In the digital economy era, the pathways of digital transformation and intelligent development have emerged as crucial avenues for enterprises’ high-quality development. Focusing on listed private enterprises from 2011 to 2020, this study uses text mining to extract keywords related to digital transformation, as disclosed in annual reports. We construct a digital transformation index and empirically examine its impact on enterprise innovation and innovation incentive policies’ synergistic effects. The results demonstrate that digital transformation significantly promotes innovation in private enterprises, with a more pronounced catalytic effect in economically developed regions characterised by higher levels of the digital economy and larger enterprises. Simultaneously, innovation incentive policies play a crucial role in enhancing digital transformation's impact on innovation in private enterprises. Further investigation reveals that digital transformation's impact mechanism on private enterprise innovation is driven primarily by four paths—specifically improving information transparency, reducing operational risks, alleviating financing constraints, and enhancing total factor productivity. This study provides empirical evidence regarding innovation breakthroughs and driving paths for private enterprises to achieve high-quality development as well as valuable references and insights for policy formulation.

As the new generation of information technology, big data, and artificial intelligence evolves, data are emerging as a pivotal factor in propelling economic development and technological change (Alnuaimi, Singh, Ren & Budhwar, 2022; Siachou, Vrontis & Trichina, 2021). Digital technology's constant integration with the real economy is ushering in a digital economy era, precipitating radical institutional changes and the combined effects of digital innovations (Hinings, Gegenhuber & Greenwood, 2018). The global digital economy is progressing rapidly, and within the European Union, digitalisation stands out as a major force driving economic and social change (Ha, 2022). In 2017, China strategically incorporated the digital economy's construction into its national agenda, thereby actively fostering the digital economy's growth in recent years. By 2020, the Chinese digital economy's scale reached 39.2 trillion yuan, accounting for 38.6 % of China's GDP. Meanwhile, in 2021, Norway's digital economy witnessed a growth of 34.4 %, and in Germany, the United Kingdom, and the United States, the digital economy contributeds more than 65 % of the GDP.

In the digital economy era, enterprises are aligning with the digital transformation trend to navigate significant changes swiftly. Recently, digital transformation has profoundly impacted individuals, businesses, and systems (Galindo-Martín, Castaño-Martínez & Méndez-Picazo, 2019; Del Giudice et al., 2020). This revolution is altering how companies operate, presenting novel management opportunities and challenges in organizational management and technological innovation. The “Digital Technology+” strategy—recognised as a crucial approach for enterprises (Yang & Liu, 2020)—has brought vital opportunities for private enterprises’ transformation and upgrading. Furthermore, research indicates that digital transformation changes business dynamics and offers new prospects for innovators and entrepreneurs (Baiyere, Salmela & Tapanainen, 2020; Bresciani, Huarng, Malhotra & Ferraris, 2021), with a broader impact on value creation and capture (Nambisan, Wright & Feldman, 2019). As the digital economy advances, more enterprises are actively embracing digital technology to facilitate transformation and respond to innovation trends (Hung et al., 2023; Peng & Tao, 2022).

However, digital transformation exhibits characteristics of periodicity, hesitation, and uncertainty. Most Chinese enterprises remain in the exploratory stage of this transformation. Additionally, compared to state-owned enterprises, private enterprises face inherent challenges, such as low technical content, delayed operations, a shortage of talent, and limited investment channels, thus hindering their rapid economic development. Currently, research on whether digital transformation effectively drives innovation in private enterprises is limited. Existing studies posit that digital transformation fosters technological innovation in enterprises (Liu, Li, Wang & Li, 2023; Xue, Zhang, Zhang & Li, 2022; Zhang & Chi, 2022). Digital transformation has become a pragmatic choice for numerous private enterprises, prompting growing interest from the government, businesses, and academia to understand which dimensions of digital transformation promote enterprise innovation. Previous research on digital transformation and enterprise innovation has focused on several dimensions. First, digital transformation propels innovation in enterprise business models (Bresciani et al., 2021; Loebbecke & Picot, 2015). Second, it drives innovation in enterprise organizational management (Hinings et al., 2018). Third, it stimulates innovation in enterprise operational logic and business process management, encompassing aspects such as inventory and value chain management (Baiyere et al., 2020; Marín, Santos-Arteaga, Tavana & Di Caprio, 2023; Zhang & Chi, 2022). Fourth, digital transformation fuels innovation in enterprise infrastructure and institutional building blocks (Appio, Frattini, Petruzzelli & Neirotti, 2021; Hinings et al., 2018), with digitalisation transforming organisations’ resources and capabilities (Leal-Rodríguez, Sanchís-Pedregosa, Moreno-Moreno & Leal-Millán, 2023). Given this enquiry into how digital transformation promotes enterprise innovation, we aim to explore the following fundamental theoretical question: is digital transformation conducive to promoting innovation in private enterprises? If so, through what mechanism does digital transformation promote innovation in private enterprises?

Furthermore, based on the aforementioned analysis and challenges, relying solely on the “Invisible Hand” of private enterprises or markets proves challenging to overcome effectively. In China, private enterprises—compared with their state-owned counterparts—face severe financing constraints that hinder technological innovation. Previous studies have highlighted government policies’ significant impact on enterprise innovation, with public subsidies and assistance being key drivers of innovation (Carboni, 2011; Peng & Tao, 2022). This underscores the need for a “Tangible Hand” to aid digital transformation and technological innovation activities in private enterprises, thereby stimulating innovation investments at the firm level (Lin & Luan, 2020; Liu, Zhao & Wang, 2020). Government policies influence enterprise innovation through factors such as the regional innovation environment, innovation level of regional digital industry, and development level of regional digital economy(Li et al., 2023; Qinqin et al., 2023). Against the backdrop of digital transformation, the role of government innovation incentive policies in private enterprises’ digital transformation remains unclear.

