Addressing climate challenges and achieving the Sustainable Development Goals (SDGs) necessitate a deep understanding of how green policies influence carbon emissions. Therefore, this study explores the impact of green finance, innovation, and taxation on carbon emissions in OECD countries while accounting for economic growth, renewable energy, and energy productivity. Utilizing the method of moment quantile regression analysis, we find that green finance, taxes, and innovation significantly reduce emissions in OECD economies. The impacts of green finance and taxes exhibit an increasing trend, with higher coefficients at higher quantiles. Conversely, green innovation shows a decreasing trend, with coefficients showing lower magnitude at higher quantiles. The results also show that renewable energy and energy productivity significantly mitigate emissions. In contrast, economic growth correlates positively with CO₂ emissions. Our findings highlight the need for robust policies that invest in clean technologies, broaden green financial instruments, and enhance energy efficiency. In line with the frameworks established at COP28, we emphasize the pivotal role of both public and private funding in facilitating the transition to a low-carbon economy.

Countries around the world, including those in the OECD, are facing the massive challenge of addressing climate change. Despite various international agreements and environmental initiatives, the problem continues to deteriorate as carbon emissions rise. Carbon emissions comprise roughly 74% of all greenhouse gases (Olivier & Peters, 2020), the leading contributor to global warming. This growing crisis is highlighted by the substantial finances still directed toward fossil fuels. In 2022, G-20 nations collectively spent $1.3 trillion on fossil fuel subsidies, funds that could have been used for solar power. Fossil fuel support in 2021 also saw a sharp rise, reaching almost $600 billion, a 14% increase from 2017 (Cuming & Godeme, 2023; Teske et al., 2022). As per BloombergNEF, among the biggest contributors, Saudi Arabia spent $2309 per capita, followed by Argentina, $665, Russia $492, Australia at $363, and France at $344 per capita. The increase in fossil fuel expenditures highlights the persistent difficulties in addressing climate change.

One of the most pressing challenges of recent years is climate change's harmful impact on humanity, primarily driven by carbon emissions (Umar et al., 2024). It is imperative to address this challenge and implement measures to reduce CO₂ emissions to ensure future generations' welfare, as these changing weather patterns pose a significant risk to human survival (IPCC, 2021; Zhao et al., 2022). The OECD economies are facing many obstacles in their efforts to address the increasing emissions, such as the balance between economic growth and environmental sustainability and the transition to cleaner energy sources. Numerous countries, such as the United States, the European Union (EU), the United Kingdom, and Japan, have outlined mitigation strategies and committed to achieving net-zero emissions by 2050. In the G-20 economies, a few countries have employed carbon pricing schemes over $40 per metric ton, a threshold for reducing emissions (BloombergNEF, 2023). Moreover, the effectiveness of carbon-pricing policies that account for 21% of global GHG emissions is restricted by their low prices and concessions, including the free emission allowances (Cuming & Godeme, 2023). However, further steps must be taken to reduce environmental pollution and its impact.

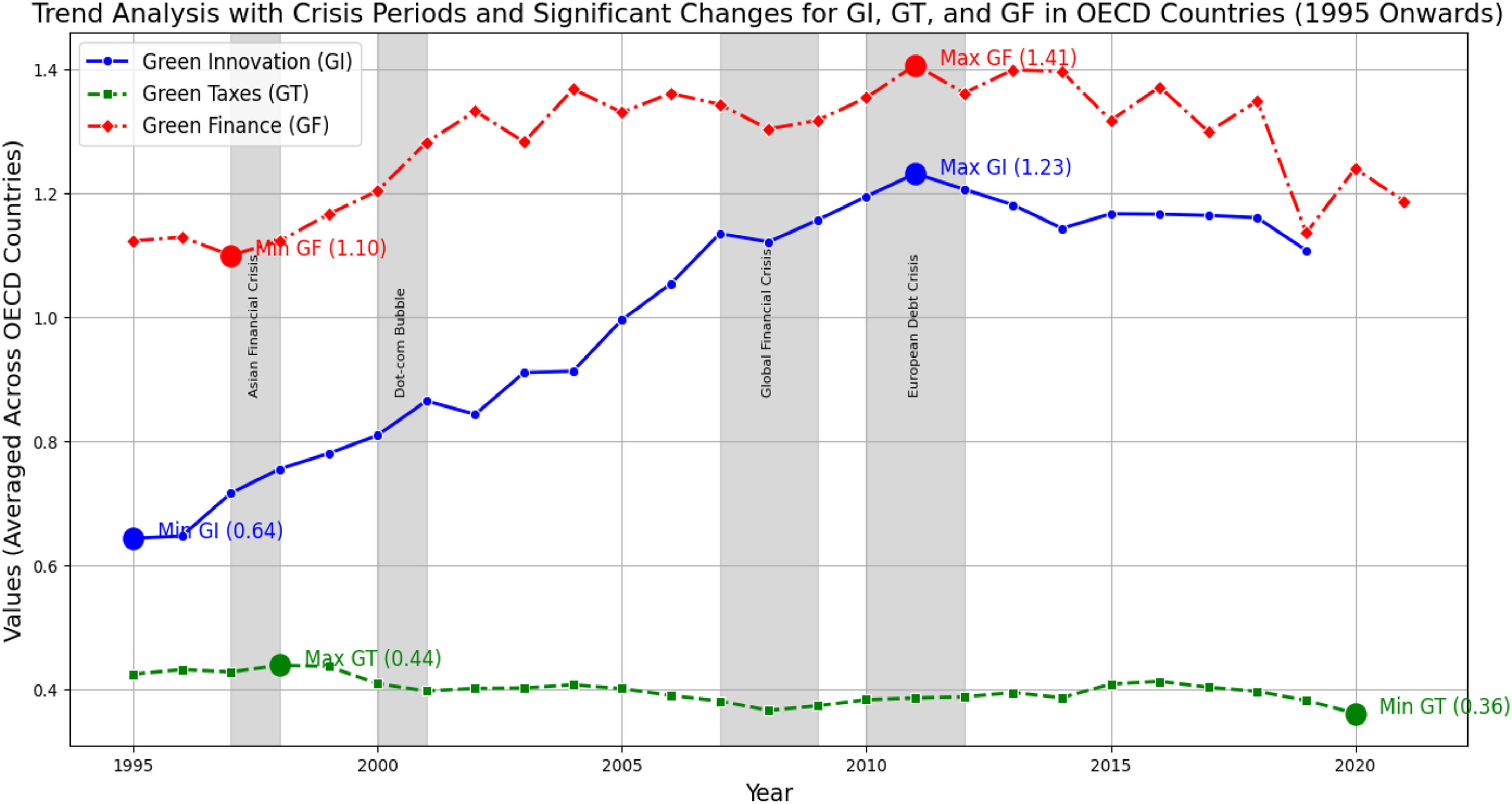

In order to tackle climate change, COP28 placed emphasis on further improving the climate finance framework by gradually mobilizing funds to eliminate the subsidies for fossil fuels and achieve the net zero carbon emissions goals set by the countries. During COP 28, climate finance remained a topic of interest, highlighting its significance for advancing global climate action and realizing the objectives of the Paris Agreement. Songwe et al. (2022) emphasized that by 2030, emerging markets and developing countries, excluding China, need to require an annual investment of $2.4 trillion, a fourfold increase from current levels, to meet climate goals. To address the shortfall in climate financing, countries have introduced the climate finance framework at COP 28. This initiative aims to mobilize public and private investments, focusing on concessional finance that needs to increase fivefold by 2030. By that year, multilateral development banks are expected to triple their annual lending to $390 billion. Their primary goal is to lower capital costs and enhance support for climate adaptation and mitigation projects (Bhattacharya et al., 2023). Therefore, the integration of climate finance, taxation, and innovation is important to achieve net zero carbon emissions. Fig. 1 illustrates the trends in green finance (GF), taxation (GT), and innovation (GI) for OECD economies, highlighting their collective impact on advancing global climate objectives. GF exhibited a steady rise starting in 1995, reaching a peak value of 1.41 in 2011. After this peak, GF showed fluctuations and declined to 1.24 by 2020. Similarly, GI followed an upward trajectory, attaining its highest point at 1.23 in 2011 before experiencing slight declines in subsequent years. In contrast, GT remained relatively stable with a value of 0.4 and a slight decrease after 2010, reaching 0.36 in 2020.

Based on the above discussion, this study intends to explore the role of green finance, innovation, and taxation in advancing sustainable development within selected OECD economies from 1990 to 2022. This study's primary goal is to analyze how green innovation, green finance, taxes, economic growth, energy productivity, and renewable energy influence carbon emissions. We utilize the method of moments and bootstrap quantile regression analysis to investigate these relationships across various quantiles of CO₂ emissions. This comprehensive approach integrates multiple facets of CO₂ emissions, including economic expansion, green technologies, and policy-driven financial instruments like green finance and green environmental taxes. By examining these green policy indicators' individual and collective impacts, we offer a fresh perspective on strategies that can effectively reduce carbon footprints in OECD nations.

