Academic entrepreneurial opportunities are a key factor in the development of new spin-offs. This study examines the relationship between academic entrepreneurial opportunities perceived by academics and these academics’ entrepreneurial self-efficacy (ESE) to determine which dimensions of ESE (among management, innovation, marketing, risk-taking and financial control) are significantly related to these opportunities. It also analyses how industrial and entrepreneurial networks, as part of the university's entrepreneurial ecosystem, influence this relationship. A quantitative method is used to achieve this goal, developing a structural equations model and applying partial least squares technique to analyse a sample of 388 Spanish academics. The results show that the dimensions of ESE related to variables such as management, innovation and marketing have a positive and significant relationship to perception of entrepreneurial opportunities. This situation is different, however, for dimensions such as risk-taking and financial control. Moreover, the findings show that entrepreneurial and industrial networks have a significant effect on this relationship.

Entrepreneurship ecosystems, understood as the “interaction of actors, roles and the environment that determine the entrepreneurial performance” (Neck et al., 2014, p. 191), constitute an emerging research field (Bhagavatula, 2010; Ozgen, 2011; Zahra et al., 2014; Acs, Szerb & Autio, 2017; Colombo et al., 2016). The idea underlying this field is that shared resources and knowledge, institutional support, and formal and informal networks generate synergies beyond the focus of the new firm's specific competitive advantage (D'Aveni et al., 2010; Minà et al., 2016; Audretsch & Belitski, 2017; Jackson et al., 2017; Lehmann & Menter, 2016, 2018; Kuratko et al., 2017). In the university environment, the focus on entrepreneurial university ecosystems can contribute to better understanding of why some universities create more successful spin-offs than others.

Study of one part of these ecosystems, networks in entrepreneurial university ecosystems, has focused on their influence on spin-off performance (Hayter 2015; 2016; Jackson et al., 2017; Huynh et al., 2017), the influence of university networks in attracting financing (Soetanto & Van Geenhuizen, 2015), the academic researcher's network of personal contacts (Karlsson & Wigren, 2012; Krabel et al., 2012; Fernández-Pérez et al., 2015) and networks’ importance for creating and growing new firms (Elfring & Hulsink, 2007; Hite, 2005; Hite & Hesterly, 2001; Sullivan & Ford, 2014). Although the literature proposes that networks play a key role in recognition of entrepreneurial opportunities, few studies provide evidence of how networks influence the recognition of opportunities that originate in the university (Rasmussen & Wright, 2015) Shane (2000).

Andersson & Evers (2015) identify entrepreneurial self-efficacy (hereafter ESE) and personal networks as antecedents of entrepreneurial opportunity recognition. The literature considers these networks as a fundamental part of entrepreneurial ecosystems because they provide a flow of information that enables effective distribution of knowledge generated Stam & Spigel (2016) and because they can influence the dimensions composing the individual's ESE as it relates to management, innovation, marketing, risk-taking and financial control (Chen et al., 1998).

The capabilities and resources of the university ecosystem in general—and of academics in particular—to identify and develop business opportunities are key to the process of new academic spin-off creation (Carree et al., 2014; Guerrero et al., 2014). Understanding how both academics’ ESE and their networks influence identification of business opportunities is thus crucial to advancing knowledge of the conditioners of academic spin-off creation (Mustar et al., 2008; Colombo et al., 2010; Bigliardi et al., 2013; Iacobucci & Micozzi, 2015).

The foregoing raises two questions for more in-depth analysis. Is there a relationship between the ESE perceived by academics and identification of academic entrepreneurial opportunities? Could networks for academic collaboration condition this relationship?

By focusing on these questions, this study aims to advance understanding of how networks influence the generation of academics’ capabilities and academics’ identification of opportunities, while also seeking to expand existing knowledge of the relationships among capabilities and perceived business opportunities. To achieve this objective, quantitative research is performed using the partial least squares technique to analyse a sample of 388 academic entrepreneurs from five Spanish public universities that compose the Valencian Community's university system.

The analysis can thus contribute to developing a more substantial concept of the university entrepreneurial ecosystem (Zahari et al., 2018). Like other research in this area, this study defines an academic entrepreneur through the faculty-as-entrepreneur approach, given professors’ role as principal investigators on sponsored research projects, relatively uniform intellectual property guidelines for faculty who conduct federally-funded research, and faculty members’ academic rank and technical knowledge. All of these factors are important for the establishment of new spin-off companies (Bradley et al., 2013; Link et al., 2007).

The main novelty of this study is its differentiated analysis of the multidimensional construct of ESE. Analysing the direct influence of each dimension on the perception of opportunities enables detection of the meaning of each dimension, a crucial issue in the case of academic researchers.