In summary, this study aims to explore digital transformation's path mechanism in promoting innovation in private enterprises and assesses government innovation incentive policies’ impact on private enterprises’ digital transformation and innovation. This study's contributions are fourfold. First, it analyses digital transformation's impact on enterprise innovation from the perspective of private enterprises, thus enriching the literature on digital transformation's implementation effects. Second, it provides evidence for the influence of innovation incentive policies on enterprise innovation during digital transformation. Third, it explores the influencing factors contributing to differences in digital transformation and private enterprise innovation, considering external and internal dimensions, such as regional differences in the level of the digital economy and enterprise scale. Fourth, it investigates the path mechanism of private enterprises’ digital innovation by identifying four pathways—specifically, enhancing the transparency of enterprise information, reducing operational risks, alleviating financing constraints, and improving total factor productivity. This expansion contributes to a more accurate understanding of how digital transformation drives private enterprise innovation and offers evidence for facilitating enterprises’ high-quality transformation and upgrading.

Theoretical analysis and research hypothesesDigital transformation and private enterprise innovationIn the last decade, management and organizational scholars have paid increasing attention to the interconnections between digital transformation and innovation management (Appio et al., 2021). (1) The digital economy's development compels private enterprises to adapt to the challenges posed by digital technology. Based on the theory of enterprise dynamic capability, enterprises’ digital transformation entails the use of digital concepts and technology to enhance their market competitiveness and adapt to a rapidly evolving market. Faced with complex external factors, bolstering dynamic capabilities becomes imperative to address the potential problems arising from instability. With the digital economy's rapid development, enterprises have leveraged digital concepts and management practices to enhance competitiveness, undergo digital transformation, and achieve technological innovation from a resource perspective. (2) Digital technology facilitates the integration of resources in private enterprises through digital platforms, wherein data have become a new factor of production. Digital transformation utilises data mining and processing to effectively reshape enterprise businesses, cultivate novel production and operation paradigms, and leverage digital platform construction to accelerate technological innovation (Cao, 2019). The collaborative integration of enterprises using information technology positively impacts their innovation capability (Chen, Liu & Zhang, 2017). Digital transformation in enterprises positively influences the R&D intensity, number of patent applications, and patent grants (Liu et al., 2023). (3) Digital transformation enhances the efficiency and value of innovation in private enterprises. The application of digital technology helps private enterprises acquire and identify high-quality information resources, make autonomous decisions, integrate big data applications more deeply into traditional value-creation activities (Loebbecke et al., 2015; Meng et al., 2023), and improve overall investment efficiency (Zhou, 2023). The digitalisation of the enterprise value chain acts as a catalyst for scientific and technological innovation, facilitating knowledge acquisition through vertical and institutional cooperation across the value chain in the introduction of patents and technology (Marín et al., 2023).

Therefore, this study proposes the following hypothesis:

H1 Digital transformation promotes private enterprise innovation.

Enterprises’ innovation activities exhibit the characteristics of large capital investments and uncertain results, precipitating considerable risks in innovation behaviour. Factors such as difficult scale and small debt limit private enterprises’ weak risk tolerance. According to previous studies, higher risk tolerance correlates with stronger technological innovation ability and greater corresponding innovation investment (Lewis, 2003). Entrepreneurial ability and enterprise risk tolerance positively promote the willingness and intensity of R&D investment in new products, technologies, and services (Ünlüakin & Aktaş, 2023; Ya & Wu, 2022).

Considering the long-term and high-risk characteristics of enterprise innovation and R&D, stable capital investment forms the foundation for successful innovation activities. The theory of modern economic growth emphasises that technological innovation and R&D have the attributes of public goods, requiring a “Guiding Hand” in innovation intervention, with subsidies as a crucial policy tool. Injecting R&D funds into enterprises stimulates R&D, alleviates constraints and risks, and enhances corporate innovation efficiency (Yang, Wei & Luo, 2015). Digital transformation stimulates enterprise innovation momentum, and enterprise innovation's policy effect is the most significant in promoting cost reduction, profit increase, efficiency improvement, and innovation encouragement (Peng & Tao, 2022). Signal transmission theory suggests that government innovation subsidy incentives play a guiding and demonstration function, helping enterprises gain recognition and favour from stakeholders, guiding financial resources to concentrate on specific enterprises, and establishing a solid capital foundation for R&D in enterprise innovation (Appio et al., 2021; Lee CY, 2011). This encourages enterprises’ innovation projects to successfully overcome difficulties, reduce the risk of innovation failure, and improve their ability to withstand risk (Ivanov, Dolgui & Sokolov, 2019; Lichtenthaler U, 2016). Additionally, innovation activities have spillover effects, and innovation results can be imitated quickly and easily. If compensating for innovation risks is challenging for enterprises, their R&D enthusiasm is weakened. Therefore, adopting an effective risk compensation and sharing mechanism through the “Visible Hand” has become the key to stimulating innovation in private enterprises. Public assistance positively affects private R&D investment, and recipient firms achieve more private R&D than they do without public support (Carboni, 2011). Helping enterprises share innovation risks through innovation subsidies stimulates private enterprises’ innovation potential.

