This paper adopts a configurational approach to explore the degree of matching among typologies of organizational culture and categories of family firm. Based on a sample of 491 Spanish firms with diverse levels of family involvement and using the organizational cultural assessment instrument (OCAI), results show that family owned and managed firms and professionally managed family are characterized by a clan culture typology while market and hierarchy cultures are more relevant in non-family firms. Potential determinants and consequences of these matches are explained and discussed.

Este trabajo adopta un enfoque configuracional para explorar el grado de correspondencia entre diversas tipologías de cultura organizativa y distintas categorías de empresa familiar. A partir de una muestra de 491 empresas españolas con diversos niveles de implicación familiar y utilizando el instrumento de evaluación cultural organizativa (IECO), los resultados muestran que tanto las empresas de propiedad y dirección familiar como las gestionadas de manera profesional se caracterizan por una tipología de cultura de clan; en cambio, las culturas jerárquica y de mercado son más adoptadas por las empresas no familiares. El trabajo finaliza con el análisis y discusión de los potenciales determinantes y consecuencias de dichas correspondencias.

Resource based-view theory (Barney, 1986) has significantly contributed to the understanding of organizations and their resources within a competitive scenario. Among them, organizational culture has been traditionally considered as one of the most important intangible strategic resources in developing competitive advantages (Denison, 1990; Kotter & Heskett, 1992; Leal-Rodríguez, Albort-Morant, & Martelo-Landroguez, 2016; Zahra, Hayton, & Salvato, 2004). Organizational culture is even of greater importance in the sphere of the family firm, where a set of values, beliefs and interests, highly influenced by the family relations (Chrisman, Chua, & Steier, 2002; Denison, Lief, & Ward, 2004; Gómez-Mejía, Nuñez-Nickel, & Gutierrez, 2001), may produce significant differences from any other non-family organizations (Dyer, 1986; Barontini & Caprio, 2006).

Literature on family firm has analyzed, adopting a familiness theoretical perspective (Habbershon, Williams, & MacMillan, 2003; Habbershon & Williams, 1999), the main influences and connections between family businesses and organizational culture (Denison et al., 2004; Merino, Monreal-Perez, & Sanchez-Marin, 2015). In this vein, Hall, Melin, and Nordqvist (2001), Leal-Rodríguez et al. (2016), Rogoff and Heck (2003) and Zahra et al. (2004) show connections with entrepreneurial activity. Poza, Alfred, and Maheswari (1997) illustrate relationships with the values of the founder within the organizational culture of the family business. Sorenson (2000) highlights its links to the style of leadership and the success of the firm, while Chrisman et al. (2002), Corbetta and Montemerlo (1999), Pistrui et al. (2000) and Steier (2001) examine its relationship with the history and the business background. However, there have been only a few studies which have focused on the characterization itself of the organizational culture on family firms (Denison et al., 2004; Dyer, 1986; Hall et al., 2001), from which most of them – with the exception of Zahra et al. (2004) and Leal-Rodríguez et al. (2016) – constitute a mere theoretical approach.

Thus, the aim of this exploratory paper is to analyze cultural typologies of the family firm depending on its level of family involvement. To do that, using on sample of 491 Spanish firms with different degrees of family involvement, we adopt the organizational cultural assessment instrument (OCAI) developed by Cameron and Quinn (1999), in order to analyze the potential alignment of the fourth scenarios of organizational culture – clan, adhocracy, market and hierarchy – with diverse classical archetypes of family firms (Chrisman et al., 2002; Chrisman, Chua, Pearson, & Barnett, 2012; Chua, Chrisman, & Sharma, 1999). With this paper we theoretically and empirically respond to calls regarding the need to additional contributions for a better understanding of the fit of the organizational culture in family firms, as we advance in the knowledge about the variations of culture among different types of family firms (Sanchez-Marin, Danvila-del-Valle, & Sastre-Castillo, 2015). In addition, this research adds new contextualized evidence of these links regarding a specific economy in which family SMEs operate: Spain, a representative country of family firms mainly oriented towards traditional and conservative culture (Merino et al., 2015). The 80% of Spanish SMEs are considered as family businesses, representing 70% of the gross domestic product – 65% and 50% in the European Union (EU) and the United States (US), respectively – and mostly operating in internal housing and services industries, characterized by low investments in innovation, limited productivity, and reduced international orientation (Monreal-Pérez & Sánchez-Marín, 2017).

With this aim, the paper is organized as follows. First, theoretical framework regarding relationships between organizational culture and family firm is developed. Then, methodology and results obtained are described. Finally, conclusions are presented and discussed.

Theoretical framework and hypothesesOrganizational culture is the set of beliefs, expectations and basic principles shared by the members of an organization (Schein, 1995). These beliefs and expectations lead to powerful behavioural norms that shape the behaviours of individuals and groups within an organization and which distinguish it from others (Alvesson, 1993). Organizational culture can be understood from the perspective of resource-based view as a resource closely interrelated with the rest of the company's resources (Hall et al., 2001) as well as a management mechanism that can be provide competitive advantages (Alvesson, 1993; Barney, 1986). In that regard, Cameron and Quinn (1999) adopt a general culture model, the Organizational Cultural Assessment Instrument (OCAI), that fits in well with this competing perspective of organizational culture (Stock, McFadden, & Gowen, 2007).

