This study investigates the relationships among the influence of the largest shareholder, the entry mode of foreign direct investment companies in Korea, and subsidiary divestitures to demonstrate how the government's FDI policies can work as a moderator. Using data from 468 foreign manufacturing firms that set up plants in Korea through FDI between 2008 and 2011, a survival analysis was performed using the Cox proportional hazards model. The statistical results suggest that the possibility of foreign subsidiary divestiture increased with the level of influence held by the company's largest shareholder. Also, the entry mode of mergers and acquisitions was more likely than the greenfield entry mode to result in foreign subsidiary divestiture. Lastly, the host country's FDI policies moderate the relationship between the influence of the largest shareholder and foreign subsidiary divestiture.

Foreign subsidiary divestiture, also known as foreign direct divestment or foreign divestiture (FD), occurs when a multinational corporation (MNC) transfers the business activities of a foreign subsidiary to its home country or a third country. After entry into a host country market through foreign direct investment (FDI) or other business enterprises, an MNC that has decided on FD either recovers its invested capital from the foreign subsidiary or closes operations due to endogenous or exogenous factors. An MNC that undertakes FDI goes through a series of decision-making steps regarding setting up a subsidiary, gaining a foothold in the host country market, and divesting the foreign subsidiary. FDI involves transferring production factors, such as capital, from a home county to a host country. A foreign subsidiary thrives if its business runs well in the host country, but the parent company can still decide to divest it for economic or other reasons. In particular, FD can occur because of problems concerning ownership, asset disposition, land expropriation, and securitization; those factors make FD as challenging as FDI (Shin, 2000). Endogenous reasons for FD include economic factors, such as failure to explore the local market, poor performance of the subsidiary, poor management of the parent company, and changes of production location, and non-economic factors, such as a lack of communication between the parent company and foreign subsidiary, a subsidiary's loss of control or rights, mismanagement of the subsidiary, and conflicts with local partners (Casson, 1987).

Recent research has begun to raise interest in the issue of business withdrawal, with particular emphasis on the factors that drive the withdrawal or survival of overseas subsidiaries (Burt, Coe & Davies, 2019; Fisch & Zschoche, 2012; Mohr, Batsakis, & Stone, 2018; Procher & Engel, 2018). However, within the area of FDI, business withdrawal is considered to be a somewhat limited area.

Studies related to foreign direct investment mainly focus on the motivational aspects of overseas investment such as determinants of foreign direct investment (Bang, 1993). However, since the withdrawal of multinational corporations from business is an event that can have a great impact on individual stakeholders surrounding the company, particular interest should be placed on this topic (Corredor & Mahoney, 2021). This is because, as mentioned above, in the process of the withdrawal of the business, there may be a combination of supply and demand problems in the country as well as the industry, ownership processing problems, financial problems of the company, and withdrawal costs.

In order to expand the scope of this study's discussion, institutional theory and resource-based theory can be introduced into the research. First, institutional theory is largely determined and justified by the surrounding environment (Eisenhardt, 1988), which acts as an important factor in multinational companies’ suitability and the performance of investment methods. In other words, the institutional approach focuses on “external” factors (Amin, 1999) and is affected not only by each region and market but also by the specific institutional environment in which they work. In particular, governments of each country systematically affect the development of specific industries through incentives and publicity to encourage investment in their own countries in terms of employment and GDP (Lampón, Lago-Peñas & González-Benito, 2015; Lampón, Cabanelas & Carballo-Cruz, 2017) Flickinger & Zschoche (2018). also argued that institutional perspective is related to business withdrawal and performance. Meanwhile, from a resource-based view (RBV), Mohr, Batsakis, & Stone (2018) found that overseas businesses could be withdrawn due to resource constraints, and Burt, Coe & Davies (2019) argued that the performance of overseas subsidiaries of multinational corporations depends on their unique characteristics and local environment. That is, the background of the business withdrawal of multinational corporations can also be found in these two theories.

In a study by Mata & Portugal (2000), the withdrawal of overseas subsidiaries from the perspectives of M&A and Greenfield was reviewed, and through this, the failure rate of foreign direct investment was shown. Based on this work, this research intends to focus on the investment method related to the exercise of ownership of a relevant company among the various variables influencing the withdrawal of the business. This is because corporate capital ownership plays an important role in integrating into the institutional environment (Aláez & Barneto, 2008), this is characterized by the mechanism by which the headquarters coordinates the operation of subsidiaries.

On the other hand, FDI inducement policies are emerging as an important issue because many countries across the globe are stepping up their efforts to attract foreign investors. MNCs use FDI policies as criteria when they are making decisions about entering a foreign market, and the policies can greatly affect post-entry business performance. The most common type of FDI inducement policy is an FDI incentive policy, which is widely understood to attract foreign direct investors. FDI incentive policies to attract MNCs aim to eradicate factors such as regulatory and institutional hurdles that can intimidate multinational investors. The basic strategy in providing incentives to attract FDI is to guarantee the recovery or restitution of investment costs. With that security, the foreign subsidiary of an MNC can generate positive external effects in the host country and gain strong negotiating power in the local market (Aitken, Harrison & Ripsey, 1996), which enhances its chances to outperform local firms (Bellak, 2004). Using an expansive perspective on this process chain, the provision of FDI incentives is thus directly and indirectly associated with the business performance and FD of foreign subsidiaries.

Previous studies applied and interpreted FDI inducement policies in the context of entry mode (Markusen, 1995). This study opens a new paradigm by reversing the conventional FDI-focused research flow and examining the issue from the FD side.

Accordingly, this research differentiates itself from previous studies in three ways. First, we explore FD through an in-depth investigation of foreign subsidiaries of MNCs that entered Korea through FDI. Second, we illustrate the relationships between FD (dependent variable) and the influence of the subsidiary's largest shareholder and the entry mode (independent variables) and explain the relevance of those relationships to FDI inducement policies. Third, to control the determinants of FD, care was taken to eliminate lagging bias by collecting and analyzing longitudinal panel data, thereby integrating cross-sectional and longitudinal information.

This research will sequentially reveal how the influence of the largest shareholder and entry mode have a relationship to business withdrawal with this discriminatory approach and how the incentive policy of the investment target country will control this relationship. This approach will provide an expanding perspective on the existing FD research field and will show differentiation from existing literature in that it can reflect national uniqueness, especially in the field of business withdrawal.

The results of our study are discussed in the following order. First, we survey previous studies and related theories and explain our research model and hypotheses. Then we present the samples we used to test our hypotheses, the measurements we used for individual variables, and our statistical model, followed by our empirical analysis and results. Finally, we discuss our study results and their implications.

2Theoretical backgroundMany FDI studies and much research on the drivers of internationalization have argued that some factors facilitate the withdrawal of foreign subsidiaries (McDermott, 2010; Soule, Swaminathan, & Tihany, 2014).