Literature reviewThis section reviews the existing literature on the role of green finance, taxes, and innovation in achieving sustainable development goals (SDGs). Khan et al. (2022) and S. Li and Shao (2022) revealed that green finance can significantly decrease carbon emissions. The emergence of green finance as a major financial paradigm has attracted considerable attention in research and international policy discussions (Zhang et al., 2019). Hu et al. (2023) emphasized that green finance is a crucial tool for achieving a low-carbon economic transition. A study by Li and Jia (2017) also argued that sustainable finance represents the most efficient approach to mitigating environmental degradation. Gu et al. (2024) find that green finance plays a significant role in addressing environmental challenges. However, their study also highlights that the effectiveness of green finance heavily depends on regional factors, such as the level of financial development and the maturity of credit and capital markets.

Doğan et al. (2022) explored the influence of environmental taxes on CO2 emissions for G-7 economies and showed that taxes reduce emissions. They argued that enterprises will transition to cleaner production processes in response to strict environmental tax regulations. Lin and Jia (2019) also argued that imposing taxes on the fossil fuel sector can significantly mitigate emissions. Similarly, Aydin and Esen (2018) explored the impact of environmental taxes on CO2 emissions in fifteen European Union economies. They showed an asymmetrical relationship of environmental taxes, indicating that once threshold levels for total, energy, and pollution taxes are surpassed, their impact on CO2 emissions shifts from insignificantly positive to significantly negative. In addition, Yunzhao (2022) demonstrated that carbon emissions are reduced in E-7 economies through the implementation of environmental taxes, renewable energy, and eco-innovation. The study conducted by Morley (2012) on the EU and Norway demonstrated a negative correlation between pollution and environmental taxation. However, no correlation was observed between taxes and energy consumption.

More recently, the literature on climate change has paid significant consideration to green innovation. Sun et al. (2021) assert that green innovation reduces the expense of renewable energy and accelerates the transition from fossil fuels in economies. Furthermore, the study argued that CO2 capture and storage are enhanced by green innovation. Many studies have demonstrated a similar positive influence of green innovation on environmental quality (N. Amin et al., 2023; Du et al., 2021; Makpotche et al., 2024; Umar & Safi, 2023; Xu et al., 2024). On the other hand, Weina et al. (2016) investigated the correlation between CO2 emissions and green innovation in 95 Italian provinces from 1990 to 2010. The findings indicated that although green technology has increased environmental production, it has not yet made a major contribution to environmental sustainability. Similarly, Razzaq et al. (2021) found that the emissions reduction effect of green innovation was only notable at the highest emissions quantiles in Brazil, Russia, India, and China. Conversely, at the lowest emissions quantiles, green innovation was positively or weakly correlated with emissions.

This study fills the gap in the literature by investigating the relationship between green innovation, taxes, finance, and consumption-based carbon emissions for selected OECD economies from 1990 to 2022, considering control variables of energy productivity, renewable energy, and economic growth. We employ the Method of Moments and bootstrap quantile regression analysis to investigate these relationships across various quantiles of CO₂ emission distributions.

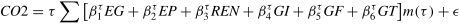

Data and methodologyData and model specificationThis study utilizes data from different sources, from 1990 to 2022, focusing on selected OECD economies. The data for CO₂ emissions representing consumption-based carbon emissions is sourced from the Global Carbon Atlas (GCA, 2023). This directly ties into SDG 13 of climate action, as it helps measure the effectiveness of policies aimed at reducing carbon emissions. Economic Growth (EG), measured by GDP from the World Bank (2022), is essential for SDG 8, which deals with decent work and economic growth, as it highlights the role of economic activities in fostering employment and driving sustainable growth. Energy Productivity (EP), defined as GDP per unit of total energy supply (TES) and sourced from the OECD database, supports both SDG 8 and SDG 7 of affordable and clean energy by promoting more efficient energy use in economic activities, which is crucial for sustaining economic growth while minimizing environmental impact. Renewable Energy (REN), measured as renewable energy consumption as a percentage of total energy consumption taken from the World Bank (2022), is critical for achieving SDG 7, which emphasizes the transition to clean and renewable energy sources. Green Innovation (GI) is measured as the development of environment-related technologies that align with SDG 9 of industry, innovation, and infrastructure. Innovation in green technologies is essential for driving sustainable industrialization and fostering research and development, which in turn also supports SDG 12 of Responsible Consumption and Production by leading to more efficient resource use and sustainable production processes. Green Finance (GF), measured by renewable energy public RD&D budget as a percentage of total energy RD&D, is a key driver for SDG 9 and SDG 7 by funding the development and deployment of clean energy technologies. Lastly, Green Taxes (GT), measured by environmentally related taxes as a percentage of GDP, directly supports SDGs 7, 13, 14, and 15 by providing economic incentives and enhancing the shift towards cleaner energy sources to reduce carbon emissions. These variables emphasize the role of green policies and innovation in achieving SDG goals. The basic econometric models are given as follows:

Empirical methodologyIn our study, we undertake a comprehensive analysis approach to examine the influence of green finance, taxes, and innovation on carbon emissions. We commence the analysis by providing descriptive statistics to offer a preliminary insight into the variables. In order to account for cross-sectional dependencies and heterogeneous slopes across units and ensure robust estimations, we incorporate the Cross-Sectional Dependence and slope heterogeneity analysis, as recommended by Pesaran (2004) and Pesaran and Yamagata (2008), respectively. We employ the unit root test, developed by Im et al. (2003), to confirm the stationarity of our variables. We subsequently investigate the long-term equilibrium relationships among the variables using Westerlund's (2005) cointegration analysis, which enables us to determine whether a stable, long-term association exists.

We utilize the Method of Moments Quantile Regression (MMQR), as presented by Machado and Silva (2019), for our baseline analysis. The MMQR method enables us to investigate the extent to which the independent variables influence CO₂ emissions at various points in the distribution rather than focussing on the mean. The equation for the above model is given as:

In the above equations, βiτ shows the Quantile-specific coefficients estimated via moment conditionsm(τ) shows the Quantile function, ∑τ Integrates across all quantiles, and ϵ is the error term. Additionally, as a robustness test analysis, we have taken the bootstrap quantile regression analysis.

Theoretical frameworkBased on the Environmental Kuznets Curve (EKC) hypothesis, we argue that although OECD countries are developed economies, economic growth within these nations still contributes to increased carbon emissions. However, the adoption of green energy sources and innovative technologies leads to a reduction in emissions. This indicates that even in advanced economies, proactive implementation of sustainable practices is essential to decouple economic growth from environmental degradation (Voumik et al., 2022). The innovation theory and Resource-based view theory explain the negative influence of green innovation, green taxes, green finance, renewable energy, and energy productivity on carbon emissions. Based on the innovation theory, the development of advanced, energy-efficient technologies will lead to a reduction in emissions. The Resource-Based View (RBV) theory explains that green taxation and financial constraints drive companies to adopt sustainable practices that reduce CO₂ emissions. This enables countries to increase production efficiency while consuming less energy, particularly through cleaner energy sources, and contributes to emission reductions. These factors underscore the critical role of green policies in achieving a low-carbon economy (Ouyang, Guan, & Yu, 2023; Sharma, Verma, Shahbaz, Gupta, & Chopra, 2022; Wang, Jin, Qin, Su, & Umar, 2024). Fig. 2 overviews the expected relationships based on literature review and theoretical reasoning.