Furthermore, based on information processing theory, digital technology is considered an important measure for overcoming risks. With the increasing information complexity faced by private enterprises, digital transformation enables them to better identify and search for external knowledge and improves information availability (Qinqin et al., 2023). Using digital technology to collect and process market information helps make rational decisions and improve investment efficiency. Simultaneously, leveraging the advantages of big data facilitates the sharing of data resources, enhances information transparency, and builds trust among external investors in enterprise innovation projects. Moreover, enterprises understand the risk of innovation failure by learning from peers’ research and updating their technical resources.

In sum, enterprises’ digital transformation and innovation incentive policies are crucial factors that influence private enterprises’ innovation. According to a 2020 survey of 10,000 private enterprises evaluating businesses, most Chinese enterprises are still in the planning or initial stages of digital transformation. Challenges hindering private enterprises’ digital transformation include insufficient core technology, talent scarcity, high transformation costs, and weak policy support. Previous studies have emphasised that government support is a pivotal factor in successfully facilitating enterprise digital transformation. Against the backdrop of the digital economy becoming an endogenous economic driver, the incentive effect of innovation subsidy policies guides private enterprises’ digital transformation and upgrading. First, government innovation incentive policies guide the allocation of innovation resources in private enterprises, allowing trial-and-error opportunities for digital technology innovation to share the risks of digital transformation. Second, government innovation incentive policies aim to encourage private enterprises to innovate in R&D behaviour, as innovation subsidies compensate for their lack of innovation resources and the costs associated with private enterprise transformation. Third, government innovation incentive policies aid enterprises in building and cultivating high-end compound digital talents and provide intellectual support for private enterprises’ digital transformation. Government innovation incentive policies as an essential means to enhance private enterprises’ innovation capabilities, assist them in realizing digital transformation, accelerating the pace of innovation breakthrough (Kleer, 2010), and synergistically strengthening their innovation.

Accordingly, this study posits the following hypothesis:

H2 Innovation incentive policies enhance the promotion of digital transformation, thus precipitating innovation in private enterprises.

As the above literature analysis indicates, the value and application of data have become more extensive with the development of digital technology, information technology, cloud computing, and other technologies, thus promoting the development and transformation of innovation resources and significantly enhancing innovation capabilities in enterprises. What specific pathways and mechanisms does digital transformation employ to promote private enterprises’ innovation? Based on previous research, this study proposes that digital transformation may promote private enterprise innovation through four pathways.

First, digital transformation fosters enterprise innovation by enhancing information transparency. According to principal–agent theory, information asymmetry often exists between the principal and agent. Considering self-interested behaviour and risk-aversion tendencies, agents are inclined to reduce enterprise risk-taking and invest less in R&D (Liu et al., 2023). With the application of digital technology, business processes are optimised, the transparency of accounting and business information are improved, and client supervision efficiency is enhanced (Wang, 2023). Correcting the agent's short-term behaviour not only improves governance but also promotes enterprise innovation and research. Moreover, sharing of data and resources has become the norm in the digital transformation context. Digital technology overcomes the constraints of time and space, allowing information to spread rapidly and reducing information search and transaction costs (Ferreira, Fernandes & Ferreira, 2019; Matarazzo, Penco, Profumo & Quaglia, 2021). Breaking the “Data Island” and filling the “Digital Divide” significantly improves information transparency, which promotes division and cooperation between enterprises, reduces trial and error costs for mutual benefit, and enhances the success rate of digital transformation.

Second, digital transformation promotes innovation by reducing enterprises’ operational risks. Venture innovation projects entail a high degree of uncertainty, and decision-makers must master the relevant information to avoid risks (Liu et al., 2023). Considering the overall risk tolerance level of the enterprise, its management believes that as operational risks increase, investments in R&D for innovative projects decrease. With the support of various new digital technologies, enterprises can process massive amounts of data at a lower cost, improve the breadth and depth of information absorption, reduce processing costs, and acquire key decision-making information (Chania, Myers & Hess, 2019). Digital transformation enhances management's risk aversion and reduces irrational decision-making and inefficient investments (Ghezzi & Cavallo, 2020; Yi et al., 2021). Thus, the use of digital technologies reduces information search costs, restrains management's opportunistic behaviour, reduces inefficient investment, and enhances enterprise risk-taking. Digital technology promotes corporate risk-taking by improving operating flexibility and financing availability (Tian, Li & Cheng, 2022). With the application of digital information systems, management can identify operational problems in a timely manner and manage risks to a great extent. Additionally, digital transformation breaks down industry barriers, promotes cross-border competition among enterprises, fosters a specialised division of labour and cooperation (Bresciani et al., 2021), and enables the sharing of innovation and operational risks among enterprises, thus ensuring the smooth progress of private enterprise innovation.