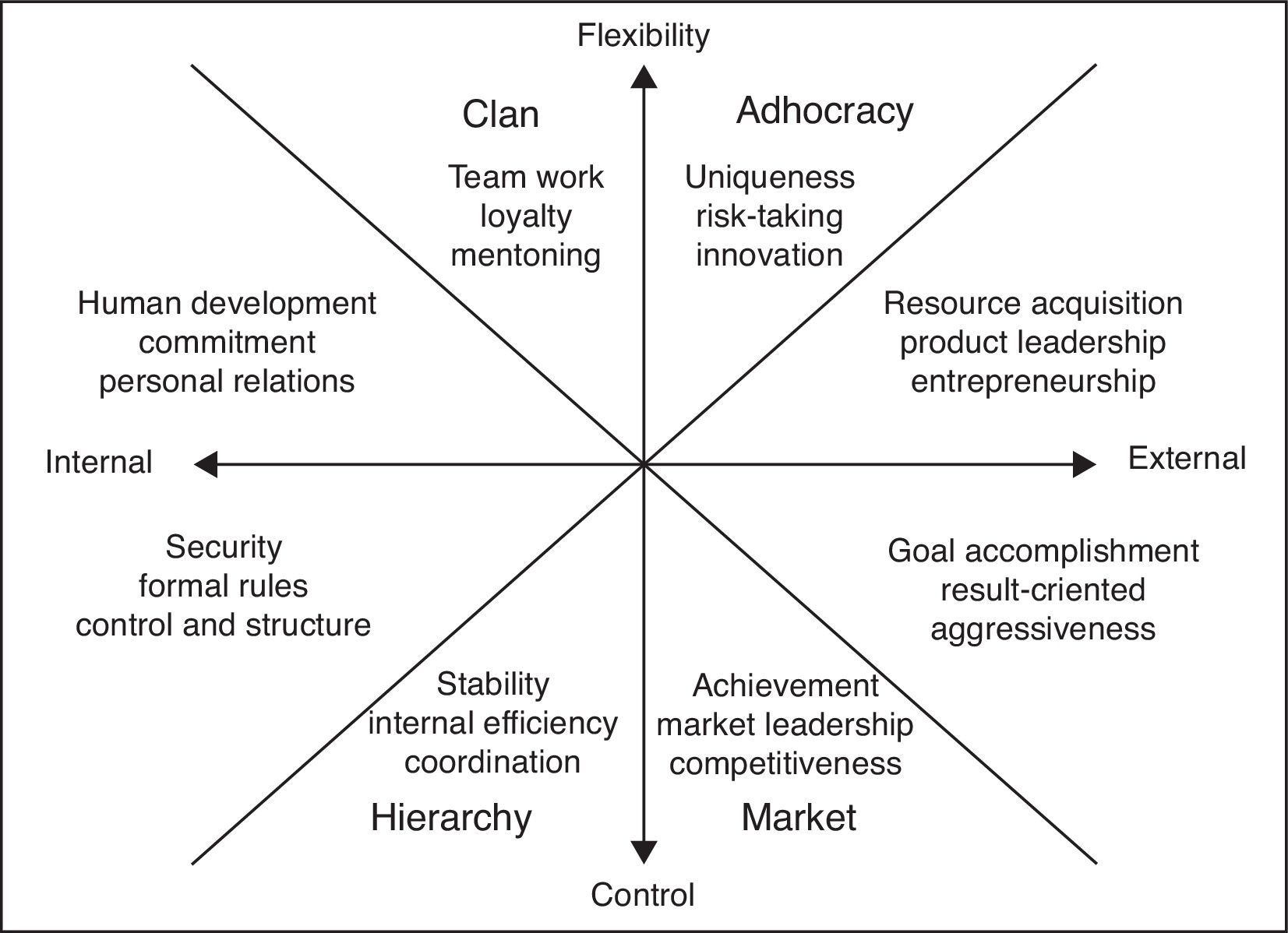

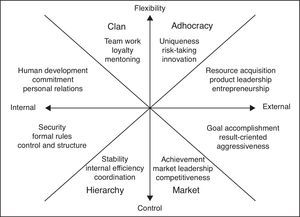

The OCAI framework explains a firm's organizational culture on the basis of four types of culture based on two dimensions that reflect different orientations towards values (Sanchez-Marin et al., 2015; Stock et al., 2007): the flexibility-control axis – that shows the degree of emphasis the organization places on change or stability and the internal-external axis – distinguishing whether an organization is more oriented towards internal or external environment and factors. From these two dimensions four types of organizational culture are configured (Cameron & Quinn, 1999), corresponding to each of the four quadrants depicted in Fig. 1. The clan culture corresponds to the model of human relations of the organizational theory, where the emphasis is on flexibility and change and which is characterized by strong human relations, affiliation, and an orientation towards internal organizational relations. The adhocracy culture corresponds to the open system model with the emphasis on flexibility and outward orientation. Its focus is based on growth, resource acquisition, creativity and adaptation to the environment. The market culture corresponds to rational model of objectives and is also outward oriented but it is also oriented towards control. Its focus is based on productivity and achievement, with clearly defined objectives and with external motivation as a driving factor. Finally, hierarchy culture corresponds to internal processes and puts its emphasis on stability. This culture is characterized by uniformity, coordination, internal efficiency and a preference for rules and regulations, in contrast to the rational culture, though, it is oriented towards what is internal to the organization.

