2899 (0.4537) | 0.5174 (0.4997) |

| Digital value chain | Firm sales to or purchases from other companies through the Internet (1 yes, 0 no) | 0.3144 (0.4643) | 0.3014 (0.4589) | 0.4143 (0.4926) |

| Vertical cooperation | Technological cooperation with customers or suppliers (1 yes, 0 no) | 0.2348 (0.4239) | 0.1707 (0.3762) | 0.5575 (0.4967) |

| Institutional cooperation | Technological cooperation with universities or R&D centers (1 yes, 0 no) | 0.2246 (0.4170) | 0.1549 (0.3618) | 0.5657 (0.4957) |

| R&D intensity | R&D expenditure (as a percentage of sales) | 0.0075 (0.0262) | 0.0072 (0.0956) | 0.0207 (0.4772) |

| Productivity | Labor productivity (value added by employee, € millions) | 3.372 (94.700) | 0.1553 (0.2529) | 17.000 (216.000) |

| Size | Firm size (number of employees) | 219.0511 (706.18) | 65.409 (62.020) | 887.7429 (1,427.483) |

| Age | Firm age | 31.2670 (22.7958) | 29.52 (21.0286) | 44.3708 (26.0426) |

| Foreign | Foreign ownership (1 yes, 0 no) | 0.1727 (0.3780) | 0.1103 (0.3133) | 0.4717 (0.4992) |

| Export intensity | Export volume (as a share of sales) | 0.2192 (0.2831) | 0.1986 (0.2770) | 0.3755 (0.2998) |

When considering digitalization, we observe that more than 30 % of firms are involved in digital value chains, with this share increasing up to 41 % in the case of large companies. Regarding technological cooperation, the percentage of firms cooperating with customers and suppliers is similar to that of firms cooperating with universities and R&D centers. However, large firms are more involved in innovation networks.

As expected, control variables illustrate that large firms are more R&D-intensive, productive, and export-oriented than SMEs while also being characterized by substantial heterogeneity. In addition, 47 % of large firms are foreign-owned, a percentage that decreases to 11 % when considering SMEs.

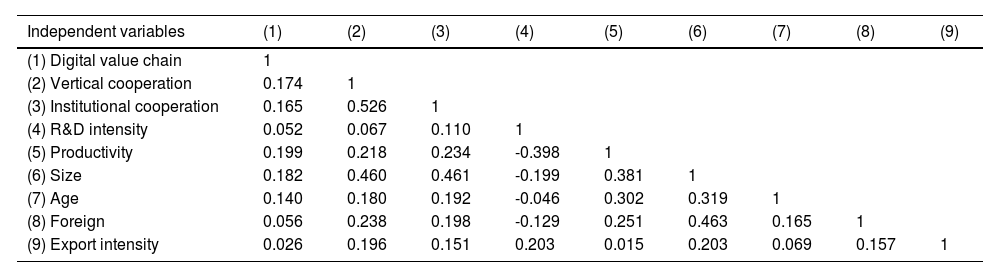

Finally, Table 2 presents the correlation matrix, highlighting the absence of any significant relationship among the variables considered.

Correlation matrix

| Independent variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| (1) Digital value chain | 1 | ||||||||

| (2) Vertical cooperation | 0.174 | 1 | |||||||

| (3) Institutional cooperation | 0.165 | 0.526 | 1 | ||||||

| (4) R&D intensity | 0.052 | 0.067 | 0.110 | 1 | |||||

| (5) Productivity | 0.199 | 0.218 | 0.234 | -0.398 | 1 | ||||

| (6) Size | 0.182 | 0.460 | 0.461 | -0.199 | 0.381 | 1 | |||

| (7) Age | 0.140 | 0.180 | 0.192 | -0.046 | 0.302 | 0.319 | 1 | ||

| (8) Foreign | 0.056 | 0.238 | 0.198 | -0.129 | 0.251 | 0.463 | 0.165 | 1 | |

| (9) Export intensity | 0.026 | 0.196 | 0.151 | 0.203 | 0.015 | 0.203 | 0.069 | 0.157 | 1 |

Note: R&D intensity, productivity, size, age, and export intensity are defined in natural logarithms.

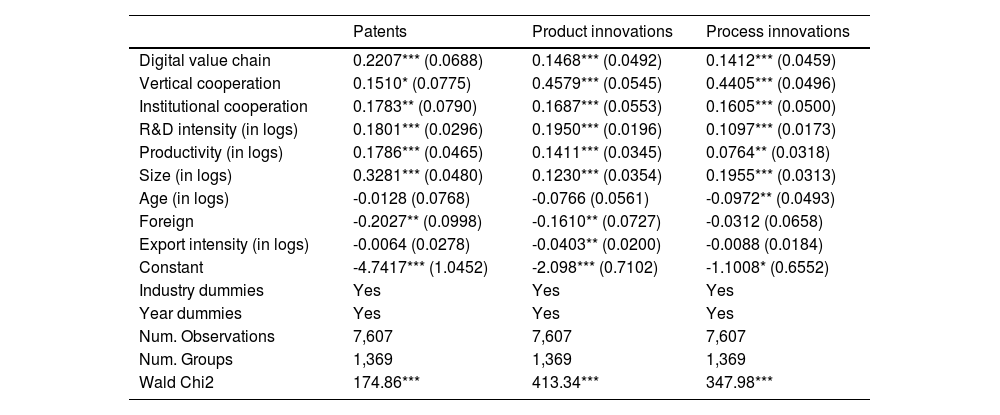

Given the panel structure of the data and the binary character of the dependent variable, the three empirical models analyzed have been estimated following a random-effects probit panel model. The main results derived from the analysis are presented in Tables 3 to 5. Table 3 describes the results obtained when the whole set of firms is considered, while the scenarios focusing on SMEs and large firms are presented in Tables 4 and 5, respectively.

