Market efficiency has been questioned since behavioural finance emerged. However, there is no theory consolidating both irrational investors´ behaviour and their influence on financial markets. In this paper, we use bibliometrics to gain better knowledge of the current situation and trends in this research area. The results obtained by analysing the 1987–2017 period show a growth potential of Behavioural Finance. Investor sentiment is the main subject among the thirteen main subjects of this area.

In recent years, a new research area in finance has emerged and it has revolutionized the financial theory. Continuing anomalies which were found in financial markets are leading to determine that markets are not as efficient as had previously been thought over the last century, but are influenced by several biases that demonstrate their imperfection, opening a new theory known as "Behavioural Finance".

We have witnessed from the contribution of the theory of expected utility of Von Neumann and Morgenstern (1944) to the establishment of several models whose aim is to explain the behaviour of financial markets. During most of the twentieth century, Modern Finance has been the prevailing trend, based on the assumption that the conditions of a market in equilibrium can be implicitly or explicitly expressed in terms of expected returns (Fama, 1970). One of the most relevant authors regarding Modern Finance has been Fama, who has most defended the efficiency of markets, defining an efficient market as a market in which "prices always 'fully reflect' available information" (Fama, 1970, p. 383).

Investor rationality has been highly criticized, as well as the efficiency of financial markets when prices are allocated. Simon (1956) is one of the first authors who criticized the economic and statistical theories of rational behaviour, arguing that learning theories explain observed behaviour better. In his study, Simon (1956) confirms that human beings adapt well enough to satisfy their needs at a specific level, but they are not able to find the optimal way to maximize the ‘utility function’. However, Tversky and Kahneman (1974) had a greater impact on defending the irrational behaviour of investors, supporting a better understanding of heuristics and biases in order to improve judgements and decisions in environments of uncertainty. Kahneman and Tvesky (1979) also put the expected utility theory into question. They defend that individual preferences breach the axioms of this theory, which leads to the development of the prospect theory.

Statman and Caldwell (1987) defined Behavioural Finance as a descriptive theory of choice under conditions of uncertainty. This concept encompasses a broader view of social sciences, including both psychology and sociology (Shiller, 2003). In general, Behavioural Finance defends that ‘irrational expectations or non-standard preferences affect asset prices’ (Campbell, 2000, p. 1551) and thus, deviations between prices and asset values depend on investors’ psychological motivations (Ofek, Richardson, & Whitelaw, 2004). Due to a growing interest in this new theory, especially in this century, it is absolutely necessary to analyse the evolution, the issues addressed and the current state of Behavioural Finance.

In order to explain the performance and productivity of Behavioural Finance, as well as to understand the themes that it is comprised of and its state, we have developed a bibliometric analysis. We found other bibliometric analyses of Behavioural Finance, however, none of them address this research area on its own (Fonseca, de Melo, de Melo, & Willer, 2017; Fonseca, de Melo, & de Melo, 2019). In addition, a list of all the relevant themes covered by this research area has not been found in any of the studies. Therefore, to provide a broader vision of Behavioural Finance, we performed a co-word analysis using SciMAT software (Cobo, López Herrera, Herrera Viedma, & Herrera, 2012). This enabled us to find the most important themes of the research area and to classify them according to their development and importance.

This work is structured as follows. In the next section the methodology and the process used in this study will be presented. In the third section, we will explain the data used in the analysis. The fourth section presents the results obtained relating to productivity and performance, as well as the analysis of scientific maps. In the fifth section, the conclusions will be explained. In the last section, we will highlight the limitations, which we had to face in this work.

2MethodologyIn this work, a bibliometric analysis will be carried out in order to define the intellectual structure of Behavioural Finance. We used SciMAT software (Cobo, López‐Herrera, Herrera‐Viedma, & Herrera, 2012), which was chosen due to its flexibility when selecting measurements to obtain and visualize bibliometric networks. This tool also provides a wide range of pre-processing techniques that allow us to refine the results obtained from the database, improving their quality.

Bibliometrics analysis is defined as a part of scientometrics, which uses mathematical and statistical methods to analyse scientific activities in a research field (Aparicio, Iturralde, & Maseda, 2019; Callon, Courtial, & Laville, 1991). We conducted a bibliometric study from its two key procedures: evaluation and performance and scientific productivity analysis, and scientific maps (Cobo, 2012).

The analysis of scientific maps is one of the techniques whose aim is to monitor a scientific field in order to understand its structure, development and its main participants (Noyons, Moed, & Luwel, 1999). The different types of information that can be used are known as units of analysis. In this work, the chosen unit of analysis is the keyword.