From the familiness perspective, organizational culture characterization may vary according to the level of family involvement in the business (Denison et al., 2004; Habbershon et al., 2003; Habbershon & Williams, 1999; Merino et al., 2015). Considering family ownership and management dimensions, we can configure three types of family firms (Carrasco-Hernández & Sanchez-Marin, 2007; Chrisman et al., 2002; Chua et al., 1999) depending on their level of family involvement – family owned and managed firms (high concentration of ownership and management in the hands of the family), professionally managed family firms (family owners with management in the hands of non-family members) and non-family firms (ownership and management in the hands of non-family members) – which may have different adjustment with the organizational culture typologies described above. Taking into account that interests, behaviours, incentives and goals are different from family to non-family firms (Chrisman et al., 2012; Chua, Chrisman, Steier, & Rau, 2012), it is expected that the adoption of a specific cultural configuration will also vary according to level of family involvement in the business (Chrisman et al., 2002; Denison et al., 2004). We analyze the expected relationships below.

Clan and market cultures in family firmsWhile clan culture based its values and beliefs on the internal aspects related to the firm and on the organizational flexibility, market culture reflects organizations whose beliefs and values are externally oriented and based on goals accomplishment, achievement and competitiveness (Cameron & Quinn, 1999; Stock et al., 2007). Several studies have characterized the family owned and managed firms as companies highly influenced by clan culture (Dyer, 1986; Gersick, Davis, McCollom, & Lansberg, 1997; Sanchez-Marin et al., 2015). In this vein, Gallo (1992) defines family owned and managed firm as “one in which the family and the organization willingly share part or all of its culture and traditions”. This type of firms assumes a culture deeply rooted in the family values and traditions (Dyer, 1986; Merino et al., 2015) considering that family members have the power and position to take the main organizational decisions either as owners or as managers (Sorenson, 2000). These firms usually adopt and maintain the early values established by the owner-manager who takes the role of founder and creates the basis of the organizational culture (Denison et al., 2004; Gersick et al., 1997). Schulze, Lubatkin, Dino, and Buchholtz (2001) refer to these family firms as companies highly adverse to risk which leads them to being more introverted and bounded by old and unchanged traditions. Some other studies (Karra, Tracey, & Phillips, 2006; Sanchez-Marin et al., 2015) even refer to a peculiarity of these firms in terms of their altruistic values and the tendency to favour certain internal family values in detriment to other more rational ones. The size and age of the firm also affect its organizational culture. Family owned and managed firms are usually younger organizations and are often smaller in size (Jorissen, Laveron, Martens, & Reheul, 2005; Merino et al., 2015), which favour and reinforce the presence of internal values of group unity against external influences.

As family firm becomes more professionalized in terms of incorporation of non-family members in the management, family loses control over the predominant organizational culture as the new non-family managers may not necessarily share the same values and believes as the family (Denison et al., 2004; Sanchez-Marin, Meroño-Cerdan, & Carrasco-Hernandez, 2017). Since non-family managers are hired and evaluated according to business standards and objectives, their decisions are therefore more rational and less altruistic than those of a family owned and managed firm (Gómez-Mejía, Haynes, Núñez-Nickel, Jacobson, & Moyano-Fuentes, 2007; Gómez-Mejía et al., 2001). Furthermore, since they are usually businesses of longer seniority and greater size (Jorissen et al., 2005; Merino et al., 2015) the family idiosyncrasy tend to be replaced by a more rational, environment-based approach. Finally, in non-family firms, managers’ actions are more prone to risk (Gómez-Mejía et al., 2001, 2007; Sanchez-Marin, Portillo-Navarro, & Clavel, 2016) as well as totally oriented to the financial performance of the business (Anderson, Mansi, & Reeb, 2002; Van den Berghe & Carchon, 2003). To do this they need to respond to market opportunities, which is why in these organizations the commitment is with the individual rather than the group and with his or her ability to achievement looking for external challenges and for sustainable competitiveness, which is clearly adapted to the market culture. These arguments lead us to propose the following:H1 Orientation towards a clan culture is high in family owned and managed firms, medium in professionally managed family firms and low in non-family firms. Orientation towards a market culture is high in non-family firms, medium in professionally managed family firms and low in family owned and managed firms.

