Government intention to spur innovation can result in the proliferation of low-quality patents, which is especially pronounced in countries with a low level of government accountability. This study examines the paradoxical effects of government-funded innovation in weakly institutionalized environments. I offer a game-theoretic model, in which the government has a stake in technological development and invests in research and development, although this encourages the growth of low-quality patents. Using Russian patents data between 1998 and 2016, I illustrate this mechanism by demonstrating the causal impact of Russia's government policy, which resulted in a simultaneous increase in the number of patents and a decrease in the absolute number of high-quality patents in the patent pool. This study provides a theoretical background for evaluating the impact of political incentives for investing in the creation of new technologies in the technological development of countries.

Government investment in research and development (R&D) is a vital input into the creation of new technologies, which is in turn an important determinant of sustained economic growth (Acemoglu et al., 2018; Aghion et al., 1998; Romer, 1990). Well-documented positive externalities from the development of new technologies further justify government support for innovation (Abbas et al., 2019; Aghmiuni et al., 2020; Audretsch & Feldman, 1996; Babina et, al.,2023; Bloom et al., 2013; Fieldhouse & Mertens, 2023; Griliches, 1992; Jaffe, 1986). Not surprisingly, governments worldwide invest considerably in R&D.a

This study examines government investment in R&D in a weakly institutionalized environment. Lower-quality institutions have been shown to be associated with poor economic growth (Acemoglu et al., 2005; Keefer & Knack, 1997). For instance, week institutions have a detrimental effect on technological change (Acemoglu & Robinson, 2006; Ruttan, 1997). However, Sharma et al. (2022) suggest that better institutional quality can be detrimental to innovation due to stronger monopoly provided by intellectual property rights. This study focuses on the role of political incentives under weak institutions on government innovation policy. Given that the success of government R&D policy is difficult to evaluate in the short term (Bloom et al., 2019), investment in R&D is an attractive vehicle for rent-seeking. Corporate transparency (accounting information quality) has been shown to be positively related to the efficiency of government R&D expenditures (Zuo & Lin, 2022). However, in the absence of independent expertise and corruption deterrence, strong incentives for innovation, such as patent prizes or state grants, allow bureaucrats to extract bribes for awarding patents with little, if any, quality control. This in turn incentivizes agents to file low-quality patents with the mere intention of receiving government grants (Arutyunov 2008). Rather than investing in strengthening institutions, a benevolent government may rely on key performance indicators (KPIs), such as the total number of new patents or the efficiency of government R&D expenditures measured by the ratio of the number of patents to the amount spent (Tijssen & Winnink, 2018).

Nevertheless, even in the absence of strong institutions, politicians’ behavior is constrained by the market response: if patented technology buyers perceive that all patents are “lemons” (Akerlof, 1970; Wilson, 1991), they would not buy patents. The proposed theoretical model seeks to explain how the opportunity to take bribes granting patents for “lemons” leads to the following empirical observation: an increase in government funding leads to an increase in the number of patents, while in the presence of a corrupt motive, is accompanied by the proliferation of “lemon” patents.

This study's setting in which bureaucrats verify the quality of the product, or can be influenced by bribes, is somewhat similar to the problem of government procurement under corruption, as explored by Celentani and Ganuza (2002) and Burguet (2017). However, these works differ in that the procurement agent allocates the realization of a project, whereas in this study, the approved patent enters the market, and private companies determine whether to purchase it or not.

The proliferation of low-quality patents is not necessarily a result of corruption. Picard and van Pottelsberghe de la Potterie (2013) discuss the role of quality in the patent examination process from the perspective of patent offices’ behavior and organization and show that the patent examination quality is the highest in an office maximizing incentives to innovate and the lowest in one maximizing the number of granted patents. Frakes and Wasserman (2015) demonstrate that the resource-constrained USPTO over-grants patents due to incentives. For instance, examiner behavior is altered depending on the time allocated for reviewing patent applications (Frakes & Wasserman, 2017). Insufficient examination time may hamper examiner search and rejection efforts, making examiners more inclined to grant invalid applications. This is exacerbated by increased examiner procrastination following the introduction of telecommuting in the patent office (Frakes & Wasserman, 2020). However, these factors do not explain why patent applicants continue to spend time, money, and effort to acquire invalid patents. This study suggests that applicants are incentivized by government R&D programs that favor the distribution of funds to researchers based on the number of patents.

Meanwhile, such incentives explain the increase in patent applications in affected areas of study, putting pressure on patent examiners in these areas and reducing the quality of patents. Nevertheless, this requires irrational politicians who continue to invest in a policy that is welfare-reducing. Therefore, this study's theoretical model assumes the politician to be rational and even to care about economic growth. A setting with weak institutions and sufficiently large government program, targeted at one sector of R&D is required to empirically test this. Additionally, the purposes of the established program should not completely match the anticipated developments in the field. In such circumstances, the empirical strategy builds a valid counterfactual and estimates the effect of the program on such outcomes as patent quality and patenting activity. Russia presents an excellent field laboratory to explore the impact of government policy in the presence of weak institutions (Frye, 2017; Gans-Morse, 2017; Markus, 2016; Wengle, 2015, 2018). Within this setting, a government program supporting nanotechnology offers a suitable study policy. From 2008, Russia has dramatically increased government support for R&D in the nanotechnology field, which was, to a large extent, driven by the political agenda of Dmitry Medvedev. Upon succeeding Vladimir Putin as president in 2008, he put “technological modernization” at the forefront of his agenda and drastically increased funding of nanotechnology. In a statement representative of this, he stated, “Instead of the primitive raw material economy, we will create a smart economy generating unique knowledge, new useful things, and technologies.”bLamberova (2021) demonstrates that the mentions of the word “nanotechnology” by itself and in combination with the name “Medvedev” in the Russian media increased three and two times, respectively, during his presidency. However, many policies that were established during that period lasted long into the future as was the case with the program promoting nanotechnology.