This research provides more evidence on the detection of business opportunities based on university research for policy makers and researchers. Specifically, it emphasises the importance of developing policies and actions aimed at improving the dimensions of ESE in all academics, not just those involved in spin-offs.

This study thus aims to provide a broader vision of how the dimensions of ESE affect the perception of academic opportunities. To complement this goal, it also focuses on how networks influence this relationship.

This paper is structured as follows. First, a literature review of the study variables is performed and the research hypotheses are justified. Next, the study's setting and methods are described, as well as the results of hypothesis testing. The paper concludes with discussion, implications, limitations and future research opportunities.

2Theoretical background and hypothesis development2.1Academic entrepreneurial opportunities and ESEShane & Venkataraman (2000) argue that the opportunity is an objective phenomenon that not all individuals recognize and whose existence depends on perceptions: “opportunity by definition is unknown until discovered” (Kaish & Gilad, 1991, p. 38). From this perspective, some individuals are more alert to changes and seek new information systematically (Kirzner, 1973; Chandler et al., 2011; Tang & Tang, 2012), and potential entrepreneurs who discover opportunities tend to analyse and exploit existing resources and knowledge (Shepherd et al., 2007; Chandler et al., 2011).

Other authors believe that entrepreneurs create opportunities through a creative process based on the entrepreneur's efforts and actions (Sanz-Velasco, 2006; Sarasvathy et al., 2010; Dutta & Thornhill, 2014). From this perspective, opportunities are generated as possibilities that the individual imagines and take shape based on the actions performed. Since the viability of recently developed ideas is likely to be uncertain, the entrepreneur begins the transformation processes with the goal of creating opportunities (Alvarez & Barney, 2007; Klein, 2008; Wood & McKinley, 2010; Shane, 2012).

The literature based on cognitive psychology and social cognition theory suggests that cognitive resources explain how entrepreneurs perceive opportunities (Tumasjan & Braun, 2012). In reviewing the cognitive research on entrepreneurship, Grégoire et al. (2011) identify a series of cognitive resources that have been examined in entrepreneurs who seek opportunities. ESE is prominent among these resources.

Over the years, the literature has recognized ESE as the individual's belief in his/her capability to perform tasks and roles oriented to obtaining business results (Chen et al., 1998; De Noble et al., 1999; Cooper et al., 2016; Austin & Nauta, 2016). Research provides evidence that this belief plays a fundamental role in determining entrepreneurial intention (Naushad et al., 2018; Alsaidan & Zhang, 2018).

To understand the effects of ESE, some researchers have analysed self-efficacy as an overall belief in an individual's capabilities to resolve future tasks of any kind (Judge & Bono, 2001; Scholz et al., 2002). Most experts agree, however, that self-efficacy is domain-specific, in accordance with the conceptualization of the construct developed by Bandura (1997).

The social cognitive theory of career and academic interest, choice and performance Lent, Brown & Hackett (1994) emphasizes that occupation-specific self-efficacy (as opposed to generalized self-efficacy) influences career development and performance positively. One type of occupation-specific self-efficacy is ESE.

Bandura's research on self-efficacy (1986, 1997) is accepted as a predominant methodology in entrepreneurship, since it helps to understand an entrepreneur's actions and action-related beliefs Frese (2009). Entrepreneurial intention depends on an individual's perceived capability to execute the desired behaviour. This intention is expressed through ESE, willingness to engage in a risk-taking process, attitudes toward the advisability of an entrepreneurial career due to perceived models of behaviour and subjective norms, which form through interaction with personal networks (Prodan & Drnovsek, 2010).

ESE is demonstrated to be related to various factors, especially to the search for opportunities and entrepreneurial intention (Lüthje & Franke, 2003; Guerrero, Rialp & Urbano, 2008; Trevelyan, 2009; Schlaegel & Koenig, 2014; Kurczewska & Bialek, 2014) Hernández-López, Moncada-Toro & Henao-Colorado, 2018), innovation and creation (Hmieleski & Corbett, 2008) and issues related to management, innovation, marketing, risk-taking and financial control (Chen et al., 1998).

According to Hannibal et al. (2016), the collective theory construct based on opportunity recognition, organizational emergence and ESE is used as the first step in studying the entrepreneurial opportunities that lead academics to create research-based spin-offs (Katz & Gartner, 1988). This theory positions ESE as a driver of academic researchers’ intention and considers recognition of entrepreneurial opportunity as the key resource for the emergence and development of new academic spin-offs.