While adhocracy culture reflects the beliefs and attitudes related to business, leadership, product acquisition, innovation and risk, hierarchy culture is oriented to the values of security, formal rules, control, structure, coordination and internal efficiency (Cameron & Quinn, 1999; Sanchez-Marin et al., 2015; Stock et al., 2007). Family owned and managed firms, motivated by the existence of group values and participative leadership (exercised through the family members and specially by means of the figure of an entrepreneurial founder), are companies characterized by a greater innovative culture with less bureaucracy and less formalized practices (Chandler, Keller, & Lyon, 2000; Ogbonna & Harris, 2000; Sanchez-Marin et al., 2017; Zahra et al., 2004). Thus, family owned and managed firms are clearly less oriented towards hierarchy values since considering the tight control exerted by the family because of the high level of concentration of ownership and management in its hands (Monreal-Pérez & Sánchez-Marín, 2017; Sanchez-Marin et al., 2015), there is less need of monitoring through the use of highly structured formal policies (Carrasco-Hernández & Sanchez-Marin, 2007; Dyer, 1986).

In professionally managed family firms, although the family has less influence on the management of the company it is still present on the board of directors, leading it to a culture that is more change oriented than that of non-family firms (Carrasco-Hernández & Sanchez-Marin, 2007; Donckels & Frölich, 1991; Gudmundson, Burk, & Hartman, 2003). In these firms the cultural values developed will tend more towards hierarchy, since these are more complex firms than in family owned and managed firms and managing by professionals, there is a tendency to adopt more formalized organizational systems (Rogoff & Heck, 2003; Sanchez-Marin et al., 2017; Sorenson, 2000). However, it is not as marked as in non-family firms, where the tendency to financial performance emphasizes formalization and internal efficiency usually in detriment of innovation and risk taking (Denison et al., 2004; Monreal-Pérez & Sánchez-Marín, 2017; Zahra et al., 2004). These arguments lead us to propose the following:H3 Orientation towards an adhocracy culture is high in family owned and managed firms, medium in professionally managed family firms and low in non-family firms. Orientation towards hierarchy is high in non-family firms, medium in professionally managed family firms and low in family owned and managed firms.

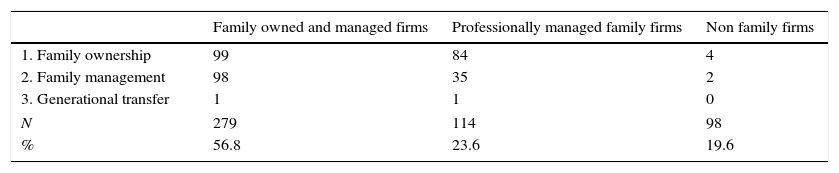

The sample was drawn from the SABI (Analysis System of Spanish Balance Sheet) database. From the total population of Spanish manufacturing and service firms with more than 10 employees, we have carried out a random selection process – using the Excel (version 2013) random function – in order to obtain a representative sample of firms with these characteristics. Thus, initially our sample was composed of 836 companies. We provided a market research company with these initial contacts to carry out a personal (face-to-face) interview through a structured questionnaire of closed questions with the CEO of the firm. Information was gathered from November 2008 to January 2009, obtaining a final sample of 491 responding firms, consisting of 393 family firms – 80.4% of the sample – and 98 non-family firms – 19.6% of the sample – (see variables section and Table 1 for a more detailed categorization). Most of the sample (75.5%) is distributed in six sectors: food products, beverages and tobacco industry (10.6%); Textile industry, clothing and leather goods (5.5%); Metallurgy and manufacture of metal and non-metal products (15.6%); Furniture industry (9.2%); Commerce, accommodation and catering (26.8%); Transport, storage and communications (7.8%). The remaining firms (24.5%) have been grouped in the category of other industries.

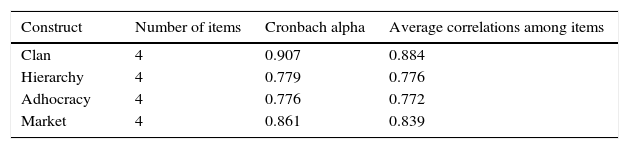

VariablesOrganizational cultureThe Organizational Culture Assessment Instrument was used to measure organizational culture (Cameron & Quinn, 1999; Stock et al., 2007). Sixteen items proposed by this instrument were included. The items were compiled in four questions which measure different aspects of culture – type of organization, leadership, shared values and company orientation – and a constant addition scale was used for each one. Each question has four items or responses (a, b, c, d) and each response is measured on a continuous scale from 0 to 100. For each question the sum of the values assigned to the four responses must be equal to 100. Since we are using the original Cameron and Quinn (1999) model which uses a constant sum scale, and given the perfect correlation between the items, we have run, instead of a factorial analysis, the process proposed by Deshpandé, Farley, and Webster (1993). First, the internal validity of each culture orientation has been calculated from the average item-construct correlations, obtaining highly significant scores (Table 2); second, the internal consistency was rated in each of the cultural orientations, using the Cronbach alpha, obtaining acceptable levels of reliability (Table 2).

