The changes occurring in the business world, due to major challenges such as competition, globalization and technological development have posed major challenges to accountants. They have been urged to play more proactive and demanding roles in organizations, because they hold privileged information about the economic and financial situation, which allows them to participate in boosting economic activity by anticipating problems and creating value. Based on these assumptions, this study presents exploratory research focused on the distinct roles played by accountants in a Portuguese medium-sized company, which contributes to the academic and professional debate about the increasing business partner role of accountants through a different organizational context.

The work presented here is the result of exploratory fieldwork carried out in Politejo, a medium-sized company, which has as its principal activity the production and marketing of thermoplastic products, notably tubes and accessories in PVC, PEAD and PP. Despite its increasing size, Politejo continues to be a family business that, knowing how to take advantage of market opportunities, has become market leader in Portugal, a position that it has used as a springboard for the expansion of its activities into Spain. Currently, Politejo has also established its presence in such countries as Mozambique, Angola and Brazil.

In Politejo, it is expected that accountancy will work as a valuable tool in the structure supporting the management of the company. The literature on management accounting has discussed distinct roles played by accountants in support of decision-making processes (Robalo & Ribeiro, 2015). The authors mention that in recent decades we have witnessed a growing academic and professional debate about the change of focus of the accountants from being producers of ‘passive’ information (disparagingly referred to as bean-counters) to actively focussing their attention also on additional aspects of the control function of management, which involves them in the processes of taking decisions (as business partners), working more and more as agents of organizational change. Thus, in this context, it is our aim to identify among the accounting staff of Politejo the distinct roles documented in the literature.

Do we have, on the one hand, accountants who are limited merely to the role of bean-counter and, on the other hand, accountants who take on the role of business partner? Or are we, rather, dealing with flexible accountants to whom we can attribute neither the role of bean-counter, nor that of business partner, it making more sense to speak of hybrid accountants who are capable of carrying out both roles? We believe that this work can contribute to the debate on the theme, which does not yet empirically justify the existence of a true evolution of the role of accountant from bean-counter to business partner (Byrne & Pierce, 2007; Järvenpäa, 2007; Lambert & Sponem, 2012; Robalo & Ribeiro, 2015, 2016). However, it is important to emphasize that, the theoretical-conceptual framework presented in this study mostly highlights studies of the roles of the management accountant in other countries, in contrast to the Portuguese context in general in which ‘management accountant’ is not a recognized and regulated profession. Moreover, the organizational scale of the business under study (a medium-sized company) requires that our focus will be on the various accountancy tasks undertaken in Politejo by financial and management accountants.

The remainder of the paper is organized as follows. In the next section, we present the literature review that guides this study. Section 3 describes the research method and Section 4 presents and discusses the results of the study. Conclusions and contributions are outlined in the last section.

2Literature reviewThe classic studies, which generally follow a line that investigates the sort of roles played by accountants in organizations, began in the 1950s with the work of Simon, Guetzkow, Kozmetsky, and Tyndall (1954). The authors present the typology of the roles performed by management accountants: scorekeeping (producing information about the global performance); attention-directing (producing information centred on specific aspects of regular concern); and problem-solving (producing and analysing information about specific situations with the objective of supporting the management in taking decisions on irregular occurrences).

Some decades later, the theme of the roles of accountants is taken up again (Hopper, 1980; Sathe, 1983). Hopper (1980) presents a typology with two roles: scorekeeping and customer service. The author refers to an inherent conflict between these two roles due to the fact that, on the one hand, (management) accountants have to perform a scorekeeping role (functions that involve activities of control over operational managers) and, on the other hand, they aim to carry out a role of customer service (providing information to operational managers with a view to supporting business activities). In his turn, Sathe (1983) in his work argues for the importance of the role of the accountant and presents a typology of the roles of accountants: management-service responsibility (a role connected with functions that help managers in the decision-making process) and financial reporting and internal control responsibility (a role connected to the supply of credible financial information, in compliance with internal control practices as well as accounting and tax policies).

In the nineteen-nineties, the theme of the roles of professional accountants continued to be debated. Mouritsen (1996) advanced a new typology of the roles played in accounting departments, dividing them into: accounting (tasks clearly connected with financial transactions); consultancy (tasks related to decision-making processes in relevant, specific situations); banking (tasks centred on aspects of management of the treasury movements); control (tasks of analysis of the fulfilment of objectives and budgets and the management of resources); and administration (tasks focused on administrative systems unconnected with financial data).