Starting from this theory, therefore, the activities and interactions demonstrated in the process of creating a spin-off are first developed at the individual level and start from the academic's ESE and capability to drive the process that develops the activity (Hannibal et al., 2016).

Different measures of ESE have been used in the analyses performed in these studies. One of the most frequent is the multi-dimensional measure developed by Chen et al. (1998). Part of the popularity of Chen et al.’s (1998) measure may be the fact that it has lasted longer than any other scale developed to measure ESE (Valencia-Arias & Marulanda-Valencia, 2019), although use of this scale has not diminished over time. For example, recent studies by Cooper et al. (2016) and Austin & Nauta (2016) use this scale. The scale's factor analysis of the items indicates that ESE is composed of 5 sub-dimensions or factors that capture ESE's relationship to management, innovation, marketing, risk-taking and financial control.

Chen et al. (1998) build specifically on three studies performed by Long (1983), Miner (1990, 1993) and Kazanjian (1988). The latter recognizes six groups of tasks that refer to the dimensions mentioned above.

The dimensions listed above are considered critical when analysing academic researchers’ ESE. They subdivide the multi-dimensional construct developed by Chen et al. (1998) to analyse the influence of each dimension on entrepreneurial opportunity. For example, the dimension “innovation” is a key entrepreneurial capability, and the capability of being “innovative” is the decisive factor distinguishing “entrepreneurs” from business “managers” (Chen et al., 1998). In fact, their study concludes that the dimensions of ESE related to “innovation” and “risk-taking” are fundamental entrepreneurial capabilities.

According to O'Dwyer, Gilmore & Carson (2009), the Entrepreneurship Theory of Innovation suggests that entrepreneurial firms grow and survive due to the entrepreneur's ability to innovate continuously in order to lead or react to shifts in dynamic conditions involving customers and competitors. Perception of the entrepreneur's capability to “develop new products and market opportunities” could thus be a key driver of his/her performance in seeking new entrepreneurial opportunities.

Moreover, previous studies, such as Lee et al. (2016), have examined the relationship between ESE and business performance at the latent construct level and used the parcelling method to operationalise the multi-dimensional construct of ESE into a latent construct to explore how the first order-factors of ESE correlate with business performance.

Based on the findings presented above, ESE seems to drive perception of opportunities. The following hypothesis and sub-hypotheses are thus proposed:

H1: Academic researchers’ ESE is positively related to perception of academic entrepreneurial opportunities.

H1a: The management dimension of ESE perceived by academic researchers is positively related to perception of academic entrepreneurial opportunities.

H1b: The innovation dimension of ESE perceived by academic researchers is positively related to perception of academic entrepreneurial opportunities.

H1c: The marketing dimension of ESE perceived by academic researchers is positively related to perception of academic entrepreneurial opportunities.

H1d: The risk-taking and financial control dimension of ESE perceived by academic researchers is positively related to perception of academic entrepreneurial opportunities.

The concept of entrepreneurial ecosystem can be understood as a synonym of relevant factors and resources needed to create economic knowledge through entrepreneurial engagement (Acs et al., 2014). This concept has been analysed from various perspectives, taking the firm as unit of analysis. Among these are the focus on industrial districts (Krugman, 1991; Markusen, 1996), on clusters (Porter, 1998; Kajikawa et al., 2010), on a regional perspective (Mitze & Stotebeck, 2019) and on innovation systems (Freeman, 1987; Lundvall, 2007).

From this perspective, Stam (2015, p. 1761) stresses that “the entrepreneur, rather than the enterprise, is the focal point (of entrepreneurial ecosystems). The entrepreneurial ecosystem approach thus begins with the entrepreneurial individual instead of the company, but also emphasizes the role of the entrepreneurship context”. Systemic conditions are the heart of the ecosystem and include networks, leadership, finance, talent, knowledge and support services. This entrepreneurial system involves complex, diverse actors, roles and environmental factors that interact to develop and exploit entrepreneurial opportunities. The university entrepreneurial ecosystem has great potential to generate knowledge and skills, and to create networks, business opportunities and even financial capital critical for entrepreneurial success (Shane, 2000; Zhao et al., 2005; Guenther & Wagner, 2008).

University entrepreneurial ecosystems are a means to create and maintain a dynamic process of new opportunity creation (Feldman et al., 2005; Malecki, 2009). Social networks are a central aspect, as they can serve as links to greater knowledge of technological and market changes Shane (2000).

Various studies confirm the important and varied role that networks perform to influence business processes and results (Hoang & Antoncic, 2003; Jack et al., 2010; Hayter, 2013). These business processes include activities such as identification of opportunities and mobilization of resources (Shane & Venkataraman, 2000).