Using the trajectory balancing approach (a version of synthetic control), I show that, compared with non-nanotechnology patent classes, nanotechnology patent classes saw an increase in the number of patent applications (by 15 %), a drop in the total number of citations (by 5 %), and a drop in the average number of citations per patent (by 1.6 %). I corroborate these findings at the individual patent level using a DID approach. This establishes a causal link between the availability of government R&D support and the quality of patents in the affected field. At the individual patent level, I find that the drop in the probability of being cited for nanotechnology-related patents filed after the onset of the policy was 4.5 % compared to patents filed before and after policy onset in other fields. Quantitatively, this is a large decrease, as only 2 % of all Russian patents are cited at all.c

While the DID approach mitigates the potential omitted variable, the estimated average treatment effect can still be biased if there exists an omitted variable (or a group of variables) that varies by time and the patent type and affects patent citations. I perform sensitivity analysis to assess the vulnerability of the average treatment effect to omitted variable bias and find the robustness value to be rather low – in most specifications, the unobserved confounders (orthogonal to the covariates) that explain more than one percent of the residual variance of both the treatment and the outcome to reduce the absolute value of the effect size by 100. Hence, I supplement the DID analysis by additionally comparing the quality of Russian patents to that of US patents. This triple-difference approach eliminates the potential impact of omitted variable (or a group of such variables) that could occur due to natural trends in technological development (Berck & Villas-Boas, 2016; Olden & Møen, 2020). The results of triple-difference estimation are consistent with the conclusion that the average quality of nanotechnology patents decreased after the rise of government funding for this technological field.

This study contributes, first, to the understanding of the effects of rent-seeking and corruption on economic growth. In their book, Rowley et al. (2013) outline the different facets of rent-seeking and its effect on the economy and politics. They argue that an incumbent maximizes his or her chances to stay in power, as well as the amount of collected rents (Buchanan & Tullock, 1962; Downs, 1957; Peltzman, 1972). Appelbaum and Katz (1987) present an outlook in which regulators endogenously set the rents and firms and consumers respond to rent-setting in a self-motivated manner. Grundler and Potrafke (2019) investigate the effect of corruption on growth and find that real per capita GDP decreased by approximately 17 % when the reversed CPI increased by one standard deviation. Treisman (2007) demonstrates that reported corruption experiences correlate with lower development and possibly with dependence on fuel exports, lower trade openness, and more intrusive regulations. This study illustrates how rent-seeking, associated with the distribution of government R&D grants, can have a detrimental effect on the technology transfer market.

Some scholars emphasize the mechanisms of international political economy in setting industry standards (Mattli & Büthe, 2003) and enforcement of intellectual property rights (Shadlen et al., 2005). However, others emphasize the role of domestic groups of interest. For instance, Shadlen (2009) examines the impact of indigenous pharmaceutical capacities on the design of the patent system in Brazil and Mexico.

This work is related to the investigation of the broader effects of government pro-R&D policies on the economic development of countries. Azoulay et al. (2019) show that National Institutes of Health (NIH) funding spurs the development of private-sector patents: A $10 million boost in NIH funding spurred the development of private-sector patents and a net increase of 2.7 patents. Investigating data from Italy, Akcigit et al. (2018) found that government R&D subsidies led to higher profits for politically-connected firms with no change in their efforts to produce new technologies, indicating a legal monopoly on new technology derived from patents and protection from competition due to political connections.

This studies draws on the body of literature focusing on corporate patenting activity. Patents are a key measure of innovative activity output,d as they are the most important form of industrial innovation protection. Schmookler (1953) pioneered the use of patent statistics for the assessment of the rate of American inventing. Although, Lee and Walsh (2016) reveal a substantial innovative activity outside R&D, this study focuses on the government's decision to boost R&D activity.

Importantly, not all patents are created equal (Griliches, 1979; Frietsch et al., 2014; Nagaoka et al., 2010; Zaller, 1992;), some represent superstar technologies responsible for substantial technological breakthroughs, but are unutilized or uncited (Hall et al., 2005). Gilfillan (1960) suggests that the necessity to differentiate patents by quality. Griliches’ (1979) work, the first large sample work using computerized USPTO data, emphasizes the varied quality of patents and the use of patent citations as an important adjustment criterion. Kwon et al. (2017) discuss the varying qualities of patents registered at the USPTO in different countries. However, patent citations can measure technological spillovers (Van Zeebroeck, 2011). Unlike other patent families, 95 % of Russian patents belong to private individuals and not companies; thus, a common mechanism of citations as a measure of technology spillovers is less likely. In addition, a vanishingly small number of Russian patents are also patented in other patent families, which would be an alternative measure of patent quality (Svensson, 2020). Patenting outside of the Russian Patent Office is relatively costly, as it requires not only greater patent application fees, but also the additional work of patent attorneys and translators. A small fraction of Russian patents that are patented in other patent families is unrepresentative. This does not assume that all patents fall in quality, but rather that additional incentives produce cheap domestic patents that suffice for government grant applications. Thus, this study is limited to patents in the Russian Patent Office. Moreover, patent quality is also measured by patent renewal, which is highly correlated with commercialization (Svensson, 2020). These data are not available for this study. Thus, the primary measure of patent quality is forward citations (excluding self-citations).

While Woo et al. (2015) notes that sometimes a high number of patents is negatively correlated with industry value-added, their explanation (blocked access to technology) does not explain the extraordinary number of patents in some countries with low technological development. This study finds that a more plausible explanation is that when government accountability is low, patent efficiency becomes a poor indicator of the development of functional technology, and, under certain conditions, can stifle technological development.

The remainder of this paper is organized as follows. Section 2 offers a model of corrupt patent promotion policy that accounts for such differences. Section 3 presents the background of Russian R&D landscape and empirical analysis of R&D policy in Russia. Section 5 concludes.