In their turn, Granlund and Lukka (1998) presented a typology with only two roles: bean-counter and business partner. The idea conveyed by these authors is that there exists a trend of growing change from the role of mere passive producer of financial information (bean-counter) towards a more proactive role (business partner), capable of influencing the decision-makers and focused on a much vaster set of information that goes beyond the merely financial and standardized data. However, the authors suggest that despite the diminution of the importance of the role of bean-counter, this job is still the central function of the work of (management) accountants and the need to do it right in the standard format is their chief problem, together with the execution of accounting and financial procedures. In this sense, the authors argue that the current trend towards change promotes the division of labour among accountants, as is demonstrated by the fact that both types of accountants are simultaneously necessary. For this reason, the authors advocate the existence of a hybrid role for professional accountants, able to unite the characteristics of bean-counter with those of business partner in the same accountancy department.

In the same sense, Paulsson (2012) carried out a study in a Swedish public sector organization with the objective of understanding the roles (or roles) of the management accountants in the context of New Public Management and the requirements in terms of their knowledge and competences. Among other things, the results confirmed these professionals perform a set of diverse and expandable tasks. For this reason, we may often speak of ‘hybrid accountants’, it not being possible to label them just bean-counter or business partner. It only makes sense to identify the roles that are more important to some than to others. In respect to the use of these labels, Friedman and Lyne (2001) have already reported that the widespread use of the term bean-counter is a relatively recent phenomenon. Nonetheless, the authors mention that the stereotype, with its various nuances, goes back a long way.

The theme of the roles of accountants has continued to rouse the interest of researchers during the last decade. The identification of antecedents, characteristics and consequences of the roles of (management) accountants were studied by Byrne and Pierce (2007). The authors demonstrate that the individual attitudes, personalities and initiatives of accountants influence their own roles and identify contingencies and conflicts in terms of their interactions with other organizational managers.

Other research addresses the theme of the roles of accountants, adopting a perspective that relates accountancy to the organizational culture (Järvenpäa, 2007; Lambert & Sponem, 2012). Through the application of a longitudinal approach to the research and an interpretative spirit, Järvenpäa (2007) developed a work of cultural nature whose objective was to reply to the following questions: what type of cultural interventions were made (consciously or unconsciously) that affected the orientation towards the business in practice, and how was this done? The author concluded that accountancy is a cultural phenomenon that is inherently rooted in organizations, and identified diverse instruments of intervention in the cultural change of accountants relative to their orientation towards business, notably: structural interventions; development of effective accounting information systems; implementation of accounting innovations; directing personal attention; moderating role performed by financial management; and, above all, official statements of value and narratives about change and about top managers. In sum, the growing business orientation of accountants is neither simply associated with the implementation of accounting innovations nor with the question of being more active in terms of management, but depends on a set of different interventions that promote cultural change.

In their turn, based on organization theory as determinant in the role of the accountant, Lambert and Sponem (2012) developed a work from the starting point of a qualitative approach based on multiple case studies. The authors identified four typical styles among (management) accountants, these being: discreet, safeguarding, partner and omnipresent. With these four styles it was possible to associate the following four roles: discreetly controlling the behaviour of managers (a role that we can make correspond with the role of bean-counter); socialization of operational managers (a role more directed towards the fulfilment of objectives demanded by top management, which they are closer to); facilitating decision-making at the local level (related to the role of business partner); and centralizing power (a role very close to the customer service identified by Hopper). The authors also looked at the question of the authority of accountants, concluding that in the organizations where their function has little authority, their activities are limited to merely technical tasks. On the other hand, in organizations where they have significant authority, they perform both technical and consultative tasks. The authors also raise the question of the independence of accountants, observing that the closer the involvement of accountants with other organizational managers, the greater the accountants’ difficulty in keeping their independence and following an ethical path.

In recent years, the theme of the roles of professional accountants has also been taken up in Portuguese organizational contexts (Robalo & Ribeiro, 2015; Vicente, Major, Pinto, & Sardinha, 2009; Vicente, 2014). Vicente et al. (2009) replicated in Portugal the study of Scapens, Ezzamel, Burns, and Baldvinsdottir (2002) with the aim of understanding the importance that the (management) accountants have come to assume in businesses in Portugal, as well as analysing the nature and causes of the changes that have occurred in their roles. The authors conclude that in Portuguese business the accountants have been assuming a role that integrates diverse sources of information, financial and non-financial, becoming ever more involved in management strategies.

