This study considers factors affecting to audit performance by risk-based approach (RBA) as well as audit quality in Vietnam. In addition, the study also examines the relationship between RBA and quality of independent audit firms. A descriptive survey research was adopted using both quantitative and qualitative methods. Qualitative research was conducted to consider the characteristics of RBA, and to identify items affecting to RBA application. A purposeful sampling method was used to select intentionally a target audience of 18 qualified experts. To examine influent factors, the study targeted 500 professional auditors but 355 returned the survey questionnaire. Performing data analysis by using structure equation modeling (SEM), the research findings revealed positive relationships between capacity of auditors, job pressure on auditors, the support of information technology, competitive ability of audit firms, audit fees, client's risks and the application of RBA, as well as quality of independent audits in Vietnam. Of which as supported by many previous studies, client's risks and information technology have the strongest relationship. On the other hand, RBA also positively and significantly affect to quality of independent audit firms. Finally, some recommendations were proposed based on the results of influent factors.

Choosing an audit approach is one of the important factors that affect the outcome of an audit. If auditors apply an inappropriate audit approach, the likelihood of the audit failure will increase. These failures can lead to reduced credibility, litigation or waste of effort and money. At the same time, the deployment of audit techniques and procedures consistent with the selected audit approach, and also demonstrate the ability and qualification of auditors in improving quality, efficiency, and cost savings. With this importance, audit approaches are often mentioned in the guidance documents of auditing professional organizations such as AICPA (2018), and ECA (2013).

Especially, after a series of financial scandals of many large companies in the world (Eron, MCI Wordcom, Arthur Andersen, AIG), auditors and professional associations have acknowledged that adjustments are needed in the audit. Audit firms are more proactive in identifying risks, especially critical risks. They also develop audit methods, programs and approaches based on business risks. The initiation of the RBA from auditing practices has inspired many studies to conduct theoretical research. Bell, Marrs, Solomon and Thomas (1997) are a pioneer when coming to this method in his research. According to Bell et al. (1997), instead of performing an audit based on a traditional approach which relies on checking operations and balances to derive information on financial statements, auditors understand business strategies of clients, the risks threaten the success of the strategy, their response to the risk, and determine the impact of risks leading to material misstatements in financial statements. Many researches of RBA have appeared that there are two trends including: (1) Studying the process of formation and development of RBA and (2) Studying the impact of RBA on the audit process and quality (Bell et al., 1997).

Following the first research direction, RBA is an inevitable trend in the process of audit development to provide reasonable assurance for the audited subjects, fully comply with professional regulations, and narrow users’ expected distance of audit results (Bell, Peecher & Solomon, 2005; Eilifsen, Knechel & Wallage, 2001; Knechel, 2007; Lemon, Tatum & Turley, 2000; Prinsloo, 2008). With the second trend, many researchers have stated that RBA is closely related to the process of auditing financial statements including scope of audit planning and the number of audit evidences collected (Abdallah, Mssadeh & Othman, 2015; Fogarty, Graham & Schubert, 2006; Hayes, 2006). RBA provides a framework for enhanced audit efficiency and effectiveness and ultimately audit quality. Although there are many studies, which confirm the superiority of RBA. There is a lack of studies on the factors that influence the audit performance of RBA. Moreover, RBA is rarely done by small auditing firms as well as in developing countries such as Vietnam (Naibei, Oima & Ojera, 2014).

In Vietnam, audit firms have actually applied RBA on a large basis since 2014 when Ministry of Finance issued a new system of audit standards, including requiring auditors to identify, evaluate, and handle risks of material misstatement according to ISA 315 and ISA 330 (IAASB, 2006). This approach is highly appreciated by auditors about its importance and significance for the audit. However, because it is a new approach, audit performance of financial statements by RBA still reveals many limitations at audit firms. According to the results of the audit of audit service quality in 2017 by the Department of Management of Accounting and Auditing, many procedures for risk assessment and customer acceptance are sketchy; identification and staking procedures have not been used to design audit procedures. Further, there are differences in the implementation of risk-based audits between Big 4 and non-Big 4 firms in Vietnam (Le & Nguyen, 2020; Nguyen & Le, 2019). As a result, research questions are set out. Which factors affect the performance of RBA by independent auditing companies? Does performing an audit under RBA affect quality of independent audit?