Finally in order to identify the four cultural orientations, addition scales were created, each corresponding to the mean of the items of each factor. Four culture variables were established: clan, adhocracy, market and hierarchy. The first one, measures the degree of orientation of the organization towards the clan culture, which is a continuous variable ranging from 0 to 100 according to the mean of the values of “a” responses given for the 4 questions. The second one measures the degree of orientation of the organization towards adhocracy, which is a continuous variable ranging from 0 to 100, according to the mean of the values of “b” responses for the 4 questions. The third one measures the degree of orientation of the organization towards the market culture, which is a continuous variable ranging from 0 to 100, according to the mean of the values of the “c” responses to the 4 questions. The fourth one measures the degree of orientation of the organization towards the hierarchy culture, which is a continuous variable ranging from 0 to 100, according to the mean of the values of the “d” responses to the 4 questions. Thus, the sum of the four calculated variables is equal to 100.

Family firm typeWe have classified businesses from family to non-family using three categories based on the level of family involvement in the business (Chrisman et al., 2012; Chua, Chrisman, & Chang, 2004; Chua et al., 1999; Litz, 1995). Based on the definition of family firm of Chua et al. (1999) – firms that are owned and managed by family members and seek to ensure transgenerational involvement through family succession are unquestionably family firms – we therefore used the components of ownership, management, and family succession to determine the extent of family involvement in a business. These constructs have been measured, respectively, as a continuous variable ranging from 0% to 100% according to the amount of ownership in the hands of the family; a continuous variable ranging from 0% to 100% according to the proportion of family managers over total managers; and by a dichotomous variable which takes the value 1 when the family intends to continue with the business and 0 otherwise. Chrisman et al. (2002) show that family and non-family firms can be suitably classified by a cluster analysis which uses the three dimensions proposed. Thus, after applying a K-means cluster analysis, three firm clusters were distinguished: (1) family owned and managed firms; (2) professionally managed family firms; and (3) non-family firms.

As Table 1 shows, the groups of firms are homogeneous and statistically significant First, non-family firms (representing 19.6% of the firms) are characterized by presenting less than 50% of family ownership, less than 50% of managerial position held by family members, and by the intention of not continuing the business in the future. Second, family owned and managed firms (representing 56.8% of the firms) are characterized by a majority of family ownership (more than 50%) and management (more than 50%), and by a clear intention to continue the business. Finally, professionally managed family firms (representing 23.6% of the firms) are characterized by a majority family ownership (more than 50%), but with minority of family managers (less than 50%) and by a clear continuity intention. Based on the cluster results, we created a variable called family firm type, coded as 1 when the firm is professionally managed, 2 when the firm is a non-family company, and 3 when the firm is owned and managed by the family.

Control variablesThree control variables, firm size, industry and firm age, have been included considering their potential effects on the main variables analyzed (Fey & Denison, 2003; Leal-Rodríguez et al., 2016). Firm size, which can influence culture since firm culture is the result of the relations existing between the number of firm members (Tsui, Zhang, Wang, Xin, & Wu, 2006), has been measured as the total number of employees. Industry has been included since organizational practices and values vary significantly between industries (Merino et al., 2015). It has been measured as a dichotomous variable taking the value 1 if the sector is services and 0 if industrial. Firm age, which can also be an important influencer of organizational culture (Carrasco-Hernández & Sanchez-Marin, 2007), has been measured as the number of years from the firm's inception.

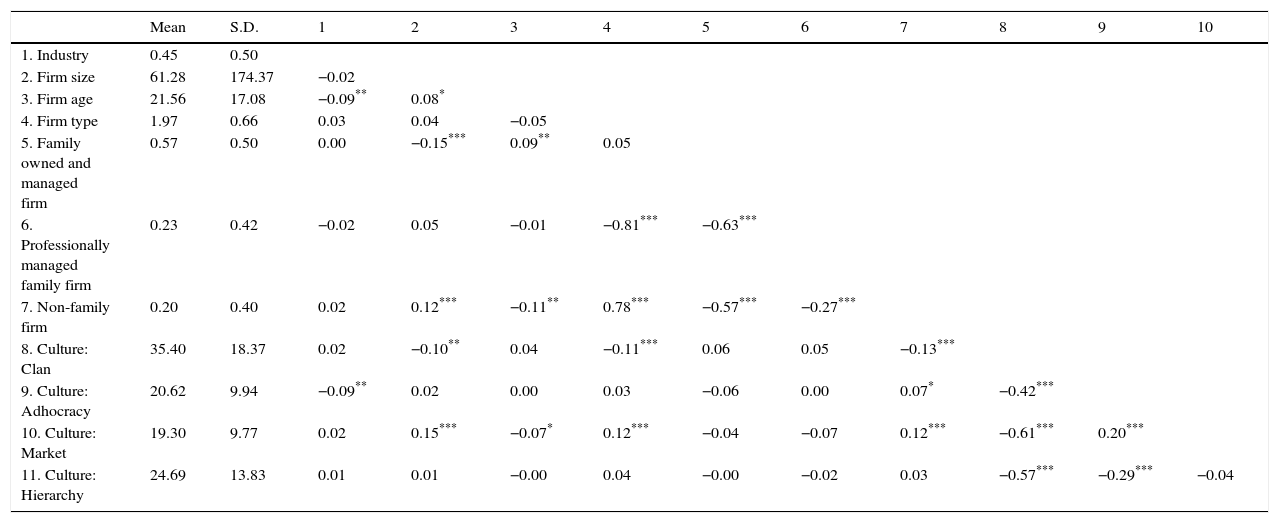

ResultsDescriptive statistics and the correlations are shown in Table 3. There are significant correlations between the culture variables, the family firm type, as it can be expected, although none of them are very high, which indicates that there are no problems of multicollinearity, as we have checked through the VIF indexes.