Subsidiary divestiture began to be seriously researched in the 1980s as US-based MNCs entered the phase of maturity (Vaupel & Curhan, 1969). In earlier discussions, FD was defined as selling or closing a foreign subsidiary to recover invested capital (Torneden, 1975; Boddewyn, 1979) Sachdev (1976). defined divestiture as a company's plan to terminate a production or business operation to achieve a long-term goal and, when applied to a foreign subsidiary, a process of transforming its ownership from total to partial. Foreign direct divestment theory, the most influential theory explaining FD, was developed by Boddewyn (1983) in response to the eclectic theory of Dunning (1982). It is acclaimed as the theory that established the notion of FD. According to eclectic theory, a company needs to achieve a firm-specific advantage, internalization advantage, and location advantage to be willing to pursue FDI. In contrast, Boddewyn (1983) argued that MNCs divest their foreign subsidiaries when any of the following conditions are met: (1) competitive advantage is lost in a specific market; (2) selling the subsidiary is more profitable than keeping it, even if a competitive advantage is maintained; or (3) termination of production is more profitable than maintaining the subsidiary. As factors influencing divestiture decisions, Boddewyn named mistakes in the process of reviewing FDI, structural aspects of resources and organizations, an adverse environment, external pressure, and the divestiture conditions of the host country.

Many empirical studies have derived various factors associated with divestiture decision-making Torneden (1975). argued that a parent company can more readily choose divestiture when its financial situation worsens, its business size is small, or a management change takes place Boddewyn (1979). noted that divestiture occurs as a consequence of poor business performance or a managerial strategy that considers the position of the organization or the intention of its decision-maker (Chung & Yoon, 2020) Duhaime & Grant (1984). investigated 40 large US firms and reported that a subsidiary's business performance, subsidiary interdependence, and the parent company's financial performance were important factors in divestiture decisions Casson (1986). defined FD as the loss of managerial control of a foreign subsidiary and claimed that the solution lay in the relationship between the parent company and foreign subsidiary.

In a study on the selection, performance, and expiration of global joint ownership, Makino & Beamish (1998) said that local accessibility was an important factor in the ownership of a joint venture that could determine the performance and expiration of the joint venture Mackie (2001). analyzed family ownership and survival relationships and found that long-lived family owners differed from other types of companies in their survival rates Kronborg & Thomsen (2009). analyzed the relationship between foreign ownership and long-term survival rates and demonstrated that foreign-owned entities had an advantage in survival Park & Min (2008). looked at determining factors related to a firm's survival and longevity and reported that companies run by owners and those run by professional managers had no significant differences in their long-term survival but that indirect ownership control through affiliates adversely affected the survival of a company.

Overseas investment methods have also been regarded as important factors that affect the local performance and survival of overseas subsidiaries (Agarwal & Ramaswami, 1992; Kogut & Singh, 1988).

On the other hand, studies on the host country's FDI inducement policies have been conducted primarily within the scope of attracting FDI (i.e., entry of FDI) (Markusen, 1995; Porcano & Price, 1996). However, given the additional function of FDI inducement policies as a core resource for continuing local operations, in addition to their main function of attracting FDI, examining FD in relation to FDI policies is an important new research direction.

3Research model and hypotheses3.1Hypothesis formulation3.1.1The influence of the largest shareholder and foreign divestitureSome areas of FDI research show links between variables involved in corporate ownership structures (Dikova & Sahib, 2013). What those studies have in common is their focus on equity structures. In other words, they all agree that the corporate ownership structure affects business performance and business withdrawal. Discussions on the relationship between the largest shareholder's stake and corporate value are active, and the higher the largest shareholder's stake, the better the corporate value by reducing agent costs and simplifying decision-making (Morck, Shleifer & Vishny, 1998; Stulz, 1988; McConnell & Servaes, 1990), which is directly related to governance (Goranova, Abouk, Nystrom & Soofi, 2017). Since ownership and decision-making powers coincide, competition for the centralization of ownership means that equity competition is fierce (Basu, Paeglis & Rahnamaei, 2016; Boubaker, Rouatbi & Nguyen, 2016; Rossi, Barth & Cebula, 2018).

Ownership describes the rights that arise from possessing a firm (Grossman & Hart, 1986). A parent company possesses its subsidiary, or its largest shareholder owns the subsidiary (Child & Yan, 2003). The largest shareholder plays a decisive role in making core decisions about a foreign subsidiary. In general, the largest shareholder is one individual who holds the largest number of outstanding shares. Key features of the largest shareholder of a subsidiary are ownership of the greatest proportion of its shares as an investor, the monitoring of its management, and the ability of that shareholder to exercise control or rights for personal profit maximization. The largest shareholder fulfils those functions based on the trust of the board members (Frederickson, Hambrick, & Baumrin, 1988) and often occupies the CEO position Torneden (1975). noted that FD can occur based on the personal decision of the largest shareholder, which accelerates the decision-making process Boddewyn (1979). also mentioned that the decision for FD can easily be made as a managerial strategy by the individual holding the most votes. That is, the largest shareholder of a foreign subsidiary directly controls strategic decision-making and performance monitoring as the de facto owner of the subsidiary (Hambrick & Mason, 1984) and thus has a crucial influence on the FD decision.

The FDI share is the most powerful way to influence a foreign subsidiary (Brouthers, 2002), and the largest shareholder is at the center of all important decision-making because they assume the risk of and responsibility for transaction costs (Fama & Jensen, 1985). Therefore, the greater the influence of the largest shareholder, the more priority and voting rights they have in major decision-making processes (Nitsch, Beamish, & Makino, 1996). Furthermore, when the largest shareholder has a high shareholding ratio, they tend to manage and monitor the firm (Shleifer and Vishny, 1997; Holderness, Kroszner & Sheehan, 1999), which can accelerate decision-making processes about the subsidiary they own (Geringer & Herbert, 1989).

The common finding of previous studies is thus that the largest shareholder plays a crucial role in making important decisions. Given that the largest shareholder, who holds decisive influence, can simplify, facilitate, and accelerate important decision-making processes, the following hypothesis is set with regard to the relationship between the influence of the largest shareholder and FD.

Hypothesis 1 The greater the influence of the largest shareholder in the foreign subsidiary of a multinational corporation, the higher the possibility of foreign divestiture.

Recently, discussions on the selection of entry modes in overseas markets have been active (Boellis, Mariotti, Minichilli & Piscitello, 2016; Ilhan-Nas, Okan, Tatoglu, Demirbag, Wood & Glaister, 2018; Xu, Hitt & Miller, 2020), and Yim, Kim, & Jung (2018) argued that the investment decision models for foreign direct investment are divided into both greenfield type and M&A type and that innovation in the field is active. In addition, as a result of examining the reinvestment of local subsidiaries in uncertain situations, Slangen (2013) found that greenfield was somewhat superior. In contrast, Mariotti, Marzano & Piscitello (2021) found that when family companies make overseas investments, they prefer to enter overseas markets through greenfield investments because they lack the appropriate organizational capability to carry out and manage cross-border acquisitions.

Brouthers & Brouthers (2001) found that the investment-intensive nature, environmental uncertainty, and risk propensity of manufacturing affects manufacturers' choice of entry mode (investment method) Delios & Beamish (2001). used a Japanese subsidiary to investigate how an MNC's intangible assets and experience affected the survival and profitability of its overseas subsidiaries. They found that survival and profitability have different precedents, and their relationship is determined by the entry mode Luo (2001). found that investment choices in emerging economies are affected by situational contingencies at four levels: national, industrial, corporate, and project. Those results suggest that in China, the method of joint ventures is preferred if government intervention is severe or if the host country has little experience.

In FDI-related decision-making, the entry mode depends on choices between exclusive or joint control over the foreign subsidiary and between the acquisition of an existing firm or the creation of a start-up in the host country (Hennart & Park, 1993).

