The use of cryptocurrencies offers attractive business opportunities, in the context of financial services, smart contracts and token-based business models. The objective of this study is to provide a value-based understanding of what drives people to use cryptocurrencies for value exchange. Based on the users’ perceived value of the technology, as logic of decision making, we explore the role of perceived financial value and the perceived emotional value in the intention to use the technology. The unified technology adoption theory provides the potential drivers of these value concepts, which are extended accounting for sustainability. Furthermore, to capture users’ evolving experience with blockchain technologies, we propose the concept of the cryptocurrency knowledge path, capturing the scope and depth of users’ knowledge on the applicability of cryptocurrencies, as potential influence on the value concepts in the decision to actively use cryptocurrencies. For the analysis, a structural model is set up and estimated using partial least square analysis (PLS-SEM). We identify a positive effect of both value concepts, financial and emotional value, on the intention to use cryptocurrencies. However, interestingly, we find that the emotional value assessment is fully mediated through the knowledge path. Furthermore, we find that environmental sustainability considerations are fully mediated through either of the two value concepts. These results provide guidance for a customer-centric, sustainable design and marketing of crypto-projects.

A customer-centric value assessment of financial technologies finds increasing interest for the creation of new business models and marketing, which goes beyond economic performance. The use of cryptocurrencies as a digital medium of value exchange, which relies on decentralized blockchain technology, offers increasing business opportunities in the context of creating network-based trust enabling environments and has experienced an increase in market value from zero to more than $1 trillion (Lee, 2021; Nadeem et al., 2021; Hall & Li, 2021). Examples of how firms are building on cryptocurrencies reach from the realization of payments at Dell, Microsoft, AliExpress, among others (Abbasi et al., 2021), to service exchange or value storage in smart cities or virtual environments and marketplaces (Sharma & Park, 2018), purchase of cloud computing power or cloud-based storage (e.g. Golem or Storj), smart contracts and information traceability for clients (García-Monleón et al., 2021), supply chain management and finance (Aslam et al., 2022; Zheng et al., 2022), and capturing value co-creation based on reward systems and incentive schemes, as for instance in blogging platforms (e.g., Steemit), decentralized streaming platforms (e.g., DTube), social networking platforms (e.g., Reddit, Discord) or learning platforms (e.g., Tutellus). Given this increasing scope of cryptocurrency use, we need to broaden understanding of how cryptocurrencies create expanded value for new business projects and marketing. This can be addressed through the analysis of customers’ perceived costs and benefits in line with the suggestions by Zheng et al. (2022).

The literature on technology adoption of cryptocurrencies has so far focused on Bitcoin as a payment for product acquisition (Palos-Sanchez et al., 2021; Alharbi & Sohaib, 2021; Nadeem et al., 2021) or cryptocurrencies in general (Abbasi et al., 2021). However, a human-centered approach to the adoption of cryptocurrencies is still sparse (Nadeem et al., 2021; Alshamsi & Andras, 2019). Considering the adoption of disruptive technologies in general, a value-based approach to technology adoption (the VAM approach, introduced by Kim et al. 2007), which models the perceived value as a mediating effect between determinants of technology adoption and behavioral intention, finds increasing application with the objective to identify and assess value drivers (Erdmann, Mas, & Arilla, 2021; Vishwakarma et al., 2020; Kim et al., 2017a, 2017b). Likewise, in the context of investment decisions, cognitive values (e.g. financial and functional value) as well as affective values (e.g., emotional value) have been found to be relevant to support network-based investments like crowdfunding (Moysidou & Spaeth, 2016).