Some studies performed in the field of academic entrepreneurship stress networks of actors from the industrial and academic environment, demonstrating that these can be a key resource for recognizing business opportunities (Ismail et al., 2010; Camelo-Ordaz et al., 2018). More specifically, the literature on academic entrepreneurship shows that networks are important for the success of academic spin-offs (Shane & Cable, 2002; Nicolaou & Birley, 2003; Hayter, 2013).

In the field of academic entrepreneurship, some studies argue that relationships with agents from the industrial and academic environment can be critical for helping academic spin-offs to recognize entrepreneurial opportunities (Van Geenhuizen & Soetanto, 2009; Ismail et al., 2010). Firstly, industrial agents supply academic entrepreneurs with knowledge of evolving customer needs, new commercial applications of their scientific discoveries, potential markets and competing products, helping academics to recognize opportunities in the market (Rasmussen et al., 2015). Secondly, academic networks can play a key role in enhancing opportunities detected by academic entrepreneurs. These networks help to promote academic incubation programs, in which academic entrepreneurs receive specific training, not only to recognize opportunities in the market but also to access relationships with industrial agents, such as clients, other entrepreneurs and suppliers (Van Geenhuizen & Soetanto, 2009; Ismail et al., 2010). For these reasons, this study focuses on industrial and academic networks.

Following this line of reasoning, Vohora et al. (2004) and Rasmussen et al. (2011) find that academic entrepreneurs rely on venture capital, customers and consultancies to strengthen their ESE and discover entrepreneurial opportunities. Further, Rasmussen et al. (2015) argue that industrial actors provide academic entrepreneurs with knowledge of the evolution of their customers’ needs, potential markets, the competition's products and new applications for scientific discoveries. These activities strengthen the recognition of business opportunities.

Other researchers, such as Ostgaard & Birley (1994) and Lechner & Leyronas (2007), stress that knowing other entrepreneurs may be the most important strategic resource, as it provides knowledge and information beneficial for the development and growth of newly created firms. One of the first studies of this issue, performed by Birley (1985), documents the frequency with which entrepreneurs seek advice and feedback on the main ideas of their business plan when they turn to these networks.

Networks are elements that positively affect the search for opportunities in the initial stages of the entrepreneurial process. For example, Singh et al. (1999) find that entrepreneurs in the information technology industry who have weak network ties (ties developed merely as contacts, in which they did not get to know the other party well) achieved more access to new entrepreneurial opportunities in a period of 12 months than did entrepreneurs with fewer ties. Hills et al. (1997) find that around 50% of entrepreneurs identified ideas for new firms through their social network. The presence of social networks seems to influence nascent entrepreneurs to continue in their start-up process (Honig & Davidsson, 2000).

Soetanto & Van Geenhuizen (2009), on the other hand, view networks as fundamental instruments for obtaining knowledge and confidence in developing entrepreneurial skills. For these authors, networks contribute to connection with other firms or actors who possess the knowledge and access to resources needed. Further, in the process from idea to real start of a firm, prior knowledge Shane (2000) and information Fiet (1996) are two of the most important variables for reducing the risk of the business opportunity. Both variables are closely tied to networks, since network relationships can be seen as ways to access knowledge and information. Much of the literature shows that networks have a positive influence on academic entrepreneurship (Shane & Cable, 2002; Nicolaou & Birley, 2003; Hayter, 2013).

According to (Walter, Auer & Ritter, 2006), the availability of industrial and entrepreneurial networks contributes to generating sources of advantage for performance and to promoting market-oriented behaviour and the search for opportunities. Such availability can influence entrepreneurial capability and moderate the relationship between ESE and the search for opportunities.

Building on research findings on the relevance of networks, it can be argued that academic researchers’ networks contribute to identifying and evaluating opportunities and to providing access to a diverse set of capabilities and resources that range from potential markets to innovations and new commercial practices. Such resources and capabilities can encourage ESE. Based on these arguments, the following is proposed:

H2: Availability of networks to the academic researcher intensifies the relationship between ESE and his/her perception of academic entrepreneurial opportunities.

H2a: Availability of industrial networks to the academic researcher intensifies the relationship between ESE and his/her perception of academic entrepreneurial opportunities.

H2b: Availability of entrepreneurial networks to the academic researcher intensifies the relationship between ESE and his/her perception of academic entrepreneurial opportunities.

Fig. 1 presents the relationships articulated in the hypotheses proposed:

3MethodologyThe empirical study analysed a population of 388 academic researchers from five Spanish public universities in the Valencian Community's university system. As in other studies in this field Abreu & Grinevich (2013), the data were gathered by online survey, a method appropriate for reaching individuals in different geographic areas (Dillman et al., 2009). The number of responses is satisfactory, as it exceeds the minimum threshold for applying structural equations methodology and testing the psychometric properties of the measurement scales (Spector, 1992; Williams et al., 2004).