Regression results for the whole set of firms

| Patents | Product innovations | Process innovations | |

|---|---|---|---|

| Digital value chain | 0.2207*** (0.0688) | 0.1468*** (0.0492) | 0.1412*** (0.0459) |

| Vertical cooperation | 0.1510* (0.0775) | 0.4579*** (0.0545) | 0.4405*** (0.0496) |

| Institutional cooperation | 0.1783** (0.0790) | 0.1687*** (0.0553) | 0.1605*** (0.0500) |

| R&D intensity (in logs) | 0.1801*** (0.0296) | 0.1950*** (0.0196) | 0.1097*** (0.0173) |

| Productivity (in logs) | 0.1786*** (0.0465) | 0.1411*** (0.0345) | 0.0764** (0.0318) |

| Size (in logs) | 0.3281*** (0.0480) | 0.1230*** (0.0354) | 0.1955*** (0.0313) |

| Age (in logs) | -0.0128 (0.0768) | -0.0766 (0.0561) | -0.0972** (0.0493) |

| Foreign | -0.2027** (0.0998) | -0.1610** (0.0727) | -0.0312 (0.0658) |

| Export intensity (in logs) | -0.0064 (0.0278) | -0.0403** (0.0200) | -0.0088 (0.0184) |

| Constant | -4.7417*** (1.0452) | -2.098*** (0.7102) | -1.1008* (0.6552) |

| Industry dummies | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes |

| Num. Observations | 7,607 | 7,607 | 7,607 |

| Num. Groups | 1,369 | 1,369 | 1,369 |

| Wald Chi2 | 174.86*** | 413.34*** | 347.98*** |

Coefficients report marginal effects (dy/dx) at sample means. For dummy variables, marginal effects represent the discrete change from 0 to 1.

Robust standard errors in parenthesis.

* Significant at 10 %; ** significant at 5 %; *** significant at 1 %.

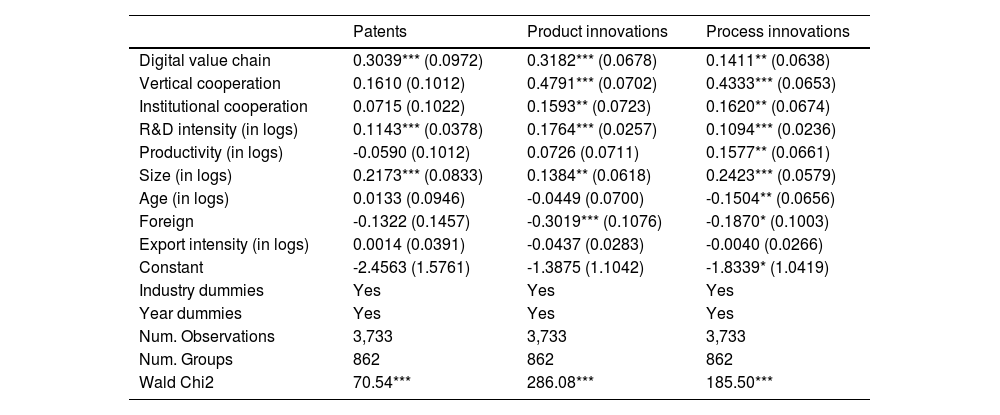

Regression results for SMEs

| Patents | Product innovations | Process innovations | |

|---|---|---|---|

| Digital value chain | 0.3039*** (0.0972) | 0.3182*** (0.0678) | 0.1411** (0.0638) |

| Vertical cooperation | 0.1610 (0.1012) | 0.4791*** (0.0702) | 0.4333*** (0.0653) |

| Institutional cooperation | 0.0715 (0.1022) | 0.1593** (0.0723) | 0.1620** (0.0674) |

| R&D intensity (in logs) | 0.1143*** (0.0378) | 0.1764*** (0.0257) | 0.1094*** (0.0236) |

| Productivity (in logs) | -0.0590 (0.1012) | 0.0726 (0.0711) | 0.1577** (0.0661) |

| Size (in logs) | 0.2173*** (0.0833) | 0.1384** (0.0618) | 0.2423*** (0.0579) |

| Age (in logs) | 0.0133 (0.0946) | -0.0449 (0.0700) | -0.1504** (0.0656) |

| Foreign | -0.1322 (0.1457) | -0.3019*** (0.1076) | -0.1870* (0.1003) |

| Export intensity (in logs) | 0.0014 (0.0391) | -0.0437 (0.0283) | -0.0040 (0.0266) |

| Constant | -2.4563 (1.5761) | -1.3875 (1.1042) | -1.8339* (1.0419) |

| Industry dummies | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes |

| Num. Observations | 3,733 | 3,733 | 3,733 |

| Num. Groups | 862 | 862 | 862 |

| Wald Chi2 | 70.54*** | 286.08*** | 185.50*** |

Coefficients report marginal effects (dy/dx) at sample means. For dummy variables, marginal effects represent the discrete change from 0 to 1.