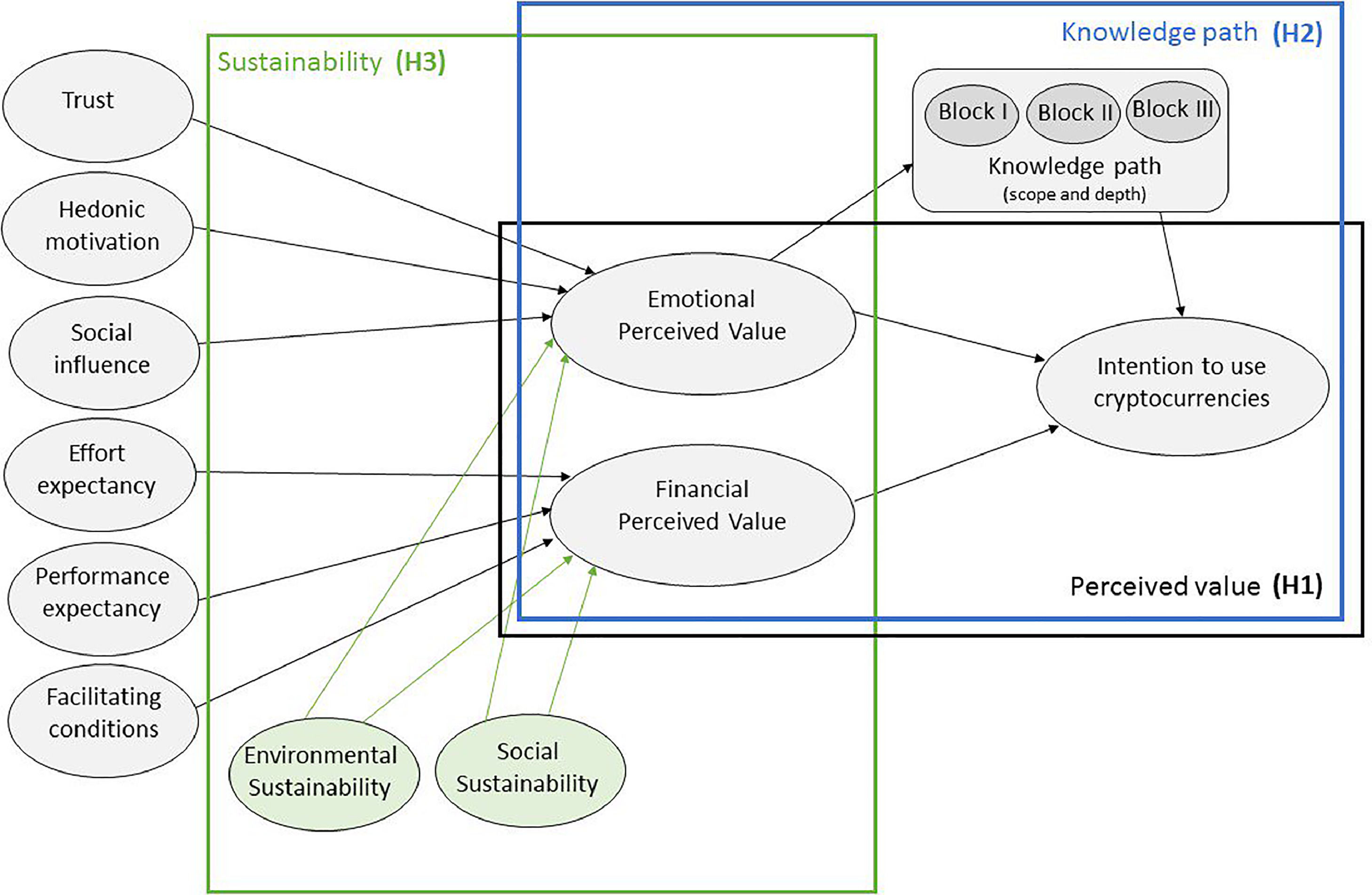

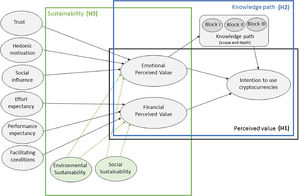

Hence, in order to explore from a customer-centric perspective what drives the decision to use cryptocurrencies, this paper analyzes the intention to use cryptocurrencies based on the users’ perceived value of the technology, which is differentiated in financial and emotional perceived value. Concretely, we set up an adapted structural model of value-based technology adoption (VAM). To account for the increasing applicability of cryptocurrencies and knowledge, we investigate the role of the ‘crypto knowledge path’ (a staggered construct of the scope and depth of knowledge on the applicability of cryptocurrencies) in the relationship between the users’ value assessment and intention to use the technology. The antecedents of the perceived value concepts are the usual constructs from the technology adoption theories (UTAUT2 by Venkatesh et al., 2012), which are extended by sustainability considerations. Given that anonymity of the user profile of blockchain technology (Meng et al., 2023), data have been gathered through an online survey of a random sample of potential users grouped by common interests. The model is estimated using partial least square analysis (PLS-SEM).

The results suggest a positive effect of both value concepts, financial and emotional value, on the intention to use cryptocurrencies. However, interestingly, we find a full mediation effect of the emotional part of the perceived value through the knowledge path. Furthermore, we find that environmental sustainability considerations in the intention to use cryptocurrencies are fully mediated through the perceived financial value while social sustainability considerations are fully mediated through the financial as well as emotional perceived value. This contributes to a customer-centric understanding of the value drivers of cryptocurrency-projects and a sustainable and smart investment.

The paper proceeds as follows. Section 2 introduces the value perspective on cryptocurrency in the context of technology adoption, and develops the hypothesis of potential value drivers, including the importance of the role of experience in the users’ intention. Section 3 presents the methodology and data used. Section 4 presents the results. Section 5 provides a discussion of the results and management implications, and the last section concludes.