Third, digital transformation promotes enterprise innovation by alleviating financing constraints. Compared with other enterprises, those with digital transformation find it easier for the government, financial institutions, and other stakeholders to recognise and focus on enhancing enterprises’ ability to obtain investment. This alleviates the pressure of constraints on enterprises and helps promote innovation (Hung & Nham, 2023). Simultaneously, digital transformation improves the transparency of accounting information, enabling enterprises to enhance their future growth prospects (Wang, 2023). The introduction of digital technologies has expanded investment opportunities for entities, contributing to a more effective implementation of their economic and institutional interests (Konovalova, Kuzmina & Zhironkin, 2020). The application of digital technology makes it convenient for external stakeholders to supervise and invest in enterprises. Moreover, digitalisation is more effective than traditional approaches in alleviating financing constraints and enhancing financial inclusion. The use of digital financial services—such as payments, money funds, credit, insurance, and investment—plays a crucial role in mitigating information asymmetry and facilitating SMEs’ access to finance (Zhang, Li, Xiang & Worthington, 2023). The application of digital technology breaks through the geographical restrictions of information and capital flows, provides effective investment decision-making information for external investors, and attracts a wider range of investors, establishing a solid foundation for facilitating innovation and breakthroughs in private enterprises. Furthermore, digitalisation in enterprises significantly improves the overall investment efficiency, thus alleviating underinvestment (Zhou, 2023). Enterprises’ innovation and investment activities in the context of digitalisation increase their global competitiveness(Kravchuk, Rusinova, Desyatov, Lapshyn & Alnuaimi, 2022).

Fourth, digital transformation promotes innovation by enhancing total factor productivity. Relying on the “input–output” relationship inherent in the operational logic of digital technologies, data production has witnessed exponential growth (Kabakus & Ahmet, 2022). With the continuous breakthrough and application of technologies, such as big data, artificial intelligence, and the Internet, data volume, velocity, and variety are escalating. With digital technologies’ proliferation, the transition from data mining to big data in enterprise digital transformation has precipitated a more transparent data environment, significantly boosting total factor productivity (Zeng & Lei, 2021). Firm-level digital transformation enhances productivity and profitability—primarily driven by human capital, operational capabilities, and investment efficiency (Du & Jiang, 2022). Private enterprises leverage technology-upgraded data to process decision-making information intelligently and improve production efficiency. This reduces external management costs, optimises resource allocation efficiency (Gao, Yan, Zhou & Mo, 2023; Li et al., 2023; Zhao, Wang & Li, 2021), elevates the level of innovative research and development, and enhances value creation (Marín et al., 2023).

Accordingly, this study proposes the following hypothesis:

H3 Digital transformation promotes private enterprise innovation by improving information transparency, reducing operational risks, alleviating financing constraints, and enhancing total factor productivity.

The dependent variable is enterprise innovation (Innovn). Two types of enterprise innovation measurements exist in the literature: one measures R&D support from the perspective of enterprise innovation investment, while the other gauges the number of patent applications as a reflection of enterprise innovation output. Per prior studies, using patent indicators to measure innovation output reflects the real innovation capability of enterprises better than using R&D investment variables (Guo Wei, 2018). Additionally, considering the efficacy of enterprise patent technology, invention patents with higher technical content are selected as the core index of enterprise innovation, providing an appropriate reflection of enterprise innovation ability. This study measures enterprises’ innovation levels using the natural logarithm of the number of invention patent applications plus 1.

Independent variablesThe independent variables are digital transformation (Dt) and innovation incentive policy (Sub). This study references Zhao et al. (2021) and Wu, Hu, Lin and Ren (2021) to collect and organise the annual reports of all private listed enterprises through a Python crawler function, extracting the content using the Java PDFbox library as the source of digital transformation keywords. Word frequencies of matching and statistical keywords are searched and logarithmised as the variable index of digital transformation. Following Chen et al.’s (2022) approach, subsidy information related to “Non-Operating Income” in the notes to the financial statements of enterprises is collected using keywords. The final innovation subsidy project information is determined by manually screening, merging, and dividing the information by multiplying the total assets at the end of the period by 100.

Control variablesThis study's control variables are selected based on previous literature (Liu et al., 2023; Tang, Wu & Zhu, 2020) and China's institutional background; accordingly, factors that may affect private enterprises’ innovation activities are taken as control variables: company size (Size), total assets turnover (Ato), cash flow ratio (Cashflow), operating income growth rate (Growth), dual (Dual), listing age (ListAge), institutional shareholding ratio (Inst), and whether the audit firm is Big4 (Big4).

Research modelModel 1 is constructed with enterprise innovation (Innovn) as the explanatory variable and digital transformation (Dt) as the explanatory variable to test H1. Model 1 is expressed in Formula (1). Simultaneously, based on Model 1, the intersection term of innovation incentive and digital transformation (Dt × Sub) is added to build Model 2 to test H2. Model 2 is expressed in Formula (2), where Controls represent the control variables Year and Ind.

Table 1 presents the main variables’ detailed definitions.

Definitions of the main variables.

Our sample comprises annual data from 2011 to 2020 that focus on China's listed private enterprises and are derived from China's stock market and accounting research. To enhance the empirical regression, this study processes the data as follows: first, enterprises in special industries, such as finance, are eliminated. Second, the ST*STPT enterprises are eliminated. Third, missing and abnormal values are removed from key financial data, retaining the data for at least five consecutive years. Finally, to address outliers’ interference, the continuous variables at the micro level are processed by 1 % up and down, resulting in 7505 processed samples.

Descriptive statistical analysis of variablesTable 2 provides all variables’ summary statistics. Table 2 evidently reveals that the minimum value of enterprise innovation is 0, the maximum value is 11.04, and the difference is 1.529, indicating significant differences in innovation among private enterprises. Digital transformation's maximum and minimum values are 4.635 and 0, respectively, with a difference of 1.394, illustrating substantial variation in digital transformation among enterprises. The average value of digital transformation is 1.398, indicating a low overall digital transformation level among private enterprises. The differences between innovation incentives’ maximum and minimum values are 3.487 and 0, respectively, indicating considerable diversity in the amount of innovation incentives obtained by private enterprises.