In summary, although there are many studies that play a crucial role in developing awareness of the concept, content, and benefits of RBA, additional research on factors affecting the performance of financial statements audits using RBA is very necessary to increase the generalization of the research problem as well as expand practical knowledge. The study addressed these objectives.

2Research overview2.1Audit approachesThe strong explosion of science and technology along with the pressures from the increasing demands of community have posed significant challenges for auditing profession that require adjustments in the approach to eliminate deficiencies and improve the audit process (Sardasht & Rashedi, 2018). Audit approach is a way of orienting and applying techniques in the financial statement audit. In general, the audit approach does not depend much on the operation field of clients but on each development stage of audit science, each country, each condition, and the views of each audit firm (Prinsloo, 2008). Until now, there are 4 audit approaches:

First, the substantive procedures audit approach appeared before 1904. Following the approach, auditors perform a detailed examination about a large number of transactions on assets, liabilities and revenue on the test balance sheet, aiming to detect and report errors in accounting data (Dicksee, 1904). Due to the inspection of a large number of transactions and account balances, the collected audit evidences are highly convinced. However, auditors will take much time and cost to conduct the inspection. On the other hand, this approach is purely based on the results of a detailed inspection without systematic approach, which examines the risks arising in business operation. The approach only stems from past information that is not oriented in future (Prinsloo, 2008).

Second, balance sheet - based audit approach was appeared from 1904 to 1940. The items on the balance sheet will be divided or grouped into an operating part to assign the work to the audit team members. The approach focuses on audit procedures for accounts on the balance sheet, and only a very limited number of procedures are performed on the items in the income statement. It was explained by many studies that accounts on income statement have reciprocal relations with accounts on balance sheet. Therefore, if all the items on balance sheet are checked, and verified for honesty and accuracy, they can be deduced in income statement (Hanson, 1942). Similar to the first audit approach, the main goal of this approach is to detect and report violations, so the procedure of checking transaction details accounts the majority of auditors’ work. The stage of audit planning and the determination of the content carried out to gather audit evidence are not taken seriously.

Third, in the stage of audit planning, auditors must spend time to learn the characteristics of customers, especially internal control systems which help auditors identify the strengths and weaknesses in each control stage. If the control stage is assessed to be effective, auditors will mainly perform control test and reduce base test. The system-based audit approach helps auditor to find the weaknesses in the business process and to offer future solutions. However, this method does not take into account business risks, and potential risks of clients, which lead to not detect all the significant errors of clients (Nguyen & Le, 2019).

Fourth, auditors learn about customers' business strategies, the risks that threaten the success of their strategies, their responses to risks and the impact of risks on material deviations in the financial statements. Then, audit procedures are designed to handle risks in the direction of increasing base test for non-regular transactions and only performing control test for regular transactions (Bell et al., 1997). According to Hayes (2006), auditors may issue an unqualified report because of the auditor's failure to detect material risk. RBA requires identification of high risk areas that are considered to have material misstatements. It must then show which audit method is used to reduce the risks.

Among the above-mentioned audit approaches, the RBA is currently the most common method used by audit firms in the process of auditing financial statements. The reason for this popularity is because that RBA focuses on risks, the underlying causes of financial surprises, not just the accounting records. Further, RBA focuses on inspecting the quality of the financial statements to add value to the bank's operations (Gibson, 2003). Performing RBA is actually more effective than traditional approaches because auditors increasingly evaluate, and improve the appropriate design and implementation of audit procedures to minimize risks (Fogarty et al., 2006). This point of view also receives agreement in the research of Vietnam, identifying that RBA is most suitable for auditing financial statements of commercial banks, FDI enterprises, and insurance enterprises. RBA has taken a step further than the traditional methods (Pham, Duong, Pham & Ho, 2017). That is, not only focusing on mere audit risks but also taking into account the risks of the business, allowing the optimal use of rare audit resources, reaching a higher consensus between auditors and business goals, while minimizing potential risks.