Among all units of analysis, different types of relationships can be established in order to create different bibliometric networks. In this work, we have used a co-occurrence relationship (Callon, Courtial, Turner, & Bauin, 1983). The co-occurrence relationship occurs when two elements appear together in a document. This analysis allows us to identify the main themes of a scientific field, showing its conceptual and cognitive aspects (Cobo, 2012).

In order to obtain significant information about the area through the analysis, we should normalize the bibliometric network. Normalizing the network allows us to relativize the relationships between two analysis units. The normalization measure used in this work was the equivalence index (Callon et al., 1991).

Once the network has been normalized, we can extract the themes by using clustering techniques with which to divide the set of elements into different subsets, whose nodes are strongly linked together, and scarcely linked with others. In this paper, we use the clustering algorithm based on simple centres, which has the advantage of automatically returning labelled clusters with the most central node in the group (Cobo, 2012).

In order to evaluate the position of each theme in the area, we represent the different clusters on the well-known Strategic Diagram established by Callon et al. (1991). The Strategic Diagram allows us to place the themes according to their centrality (axis x) and density (axis y). Centrality measures the degree of interaction of a theme with the rest; in other words, it measures the strength of the external links of a theme with the rest. Centrality allows us to measure the importance of a theme in the global development of the scientific field (Cobo, 2012). Density measures the degree of internal cohesion of a theme, so it measures the internal strength of the different links of the nodes within a cluster. This value can be understood as the measure of the development of the theme (Cobo, 2012).

In this context, we can classify the themes into four categories in the Strategic Diagram:

- •

Motor-themes: they are located in the upper-right quadrant and they show strong centrality and density. They are well developed and important in the research field.

- •

Highly developed and isolated themes: they are found in the upper-left quadrant and show low centrality, but high density. These themes are of marginal importance for the field.

- •

Basic and transversal themes: they are in the lower-right quadrant and show strong centrality, but low density. They are interconnected with the other themes but are not well developed.

- •

Emerging or declining themes: they are in the lower-left quadrant and they show low centrality and density. They are both weakly developed and marginal.

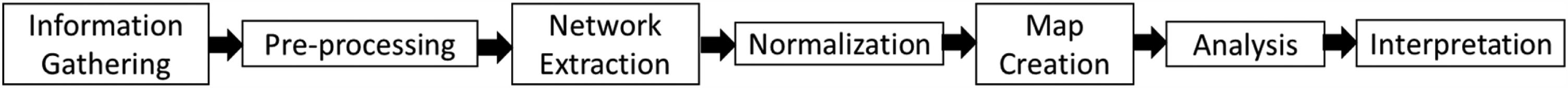

The process followed to define the intellectual structure of Behavioural Finance can be observed schematically in Fig. 1.

3DataThe data set used for the bibliometric analysis was extracted from the Web of Science (WOS) of Thomson Reuters. WOS was preferred to other platforms like SCOPUS because of a greater number of scientific publications it has provided since 1900 (SCOPUS has only collected scientific publications since 1966).

The search was made on 1 January 2018 by choosing only scientific papers that were published until 2017 (including) in journals indexed in the database of the Social Sciences Citation Index (SSCI).

Many concepts applied in Behavioural Finance have been developed in other areas and disciplines, and therefore, have not been included in the search, such as:

- •

Prospect Theory: the work developed by Kahneman and Tversky (1979) has been one of the most cited in Behavioural Finance. Nevertheless, this theory has also been used on other areas of the economy and has a special impact on psychology.

- •

Mental Accounting: this term has had a strong impact on Behavioural Finance; however, it has also been applied in other economic disciplines, especially in the Marketing area, due to its consumer behaviour studies.

- •

Cognitive Bias: this concept is related to studies on investor expectations, but which stands out mainly in health studies. In the economic field, its study stands out in the area of entrepreneurship.

The main concepts studied in this work are “Behavioural Finance”, “Behavioural Portfolio” and “Investor Sentiment”. The search by topics was carried out, so the selected articles contained the previous concepts on the title, summary or keywords. Therefore, we carried out the following search: TS= ("behavioral financ*" OR "behavioural financ*" OR "behavioral portfolio" OR "behavioural portfolio" OR "investor sentiment*"). Thus, a total of 1.214 published articles from 1987 to 2017 were obtained.