Descriptive statistical analysis of variables.

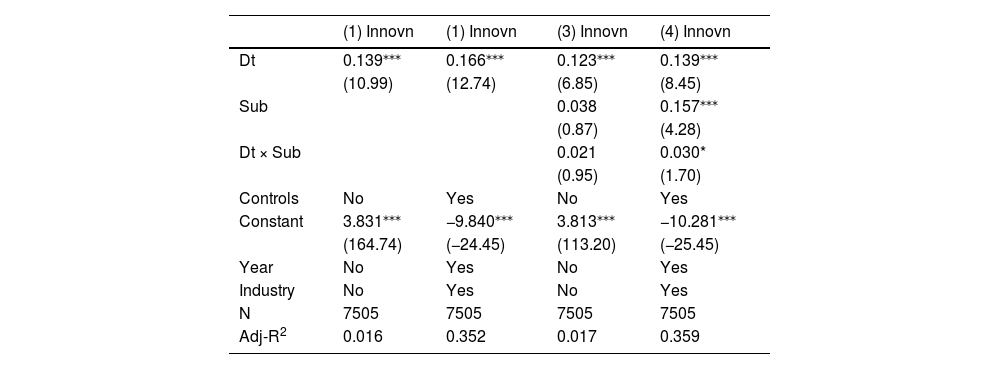

Table 3 presents the full-sample regression results of digital transformation's impact on enterprise innovation. Column (1) presents the regression results for digital transformation and enterprise innovation without control variables, with the coefficient of Dt being 0.139—significantly positive at the 1 % level. Column (2) presents the regression results after adding the control variables, with the coefficient of Dt being 0.166—still significantly positive at the 1 % level. Notably, the coefficients of Dt and Innovn are significantly positive, irrespective of whether control variables are added. Thus, digital transformation significantly positively increases private enterprises’ investment in innovation and R&D innovation. Thus, H1 is supported.

Impact of digital transformation (Dt) and innovation incentive policy (Sub) on innovation.

Note: ***, **, and * represent significance at the 1 %, 5 %, and 10 % levels, respectively. The standard errors are reported in parentheses.

Table 3 presents the estimated results, which indicate the synergistic effects of innovation incentives and digital transformation on the promotion of private enterprises’ innovation. In Column (3), the synergistic effect of innovation incentives between digital transformation and enterprise innovation is tested without adding control variables. The coefficient of Dt × Sub is 0.021. When the control variables are introduced, except for the regression coefficient being 0.030, the synergistic effect is significantly positive at the 10 % level—consistent with most studies. This suggests that digital transformation enhances private enterprises’ innovation when the availability of innovation incentives is high, indicating that innovation incentives and digital transformation can be integrated to improve private enterprises’ innovation. Hence, H2 is substantiated. One possible explanation is that operational risks are more significant for private enterprises than for state-owned enterprises, especially for small and medium-sized private enterprises, making it more challenging to achieve economies of scale or scope. Policy support strengthens enterprises’ ability to share the risk of innovation and R&D, significantly boosting their enthusiasm for innovation and R&D (Peng & Tao, 2022).

Heterogeneity testDifferences in digital transformation's impact on private enterprises’ innovation may exist based on the external region in which the enterprise is located and its scale characteristics. Enterprises’ geographical location, the level of the digital economy (Qinqin et al., 2023), and enterprises’ scale are key factors affecting the incentive effect of digital transformation on innovation and competition. Therefore, this study categorises registered provinces into eastern, central, and western regions; divides regions into higher and lower levels of the digital economy based on the provincial digital economy index; and classifies enterprises into large- and small-scale based on the median asset scale. This categorisation compares the heterogeneity of digital transformation's impact on enterprise innovation across different dimensions.

Heterogeneity test between digital transformation and enterprise innovationColumns (1) and (2) in Table 4 focus on regional dimensions. The results reveal that private enterprises’ digital transformation in both the eastern and central-western regions can promote innovation. Digital transformation promotes enterprise innovation in the eastern and central-western regions at the 1 % and 5 % levels, respectively. Digital transformation plays a more pronounced role in enterprise innovation in the eastern than in other regions. One possible reason for this phenomenon is that the more developed enterprises in the eastern region face greater market competition pressure. To stand out in this fierce competition, enterprises in the eastern region have a stronger drive to promote digital transformation than those in other regions. Moreover, the degree of digital transformation is generally higher in the eastern region than in the other regions, and the network infrastructure in the central-western regions is relatively underdeveloped. The lack of digital talent and technical proficiency hampers the speed and requirements of the digital transformation of enterprises in these regions. Therefore, digital transformation's competitive impact is more evident in economically developed areas that promote enterprise innovation.

Group test of digital transformation's impact on enterprise innovation.

Note: ***, **, and * represent significance at the 1 %, 5 %, and 10 % levels, respectively. The standard errors are reported in parentheses.

