This study uses the Markov chain and agency theory to demonstrate a link between a salesperson's perceived attributes with customer retention and both optimal effort and commission, using a relational perspective. The purpose is to show sales managers that, with a customer survey, they can use perceived sales force attributes to monitor and motivate employees during relationship marketing. This paper also demonstrates that optimal sales force compensation drives salespeople to enhance perceived attributes.

The context of salesperson–buyer interactions is characterized by market dynamics that depend on the evolution of technology and customer preferences, combined with market globalization, aggressive competition, and turbulent environments (Moncrief, 2017; Oh, 2017; Sharma & Syam, 2018). Considering these challenges, several researchers have called on companies to develop long-term relationships with customers through salespeople (Echchakoui, 2014; Palmatier, Scheer, Houston, Evans, & Gopalakrishna, 2007). Value creation is a central relational marketing construct confronting managers. Researchers underscore value creation as essential to marketing (Babin, Griffin, Borges, & Boles, 2013; Doyle, 2000) and creation and sharing of value as the purpose of supplier–customer relationships (Gronroos, 2008). In this relationship, value can be perceived by either a supplier (i.e., customer value) or customer (i.e., customer perceived value). We examine customer value, and more specifically, the financial value produced by salespeople through their relationships with a customer portfolio. Kumar et al. (2014, p. 593) define a salesperson's financial value as the net present value of that salesperson's future cash flows from customers, considering salesperson-related costs.

Many researchers highlight salespeople's strategic contribution to organizational success (Alavi, Habel, Guenzi, & Wieseke, 2018), and the literature broadly emphasizes their primary role in defining relational orientation (Blocker, Cannon, Panagopoulos, & Sager, 2012; Echchakoui, 2014, 2017a; Haas et al., 2012). Despite developing relational marketing concepts, few studies investigate relationships between a salesperson's financial value, the degree of that salesperson's relationships with customers, and the tools involved in managing a sales force, particularly wages. Using customer lifetime value (CLV), Echchakoui (2014) shows that, from a relational perspective, a salesperson's profitability depends on wages, customer retention, and the length of relationships in a customer portfolio. Customer retention (r) represents the probability that a customer remains active in a customer–supplier relationship (Zhang, Dixit, & Friedmann, 2010). Although retention is important to assessing sales force profitability (Echchakoui, 2014), few researchers assess the potential of this concept when conducting research on sales forces. Using agency theory to demonstrate CLV, Echchakoui (2017a) demonstrates that retention can be factored into a salesperson's commission. Contrary to the view that, from a relationship perspective, salary alone motivates salespeople, managers can use a salesperson's commission to control, motivate, and guide a sales force (Echchakoui, 2017a). Studies to date have used retention as either a constant (Echchakoui, 2014) or random variable with a normal distribution (Echchakoui, 2017a). However, using retention might be inappropriate since customer–salesperson relationships are not always continuous and are subjective (e.g., breach in time followed by recovery and definitive split). Consequently, the question is how retention can be used and measured. Sales force literature uses salespeople's attributes to assess customer responses or value added by salespeople. For example, using socioanalytic theory, Echchakoui (2017b) shows that salespeople's social reputation determines both their value and customer loyalty, with social reputation defined as a customer's perceptions of a salesperson's personality. The question then is whether customer retention can be measured using a salesperson's attributes, such as social reputation. Drawing on the Markov chain and Rust, Lemon, and Zeithaml (2004), this paper addresses this question. To demonstrate the utility of responses, the objective is to derive a sales force's optimal commission and effort in relationships based on customers’ perceptions of a salesperson's attributes. This issue is important because much sales force control literature uses salespeople's attributes as behavior controls, with salespeople's compensation as an outcome control (Darmon & Martin, 2011; Echchakoui, 2013). We also show how a salesperson's perceived attributes can be used to compare that salesperson's optimal commission, effort, and risk aversion from transactional and relationship perspectives.