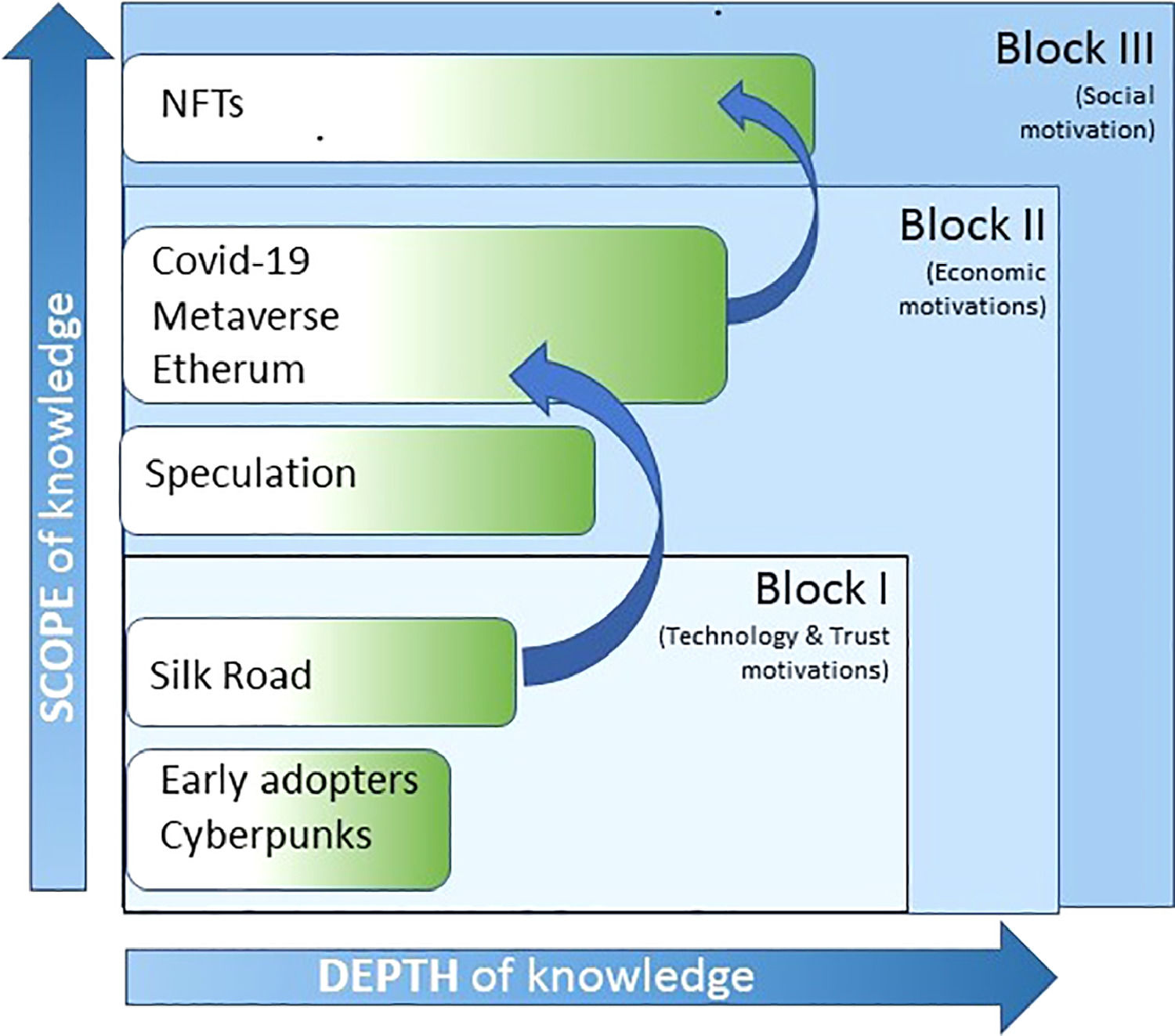

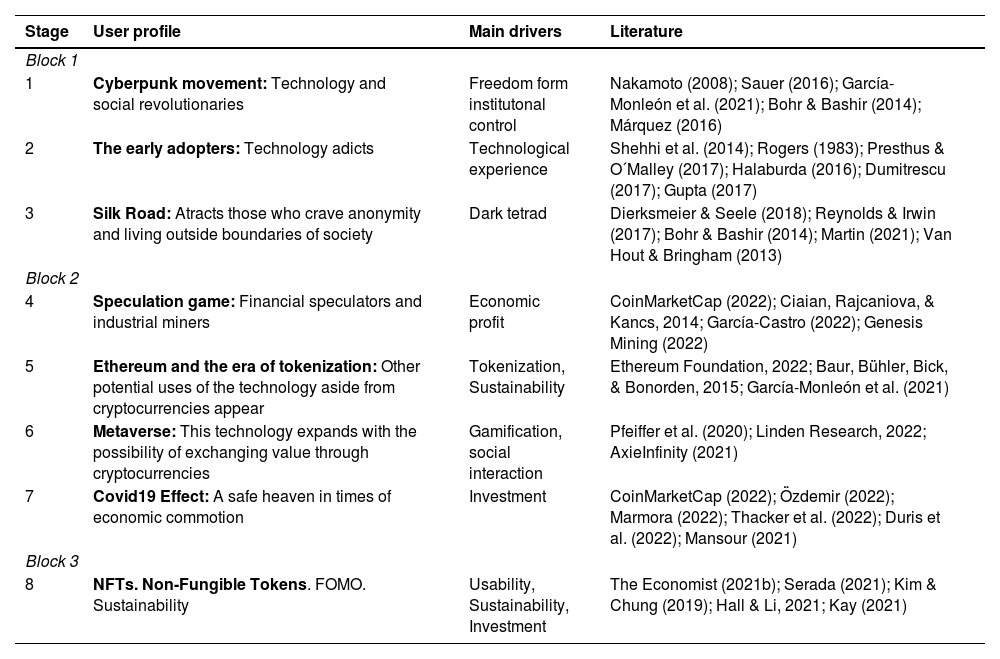

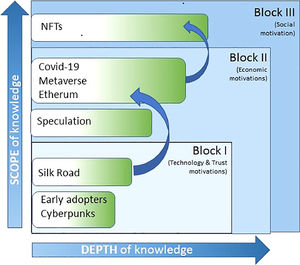

Literature reviewThe perception and intention to use cryptocurrencies is a natural consequence of the environment and conditions in which the blockchain was born and the understanding of the behavioral intention of potential users is key for a successful implementation in different business contexts. The unique features of blockchain provide solutions for different aspects in B2B as well as B2C commerce. For instance, Aslam et al. (2022), focusing on logistics, highlight how blockchain can improve the supply chain, especially with respect to information sharing which is crucial for integration and coordination within the supply chain. However, Zheng et al. (2022) argue that in order to facilitate the adoption of blockchain technology, relevant research should explore the costs and benefits perceived by customers. The benefits go beyond economic and financial incentives. Users value the speedy transactions, transparency, freedom of investment without government control, anonymity, privacy and the potential contribution to sustainability in its different dimensions, such as financial inclusion or from an environmental perspective (Lee, 2021; Nadeem et al., 2021; Hall & Li, 2021; Zheng et al., 2022). The main drivers for cryptocurrency adoption have been evolving throughout its brief history with the evolution of the main user profile (Table 1). This goes along with the evolution and depth of knowledge on cryptocurrencies, which we denote as the “Crypto-Knowledge path” (Fig. 1). To understand people's decision making regarding the use of cryptocurrencies, the perceived value offers a logic of predicting the intention to use a technology, and technology adoption theories provide guidance in the identification of value drivers for the assessment of the technology.

Stages of cryptocurrency adoption.

| Stage | User profile | Main drivers | Literature |

|---|---|---|---|

| Block 1 | |||

| 1 | Cyberpunk movement: Technology and social revolutionaries | Freedom form institutonal control | Nakamoto (2008); Sauer (2016); García-Monleón et al. (2021); Bohr & Bashir (2014); Márquez (2016) |

| 2 | The early adopters: Technology adicts | Technological experience | Shehhi et al. (2014); Rogers (1983); Presthus & O´Malley (2017); Halaburda (2016); Dumitrescu (2017); Gupta (2017) |

| 3 | Silk Road: Atracts those who crave anonymity and living outside boundaries of society | Dark tetrad | Dierksmeier & Seele (2018); Reynolds & Irwin (2017); Bohr & Bashir (2014); Martin (2021); Van Hout & Bringham (2013) |

| Block 2 | |||

| 4 | Speculation game: Financial speculators and industrial miners | Economic profit | CoinMarketCap (2022); Ciaian, Rajcaniova, & Kancs, 2014; García-Castro (2022); Genesis Mining (2022) |

| 5 | Ethereum and the era of tokenization: Other potential uses of the technology aside from cryptocurrencies appear | Tokenization, Sustainability | Ethereum Foundation, 2022; Baur, Bühler, Bick, & Bonorden, 2015; García-Monleón et al. (2021) |

| 6 | Metaverse: This technology expands with the possibility of exchanging value through cryptocurrencies | Gamification, social interaction | Pfeiffer et al. (2020); Linden Research, 2022; AxieInfinity (2021) |

| 7 | Covid19 Effect: A safe heaven in times of economic commotion | Investment | CoinMarketCap (2022); Özdemir (2022); Marmora (2022); Thacker et al. (2022); Duris et al. (2022); Mansour (2021) |

| Block 3 | |||

| 8 | NFTs. Non-Fungible Tokens. FOMO. Sustainability | Usability, Sustainability, Investment | The Economist (2021b); Serada (2021); Kim & Chung (2019); Hall & Li, 2021; Kay (2021) |

Source: Own elaboration.