Robust standard errors in parenthesis.

* Significant at 10 %; ** significant at 5 %; *** significant at 1 %.

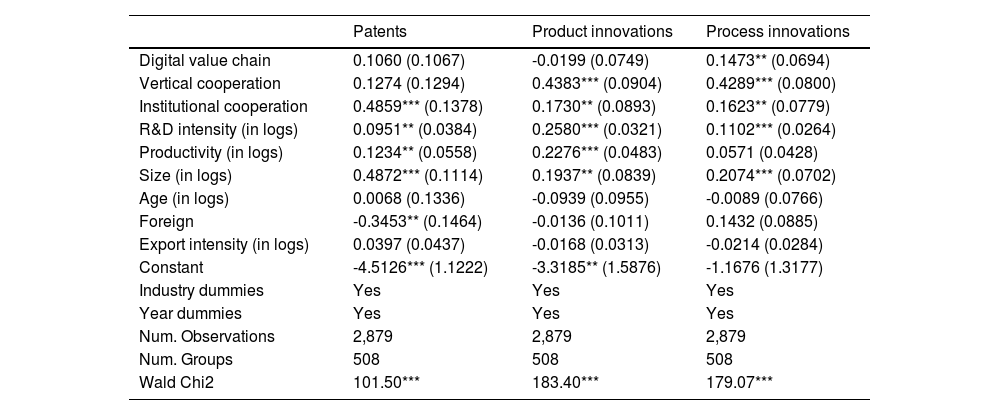

Regression results for large firms

| Patents | Product innovations | Process innovations | |

|---|---|---|---|

| Digital value chain | 0.1060 (0.1067) | -0.0199 (0.0749) | 0.1473** (0.0694) |

| Vertical cooperation | 0.1274 (0.1294) | 0.4383*** (0.0904) | 0.4289*** (0.0800) |

| Institutional cooperation | 0.4859*** (0.1378) | 0.1730** (0.0893) | 0.1623** (0.0779) |

| R&D intensity (in logs) | 0.0951** (0.0384) | 0.2580*** (0.0321) | 0.1102*** (0.0264) |

| Productivity (in logs) | 0.1234** (0.0558) | 0.2276*** (0.0483) | 0.0571 (0.0428) |

| Size (in logs) | 0.4872*** (0.1114) | 0.1937** (0.0839) | 0.2074*** (0.0702) |

| Age (in logs) | 0.0068 (0.1336) | -0.0939 (0.0955) | -0.0089 (0.0766) |

| Foreign | -0.3453** (0.1464) | -0.0136 (0.1011) | 0.1432 (0.0885) |

| Export intensity (in logs) | 0.0397 (0.0437) | -0.0168 (0.0313) | -0.0214 (0.0284) |

| Constant | -4.5126*** (1.1222) | -3.3185** (1.5876) | -1.1676 (1.3177) |

| Industry dummies | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes |

| Num. Observations | 2,879 | 2,879 | 2,879 |

| Num. Groups | 508 | 508 | 508 |

| Wald Chi2 | 101.50*** | 183.40*** | 179.07*** |

Coefficients report marginal effects (dy/dx) at sample means. For dummy variables, marginal effects represent the discrete change from 0 to 1.

Robust standard errors in parenthesis.

* Significant at 10 %; ** significant at 5 %; *** significant at 1 %.

When considering the whole set of firms, results are positive and significant for all the digitalization variables. That is, the digital interaction of firms across the value chain and their vertical cooperation with other elements of the chain or research institutions positively affect the introduction of technological innovations. The effect weakens slightly for patents when considering the cooperation variables, but its positive significance remains. Thus, firms engaging in digitalization and interacting with the different actors composing their value chains display consistent positive effects regarding technological innovations.

Control variables provide consistency to these results behaving as expected from the corresponding descriptions presented in Section 4. R&D intensity, productivity, and size are positive and significant for all innovations, with age negatively affecting process innovations. The foreign and export intensity variables add to the heterogeneity of results obtained in the literature. Foreign ownership discourages the introduction of patents and product innovations. That is, the subsidiaries located in Spain do not enter the market searching to innovate. Export intensity negatively affects product innovations; namely, firms increasing their volume of exports do not aim at introducing new products into the market. All in all, both groups of firms seem to have integrated digitalization processes in the development of their innovation systems.

The behavior of SMEs described in Table 4 is similar to that of the whole set of firms. All digitalization variables are positive and significant for product and process innovations, while only digital value chain interactions display a positive effect on patents. The coefficients of the control variables validate the corresponding intuition. R&D intensity and size are positive and significant for all innovation activities, while age keeps on displaying a negative effect on process innovations. Productivity loses significance among SMEs; its positive impact involves only process innovations. We also observe that the negative effect of age on process innovations follows from the behavior of relatively older SMEs. Finally, being a foreign subsidiary negatively impacts product and process innovations, highlighting the fact that MNEs are not driven by technological incentives when entering Spain.