Game-theoretic modelThis section introduces a model that examines the seemingly uncontroversial design of government R&D policy which includes providing grants to researchers with more patents and can lead to both welfare-improving (under good institutions) and welfare-reducing (under bad institutions) consequences. In both cases, this policy design is compatible with the political incentives of the incumbent. Under good institutions, such a policy mitigates the problem of under-investment that arises due to positive externalities emerging from the creation of new technology. Under bad institutions, it enables rent-seeking in patent markets, generating incentives to file cheap but empty patents. Importantly, this is a general equilibrium model: the politician selects a policy, researchers optimize their efforts, and then a competitive market determines the value of patents in the market.

Model setupThe game model features two types of strategic players: a politician and researchers and non-strategic profit-maximizing firms. Researchers differ depending on their talent: there are R¯ of talented researchers who can either produce a valuable innovation at a cost c and produce a high-quality patent, or choose to do nothing. There is also a pool of size 1 of non-talented researchers who can imitate research; the idiosyncratic cost of producing a “lemon” for non-talented researcher i is ai, uniformly distributed over [0,1]. These researchers can also choose to do nothing.

Generally, the politician cares about both the economic benefits obtained from the creation of new technology and rents collected from sub-par patents. The controlling policy parameter that the politician chooses is the level of bribe b to be paid by an author of a “lemon.” In equilibrium, this choice determines the market price for a patent, and, thus, the incentive for talented researchers to produce valuable innovations.

Making their individual decisions, all researchers observe the levels of bribe, b, and available research grants, π. If a talented researcher engages in patent production, the utility is UT(P)=π+p−c, where π is the award, p is the market-determined price that can be received for selling a patent, and c is the cost of research. Otherwise, the researcher receives 0.

If a non-talented researcher engages in patent production, the bribe, b, has to be paid to pass as an expert with probability 1−θ, where θ represents the quality of institutions. High θ corresponds to strong institutions (a bad patent application has a low chance of being approved), while low θ proxies the weak ones. In this case, the utility of the non-talented researcher iis UNT(P)=(π+p)(1−θ)−ai; otherwise, the researcher receives 0. Notably, the market cannot determine the quality of an individual patent; the market price reflects, in equilibrium, the relative shares of good and bad patents. Consequently, the non-talented researcher, after paying a bribe and (possibly) passing as an expert, receives not only the award π, but also the market price p.

Firms purchasing patents do not consider the quality of individual patents before purchasing them. In equilibrium, they use the shares of high- and low-quality patents in the market to determine the price p. Their expected value for high-quality patents is H>0, and 0 for low-quality patents; they are risk-neutral.

The utility function for the politician that cares both about the public welfare (amount of innovation) and the rent extracted, is as follows:

where R is the total amount of research produced, H is the value of new technology for society, α is the weight of economic development in politician's utility, and B is the amount of bribes collected from non-talented researchers.AnalysisIn this analysis, I focus on the case 0

Let λ be the share of high-quality patents in the market. A firm purchases a patent if λH−p≥0, such that the market for technology clears, as in the simplest version of Akerlof's (1970) “lemons” model, at price p=λH.

Suppose that b is the politician's policy choice, the size of the bribe. Then, the number of talented researchers R who engage in innovation is determined as follows:

If R=0,p=0 as firms realize that there are no good patents in the market. Then the number of low-quality patents on the market of technology is

and the total amount of bribes isThe politician's utility is UP=(1−α)b(π(1−θ)−b), which is maximized at b0=12π(1−θ), which in turn yields UP(b0)=14(1−α)π2(1−θ)2. When the market price for patents is 0, the sole purpose of paying a bribe is receiving the awardπ.

Suppose that =R¯, that is, talented researchers innovate. If the bribe is set at b, and the market price is p, the number of low-quality patents in the market is

The price of the patent in the market is determined by the share of good patents applications in the total pool

Let p(b) be a unique solution of (2) given the politician's choice of b; the existence and uniqueness of the equilibrium price follows the fact that the left-hand side of (2) is an increasing function of p, and the right-hand side of (2) is decreasing in p. Naturally, the function p(b) depends positively on b: the higher is the bribe that non-talented researchers pay for the opportunity to receive a patent, the lower is the share of false patents, and, consequently, the higher is the price that the market is ready to pay for a patented innovation.

The total amount of bribes is

Let b∗, the optimal politician's choice, be defined as

To demonstrate that there exists, for a certain natural range of parameters, an equilibrium, in which talented researchers innovate and the market price is non-zero, I need to show that

π+p(b*)≥c and UP(b*)>UP(b0), that is, the politician in equilibrium prefers innovation by talented people to the situation whereby non-talented researchers pay bribes to receive state funds and high-skill researchers do nothing.

Suppose that the bribe is set at the level b1=(π+H)(1−θ). Then, p(b1)=H,π+p≥c by assumption, and the politician's utility isUP(b1)=αRH. It remains to choose parameters α, R, θ, and H such that the following equation is satisfied:

By the definition of b∗, we have UP(b*)≥UP(b1). Thus, for the same set of parameters, UP(b*)>UP(b0), and the following Proposition is proved.

Proposition 1: When the parameters, α,R¯,θ, and Hs, are sufficiently large (exceed certain thresholds), the politician prefers to set the optimal bribe at the level that makes, through the price for patented innovation, the talented researchers to innovate.

The results for the Proposition are very intuitive. Strong incentives for innovation depend positively on the politician's interest in growth, α, total number of talented researchers, R¯, quality of institutions that make it more difficult to patent a false invention, and extent of spillovers, Hs. When each of these parameters is sufficiently large, the market does not unravel. Consequently, an increase in government funding may result in an increase in the total number of patents, an increase in the number of good patents, and a fall in the share of good patents in the total pool.