In general, foreign entry mode has been considered an important factor in the performance and survival of a foreign subsidiary in the local market (Agarwal & Ramaswami, 1992; Kogut & Singh, 1988). Because the discussion of entry modes in this study is based on the ownership structure, we consider it in terms of greenfield vs. M&A (mergers and acquisitions) investment, which has been shown to accurately explain post-entry business operations in a local market (Anderson & Gatignon, 1986). These two foreign market entry modes differ fundamentally. A greenfield FDI involves the onsite purchase and construction of production facilities, whereas an M&A FDI takes over an existing firm by purchasing the majority of its shares (Garita & Marrewijk, 2007). Table 1 summarizes entry mode depending on the shareholding ratio.

How, though, does FD relate to the entry mode? It is generally understood that a greenfield FDI has high initial fixed costs and carries a risk of sunk costs due to various cost and time factors (Fluck & Lynch, 1999). That is, a greenfield FDI is inherently prone to structural exit barriers, including FD-related sunk costs associated with the investment (Bain, 1956). Another drawback of a greenfield FDI is the high time burden until the subsidiary enters the phase of stable management. On the other hand, a longer period spent gaining a foothold in the host country, compared with the M&A entry mode, can improve the foreign subsidiary's ability to adapt to the local market situation and thus extend its survival in the local market, which could reduce its risk of FD. In contrast, an M&A FDI is more likely than a greenfield FDI to result in exit due to cultural clashes and conflicts between owners and local partners (Jemison & Sitkin, 1986). In fact, Wilson (1980) studied the relationship between an MNC's choice of entry strategy and the survival of foreign subsidiaries and concluded that greenfield-type foreign subsidiaries were less likely to be divested than their M&A-type counterparts. Likewise, Hennart, Kim, & Zeng (1998) pointed out that M&A-type subsidiaries have a lower survival rate. This could reflecting the negative effects of M&A investments at the levels of local costs and business performance, which translate into a high FD rate (Burt, Dawson, & Sparks, 2004; Pattnaik & Lee, 2014).

Taking these discussions together, the greenfield model faces structural exit barriers related to the domestic economic structure, whereas the M&A model faces international cultural and organizational barriers, which puts it at a comparatively higher risk of FD. Therefore, the following hypothesis is set with regard to the relationship between an MNC subsidiary's entry mode and its FD.

Hypothesis 2 The M&A entry mode for the foreign subsidiary of a multinational corporation will increase the possibility of its foreign divestiture.

Most countries trying to attract foreign direct investors offer various FDI inducement policies, particularly incentive policies. FDI incentives do not include core elements, such as basic investment factors, but they can play a decisive role in certain circumstances. In light of the ongoing global race for FDI, as countries compete to provide favorable investment environments under the current conditions of international economic consolidation, the importance attached to incentives is increasingly recognized as a crucial means to enhance and maintain a competitive advantage in attracting FDI (Wint & Williams, 2002; Loree & Guisinger, 1995).

Kim & Lee (2019) study argued that the incentives to be provided by an investment destination country would play a decisive role in the operation and investment of local subsidiaries of multinational corporations, which means that they generate good performance based on incentives in host countries Nicolas, Thomsen, & Bang (2013). research also emphasized the importance of incentives in research on the transformation of local governments’ foreign direct investment policies and systems. As such, the effect of government policy of investment target countries in selecting and entering host countries is considered an important factor in foreign direct investment (Moalla & Mayrhofer, 2020).

FDI incentives are benefits granted to foreign direct investors to enable them to pursue their profits in a low-risk environment by reducing the costs and risks of investment. Consequently, related policies inevitably cause reverse discrimination to domestic businesses and require justification, and their effects give rise to opposing views. Advocates point to ways in which such incentives attract foreign direct investors (Root & Ahmed, 1978), and opponents argue that they do not significantly affect FDI (Porcano & Price, 1996). Previous studies have predominantly found that FDI incentives play their desired role. Of them, Hines (2005) argued that tax incentives are an essential factor in attracting FDI Kang, Lee & Park (2011). emphasized the effect of the host country's proactive incentive policies, such as tax concessions, location advantages, and administrative services, on MNCs’ FDI-related decisions. As a result of incentives granted, MNCs’ foreign subsidiaries can be used to generate external effects that act as a positive factor for business performance (Beamish, 1993; Woodward & Rolfe, 1993). Thus, the incentives act as mechanisms that extend the period of survival in the local market.

How, then, would FDI incentive policies affect the relationship between a company's largest shareholder and FD? The largest shareholder of a foreign subsidiary is usually viewed as a long-term investor with a long-term incentive to maximize the wealth of the subsidiary because its wealth is directly associated with their own wealth (Anderson & Reeb, 2004). Therefore, from the perspective of the largest shareholder, the absence of incentives from the host country creates additional steps that must be taken to gain benefits equivalent to those in the missing incentives and compensate for those lost profits, so the largest shareholder needs to generate business profits by implementing stronger local market–oriented strategies. Put differently, if a foreign subsidiary's largest shareholder has a strong power position that is not granted by the host country's incentives, they are more likely to stay in the host country to generate profits equivalent to the quantity of the lost incentives. Thus, the largest shareholder is less likely to divest from the subsidiary because they need to retain it to meet their goal and provide organizational justification of their decision to invest in the first place.

We hypothesized above that a foreign subsidiary established by an M&A entry mode would have a high FD rate. In general, FDI incentive policies are directed at greenfield FDI rather than M&A FDI, which indicates that the host country believes that greenfield FDI will generate greater economic effects than M&A FDA because it involves the construction of production facilities, which induces foreign capital inflow and job creation. In contrast, an M&A FDI merely changes the ownership of an existing firm, which has negligible effects on job creation and capital building. In fact, the Korean government promotes greenfield FDI by operating foreign investment zones and granting various incentives, including tax exemptions, rent exemptions, and administrative waivers of regulations to firms established in the foreign investment zones. That implies that the largest shareholder of a foreign subsidiary established by the M&A entry mode is less likely to divest from that subsidiary to make up for the incentive-related disadvantages it has against greenfield startups. Therefore, the following hypotheses are set with regard to the moderating effects of the host country's FDI inducement policies.

Hypothesis 3 The non-provision of incentives to the foreign subsidiary of a multinational corporation will moderate the relationship between the influence of the largest shareholder and foreign divestiture in a negative direction.

Hypothesis 4 The non-provision of incentives to the foreign subsidiary of a multinational corporation will moderate the relationship between the entry mode and foreign divestiture in a negative direction.