Large firms constitute a more mixed bag, as illustrated in Table 5. Institutional cooperation remains significant across all innovations, while vertical cooperation loses its effect on patents. The digital value chain variable loses significance and remains focused on process innovations. The institutional interactions of large firms constitute their main channel to develop technological innovations, while standard actors along the chain remain quite significant in this respect. R&D intensity and size remain significant across all technological innovations, while productivity positively affects patents and product innovations. This last result highlights the complementarity of SMEs and large firms regarding innovation objectives. Highly productive SMEs focus on technologically improving their processes, while larger firms shift their objectives towards products and patents. Age lacks significance for large firms across all technological innovations, while being a foreign subsidiary negatively affects patents. Once again, technological motives do not seem to drive the strategic entry of MNEs in Spain.

DiscussionWe have illustrated the relationship existing between the digitalization of the value chain and the development of patents, new products, and processes. The knowledge acquired through digital transformation together with the vertical and institutional cooperation across the value chain foster the introduction of technological innovations. These effects are particularly relevant among SMEs, for which the adoption and implementation of digital technologies can be a source of competitive advantage (Thrassou et al., 2020).

In a related paper, Radicic & Pinto (2019) considered the persistent behavior displayed by technological innovations when analyzing a set of Spanish manufacturing firms. As is the case in our analysis, these authors concluded that cooperation with suppliers and universities has a positive effect on product and process innovations. They also differentiated sectors by technological intensity and observed that in high (lower) intensity industries, cooperation with suppliers (universities) increases the propensity of firms to innovate.

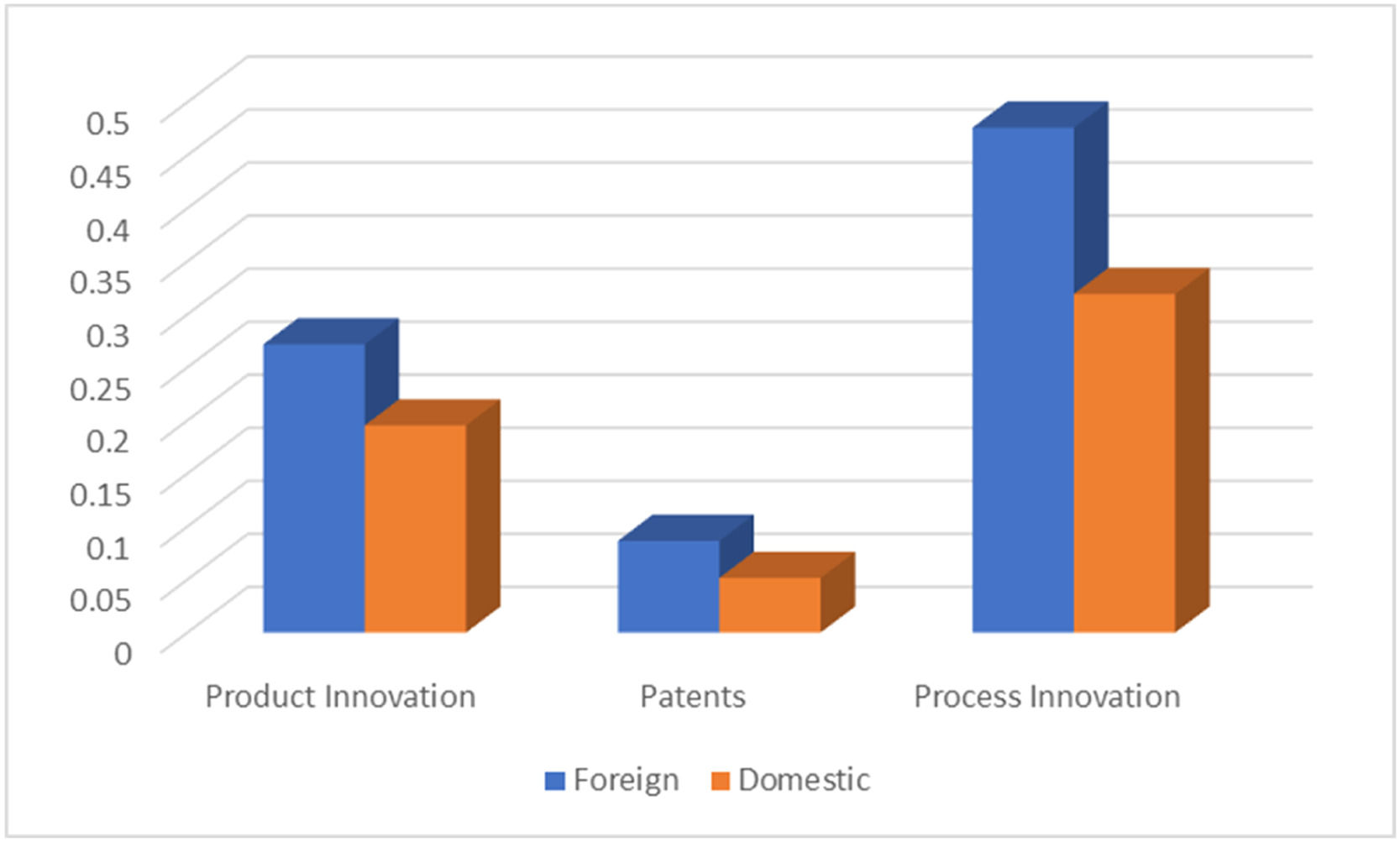

Almodóvar & Nguyen (2022) analyzed the product innovation differences between domestic firms and foreign MNE subsidiaries in Spain through the period (2006–2016). They concluded that foreign subsidiaries introduce more product innovations than domestic firms and that the latter use different external knowledge sources to reach the performance capacity of the former. We observe the effects of cooperation across the value chain as a source of technological innovation; however, in our analysis, foreign subsidiaries display negative coefficients for patents and product innovations. We discuss both these features through the following subsections.