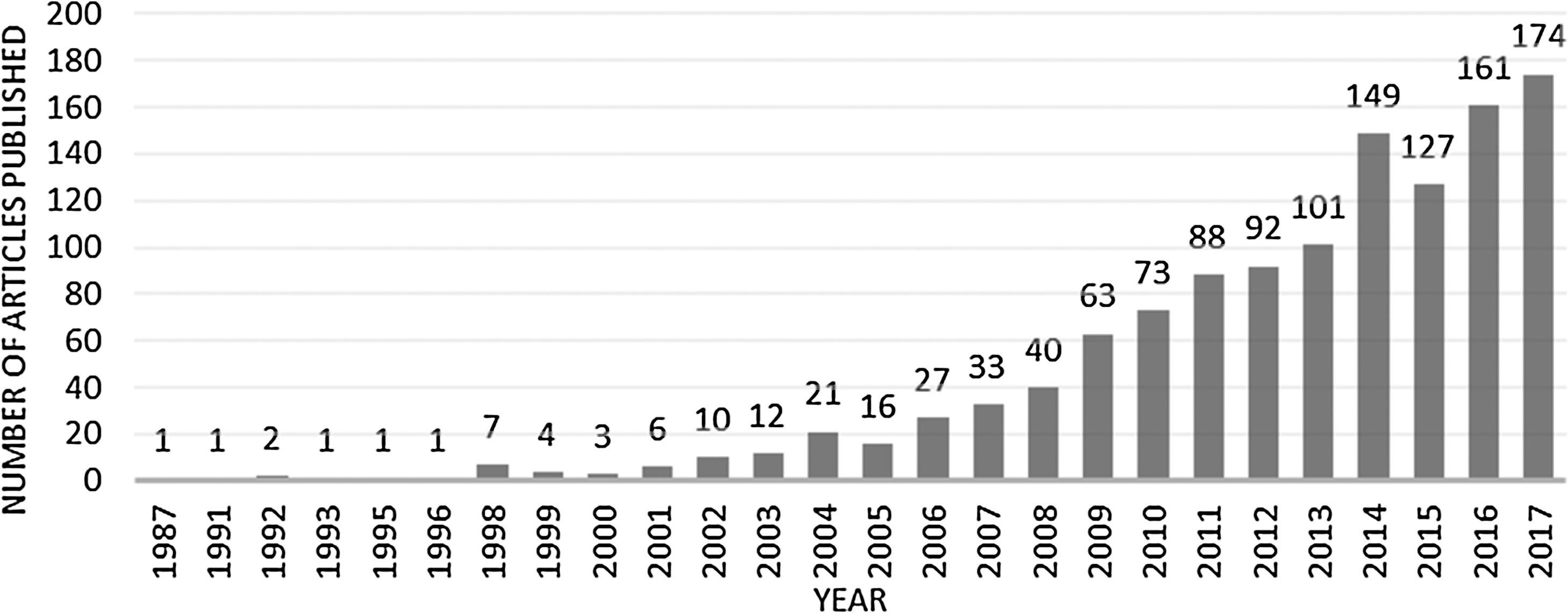

4Results4.1Evaluation and analysis of performance and scientific productionIf we analyse the evolution of the articles published on Behavioural Finance (Fig. 2), we can see a high growth of this area, particularly from 2009, finding that 84.68% of all studies published are between 2009 and 2017. This analysis reveals a growing interest and development of the area, demonstrating that Behavioural Finance represents an important area of research.

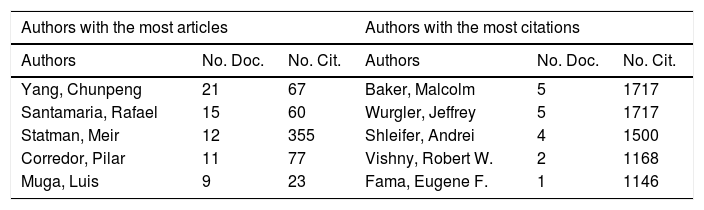

When analysing the authors who have done research on Behavioural Finance (Table 1), we find that the most productive author is Chunpeng Yang, with more than 21 published articles in WOS. However, we note that the most cited authors have been Malcom Baker and Jeffrey Wurgler, who had a total of 1.717 citations with only 5 published documents.