2.2Factors affecting RBA application and audit qualityPerforming an audit based on RBA and the audit quality may be affected by factors such as legal institutions, people, the environment and working conditions, as well as by other characteristics of clients. Moreover, the influence degree of these factors will vary in different cultural and national environments. If localized factors are not considered, this inflexibility will compel the audit to experience failure (Kutum, Fraser & Hussainey, 2015). In other words, the consideration of factors influencing RBA implementation and the quality of the audit should be placed in a specific study space and scope.

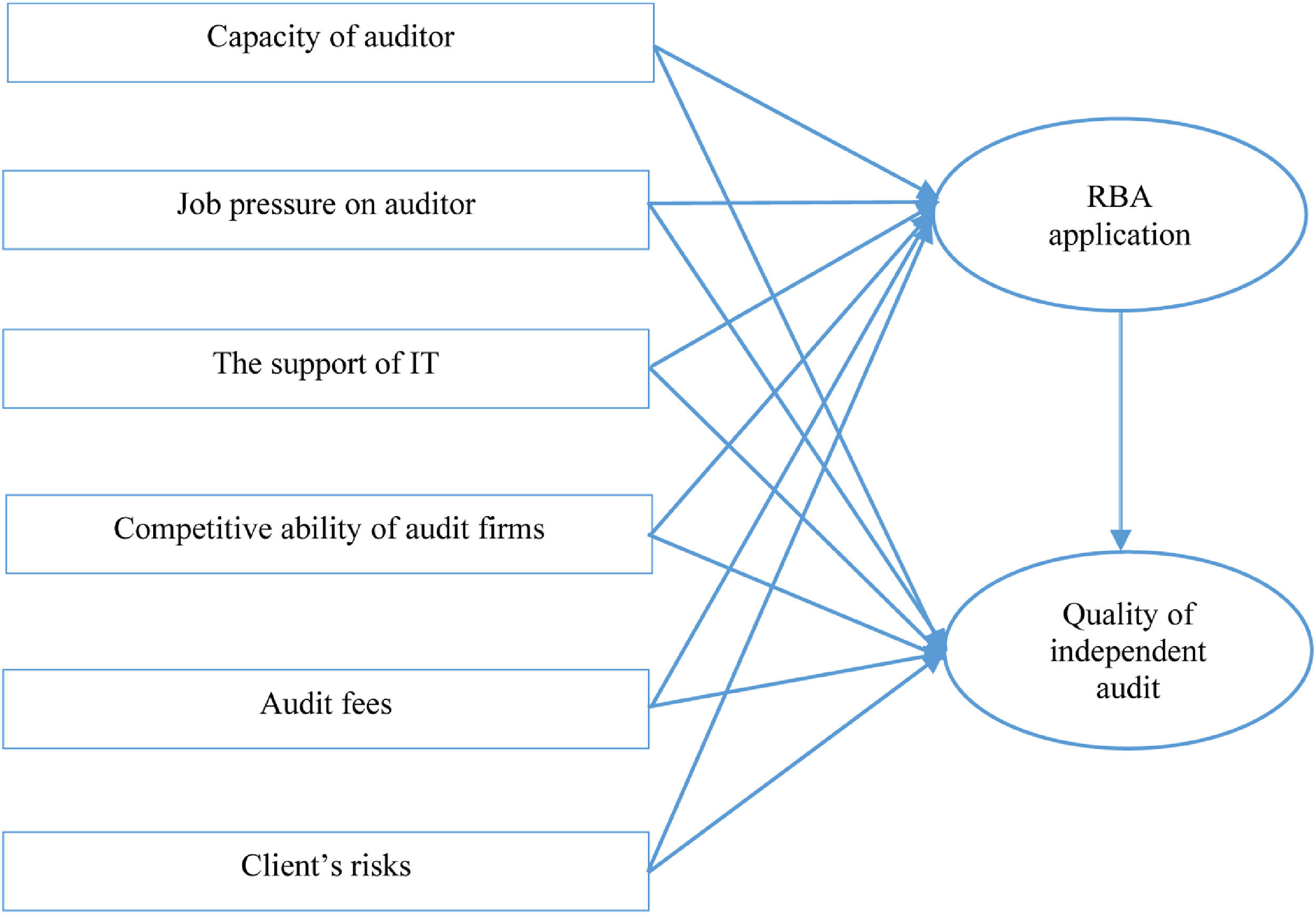

On the basis of inheriting the previous research results of Abdallah et al. (2015), Allaham, Nassar and Reesh (2017), Nazmi, Arori and Ibrahim (2017), and Sardasht and Rashedi (2018) and placed within the research scope in Vietnam, we identify factors affecting RBA application and the quality of independent audit as follows:

Capacity of auditor: Many studies show that the auditor's capacity plays a very important role in detecting errors (Owhoso, Messier & Lynch, 2002), performing analytical procedures (Danescu & Chira, 2014), assessing the components of audit risk (Kochetova-Kozloski & Messier, 2011; Moroney & Simnett, 2009), and affecting audit quality (Boon, McKinnon & Ross, 2008; Do, 2015; Sulanjaku & Shingjergji, 2015). Along with the above viewpoint, other studies emphasize that capacity of auditors is closely related to the audit process based on RBA.

In order to perform successful audits, RBA required auditors to have a greater level of knowledge and additional skills (Sardasht & Rashedi, 2018). Fundamental aspects of the new model to investigate the factors influence to RBA (Sardasht & Rashedi, 2018). The results showed that auditor's professional knowledge belonging to main factor based on audit, has the highest level of influence on detection risk, then audit evidence and size of sample. Experienced auditors perform audit procedures, collect and process audit evidence more effectively than compared with less experienced auditors (Moroney & Simnett, 2009). Furthermore, once the team leaders have extensive knowledge of the environment of clients, they can better establish and assess audit risks, as well as make decisions regarding the audit process, members, and audit time (Low, 2004). Based on prior researches, we hypothesize that:

H1a

Capacity of auditor has a positive relationship with the application of RBA in Vietnamese audit firms.

H1b

Capacity of auditor has a positive relationship with the quality of independent audit in Vietnam.

Job pressure on auditor: According to Margheim, Kelley and Pattison (2011), time pressure can lead to dysfunctional behaviours and those may directly affect the audit report such as: reducing audit procedures, signing off audit report before completion, lack of research on accounting standards, superficial reviews of clients’ documents and accepting weak explanations. Likewise, stress (time and work complexity) negatively affects the psychology and behavior of auditors (Umar, Sitorus, Surya, Shauki & Diyanti, 2017). As a result, it reduces the likelihood of detecting material misstatements on the financial statements. Besides improving RBA, there are certain complexities surrounding an audit that should be considered including: the expectation gap; the uncertainties surrounding the responsibilities of the auditor; the provision of reasonable assurance; and the practical implementation of the standards (Le & Nguyen, 2020; Prinsloo, 2008). These factors put pressure on auditors to conduct audits according to the risk approach and form the next hypotheses.

H2a

Job pressure on auditor has a negative relationship with the application of RBA in Vietnamese audit firms.

H2b

Job pressure on auditor has a negative relationship with the quality of independent audit in Vietnam.

The support of information technology: The outstanding development of information technology has fundamentally changed the method of current auditing by applying electronic documents, and aggregation software, which process audit data as well as enable real present auditing methods in computerized environment.

A study conducted by Bierstaker, Burnaby and Thibodeau (2001) shows that there is a significant effect of infrastructure on the application of risk-based internal audit. Therefore, infrastructure cannot be ignored as far as the implementation of risk-based audit is concerned. Nazmi et al. (2017) carry a study on the factors affecting the audit strategy based on the business risks and its impact on the quality of the external audit in the Jordanian commercial banks. The study found that there is a high impact for the technological development to the business risk audit. There is an average impact for the audit fees and audit time to the business risk audit. A model developed by Van Buuren, Koch, van Nieuw Amerongen and Wright (2014) examines a continuum of audit approaches ranging from a SBA to RBA. They found that investment in audit technology is an important factor explaining the use of RBA by non-Big 4 firms. The results of Tarek, Mohamed, Hussain and Basuony (2017) on the impact of information technology on audit in developing countries show that the level of IT application in auditing depends on the expertise of auditors and IT experts instead of characteristics of clients or the firm's size. Using information technology in audit can improve audit efficiency (Barta, 2018). These arguments lead to the following hypotheses:

H3a

The support of IT has a positive relationship with the application of RBA in Vietnamese audit firms.