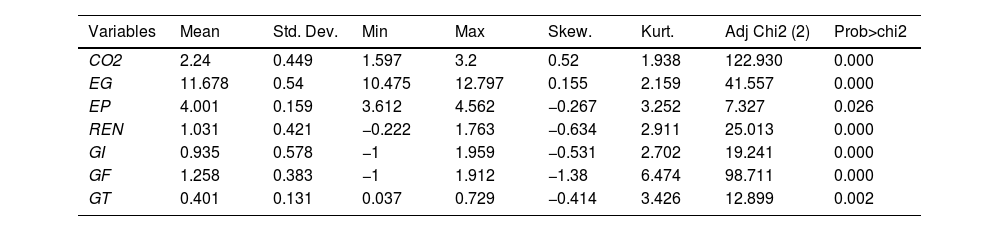

ResultsThe descriptive statistics for the key variables utilized in this research are all summarized in detail in Table 1. A moderate variability is indicated in the consumption-based carbon emissions (CO2), which have a mean of 2.24 and a standard deviation of 0.449, ranging from 1.597 to 3.2. A distribution that is considerably flatter and right-skewed than a normal distribution is suggested by the slight positive skewness (0.52) and kurtosis of 1.938. The results of economic growth (EG) demonstrate a nearly symmetric distribution with a small platykurtic tendency. The data spans from 10.475 to 12.797, with a mean of 11.678 and low variability (standard deviation of 0.54), skewness (0.155), and a kurtosis of 2.159. Green technological innovation (GI) ranges from −1 to 1.959, with a mean of 0.935 and a greater standard deviation of 0.578, indicating notable variations. A kurtosis of 2.702 and negative skewness (−0.531) emphasize the variability in innovation uptake. Energy productivity (EP) has a moderately peaked kurtosis of 3.252, a slightly left-skewed distribution (−0.267), and a mean of 4.001 with little variance (standard deviation of 0.159). Renewable energy consumption (REN) results range from −0.222 to 1.763, with a mean of 1.031 and a standard deviation of 0.421. The kurtosis of 2.911 and negative skewness (−0.634) indicate that more nations are adopting renewable energy at the higher end of the spectrum. Green finance (GF) has a mean of 1.258, a distribution (−1.380 skewness), a peaked kurtosis of 6.474, and minimal variability (standard deviation of 0.383). With a peaked distribution (kurtosis of 3.426), a wide range from 0.37 to 0.729, negative skewness (−0.414), and a mean of 0.401, environmental taxes (GT) show high skewness and variability. These results suggest that while some OECD economies have very low or negligible environmental tax levels, others have more robust tax policies. All variables exhibit substantial deviations from normal distributions, as shown by the Chi2 tests for normality, with p-values of 0.000 for CO2, EG, REN, GI, and GF. The present research underscores the dataset's heterogeneous nature and posits notable fluctuations in pivotal indicators such as innovation, renewable energy, and environmental taxation. These insights will be crucial in comprehending the relationship between these variables and carbon emissions.

Descriptive Statistics.

| Variables | Mean | Std. Dev. | Min | Max | Skew. | Kurt. | Adj Chi2 (2) | Prob>chi2 |

|---|---|---|---|---|---|---|---|---|

| CO2 | 2.24 | 0.449 | 1.597 | 3.2 | 0.52 | 1.938 | 122.930 | 0.000 |

| EG | 11.678 | 0.54 | 10.475 | 12.797 | 0.155 | 2.159 | 41.557 | 0.000 |

| EP | 4.001 | 0.159 | 3.612 | 4.562 | −0.267 | 3.252 | 7.327 | 0.026 |

| REN | 1.031 | 0.421 | −0.222 | 1.763 | −0.634 | 2.911 | 25.013 | 0.000 |

| GI | 0.935 | 0.578 | −1 | 1.959 | −0.531 | 2.702 | 19.241 | 0.000 |

| GF | 1.258 | 0.383 | −1 | 1.912 | −1.38 | 6.474 | 98.711 | 0.000 |

| GT | 0.401 | 0.131 | 0.037 | 0.729 | −0.414 | 3.426 | 12.899 | 0.002 |

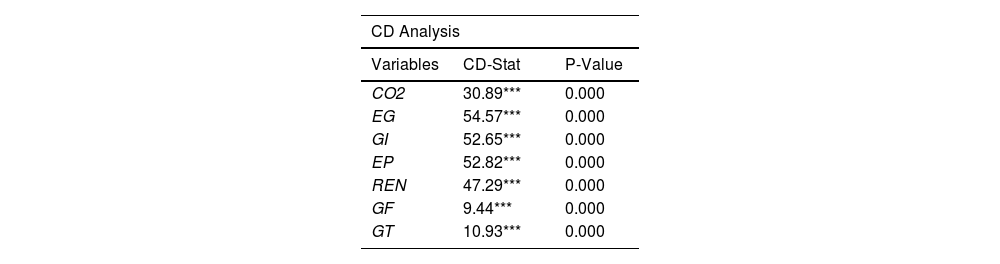

Table 2 shows Cross-Sectional Dependence (CD) and Slope Heterogeneity Analysis findings, which help explain country interconnection and heterogeneity. CO2, EG, REN, and GT have CD-stat p-values of 0.000. These findings reveal considerable cross-sectional dependency, suggesting global issues like international commerce and environmental accords affect these variables across nations. Green innovation (GI), energy productivity (EP), and Green Finance (GF) also exhibit substantial connection with p-values of 0.000, demonstrating interconnectivity in technology, energy consumption, and financing. The slope heterogeneity analysis determines whether independent variables and CO2 emissions vary considerably between nations. The first model, which includes CO2, EG, GI, EP, and REN, has a Delta statistic of 19.631 and an adjusted Delta of 21.954, suggesting slope variability among nations. The second model with GF has a Delta (15.631) and adjusted Delta (18.222) statistics. Similarly, the third model with GT has reduced Delta (11.740) and adjusted Delta (14.538) statistics but is significant, demonstrating that these factors minimize slope heterogeneity. These findings emphasize the necessity of accounting for cross-sectional dependency and slope heterogeneity when studying CO2 emissions.

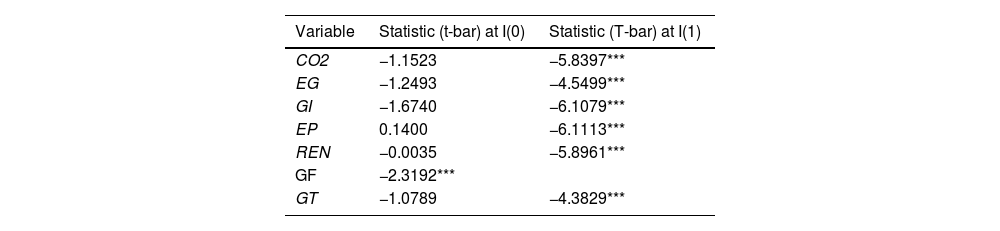

Table 3 gives the unit root analysis. The results show that all the variables (CO2 EG EP REN, GI, and GT) are stationary at the first difference, whereas GF is stationary at the level. In Table 3, green finance (GF) is stationary at level I(0), with significant t-bar statistics of −2.3192. For the remaining variables, stationarity is achieved at the first difference I(1), with CO2 showing a t-bar statistic of −5.8397, economic growth (EG) at −4.5499, green innovation at −6.1079, energy productivity (EP) at −6.1113, renewable energy (REN) at −5.8961, and environmental taxes (GT) at −4.3829, all significant at the 1% level.

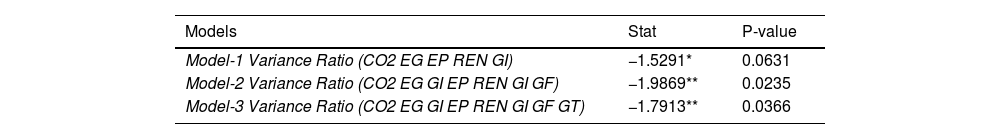

Table 4 gives the cointegration analysis and shows the presence of long-run relationships among the variables across all three models. Model 1 shows significance at 10 percent (p-value = 0.0631), while Models 2 and 3 display stronger evidence of cointegration with p-values of 0.0235 and 0.0366, respectively. The decreasing p-values and consistent significance as more variables are added indicate that expanding the model enhances the detection of stable long-term relationships among the variables.