Performance of authors

| Authors with the most articles | Authors with the most citations | ||||

|---|---|---|---|---|---|

| Authors | No. Doc. | No. Cit. | Authors | No. Doc. | No. Cit. |

| Yang, Chunpeng | 21 | 67 | Baker, Malcolm | 5 | 1717 |

| Santamaria, Rafael | 15 | 60 | Wurgler, Jeffrey | 5 | 1717 |

| Statman, Meir | 12 | 355 | Shleifer, Andrei | 4 | 1500 |

| Corredor, Pilar | 11 | 77 | Vishny, Robert W. | 2 | 1168 |

| Muga, Luis | 9 | 23 | Fama, Eugene F. | 1 | 1146 |

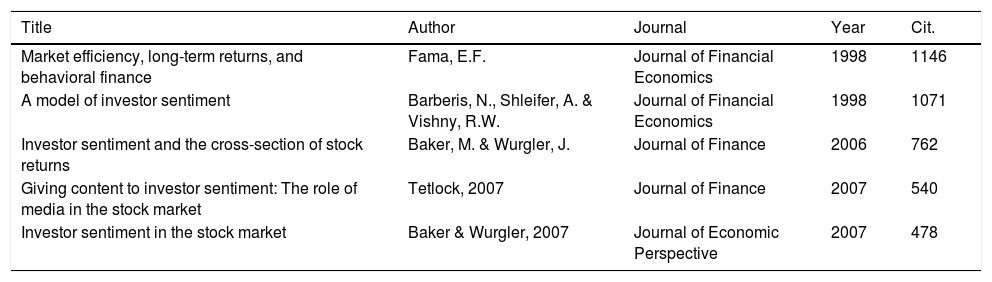

If we analyse the most cited papers in the area (Table 2), the 5 most cited articles have been published in 3 journals: Journal of Financial Economics (2), Journal of Finance (2) and Journal of Economic Perspectives (1). The most cited article is “Market efficiency, long-term returns, and behavioural finance” by Fama (1998), with 1.146 citations. This article defends the efficiency of financial markets against behavioural finance.

Most cited articles in the area.

| Title | Author | Journal | Year | Cit. |

|---|---|---|---|---|

| Market efficiency, long-term returns, and behavioral finance | Fama, E.F. | Journal of Financial Economics | 1998 | 1146 |

| A model of investor sentiment | Barberis, N., Shleifer, A. & Vishny, R.W. | Journal of Financial Economics | 1998 | 1071 |

| Investor sentiment and the cross-section of stock returns | Baker, M. & Wurgler, J. | Journal of Finance | 2006 | 762 |

| Giving content to investor sentiment: The role of media in the stock market | Tetlock, 2007 | Journal of Finance | 2007 | 540 |

| Investor sentiment in the stock market | Baker & Wurgler, 2007 | Journal of Economic Perspective | 2007 | 478 |

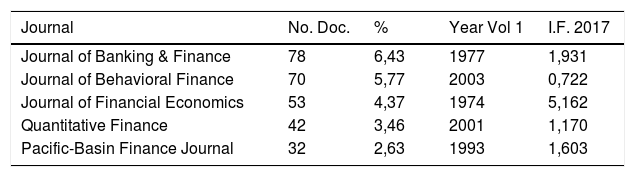

Regarding the journals where articles on Behavioural Finance were published, the 5 journals with the most published articles can be seen in Table 3, and they include 22.66% of all articles. The journal that published most of the articles on Behavioural Finance was “Journal of Banking & Finance”, with 78 articles (6.43%). It is important to highlight that the second journal in the ranking is “Journal of Behavioural Finance”, with 70 articles (5.77%), despite only being in circulation since 2003.

Most productive journals in the area.

| Journal | No. Doc. | % | Year Vol 1 | I.F. 2017 |

|---|---|---|---|---|

| Journal of Banking & Finance | 78 | 6,43 | 1977 | 1,931 |

| Journal of Behavioral Finance | 70 | 5,77 | 2003 | 0,722 |

| Journal of Financial Economics | 53 | 4,37 | 1974 | 5,162 |

| Quantitative Finance | 42 | 3,46 | 2001 | 1,170 |

| Pacific-Basin Finance Journal | 32 | 2,63 | 1993 | 1,603 |

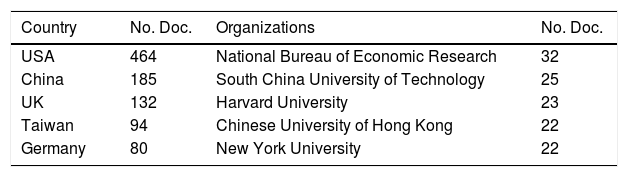

In order to study the productivity in the area according to its country and organization (Table 4), we can state that studies on Behavioural Finance are located in 56 different countries, being the country with most of the documents the United States (464). Regarding the most productive organization, we find that National Bureau of Economic Research (32) is the organization with the most documents published in Behavioural Finance.