Theoretical contributionsWe have shown how digital transformation has a positive effect on technological innovations across Spanish firms, a quality that is particularly evident among SMEs. The literature has consistently emphasized the fact that the innovation capacity of larger firms and their implementation of digital transformation processes are both higher than those of smaller firms. In this regard, we have observed how digitalization helps the latter improve their innovation performance, particularly when considering patents and product innovations. At the same time, cooperation with customers, suppliers, and research institutions across the value chain constitutes a source of knowledge consistently exploited by all firms to develop technological innovations.

Another important result is the consistently positive and significant contribution of R&D activities to technological innovation for all firms. This result contrasts with Usai et al. (2021), who highlighted the standardized quality of the knowledge driving digital transformation. As a result, these authors suggested that SMEs engaging in R&D activities might be unable to use it to introduce new products and processes, while those SMEs not performing R&D activities could rely on this knowledge when developing innovations.

The remaining effects, particularly those corresponding to the size, age, and productivity variables, coincide with the intuition provided throughout the literature review section.

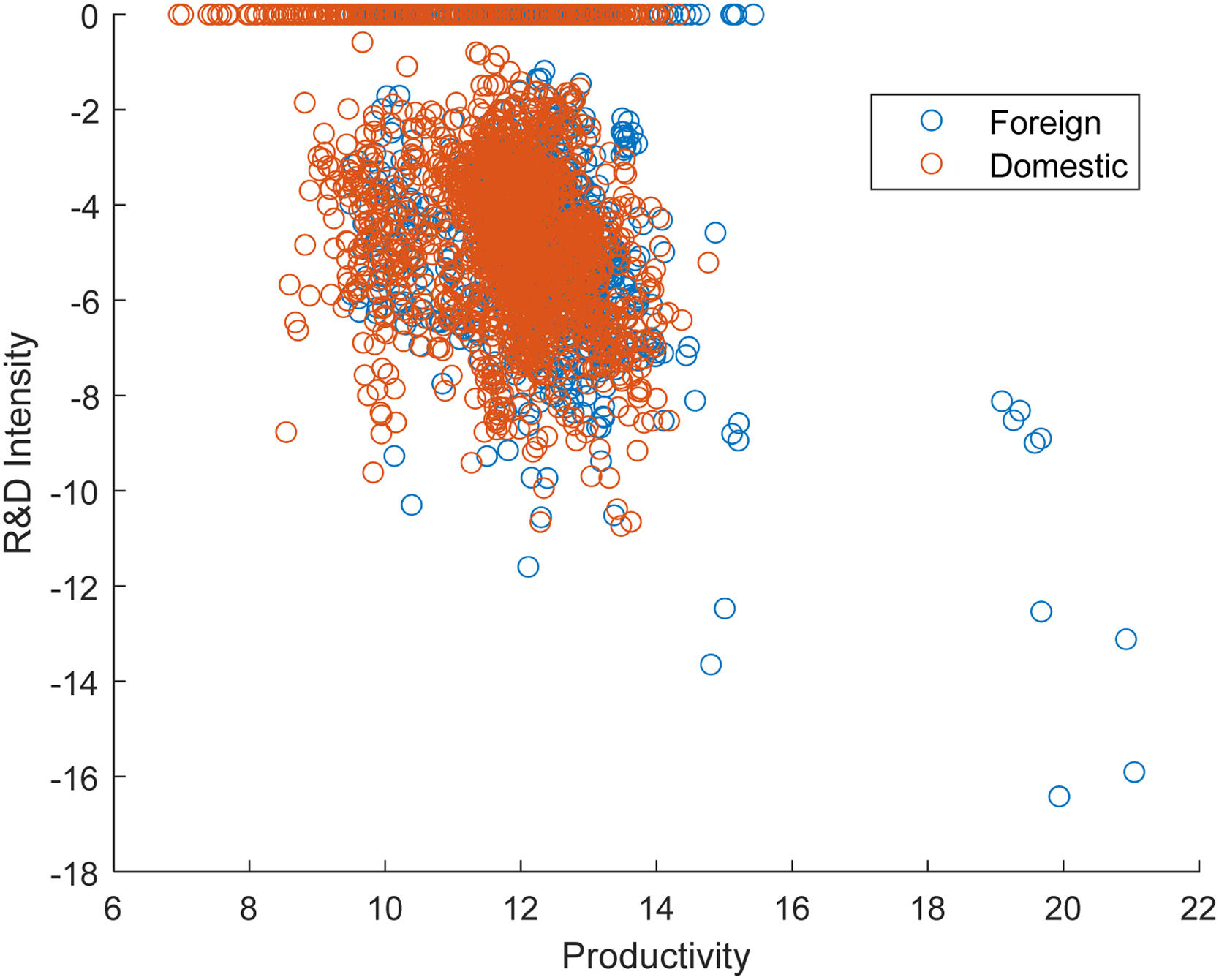

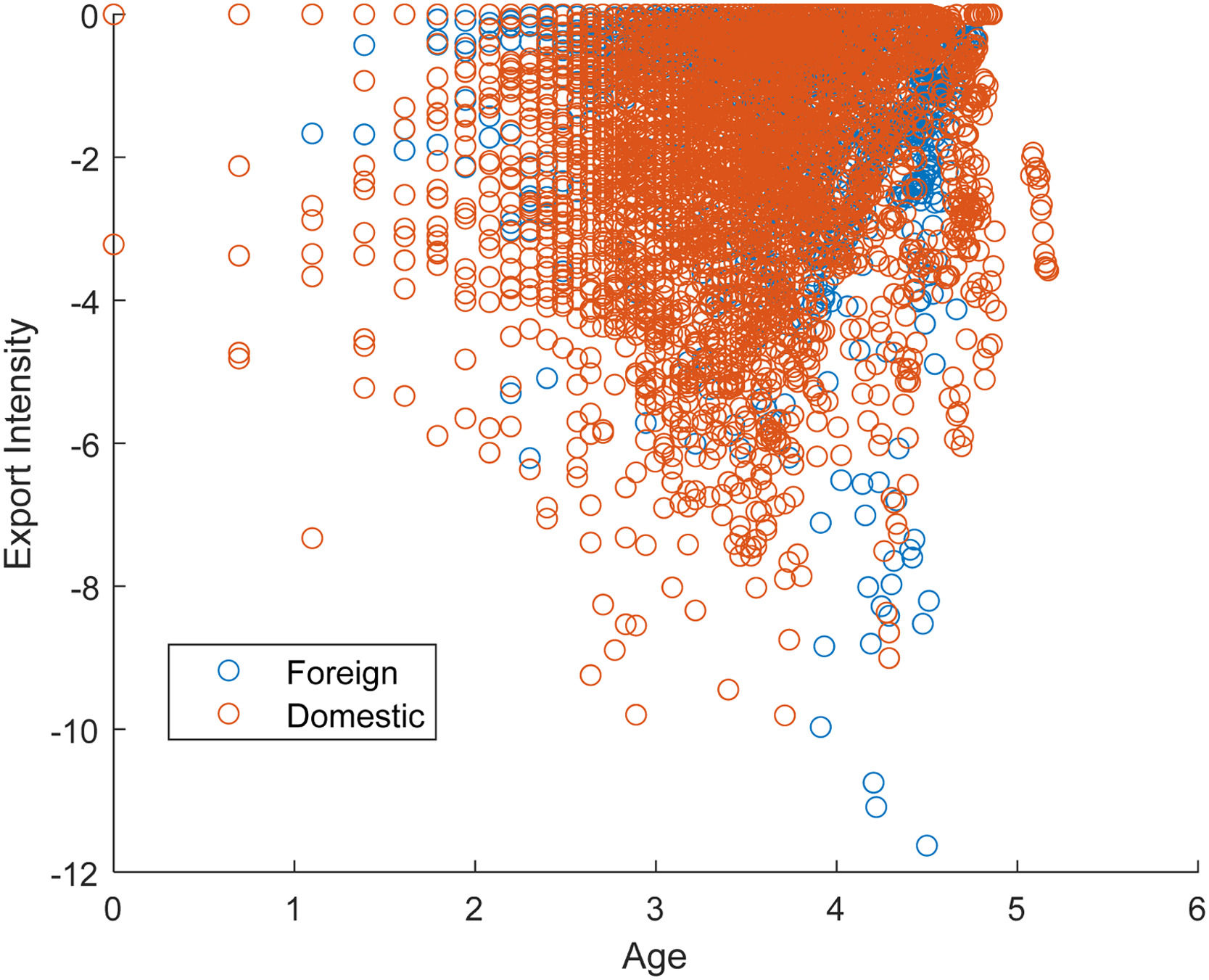

A couple of important remarks are due, requiring a more detailed analysis of the differences in innovation incentives and outcomes between domestic and foreign firms. To do so, we select a subset of domestic and foreign firms from the database according to their prevalence throughout the whole period of analysis. That is, given the length of the period considered, many firms