Columns (3) and (4) present the Digital Economy Level Dimension. The results in Table 4 reveal that an enterprise's external digital economy contributes to promoting digital transformation and innovation. Irrespective of the level of the external digital economy, digital transformation significantly promotes enterprise innovation at the 1 % level. The results align with expectations, indicating that digital transformation in areas with a higher digital economy level has a more significant effect on promoting enterprise innovation. This is because the digital economy creates favourable infrastructure conditions for enterprises’ digital transformation, attracting a large number of innovative talents. A more developed digital economy fosters external uncertainty and stimulates enterprises’ innovation. Thus, the digital economy supports enterprises’ digital transformation and strengthens its positive impact on enterprise innovation.

Columns (5) and (6) present the Enterprise Scale Dimension. Table 4 demonstrates that although the digital transformation of both large- and small-scale enterprises promotes enterprise innovation at the 1 % level, the innovation promotion effect of this transformation is more pronounced in large-scale enterprises. This result aligns with the well-known “Schumpeter Hypothesis.” This is probably because large enterprises—compared to small and medium-sized enterprises—enjoy substantial advantages in risk-sharing economies of scale and innovation investment support, thus increasing the degree of digital transformation. Consequently, compared to small and medium-sized enterprises, the innovation promotion effect embodied in the digital transformation of large enterprises is more significant.

Heterogeneity test of synergistic effect between innovation incentive and digital transformationColumns (1) and (2) of the Regional Dimension in Table 5 reveal that at the 5 % level, the greater the intensity of innovation incentives in the eastern region, the more significant the effect of digital transformation on promoting private enterprise innovation. However, the synergistic effect of innovation incentives and digital transformation on the promotion of private enterprise innovation is not significant in the central and western regions. A plausible reason is that the eastern region possesses unique advantages, including a developed and comprehensive Internet infrastructure, advanced digital innovation capabilities, and a large pool of high-end digital talents. Indubitably, government innovation subsidies and public assistance aid private enterprises in accelerating digital transformation and efficient innovation.

Group test of the synergistic effect between innovation subsidy and digital transformation.

Note: ***, **, and * represent significance at the 1 %, 5 %, and 10 % levels, respectively. The standard errors are reported in parentheses.

The results in Columns (3) and (4) of the Digital Economy Dimension in Table 5 reveal that the synergistic effect of innovation incentives and digital transformation in promoting private enterprise innovation is not significant in areas with a high digital economy level. Compared with regions with a higher digital economy level, innovation incentives’ synergistic effect on enterprises with a lower level of regional digital economy and digital transformation to promote innovation among private enterprises is more significant and significantly positive at the 10 % level. According to the resource-based view, regional digital infrastructure is an external driver of enterprises’ digital transformation and entrepreneurial orientation (Wu, Wang, Jiang & Zhou, 2023). Therefore, the digital transformation degree of enterprises in areas with low digital economy levels is generally low, and factors such as the uncertain risk of innovation activities frequently inhibit enterprise innovation. Simultaneously, enterprises that pay greater attention to the digital economy stimulate greater vitality in innovation (Qinqin et al., 2023). However, innovation subsidies inject funds into enterprises with a low digital transformation degree to alleviate the constraints and compensate for digital transformation's incremental effect, which is hindered by a lack of resources. Additionally, it compensates for innovation activities’ spillover effect and bears the risk of innovation failure, thus increasing the significance of the promotional effect on innovation of this type of private enterprise.

The results in columns (5) and (6) of the Enterprise Scale Dimension in Table 5 reveal that innovation incentives’ synergistic effect on large-scale enterprises’ digital transformation to promote private enterprise innovation is not significant. By comparison, innovation subsidies play a more pronounced synergistic role in the relationship between digital transformation and enterprise innovation for small-scale enterprises, which is significantly positive at the 1 % level. This may be because, compared with large-scale enterprises, small-scale enterprises face more prominent challenges, such as being “Difficult” and “Expensive,” and their ability to bear risks is relatively weak. Nevertheless, they engage in risky innovation activities. Although digital transformation promotes enterprise innovation by mitigating constraints on enterprise risk, its transformative effect has a certain “Lag” and “Timeliness.” Government innovation incentives contribute to direct R&D risk as well as provide the necessary financial support for private enterprises’ innovation activities quickly and effectively. Therefore, the innovation subsidy effect on small-scale private enterprises in urgent need of “blood transfusions” is more significant.

Endogeneity testTo ascertain the reliability of this study's results, multiple endogeneity tests are performed. First, employing the instrumental variable method involves using the explanatory variable digital transformation with a one-period time lag as the instrumental variable (IV), following Fisman and Svensson's (2007) construction of instrumental variables. The minimum eigenvalue of the F-statistics is 74,569, surpassing 10, indicating that it can serve as a weak instrumental variable reference. Second, the Keckman two-stage model method is employed. Referring to Liu and Wang (2023), the following two approaches are adopted: first, the median of digital transformation of enterprises in the current year is grouped to obtain the dummy variable index of digital transformation (M_Dt), which is used as the dependent variable for the probit regression. The coefficient of digital transformation (Dt) is significantly positive at the 1 % level, which is consistent with the main regression conclusion and supports this study's results. Third, the propensity score matching method is used. The dummy variable index of digital transformation in the current year (M_Dt) serves as the dependent variable, with the matching variables being the control variables mentioned earlier—namely, Size, Ato, cash flow, Growth, Dual, ListAge, Inst, and Big4. The nearest-neighbour matching method is employed for 1:1 matching to re-regress the relationship between digital transformation and enterprise innovation. Column (5) in Table 6 indicates that the coefficient of digital transformation (Dt) is significantly positive at the 1 % level, verifying the robustness of this study's results.

Endogeneity test: Iv, Heckman, Psm.