Proposition 2: If the prize that is independent of the market price, π, is high, then the optimal choice is to have the bribe level at 12π(1−θ), the market price of patents at 0, and no innovation produced.

In other words, in a corrupt environment, there is a risk of overpaying for patents “lemons” proliferate the market, which unravels. By contrast, when government grants are absent, the market price for patents would be p=HR¯R¯=H as only high-quality patents would be produced. The number of patents produced would thus be p−c. If, π>0, the number of patents produced would be π(1−θ). Therefore, for π>p−c, the number of patents produced would be higher than in the absence of government grants.

Empirical analysisIn this Section, I illustrate the implications of Proposition 2 by focusing on Russia, characterized by low government accountability and dramatic increase in investment in R&D since 2009. First, I provide background information on government R&D policy in Russia and the Russian patent systems. Then, I introduce data and the methods used in this study. Subsequently, the results at patent class and patent levels are presented, and use US data to check the robustness of the main results. Finally, I establish whether the decline in patent quality as measured by patent citations leads to a reduction in technology purchases as measured by licenses.

BackgroundRussia presents an interesting case for investigating government policy on supporting innovation (Frye, 2017; Wengle, 2015). Initially, after the collapse of the USSR, the funding toward supporting innovation was largely absent, leading to shortages of lab supplies and months of unpaid wages (Frye, 2000; Ganguli, 2017; Woodruff, 1999). In the early 2000s, observers considered Russia's science and technology as its “major untapped resource” (Gianella & Tompson, 2007; Sher, 2000). Scholars submit two main determinants of unsatisfactory innovative performance of the country: weak demand for R&D in the economy and low government funding for R&D (Makarov &Varshavsky, 2013). After 2007, the drastic increase in state investment and grant programs had been targeting specific areas of research. For instance, various grant programs prioritized research in spheres of nanotechnology and, more recently, age-related medical research. In 2007, the Russian government established a government-owned joint-stock $10 billion Private Equity and Venture Capital Evergreen Fund called Rusnano aimed at commercializing developments in nanotechnology and another conglomerate established in 2007, called Rostec, specializing in strategically important companies, mainly in the defense industry. Other sources of government funding, such as the Russian Fund for Basic Research, prioritize nanotechnology.

In many instances, obtaining a patent was sufficient to claim the successful completion of a project undertaken with government funding. Thus, researchers in the field of nanotechnology were incentivized to produce more patents. I argue that this has led to a disproportionate decline in patent quality and value in this field compared with that in others. Sometimes, the nature of the patent and its practical usage can be inferred from the title: US 6,368,227 patents a “Method of swinging a swing” and US 604,596 is “On the method of applying a peanut butter and jelly sandwich.” Arutyunov (2008) summarized patent names and associated technological problems (see Table A-2). A useless Russian patent is typically disguised as something that appears genuine to nonspecialists. The Russian patenting agency patentum.rue states that performing a patent search and filing an actual claim costs 145 thousand rubles (approximately $2500), which is costly, excluding the mandatory filing fee. This is approximately five times the average monthly wage in Russia.

Nonetheless, 98 % of Russian patents filed after 1996 were never cited, and only 0.02 % of Russian patents have 10 citations or more. The time lag between patent publication and its first citation is uncommonly high even for those patents that were cited (after six years) compared to usual lag in OECD patents (after three years). The technology transfer market using patents is almost absent, and >90 % of Russian patents are held by individuals, and not companies. Why would a researcher file a patent that would likely never be licensed or sold, but appears scientific to a non-specialist?

One potential use of such patents is to signal the researcher's competence. Government scientific agencies (RFBR, etc.) determine whether to finance innovative projects through a grant based on several factors, including, most importantly, the number of patents and publications submitted by the researcher. While it is costly to establish the quality of a complex research, governments often rely on patenting criteria: novelty, inventive step, and applicability. The existence of a patent does not guarantee that these criteria are met. Nonetheless, the researcher is evaluated not on the basis of true patent quality, but by the mere quantity of obtained patents.

Indeed, the relative importance of patents and publications obtained by the researcher in grant application is high, accounting for 45 % of the score a researcher receives during project evaluation. Thus, the costs of increasing one's chances of receiving a government grant decline as the sum of costs of patenting and the costs of research converge to merely the costs of patenting. This gives researchers the incentive to file low-quality patents and, hence, increases the share of low-quality patents in the pool of Russian patents. Majority of Russian patents are only filed in the Russian Patent Office, as shown in the Appendix (WIPO, 2018), as they are only intended for domestic use, which is surprising given that the Russian technology market is relatively small. For example, 50 % of Swedish patents are filed in two offices or more. Such patents can be used as a main result of the research financed by the government grants, providing the researchers with an opportunity to forgo the actual innovative activity.

Data and methodsI use the complete list of Russian patents for the 1998–2016 period, including patent classification, year of patent application and patent grant, and number of forward-citations. Unfortunately, there is no readily-available indicator denoting whether the patent covers nanotechnology-related technology. Thus, I rely on two approaches to identify such patents.

I rely on the pre-existing classification of Russian five-letter patent classes. I denote the dummy variable, nano, taking the value 1 if patent belongs to nanotechnology-related field.f For patent-level DID specification, I complement this approach with another measure and compile a dictionary of “nanotechnology-related” terms. Then, I identify the presence of such words in the title of a patent. I denote the dummy variable, nano_text, as equal to 1 if patent name contains at least one nanotechnology-related term and 0 otherwise.

Figure A-3 of the Appendix presents the histogram of patent applications in the 1998–2015 period. Colors represent the patent section in International Patent Classification, the broadest definition of the patent field.g

Figure A-4 presents the distribution of Russian patents over 1998–2016 by status (nanotechnology or not) and citations (cited within the first four years since publication or not). Table A-1 presents a summary of the number of granted patents, as well as the number of citations by nanotechnology status and application year. Evidently, patenting increased sharply since the onset of the program, with nanotechnology-related applications affected to a higher degree. The number of cited nanotechnology patents increased in the first year, compared to pre-treatment period, consistent with the fact that incentives to file nanotechnology-related patents mechanically creates a push to cite existing patents in the same area as part of the filing process. However, the share of cited patents declined in the nanotechnology field.