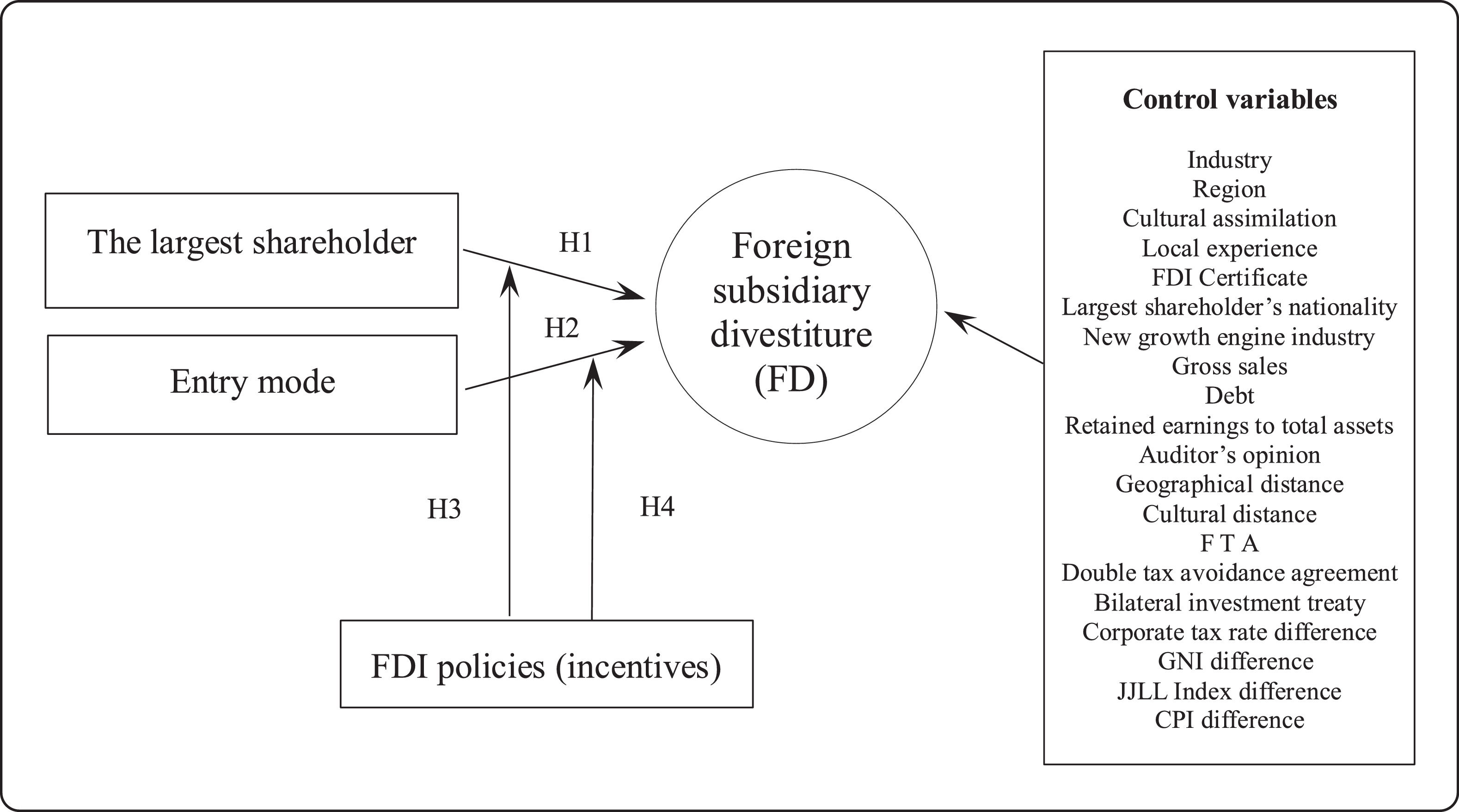

An MNC subsidiary strives for performance maximization while conducting local business activities (Delany, 2000) because it can otherwise be divested. The MNC subsidiaries sampled for the empirical analysis in this study are structurally characterized by relationships between the home and host countries and between the parent company and the subsidiary. Given that they are exposed to various FDI policies, an integrative analysis of the influence of the largest shareholder, entry mode, FD, and FDI policies can shed light on the relationships among those factors. The FD-related determinants are basically multifactorial and do not lend themselves well to being modeled as a simple theory. Therefore, further discussion about FD will be based on the research model of this study, in which the influence of the largest shareholder of the MNC's foreign subsidiary and its entry mode are set as independent variables, and the FDI incentive policies of the host country are set as the moderating variables, as schematized in Fig. 1.

4Research methods4.1Data collection and samplingThe data used for the empirical analysis in this study were extracted from a database of 7,190 FDI companies that invested in Korea between 2008 and 2011. After eliminating companies from the financial, holding, wholesale, retail, and distribution sectors, as well as those from countries designated as tax havens, such as the Cayman Islands, the Virgin Islands, the Bahamas, and Panama (OECD report, 2000), 468 manufacturing firms subject to external audit were selected for empirical analysis. The above-mentioned sectors were excluded based on the discussions in Taggart (1998). In brief, such firms are prone to discrepancies in parent company control and subsidiary activities, and they lack publicly available data. We chose companies larger than the required external audit corporation size because all data in Korea can be viewed only when they are eligible for an external audit corporation, and the reliability of those data can be secured.

In Korea, the chaebol groups traditionally form the mainstream. It is interesting to observe the ecology of FDI companies in such an environment. Also, Korea's foreign investment incentive policy is highly advanced and generalized, so it is suitable as a model country by which to judge the effectiveness of FDI policies.

The observation period for incidents of FD was 2009–2015, and the explanatory variations were derived using a 10-year firm-year panel dataset (2006–2015). Given that a one-year temporal lag was applied to the main variables, at least 5 years of data on FD incidents were secured. As a result, a total of 4,114 firm–year dyads could be used in the analysis. Of the 468 foreign subsidiaries analyzed, 54 firms (11.5%) underwent FD during the observation period.

4.2Variable definitions and measurements4.2.1Dependent variableThe dependent variable in this study is FD. The incidence of FD was determined by verifying whether a sample firm operated in a normal manner or underwent divestiture during the observation period. Each observation point is a firm–year pair. At each observation point, the survival or divestiture of a firm was determined by whether the firm was observed in the following year. To determine whether the absence of a firm was attributable to a complete exit or M&A to another firm, we first examined the KIS-VALUE to verify the firm's absence therefrom and then checked the business registration number against the list of firms that filed a business registration cancellation with the National Tax Service. Final FD status was verified by assessing whether divested firms underwent M&D on the electronic disclosure systems and individual websites. The dependent variable thus determined was converted into a dummy variable for right-censoring. Sample firms right-censored during the observation period were given the value of “0” and “1” (= FD) otherwise.

4.2.2Independent variablesThe research model in this study tests two independent variables. The effect of the largest shareholder was operationalized as the largest shareholder's shareholding ratio. The largest shareholder was set as an individual and their associates, including affiliates. The shareholding ratio information was retrieved from the annual electronic disclosure systems operated by KIS_VALUE, KED, and FSS and put into the model as a one-year lagging series.

The entry mode data were collected from the Ministry of Trade, Industry and Energy (MOTIE) database and checked against the electronic disclosure systems of KIS_VALUE and KED. The thus determined entry mode was processed as a dummy variable (0 = M&A; 1 = greenfield).

4.2.3Moderating variableFDI inducement policies were quantified by converting them into a dummy variable depending on the presence or absence of incentives. The term “incentives” was operationalized to foreign investment zones, drawing on the studies of Park & Kim (2004). Sample firms located in one of the incentive zones were given the value of “1” and “0” otherwise. A foreign investment zone is a dedicated business complex created to attract foreign direct investors, and firms in such zones enjoy a bundle of incentives. The Korean government operates four types of foreign investment zones: complex-type foreign investment zone, individual-type foreign investment zone, free trade zone, and free economic zone. Accordingly, we tracked firm locations to determine whether the sample firms were located in one of those foreign investment zones using data provided by MOTIE and KOCOX with the global positioning system operated by the Korea National Geographic Information Institute (NGII).