Perceived value is an implicit criterion used by consumers in the decision process, which account for benefits and sacrifices of monetary values (transaction costs, relational costs etc.) as well as nonmonetary values (e.g. time, effort, risk). Given the investment nature of cryptocurrencies, some authors have suggested that the value concept may need differentiation (Boksberger & Melsen, 2011). From an economic perspective, value is traditionally understood as a utility concept, however, perceived value is a broader and more complex concept which involves more than rational utility assessment. The axiology of value, as a multidimensional view of the concept of perceived value, based on Hartman (1967), differentiates between extrinsic value (utilitarian or instrumental use), intrinsic value (emotional appreciation), and systemic value (rational or logical aspects, e.g. relationship between sacrifices and returns.) This framework was adapted by Mattsson (1991) to the three generic value dimensions: emotional (focuses on the feelings of consumers), practical (focuses on functional and physical elements of consumption), and logical (the rational part of the purchase). The latter combines rational decision making, rooted in economics, and assessment of psychological values, and hence has found broad application in different disciplines (e.g., Danaher & Mattsson, 1994). In the financial context, for instance, Moysidou and Spaeth (2016) study the decision making of crowdfunding, differentiating between cognitive and affective components in decision making, which both turn out to be relevant for loan crowdfunding. Whether a similar value differentiation holds for peer-to-peer-based financial technologies such as cryptocurrencies remains an empirical question. In any case, the overall assessment of the different value concepts is understood as an additive function of perceived value concepts (Cronin et al., 1997). Hence, we hypothesize that the perceived value, differentiated into perceived financial value and perceived emotional value, affects the intention to use cryptocurrencies:

H1: The intention to use cryptocurrencies is determined by the users’ perceived value.

H1a: The financial perceived value (as a result of economic cost-benefit analysis) positively influences consumers’ intentions to use cryptocurrencies.

H1b: The emotional perceived value positively influences consumers’ intentions to use cryptocurrencies.

Given this value-based decision-making with respect to cryptocurrencies, it becomes crucial to identify what data drive the perceived rewards of adoption of the technology. Researchers have identified various determinants of the intention to use cryptocurrency using technology adoption theories. Magotra et al. (2017), for instance, studied perceived usefulness as an indication of value perception in the adoption of banking products. Considering the use of cryptocurrencies, the basic drivers of the technology adoption model (TAM), as developed in the seminal work by Davis (1989), namely perceived ease of use and perceived usefulness, have been confirmed in several studies to predict the intention to use cryptocurrencies (Nadeem et al., 2021). This is because fast and decentralized transaction processing is identified as a positive impact on the perceived usefulness of cryptocurrency. However, the focus has been on financial and technological aspects. Venkatesh (2003) proposes a synthesized model based on eight technology adoption theories, which is known as the Unified Theory of Adoption and Use of Technology (UTAUT), which was later extended to the UTAUT2 model (Venkatesh et al., 2012). Both models have replaced the TAM in many research studies emphasizing the higher explanatory power (Abbasi et al., 2021; Shaw & Sergueeva, 2019).

Applied to the adoption of financial innovations for value exchange, several drivers have been highlighted. Effort expectancy has been identified for transactions such as mobile payments (Shaikh et al., 2018) and has been confirmed as a significant element of the adoption of cryptocurrencies (Ji-Xi et al., 2021). Similarly, performance expectancy has been identified as a significant driver of the adoption of cryptocurrencies (Ji-Xi et al., 2021). Accounting for the role of trust in cryptocurrencies, given the historical evolution of usage, it is not surprising that this factor has been identified by several authors as a crucial and strong determinant of intention to use (e.g., Abbasi et al. 2021). This is the case because the underlying blockchain technology is based on codes or blocks in dispersed peer-to-peer networks, verifiable by everyone to keep track of legitimate transactions and ownership, which makes it especially trustworthy (Palos-Sanchez et al., 2021; Lee, 2021; Burniske & Tatar, 2017). Furthermore, considering how important are opinions from others in the intention to adopt new technologies, a variety of technology adoption models consider the social influence. However, for the adoption of cryptocurrency technologies the effect of the opinions of peers, family or friends (subjective norm) has been ambiguous. Abbasi et al. (2021) do not find any effect of social influence while Ji-Xi et al. (2021) find that social influence only has an effect on investment intention in cryptocurrencies when moderated by age. Furthermore, the resources and opportunities which allow a concrete behavior to be performed using the technology, summarized as facilitating conditions, are potential determinants of technology adoption, and have been confirmed in the case of cryptocurrencies (Ji-Xi et al., 2021). Finally, considering enjoyment as an important element in the behavioural intention towards a new technology, applied to cryptocurrencies adoption, a direct effect of the hedonic motivation on behavioral intention could not be identified. However, Abbasi et al. (2021) identify an influence on perceived private value, which in turn affects the intention to adopt cryptocurrencies. These results suggest a value-based approach to the adoption of cryptocurrencies or blockchain technology in general.

At the same time, we observe a shift towards value-based assessment of technology adoption. Kim et al. (2007) were the first to incorporate the value dimension in terms of perceived value (considering monetary and non-monetary costs and benefits) in a TAM framework of mobile internet adoption, which has been applied and extended to a variety of technologies, such as augmented reality smart glasses, virtual reality, smart home services, tablet PCs (Erdmann, Mas, & Arilla, 2021; Vishwakarma et al., 2020; Kim et al., 2017a, 2017b). In the same line, based on the UTAUT2 applied to mobile commerce, Shaw and Sergueeva (2019) replace price value with perceived value and find evidence that consumers evaluate the trade-off, that is, perceived value has a significant effect on the adoption of e-commerce. Considering cryptocurrency adoption, some elements have been found to have a mediated effect on the intention to adopt the technology through price value (Abbasi et al., 2021), which suggests for the adoption of cryptocurrencies that the underlying decision is driven by users’ perceived value, as has been identified for other disruptive technologies.