H3b

The support of IT has a positive relationship with the quality of independent audit in Vietnam.

Competitive capability of audit firms: Many studies found a relationship between competitiveness and audit quality. Sustainable competitive advantage is very important for audit firms (Berry, Bennett & Brown, 1989). Increasing the image of the company, reducing costs, improving business efficiency and committing service quality create a competitive advantage to attract and retain customers. In line with views, the large size of audit firms and greater financial resources for maintaining the quality of service can minimize the likelihood of lawsuits (Lennox, 1999; Shu, 2000). Similarly, large-scale audit firms build brands and protect their reputation by providing high quality audits (Alaraji, Al-Dulaimi, Sabri & Ion, 2017; Albrecht, Albrecht, Wareham & Fox, 2006; Francis, 2011; Mawutor, Francis & Obeng, 2019).

Recently, based on the theory of enterprise resources, Phua, Lau and Chris (2011) compare the competitive advantages of 8 auditing firms in Hong Kong and concluded that large-scale businesses which have advantages in technology, staff qualifications, financial resources, brands, have a better competition. They also pay attention to minimize lawsuits, preserve their image so ensure the audit quality. A vast number of studies in Vietnam (Le & Nguyen, 2020; Nguyen & Le, 2019; Phan, Chuc & Le, 2019) had the same comment that RBA is being practiced by Big 4 firms and apply with listed enterprises and insurance enterprises. RBA has not been done or it has not done thoroughly by non-Big 4 firms. Moreover, competition has impact on audit quality, in addition to the impact of audit tenure, and the change of senior personnel (Pham et al., 2017). The fourth hypotheses are expanded:

H4a

Competitive capability of auditing firms has a positive relationship with the application of RBA in Vietnamese audit firms.

H4b

Competitive capability of auditing firms has a positive relationship with the quality of independent audit in Vietnam.

Audit fee: A lot of research finds a relationship between audit fee and audit quality to through the sign of the abnormal fees. However, there are two different views in the literature on this issue. The first view is that audit fee has a negative relationship with audit quality. Auditors receive abnormally high fees that adversely affect the audit quality (Choi, Kim & Zang, 2006; DeAngelo, 1981; Dye, 1993; Mawutor et al., 2019). At that time, auditors depend on the financial position of customers, and create economic bonding between them. The association between abnormal audit fee and audit quality in Indonesia is examined by (Fitriany & Anggraita, 2016). They discovered that positive abnormal audit fee negatively impacts on audit quality, while negative abnormal audit fee positively affects to audit quality. The second view is that audit fees have a positive relationship with audit quality. High audit fee may reflect an increase in the audit firm's efforts and audit procedures which help improve audit quality (Higgs & Skantz, 2006). The same, higher audit fee is the result of the audit firm working longer hours and/or the audit firm charging a higher rate because it is a better auditor (Abdul-Rahman, Benjamin & Olayinka, 2017; Defond & Zhang, 2014; Nazmi et al., 2017; Tobi, Osasrere & Emmanuel, 2016). Conversely, if audit fee is low, the firms will adjust their efforts and reduce the audit procedures, which make poor quality of audit (Eshleman & Guo, 2014).

H5a

Audit fee has a positive relationship with the application of RBA in Vietnamese audit firms.

H5b

Audit fee has a positive relationship with the quality of independent audit in Vietnam

Client's risk: Previous researches (Houston, Peters & Pratt, 1999; Mock & Wright, 1999) indicated that auditors adjust the extent of testing depending on the client's risks and found that the presence of risk factors increases demand for additional audit evidence. Risk assessment depends significantly on the number of risk factors identified in each area or in a client with high business risks (Johnstone, Bedard & Ettredge, 2004). Further, high inherent risk and high control risk jointly increase significantly the number of planned audit hours compared to when the both risks are low. Customer risks, especially risks of information systems affect the risk identification and audit planning (Bedard, Graham & Jackson, 2005). Likewise, the existence of business risks necessitates more audit work (Sandra & Patrick, 1996). Audit effort increases with the assessment of inherent business risk (Bell, Landsman &Shackelford, 2001). A questionnaire which distributed to 200 audit firms in Malaysia is used to examine the influence of the assessment of business risk on the auditor's choice of audit procedure (Paino, Smith & Ismail, 2013). The results show significant shift of audit procedures by the auditors in response to the clients’ business risk. Abdallah et al. (2015) measure the impact of business risk on the quality of the auditing process by distributing a questionnaire to 325 auditors working in 82 audit offices in the Jordan. The results showed that three kinds of business risks are systematic risk, environmental risk and occupational risk impact on the quality of the audit process. The above discussion leads to the sixth hypotheses:

H6a

Client's risk has a positive relationship with the application of RBA in Vietnamese audit firms.