The data were analysed using the structural equations method with partial least squares technique (PLS-SEM) (Fornell & Cha, 1994) and the program Smart PLS 3.0 (Ringle et al., 2015). The PLS model chosen was noted for its advantages for studying human behaviour (Hair et al., 2011), optimal predictive potential (Cepeda & Roldán, 2004) and suitability for small samples (Hair et al., 2011). In addition, PLS-SEM presents less-restrictive requirements in the measurement of sample size scales and in the distribution of the data. Today, the approach has gained wide acceptance, mainly in the social sciences (Martínez Ávila & Fierro Moreno, 2018). It is especially suitable for small samples like the one discussed in this study.

Analysis of the sample's sociodemographic characteristics indicates that 64.4% of participants were men, and 71.6% had been working at the university for more than 10 years. By age, 4.9% were under 30 years old, 16.2% were ages 30–40, 27% were 41–50, 33% were 51–60 and the rest were over 60. As to perception of opportunities, 76.5% believed that their research results could be converted into a business opportunity.

3.1Measurement instrument3.1.1Academic entrepreneurial opportunityA Likert scale was used to analyse the variable academic researchers’ recognition of opportunities. Academic researchers were asked if they had ever thought that their research results (knowledge or technology) could be converted into a good business opportunity, based on the GEM project (Reynolds et al., 1999; Kelley et al., 2012). Firstly, the sample members were asked why it would be desirable for the academic entrepreneur to start a new business based on research results and if this action would bring her/him more advantages than disadvantages. Secondly, respondents were asked if they considered research results (knowledge or technology) as a good business opportunity. The questions were measured by a Likert scale ranging from 1 to 5 points (where 1 = Strongly disagree and 5 = Strongly agree).

3.1.2Entrepreneurial self-efficacyThe variable ESE was measured using 8 items based on the scale developed by Chen et al. (1998). This scale was conceptualized as a multidimensional latent construct with four dimensions: 1) marketing, 2) innovation, 3) management and 4) risk-taking and financial control. These items were measured on a 5-point Likert scale with responses ranging from “disagree completely” (1) to “agree completely” (5). The academic researchers were asked if they believed they were capable of performing the tasks in the dimensions previously identified in the survey to create and manage a firm based on their research results.

3.1.3Industrial networkThe scale developed by Guerrero (2008) was used to analyse this variable. The questionnaire administered asked the academic researchers whether they performed their research with a mixed team of academics and companies in R&D&I activities. Following Ventura & Satorra (2015), the evaluations provided were adapted to a Likert scale ranging from 1 to 5 points (where 1 = Strongly disagree and 5 = Strongly agree).

3.1.4Entrepreneurial networkEntrepreneurial networks were measured based on the scale developed by Landry et al. (2006). These authors measure intensity of the researcher's ties with networks outside the university environment.

The scale developed by Prodan & Drnovsek (2010) was used to analyse networks of academic entrepreneurs. This scale measures certain role models found in the entrepreneurial network in the university environment.

According to Greve & Salaff (2003), the personal network includes all first-order contacts, independently of their intensity or the type of tie or interaction.

In addition, Renzulli et al. (2000) consider intensity of ties based on the total number of people with whom one discusses business as a rough measure of number of direct contacts. Their study is not limited to analysing the tie's intensity. As with the previous variable, the evaluations provided were adapted to a Likert scale ranging from 1 to 5 points (where 1 = Strongly disagree and 5 = Strongly agree).

3.1.5Control variablesThis study analysed two control variables that can affect identification of academic entrepreneurial: age and gender of the entrepreneur (Ozgen & Baron, 2007). On the one hand, the prior literature finds that age is a significant factor in entrepreneurial intention Davidsson & Honig (2003) and can affect the search for and recognition of new opportunities. On the other hand, abundant empirical evidence attests to differences between women's and men's propensity to start a business Langowitz & Minniti (2007). The academic researcher's gender may thus affect the number of opportunities identified. It may also be useful to include years of work experience, since experience and years working have previously been considered influential factors in entrepreneurial behaviour (Singh et al., 2000).

4ResultsTable 1 presents the results of the descriptive analysis of the data and the correlation matrix. The table shows that the variables used in the model have a good relationship of association.