4.2.4Control variablesBecause FD is an event caused by interactions among several conditions, we controlled for all factors that could influence FD other than the independent variables. This subsection presents the control variables one by one.

Industry. Drawing on the industrial effects proposed by Becerra & Santalo (2003), we included the industrial sector of each sample firm as an industry dummy based on the two-digit level classification of the 9th version of the Korean Standard Industrial Classification, using related data provided by MOTIE.

Home country's region. We categorized the home countries of the sample firms into Asia, Europe, North America & UK, and Latin America using related MOTIE data and then included each region as a region dummy. It was controlled to reflect country-specific characteristics in terms of entry purpose and operation mode, as well as business environment.

Cultural assimilation. This variable was operationalized as corporate identity (CI), a notion that can influence internal and external stakeholders and is used as a strategic instrument in the local market (Balmer & Wilson, 1998). CI is tantamount to the corporate emblem (Bernstein, 1986) and corporate values that differentiate it from other firms (Shee and Abratt, 1989). This variable was controlled because an efficient CI can offer competitive advantages and goodwill among related stakeholders and thus contribute to long-term growth and development. CI was converted into a dummy variable (1 = Korea-associated name, such as Hankuk, Korea, Korean, and Silla; 0 = otherwise).

FDI Certificate. An FDI Certificate indicates cases in which a subsidiary's legal status changed from being a common company to an FDI company. This variable was controlled to verify whether the requirements for the status of FDI company can influence the FD decision through delays in administrative procedures, which is often the case with M&A subsidiaries. The value of “1” was assigned from the time at which the status of FDI company was obtained.

Largest shareholder's nationality. The nationality of the largest shareholder was converted into a dummy variable (0 = Korean name; 1 = non-Korean name). This method is commonly used in nationality-related studies (Gong, 2003; Harzing, 2001). Given the clear distinction between Korean and non-Korean names, the reliability of this method is considered high. The data for determining the nationality and legal personality of the largest shareholder were extracted from the electronic disclosure systems operated by KIS_VALUE, KED, and FSS.

New growth engine industry. Whether or not a sample firm belonged to a new growth engine industry was checked against each year's list of new growth engine industries, as announced by the Korean government. Because the observation period of this study covers 2006–2015, two consecutive lists within this period were used: the ten next-generation growth engine industries released in June 2004 and applied until 2008 and the 17 new growth engine industries released in January 2009 and applied until 2015. Each sample firm's business category was verified against data provided by MOTIE using the industry classification table, and the result was recoded as a dummy variable (1 = one of the new growth engine industries of the corresponding year; 0 = otherwise).

Gross sales. Because gross sales are an important metric for business performance, low gross sales are usually perceived as a warning sign that a market exit could be nigh. In fact, low gross sales are the strongest predictor of FD (Dranikoff, Koller, & Schneider, 2002). We used the annual gross sales of each sample firm by converting the KIS_VALUE and FSS data into log values and inputting those values into the model as a one-year lagging series.

In consideration of the direct effects of financial metrics on the survival and divestiture of foreign subsidiaries (Globerman and Shapiro, 2002), we also controlled for key financial indicators.

Debt is an important variable explaining corporate restructuring (Hoskisson, Johnson, and Moesel, 1994; Markides, 1995). The higher the amount of debt, the heavier the interest burden and the lower the company's profitability. A high debt-to-asset ratio generally increases the need for restructuring, including FD, to lower the cost of debt. After collecting the relevant data from the KIS_VALUE database, we took the log of the annual total debt and input that value into the model as a one-year lagging series.

Retained earnings to total assets is a measure for estimating the accumulated profits generated by the assets put into a local operation. We calculated this variable because a high retained earnings to total assets ratio indicates healthy corporate management. In a case study of Korean small and medium-sized enterprises that entered overseas markets, Suh & Yi (2008) identified the accumulated deficits of foreign subsidiaries as the most common cause of FD. After collecting the relevant data from the KIS_VALUE database, we took the log of the annual retained earnings to total assets ratio and input that value into the model as a one-year lagging series.

Auditor's opinion is a formal statement of the audit result indicating whether the financial statements of a company accurately reflect its financial performance and health. Its purpose is to provide a rapid and accurate judgement of a company's financial performance Chen & Church (1996). reported that a qualified audit opinion serves investors as a predictor of insolvency. We verified each sample firm's annual auditor's opinion using KIS_VALUE and FSS data and converted it into a dummy variable (1 = unqualified opinion; 0 = otherwise) as a one-year lagging series.

We also controlled for variables that well explain inter-country characteristics.

Geographic distance. The geographic distance between the home and host countries increases the liability of foreignness (Zaheer, 1995) and transaction costs (Hennart & Larimo, 1998), acts as a barrier to institutional legitimacy building (Kostova, 1999), and greatly affects the survival and performance of a foreign subsidiary (Barkema, Bell, & Pennings, 1996). A study using the gravity model reported that the geographic distance between the home and host countries negatively affects international trade and capital flow (Head and Mayer, 2011). We obtained the flying distance between Korea and each home country online at worldatlas.com and used log values to calculate this variable.

Cultural distance. We tried to control for cultural distance between individual countries in addition to the home country's region variable defined above because within the general characteristics of continents, each country has its own culture and differences from other countries (Park, Han, & Yoon, 2018). Foreign direct investors prefer international market expansion to countries with which they share a cultural affinity (Brouthers & Brouthers, 2001). The greater the cultural distance, the greater the difficulty associated with local management due to the increasing information burden necessary for decision-making. That is, the greater the cultural distance, the higher the risk of business failure (Li & Guisinger, 1991); foreign subsidiaries find their ability to create profits increasingly limited in a new market as the cultural distance increases. We estimated the cultural distance between Korea and each home country using the following formula (Kogut & Singh, 1988) after collecting each country's cultural index at Hofstede's website (https://geert-hofstede.com).

CDjk: cultural distance between country j and Korea

Iij: index for the index of cultural dimension i in country j

Vi: variance in the index for cultural dimension i

FTA. The purpose of a free trade agreement (FTA) policy is to resolve a shortage of resources necessary for economic growth and improve corporate production and management efficiency. The presence of an FTA between the home and host countries can lower the FD rate Jung (2007). analyzed the effect of FTAs on FDI inflow and proved that they have a positive effect. Therefore, we controlled for an FTA between Korea and each home country as an FD-related variable. For data collection, we used the FTA homepage (fta.go.kr) and converted the data into a dummy variable (1 = presence of FTA; 0 = otherwise) as a one-year lagging series.

Double tax avoidance agreement. A double tax avoidance agreement smooths capital and technology transfers between countries and prevents international fiscal evasion by preventing double taxation on the same income through inter-country tax jurisdiction and tax rate adjustments. Because such agreements are also used to attract FDI, the presence of a double tax avoidance agreement between the home and host countries can lower the FD rate. We extracted the related annual data from the website of the Ministry of Foreign Affairs (mofa.go.kr) and converted the data into a dummy variable (1 = presence of a double tax avoidance agreement; 0 = otherwise) as a one-year lagging series.

BIT. A bilateral investment treaty (BIT) is an inter-country policy secondary to an overarching economic agreement. A BIT is a strong policy means by which MNCs can protect their foreign subsidiaries and reduce the risk of forfeiture (Drabek & Payne, 2002). The presence of a BIT between the home and host countries enables a foreign subsidiary to execute business operations in a stable environment and overcome managerial constraints. We extracted the related annual data from the website of the Ministry of Foreign Affairs (mofa.go.kr) and converted the data into a dummy variable (1 = presence of a BIT; 0 = otherwise) as a one-year lagging series.