Furthermore, Venkatesh et al. (2012) introduce the latent variable habit, a construct which is understood as an action learned over time which goes along with an almost automatic response (Shaw & Sergueeva, 2019), but has so far not been included in models of cryptocurrency adoption with the argument of the state of early adoption (e.g., Abbasi et al. 2021). Chou and Hsu (2015) find that the online shopping habit moderates customers’ perception of a retailer and the intention to repurchase from the firm. In this case, habit is defined as a behavior that has become automatic, and reflects the history of interaction between the customer and the firm. Note that for disruptive technologies, the term ‘habit’ is too strong if the technology is not yet consolidated, however, this is analogous to considering the acquired experience and scope in use of the new technology which will eventually become a habit. Through the lens of experience, Zhao and Zhang (2021) analyze the effect of financial knowledge and investment experience on investment in cryptocurrencies and find a significant direct effect of subjective knowledge on investment behavior and a mediating effect of experience on cryptocurrency investment. Given the practiced actions, experience may result in conscious or less conscious investment behavior, however, has so far been left unconsidered in the UTAUT2 framework applied to cryptocurrencies (Abbasi et al., 2021). Also, the literature has shown that personal traits of technology readiness have a positive impact on the adoption of cryptocurrencies (Alharbi & Sohaib, 2021; Sohaib et al., 2019). In the same line, psychological discomfort related to technology use (introduced by Parasuraman and Colby, 2015) has been found to influence the relationship between motivation and intention for continuous use (Kim et al., 2021). Hence, given the evolution of the knowledge of cryptocurrency use, in scope of knowledge and depth of knowledge, as conceptualized in Fig. 1 (based on the evolution of cryptocurrency use, Table 1), the users’ stage within the crypto knowledge path may influence the intention to use cryptocurrencies and potentially affect the role of psychological value aspects. Concretely, we hypothesize and test empirically whether the knowledge path, as a staggered construct of the scope and depth of knowledge, has a possible mediating effect on the intention to use cryptocurrencies.

H2: Depth and scope of crypto-knowledge mediate the relationship between perceived value and intention to use cryptocurrencies.

H2a: The knowledge path (fully) mediates the relationship between the emotional perceived value and the intention to use cryptocurrencies.

H2b: The knowledge path (fully) mediates the relationship between the financial perceived value and the intention to use cryptocurrencies.

In addition to the determinants identified by previous literature, sustainability has become a key aspect in the discussion of adopting disruptive technologies at a large scale, with the investor side pushing for more ESG solutions (GreenBiz, 2020), and governments and international institutions are pushing through changes (e.g., OECD Green Growth Strategy) providing recommendations and measurement tools to support countries’ effort to achieve sustainable economic growth and development (OECD, 2022). Sustainability in the context of investment in blockchain currency can be considered in terms of green processing technology (SDG7), accessibility to financial markets and equal opportunities (SDG1), decent work and economic growth through sharing (SDG8), and the development of smart cities (SDG11). Crypto assets mining constitutes a threat to energy efficiency and contamination since it generates high consumption of energy (Jiang et al., 2021). Contribution to this SDG shall come from technological improvements which reduce the carbon footprint from block processing. The potential contribution from blockchain may come from increased efficiency in data processing or be the base for clean energy projects (Hou, Wang, & Liu, 2018) and green IoT ecosystems (Sharma, Kumar, & Park, 2020). Furthermore, cryptocurrencies may contribute to the reduction of poverty by reducing financial exclusion in communities with no access to financial markets due to not having any financial institution nearby, or not having access to a personal identification document (Lewis, McPartland, & Ranjan, 2017). Also, blockchain technology may contribute to this SDG through shared economic projects (Pazaitis et al., 2017). Differentiating between environmental sustainability considerations and social sustainability considerations (in terms of accessibility and equality of opportunities), we hypothesize that sustainability considerations influence the adoption of cryptocurrencies through perceived value.

H3: Sustainability considerations affect the intention to use cryptocurrencies fully through the users’ perceived value.

H3a: Environmental sustainability considerations affect the intention to use cryptocurrencies through the perceived value concepts (financial or emotional perceived value).

H3b: Social sustainability considerations affect the intention to use cryptocurrencies through the perceived value concepts (financial or emotional perceived value).

Fig. 2 presents the conceptual framework accounting for H1–H3, which address the objective to explore the role of perceived value, sustainability considerations and the knowledge path in the intention to use cryptocurrencies.

Methodology and dataFor the exploration of the relationship between concepts of consumers' assessment and behaviour intention to use cryptocurrencies, we estimate the proposed model (Fig. 2) using partial least squares structural equation modeling (PLS-SEM). The PLS-SEM approach, as an alternative to factor-based structural equation modeling (SEM), has grown significantly in the last decade, finding application in different areas in Social Science (Henseler et al., 2012). While the literature often justifies the use of the model with good performance for small sample sizes or better parameter accuracy for non-normal data, Sarstedt et al. (2021) emphasize that an important advantage of PLS-SEM is the causal-predictive paradigm, which combines a predictive-oriented approach (as used in technology acceptance models by Davis 1989 and Venkatesh et al. 2003) with factor-based theory confirmation, and hence is especially relevant in applied explorative research in Marketing. Recently, structural equation modeling based on latent variables, and in particular the PLS-SEM approach, finds also increasing interest in the financial literature (Ramli, Latan, & Solovida, 2019).

To estimate the model, a questionnaire has been constructed based on a validated five-point Likert scales, adopted and adapted from previous literature. The target outcome, the intention to use cryptocurrencies, has been adapted from Abbasi et al. (2021), Alharbi and Sohaib (2021) and Nadeem et al. (2021), all focused on the adoption of cryptocurrencies in general or Bitcoin, based on the original scale by Venkatesh et al. (2012). We excluded those items restricted to the purchase of products rather than general intention to use. The perceived value, as defined by Kim et al. (2007), is here differentiated into financial perceived value and emotional perceived value. The financial perceived value is adapted from the private value construct introduced by Venkatesh et al. (2012), in line with the perceived financial value from Lutfi et al. (2021). The four items used are in line with the cost-benefit analysis as suggested by Kim et al. (2007). The emotional perceived value is adopted with all 16 items from the original scale by Ahn and Seo (2015), based on the emotional state model by Mehrabian and Russell (1974). Given the well-established construct, we make use of the Spanish translation of the scale by Gurbindo and Ortega (1989). In order to explore the effect of the cryptocurrency knowledge path, we measure the experience or expertise of respondents in the use of cryptocurrencies in a particular context, classified into three different constructs, one for each established knowledge block. The scales for each knowledge block have been adapted from Gleim and Lawson (2014). Finally, the UTAUT2 constructs have been used, adopting the scales from Venkatesh et al. (2003, 2012), in line with the work by Abbasi et al. (2021). Sustainability considerations in the context of cryptocurrencies are differentiated in environmentalism, adapted from Cervellon (2012), who evaluates the extent to which consumers consider in their decision that products or services – here digital assets – are the least harmful for people and the environment) and social sustainability in terms of equal opportunity and inclusion, adapted from Grappi et al. (2013), who measures the importance a person places on social goals such as equality and cooperation in his/her value system.

All the questions were translated into Spanish and an online questionnaire (using Google Form) was sent out to the different age groups through the university network for students as well as professional networks for other age groups. The different groups by stages of technology adoption were addressed through naturally occurring clustering by interest in blogs, chats, companies, and client lists of private companies.