Means, standard deviations and correlations.

n=388; †p<0.10; * p<0.05; **p<0.01; ***p<0.001

The measurement model was evaluated by assessing the items’ individual reliability. The indicators’ factor loadings (λ) on their respective constructs were calculated. For all constructs, α and CR show values above the required threshold of 0.7 (Hair et al., 2011). Fornell & Larcker (1981) recommend that the average variance extracted (AVE) be above 0.50, indicating that more than 50% of construct variance is due to its indicators. The AVE is above 0.50 for all constructs.

Discriminant validity was confirmed using the (Fornell & Larcker, 1981) criterion which requires the AVE to be greater than the variance one construct shares with the other constructs in the model (square of the correlations). All constructs used in the study fulfilled this requirement (see Table 2).

Discriminant Validity.

Common method bias is analysed using Harman's one-factor test (Podsakoff et al., 2003, 2012). The data show no problems of common method bias. The total variance extracted by one factor is 43.246%, less than the recommended threshold of 50%. Table 3 displays the results obtained.

Total Variance Explained.

Extraction method: principal component analysis.

The second stage in analysis and interpretation of a PLS-SEM model is to evaluate the structural model. Table 3 summarizes the results of the PLS-SEM analysis. Evaluation of the variance of the dependent latent variables explained by the constructs that predict them (R2) shows that a variance of over 0.1 is explained for all latent variables. According to Falk & Miller (1992), R2 should not be less than 0.1. While analysing size of R2 as a criterion of predictive relevance, the sample reuse method proposed by Stone (1974) and Geisser (1975) was also applied (obtaining Q2 through blindfolding). Q2 is greater than 0 for all dependent latent variables, indicating that the model has predictive validity. Finally, to evaluate the significance of the structural relationships, a bootstrapping procedure was applied (with 500 samples from the original sample). The results show that all structural relationships proposed are significant (see t-value, Table 4).

Moderator Effect.

n = 358; †p < 0.10; *p < 0.05; **p < 0.01; ***p < 0.001

Next, Table 4 presents analysis of the theoretical model, starting with a study of the relationship between ESE and entrepreneurial opportunity, and including the moderator effect of industrial and entrepreneurial networks in this relationship.

First (Models I and II), the effect of the independent variables on the dependent variable was analysed to confirm Hypotheses H1 and sub-hypotheses H1a, b, c and d. Next (Models III, IV and V), the effect of the moderator variable was analysed separately, as well as its interaction with the independent variables.

The results show that ESE is related positively and significantly to perception of entrepreneurial opportunities. When ESE is considered as a concept with various dimensions and the effect of these dimensions in the relationship subdivided, however, heterogeneous effects become visible. First, the model shows that the relationship of the dimensions involving management, innovation and marketing to the perception of opportunities is positive and significant (β=0.27***, β=0.30*** and β=0.19*** Model II). This information indicates that academic researchers who perceive that they have the skills to develop tasks based on definition of organizational responsibilities and tasks, development of new business ideas and achievement of market share are more likely to identify new business opportunities.

The results also show, however, that the relationship between risk-taking and financial control is positive but not significant (β=0.06 Model II). This finding does not affirm a relationship between the academic researchers’ perception of opportunities and their ESE relative to risk-taking and financial control. This result reinforces the part of the literature that views these capabilities as an aspect of academic researchers’ limitations in the face of spin-off creation based on research results.

All of these results lead to partial acceptance of Hypothesis H1. Although H1a, b and c are fully accepted, H1d must be rejected.

Models III, IV and V introduce the possible moderation of the variables of industrial and entrepreneurial networks in the ESE-opportunity perception relationship. The results confirm that the availability of both types of network influences the relationship between the dimensions of ESE and perception of opportunities. However, the effect is the opposite of that hypothesized in H2, H2a and H2b. The moderator effect of both variables is negative in all cases; availability of networks is inversely related to the relationship between the different ESE dimensions and perception of opportunities. These results lead to rejection of H2, H2a and H2b. The data indicate that a greater number of contacts in industrial and entrepreneurial networks negatively conditions the relationship between the dimensions of academic researchers’ ESE and their perception of opportunities.

The moderator effect was also analysed by exploring the values of R2 in the original model and in the interaction model. The following expression was used: f2 = (R2 with interaction – R2 without interaction) / 1-R2 with interaction, where f2 is known as effect size, or size-effect Cohen (1998), with the following reference values: below 0.02 indicates no moderation; 0.02 to 0.15 indicates a weak moderator effect; 0.15 to 0.35 indicates a moderate effect, and values over 0.35 indicate strong or significant moderation.

Applying the f2 criterion shows that the moderator effects analysed are weak in all cases, ranging from 0.02 to 0.06. Table 5 shows the results of the moderator effect described above.

Size of Moderation Effects.