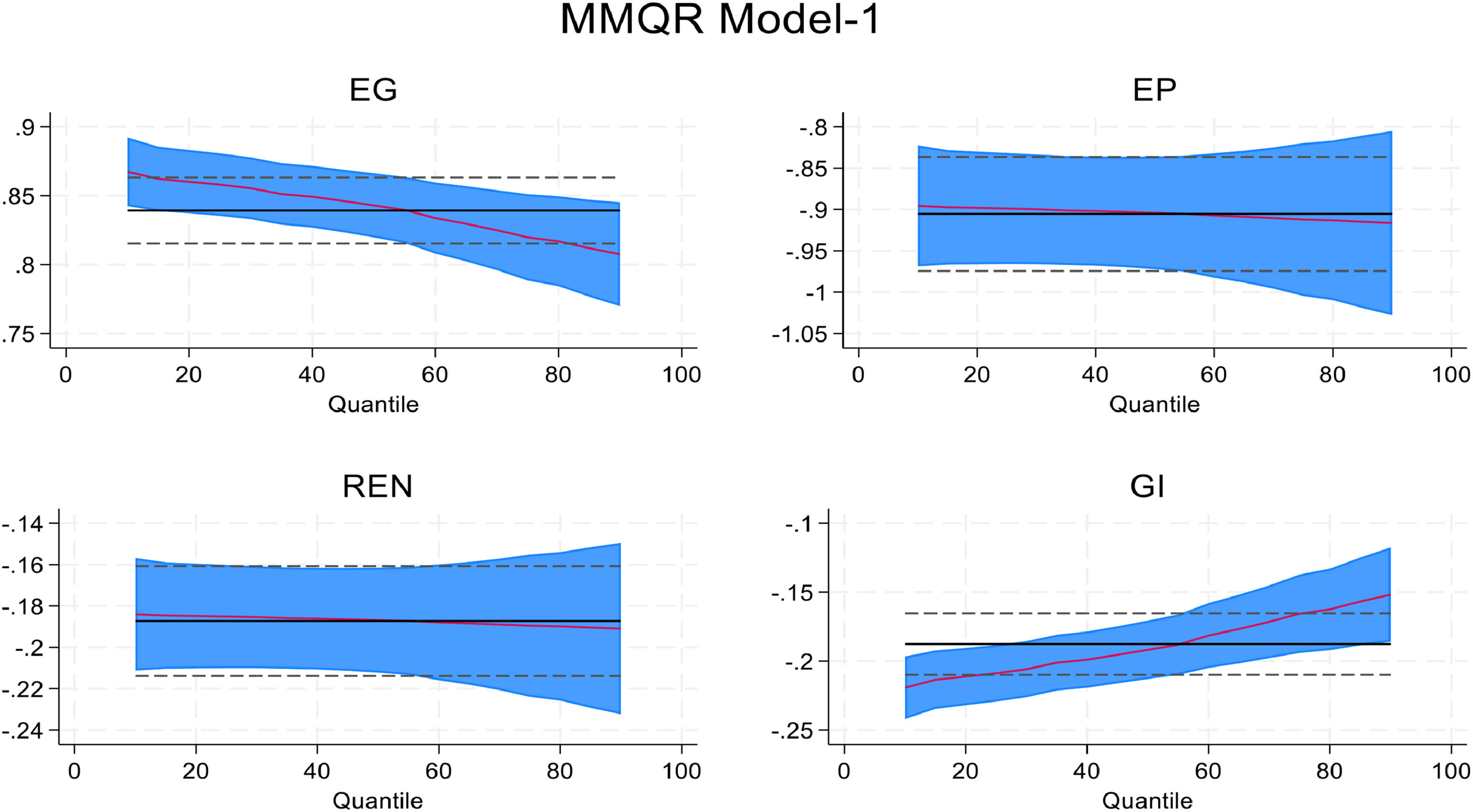

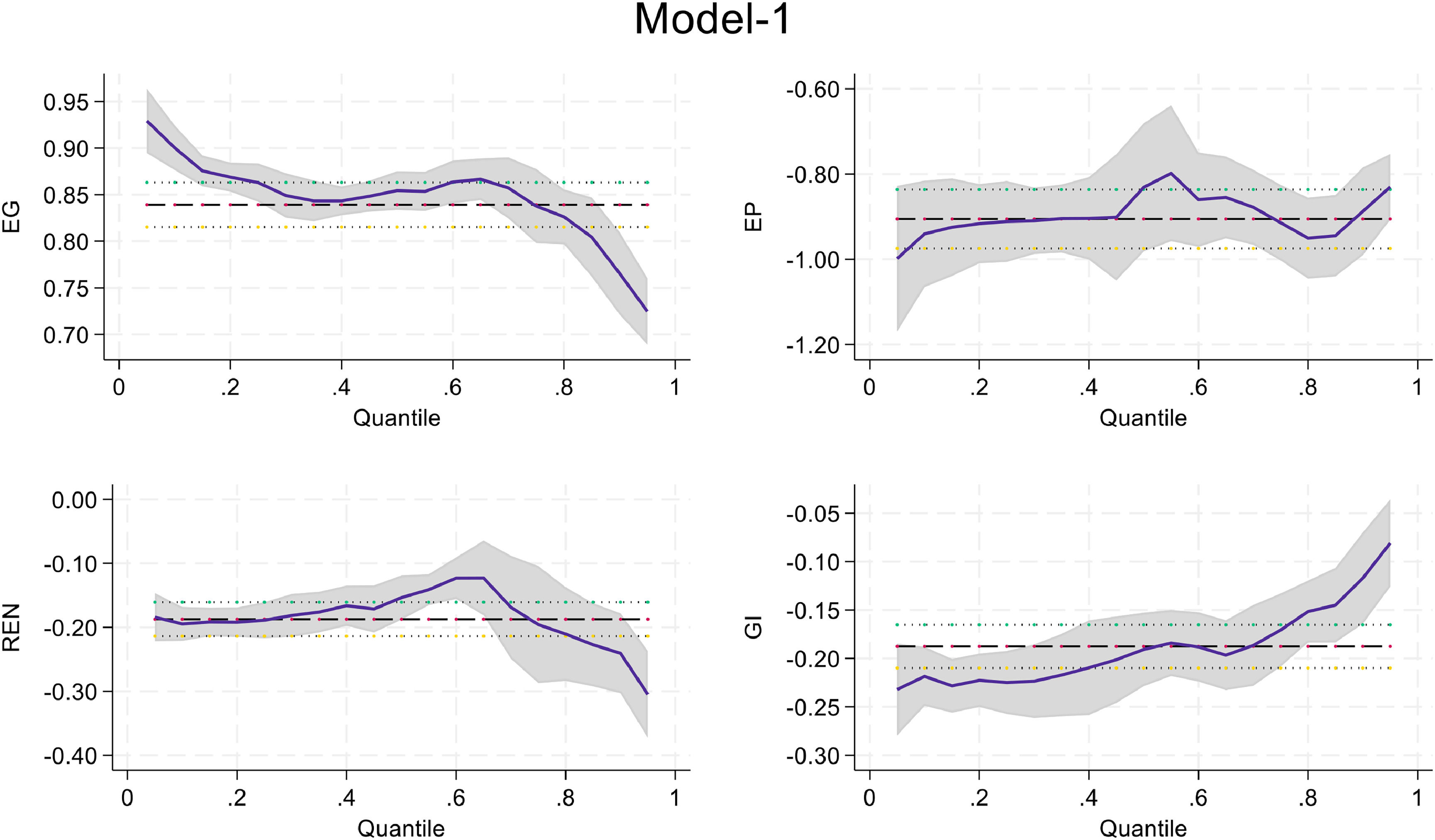

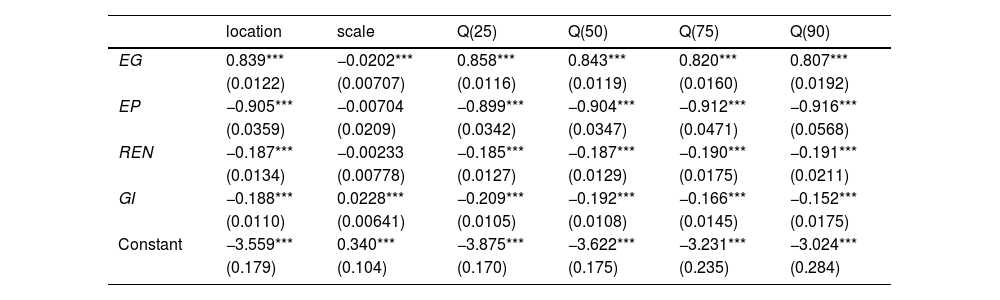

Table 5 gives results for the MMQR Model-1 and shows the influence of the independent variables on consumption-based CO₂ emissions. Economic Growth (EG) consistently has a positive and significant impact on CO₂ emissions across all quantiles, with a decreasing trend as the quantiles increase (0.858 at the 25th quantile to 0.807 at the 90th quantile), indicating that as economic growth rises, the carbon emission diminishes. Energy Productivity (EP) shows a strong negative effect on CO₂ emissions across all quantiles, becoming more negative as quantiles increase (−0.899 at the 25th quantile to −0.916 at the 90th quantile), emphasizing the growing importance of energy efficiency at higher emissions levels. Renewable Energy (REN) also has a negative significant and more stable effect across quantiles (−0.185 at the 25th quantile to −0.191 at the 90th quantile), indicating consistent benefits from renewable energy adoption across all emissions levels. Interestingly, Green Innovation (GI) displays a generally negative effect on CO₂ emissions, but with a slightly positive scale coefficient (0.0228) indicating a minor increase at certain intermediate points, though its overall impact remains negative across higher quantiles (−0.209 at the 25th quantile to −0.152 at the 90th quantile). These results highlight that while economic growth drives emissions, improvements in energy productivity, renewable energy, and green innovation play critical roles in reducing CO₂ emissions, with their influence becoming stronger at higher quantiles. Fig. 3 visualizes these trends, illustrating the varying impacts across different emissions levels.