Patent class-level analysis: trajectory balancing approachI explore the policy change in the provision of R&D funding in 2008 that provided large grants to researchers in the nanotechnology field. Using patent classification, I determine the research-based patent filings that were eligible for government support. Then, I employ kernel-based trajectory balancing approach (Hazlett & Xu, 2018) to demonstrate that the average quality of patents eligible for government grants dropped after the onset of government R&D programs compared to patents in fields in which government support for innovation was less pronounced. This is a version of synthetic control that reweights the control units such that the averages of the pre-treatment outcomes are approximately equal between the treatment and (reweighted) control groups. A great advantage of trajectory balancing is that it tolerates time-varying confounders affecting government R&D programs, propensity of researchers to produce patents, and quality of patents as measured by the number of citations.

I compare the number of patent applications in nanotechnology-related patent classes with the number of patent applications in non-nanotechnology patent classes in the same year. I repeat the same analysis for the total number of citations and average number of citations in patent classes.

Intuitively, this method can be understood as follows: assume that both the outcome (number of patent application, total number of citations, and average number of citations per patent) and a treatment (R&D funding) depend on omitted time-varying variables as well as some fixed variables. After identifying and applying such a weighting to the control units such that their pre-treatment trend matches the trend of the treated unit, the unobserved confounders are automatically adjusted for.

The weights applied to the control units follow the formula:

For the control group, ∑Gi=0wi=1,wi>0. The choice of ϕ is achieved with a Gaussian kernel k(Yi,Yj)=exp(−||Yi−Yj||2/h)

Then, under a set of general assumptions, the Average Treatment Effect on the treated is calculated as follows:

For the empirical analysis, I estimate the equivalent of the following equation:

where Y is an outcome defined for the patent class i in year t. The key outcomes are the number of patent applications, total number of citations, and average number of citations per patent. Nano is an indicator for the patent class i related to nanotechnology. It equals 1 if patent class i is considered nanotech and 0 otherwise. Thus, the resulting coefficients of interest are given by vector Γ, expected to be 0 before and including 2008 and have a substantive interpretation after 2009.First, I examine the impact of government funding on the number of patent applications in different patent classes.

Fig. 1a illustrates the average treatment effect of government funding in nanotech-related patent classes versus other patent classes. Fig. 1b shows that the exact matching on the pre-treatment outcomes was achieved successfully. Fig. 1c shows the balance on mean pre-treatment outcomes pre- and post-adjustment. The number of patents are observed to increase in response to increased government R&D funding.

Next, the impact of government funding on the raw number of citations in different patent classes is examined. The total number of citations is essential in indicating a definite decline in patent quality and not just the mechanical change in the probability of being cited due to the increased number of patents. Fig. 2a reveals that there is a decline in the number of citations in all patents over time, and as expected, older patents have more time to get cited. However, the exact match on pre-treatment outcome guarantees that this effect does not impact causal estimation: the number of citations in nanotechnology-related patent classes declines relative to other patent classes.

Finally, Fig. 3a depicts the results of trajectory balancing estimation for the average number of citations per patent in treatment and control patent classes. As before, the balance on pre-treatment outcomes is achieved successfully, allowing causal conclusions. The Average Treatment effect on the Treated is −0.016, suggesting that each patent in nanotechnology-related patent classes receives 1.6 % fewer citations compared to patents in non-nanotechnology-related patent classes. The magnitude of the effect is sizable, considering that only 2 % of Russian patents are cited at least once. Tables A-3, A-4, and A-5 present the result of estimation, including pre-treatment periods.

Patent-level analysis: difference in differences (DID) approachThe trajectory balancing approach must be performed on a balanced panel of observations. However, patents are granted or expire in such a way as to make such analysis difficult. Therefore, I resort to traditional DID analysis for the patent- level data. In addition to designating a patent to be nanotechnology-related if it is in a nanotechnology-related patent class, I compile a dictionary of nanotechnology-related terms. Then, I identify the presence of such words in the title of a patent. I represent the dummy variable nano_text as equal to 1 if a patent name contains at least one nanotechnology- related term and 0 otherwise.

The non-nanotechnology patents serve as a control group as they are less likely to receive government support. Treatment period ∈ 0, 1 is 0 before the onset of a massive campaign to support innovation in nanotechnology in 2008 and 1 after the onset of a program.

Eq. (5) provides the details of the estimation.

The treatment variables are as follows: programt is an indicator variable, denoting whether the government program subsidizing researchers in the field of nanotechnology was present in the year the patent was obtained; nanoi is an indicator variable that shows whether the patent is categorized as nanotechnology.

As <2 % of Russian patents are cited, I focus on the following measures of citations: citations1 is a dummy variable that takes the value 1 if the patent received at least 1 citation by 2016 and 0 otherwise. citations10 is a dummy variable that takes the value 1 if the patent received at least 10 citations by 2016 0 otherwise.

Control variables: To account for the fact that older patents have more time to be cited, I include year of publication as a control variable. Additionally, by including fixed effects of the first three letters of patent classification, I account for the fact that patents in some fields are more likely to be cited than in others.

As in any DID analysis, I rely on a parallel trends assumption. Figure A-5 illustrates trends for mean age-adjusted patent citations over the first five years of patent existence. Nanotechnology patents are identified via dictionary-based and class-based approaches. Both dictionary-based and class-based classifications suggest that the decline in patent citations was more pronounced in classes receiving greater government support in nanotechnology-related classes.

Table 1 demonstrates the decline in the probability of being cited for nanotechnology patents during years of additional government support for nanotechnology compared with other fields without similar support.