The structural equation model, based on the graphical representation in Fig. 2, can be expressed as follows based on the latent variables.

Direct effectsMediation effect of Perceived Value considerations

Mediation effect of Knowledge Path

where, IUC is the dependent variable (intention to use cryptocurrencies) and the first equation represents the direct effect of all the considered determinants of adoption of technology (trust, hedonic motivation, social influence, performance expectancy, effort expectancy, facilitating conditions, environmental sustainability, social sustainability). The second block of equations models the mediation effect of the financial perceived value (Financial PV) and the emotional perceived value (Emotional PV), as established in hypotheses H1a and H1b. The third block of equations models the relationship between the perceived value constructs and the dependent variable mediated through the knowledge path, as established in hypotheses H2a and H2b. The mediation analysis (as well as a test of a potential moderated effect) was carried out using SmartPLS software. The model is estimated using resampling techniques (bootstrapping with 500 samples).In order to determine the minimum sample size to obtain accurate results, we follow the suggestions by Hair et al. (2019) to perform a power analysis. For the analysis, we use the software G*Power 3.1 (Faul et al., 2007) to determine, prior to the analysis, the necessary sample size to achieve a statistical power of at least 0.8 with a medium effect size of 0.15, as suggested by Cohen (1988). The number of predictors in the established model is eight, as the largest number of antecedent latent variables. The F-test suggests that for a significance level of 5% we need at least 109 valid responses to estimate the full model and to achieve a power of at least 0.95, a sample size of 160 observations would be sufficient. Since we count a total of 179 respondents and 175 valid and complete questionnaires, the sample is sufficiently large to guarantee accurate results.

The definition of a representative sample of potential user profiles is challenging, since the academic literature is scarce with regards to the blockchain user profile and given that the main feature of this technology is anonymity. However, there is increasing research in this field and user profile models from technology adoption research start to appear (e.g., Albayati, Kim, & Rho, 2020; Aslam et al., 2022; Zheng et al. 2022; Sun, Shahzad, & Razzaq, 2022). For our analysis, we propose a segmentation of the user type and drivers for adoption by its stage in the construct of the knowledge path, in terms of the variety of applications (scope of knowledge) and the grade of knowledge (depth of knowledge), as illustrated in Fig. 1.

The sample for the survey was obtained from five different groups: the first two groups were potential users from the Higher Education sector, without a specifically revealed blockchain profile. First, to address the youngest potential users, students from a private university in Spain were surveyed. Second, addressing the group of older potential users, university professors were surveyed. The other three groups were all people which given their natural environment or association have previously shown interest in the field of blockchain technology. The third group comes from the database of clients from a Spanish consulting firm in the branch of cryptocurrencies. The fourth group are followers from a blog on cryptocurrencies (Gracía-Monleón, 2022), which allows the sector of professional users to be addressed. Finally, to address users from different ages but with an already clear interest in these technologies, with the same purpose but through a different channel, LinkedIn followers from several blockchain professionals were addressed.

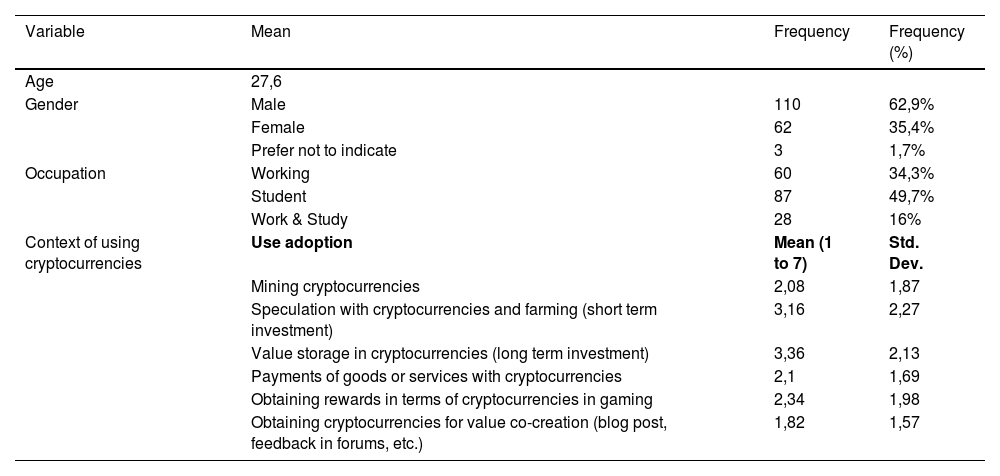

The demographic profile of the respondents is presented in Table 2. The average age of the 175 respondents is 27.6 years with a preponderance of male over female (62.9% to 35.4%). With respect to the occupation dimension, the preponderance is in favor of students over workers (49.7% to 34.3%). With respect to the adoption levels of the different dimensions of cryptocurrency uses, based on a scale of 1 to 7, the most adopted use for cryptocurrencies would be value storage (3.36) closely followed by speculation (3.16), leaving as the less adopted use reward for value co-creation (1.82).

Profile of respondents.

Source: Own elaboration.

The relatively low age of the respondents can be explained by the blockchain technology adoption pattern. Nonetheless, the literature in this regard is to some extent contradictory. For Yeong, Kalid, and Sugathan (2019), age is not a driver for the adoption of this technology, whereas Bohr and Bashir (2014) surveyed Bitcoin users, finding that this asset had spread mainly among youngsters with an average age of 33 years. The contradiction of these two sources may arise from different societies, cultural aspects or different time horizons which imply differences in the stages of cryptocurrency use.

ResultsAnalysis of the measurement modelThe correlation loadings for all constructs are in the interval between [0.789; 0.977], that is, all loadings are larger than 0.708, which according to Carmines and Zeller (1979) reveals a sufficient level of explained variance of the respective indicator. Additionally, the reliability of the constructs is analyzed. As suggested by Nunnally and Bernstein (1994), to guarantee reliability, Cronbach's Alpha should be superior to the critical value of 0.7, which is met for all the considered latent variables with the lowest value being 0.900. Moreover, the same authors recommend that the composite reliability should be larger than 0.7, which is also the case, with the lowest value being 0.930. Furthermore, following Hair et al. (2019), the convergent validity, based on the average variance extracted, should be at least 50%, which is also fulfilled, with the lowest value being 0.717. These results were expected since all the scales used had been validated in previous literature. Finally, we consider the correlation table between constructs to carry out a discriminant analysis following Fornell and Larcker (1981), which requires that the square root of the average variance extracted for each latent variable is larger than the correlation between variables, that is, a variable should share more variance with its indicators than with others. This is the case for all variables, except for block 2 with block 1 and block 3 with block 2. Although the corresponding cross-loadings for each block are the highest, the correlation of block 2 with block 1 is 0.947 and the correlation of block 3 with block 2 is 0.910. Likewise, considering the Heterotrait-Monotrait by Henseler et al. (2015), we find values of 1.014 and 0.986 respectively. Following the argumentation by Hafkesbrink (2021), this is the case by construction of these higher order latent constructs. In the case of the established knowledge path, this is supposed not to be an issue since by logic the constructs are accumulatively related. However, in order to avoid any possible bias in the estimates due to this issue, we adapt the proposed solution by Hafkesbrink (2021) and use latent variable scores for the knowledge blocks, that is, the knowledge path is estimated as a second order model. The results are robust to this estimation and the resulting HTMT values, as the most conservative criterion, are now all below 0.95 and hence below 1.00 so that a lack of discriminant validity is unlikely (Henseler et al., 2015).