enter and exit the database due to a variety of reasons. Thus, we have selected domestic and foreign firms with observations available for each sample year, allowing us to define a consistent profile of their evolution. The subset is composed of 397 firms, out of which 320 are domestic and 77 foreign. Two of them shifted from domestic to foreign ownership through the period analyzed.

Fig. 4 illustrates the average value – across time periods and firms – of the binary variables defining patents and product and process innovations for domestic and foreign firms. The evidence presented by Almodóvar & Nguyen (2022) is validated across all categories. Foreign subsidiaries established in Spain throughout the whole period of analysis introduce a higher number of patents and technological innovations on average than domestic firms. In this regard, the negative innovation coefficients displayed by the whole set of foreign firms align with the application of strategies favoring competence exploitation over exploration (Griffith et al., 2021; Ramachandran et al., 2019). We must, however, note that different results could be obtained when categorizing firms by the technological content of sectors, a feature defining a potential line of future research.

Fig. 5 illustrates the similar R&D intensities exhibited by the domestic and foreign firms composing the consistent subset. Note that the subsidiaries displaying a less intense R&D behavior than domestic firms tend to be more productive.

Fig. 6 describes similar export intensities among domestic and foreign firms. Note how, as domestic and foreign firms grow older, they tend to increase their export intensity. Thus, the negative signs of the export coefficient could be due to the foreign orientation of companies constituting an attempt to increase their market share, absent any innovation incentives from international competition (Acikdilli et al., 2022; Aboushady & Zaki, 2021).