Correlations and descriptive statistics.

| Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Industry | 0.45 | 0.50 | ||||||||||

| 2. Firm size | 61.28 | 174.37 | −0.02 | |||||||||

| 3. Firm age | 21.56 | 17.08 | −0.09** | 0.08* | ||||||||

| 4. Firm type | 1.97 | 0.66 | 0.03 | 0.04 | −0.05 | |||||||

| 5. Family owned and managed firm | 0.57 | 0.50 | 0.00 | −0.15*** | 0.09** | 0.05 | ||||||

| 6. Professionally managed family firm | 0.23 | 0.42 | −0.02 | 0.05 | −0.01 | −0.81*** | −0.63*** | |||||

| 7. Non-family firm | 0.20 | 0.40 | 0.02 | 0.12*** | −0.11** | 0.78*** | −0.57*** | −0.27*** | ||||

| 8. Culture: Clan | 35.40 | 18.37 | 0.02 | −0.10** | 0.04 | −0.11*** | 0.06 | 0.05 | −0.13*** | |||

| 9. Culture: Adhocracy | 20.62 | 9.94 | −0.09** | 0.02 | 0.00 | 0.03 | −0.06 | 0.00 | 0.07* | −0.42*** | ||

| 10. Culture: Market | 19.30 | 9.77 | 0.02 | 0.15*** | −0.07* | 0.12*** | −0.04 | −0.07 | 0.12*** | −0.61*** | 0.20*** | |

| 11. Culture: Hierarchy | 24.69 | 13.83 | 0.01 | 0.01 | −0.00 | 0.04 | −0.00 | −0.02 | 0.03 | −0.57*** | −0.29*** | −0.04 |

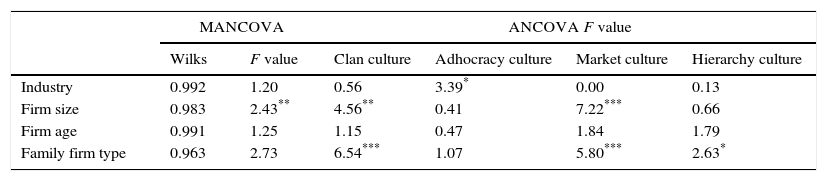

We conducted univariate and multivariate analyses of the covariance (ANCOVA and MANCOVA, respectively) and the univariate results of the covariance since they are considered to be the most appropriate to examine the degree of matching among configurations (Hair, Black, Babin, & Anderson, 2014), which fits with our aim to investigate on the relationships among typologies of organizational culture and categories of family firm. Table 4 shows the main results.1 The high F-values of MANCOVA indicate that the family firm type variable is significantly related to the organizational culture variables. Moreover, the univariate effects of the family firm type variable are significantly related to the clan variable (F=6.54, p<0.01), market variable (F=5.80, p<0.01) and hierarchy variable (F=2.63, p<0.1). Non-significant differences have been found for adhocracy culture. These results confirm, in a first step, that the relationships among types of family firm and the clan, market and hierarchy cultures are significant. However, further analyses are required to confirm the specific hypotheses.

Variance results: cultural orientations through family firm types.