Government Policy and Patent Quality.

Specifically, a dictionary-based approach suggests a 4.6 % decline in the probability of being cited at least once by 2016 for nanotechnology-related patents owing to increased government support. A classification-based approach suggests a 1 % decline in the probability of being cited by 2016. These results are robust for the two ways of classifying patents: text analysis of the patent name or the five-letter patent class it belongs to.

Omitted variable bias can seriously impact any analysis of social phenomena. A DID approach relies on a parallel trends assumption to mitigate the effects of extraneous factors and selection bias, but it can still be subject to the omitted variable bias. There are multiple approaches to sensitivity analysis (Blackwell, 2014; Dorie et al., 2016; Frank et al., 2013; Heckman et al., 1998; Hosman et al., 2010; Imai et al., 2010; Imbens, 2003; Middleton et al., 2016; Rosenbaum & Rubin, 1983; VanderWeele & Arah, 2011). I choose the approach of Cinelli and Hazlett (2020) for the following reasons. First, it relaxes some strong assumptions required for the majority of these methods. Second, it provides readily-available statistics that illustrate the sensitivity of the analysis to omitted variable bias.

Cinelli and Hazlett (2020) suggested an approach to quantify the confounding that nullifies the observed regression results. To this end, I report the “robustness value” measure of sensitivity that illustrates the overall robustness of a coefficient to unobserved confounding. If the confounders’ association to the treatment and the outcome (measured in terms of partial R2) are both assumed to be less than the robustness value, then such confounders cannot “explain away” the observed effect. This measure is a function of the estimate's t-value and the degree of freedom.

Omitted variable bias can be decomposed as follows (Cinelli & Hazlett, 2020):

where se(α^}is the standard error of the main coefficient of interest a^, Y is the outcome of interest, D is the main explanatory variable,X is a vector of covariates,Z is the omitted variable, and dfis the degree of freedom of the regression.The absolute value of the bias thus depends on the strength of association of the outcome with the omitted variable (measured by the partial R2:R2Y∼Z|X,D and on the strength of association of the main explanatory variable with the omitted variable (R2D∼Z|X).

An intuitive way to interpret the results is by comparing them to the observed variables. The core assumption here is that confounding explains less of the residual variation in the treatment and outcome than of the observed covariate.

Publication year is chosen as the strongest predictor of citations received by the patent given that there is a strong positive relationship between the age of the patent and its forward citations. The robustness values for the four main models are reported in Table 1.

For Model 1, unobserved confounders (orthogonal to the covariates) that explain >0.62 % of the residual variances of both the treatment and outcome are sufficient to reduce the absolute value of the effect size by 100 %. Conversely, unobserved confounders that do not explain >0.62 % of the residual variance of both the treatment and outcome are not sufficiently strong to reduce the absolute value of the effect size by 100 %. Similarly, unobserved confounders should explain at least 0.36 %, 0.49 %, and 0.49 % of the residual variances of both the treatment and outcome in Models 2–4, respectively, to reduce the absolute value of the effect size by 100 %. The observed robustness values are relatively low, yet the citation data of Russian patents exhibit rare event characteristics, meaning that the predictive power of most variables would be relatively low. Benchmarking the effect of the DID coefficient against the publication year suggests that omitted variable is at least three times as influential as it reduces the effect to 0 (Figure A-2).

Table A-6 presents similar results for age-adjusted patents. The outcome variable is the number of citations received by patent i by year t, divided by the number of years since patent publication. The results suggest that disproportional government support of nanotechnology-related patents had a negative effect on their quality.

Class-based nanotechnology classification is negative and significant, suggesting that a 7 % decline in the probability of being cited (adjusted for patent age) is negative and statistically significant, but is still sensitive to omitted variable bias. Unobserved confounders (orthogonal to the covariates) that explain >0.18 % of the residual variances of both the treatment and outcome are sufficient to reduce the absolute value of the effect size by 100 % at the 0.05 significance level. Conversely, unobserved confounders that do not explain >0.18 % of the residual variance of both the treatment and the probability of being cited are not sufficiently strong to reduce the absolute value of the effect size by 100 % at the 0.05 significance level. Benchmarking the effect of the DID coefficient against the publication year suggests that omitted variable is at least as influential as it reduces the effect to 0 (Figure A-1).

The aforementioned DID approach measures the effect of government funding on patent citations in the treated group (nanotechnology), relative to changes in the patent citations in the control group (other patents). However, it has high sensitivity to omitted variable bias. For instance, new and growing fields, such as nanotechnology, can exhibit different patterns of development, compared to more established fields.h Thus, a time-varying confounder that behaves differently across nanotechnology and non-nanotechnology patent fields can be employed. A time-varying confounder that is not class-invariant violates the common trend assumption of DID. I address this problem with a DDD design, using Russian and US patent data. The assumption is that nanotechnology patents in both countries are exposed to time-varying confounders related to the relative novelty of the field, but the US patents are not influenced by the Russian policy aimed at nanotechnology funding. I employ the pre-existing classification of patent classes that are more likely to include nanotechnology patents for the construction of the Explanatory Variable. I denote the dummy variable, nano, taking the value of 1 if the patent belongs to a nanotechnology-related field.

The results of the triple-difference estimation are presented in Table A-7. They suggest that after the implementation of government support for nanotechnology in Russia, the patents in this area received fewer total citations; few had at least 10 citations. Meanwhile, the probability of Russian nanotechnology patents receiving at least one citation increased compared to US patents. This may reflect the fact that when applying for a patent, researchers are expected to cite existing relevant patents.