Note: ***, **, and * represent significance at the 1 %, 5 %, and 10 % levels, respectively. The standard errors are reported in parentheses.

Several robustness tests are conducted to ensure the results’ reliability. First, the sum of inventive, practical, and design patents (Patents) replaces the explained variables of enterprise innovation. Second, following Zhang, Li and Xing (2021), the proportion of the part related to digital transformation in the intangible assets subsidiary that accounts for the total amount of intangible assets is used to measure enterprises’ digital level. This information is sourced from the year-end assets disclosed in the notes to listed companies’ financial reports. The digital level (Dig) is employed as an alternative variable for digital transformation. Third, inspired by Li, Liu and Shao (2021), industry samples related to digital technology are excluded to prevent “Natural Digital” enterprises from interfering with this study's results. Fourth, considering the potential lag and persistence of digital transformation's positive effect on enterprise innovation, this study adds a digital transformation lag term to the benchmark regression model to test its robustness. Table 7 presents the robustness tests’ results. The regression outcomes of the core explanatory variables are generally consistent with those of previous studies, thus substantiating the robustness of this study's findings.

Robustness test: substitution variable, reduced sample, hysteresis effect.

Note: ***, **, and * represent significance at the 1 %, 5 %, and 10 % levels, respectively. The standard errors are reported in parentheses.

To further examine the internal transmission mechanism of digital transformation affecting enterprise innovation, that is, whether digital transformation improves information transparency, reduces enterprise operation risk, alleviates financing constraints, and enhances total factor productivity to promote private enterprise innovation, intermediary Models 3 and 4 are constructed based on Model 1. In these models, Mediator represents the intermediary variables used to test four potential action paths, elucidating the internal transmission logic between digital transformation and enterprise innovation.

where Inf is the mediator representing information transparency, Risk represents operational risks, Ww represents the financing constraints, and Tfp represents the total factor productivity.Information transparency's mediating effectOn the one hand, enterprises implementing digital transformation enhance business information transparency, improve client supervision efficiency, elevate governance levels, and foster innovative R&D investments through agents’ short-term behaviour. On the other hand, digital transformation facilitates enterprise division and cooperation, mutual benefit, a win-win situation, and trial-and-error costs. Moreover, it improves digital transformation's success rate and promotes innovation among private enterprises. This study selects information transparency as an intermediary variable (Zhong, 2018), with the number of analysts (teams) conducting tracking analysis of the company within one year, represented as the logarithm(Inf), to measure information transparency. A higher value indicates greater information transparency in an enterprise. The data are primarily derived from the CSMAR database in China. Column (2) of Table 8 presents the regression results of digital transformation on enterprise information transparency. The coefficient of Dt is significantly positive at the 1 % level, indicating that digital transformation significantly improves enterprises’ information transparency. Column (3) extends the analysis by adding Inf, indicating that the coefficient of Dt remains significantly positive. This establishes the intermediary path of “Digital transformation enhances information transparency to promote private enterprise innovation.”

Mediating effect test between information transparency and operational risks.

Note: ***, **, and * represent significance at the 1 %, 5 %, and 10 % levels, respectively. The standard errors are reported in parentheses.

Private enterprises that implement digital transformation improve information availability, promote professional division and cooperation, and reduce operational risks, thereby promoting innovation. Following Ji, Luan and Ding (2020), the three-year volatility (Risk) of return on assets measures operational risks. Column (4) of Table 8 demonstrates a significantly negative coefficient of Dt at the 10 % level, indicating that digital transformation reduces operational risks. Column (5) reveals that, even after adding Risk, the coefficient of Dt remains significantly positive, establishing the intermediary path of “Digital transformation reduces operational risks to promote private enterprise innovation.”

Financing constraints’ mediating effectEnterprises’ digital transformation enhances both internal and external information communication, facilitating a more efficient transmission of information to the external world. This reduction in information asymmetry between investors and innovators is well-received by investors. Simultaneously, digital transformation enables enterprises to garner support from stakeholders such as regulatory authorities and financial institutions. Consequently, the inclination toward allocating resources, such as tax incentives and financial subsidies, proves beneficial in alleviating financial pressures on enterprises and promoting innovation (Feng, Meng & Li, 2023). Drawing on White et al. (2006), we employ the Ww index to measure the degree of enterprise financing constraints and examine the intermediary path of “Digital transformation alleviates financing constraints to promote enterprise innovation” in Model 5.

where CF is cash flow, DivPos is the dummy variable for the cash dividend payer, Lev is the leverage ratio, Size is the company size, ISG is the industry sales growth rate, and SG is the company sales growth rate. The higher the index, the lower the level of enterprise financing constraints. In Column (2) of Table 9, the coefficient of Dt is significantly positive at the 10 % level, indicating that digital transformation effectively mitigates the degree of enterprise financing constraints. Upon the inclusion of Ww in Column (3), the positive coefficient of Dt persists, suggesting that easing financing constraints is also a pathway for fostering innovation within private enterprises undergoing digital transformation.Mediating effect test between financing constraints and total factor productivity.

Note: ***, **, and * represent significance at the 1 %, 5 %, and 10 % levels, respectively. The standard errors are reported in parentheses.