In a wider study, Vicente (2014) investigated the profession of accountant in Portugal. Starting from the perceptions of students and practising accountants, she concluded that in Portugal accountancy and the tasks performed by its professionals are still primarily and closely linked with the traditional aspects of compliance with tax and accounting rules and regulations, cost control, evaluation of performance and underpinning the external financial report. Tasks more connected to the strategic aspect of business, as well as those related to more active participation in the management of the company itself are relegated to a secondary level.

More recently, based on the context of an organization in the Portuguese public business sector, Robalo and Ribeiro (2015) have demonstrated the active involvement of accountants in the adoption, implementation and use of innovations in management accounting, clearly ascribing to these accountants the role of business partner. Following a procedural perspective, the authors demonstrated that the accountants sought to increase their importance in the organization by the management of the processes of adoption and implementation of distinct kinds of innovation in management accountancy.

3Research methodsBearing in mind the objective of understanding how the functions of accountants had evolved in Politejo over time, we chose to follow a line of qualitative research, more specifically the case study method.

As defined by Yin (2014), case study is a research method that investigates a phenomenon in its real setting, implying that it must be applied in situations in which there is difficulty in defining frontiers between the phenomenon itself and the context of which it is a part. We can refer to an exploratory case study, as defined by Vieira, Major, and Robalo (2016), which can be interpreted as a preliminary phase of research, likely to give rise to ideas and hypotheses that may be tested and deepened in the future.

Like any case study, what we present here demands various stages (Vieira et al., 2016). Its preparation starts with a bibliographical collection, which serves as a basis for the definition of the question to be researched and of the conceptual framework of analysis, as demonstrated in the review of literature, as well as the collection of evidence.

After the research strategy has been designed, the time arrives for gathering data or evidence. This stage, of significant importance for the success of the whole job, is one of the hardest but also one of the most interesting. We start the fieldwork by gathering documents (such as internal reports, annual reports and financial statements, and other documents of an accounting nature as well as informal registers), which enable us to characterize the business as well as understanding the whole organizational environment in cultural, economic and financial terms, whether past or future.

Afterwards, we could consider the possibility of the conduct and recording of semi-structured interviews (that is, based on a previously prepared interview script, but with sufficient margin for managing the direction of the interview whenever it is advantageous to do so) with various members of the company, including members of the board of directors and intermediate managers, and the fully qualified accountants, among others. We also fell back on the collection of reports from the fully qualified accountants themselves, as well as other professionals that work in the accounting departments, and also contacts with all those professionals and members of top management in the course of informal conversations. This kind of data collection can resemble unrecorded semi-structured interviews to the extent in which it allows the conversations to be directed towards the themes that most interest the researchers.

We had the opportunity to carry out two types of complementary observation: direct and participant. These methods of observation enabled us to collect a lot of data with a view to a better understanding of the roles of the accountants in the company. This form of data gathering helped us to understand how the company functioned, notably the organization of work and the existing relationships within the accounting departments, and between these and other organizational departments.

As we will be able to see in the next section, all the work of data gathering culminated in an analysis of the collected data. Initially, a documentary analysis of the archive materials was made, which served as a basis for the rest of the information gathering, as well as a characterization of the entity and its organizational environment.

After that, starting from the systematic and detailed analysis of collected data, an interpretation of the roles of (financial and management) accountants was done, taking as a base the roles of bean-counter and business partner as defined in Robalo and Ribeiro (2016). The role of bean-counter is applied to accountants centred on the production of standardized information, above all financial, whereas the role of business partner is associated with accountants more involved in processes linked to management.

4Field study4.1Recent changes with organizational impactPolitejo, founded in 1988, is now the public face of a group of companies that has attained a multinational dimension, thanks to the business vision and great know-how of its founder, an entrepreneur with little academic education but capable of doing any job within its organization. Those who had worked with him from the beginning remember him as a many-sided man who on the same day manufactured tubing (production), sold it (marketing), delivered it (logistics) and still managed to perform his administrative duties. In this way, in a few decades Politejo took the position of market leader, passing from a small family business to a medium-sized company with an annual turnover in the order of 45 million euros.