These results serve as an additional robustness check for the main results. I demonstrate that both quality (measured by citations) and market attractiveness (measured by licenses) of nanotechnology-related patents declined in the aftermath of government support for innovation in this field. There are possible alternative explanations for these results. First, if government support triggers growth in fundamental research, companies may become interested in the resulting technologies later on, whereas the present-day positive impact on licensing could be negative. However, this hypothesis fails to explain the decline in patent quality as the comparison is drawn between patents of the same publication year. Nonetheless, government support for RD should prompt the increase in citations as patenting requires citing relevant research. Thus, citations in the affected fields should not decline, especially if government agencies highlight the importance of patenting for both selection of grantees and successful completion of the grant contract. For instance, Azoulay et al. (2019) show that NIH funding by the United States government spurs the development of private-sector patents that cite NIH-funded research.

A second alternative explanation is that government funding of nanotechnology patents became effective when nanotechnology research experienced a decline and the patents in the field became less cited. This conjecture is unlikely to hold as an examination of citation trends of nanotechnology and other patent citations suggests that the parallel trend assumption is true for the pre-treatment period. A fundamental change in the year when the government policy took effect, but independent of this policy, may be surmised. However, the analysis of the triple-difference model, including US patents, suggests that no such change occurred or that it was Russia-specific.

Government R&D support and licensingFurthermore, I investigate whether the decline in patent quality as measured by patent citations led to a reduction in technology purchases (measured by licenses). Licensing is one of the most common ways of technology transfer and, thus, reflects the changes in the patent market. As licensing data are not readily available for Russian patents, I rely on government- compiled reports, which provide the number of licenses of nanotechnology and non-nanotechnology patents. However, these data are limited: the exact patent class or any other unit-level information cannot be observed and I collect data only for a limited span of time, from 2000 to 2011. Thus, these results can only serve as illustrative evidence.

Fig. 4 indicates that nanotechnology patents affected by government policy receive fewer licenses compared to those during post-policy implementation, and this decline is especially pronounced when compared to the increase in licensing of non-nanotechnology patents.

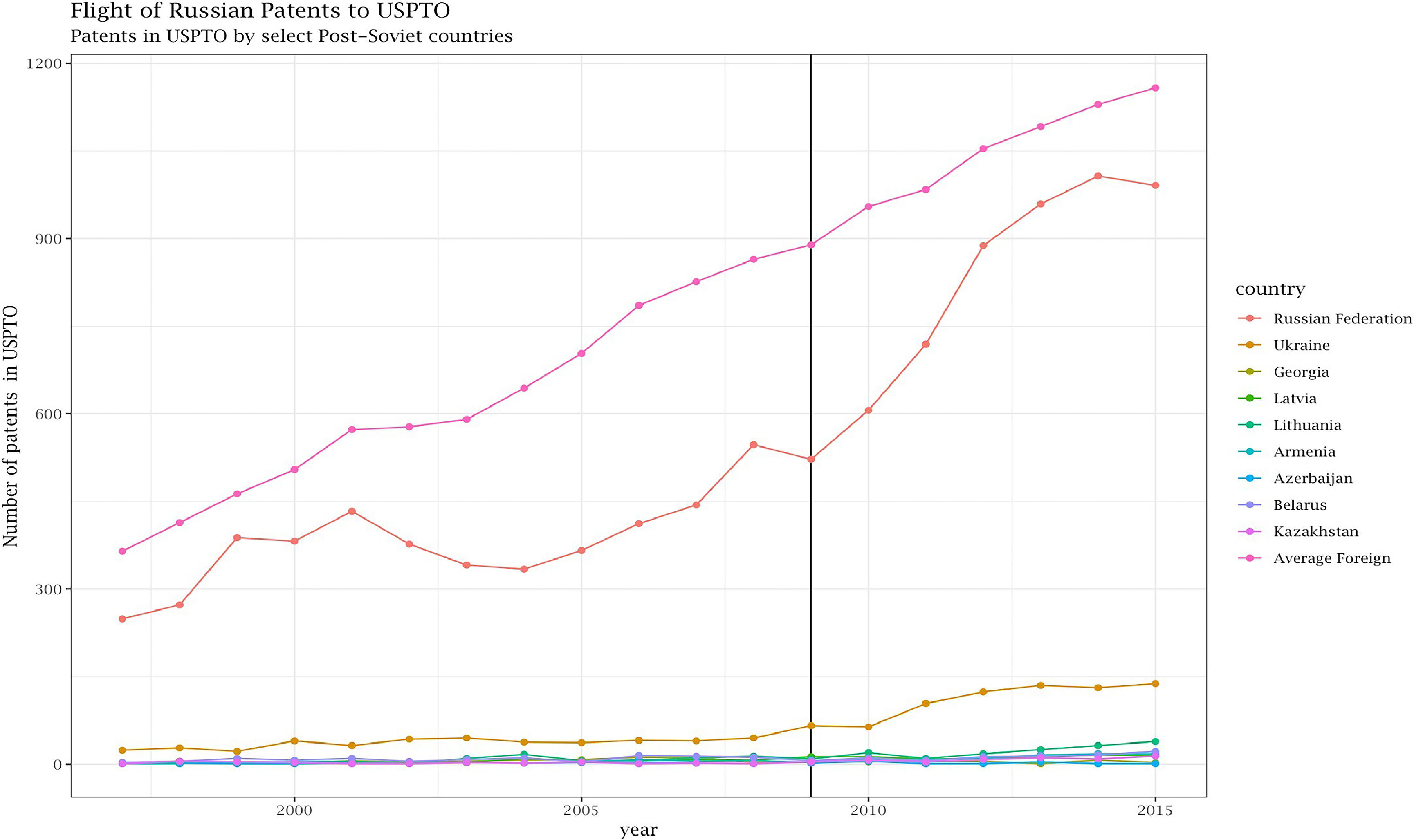

If the average quality of Russia declines, thereby reducing the price of technology transfer to companies, inventors move to other patent offices. An illustrative example (Fig. 5) uses data on foreign patents filed in USPTO. “Average Foreign" represents the total number of foreign patents filed in USPTO divided by the number of countries that filed patents in USPTO office in a year. USPTO patents for Russia are compared with select post-soviet countries. It suggests that soon after the onset of government R&D funding, the number of Russia patents filed in USPTO increased dramatically. There was no comparable jump in USPTO patents for other post-soviet countries. This observation does not contradict the view that the deterioration of average patent quality in USPTO for Russia pushed inventors to file patents in other patent offices.