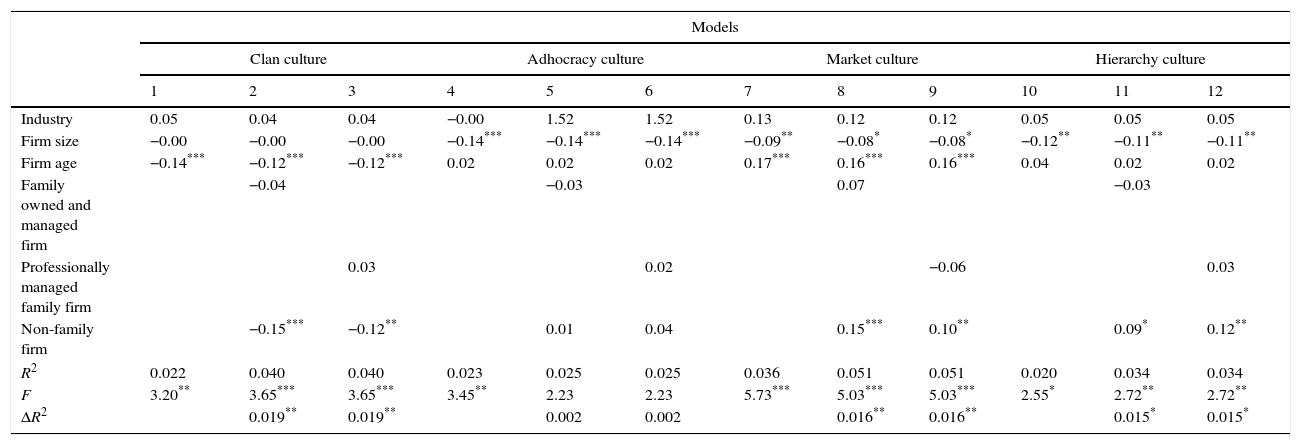

In this vein, a four hierarchical regression analysis has been performed using as dependent variables, respectively, clan, adhocracy, market and hierarchy cultures. As can be seen in Table 5, independent variables are, on the one hand, the family firm type included as dummy variables (family owned and managed, professionally managed family and non-family) and, on the other hand, the three control variables. Each of the four regression models contains three steps: the first contains only the control variables – models 1, 4, 7, 10; the second and third ones include the dichotomous variables representing the family firm types and taking, respectively, the family owned and managed firms – models 2, 5, 8, 11 – and the professionally managed family firms – models 3, 6, 9, 12 – as the reference variables. With the last eight models we seek to analyze whether the connections between each type of firm and each culture variable are significant. Thus, in general terms, there is an increase of R2 in all the culture models (models 2 and 3: ΔR2=0.019, F=3.65, p<0.05; models 5 and 6: ΔR2=0.0.016, F=4.28, p<0.05; models 8 and 9: ΔR2=0.015, F=2.72, p<0.1) with the exception of the adhocracy culture model. These results agree with those of MANCOVA.

Regression results: cultural orientations matching family firm types.

| Models | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Clan culture | Adhocracy culture | Market culture | Hierarchy culture | |||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Industry | 0.05 | 0.04 | 0.04 | −0.00 | 1.52 | 1.52 | 0.13 | 0.12 | 0.12 | 0.05 | 0.05 | 0.05 |

| Firm size | −0.00 | −0.00 | −0.00 | −0.14*** | −0.14*** | −0.14*** | −0.09** | −0.08* | −0.08* | −0.12** | −0.11** | −0.11** |

| Firm age | −0.14*** | −0.12*** | −0.12*** | 0.02 | 0.02 | 0.02 | 0.17*** | 0.16*** | 0.16*** | 0.04 | 0.02 | 0.02 |

| Family owned and managed firm | −0.04 | −0.03 | 0.07 | −0.03 | ||||||||

| Professionally managed family firm | 0.03 | 0.02 | −0.06 | 0.03 | ||||||||

| Non-family firm | −0.15*** | −0.12** | 0.01 | 0.04 | 0.15*** | 0.10** | 0.09* | 0.12** | ||||

| R2 | 0.022 | 0.040 | 0.040 | 0.023 | 0.025 | 0.025 | 0.036 | 0.051 | 0.051 | 0.020 | 0.034 | 0.034 |

| F | 3.20** | 3.65*** | 3.65*** | 3.45** | 2.23 | 2.23 | 5.73*** | 5.03*** | 5.03*** | 2.55* | 2.72** | 2.72** |

| ΔR2 | 0.019** | 0.019** | 0.002 | 0.002 | 0.016** | 0.016** | 0.015* | 0.015* | ||||

When specifically comparing the hypotheses, the results shown in Table 5 for the clan culture indicate that there are no significant differences between the orientations of family owned and managed firms and professionally managed family ones (models 2 and 3, p>0.1), and both show a greater orientation towards this culture than the non-family businesses (model 2, β=−0.15, p<0.01; model 3, β=−0.12, p<0.01). Thus, we partially confirm Hypothesis 1. Regarding market culture, results again point to non-significant differences in cultural orientation between family owned and managed and professionally managed family firms (models 8 and 9, p>0.1), while non-family firms show a greater orientation towards this culture (model 8, β=0.15, p<0.01; model 9, β=0.10, p<0.01). Hypothesis 2 is, therefore, only partially confirmed. In the case of adhocracy, the results reveal non-significant differences among the three types of firms, rejecting therefore Hypothesis 3. Finally, results show that non-family firms have a higher orientation towards hierarchy culture than family firms (model 9, β=0.12, p<0.05; model 11, β=0.09, p<0.1), with non-significant differences between family owned and managed and professionally managed family firms (models 11 and 12, p>0.1). Thus, Hypothesis 4 is partially confirmed.

Conclusions and discussionThe aim of this exploratory study is to characterize organizational culture through diverse types of family firm, contributing as a first step in the understanding of how family firms adopt culture patterns based on their potential resources needed to compete (Habbershon et al., 2003; Habbershon & Williams, 1999). Considering the typology of organizational culture proposed by Cameron and Quinn (1999) and taking into account the types of family firms based on their levels of family involvement (Chrisman et al., 2012; Merino et al., 2015), our results show that organizational culture significantly varies according family firms (Chrisman et al., 2002; Denison et al., 2004). Organizational culture, therefore, is a unique resource which can be used by (and adapted to) family firms particularities in order to develop and improve its competitive advantage (Chrisman et al., 2012; Chua et al., 2012; Leal-Rodríguez et al., 2016).