With the expansion and growth of Politejo, the complexity of the business, competition, legal and tax demands also grew, which created new needs at various levels in the company. At the beginning of this millennium, Politejo was still being run by its founder, but he went on to be assisted by his sons, who had gained higher education degrees in the field of management. Little by little, power was transferred to them and they began to assume formal positions on the board of directors of the company, the founder withdrawing to the rear guard, but always keeping the last word. With them in charge, the business continued to expand, but simultaneously new business and organizational perspectives were coming up. The biggest changes arose in the administrative areas, namely in the creation of new departments, in the growth in the number of workers and above all in the accounting services. These last, which from the starting up of the business until 2008 had been done externally, giving little more than compliance with legal and tax demands, proceeded to being done internally.

It was in this context, and in a period determined by various striking events and capable of once again leading to big changes, like the opening of manufacturing plants in Angola and Brazil and the early demise of the founder of Politejo, that our research work on the parts played by accountants took place.

4.2The roles of accountants: presentation and discussionIn the opinion of Mouritsen (1996), the role of accounting departments in organizations is more complex than it might appear and varies according to the specific organizational conditions. As a rule, it reflects the involvement of these departments with top managers, being the result of the interaction of the aspirations and knowledge of the accountants with the (daily) needs and demands of those to whom they must directly respond. In Politejo, both the Financial Accounting Department and the Management Accounting Department report directly to the board of directors and are understood to be fundamental to the success of the business, as well as the organizational ‘wellbeing’ of the company, as recognized by its managing director.

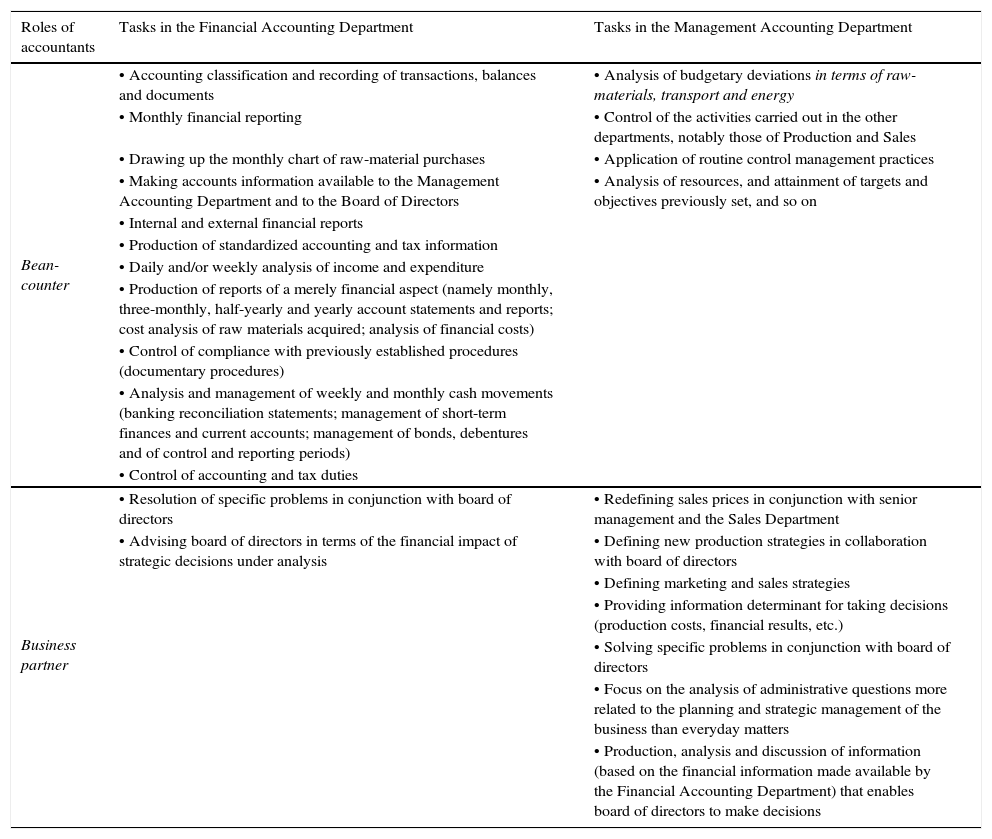

The present work enables us to identify a considerable number of tasks carried out in Politejo's Accounting Departments (Table 1), which are closely linked to the roles of (management) accountants identified in previous studies (Byrne & Pierce, 2007; Granlund & Lukka, 1998; Järvenpäa, 2007; Paulsson, 2012; Robalo & Ribeiro, 2015).