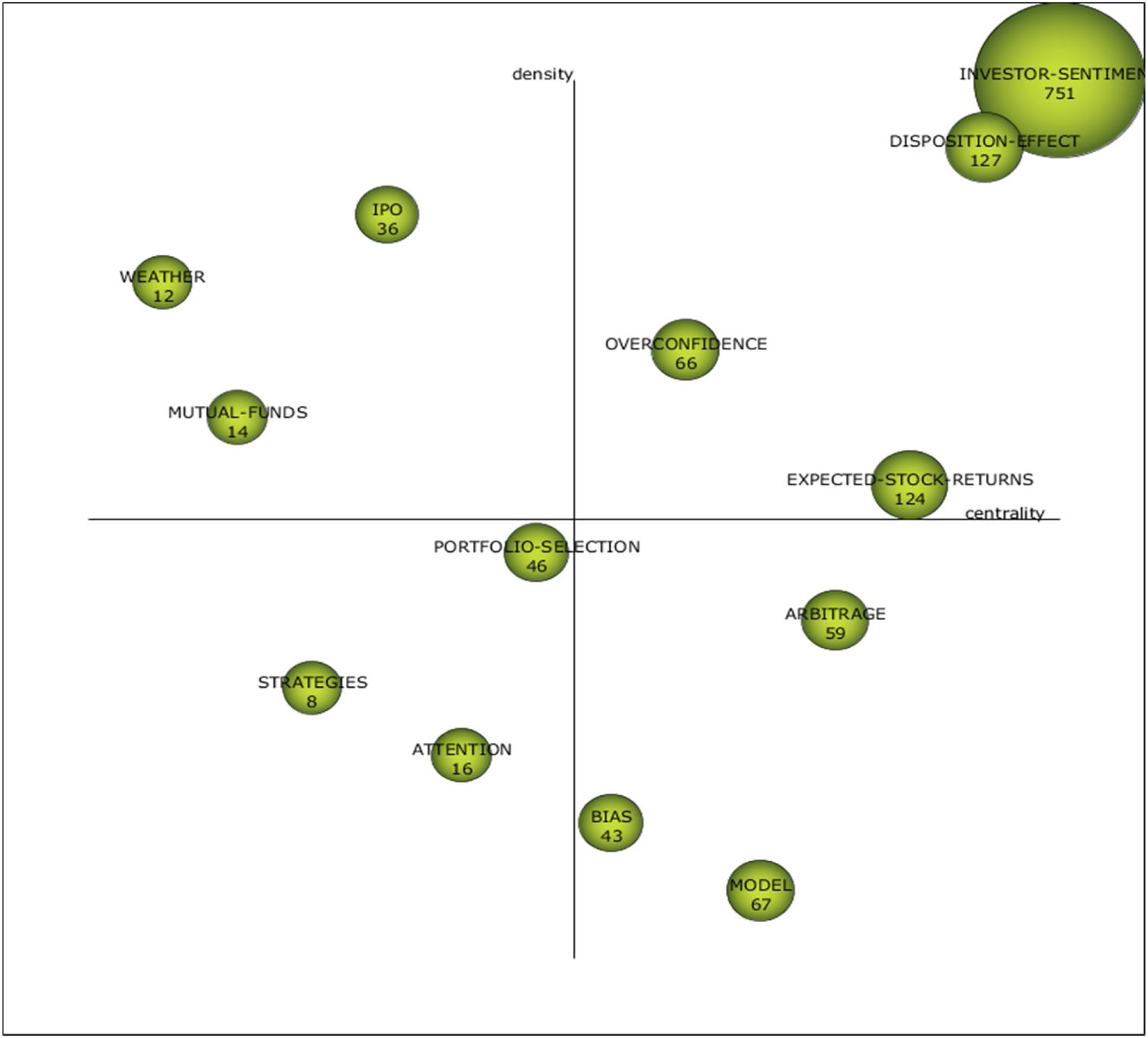

4.2Analysis of science mappingBesides evaluating and analysing the performance and scientific production of Behavioural Finance as a whole, we also sought to evaluate the theme studies on Behavioural Finance, which we extracted through a co-word analysis. We selected the keywords that had been used more than 5 times, obtaining a sample of 563 keywords. Thus, we obtained 13 representative clusters of the main themes within Behavioural Finance: Investor Sentiment, Disposition Effect, IPO, Overconfidence, Portfolio Selection, Expected Stock Returns, Arbitrage, Model, Bias, Attention, Weather, Mutual Funds and Strategies.

After identifying the themes, it is important to assess the level of development of each theme and its impact on the area. The different themes found were classified by their density and centrality and can be observed in the Strategic Diagram (Fig. 3).