MMQR Model-1.

| location | scale | Q(25) | Q(50) | Q(75) | Q(90) | |

|---|---|---|---|---|---|---|

| EG | 0.839*** | −0.0202*** | 0.858*** | 0.843*** | 0.820*** | 0.807*** |

| (0.0122) | (0.00707) | (0.0116) | (0.0119) | (0.0160) | (0.0192) | |

| EP | −0.905*** | −0.00704 | −0.899*** | −0.904*** | −0.912*** | −0.916*** |

| (0.0359) | (0.0209) | (0.0342) | (0.0347) | (0.0471) | (0.0568) | |

| REN | −0.187*** | −0.00233 | −0.185*** | −0.187*** | −0.190*** | −0.191*** |

| (0.0134) | (0.00778) | (0.0127) | (0.0129) | (0.0175) | (0.0211) | |

| GI | −0.188*** | 0.0228*** | −0.209*** | −0.192*** | −0.166*** | −0.152*** |

| (0.0110) | (0.00641) | (0.0105) | (0.0108) | (0.0145) | (0.0175) | |

| Constant | −3.559*** | 0.340*** | −3.875*** | −3.622*** | −3.231*** | −3.024*** |

| (0.179) | (0.104) | (0.170) | (0.175) | (0.235) | (0.284) |

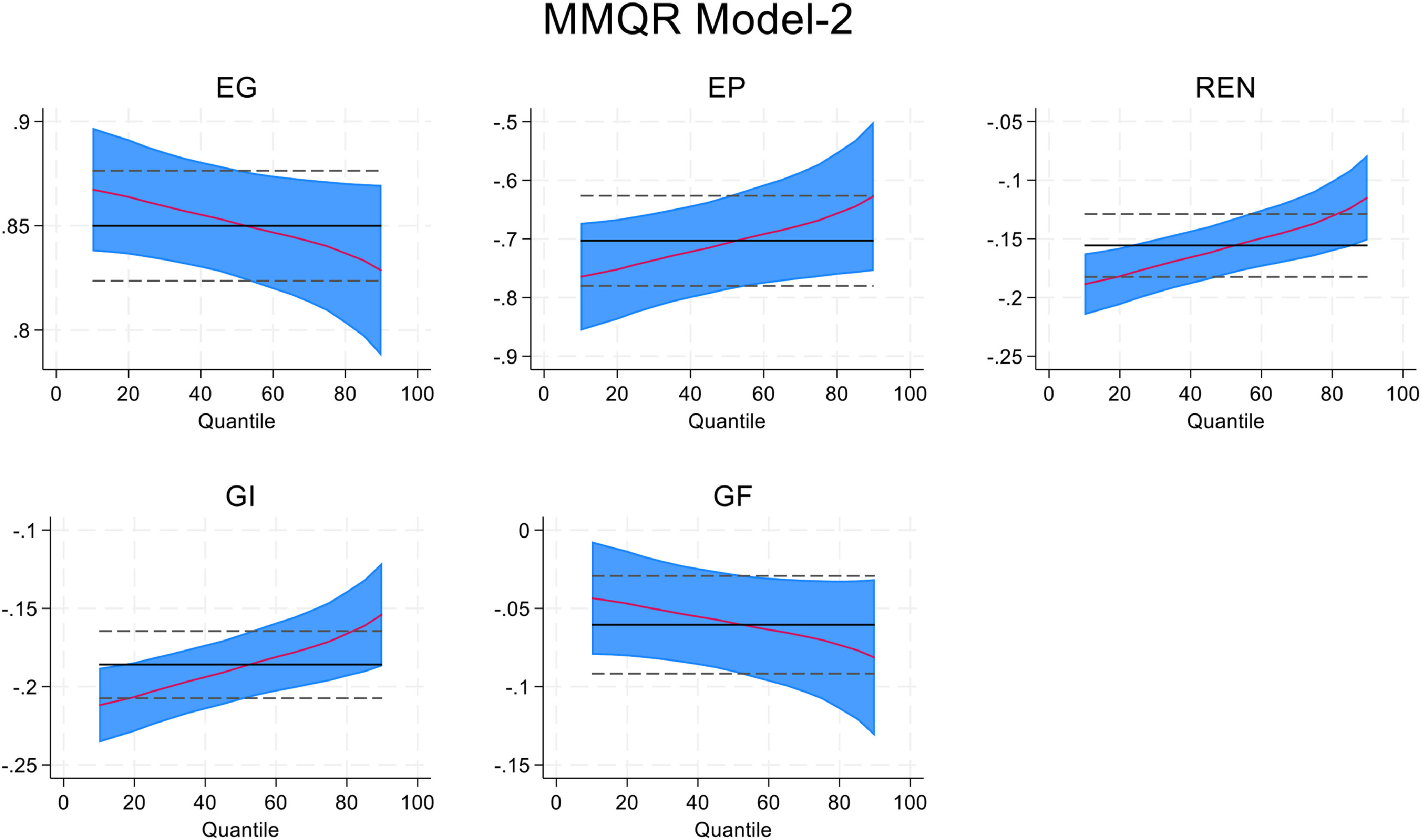

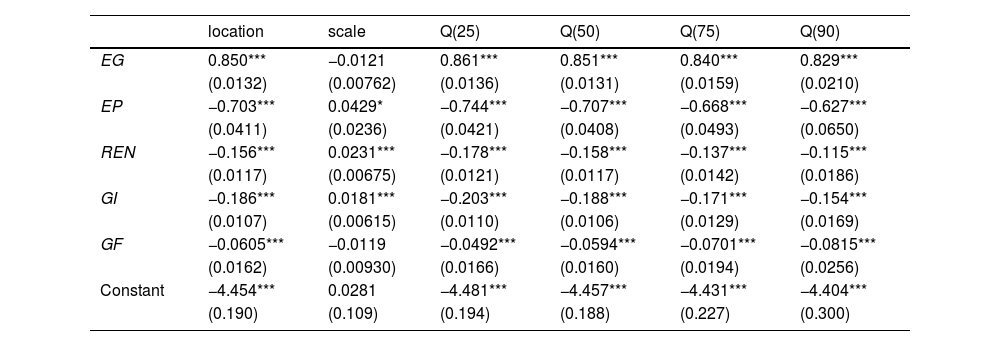

The results for Economic Growth (EG), Energy Productivity (EP), Renewable Energy (REN), and Green Innovation (GI) in Table 6 are consistent with those in Table 5, showing similar trends across all quantiles. The focus here is on the effect of Green Finance (GF) on CO₂ emissions. Green finance has a significant negative influence on CO₂ emissions across all quantiles, with higher coefficients at higher quantiles (−0.0492 at the 25th quantile to −0.0815 at the 90th quantile). With the increase in green finance initiatives, carbon emissions are reduced significantly with higher coefficients. The increasing impact of GF at higher quantiles suggests that investments in green projects, such as renewable energy and clean technology, are particularly effective in high-emission contexts where larger financial commitments are needed to drive significant environmental improvements. Fig. 4 shows the results as a graph, illustrating the varying impacts across the quantiles.

Model-2.

| location | scale | Q(25) | Q(50) | Q(75) | Q(90) | |

|---|---|---|---|---|---|---|

| EG | 0.850*** | −0.0121 | 0.861*** | 0.851*** | 0.840*** | 0.829*** |

| (0.0132) | (0.00762) | (0.0136) | (0.0131) | (0.0159) | (0.0210) | |

| EP | −0.703*** | 0.0429* | −0.744*** | −0.707*** | −0.668*** | −0.627*** |

| (0.0411) | (0.0236) | (0.0421) | (0.0408) | (0.0493) | (0.0650) | |

| REN | −0.156*** | 0.0231*** | −0.178*** | −0.158*** | −0.137*** | −0.115*** |

| (0.0117) | (0.00675) | (0.0121) | (0.0117) | (0.0142) | (0.0186) | |

| GI | −0.186*** | 0.0181*** | −0.203*** | −0.188*** | −0.171*** | −0.154*** |

| (0.0107) | (0.00615) | (0.0110) | (0.0106) | (0.0129) | (0.0169) | |

| GF | −0.0605*** | −0.0119 | −0.0492*** | −0.0594*** | −0.0701*** | −0.0815*** |

| (0.0162) | (0.00930) | (0.0166) | (0.0160) | (0.0194) | (0.0256) | |

| Constant | −4.454*** | 0.0281 | −4.481*** | −4.457*** | −4.431*** | −4.404*** |