Limitations and further researchThis study has several limitations. First, it focuses on the Russian patent system, which has unique aspects that differ from global standards, such as a high percentage of patents held by individuals rather than companies and a relatively low rate of patent citations. These differences could influence the behavior of patent applicants and the interpretation of patent metrics in Russia. Moreover, while the model presented in this paper covers both countries with strong and weak institutions, the empirical investigation focuses only on the latter. The empirical findings are based on the specific context of Russia, a country with weak institutions and high levels of corruption. Therefore, the unique political and economic environment in Russia may limit the generalizability of the findings to other contexts.

Second, this study focuses on a specific period (1998–2016) and may not capture longer-term trends or the evolving impact of government RD policies on patent quality. Changes in political leadership, economic conditions, and global technological trends could affect the relevance and applicability of the findings over time. Another possible concern is the use of forward citations as a proxy for patent quality. Forward citations may not accurately reflect the true value or impact of a patent, as they can be influenced by various factors such as strategic citing, differences in citation practices across industries, and changes in the patenting landscape over time. Additionally, the exclusion of patent renewal and family-size data may affect the robustness of the findings as these are critical indicators of a patent's long-term value and international relevance. Future research could extend the analysis presented in this paper by exploring similar dynamics in other countries with varying levels of institutional quality and corruption. Comparative studies could provide valuable insights into the conditions under which government RD funding effectively promotes high-quality innovation. Additionally, longitudinal studies could examine the long-term effects of government support on technological development and economic growth, shedding light on the sustainability and broader implications of such policies.

ConclusionWhile government R&D funding is intended to spur technological development and economic growth, it can lead to unintended consequences, such as the proliferation of low-quality patents, in contexts with high levels of corruption. This paradox is particularly evident in the case of Russia, where increased government support for nanotechnology resulted in a higher number of patent applications but a decline in the average quality of these patents.

In weaky institutionalized environments, political incentives and rent-seeking behaviors can distort the outcomes of government innovation policies. Bureaucrats may prioritize the quantity of patents over quality to meet performance metrics, extract rents, or signal competence. This creates a perverse incentive for researchers to file low-quality patents, undermining the overall effectiveness of government R&D support.

I document the wide discrepancies in the impact of government funding on the creation of patented technologies and demonstrate that countries with higher levels of corruption have a greater patenting efficiency, but this does not translate into actual technological development. This study's game-theory model presented in the study provides a plausible explanation for this phenomenon. I suggest a mechanism that explains how corruption in the public sector creates incentives for polluting the technology market with fake patents and leading to the creation of the "lemons" problem in the technology market. Furthermore, I employ trajectory balancing and a DID approaches in the context of Russian government policy to support nanotechnology. I demonstrate how government support for innovation can reduce the overall quality of patents in the field that is eligible for such support. These findings help to reconcile various findings regarding the efficiency of government innovation policies in different countries by incorporating political incentives and institutional quality into policy analysis. Furthermore, they provide a theoretical background for evaluating the impact of political incentives for investing in the creation of new technologies in the technological development of countries.

CRediT authorship contribution statementNatalia Lamberova: Writing – review & editing, Writing – original draft, Visualization, Validation, Software, Methodology, Investigation, Formal analysis, Data curation, Conceptualization.

This study would not be possible without the generous help of Konstantin Sonin, Chad Hazlett and Daniel Treisman. I am also grateful to Maxim Ananyev and Anton Sobolev, participants of MPSA and APSA for their feedback. I want to thank anonymous reviewers for their comments. I am grateful to the Institute for Humane Studies for their support (grant no IHS017319).

In 2010, the EU outlines five main long-term goals for the 2020 strategy and pledged to devote 3 % of GDP to R&D support. The U.S. government spent $39.9 billion on R&D in 2017 (Sargent Jr, 2018), comparable to the $44.3 billion budgeted for elementary and secondary education.

CNN report: http://edition.cnn.com/2009/WORLD/europe/11/12/russia.medvedev.speech/

A different measure of patent citations suggests a decrease of 1 %. They are also less likely to obtain 10 or more citations by 1 %.

Patents are strongly related to R&D across firms, with elasticity close to one, but controlling for unobserved differences across firms, the elasticity is lower (approximately 0.3).

https://patentus.ru/sroki-i-tzeny/patentovanie-izobreteniy/

6B82B1/00, B82B3/00, B82B10/00, B82B20/00, B82B30/00, B82B40/00, B82C5/00, B82C15/00, B82C20/00, B82C25/00, B82C30/00, B82C35/00, B82C99/00, B82C, 619/51, B05D1/00, 0131/02, G01B 1/00-15/00, G01N 13/10-13/24, G02F 1/017, G12B 21/00-21/24, H01F 10/32, H01F 41/30, H01L 29/775.

Figure A-3 shows that the number of patent applications increased after the announcement of large- scale government R&D funding. This growth was particularly large in sections B (performing operations), C (chemistry), and G (physics). These are the sections most likely to contain nanotechnology-related patents and, therefore, are eligible for additional government support. Similar growth in nanotechnology-related patent applications is noticeable using the dictionary-based approach, as demonstrated in Table ?? of the Appendix.

Nanotechnology became a specialized field in the 1980s after two major breakthroughs: the invention of the scanning tunneling microscope in 1981, which provided unprecedented visualization of individual atoms and bonds, and the discovery of fullerenes in 1985. Nanotechnology-related patent classification—Class 977—was created in January 2011.

- Descargar PDF

- Bibliografía

- Material adicional