Policy implicationsDespite the potential advantages of digitalization, the adoption of digital technologies among SMEs is generally limited due to the financial and capital constraints derived from their relative size (Estensoro et al., 2022; Santos-Arteaga et al., 2020). In this regard, Saratchandra et al. (2022) highlighted the importance that external knowledge and the capacity of SMEs to source it have for innovation. This knowledge can be used to complement the one generated internally by R&D-based SMEs. On the other hand, if the SMEs are non-R&D-based, this knowledge would help foster their capacity to innovate.

The Spanish digitalization strategy is summarized in Ministerio de Asuntos Económicos y Transformación Digital (2023). This report emphasizes the limited progress achieved in the digitalization and R&D activities of SMEs over the last two decades and the subsequent priority assigned to correcting this tendency. Furthermore, the website dedicated to the digital transformation of Spain across its economic and social domains, http://espanadigital.gob.es/home, highlights the strategic importance of digitalization for SMEs and the general population.

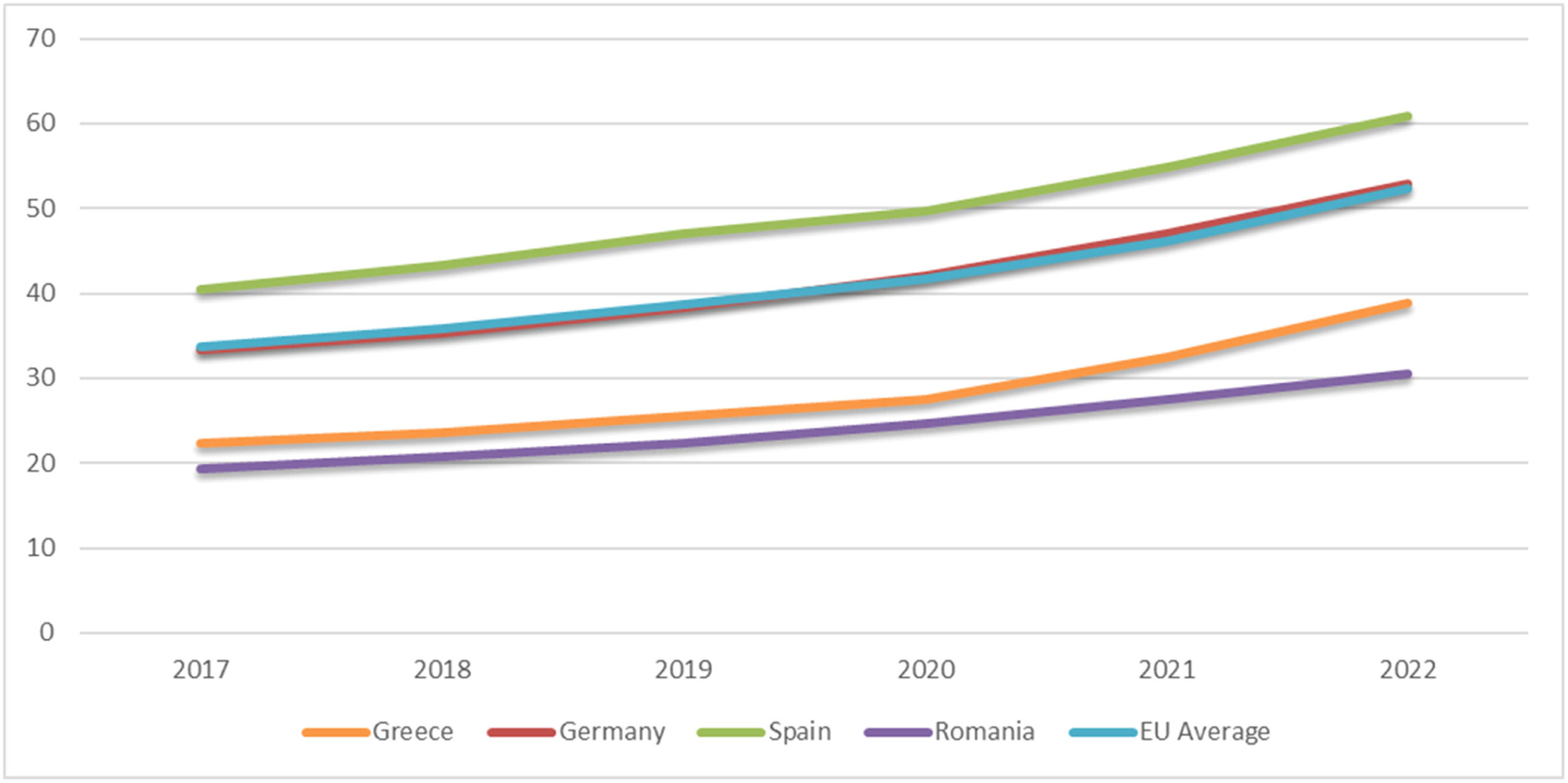

The results obtained from the current analysis imply that the digital strategy implemented by Spain is paying off, a quality validated through the behavior of its DESI index. The consistently superior performance of the latter relative to the European Union (EU) average is described in Fig. 7. However, despite these features and as illustrated in Table 1, the digital competitiveness of Spanish firms has not been reflected in their innovation score.