Specifically, our results show, confirming partially what was expected, that family firms have a greater orientation towards the clan culture, while non-family firms show their preference for the market and hierarchy cultures. These results are consistent with several theoretical and empirical articles (Denison et al., 2004; Deshpandé et al., 1993; Leal-Rodríguez et al., 2016; Sanchez-Marin et al., 2015; Zahra et al., 2004) indicating that the predominant culture in family firms is characterized by an group, internal, and emotional-personalist values, while non-family firms adopt a culture based mainly in a meritocratic, rational, external and efficiency seeker culture. Additionally, this evidence confirms the predominance of tradition and conservatism in Spanish family firms (Merino et al., 2015; Monreal-Pérez & Sánchez-Marín, 2017), which can explain to a large extent the low levels of innovation, productivity and international orientation of these firms compared with their family firms counterparts in the EU and US.

We also reveal that there are no outstanding differences between the culture orientations of family owned and managed firms and professionally managed family firms. Several potential explanations of these results may be point out. Firstly, the high level of ownership concentration of both types of family firms may lead to similar levels of risk bearing for family owners that, in turn, may result on adopting similar goal preferences, decisions makings and, finally, attitudes and interests (Chrisman et al., 2012; Sanchez-Marin et al., 2015). Secondly, the organizational culture in both types of family firms may have heavily influenced by the founder who, even in spite of professionalization, imprint his/her personalized and strong character into the values and believes of the family firm which may be installed over generations, even when these move away from the organization (Denison et al., 2004; Merino et al., 2015; Sanchez-Marin et al., 2017). An thirdly, considering culture as a strategic resource stablished by family owners-managers and finding in both types of family firms a governance mechanisms dominated to a greater or lesser extent by family members, is the family who have the power and opportunity to effectively transmit their values to the organization (Monreal-Pérez & Sánchez-Marín, 2017; Zahra et al., 2004). Moreover, it should be highlighted the absence of significant differences among family and non-family firms regarding the adhocracy culture. An explanation to this result can be found in the arguments of Chandler et al. (2000), for whom this cultural orientation have sense mainly in smaller organizations, which are usually more entrepreneurial (Sanchez-Marin et al., 2015).

In sum, the configurational approach of this study allow to confirm organizational culture as an intangible and strategic resource for family firms (Leal-Rodríguez et al., 2016; Merino et al., 2015; Sanchez-Marin et al., 2015; Zahra et al., 2004) highlighting the power of the families – personalized in the figure of founder (Sorenson, 2000) and going through subsequent generations, even when the family dissociate themselves from the business management – in constructing and enduring values and believes for their business, usually based on internal and closed traditions but also with an entrepreneurial, innovative and flexible vision (Leal-Rodríguez et al., 2016). Although there are large cultural differences between family and non-family firms, we can conclude that does not exist a best culture for business, demystifying some traditional claims linking organizational culture with certain disadvantages in the family firm.

This study also has important implications for practitioners. First, managers should know how to identify the culture of their company, understand it and take advantage of the positive effects of such resources can provide. The analysis of these main values and believes will enable the family to ascertain their influence in the firm and to determine whether that influence compares favourably or not with other resources in the organization (Sanchez-Marin et al., 2015). And second, if family firms want to reorient their emotional, internally-oriented organizational culture towards a more rational, market-oriented – typically representative of non-family firms’ – organizational culture, family owners and managers may encourage a professionalized and dynamic culture that favours innovation, internationalization and financial outcomes that, although risky, likely will prevent subsequent loss of family wealth and family control (Gómez-Mejía et al., 2001, 2007; Monreal-Pérez & Sánchez-Marín, 2017).

Finally, this study has not exempt of limitations that provide interesting lines of future research. First, although our measures of configurations of family firm and organizational culture are generally accepted in literature, a more refined measure of these concepts should be necessary in order to provide a more detailed relationship among family firm dimensions and organizational culture components. Second, other intermediate variables, acting as moderator or mediator should be integrated in the model as, for example, CEO individual characteristics, human resource management policies orientations, and socioemotional wealth positioning, as they probably exert important effects into the relationships between family firm and organizational culture. Finally, although we theoretically assume organizational culture as a unique intangible resource that is critical for competitive advantage, it should be needed an empirical examination of the consequences of the cultural orientation in terms of firm performance and success.

Conflict of interestsThe authors declare that they have no conflicts of interest

Financial support from the Research Program of Ministry of Economy and Competitiveness of Spain (Project ECO2014-54301-P) and Fundación Cajamurcia is greatly acknowledged.

Multivariate tests of normality and homoscedasticity were performed prior to the analysis of MANCOVA and ANCOVA indicating values among the accepted parameters (Hair et al., 2014).