Analysis of the structural modelThe baseline model, that is, the model without the consideration of the knowledge path, reveals an overall effect size of R2=0.669. The coefficient of determination of the financial perceived value is R2=0.81 and for the emotional perceived value R2=0.41. However, when estimating the full model, accounting for the mediating effect of the knowledge blocks, the explained variance in the intention to use cryptocurrency improves considerably, rising to 83% (R2=0.834).

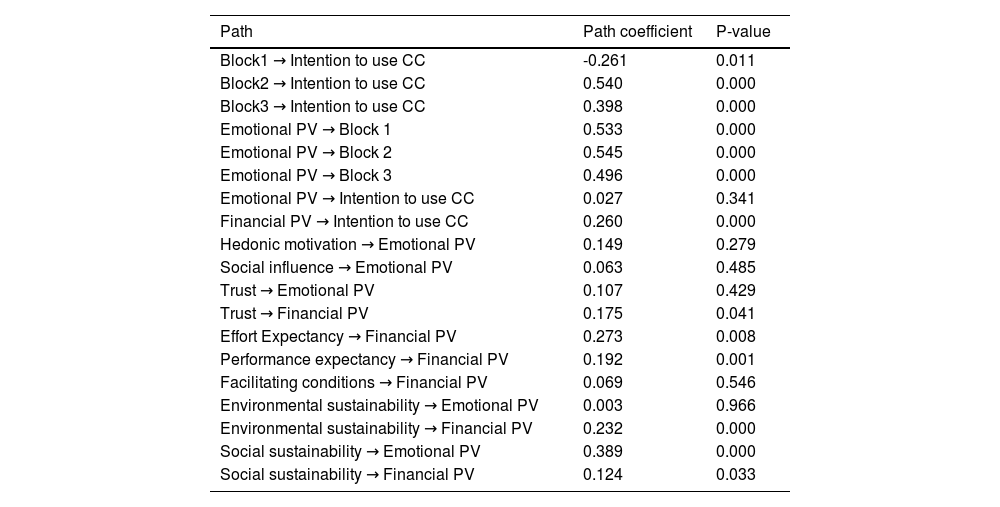

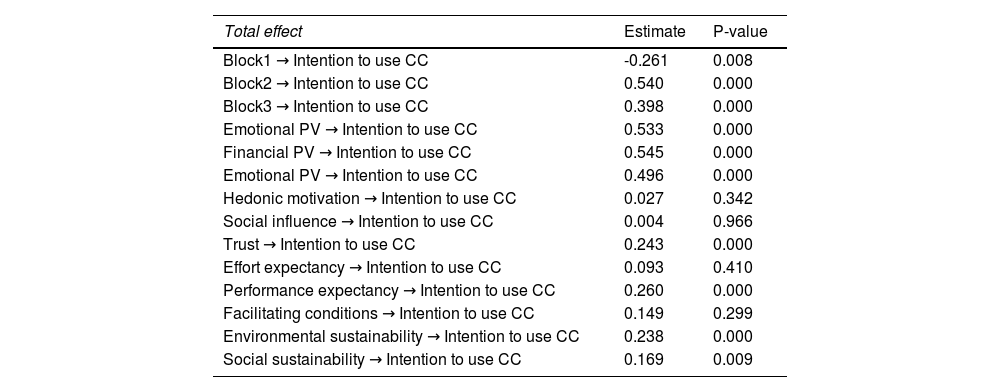

Table 3 provides the estimated path coefficients for the proposed model and Table 4 reports the total effects.

Estimated path coefficients.

Source: Own elaboration.

Total effects.

Source: Own elaboration.

Based on the perceived value consideration in the intention to use cryptocurrencies, we identify a significant positive direct effect of the financial perceived value on the intention to use cryptocurrencies (H1a). Understanding the financial value assessment as a cost-benefit relation, the study identifies effort expectancy and performance expectancy as relevant value drivers. This is in line with Shaikh et al. (2018) or Ji-Xi (2021), who identify effort expectancy as a relevant driver for cryptocurrency adoption. Likewise, performance expectancy has also driven technology adoption in tune with previous studies such as Ji-Xi (2021). Furthermore, trust has been confirmed as a relevant factor in users’ value assessment of cryptocurrencies, which was to be expected since this is possibly the main grounding for the historical birth of this technology, with trust being achieved by the absolute anonymity of users (Venkatesh et al., 2012; Palos-Sanchez et al., 2021; Lee, 2021; Burniske & Tatar, 2017). The direct effect of the emotional perceived value of cryptocurrencies is only significant in the baseline model, but the full structural model reveals that the emotional perceived value is fully mediated through the knowledge path (H2a). The joint outcome of the analysis of H1(a and b) and H2a is a portrait of the concept of value from the perspective of cryptocurrencies adoption. This value is mainly understood from a financial perspective given the historical origin as a purely financial tool, and emotional value assessment affects the intention to use cryptocurrencies through the users’ knowledge stage. That is, knowledge becomes a mediator for emotional considerations, which cannot be addressed by a user who lacks the basis for a full value assessment, as analyzed by Domingo, Piñeiro-Chousa, and López-Cabarcos (2020) for the particular case of Initial Coin Offerings. The positive total effect of both types of perceived value is in line with rational and psychological values in decision making (Danaher & Mattsson, 1994) and, in particular, the role of cognitive as well as affective values in other types of network-based financial decision making (Moysidou & Spaeth, 2016). The mediated effect of the emotional perceived value suggests that it is not so much the emotions but actually the scope of knowledge respective to the possibilities of applications of the new technology and the depth of this knowledge which induces potential users to adopt cryptocurrencies. That is, it is the evolutionary stage of the technology in which the consumer implicitly projects himself into what drives his intention to use the technology.