| (0.190) | (0.109) | (0.194) | (0.188) | (0.227) | (0.300) |

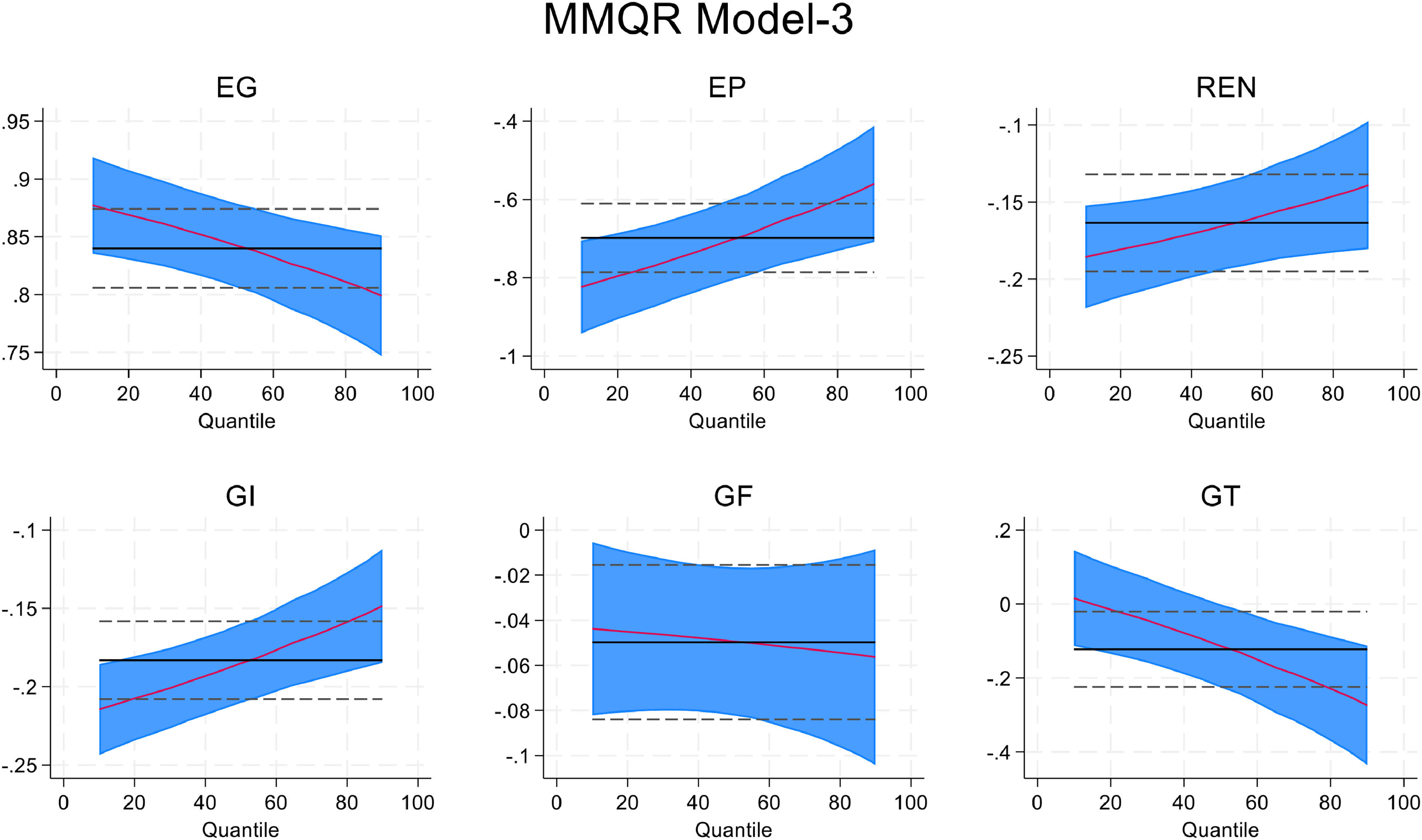

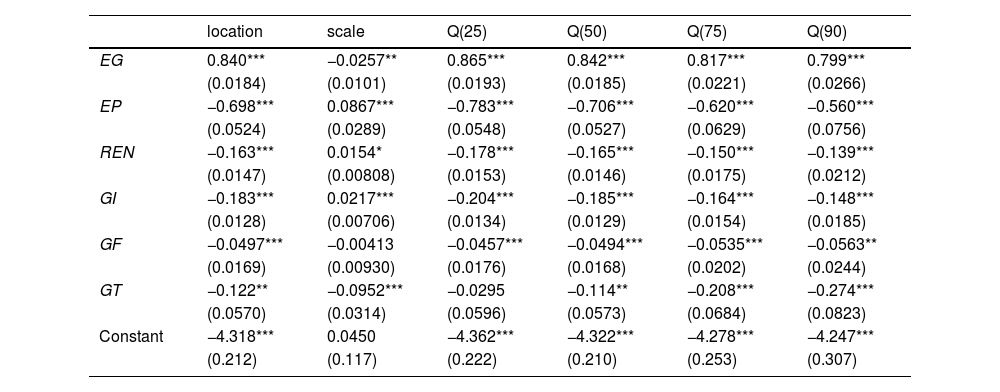

The results for EG, EP, REN, GI, and GF in Table 7 are consistent with those in Tables 5 and 6, showing similar trends across all quantiles. Table 7 provides evidence for the relationship between Green Taxes (GT) and CO₂ emissions. GT shows a negative and significant impact on CO₂ emissions, with its effect becoming stronger at higher quantiles. For instance, the effect ranges from −0.0295 at the 25th quantile to −0.274 at the 90th quantile. This increasing impact suggests that green taxes are particularly effective in reducing emissions in high-emission contexts, where they likely impose significant costs on polluting activities, thereby incentivizing a shift towards cleaner practices and technologies. The stronger effect at higher quantiles could be attributed to the greater reliance on energy-intensive activities in high-emission scenarios, where green taxes can lead to substantial reductions by pushing firms and consumers towards more sustainable alternatives (Aydin & Esen, 2018). Fig. 5 visualizes these trends, illustrating the varying impacts across different levels of emissions.

Model-3.

| location | scale | Q(25) | Q(50) | Q(75) | Q(90) | |

|---|---|---|---|---|---|---|

| EG | 0.840*** | −0.0257** | 0.865*** | 0.842*** | 0.817*** | 0.799*** |

| (0.0184) | (0.0101) | (0.0193) | (0.0185) | (0.0221) | (0.0266) | |

| EP | −0.698*** | 0.0867*** | −0.783*** | −0.706*** | −0.620*** | −0.560*** |

| (0.0524) | (0.0289) | (0.0548) | (0.0527) | (0.0629) | (0.0756) | |

| REN | −0.163*** | 0.0154* | −0.178*** | −0.165*** | −0.150*** | −0.139*** |

| (0.0147) | (0.00808) | (0.0153) | (0.0146) | (0.0175) | (0.0212) | |

| GI | −0.183*** | 0.0217*** | −0.204*** | −0.185*** | −0.164*** | −0.148*** |

| (0.0128) | (0.00706) | (0.0134) | (0.0129) | (0.0154) | (0.0185) | |

| GF | −0.0497*** | −0.00413 | −0.0457*** | −0.0494*** | −0.0535*** | −0.0563** |

| (0.0169) | (0.00930) | (0.0176) | (0.0168) | (0.0202) | (0.0244) | |

| GT | −0.122** | −0.0952*** | −0.0295 | −0.114** | −0.208*** | −0.274*** |

| (0.0570) | (0.0314) | (0.0596) | (0.0573) | (0.0684) | (0.0823) | |

| Constant | −4.318*** | 0.0450 | −4.362*** | −4.322*** | −4.278*** | −4.247*** |

| (0.212) | (0.117) | (0.222) | (0.210) | (0.253) | (0.307) |

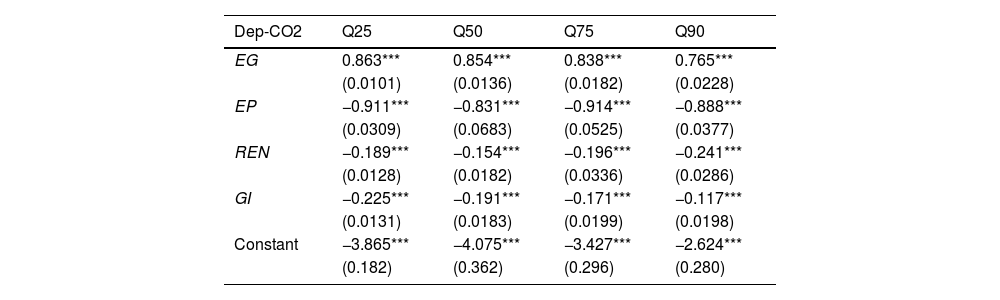

The bootstrap quantile regression analysis for Model-1 confirms the robustness of the earlier results, as presented in Table 8. Economic Growth (EG) consistently shows a positive and significant effect on CO₂ emissions across all quantiles, though its influence decreases slightly at higher quantiles (from 0.863 at Q25 to 0.765 at Q90). Energy Productivity (EP) maintains a strong negative relationship with emissions across all quantiles, reinforcing its critical role in reducing CO₂ emissions. Similarly, Renewable Energy (REN) continues to exhibit a negative and significant impact, with its effect becoming more pronounced at higher quantiles (−0.189 at Q25 to −0.241 at Q90). Green Innovation (GI) also retains its negative effect on emissions, although its influence weakens slightly as quantiles increase (−0.225 at Q25 to −0.117 at Q90). These results align with the original findings, confirming that the relationships are robust and consistent across different quantile levels. These results are supported by early studies of (Amin et al., 2022; Hassan et al., 2024). Fig. 6 graphically illustrates these results.