FD includes a U-turn of resources from the host to the home country based on a comparison between the two countries. Therefore, we controlled for differences in relevant characteristics between the home and host countries.

Corporate tax rate difference. Taxes are one of the most sensitive issues directly associated with the local business activities of an MNC's foreign subsidiary. Previous studies found that foreign direct investors tend to avoid countries with high tax rates and that high taxation on FDI negatively affects it (Desai & Dhamapala, 2006). That is, the lower the corporate tax rate of a host country, the higher the FDI flow into that host country (Grubert & Mutti, 1991; Cassou, 1997). In general, a lower corporate tax rate in the host country lowers the tax burden, which contributes to attracting more FDI. Using the data available at Trading Economics, KPMG, National Tax Service, and KOTRA, we estimated the annual corporate tax rates of Korea and each home country during the observation period and input the inter-country differences in the tax rates into the model as a one-year lagging series.

GNI difference. To consider inter-country differences in economic indicators, we input the difference in gross national income (GNI) into the model because FD can depend on the economic situations in both countries Lunn (1980). considered GNI to be a factor that influences FDI. After data collection using World Bank annual data, we took the log of the inter-country difference and input that value into the model as a one-year lagging series.

FDI in the manufacturing industry is closely associated with investment in real estate, which is the most common investment object linked to business entry and exit. In this context, we considered the following indices.

JLL. We estimated the difference in the annual Jones Lang LaSalle (JLL) Index between Korea and each home country and input those values into the model as a one-year lagging series. The JLL Global Real Estate Transparency Index (JLL Index) considers low transparency to be synonymous with corruption and transparency to indicate a market with highly efficient real estate transactions. The JLL Index scores range from 1.00 (total real estate transparency) to 5.00 (total real estate opacity) (LaSalle, 2008). Grades (Tiers) are listed below:

Tier 1: Highly Transparent Total Composite Score: 1.00–1.49

Tier 2: Transparent Total Composite Score: 1.50–2.49

Tier 3: Semi-Transparent Total Composite Score: 2.50–3.49

Tier 4: Low-Transparency Total Composite Score: 3.50–4.49

Tier 5: Opaque Total Composite Score: 4.50–5.00

CPIGoldberg & Campa (2010). emphasized the importance of transparency in the host country as a key factor in successfully attracting FDI. Each country's degree of transparency is measured using the Corruption Perceptions Index (CPI), which is operated by Transparency International (transparency.org). Transparency International releases the CPI every year by analyzing surveys on corruption and the misuse of public power that are conducted by seven independent institutions, including the International Bank for Reconstruction and Development. CPI scores range from 0 to 10, with higher scores indicating lower degrees of corruption. We calculated the annual CPI difference between Korea and each home country and input those values into the model as a one-year lagging series.

Table 2 gives an overview of all the variables in the research model, along with their operational definitions and measurement methods.

4.3Statistical analysis modelBecause the dependent variable of this study is FD, i.e., whether FD took place during the observation period, we performed a survival analysis—which is used to measure the dependent variable's duration or the incidence of the event—to test for statistical significance and each corresponding hypothesis. This analysis method is highly appropriate because the purpose of this study is to determine whether MNCs’ foreign subsidiaries underwent FD over time. A survival analysis allows for the prediction of a hazard rate, or the probability that a specific event will happen at each instant of measurement in a longitudinal study (such as the probability that a sample firm will undergo FD). Specifically, a survival analysis measures the state of each sample firm (whether FD took place) at each measurement instant as a discrete variable and converts those data into a continuous variable in the form of a transformation rate (FD rate), thus generating a dependent variable and predicting the transformation rate through independent variables (Blossfeld, Golsch, & Rohwer, 2007). For this analysis, we used the Cox proportional hazards model, which is the most widely used survival analysis model.

The main advantage of the Cox model is its use of partial maximum likelihood estimation, whereby the hazard function of a component is estimated using the ratio of the hazard functions of other components. This yields a constant ratio regardless of the survival period, enabling the use of the statistical distribution function of the survival period, even in ambiguous cases. Whereas a binomial distribution distinguishes only between survival and divestiture without considering the duration of survival, the Cox model also considers the duration of survival. Furthermore, if the observation period is terminated without divestiture, the surviving firms are not removed, but when surviving firms are processed as right-censored data, the robustness of the estimation is enhanced. Stata version 13 was used for the statistical analysis of this model.

5Results of empirical analysis5.1Descriptive statistics of variables and their correlationsTable 3 presents the results as the means and standard deviations of the analysis variables and their correlation coefficients. Among the sample firms, FDI companies experienced an annual average of 0.013 FD. Although the Pearson's correlation coefficient between each variable pair is generally low, some of the values are high. Therefore, we estimated the variation inflation factor (VIF) as an additional test of multicollinearity and verified that the input variables have no multicollinearity problems, with mean and maximum values of 2.03 and 4.55, respectively. Additionally, because this study analyzes moderating effects, we performed mean centering of the input variables with awareness of the risk of multicollinearity between the independent and moderating variables and their interaction term (= independent variables × moderating variable). In a correlation analysis, correlation coefficients of 0.9 or higher indicate very high correlations, and coefficients of 0.7–0.8 indicate relatively high correlations. In a regression analysis, the correlation coefficient between each variable pair should be 0.6 or lower. If the VIF exceeds 10, a serious multicollinearity problem should be suspected (Chatterjee, Hadi, & Price, 2000).

5.2Results of statistical analysisA test of the business withdrawal and non-withdrawal groups to ensure the robustness of the sample and data showed an apparent mean difference between them. In particular, the results of the t-verification for the independent variables showed that the difference between the groups was significant because they all rejected the null hypothesis at a significance level p < .05, p < .01. This method is used to help solve the problem of too few samples, as in this study. A goodness of fit test to further confirm the suitability of the Cox model found that the key variables listed satisfied p > .05. The global test results also satisfy the proportional assumption with a result of .671. Table 4 shows the results of a goodness of fit test.

Table 5 gives an overview of the results of the hierarchical analysis of the Cox proportional hazards model used for FD prediction. This model is divided into four types: Model 1 considers only the control variables; Model 2 considers the control variables + independent variables; Model 3 considers control variables + independent variables + moderating variable; and Model 4 adds the interaction terms (independent variables × moderating variable) to Model 3 to analyze the moderating effects. In Model 1, FDI Certificate, gross sales, retained earnings to total assets, auditor's opinion, and CPI difference were statistically significant in the expected directions. In Model 2, the control variables FDI Certificate, gross sales, debt, retained earnings to total assets, auditor's opinion, and CPI difference were statistically significant, and the independent variable largest shareholder was statistically significant at p < .05. That is, the greater the influence of the largest shareholder, the higher the possibility of FD. Model 3, showed the same results as Model 2. In Model 4, the control variables FDI Certificate, debt, cultural distance, and CPI difference were statistically significant at p < .1; double tax avoidance agreement was statistically significant at p < .05; gross sales, retained earnings to total assets, auditor's opinion, and CPI difference were statistically significant at p < .01; the independent variables, influence of the largest shareholder and entry mode, were statistically significant at p < .01 and p < .05, respectively, in a positive direction. On the other hand, the moderating variable FDI inducement policy (presence of incentives) was statistically significant at p < .05 in a negative direction. The interaction term (independent variables × moderating variable), i.e., Hypothesis 3 (influence of the largest shareholder × FDI incentive policy) was significant at p < .1 in a positive direction, and Hypothesis 4 (entry mode × incentive policy) was not statistically significant, although the direction was consistent with expectations. Thus, the results of the hypothesis testing based on Model 4 are as follows.