Enterprises’ digital transformation contributes to improving resource allocation efficiency and elevates the levels of both inputs and outputs. Hence, digital transformation may further promote innovation in private enterprises by enhancing their total factor productivity. To investigate this mechanism, we employ Levinsohn and Petrin's (2003) method—specifically, the LP method—to measure total factor productivity. Estimating Tfp requires setting the form of the production function, commonly known as the Co-Douglas (C-D) production function. This function utilises the power functions of labour and capital to estimate output, with both sides being logarithmic and convertible into a linear model. A higher Tfp value corresponds to a higher total factor productivity. Column (4) in Table 9 reveals a significantly positive coefficient of Dt at the 1 % level, indicating that digital transformation effectively improves enterprises’ total factor productivity. Column (5) in Table 9 further demonstrates that the coefficient of Dt remains positive after incorporating Tfp, establishing the intermediary path of “Digital transformation improves total factor productivity to promote private enterprise innovation.”

In summary, as the above-mentioned tests and analyses indicate, digital transformation promotes private enterprise innovation through four paths—namely, improving information transparency, reducing operational risks, alleviating financing constraints, and enhancing total factor productivity. Thus, H3 is supported.

Conclusion and implicationsConclusionUsing listed private enterprises from 2011 to 2020 as the research focus, this study utilises text mining to extract keywords related to digital transformation from these enterprises’ annual reports. Through theoretical and empirical research, this study investigates digital transformation's impact on private enterprises’ innovation and innovation incentive policies’ synergistic effects. Additionally, it explores digital transformation's pathways and mechanisms in private enterprises’ innovation. The findings are summarised as follows: first, digital transformation significantly and positively promotes innovation in private enterprises. This conclusion holds even after performing robustness tests and addressing endogeneity issues. Second, regional and scale differences exist in digital transformation's impact on innovation in private enterprises. This catalytic effect is pronounced in developed regions with a high digital economy level and large-scale enterprises. Third, government innovation incentive policies and digital transformation synergistically promote innovation in private enterprises. This finding suggests that innovation incentive policies enhance digital transformation's impact on innovation in private enterprises. Finally, an examination of the influencing mechanism indicates that private enterprises’ digital transformation drives innovation primarily by improving information transparency, reducing operational risks, alleviating financing constraints, and enhancing total factor productivity.

ImplicationsThis study's implications are as follows: first, enhancing awareness and application of digital transformation in private enterprises accelerates the pace of innovation. Private enterprises should prioritise digital transformation's role in promoting innovation, adapting to market changes by accelerating digital transformation, and increasing investments in the R&D of digital technology. Strengthening digital infrastructure's construction is crucial for guaranteeing R&D investment in core technologies. Second, differentiated innovation incentive policies should be implemented for enterprises in different regions. The government can prioritise supporting the digital transformation of enterprises in regions with high levels of digital economic development. This involves increasing the proportion of enterprises undergoing digital transformation in these regions, enhancing digital technology applications’ depth, and investing in the training of digital technology talents. For private enterprises in regions with lower levels of digital economic development, the government should adopt pilot demonstrations and effective incentive policies to encourage digital transformation and innovation. Third, strengthening regional coordination and collaborative efforts is needed to promote digital innovation. Chinese private enterprises’ digital transformation and innovation are still in their early stages and are characterised by high risks and uncertainties. Regions with higher digital economy levels possess infrastructure and innovation environments conducive to private enterprises’ digital transformation. By leveraging improved Internet infrastructure, efficient technology markets, and a high concentration of digital talents, these regions can play a leading role in providing guidance for digital innovation in other regions and collectively advancing private enterprises’ digital transformation.

FundingThe paper is an output of the projects 23SKGH397 "Humanities and Social Sciences Planning Project of Chongqing Education Commission:Research on mechanism and path of digitalization of Chongqing manufacturing enterprises from the perspective of industrial chain coordination".

The paper is an output of the projects CSTB2022TFII-DIX0068 "Scientific Research Project of Chongqing Science and Technology Commission:Chongqing science and technology innovation ‘one district one platform’ strategy research".

CRediT authorship contribution statementLi Chen: Writing – review & editing, Writing – original draft, Supervision, Project administration, Funding acquisition, Formal analysis, Conceptualization. Ruixiang Tu: Writing – original draft, Software, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. BoXuan Huang: Writing – review & editing, Methodology, Investigation, Data curation. Haiyan Zhou: Supervision, Methodology, Conceptualization. Yumei Wu: Writing – review & editing, Supervision, Project administration, Methodology, Conceptualization.

Dr. Li Chen is a associate professor of accounting at Chongqing Technology and Business University. He has coauthored over 30 publications including Insurance Studies, Contemporary Economic Research. The current research interests in associate professor Chen's group include:(1)Corporate strategy and risk management, Financial management and internal control;(2)Financial accounting and capital markets;(3)Digital economy and enterprise innovation.

Ruixiang Tu is currently a M.A. student under the supervision of associate Prof. Li Chen. His research is centered on Digital economy and financial management innovation.

Yumei Wu is a associate professor of accounting at Chongqing Finance and Economics College. She has coauthored over 10 publications including Contemporary Economic Research, Statistics and decision. The current research interests in associate professor Wu's include: (1)Government Accounting and financial accounting;(2) Ecological economy and digital economy.

Haiyan Zhou is a professor of accounting at the University of Texas Rio Grande Valley. She has coauthored over 40 publications including Journal of Corporate Finance, Journal of Accounting Auditing and Finance. The current research interests in professor Zhou's include: (1)Capital market and accounting information disclosure;(2) Internal control and corporate governance;(3)Audit risk and audit responsibility.