This study offers several theoretical and managerial contributions. Theoretically, it demonstrates links between a salesperson's perceived attributes (e.g., social reputation) and both customer retention and the salesperson's optimal commission from a relational perspective. This study is the first to demonstrate how retention can be calculated using a customer survey. It estimates the optimal effort required by a salesperson and the influence of customer attributes (i.e., uncertainty and value) on a salesperson's degree of risk aversion. This is meaningful since current research suggests that risk aversion is intrinsic to a salesperson's characteristics (Echchakoui, 2017a; Joseph & Thevaranjan, 1998, 1999). Managerially, replacing a normal distribution with a survey to calculate customer retention facilitates commission calculations for sales managers, which is valuable since managers are more familiar with surveys than probability laws. We briefly discuss fundamental theoretical frameworks—a salesperson's financial value and agency theory—to design an optimal sales force compensation plan. We then derive parameters of sales force compensation that integrates salespeople's attributes by modeling retention using the Markov chain. The model establishes salespeople's optimal effort with a customer, combined with degree of risk aversion and optimal commission a company pays to serve the customer from a relational rather than transactional perspective. We provide an example, applying calculations required to establish these parameters relationally. We conclude with the study's contributions to the literature, theoretical and managerial implications, and a discussion of future research.

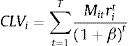

2Theoretical framework2.1Salesperson's financial valueKumar et al. (2014) define a salesperson's financial value (SFVi) to customer i as:

where CLVi represents customer lifetime value i and Si represents wages allocated to the salesperson from the relationship with customer i. According to Calciu and Salerno (2002) and Echchakoui (2014), the value of customer i (CLVi) is expressed as:where Mit is the net margin of customer i at period t, ri is the salesperson's retention rate for customer i, T is the number of periods, and β is the discount rate. If a company allocates blended wages based on a fixed salary and commission, Si can be expressed as:where Bit is the commission allocated to the salesperson for customer i during period t and Ait is the fixed salary allocated to the salesperson for customer i during period t. Considering Eqs. (1)–(3), SFVi can be expressed as:2.2Optimal sales force compensation and agency theoryThe current sales force compensation literature is based on two theoretical frameworks—agency theory and transaction cost theory (Krafft, Albers, & Lal, 2004)—though transaction cost theory (TCT) is rare in this context. Some researchers use TCT to determine the need for internal/external salespeople (Anderson, 1985; John and Weitz, 1989; Krafft et al., 2004). John and Weitz (1989) and Krafft et al. (2004) use TCT to verify predictions of agency theory regarding the influence of parameters, such as salesperson effectiveness, on wage parameters (i.e., fixed/variable salary). Echchakoui (2014) uses TCT to assess salesperson profitability from a relationship perspective. To determine optimal wages, calculate wage parameters, and predict the influence of variables on sales force wages, some literature uses agency theory (Echchakoui, 2017a). Reviewing the literature on sales force compensation, Echchakoui (2017a) shows that researchers do not use retention to calculate optimal salary or commissions assigned to a salesperson. Under the simplest agency models, organizations can be reduced to two people—a sales manager (i.e., principal) and salesperson (i.e., agent). The sales manager's role is to maximize the company's financial value for customer i (SFVi) and allocate wages to a salesperson (Si). The latter's role is to carry the risk, while making decisions on behalf of the principal that maximize the customer's utility function (Ui) (Lambert, 2001). The representative's utility during the entire relationship with a customer can be expressed as:

Drawing from extant research (Echchakoui, 2017a; Joseph & Thevaranjan, 1998, 1999; Lal & Srinivasan, 1993), we assume that a representative's utility function at time t is exponential:

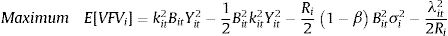

where Ri is a representative's degree of risk aversion in relation to customer i and Weit describes the disutility incurred by a salesperson from sales effort (eit) expended on customer i during period t. According to the literature (Echchakoui, 2017a; Joseph & Thevaranjan, 1998, 1999), this disutility can be expressed as:Current research (Basu, Lal, Srinivasan, & Staelin, 1985; Echchakoui, 2017a; Erevelles & Galantine, 2004) and the above equations indicate that the agency model used to derive optimal sales force wages for customer i can be expressed as:

under constraints:where Umi is the minimum utility if the salesperson refuses to work with customer i. Research (Joseph & Thevaranjan, 1998, 1999; Echchakoui, 2017) suggests that this utility is equal towhere λit represents the marginal cost of a salesperson's risk tolerance during period t when serving customer i, E[Si] is the salesperson's (Si) anticipated wages following the effort needed for customer i, μit is customer i's anticipated margin at time t (μit=E(Mit)), σt2 is the variance of customer i's margin at time t, ei is the required effort from the salesperson with respect to the customer, and CE is the certainty equivalent. Similarly, Joseph and Thevaranjan (1998, 1999) assume that the average margin obtained by a salesperson at time μit depends on effort (eit) and effectiveness (kit), or μit=kiteit. Eqs. (8)–(10) require that we calculate the retention rate (rit) according to a salesperson's effort (ei).3Optimal sales force compensation, including salespeople attributesDrawing on the Markov chain, we connect a customer's retention with salesperson attributes. We then determine optimal salesperson effort, commission, and risk aversion, comparing these parameters using relational versus transactional perspectives.

3.1Using the Markov chain to connect customer retention and salesperson attributesTo calculate a retention rate according to a salesperson's intellectual capital, we use the approach from Rust et al. (2004), which derives retention rate r from the perceived utility of a salesperson with whom a customer is interacting after estimating the latter's lifetime value. In this case, retention is associated with a customer's perception during the relationship of a salesperson's utility. Salesperson j's retention of customer i depends on the probability that customer i chooses salesperson j's offer, considering that customer i recently opted for salesperson k's offer. Drawing from Rust et al.’s (2004) formula, which links brand attributes with a customer's probability of choosing a brand, we express the probability that customer i chooses salesperson j's offer as:

where θit is the salesperson's utility of customer i, which is analogous to the formula of Rust et al. (2004):where Lik is a binary variable equal to 1 or zero, Xi is a salesperson's attributes (e.g., social reputation) as customer i perceives them, β0 is the logit regression factor that corresponds to inertia, β1 is the logit regression vector coefficient that corresponds to salesperson attributes, and ɛik is random error.Rust et al. (2004) establish customer retention at time t using Markov chains, which model customer i's transition at time t from one supplier or brand to another, or in our case, from one salesperson to another. By analogy with Rust et al. (2004), each customer i is associated with a transition matrix on the order of J×J, where J equals the number of suppliers, each of which are represented by a salesperson and transition probability pijk. This transition matrix is referred to as Zi. Row vector Ai, formed by the probabilities of the first row and column J (1×J), describes the probability that customer i purchases from a salesperson during a given timeframe. The retention rate of customer i at time rit can thus be expressed as:

where Yit is the row vector 1×J with components Yj, which represent the probability that the customer purchases from another salesperson (k) during period t, ϕ is customer i's purchase probability, and Z is the Markov transition matrix for the customer.3.2Optimal effortThe salesperson exerts maximum effort when the first derivative of the salesperson's objective is zero (i.e., the derivative of Eq. (10) is zero) for each effort invested in customer i. We therefore deduce:

From a relational perspective, Eq. (14) shows that a salesperson's maximum effort with customer i depends on three parameters—commission rate, salesperson effectiveness, and the salesperson's perceived attributes (e.g., social reputation or image)—which influence the retention rate of customer i at time t. Unlike in current studies (Basu et al., 1985; Joseph & Thevaranjan, 1998, 1999), optimal effort includes a salesperson's attributes as the customer perceives them. The optimal effort described by Eq. (14) differs from that of Kalra, Shi, and Srinivasan (2003), who found that optimal effort is an additive function that results from one term based on a salesperson's commission rate and another based on customer satisfaction. In our case, optimal effort is the commission rate multiplied by factors reflecting a salesperson's tangible and intangible attributes, which result in customer satisfaction and retention, among others.Proposition 1 From a relational perspective, a salesperson's optimal effort depends on commission rate, sales effectiveness, and perceived attributes (e.g., social reputation or image), which influence customer retention; the greater the commission, effectiveness, and perceived attributes, the greater the salesperson's optimal effort with the customer.