Hypothesis 1, the possibility of FD increased along with the influence of the largest shareholder of the foreign subsidiary of a multinational corporation, was strongly supported, verifying the FD-related influence of the largest shareholder.

Hypothesis 2, the M&A entry mode of the foreign subsidiary of a multinational corporation increased the possibility of its FD, was also supported, verifying that the M&A entry mode increases the possibility of FD compared with the greenfield entry mode. As with previous studies, we found that the likelihood of business withdrawal increased when a subsidiary's investment method was M&A (Wilson 1980; Hennart, Kim & Zeng, 1998; Burt, Dawson & Sparks, 2004; Pattnaik & Lee, 2014). M&A carries relatively high chances of business withdrawal due to cultural differences, control of resources, and ownership of the acquired companies. On the other hand, greenfield FDI is an investment method that can reduce the chances of a business withdrawal because the sunk cost is inherent.

On the other hand, we found that an FDI incentive policy (presence of incentives), which was put into the model to analyze its moderating effect, correlated with a decrease in the possibility of FD.

The interaction results between each independent variable and an FDI incentive policy (moderating variable) are as follows.

The first interaction term indicates whether granting an MNC's foreign subsidiary incentives moderates the relationship between the influence of the largest shareholder and FD. Our finding supports the hypothesis that the provision or non-provision of incentives for an MNC's foreign subsidiary moderates the relationship between the influence of the largest shareholder and FD in a negative direction. Under the controlling influence of the largest shareholder, the absence of incentives was found to lower the possibility of FD.

The second interaction term indicates whether granting an MNC's foreign subsidiary incentives moderates the relationship between entry mode and FD. We found that our hypothesis that the provision or non-provision of incentives for an MNC's foreign subsidiary would moderate the relationship between entry mode and FD in a negative direction was not supported (p = .12), although the direction was consistent with our expectations.

6Conclusions6.1Conclusions and ImplicationsIn this study, we aimed to empirically demonstrate, based on theoretical discussion and inference, the relationships among the influence of a company's largest shareholder, the entry mode of the foreign subsidiary of an MNC, and the divestiture of the subsidiary, i.e., how FDI inducement policies affect FD. For the empirical analysis, we set up 4,114 firm-year dyads from 468 FDI companies that entered Korea between 2008 and 2011 and performed a survival analysis using the Cox proportional hazards model. Our results can be summarized as follows.

First, the possibility of FD increased under the decisive influence of a foreign subsidiary's largest shareholder. This suggests that the largest shareholder exerts pivotal influence in the decision-making process as the owner of the foreign subsidiary.

Second, the possibility of FD increased when the foreign subsidiary was set up using the M&A entry mode. This was associated with M&A-related ownership, resource control, and additional costs due to cultural differences. Thus, M&A is an entry mode that carries higher risks of FD than greenfield. In contrast, greenfield was identified as an entry mode that can reduce the possibility of FD because it embraces sunk costs.

Third, we found that under the leading influence of the company's largest shareholder, the possibility of FD decreases when a foreign subsidiary does not receive incentives. The largest shareholder becomes less likely to divest the foreign subsidiary when they do not receive incentives because they need to exert more effort to maximize profits in the local market to compensate for the missing incentives. They do this, in part, to attain their personal goals for structural justification.

Fourth, the hypothesis that the possibility of FD will decrease when a foreign subsidiary does not receive incentives from the host country after entering the foreign market through M&A was rejected because it failed to attain statistical significance. Nevertheless, the result was in line with our hypothesis in terms of direction, and the trend was thus captured correctly. This result indicates that incentives do not significantly moderate the relationship between the entry mode and FD.

These results demonstrate that the influence of the largest shareholder and the entry mode of a foreign subsidiary significantly affect the divestiture of foreign subsidiaries and that the FDI inducement policies of the host country affect those relationships to a certain degree.

Based on the above research results, this study provides academic significance compared to previous studies. First, regarding the largest shareholder's stake, Goranova, Abouk, Nystrom, & Soofi (2017) directly identified corporate governance and the influence of the largest shareholder in connection with activism, but this stake was not linked to business withdrawal. In addition, in the Basu, Paeglis, & Rahnamaei (2016), ownership structure and corporate value were identified, but there was a limitation in applying the variable of business withdrawal.

In addition, regarding the entry mode, Moalla & Mayrhofer (2020), Malhotra, Sivakumar, & Zhu (2009), Boeh & Beamish (2012), Maseland, Dow & Steel (2018), and Beugelsdijk, Kostova, Kunst, Spadafora, & Van Essen, 2018) divided the entry method into cultural distance, administrative distance, geographic distance, and economic distance and only identified the entry mode based on distance, and Mariotti, Marzano, & Piscitello (2021) focused on explaining FF(family firms) companies’ selection of overseas entry modes. In addition, Lin & Ho (2019) analyzed small and medium enterprises in Taiwan, but it can be seen that the analysis was conducted at a different level than this study. In this study, the scope of the research was expanded by linking the entry mode with the withdrawal of the project.

In research related to incentive policy, Lee, Hong, & Makino (2020) also revealed their relationship with employment by focusing on tax incentives in investment target countries for multinational companies in Japan, but it can be seen that the development in that work is substantially different from that in this study.

Business withdrawal has become an essential element of corporate strategy for many companies (Kolev, 2016). Business withdrawal can increase the power of a company by changing the asset structure and resource allocation pattern and can be the driving force behind the achievement of a company's global competitiveness (Zschoche, 2016). Several recent studies have focused on topics surrounding business withdrawal (Bergh & Sharp, 2015; Blake & Moschieri, 2017; Moschieri & Mair, 2017; Feldman, Amit & Villalonga, 2016). However, despite the increasing literature on such business withdrawal, the cause of business withdrawal and the performance after business withdrawal remain ambiguous.

Business withdrawal is a context for coordinating the inconsistent relationship between shareholders and stakeholders amid economic uncertainty between the parent company and the withdrawal business (Corredor & Mahoney, 2021; Moschieri & Mair, 2017; Feldman, Gartenberg & Wulf, 2018) and is an opportunity to reorganize the parent company's governance structure (Corredor & Mahoney, 2021). Therefore, the withdrawal of the project serves as an opportunity to relocate resources and convert them into efficient projects (Lampón, Lago-Peñas & Cabanelas, 2016; Giarratana & Santal´o 2020; Morandi, Santal´o & Giarratana, 2020; Lampón, 2020). Furthermore, some researchers argue that business withdrawal is a process of disposing incomplete resources and that business withdrawal should be completely removed from the corporate portfolio (Vidal & Mitchell, 2015; Dickler & Bausch, 2016).

Recent research on business withdrawal has been conducted in a variety of contexts, as noted above. This research was conducted in relation to business withdrawal based on ownership structure. We aimed to expand our study by combining the incentive policies of the target countries. In particular, because this study was conducted using data from Korea, an economically growing region, it provides a unique glimpse into the success and failure of FDI in an economy that is more or less stable.