H6b

Client's risk has a positive relationship with the quality of independent audit in Vietnam.

Another point to consider is whether the quality of the audit is affected by conducting an audit under the RBA. Numerous studies commented that performing audits in accordance with RBA is more effective and effective than traditional approaches. However, there are viewpoints that RBA is designed for large audit firms and developed countries. It is not really suitable for small audit firms and developing countries (Andersen, 2006; Khalifa, Sharma, Humphrey & Robson, 2007). Therefore, the quality of independent audits should also be considered in relationship to RBA implementation. Hypothesis 7 is formed, as follows:

H7

The RBA has influence on the quality of independent audit in Vietnam

3Research methodTo solve the research objectives, we choose a mixed research method including qualitative research at an early stage and quantitative research at a later stage.

3.1Qualitative research methodQualitative research conducted is to achieve two objectives: (1) consider the characteristics of RBA and (2) identify items affecting the performance of the audit of financial statements according to RBA in Vietnamese audit firms. In order to achieve research objectives, an approach based on background theory of Corbin and Strauss (2015) with 3 steps is selected, as follows:

Step 1: Based on previous studies and theories, we identify and classify factors affecting the audit application of financial statements according to RBA that is a basis for developing semi-structured interview questions in hands-on discussions with experts.

Step 2: Qualitative research is conducted to explore the items affecting the performance of auditing financial statements by RBA in Vietnamese audit firms. In keeping with the background theory, we used a purposeful sampling method, selecting intentionally a target audience of qualified experts including: experts currently teaching and researching at universities, senior auditors in audit firms. The number of interviewed people would stop until there is no new information, which is compared to the information collected in previous interviews. In this study, no additional information was found when discussing with 18th expert. Accordingly, the number of samples for qualitative research is eight teen. From the results of interviews, we developed two items in influent factor “job pressure on auditor” including regulations of Government and Professional organizations; and regulations of audit firms. In addition, item named “give an opinion after handling to assessed risks of material misstatement” is added in the application of RBA.

Step 3: The interview was conducted in the form of direct communication based on the questions that the author has drafted. All interview contents for each expert are stored in separate files on the computer. These files are then carefully read in turn, reduced to the original data into a smaller set of featured topics and discussed with experts to come up with a high level. Data can be added, adjusted and retained the factors that are most suitable for the characteristics of Vietnamese audit firms as well as the cultural environment and socioeconomic context.

The purposes of quantitative research are to verify and confirm the reliability of the model. Based on study of Bryman (2012), quantitative research process is designed in the following steps:

Step 1: Building a research model. Based on qualitative research results, a research model is proposed (Fig. 1). This model shows the relationship between the dependent variables consisting of RBA application, the quality of independent audit and independent variables including Capacity of auditor, Job pressure on auditor, The support of information technology, Competitive capability of audit firms, Audit fee, and Client's risk).

Step 2: Surveying instrument design. The survey tool in this study is questionnaire. In addition to general information about respondents, the questionnaire has 35 questions using Likert scale with five levels: 1: Strongly disagree, 2: Disagree, 3: No comments, 4: Agree, and 5: Strongly agree. Of which, 32 items are inherited from previous studies and 3 items are developed by expert interview (Appendix A). Questionnaire was used to test with 115 auditors for assessing content (clarity) and form of presentation (ease of answer) of the questions. The test results were used to assess preliminary the reliability of the scale through Cronbach's alpha coefficient.