The most interconnected and developed themes, also called motor themes, are:

Investor Sentiment: this theme evaluates how investors' feelings lead them to make certain investment decisions far from what would be optimal decisions according to the theory of efficient markets. Not only studies on behavioural patterns are included Barberis, Shleifer, and Vishny (1998), but also studies that show the influence that emotions have on assets (Baker & Wurgler, 2006), taking on special relevance the analysis of the influence of these feelings on the formation of bubbles like the events of recent years.

Disposition Effect: in this theme, which we could well call attitude to risk, we find studies based on the analysis of investor risk aversion. The formulations which are representative of the attitudes of investors stand out in this theme. Thus, representative functions of satisfaction with profits and losses under a benchmark have been created, such as the prospective theory (Kahneman & Tversky, 1979) and the accumulated prospective theory (Tversky & Kahneman, 1992), and representations of preferences for the settlement of results like the disposition effect (Shefrin & Statman, 1985).

Overconfidence: in this theme, investor confidence in their expectations or judgments regarding the value of assets is studied. Studying the confidence of the individual investor trying to establish generalities (Graham, Harvey, & Huang, 2009), and measuring their impact on the formation of stock prices (Ko & Huang, 2007). Here we find positions that defend that overconfidence improves market efficiency (Ko & Huang, 2007), that this confidence does not influence efficiency (Raghubir & Das, 2010), and others that such overconfidence promotes over- or undervaluation of assets (Jin & Kothari, 2008).

Expected Stock Returns: this theme studies the movements of asset prices based on investors´ behaviour. The influence of mass psychology (Kumar & Lee, 2006), information uncertainty (Jiang, Lee, & Zhang, 2005) and transaction costs (Jiang et al., 2005) stand out in this line as motivators of the existence of anomalies in markets. These studies argue that investor sentiment enables to predict asset prices, especially on stocks with small capitalization, low institutional property, low prices, high arbitrage costs, high book-to-market ratio and high idiosyncratic volatility (Baker & Wurgler, 2006; Fang & Peress, 2009; Kumar & Lee, 2006).

The basic or transversal themes in the area, in other words, themes that have been used in numerous investigations, but that are not very developed are the following:

Arbitrage: there are studies focused on arbitrage that analyse the reasons why the differences between market values and the theoretical value are not adjusted. Among the explanations to this situation are the limits to arbitration (Abreu & Brunnermeier, 2003; Kumar & Lee, 2006) and impediments to short sales (Stambaugh, Yu, & Yuan, 2015).

Bias: this theme analyses how human psychology leads to irrational decision making and that results in the formation of wrong asset prices. When investors find themselves in situations of uncertainty, they tend to take mental shortcuts, which allow judgments to be made regarding the different assets, demonstrating certain common psychological patterns in certain circumstances (Dow, 2010). There are cognitive biases related to errors in the interpretation of information and emotional biases motivated by feelings and emotions.

Model: this theme focuses on building models in order to evaluate the impact of sentiments on financial markets. Due to the special characteristics of stock markets, models with a heteroskedastic approach stand out, such as the GARCH model promoted by De Long, Shleifer, Summers, and Waldmann (1990). Among the main motivations for the construction of these models is the possibility of foreseeing important transitions in the economy such as the crisis of recent years (Kirman, 2010).

If we focus on the least important themes, the most developed ones are:

Weather: this theme studies the impact of exogenous events on the investor’s mood. Psychology has demonstrated that mood is related to risk aversion. Among all evaluated events, the weather stands out (Hirshleifer & Shumway, 2003; Kamstra, Kramer, & Levi, 2003). However, other events have also been studied such as: air quality (Li & Peng, 2016), holidays (Kaplanski & Levy, 2012), sporting events (Gómez & Prado, 2014), wars or disasters (Kaplanski & Levy, 2012) and lunar cycles (Wang, Lin, & Chen, 2010).

Mutual Funds: it studies the sentiment of a mutual fund investor and its implications on stocks. We found studies on the investor decision-making process on mutual funds that differ from rational behaviour (Mauck & Salzeider, 2017) and other works that analyse these behaviours on asset prices (Bialkowski, Bohl, Kaufmann, & Wisniewski, 2013). It highlights the study of the "herd" effect in which the same stocks are bought or sold in mass (Lakonishok, Shleifer, & Vishny, 1992).