Considering Eq. (10) and substituting terms from (8) with terms from (9), Eq. (8) becomes:

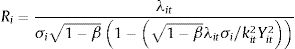

The first derivative of Eq. (15) in relation to Ri and Bit allows us to deduce:

From these results, we conclude:Proposition 2 From a relational perspective, a salesperson's degree of risk aversion in relation to customer i at time t depends on environmental uncertainty regarding customer i (σit), the marginal cost of risk regarding customer i (λit), the discount rate (β), the salesperson's effectiveness (kit), and the customer's perception of the salesperson's attributes (Yit); the greater the customer's perception of the salesperson's attributes, the lower the salesperson's risk aversion when serving the customer. However, salespeople's risk aversion increases according to their perceptions of a customer's environmental uncertainty, the capital cost of serving the customer, and the discount rate. From a relational perspective, a salesperson's commission rate at time t depends on environmental uncertainty (σit) regarding customer i, the marginal cost of risk (λit), the discount rate (β), the salesperson's effectiveness (kit), and the customer's perceptions of the salesperson's attributes (Yit); the greater the customer's perceptions of the salesperson's attributes (e.g., social reputation or image), the greater the salesperson's required commission rate. In contrast, the greater the customer's environmental uncertainty (i.e., capital cost or discount rate), the lower the salesperson's required commission rate.

Propositions 1, 2 and 3 underscore differences between transactional and relational perspectives on a salesperson's wages when serving a customer. The next section addresses this topic in greater detail.

3.4Comparison of relational and transactional perspectivesTo illustrate differences between relational and transactional perspectives when establishing a salesperson's wage plan, we calculate variables that change from one perspective to the other, including commission rate, risk aversion, and optimal effort (see Table 1 in Annex 1). Joseph and Thevaranjan (1998) use these variables to compare wage plans established by monitoring a salesperson's efforts and those established without monitoring. From Table 1, we highlight:

- •

If customer r's retention rate does not exceed a critical value equal to Yi1, the commission rate is lower in a relational perspective. This critical retention depends only on the discount rate; the greater the discount rate, the lower the Yi1. In turn, the commission in a relational perspective rises above that of a transactional perspective more quickly.

- •

A salesperson grows more risk averse in a relational perspective when the customer retention rate does not exceed a critical value equal to Yi2. This critical retention rate (Yi2) depends on environmental uncertainty (σi), the marginal cost of the risk (λi), the discount rate (β), and the effectiveness of the salesperson (ki). Yi2 increases with environmental uncertainty, capital cost, and salesperson effectiveness, but it increases or decreases according to the discount rate, depending on its position in relation to critical value λic(λic=−(3ki4−8λiσiki2+4λi2σi2/ki4)).

- •

A salesperson's maximum effort from a relational perspective remains greater than the maximum effort from a transactional one. The optimal effort required by a salesperson depends on the strength of the relationship with the customer; the stronger the relationship, the greater the optimal effort.

From this, we conclude:Proposition 4 If the customer retention rate exceeds critical value Yi1, which depends on the discount rate, the salesperson's commission from a relational perspective is higher than from a transactional one. Also, the greater the discount rate, the lower the Yi1. A salesperson's risk aversion from a relational perspective is lower than risk aversion from a transactional perspective when the customer retention rate does not exceed critical value Yi2. The greater the salesperson's perceived attributes, the lower the minimum duration, and the greater the environmental uncertainty and salesperson effectiveness, the greater the value of Yi2. From a relational perspective, a salesperson's optimal effort with a customer does not equal that of other customers (i.e., a transactional perspective) but depends on the nature of the relationship between the salesperson and customer; the weaker the relationship, the more the effort required matches the effort involved from a transactional perspective.

Holthausen and Assmus (1982) and Echchakoui (2017a) suggest that it is difficult to collect data to operationalize the model. Therefore, to demonstrate that a salesperson's attributes, such as perceived reputation, can be used to determine the retention rate, optimal effort, optimal commission, and optimal risk, we use an example, much like other researchers do (Chen & Cheng, 2005; Echchakoui, 2017a; Holthausen & Assmus, 1982; Tsai, 2009).