†p < 0.10; * p < 0.05; **p < 0.01; ***p < 0.001

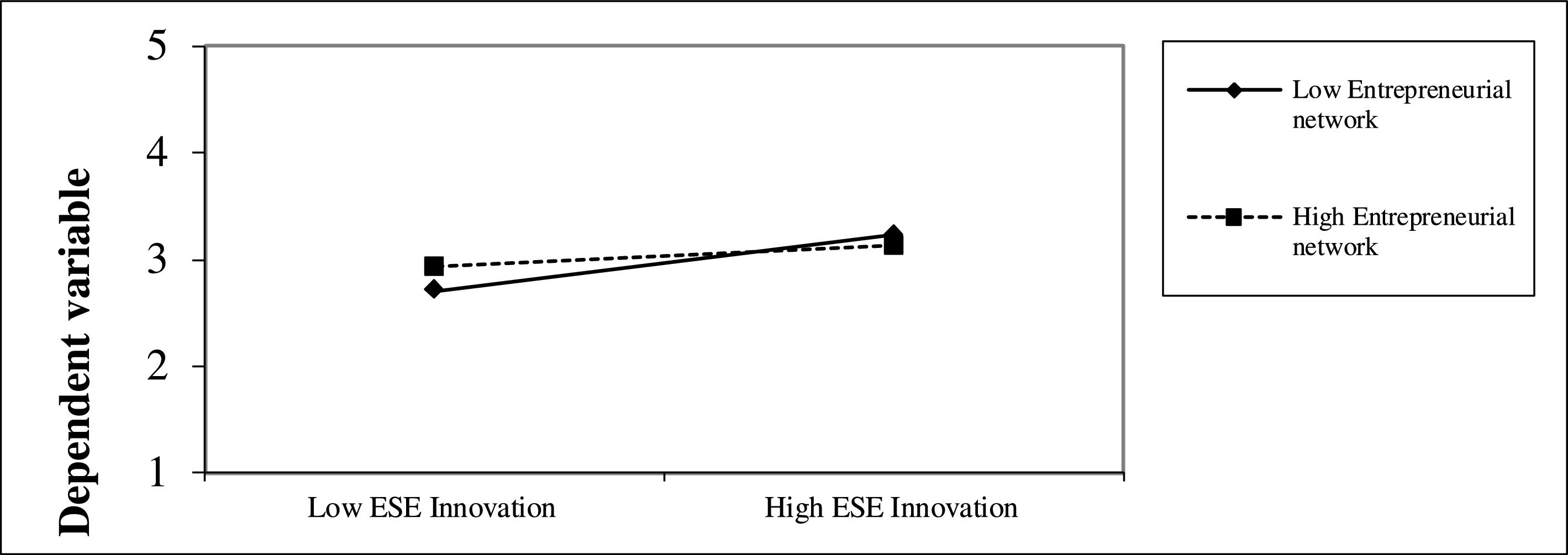

The Johnson-Neyman technique (Johnson & Neyman, 1936; Bauer & Curran, 2005) was used to interpret the moderation effects, based on simple slope tests (Cohen et al., 2003). The interaction effect was interpreted graphically (Figs. 1, 2 & 3), showing the relationship between the predictive variable and the dependent variable for selected levels of the moderator variable Dawson (2014).

Simple slope test (2-way). Indep. variable: ESE Management dimension.

Simple slope test (2-way). Indep. variable: ESE Innovation dimension.

Next, Figs. 2, 3, 4 and 5 show the slopes that enable interpretation of the interaction among the variables described above according to the moderator effects obtained in Model V. This model includes the moderator effect of industrial and entrepreneurial networks. The figures show that the relationship between the different dimensions of ESE and perception of opportunities is positive, a condition fulfilled in all cases with a low number of contacts in the industrial network. In cases with a high number of contacts in the industrial and entrepreneurial network, however, the curve tends to be negative. That is, a high number of contacts in the industrial and entrepreneurial network has a negative effect on the relationship between the dimensions of ESE and perception of opportunities.

Simple slope test (2-way). Indep. variable: ESE Marketing dimension.

Simple slope test (2-way). Indep. variable): ESE Financial Cost and Risk dimension.

Finally, the proposed model has good fit according to the majority of the indicators analysed.

5Discussion and future research opportunitiesThis study explores the relationship of the dimensions composing academics’ ESE to identification of business opportunities based on their research results, as well as the role of the academics’ networks in conditioning this relationship.