IPO: in this theme we find several works that study the price formation process in the initial public offerings of shares. There are positions for (Cornelli, Goldreich, & Ljungqvist, 2006) and against (Fink, Fink, Grullon, & Weston, 2017) Behavioral Finance, with a predominance of the first group. Thus, several investigations show the influence of optimism and pessimism on the overvaluation and undervaluation of shares in the initial public offerings (Cornelli et al., 2006), in both the short and long term. This theme is highly influenced by the technological bubble at the end of the 90 s.

Lastly, the least developed and important themes are:

Attention: this theme focuses on studying the attention of investors and how this influences investment decision-making and the formation of asset prices. Within the information era, attention has become a “limited cognitive source” (Kahneman, 1973). Thus, the aim of several studies is to assess the investors´ attention by the search carried out (e.g. Google and Yahoo) (Gómez, 2013; Leung, Agarwal, Konana, & Kumar, 2016) and the impact of different publications (e.g. twitter) (Sprenger, Tumasjan, Sandner, & Welpe, 2014). This line is highlighted by Barber and Odean (2008), with their theory of attention.

Strategies: this theme aims to explain the effectiveness of certain stock market strategies, and if it is due to economic cycles (Chordia & Shivakumar, 2002), which would be in line with the efficiency of financial markets, or if, on the contrary, the effectiveness of these strategies takes refuge in certain "irrational" behaviours. It is worth highlighting the study of the "momentum" strategy of Jegadeesh and Titman (1993).

Portfolio selection: this theme incorporates the characteristics of the investor in their choice of investments, as well as their motivations. This theme is highly influenced by theories such as the Mean-variance efficient frontier of Markowitz (1952); the Mental Accounting theory of Thaler (1985); the Cumulative Prospect theory (Tversky & Kahneman, 1992); and the Behavioural Theory of Shefrin and Statman (2000). The model of Das, Markowitz, Scheid, and Statman (2010) stands out, which includes features of the theory of mean-variance of Markowitz (1952) and the behavioural portfolio theory of Shefrin and Statman (1985), in a new mental accounting framework.

Here we find emerging themes, such as the theme of Attention, highly influenced by new technologies, and themes that tend to disappear, such as the theme of Strategies. As for Portfolio Selection, although this theme is in the lower left quadrant, it is very close to the intersection of the axes, which is why we consider that this theme cannot be classified neither as an emerging theme nor as a theme in disappearance.

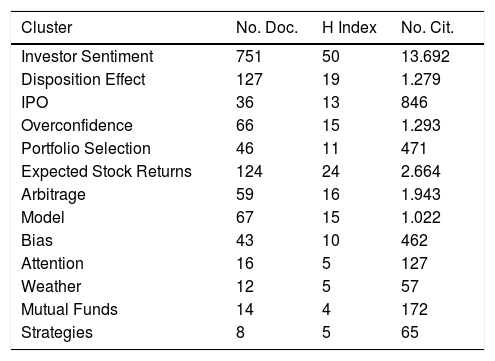

It is convenient to evaluate the productivity and the impact of each theme (Table 5), so we analyse the number of documents, the H Index (h articles of the total number of articles of the subject that have at least h citations) and the number of citations of each theme taking the main documents.

Productivity and impact for each theme.

| Cluster | No. Doc. | H Index | No. Cit. |

|---|---|---|---|

| Investor Sentiment | 751 | 50 | 13.692 |

| Disposition Effect | 127 | 19 | 1.279 |

| IPO | 36 | 13 | 846 |

| Overconfidence | 66 | 15 | 1.293 |

| Portfolio Selection | 46 | 11 | 471 |

| Expected Stock Returns | 124 | 24 | 2.664 |

| Arbitrage | 59 | 16 | 1.943 |

| Model | 67 | 15 | 1.022 |

| Bias | 43 | 10 | 462 |

| Attention | 16 | 5 | 127 |

| Weather | 12 | 5 | 57 |

| Mutual Funds | 14 | 4 | 172 |

| Strategies | 8 | 5 | 65 |

We observe how Investor Sentiment stands out remarkably over the rest by the number of published documents of this theme, as well as by the H Index and by the number of total citations received. Considering the number of documents, the most important themes are: Investor Sentiment, Disposition Effect and Expected Stock Returns, in this order. However, this order differs both if we consider the H Index and the number of citations. Thus, the most important themes according to the H Index are: Investor Sentiment, Expected Stock Returns and Disposition Effect, in this order. And according to the total number of citations, the themes with the best position are: Investor Sentiment, Expected Stock Returns and Arbitrage, respectively. The theme of Arbitrage stands out with only 59 documents, showing a total of 1943 citations.