This study is significant because it provides basic data for FD-related research topics, examines the associations among the influence of the largest shareholder, the entry mode, and the event of FD among FDI companies that entered Korea, and presents a new research direction by looking closely into the host country's FDI inducement policies in relation to FD. On the practical side, this study provides empirical data for foreign subsidiaries of MNCs currently active in Korea that could encourage them to review the possibility of FD on the basis of the influence of the largest subsidiary shareholder and entry mode and prompt discussions about the efficacy of FDI inducement policies. Despite intense government-led endeavors to attract foreign direct investors, FD problems persist. Thus, there is an urgent need to systematically manage FDI companies.

6.2Limitations of this studyThose expected contributions notwithstanding, this study has some limitations. First, the 2008–2011 economic crisis, which led to many subsidiary failure cases around the world, triggered a shift in withdrawal strategy and execution among MNCs. Korea saw a lot of investment and withdrawal during that period, and it was a very good time to look at the movements of FDI. Thus, the sample used in this study contained FDI companies that invested (including new investments) in a dynamic environment. They were good targets for examining what inherent conditions might facilitate withdrawal. Nevertheless, comparisons before and after the economic crisis could make our results more descriptive than prescriptive, which would be a good a future research topic. Second, our empirical analysis relied on secondary data and failed to reflect the qualitative factors of complex FD-related decision-making processes. Third, the observation period set for this study was five years; a longer observation period would have allowed us to improve the model fit and draw more reliable conclusions. Fourth, we approached the issue of FDI incentives from the perspective of the location (region) of an incentive recipient, following discussions in previous studies. However, the validity of our discussion could have been improved by quantifying the incentives that the FDI companies actually received in terms of type and level. Fifth, the relatively small proportion of FDI companies among the sample firms should also be mentioned as a limitation. Lastly, despite the knowledge that a parent company's strategic moves can also lead to FD, we could not verify FD events from the perspective of the parent companies because of difficulties associated with data collection. If future studies could successfully address these problems, it would add depth and perspective to the results we have presented here.

Operational definitions of the variables and measurement methods

BIT: bilateral investment treaty; CPI: Corruption Perceptions Index; FSS: Financial Supervisory Service; FTA: free trade agreement; JLL: Jones Lang LaSalle (Global Real Estate Transparency Index); KED: Korea Enterprise Data; KIAT: Korea Institute for Advancement of Technology; KICOX: Korea Industrial Complex Corporation; MOFA: Ministry of Foreign Affairs; MOTIE: Ministry of Trade, Industry and Energy; MGII: National Geographic Information Institute; MSIP: Ministry of Science, ICT and Future Planning; KIS_VALUE: Korea Information Service.

Descriptive statistics and correlation coefficients

Results of the survival analysis

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Control variables | Common characteristics | Industry | Included | Included | Included | Included | |||||

| Region | Included | Included | Included | Included | |||||||

| Subsidiary characteristics | Cultural assimilation | .219 | -.831 | -.781 | -1.279 | ||||||

| (.738) | (.864) | (.864) | (.928) | ||||||||

| FDI Certificate | 1.600 | ⁎⁎ | 1.580 | ⁎⁎ | 1.404 | * | 1.461 | * | |||

| (.774) | (.781) | (.783) | (.819) | ||||||||

| Nationality of the largest shareholder | .870 | .040 | -.327 | -.947 | |||||||

| (.774) | (.780) | (.848) | (.927) | ||||||||

| New growth engine industry | -.171 | -.162 | -.305 | -.338 | |||||||

| (.694) | (.725) | (.713) | (.776) | ||||||||

| Gross sales | -.408 | ⁎⁎ | -.463 | ⁎⁎⁎ | -.470 | ⁎⁎⁎ | -.614 | ⁎⁎⁎ | |||

| (.159) | (.156) | (.155) | (.179) | ||||||||

| Debt | .319 | .435 | * | .486 | ⁎⁎ | .484 | * | ||||

| (.221) | (.238) | (.244) | (.248) | ||||||||

| Retained earnings to total assets | -.003 | ⁎⁎ | -.003 | ⁎⁎⁎ | -.003 | ⁎⁎⁎ | -.007 | ⁎⁎⁎ | |||

| (.001) | (.001) | (.001) | (.002) | ||||||||

| Auditor's opinion | -1.765 | ⁎⁎⁎ | -2.316 | ⁎⁎⁎ | -2.371 | ⁎⁎⁎ | -2.480 | ⁎⁎⁎ | |||

| (.671) | (.748) | (.758) | (.826) | ||||||||

| Inter-country characteristics | Geographical distance | -0.680 | -.562 | -.275 | -.174 | ||||||

| (1.999) | (1.141) | (1.167) | (1.163) | ||||||||

| Cultural distance | -.841 | -1.354 | -1.409 | -1.849 | * | ||||||

| (.880) | (1.001) | (.989) | (1.006) | ||||||||

| Free trade agreement | -.886 | -.971 | -.990 | -.617 | |||||||

| (1.257) | (1.257) | (1.275) | (1.383) | ||||||||

| Double tax avoidance agreement | 1.63 | 3.146 | 3.485 | 5.324 | ⁎⁎ | ||||||

| (2.015) | (2.284) | (2.281) | (2.301) | ||||||||

| Bilateral investment treaty | -1.145 | -.048 | .060 | .306 | |||||||

| (1.450) | (1.536) | (1.578) | (1.569) | ||||||||

| Corporate tax rate difference | -.025 | -.037 | -.039 | -.063 | |||||||

| (.054) | (.055) | (.054) | (.053) | ||||||||

| Gross national income difference | -.039 | -.056 | -.066 | -.089 | |||||||

| (.061) | (.064) | (.063) | (.061) | ||||||||

| Jones Lang LaSalle Index difference | 2.964 | 3.769 | 3.779 | 3.719 | * | ||||||

| (2.079) | (2.036) | (2.034) | (2.017) | ||||||||

| Corruption Perceptions Index difference | -.123 | ⁎⁎ | -.142 | ⁎⁎⁎ | -.152 | ⁎⁎⁎ | -.183 | ⁎⁎⁎ | |||

| (.048) | (.053) | (.054) | (.060) | ||||||||

| Independent variables | Largest shareholder and entry mode | Largest shareholder's influence (A) (+) | .035 | ⁎⁎ | .038 | ⁎⁎ | .063 | ⁎⁎⁎ | |||

| (.015) | (.015) | (.020) | |||||||||

| Entry mode (B) (+) | 1.002 | 1.053 | 2.386 | ⁎⁎ | |||||||

| (.771) | (.781) | (1.091) | |||||||||

| Mod.var. | FDI policies | FDI incentive policies (C) (-) | -1.085 | -3.166 | ⁎⁎ | ||||||

| (.931) | (1.579) | ||||||||||

| Interaction term | A X C (+) | .090 | * | ||||||||

| (.054) | |||||||||||

| B X C (+) | 4.460 | ||||||||||

| (2.882) | |||||||||||

| Log likelihood | -74.58 | -70.45 | -69.66 | -64.69 | |||||||

| LR Chi2 | 47.31 | 55.57 | 57.15 | 67.09 | |||||||

| Prob > Chi2 | 0.003 | ⁎⁎ | 0.001 | ⁎⁎⁎ | 0.001 | ⁎⁎⁎ | 0.000 | ⁎⁎⁎ | |||