The insignificance of the facilitating conditions is not as expected and contrary to the results of Ji-Xi et al. (2021). Facilitating conditions are here understood as resources at hand which may explain that this is not an issue given the profile of the respondents. However, if we were defining facilitating conditions in a broader sense, like in the analysis of Magotra et al. (2017) of the Indian banking system, the economic effect of investment in digital assets like cryptocurrencies is also expected to depend on the regulations of a country. Considering, for instance, the case of China, in 2011 the investment in Bitcoins in the country exceeded the investment in the United States, however since financial institutions and banks were forbidden to trade with these digital assets (Nadeem et al., 2021) and recently also the Bitcoin exchange in China (BTCC) was suppressed by the government, with the argument that it harms the path of decarbonization of the economy (The Economist, 2021a), a new measure of sustainable economic effect of blockchain technologies is needed. This approach to facilitating conditions is expected to present different results, depending on the context. Concretely, the research opens a new line of investigation since it is expected that different social, technical and economic conditions amid potential users may present differential implications.

Social opinion could not be identified as a relevant driver of the adoption of cryptocurrencies through value considerations. In previous literature, the effect of the opinion of others with respect to cryptocurrency use is already ambiguous (Abbasi et al., 2021; Ji-Xi et al., 2021), such that our results confirm once more that social opinion is not one of the main general drivers of cryptocurrency adoption. Future investigations in this line may contribute to set uniformity in this regard.

Sustainability considerations in the intention to use cryptocurrencies turn out not to have a direct effect (H3) but are fully mediated through the perceived value constructs (H1). Concretely, social sustainability positively impacts both value concepts, although the effect on the emotional part is larger in magnitude. However, environmental sustainability has only been fully mediated through the financial perceived value. This suggests that environmental sustainability is associated with the idea of a better economic perspective. Last but not least, the positive relationship between environmental sustainability and financial perceived value may also be explained by the motivation to have a clear conscience (Lasarov et al., 2022).

Implications for managementBased on the above quoted line of argumentation, the results suggest that an increasing education in technology, in terms of depth and scope of knowledge, shall contribute to a wider adoption of cryptocurrency use. The practical implication for this is that the future development of blockchain markets and crypto-marketing shall be linked to a reinforcement of theoretical and practical education for current and potential users.

Moreover, the value-based approach allows more understanding of how sustainability considerations enter decision making in the adoption of cryptocurrencies, which contributes to paving the way to meet sustainability objectives, for instance through an appropriate value communication strategy and education. Based on this argument, it is recommended that any crypto-project aspiring to achieve financial support and market success shall be backed by a sustainability argument triggering the value perception of potential users, instead of targeting directly the intention to use the technology. Furthermore, the differences in sustainability considerations on the types of perceived value suggests to trigger different kinds of sustainability goals, depending on whether the communication is directed at emotional needs or awareness of potential users or at investment purposes. As we observe for the best brands, the image of sustainability goes along with economic success (e.g. Tesla). At the same time, we understand that social as well as environmental sustainability is associated with more stable and durable value. The objectives of the 2030 and 2050 EU agendas (United Nations, 2022) are now commonplace between investors of any kind and set a clear path for economic development which is necessarily attached to sustainability. Note that this is in line with the pattern revealed in our analysis, that is, the consciousness of sustainability objectives influences the perceived value and hence the adoption of new technologies such as cryptocurrencies.

Limitations and further lines of researchOne of the limitations of the study is the sampling based on a single geographic market and a high income region. Our conjecture is that the effect of facilitating conditions may become significant in low income regions, especially in dimensions like mining, which require a high level of infrastructure and therefore economic resources. For instance, Magotra et al. (2017) analyses the adoption of Indian banking services, where an increased value perception not only comes from increased ease of use but through the facilitating conditions in an environment of low financial accessibility. Also, it is expected that aspects like long-term saving and speculation lose their main position in favor of their complementary image, that is, credit demand. Decentralized financial services shall become one of the essential roles in areas where most of the people are unbanked PwC (2019). On the other hand, it is expected that sustainability considerations may not be as relevant since the objectives stated in the 2030 and 2050 agendas do not address low income areas. These considerations, apart from constituting a limitation of our investigation, open the door to a new research line for cryptocurrency and blockchain adoption in low income areas, as well as new and to date little explored fields of economic activity based on value perception. The potential offered by blockchain adoption in low income areas, apart from constituting an interesting future line of investigation, offers a wide field for service providers who, apart from contributing to financial sustainability, may contribute to economic expansion.

Finally, a further step in the study of the evolution of blockchain technology use in business would be the adoption of cryptocurrencies as a payment mechanism for metaverse platforms. We expect that perceived rewards using cryptocurrencies in this new context is driven by similar patterns and exchange mechanisms. Moreover, for further research, it may be interesting to go one step further in the knowledge path, and study the adoption pattern of NFTs, which are now receiving increasing interest from sectors outside the traditional field for blockchain technology adopters, such as art creators and dealers who are now facing a completely new and unexplored business field, which opens a new landscape for value perception and adoption patterns (Kay, 2021).

ConclusionsBlockchain can contribute to improve different economic areas such as banking, supply chain management, data management and protection among many others quoted throughout this research. Nonetheless, even though there are relevant research lines on blockchain technology, research in customer adoption of blockchain-based cryptocurrency based on perceived costs and benefits is still scarce and this is where this investigation finds its place to provide the basis for a customer-centric approach and Marketing of cryptocurrency projects.

This paper discusses the framework for the use of cryptocurrency and explores the main drivers for the adoption of blockchain-based cryptocurrency from the users’ value perspective. The distinction between financial and emotional value concepts suggests that the perceived financial value operates as the main driver for cryptocurrency, driven by the expected financial results, the expected effort or ease of use of the technology and trust. Emotional aspects are mediated through the depth and scope of knowledge users have on using cryptocurrencies. Concretely, the construct of a cryptocurrency knowledge path is defined, and the progress through it by users is what directly affects the adoption decision, suggesting that further education among individuals may undoubtedly drive further acceptation and, hence, market penetration. Furthermore, sustainability considerations from both social and environmental perspectives are shown to be relevant for the adoption of cryptocurrencies through the users’ perceived value. This suggests that the current contextual emphasis on the sustainability of any economic or social activity has its impact on the spread of using blockchain technology through the users’ perceived value.