Correspondence of the accounting tasks carried out in Politejo to the roles of accountants.

| Roles of accountants | Tasks in the Financial Accounting Department | Tasks in the Management Accounting Department |

|---|---|---|

| Bean-counter | • Accounting classification and recording of transactions, balances and documents | • Analysis of budgetary deviations in terms of raw-materials, transport and energy |

| • Monthly financial reporting | • Control of the activities carried out in the other departments, notably those of Production and Sales | |

| • Drawing up the monthly chart of raw-material purchases | • Application of routine control management practices | |

| • Making accounts information available to the Management Accounting Department and to the Board of Directors | • Analysis of resources, and attainment of targets and objectives previously set, and so on | |

| • Internal and external financial reports | ||

| • Production of standardized accounting and tax information | ||

| • Daily and/or weekly analysis of income and expenditure | ||

| • Production of reports of a merely financial aspect (namely monthly, three-monthly, half-yearly and yearly account statements and reports; cost analysis of raw materials acquired; analysis of financial costs) | ||

| • Control of compliance with previously established procedures (documentary procedures) | ||

| • Analysis and management of weekly and monthly cash movements (banking reconciliation statements; management of short-term finances and current accounts; management of bonds, debentures and of control and reporting periods) | ||

| • Control of accounting and tax duties | ||

| Business partner | • Resolution of specific problems in conjunction with board of directors | • Redefining sales prices in conjunction with senior management and the Sales Department |

| • Advising board of directors in terms of the financial impact of strategic decisions under analysis | • Defining new production strategies in collaboration with board of directors | |

| • Defining marketing and sales strategies | ||

| • Providing information determinant for taking decisions (production costs, financial results, etc.) | ||

| • Solving specific problems in conjunction with board of directors | ||

| • Focus on the analysis of administrative questions more related to the planning and strategic management of the business than everyday matters | ||

| • Production, analysis and discussion of information (based on the financial information made available by the Financial Accounting Department) that enables board of directors to make decisions |

In this study, we obtained evidence that the roles of bean-counter and business partner are played by the accountants of both the departments under analysis. Nevertheless, there is a different balance in the performance of these roles by each of these departments. The main tasks done by the accountants in the Financial Accounting Department of Politejo are more closely related to the role of bean-counter, whilst the main tasks in the Management Accounting Department are more related to the role of business partner. In the Financial Accounting Department of Politejo we find tasks more associated with traditional financial accountancy, such as, among other things: accounting classification and recording; invoicing; financial reporting; production of accounting and tax information; drawing up account statements and doing other closing work; and control of the treasury movements. In the Management Accounting Department, in its turn, one finds tasks more associated with support for the making of strategic decisions by Politejo's directors.

However, this research also allows us to understand that the traditional role of the accountants of the Financial Accounting Department, turned more towards the tasks of routine accounting (keeping the accounts record of past facts) and showing a passive attitude to management, no longer responds totally to the aspirations and demands of the top management of Politejo, which requires future-oriented procedures and staff able to give direct replies to questions that are essential to the taking of important decisions. This requirement can be deduced from the following extract taken from the interview with the company's managing director: ‘It is important that the (financial) accountants can go beyond financial accounting. It is important for them to understand that sending out invoices is essential, but it's also necessary to make people aware of the importance that this [information] has and that they need to go a bit further and do a bit more. They need to have a critical sense and do some analysis beyond simply sending out invoices.’

It is not rare to hear in the Financial Accounting Department expressions like these: ‘It wasn’t like this before’, ‘We used to work hard, but things were different then’, ‘Today they demand a lot and want everything done by yesterday’. Remarks like this let us know that in Politejo the traditional tasks of accountancy continue to be important, as Granlund and Lukka (1998) point out, but these days it is expected that these accountants will develop their work in ways that go beyond the traditional. However, and as understood by the managing director of Politejo, to realize today's expectations it is necessary to endow the accountants with the suitable tools and above all transmit to them what is intended.

With the objective of adapting the Financial Accounting Department to the expectations and needs of the company, changes have had to be made at various levels, from the recruitment of accountants with a higher level of qualifications to the reorganization of the tasks, including the periodicity of the presentation of financial reports (formerly presented half-yearly, now presented monthly).