Step 3: Selecting the sample and official survey. The minimum size of the study was taken by (Hair, Black, Babin & Anderson, 2009). To ensure reliability, the minimum sample size should be 5 times number of observed variables. Therefore, with 35 observed variables, the minimum number of samples must be 175. During the period from January 2019 to April 2019, the authors issued 500 surveys to auditors who are working at Vietnamese audit firms through email and face to face. In June 2019, we collected 355 valid votes.

Step 4: Processing data. We gathered and imported survey data into SPSS 22 and AMOS 20 software. The reliability of the scale, extracted factor analysis (EFA), correlation analysis, confirmatory factor analysis (CFA), and structure equation modeling (SEM) were then evaluated.

The results in Fig. 2 show that in total of 355 obtained valid votes, about gender, 62.5% of people is male, and 37.5% is female. Besides, 65.4% of auditors has CPA certificates. For experience, 51.2% of auditors is from 5 to less than 10 years. It can be seen that the surveyed respondents are qualified and experienced auditors. This ensures highly reliable answers.

4.2Testing of reliability and descriptive statisticsIt can be seen in Table 1 that Cronbach Alpha coefficients of variables reach greater than 0.6, and correlation coefficients are greater than 0.3 showing that the reliability of items is ensured. The mean of the dependent and independent variables are greater than 3.5; Std.Deviation value is relatively low, ranging from 0.580 to 0.887. Values of Skewness range between −1 to 1 indicating that the observed variables are normal distribution (Hair et al., 2009).

Testing of reliability and descriptive statistics.

| Items | Cronbach's Alpha | Corrected Item-Total Correlation | Cronbach's Alpha if Item Deleted | Mean | Std. Deviation | Skewness |