Bootstrap Quantile Regression (BQR) Analysis Model-1.

| Dep-CO2 | Q25 | Q50 | Q75 | Q90 |

|---|---|---|---|---|

| EG | 0.863*** | 0.854*** | 0.838*** | 0.765*** |

| (0.0101) | (0.0136) | (0.0182) | (0.0228) | |

| EP | −0.911*** | −0.831*** | −0.914*** | −0.888*** |

| (0.0309) | (0.0683) | (0.0525) | (0.0377) | |

| REN | −0.189*** | −0.154*** | −0.196*** | −0.241*** |

| (0.0128) | (0.0182) | (0.0336) | (0.0286) | |

| GI | −0.225*** | −0.191*** | −0.171*** | −0.117*** |

| (0.0131) | (0.0183) | (0.0199) | (0.0198) | |

| Constant | −3.865*** | −4.075*** | −3.427*** | −2.624*** |

| (0.182) | (0.362) | (0.296) | (0.280) |

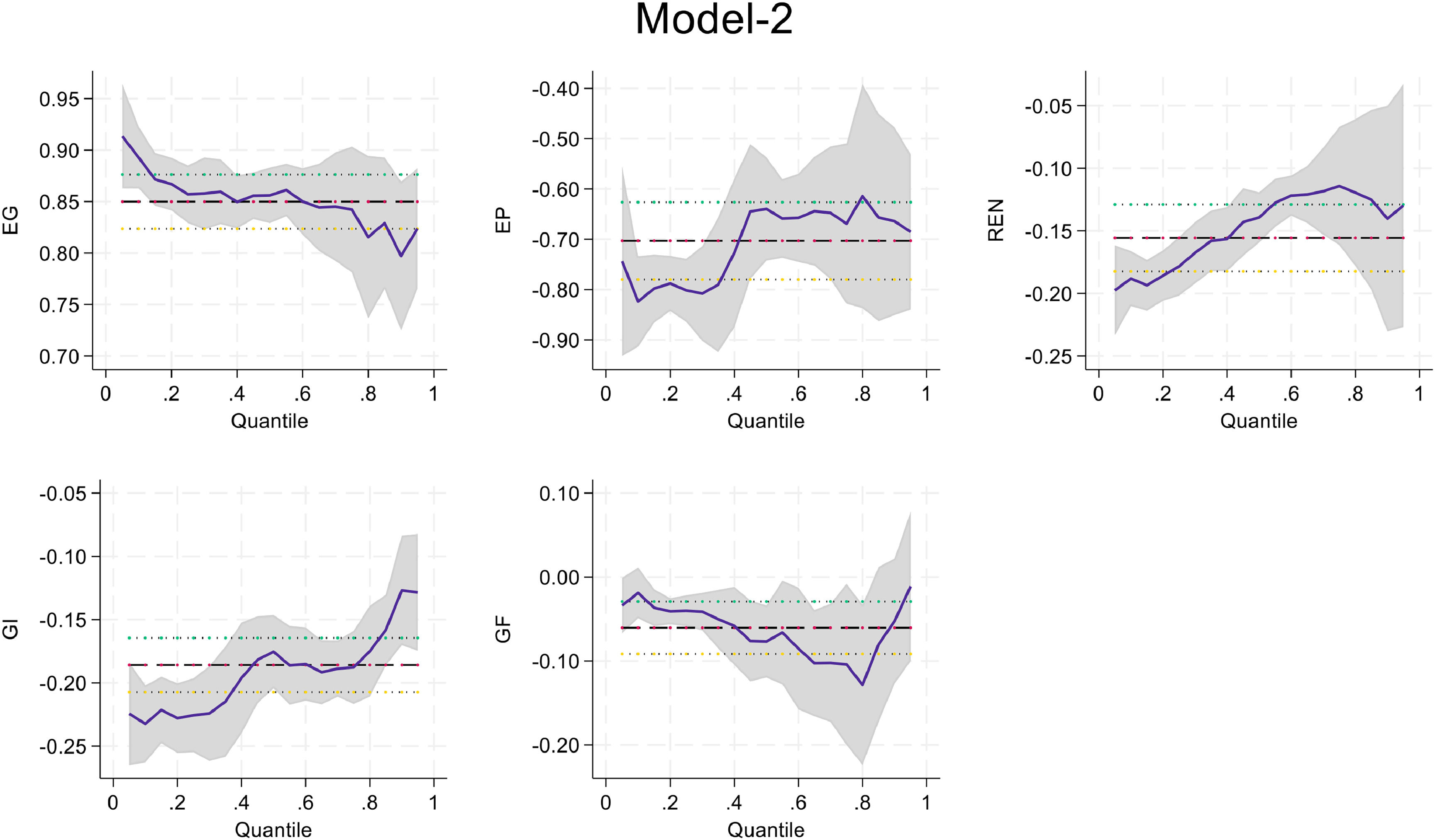

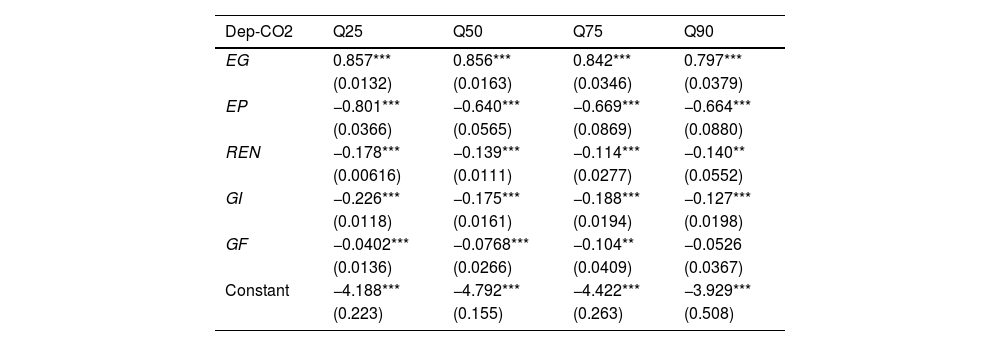

The robustness analysis for Green Finance (GF) in Model-2 reveals that its negative impact on CO₂ emissions is consistent across quantiles, although the strength of the effect varies (See Table 9). At lower quantiles (Q25 and Q50), GF shows a significant negative influence (−0.0402 and −0.0768, respectively), indicating that green finance plays a crucial role in reducing emissions in low to mid-emission contexts. However, at higher quantiles (Q75 and Q90), while the effect remains negative, the significance weakens, especially at Q90, where the coefficient is not statistically significant. This suggests that green finance is more effective in reducing emissions in lower-emission scenarios but may have diminishing returns in higher-emission contexts, possibly due to larger-scale structural factors that require more substantial interventions beyond financial investments alone. Fig. 7 illustrates these results.

Bootstrap Quantile Regression Analysis Model-2.