Prior studies confirm that academics need to gain confidence in their skills and capabilities to act in the business context, whose characteristics and culture differ from the university context (Camelo-Ordaz et al., 2018). Analysing a sample of spin-offs in Ireland and Denmark, Hannibal et al. (2016) demonstrate that ESE is a very important in helping academic researchers to develop the capability to recognize entrepreneurial opportunities. The results of the present study extend prior research by applying the multidimensional construct of ESE to the university context and analysing the direct relationship between the first-order constructs developed by Chen et al. (1998) and perception of entrepreneurial opportunities based on the academics’ research results.

More specifically, the results obtained show that the dimensions of ESE related to variables such as management, innovation and marketing have a positive and significant relationship to perception of entrepreneurial opportunities for this group. The dimension related to risk-taking and financial control, however, has a positive but non-significant relationship. The results demonstrate the importance of the skills analysed to the early stages of detecting an entrepreneurial opportunity, capabilities that traditionally constitute one of the most significant barriers to spin-off creation for academic researchers. Whereas universities usually facilitate acquisition of these capabilities for academics who become involved in spin-offs, the results obtained here show that having academics acquire these skills before they decide to become involved in spin-offs contributes to greater detection of business opportunities.

Further, the moderating effect of entrepreneurial and industrial networks on the ESE-opportunities relationship was analysed, since these networks are an important strategic resource in the functioning of entrepreneurial ecosystems (Rasmussen et al., 2015). The results show that entrepreneurial and industrial networks have a significant effect on this relationship, but in the opposite direction to that hypothesized. That is, these networks relativize the importance of the ESE-opportunities relationship. Some studies support these results, such as that by Wang & Altinay (2012), which found contradictory results for the relationship between the access to networks and entrepreneurial firms. Thorgren et al. (2011) were not able to demonstrate the existence of a significant relationship between the diversity of boards’ insiders and outsiders in the network and the search for innovative entrepreneurial opportunities. Finally, Ripollés & Blesa (2006) reported a negative relationship between network frequency and entrepreneurial orientation when considering the impact of this relationship on the growth of recently created firms.

One possible interpretation of these results is that networks provide shared resources and knowledge and generate synergies that go beyond strengthening the ESE-opportunities relationship. Interaction with industrial and entrepreneurial actors could thus relativize the importance of one's ESE, expose one's deficiencies in recognizing and exploiting business opportunities (Niosi, 2006; Iacobucci & Micozzi, 2015) and lead one to recognize the need to complement one's academic profile with other, more business-oriented profiles (Mosey & Wright, 2007; Knockaert et al., 2011).

The view of the business environment that the networks provide could also generate greater perceived risk for academics facing entrepreneurial opportunities. Risk tolerance is a central entrepreneurial characteristic and an essential factor in highly innovative entrepreneurial initiatives, since developing innovative opportunities necessarily involves an exploratory, prospective process with uncertain results (Angel Ferrero & Bessière, 2016; Camelo-Ordaz et al., 2018).

The main theoretical contribution, which derives from this model, is the study's differentiated analysis of the multidimensional construct of ESE. Studying the direct relationship of each dimension to perception of opportunities reveals the significance of each dimension, a crucial issue in the case of academic researchers.

From an applied perspective, the results of this study also have important implications for detection of business opportunities based on university research and for spin-off generation. Specifically, they demonstrate the importance of developing policies and actions oriented to improving the dimensions of ESE in all academics, not only those involved in spin-offs. Greater confidence in one's capabilities in fields such as management, innovation, marketing, risk-taking and financial control contributes to identifying a greater number of opportunities. The findings also show the importance of universities developing an active role in the design and construction of academics’ industrial and entrepreneurial networks to facilitate inclusion of appropriate profiles.

Universities must be able to provide academic entrepreneurs with the resources and information needed to search for new business opportunities. Policymakers, universities and agents supporting entrepreneurship play a crucial role in developing an ecosystem that facilitates the creation of new firms based on research results.

Whereas policies and resources sometimes focus on academics who are developing spin-offs, the results obtained here show the importance of actions that address all academics in the earliest stages of opportunity detection.

This study has various limitations. It would be interesting for future studies to test the relationships proposed here in different international contexts. The second limitation is also associated with the study sample. Future studies could differentiate between academics in the perception and the exploitation phases of a business project, identifying the type of research, field of knowledge and patents registered.

In future lines of research, the authors wish to deepen knowledge of the different factors that influence industrial and entrepreneurial networks, since this knowledge can advance interpretation of the data obtained. Another interesting future line of research could focus on how the academic's gender influences both perception of entrepreneurial opportunities and composition of the networks. Future study could also add new variables to the research model that may influence researchers’ business orientation, such as the university's ownership rules or the legal regulations in the region or in the country.

The authors confirm that there is no any financial or personal relationship that could cause a conflict of interest regarding this article.