It is in this context that one can place the question of the role of the fully qualified accountants and of the other accountants that exercise their functions in the Financial Accounting Department. Although one cannot yet speak of them directly as business partners, it is hoped that these accountants will be ever more closely involved in decision-making processes and that they have the capacity to generate integrated information from which the top management can have useful and opportune accounting data to use in arguments about tactical and strategic decisions. In this way, they will be seeking differentiation even among the typical tasks of the role of bean-counter.

In line with the present debate, it is recognized that there is a growing need for accountants who do not limit their work to the mere technicalities of bookkeeping (billing, recording transactions and preparing statements of account, etc.), maintaining their positions in organizations as passive agents in the execution of their duties. However, although the discourse of the managing director of Politejo accepts the continuing importance of these things, it adds that they must be integrated with knowledge and skills relevant to management, as can be deduced from her own words: ‘It's not by chance that we chose a fully qualified accountant to be our administrative and financial director, while other companies opted to have a manager in that job. In our opinion, the fully qualified accountant who manages to have an overall vision of the business is worth more as a decision-maker… a fully qualified accountant who also has, at the same time, the skills of a manager is very important to the organization. It's in that sense that I think our fully qualified accountant director has those qualities and has constantly growing knowledge of the business, thus providing determinant information for decision-making.’

Even so, the direct and participant observation carried out lets us understand that in Politejo the accountants of the Financial Accounting Department (including the fully qualified accountants) still do not exercise the true role of business partner as defined in the literature, doubtless because the strategic tasks required are few in number and those are confined to a limited range of activities clearly linked to the traditional accounting practices. During several months, it was possible to understand that the strategic tasks – such as the analysis of financial results, the definition of objectives and strategies, and planning – associated with the role of business partner are more often exercised by the accountants of the Management Accounting Department. However, the moderate involvement of the fully qualified accountants in some decision-making processes, above all of a financial and tax nature (namely, management of the treasury movements, financial investments and decisions with tax influence) became more visible.

In this way, the evidence gathered enables us to affirm that in Politejo the accountants of both accounting departments increasingly carry out tasks associated with the role of business partner. Nonetheless, the execution of tasks associated with the role of bean-counter continues to be important in both departments under analysis and, particularly, in the Financial Accounting Department. This result contributes to the literature providing evidence that in medium-sized businesses there is a growth in the importance of the role of business partner on the part of accountants similar to that reported in studies undertaken in large organizations (Granlund & Lukka, 1998; Järvenpäa, 2007; Paulsson, 2012; Robalo & Ribeiro, 2015). In its turn, this study demonstrates that the role of bean-counter is still very important in Politejo, which corroborates the results of other studies (Byrne & Pierce, 2007; Lambert & Sponem, 2012) carried out in large organizations.

5ConclusionIn this paper, we have presented and discussed the roles played by accountants in Politejo, based on tasks carried out by the Financial Accounting Department and the Management Accounting Department. The paper provides evidence that, in spite of the fact that internal discourse highlights the role of the accountants of the Financial Accounting Department (above all, the fully qualified accountants) as business partners, in Politejo, the tasks most associated with this role are more commonly performed by the accountants of the Management Accounting Department.

This study contributes to the literature in three ways. Firstly, being based on the organizational context of a medium-sized company, it furnishes evidence that also in this type of organization we can observe the growing importance of accountants as business partners. Secondly, this study demonstrates that, among the set of tasks typically most associated with the role of bean-counter, we can observe a greater involvement of the accountants in processes that support decision-making, even if those processes are routine and evince some degree of standardization. Thirdly, this study provides evidence that the tasks which have been associated with the role of bean-counter continue to be relevant to accountants, particularly in medium-sized organizations, because the tasks associated with this role are also necessary for the support of tasks associated with the role of business partner.

Like any research, this study is not without limitations. Maybe its greatest limitation is the fact that the subject has been dealt with in the organizational context of one specific organization, so we are unable to generalize its conclusions. Apart from this limitation, this study contributes considerable evidence to the literature on the roles of accountants. Although the study of a single case may not be unusual in the investigation of the roles of accountants, and utilization may even be recommended (Järvenpäa, 2007; Robalo & Ribeiro, 2015), other studies will be necessary for fully comprehending the way accountants balance those tasks belonging to the roles of bean-counter and of business partner.