5DiscussionWith this study, it has been possible to observe a high growth that has taken place in Behavioural Finance research, especially since 2009. This may be motivated due to an increase in anomalies detected in financial markets since the 2007 crisis, highlighting the inefficiency of these markets and the influence of individual biases on them.

When analysing the most productive and cited authors in this area, it was found that the most influential authors in the area by number of citations are Malcom Baker and Jeffrey Wurgler, who, among their contributions, promoted research on the influence of investor sentiment on stock returns. The article “Investor sentiment and the cross-section of stock returns” of these authors, has been positioned as the third most cited article. However, the most cited article was "Market efficiency, long-term profitability and behavioral finance" by Fama (1998), which is positioned in favour of the efficiency of financial markets and may have been the subject of many discussions of studies published on Behavioural Finance.

As for the journals in which Behavioural Finance research has been published, "Journal of Banking & Finance” stands out as the journal that has published the most articles. This demonstrates how until 2017, this area had been disseminated mostly in journals that publish papers of the financial field with a certain generality. However, it was expected that in the coming years, specialized journals such as the “Journal of Behavioral Finance”, would show a greater number of published articles on Behavioural Finance. It is necessary to take into consideration that this journal is relatively new, it emerged in 2003, and still occupies the second position in number of published articles on Behavioural Finance.

Regarding the productivity of Behavioural Finance by country and organization, it has been observed that research in this area is mainly concentrated in the United States, highlighting the “National Bureau of Economic Research” organization.

It should be noted that a major contribution of the study has been obtaining the main themes in which this area of research can be divided. Although articles such as those by Fonseca et al. (2017) and Fonseca et al. (2019) have performed a bibliometric analysis of Behavioural Finance, they have not performed this analysis in isolation and they have not extracted the main themes that make up this research area. To address this issue, a co-occurrence analysis of keywords has been performed using the SciMAT software (Cobo et al., 2012), in which we obtained 13 outstanding themes in Behavioural Finance, which are Investor Sentiment, Disposition Effect (which can be called attitude towards risk), OPI, Overconfidence, Portfolio Selection, Expected Return Stocks, Arbitrage, Model, Bias, Attention, Weather, Mutual Funds and Strategies. When analysing their level of development and their importance within the area, the themes of Investor Sentiment, Disposition Effect, Overconfidence and Expected Stock Returns are the most prominent themes in Behavioural Finance, positioning themselves as motor themes. As basic or transversal themes of the area, we have found the themes of Arbitrage, Bias and Model, which, although they are not themes that are highly developed internally, they do have a great influence on the rest, being usual for them to be dealt together with other themes. On the contrary, it has been found that the themes Weather, Mutual Funds and IPO are highly developed, but hardly linked to the rest, so they are very specific themes within Behavioural Finance. Finally, it should be noted that the themes Attention, Strategies and Portfolio Selection have been the least developed and related to the rest. Within these, the theme of Attention is an emerging theme in Behavioural Finance.

Finally, it is convenient to mention the productivity and impact of each theme, finding that Investor Sentiment stands out over the rest, both by number of articles published, as by the H Index and the number of total citations received. It is also worth mentioning the Arbitrage theme, which with only 59 articles has a total of 1943 citations, showing to be a theme with a high average impact per publication.

6ConclusionsWith the purpose of identifying and visualizing the intellectual structure of Behavioural Finance, in this work a bibliometric analysis has been carried out in which the performance of the scientific production of the area has been evaluated, as well as the themes that comprise it through an analysis of co-occurrence of keywords. The results contribute to the future development of Behavioural Finance.

We have observed how Behavioural Finance is a research area that is in full swing, substituting Modern Finance for new research based on the irrationality of investors, and trying to explain the various anomalies detected in financial markets, being of special relevance the bubbles occurred in recent years.

However, the great contribution of this work has been to clarify the different themes that make up this research area, obtaining a total of 13 themes: Investor sentiment, disposition effect, Overconfidence and Expected Return Stocks as motor themes; Arbitrage, Bias and Model as basic and transversal themes; OPI, Weather and Mutual Funds as specialized themes; Strategies, Attention and Portfolio Selection as emerging or declining themes.

Regarding the productivity and the impact of each theme, we have observed that the Investor Sentiment theme stands out clearly both in productivity and impact.

With all this, we have detected a hot research area in the financial field, highly influenced by psychology and sociology. The most important theme in Behavioural finance is the study of investor sentiment on the decision-making process. Future research in this line will allow us to advance in a global theory that unifies studies in Behavioural Finance.

Declarations of interestNone.

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.