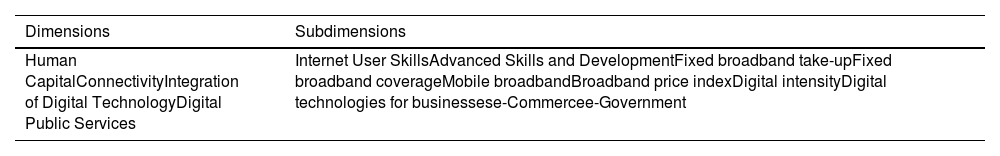

A couple of remarks must be made regarding this difference in scores. The main variables composing the dimensions and subdimensions that define the DESI index are presented in Table 6. Note that there is a prevalence of variables describing the social and institutional qualities of ICTs and their market penetration process. The index does not focus on the industrial characteristics of ICTs such as, for instance, their effect on labor productivity. This quality determines the evolution of the DESI index observed across the four reference countries described in Fig. 7.

DESI components

| Dimensions | Subdimensions |

|---|---|

| Human CapitalConnectivityIntegration of Digital TechnologyDigital Public Services | Internet User SkillsAdvanced Skills and DevelopmentFixed broadband take-upFixed broadband coverageMobile broadbandBroadband price indexDigital intensityDigital technologies for businessese-Commercee-Government |

Note: A detailed description of the main components defining the DESI index can be found at https://digital-decade-desi.digital-strategy.ec.europa.eu/datasets/desi-2022/indicators.

These countries have been selected according to their relative performances in terms of the European Innovation Scores illustrated in Fig. 1. Greece and Romania define the upper and lower score limits, respectively. Germany, a standard European reference, displays the opposite trend relative to Spain, namely, a higher innovation score than digital competitiveness. This latter variable is indeed quite similar for both countries while Spain exhibits a substantially lower innovation score than Germany.

As can be observed when comparing Figs. 2 and 7, Romania performs poorly in both scenarios in terms of all variables. The high innovation score displayed by Greece is not reflected in the evolution of its DESI index, which seems more related to its low digital competitiveness. Germany, which displays one of the highest innovation scores among European countries, performs below Spain in terms of DESI throughout the whole period the index is available. Thus, as can be inferred from comparing both figures, the DESI index and the innovation score lack a clear relationship, while digital competitiveness seems closer to the actual behavior of the DESI scores.

All in all, given the fact that digital transformation and cooperation have a positive effect on technological innovations across Spanish firms, particularly SMEs, any policy designed to foster the digitalization incentives of firms and the generation of stable links among the actors composing the value chain should be continued and reinforced.

Limitations and extensionsThe database used to perform the empirical analyses contains many variables whose effect on the innovation incentives of firms could be studied. Quite a few additional variables and scenarios have been formalized to study the relationship between digitalization and innovation performance in SMEs. For instance, Haug et al. (2023) highlighted the conditioning quality of technological orientation, while Bouwman et al. (2019) focused on business model experimentation and strategy implementation. Gruber (2019) listed four features of SMEs that limit their adoption of digital technologies: lower exposure to the consequences of digitalization, lack of managerial vision, gradual transformation processes, and limited financial resources.

Thus, while the variables used in the current paper to analyze the relationship between digital transformation and technological innovations are standard in the literature, alternative scenarios could be defined and validated. Among these, relevant complementary analyses should aim at categorizing the impact of digitalization on SMEs across sectors of different technological intensity. These extensions should help provide additional intuition regarding the differences observed between the digital competitiveness of Spanish firms and the value of their innovation score.

ConclusionThe current paper has analyzed the relationship between the digitalization of the value chain and the development of patents, new products, and processes in large firms and SMEs. We have focused particularly on the knowledge acquired through digital transformation and the vertical and institutional cooperation across the value chain as qualities fostering the introduction of technological innovations.

We have illustrated the positive effect of digital transformation on technological innovations, particularly among SMEs. We have also observed how digitalization helps SMEs improve innovation performance, especially when considering patents and product innovations. Cooperation with customers, suppliers, and research institutions across the value chain has proven to be a source of knowledge consistently exploited by all firms to develop technological innovations. The positive and significant contribution of R&D activities to patents and technological innovations for all firms constitutes a relevant result with important policy implications.

Finally, differences in innovation incentives and outcomes have been analyzed for a subset of domestic and foreign firms evaluated throughout the whole period of analysis. Foreign subsidiaries within this subset introduced a higher number of patents and technological innovations on average than domestic firms. The behavior observed complements the results derived from the econometric analysis and defines a potential line of future research when categorizing firms by the technological content of sectors.

Despite the features summarized above, which help enhance the digital competitiveness of Spain, the country displays a relatively low innovation score. Thus, future research should incorporate additional variables to the analysis and extend its focus to the innovations triggered by the digitalization of large firms and SMEs across different technological sectors.

Dr. Raquel Marín is grateful for the financial support from the Spanish Ministry of Science and Innovation [Ref: AEI/10.13039/501100011033]. Dr. Francisco J. Santos-Arteaga is thankful for the support from the María Zambrano contract from the Universidad Complutense de Madrid financed by the Ministerio de Universidades with funding from the European Union Next Generation program.

The authors acknowledge Fundación SEPI for grating them access to the corresponding data.

According to the definition of FDI established by the IMF in the VI Balance of Payments Manual, a firm is considered foreign owned if the foreign participation in equity capital is higher than 10 %. Although this criterion could be criticized, more than 90% of the firms included in the sample that are classified as foreign owned display more than 50% of foreign equity share. Furthermore, average foreign equity participation equals 90.8 %.