| Dep-CO2 | Q25 | Q50 | Q75 | Q90 |

|---|---|---|---|---|

| EG | 0.857*** | 0.856*** | 0.842*** | 0.797*** |

| (0.0132) | (0.0163) | (0.0346) | (0.0379) | |

| EP | −0.801*** | −0.640*** | −0.669*** | −0.664*** |

| (0.0366) | (0.0565) | (0.0869) | (0.0880) | |

| REN | −0.178*** | −0.139*** | −0.114*** | −0.140** |

| (0.00616) | (0.0111) | (0.0277) | (0.0552) | |

| GI | −0.226*** | −0.175*** | −0.188*** | −0.127*** |

| (0.0118) | (0.0161) | (0.0194) | (0.0198) | |

| GF | −0.0402*** | −0.0768*** | −0.104** | −0.0526 |

| (0.0136) | (0.0266) | (0.0409) | (0.0367) | |

| Constant | −4.188*** | −4.792*** | −4.422*** | −3.929*** |

| (0.223) | (0.155) | (0.263) | (0.508) |

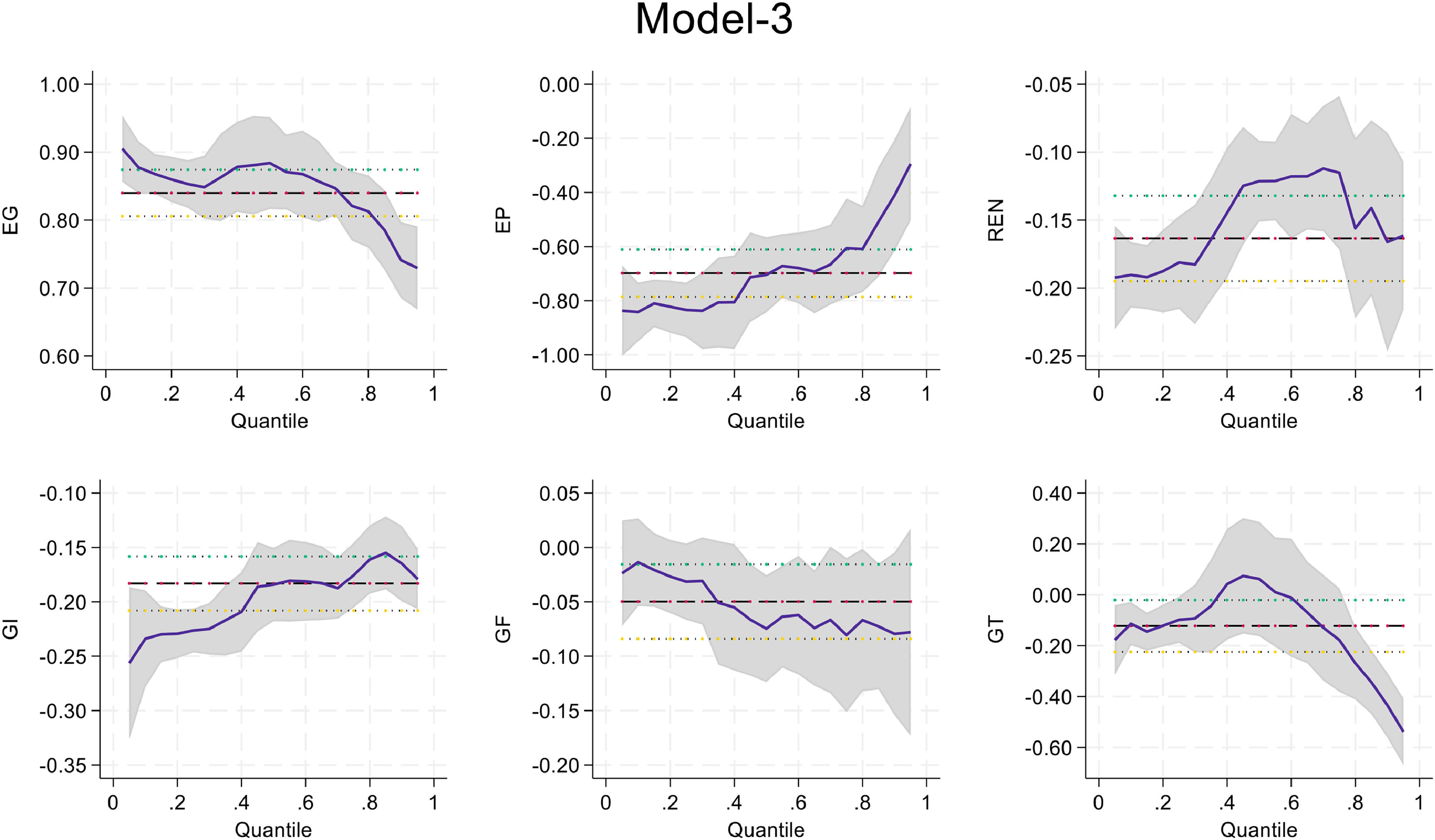

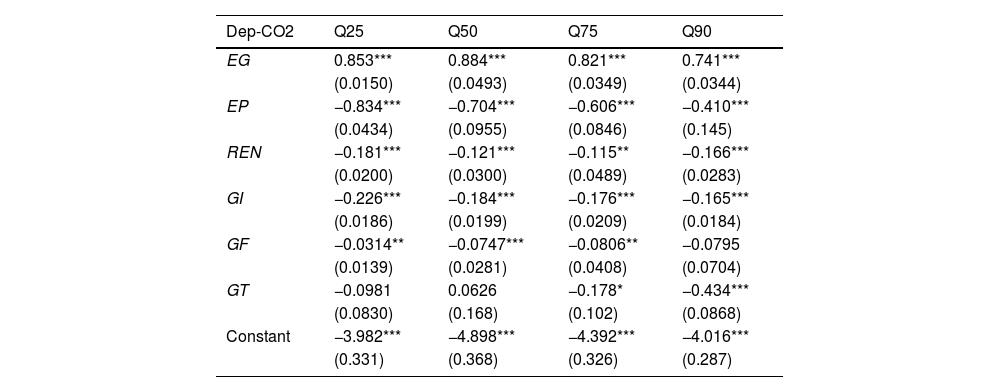

The robustness analysis for Green Taxes (GT) in Model-3 shows mixed results across quantiles (See Table 10). At the lower quantiles (Q25 and Q50), the effect of GT on CO₂ emissions is not significant, with a weak negative coefficient at Q25 (−0.0981) and a surprising positive coefficient at Q50 (0.0626), indicating limited impact in lower-emission contexts. However, at higher quantiles (Q75 and Q90), GT becomes more effective, with a significant and increasingly negative effect (−0.178 at Q75 and −0.434 at Q90), indicating that green taxes play a crucial role in curbing emissions in high-emission scenarios. This trend suggests that green taxes are more impactful in settings where emissions are high, likely due to their ability to influence behavior and reduce reliance on carbon-intensive activities when emissions reach critical levels. Fig. 8 graphically represents the results.

Bootstrap Quantile Regression Analysis Model-3.

| Dep-CO2 | Q25 | Q50 | Q75 | Q90 |

|---|---|---|---|---|

| EG | 0.853*** | 0.884*** | 0.821*** | 0.741*** |

| (0.0150) | (0.0493) | (0.0349) | (0.0344) | |

| EP | −0.834*** | −0.704*** | −0.606*** | −0.410*** |

| (0.0434) | (0.0955) | (0.0846) | (0.145) | |

| REN | −0.181*** | −0.121*** | −0.115** | −0.166*** |

| (0.0200) | (0.0300) | (0.0489) | (0.0283) | |

| GI | −0.226*** | −0.184*** | −0.176*** | −0.165*** |

| (0.0186) | (0.0199) | (0.0209) | (0.0184) | |

| GF | −0.0314** | −0.0747*** | −0.0806** | −0.0795 |

| (0.0139) | (0.0281) | (0.0408) | (0.0704) | |

| GT | −0.0981 | 0.0626 | −0.178* | −0.434*** |

| (0.0830) | (0.168) | (0.102) | (0.0868) | |

| Constant | −3.982*** | −4.898*** | −4.392*** | −4.016*** |

| (0.331) | (0.368) | (0.326) | (0.287) |

The present study primarily focuses on the role of three green policy indicators (Green finance, green innovation, and green taxes). We explored the role of these three indicators on trade-adjusted emission while taking renewable energy, energy productivity, and economic growth as control variables for selected OECD economies over a period of 1990–2022. The MMQR analysis shows that green finance, taxes, and innovation significantly reduce carbon emissions in the OECD economies, highlighting the importance of these green policy indicators for sustainable development goals. The results for the control variable show that while economic growth enhances emissions, renewable energy, and energy productivity significantly reduce emissions in the OECD economies.

Based on the results of this study, we suggest the following policy implications. The OECD economies need to adopt sustainable growth strategies as the results give a positive linkage between economic growth and emissions. Policymakers should focus on decoupling economic growth from carbon emissions through investments in innovative green technologies and energy efficiency. As emphasized by Songwe et al. (2022), there is a need to mobilize around $2.4 trillion annually by 2030 for climate-related investments, particularly in emerging markets, to achieve this decoupling. Green innovation is negatively associated with emissions, suggesting that increasing investments in green R&D can significantly influence sustainable development goals. The climate finance framework highlighted by COP28 indicates that significant investments in innovation are needed to drive the transition to a low-carbon economy. Policymakers in the OECD economies should invest in innovation supported by a robust climate finance framework.

Our results show that green taxes and green finance negatively impact CO2 emissions, highlighting their effectiveness. To further enhance their impact, governments should expand carbon pricing mechanisms and increase the availability of green financial instruments. COP28 stresses the importance of scaling up green finance, aiming to mobilize and enhance private finance by 2030, particularly in emerging and developing economies. The negative relationship between CO2 emissions and renewable energy, as well as energy productivity, emphasizes the importance of transitioning to renewable energy and improving energy efficiency. COP28 outlines the need for a massive increase in renewable energy investments to meet SDG goals. Policymakers should prioritize renewable energy projects and energy efficiency measures supported by international climate finance mechanisms to bridge the investment gap in low-income countries.

Despite providing important findings and policy implications, this study has some limitations. First, this study focuses on OECD economies, excluding emerging economies that can provide valuable insights. Second, our analysis relies on country-level data, which may overlook regional differences. Examining provincial or city-level data in future research could provide a deeper understanding of green policies and their influence on emissions. Third, our study is focused on consumption-based carbon emissions, and future research could incorporate additional environmental pollutants, including methane (CH4) and nitrogen oxide (N2O) emissions, to facilitate an in-depth assessment.

CRediT authorship contribution statementKe-Cheng Zhang: Conceptualization. Adnan Safi: Methodology. Bilal Kchouri: Software, Resources. Arindam Banerjee: Writing – original draft, Visualization. Lu Wang: Writing – review & editing, Writing – original draft, Software.

This study is supported by the National Social Science Fund project titled “Research on the Path and Countermeasures of Digital Empowerment for High-Quality Development of Rural Characteristic Industries” (No. 23BJY010).