We assume that the company that employs Salesperson A seeks to develop differentiated relationships with three customers—C1, C2, and C3—in a territory. The salesperson's objective is to generate a 3-customer portfolio while competing with other salespeople in the same territory. To ensure efficient management and optimal profitability, the company collects information for each customer over five periods: optimal effort required by the salesperson, the salesperson's risk aversion, each customer's retention rate, and the salespeople's required commission. For simplicity, (1) the salesperson's effectiveness is identical for each customer, is consistent (kit=k), and is equal to 5 (k=5; Joseph & Thevaranjan, 1999), (2) λit values are consistent and equal to 0.7805 (λit=λ=0.7805; Joseph & Thevaranjan, 1999), and (3) customer-related uncertainty is consistent and equal to 4.5 (σi=σ=4.5). We also assume a discount rate of 10% (β=10%).

4.1Calculating retentionA descriptive study was conducted to determine salesperson A's retention rate for each customer, the goal of which was to identify the three customers’ perceptions of the salesperson's social reputation in relation to three competing salespeople (Salespeople B, C, and D). According to Echchakoui (2017b), a salesperson's social reputation can be defined based on two factors: perceived stability and perceived plasticity (Table 2). A salesperson's perceived stability includes calmness, organization, cooperation, attention, and trustworthiness. A salesperson's perceived plasticity includes sociability, activeness, imagination, and intellect (Echchakoui, 2017b). Table 2 shows part of a database that contains perceptions of three customers on a scale of 1–8 for each of the four salespeople, including their latest purchase decisions (positive decision=1, rejection of an offer=0). For example, Customer 1 (C1) deems Salesperson A to be calm (6/8) with average intellect (4/8). This customer chose to purchase from salesperson B. To derive a transition matrix based on the data (Table 2), several steps were followed (see Annex 2).

4.2Calculating a salesperson's optimal effort, risk aversion, and commission for each customerEqs. (14), (16) and (17) are used to calculate Salesperson A's risk aversion with respect to each customer, and the optimal commission and effort required for the three customers (Table 4 in Annex 3 shows calculated values of retention rates, commission rates, risk aversion factors, and maximum effort required from Salesperson A for the three customers over five periods).

By comparing customers 1, 2, and 3, we deduce:

- •

The optimal rate of commission required for Salesperson A differs from one period to another and from one customer to another.

- •

A salesperson's risk aversion varies from one period to another and from one customer to another; the greater the customer retention, the lower the salesperson's aversion.

- •

At Period T1, Salesperson A's commission rate is higher when a customer holds more positive attitudes toward the salesperson. This rule, however, does not apply when the relationship time increases due to fluctuating retention rates over time.

- •

The optimal effort required from Salesperson A differs from one period to another and from one customer to another.

- •

At Period T1, the optimal effort required by Salesperson A is greater when a customer holds more positive attitudes toward the salesperson. Again, this rule does not apply when the relationship time increases due to fluctuating retention rates over time.

- •

Figure 1 shows that an increasing retention rate leads to an increase in a salesperson's optimal sales effort and commission, and a decrease in risk aversion.

The purpose of this paper was to demonstrate that a retention rate can be operationalized by using a salesperson's perceived attributes, assessed by using a customer survey. Drawing on Rust et al.’s (2004) model and the Markov chain, we illustrate how researchers and managers can perform this operationalization, an important issue since current studies include a retention rate by simply using a constant variable or treating it as a normal distribution variable (Echchakoui, 2014, 2017a). Since salesperson–customer relationships are not constant, treating retention as a constant is inappropriate, and operationalizing retention using a normal distribution is complicated. Linking retention to salespeople's perceived attributes that can then be assessed annually is more realistic. This link is significant for two reasons. First, it encourages a salesperson to consider image when interacting with customers, and second, it supports studies (Echchakoui, 2017b; Roberts, 2006) demonstrating the influence of a salesperson's image and social reputation on customer loyalty.

A second objective was to establish a link between a salesperson's attributes and compensation using agency theory and results obtained from the first objective. This link helps sales managers motivate and train sales forces. We also show that calculating optimal sales force commissions from a relational perspective requires the integration of customer value. By integrating customer value, we show that commissions establish an effective behavioral control system that goes beyond results, a concept that accords with Cravens, Ingram, LaForge, and Young (1993), who argue that the two systems of control (i.e., behavior and results-based) are not in conflict but co-exist in a complicated relationship. We emphasize that commissions and sales efforts from a relational perspective are not consistent across customers and salespeople but depend on each customer's value and each salesperson's capital. These results are significant from a management viewpoint for three reasons. First, they optimize the ways supervisors assign customers to salespeople. Second, they manage the size of a sales force since sales efforts can be optimized by considering the value of each customer, and third, profits increase when expenses and sales are correlated.

The final goal was to use the relationship found in the first objective to demonstrate differences between monitoring and rewarding salespersons from relationship versus transactional perspectives. We show that, from a relationship perspective, a salesperson must make more of an effort with customers, with results suggesting that managers reward salespersons differently depending on the perspective used. We also demonstrate that salespeople's risk aversion varies from one perspective to the other.

6Theoretical implicationsThis paper offers a new insight into how formal salesperson compensation integrates perceived attributes through customer retention. Some researchers, such as Kalra et al. (2003), include customer satisfaction in salespeople's compensation. Kalra et al.’s approach is pertinent for two reasons. First, it integrates a qualitative variable into compensation, and second, it was among the first papers to include customer attitudes toward salespeople in sales force compensation. Echchakoui (2014, 2017b) integrates customer retention in compensation but did not operationalize it. The current study is the first to use a Markov chain model to calculate retention based on a salesperson's attributes, and the first to derive optimal parameters of sales force compensation in the relationship.

This study also contributes to the sales force control literature by showing how a salesperson's perceived attributes can be used to control salesperson behaviors. The sales force control literature highlights that both behavioral and outcome controls are important to monitoring sales forces, but most compensation plans include only salespeople's results (Echchakoui, 2015, 2017b; Kalra et al., 2003). Several studies assess whether salespeople's attributes, such as knowledge, experience (personality; Churchill, Ford, Hartley, & Walker, 1985), and perceived personalities, enhance salespeople's performance. The current study contributes to such research by demonstrating that these two topics can be combined by integrating salespeople's perceived attributes into compensation plans.

7Managerial implicationsRegarding managerial implications, this study demonstrates that a salesperson's perceived attributes can be integrated in sales compensation. Through this integration, we encourage sales managers to motivate each salesperson to enhance perceived attributes or image. This issue is pertinent because Echchakoui (2017b) shows that a salesperson's social reputation, an example of an attribute, is important to the salesperson's preferences and customer loyalty from a relationship perspective. Second, calculation of a salesperson's optimal effort helps sales managers recruit the right number of salespeople based on time devoted to each customer's portfolio. It also aids them in evaluating a salesperson's call planning accurately, which enhances each salesperson's equity and performance.

Third, calculation of optimal commission based on customer retention and salesperson attributes helps a sales manager classify salespeople according to attributes and the importance of customers from a relationship perspective. It also aids sales managers in implementing an equitable pay structure based not only on salespersons’ results, but also on their behaviors. This issue is important because many studies (Anderson & Oliver, 1987; Baldauf, Cravens, & Piercy, 2005) suggest that sales managers must control salespeople's behaviors and outcomes. Finally, by comparing optimal sales compensation from two perspectives, this study advises sales managers that control of salespeople from a relationship perspective is different from that from a transactional perspective. We recommend that sales managers consider a salesperson's risk not only in the compensation package, but also during recruitment. As research has shown, attitudes toward risk differ among salespeople (Joseph & Thevaranjan, 1999).

8Future research and limitationsWe use a hypothetical database to illustrate customers’ perceptions toward competing salespeople, and although the purpose was to demonstrate how to operationalize the model, future research should use real-world databases. The study assesses fixed optimal wages required for salespeople from a relational perspective, due primarily to the difficulty of calculating wages symbolically using equations. Future research should address this and related issues. For example, research should assess whether, from a relational perspective, straight salaries should be identical for all salespeople or differ according to the value of each customer.