|---|---|---|---|---|---|---|

| Capacity of auditor (CA) | ||||||

| CA1 | 0.807 | 0.655 | 0.742 | 4.30 | 0.778 | −0.907 |

| CA2 | 0.644 | 0.748 | 4.31 | 0.795 | −0.954 | |

| CA3 | 0.585 | 0.775 | 4.35 | 0.778 | −0.983 | |

| CA4 | 0.607 | 0.765 | 4.32 | 0.809 | −0.980 | |

| Job pressure on auditor (JP) | ||||||

| JP1 | 0.855 | 0.676 | 0.823 | 3.75 | 0.796 | −0.261 |

| JP2 | 0.686 | 0.820 | 3.74 | 0.772 | −0.134 | |

| JP3 | 0.640 | 0.832 | 3.73 | 0.775 | −0.095 | |

| JP4 | 0.660 | 0.827 | 3.71 | 0.752 | −0.079 | |

| JP5 | 0.680 | 0.822 | 3.69 | 0.789 | −0.102 | |

| The support of information technology (IT) | ||||||

| IT1 | 0.858 | 0.672 | 0.830 | 4.09 | 0.732 | −0.493 |

| IT2 | 0.646 | 0.835 | 4.13 | 0.741 | −0.551 | |

| IT3 | 0.690 | 0.826 | 4.11 | 0.752 | −0.514 | |

| IT4 | 0.620 | 0.840 | 4.16 | 0.624 | −0.206 | |

| IT5 | 0.634 | 0.837 | 4.18 | 0.716 | −0.554 | |

| IT6 | 0.629 | 0.838 | 3.70 | 0.789 | −0.102 | |

| Competitive capability of audit firms (CF) | ||||||

| CF1 | 0.850 | 0.725 | 0.803 | 4.02 | 0.840 | −0.963 |

| CF2 | 0.684 | 0.821 | 4.05 | 0.816 | −0.683 | |

| CF3 | 0.679 | 0.823 | 4.03 | 0.819 | −0.776 | |

| CF4 | 0.703 | 0.814 | 4.08 | 0.760 | −0.758 | |

| Audit fee (AF) | ||||||

| AF1 | 0.803 | 0.621 | 0.751 | 3.62 | 0.857 | −0.394 |

| AF2 | 0.606 | 0.759 | 3.58 | 0.887 | −0.358 | |

| AF3 | 0.600 | 0.761 | 3.59 | 0.876 | −0.304 | |

| AF4 | 0.640 | 0.742 | 3.56 | 0.856 | −0.373 | |

| Client's risk (CR) | ||||||

| CR1 | 0.833 | 0.649 | 0.794 | 3.90 | 0.803 | −0.516 |

| CR2 | 0.689 | 0.776 | 3.51 | 0.811 | −0.128 | |

| CR3 | 0.655 | 0.792 | 3.92 | 0.797 | −0.839 | |

| CR4 | 0.653 | 0.793 | 3.46 | 0.803 | −0.280 | |

| The application of RBA (RBA) | ||||||

| RBA1 | 0.849 | 0.685 | 0.809 | 3.71 | 0.580 | −0.650 |

| RBA2 | 0.656 | 0.822 | 3.70 | 0.611 | −0.334 | |

| RBA3 | 0.728 | 0.790 | 3.74 | 0.597 | −0.237 | |

| RBA4 | 0.682 | 0.810 | 3.75 | 0.586 | −0.737 | |

| The quality of independent audit (QIA) | ||||||

| QIA1 | 0.827 | 0.644 | 0.786 | 3.73 | 0.597 | −0.384 |

| QIA2 | 0.648 | 0.784 | 3.72 | 0.624 | −0.357 | |

| QIA3 | 0.656 | 0.781 | 3.77 | 0.621 | −0.087 | |

| QIA4 | 0.664 | 0.777 | 3.74 | 0.636 | −0.373 | |

Source: data processed.

Performing exploratory factor analysis (EFA) for independent variables, the result of KMO test in Table 2 is 0.869 and Sig. value is of 0.000 < 5%, illustrating that EFA is suitable for the data. As seen in Table 3, the cumulative percentage value (55.474%) is higher than the recommended critical value of 50%. The observed variables are divided into 6 groups. The specific factor loadings are also presented in Table 3.

Rotated Component Matrix.

| Component | ||||||

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | |

| IT3 | 0.785 | |||||

| IT5 | 0.742 | |||||

| IT1 | 0.729 | |||||

| IT6 | 0.703 | |||||

| IT2 | 0.648 | |||||

| CF1 | 0.839 | |||||

| CF2 | 0.788 | |||||

| CF3 | 0.768 | |||||

| CF4 | 0.745 | |||||

| IT4 | 0.514 | 0.569 | ||||

| JP2 | 0.764 | |||||

| JP5 | 0.750 | |||||

| JP3 | 0.719 | |||||

| JP1 | 0.710 | |||||

| CR2 | 0.798 | |||||

| CR3 | 0.742 | |||||

| CR4 | 0.714 | |||||

| CR1 | 0.706 | |||||

| AF4 | 0.735 | |||||

| AF1 | 0.729 | |||||

| AF3 | 0.704 | |||||

| AF2 | 0.661 | |||||

| CA1 | 0.763 | |||||

| CA2 | 0.747 | |||||

| CA4 | 0.677 | |||||

| CA3 | 0.663 | |||||

| CA1 | 0.763 | |||||

| Cumulative percentage value of 55.474% | ||||||

Source: data processed.

In Table 3, the variable IT4 belongs to two factors, so the variable is rejected. Rerunning EFA, the results in Appendix B show that KMO value is of 0.866, Sig. = 0.000 (< 0.05). As a result, the observed variables are correlated with each other in the whole. The cumulative percentage value is equal to 54.718% (> 50%), which proves that 54.718% of data variation is explained by 6 factors.

For two dependent variables in Table 4, KMO and Bartlett's Test are > 0.5, Sig. value is 〈 0.05. Total variance explained is 〉 50% and factor loadings are > 0.7 which is explained by one factor. Factor analysis is suitable for dependent variables.

4.4Confirmatory factor analysisThe results in Fig. 3 show that indicators in Model Fit are good. Chi-Square/df =1.243<2, GFI = 0.931> 0.9, CFI = 0.981> 0.95, RMSEA = 0.026 〈0.03, PCLOSE = 1.000 〉 0.05 as indicated in the literature (Hair et al., 2009; Hu & Bentler, 1999). As a result, the model matches the data.

As seen in Table 5, CR values are greater than 0.7 and AVE values are greater than 0.5, so the scales are guaranteed convergence. The square root of AVE is greater than the correlation between variables as well as MSV values are < AVE, so discriminant is guaranteed.

Reliability, convergent validity, and discriminant validity.

| CR | AVE | MSV | JP | IT | CF | CR | AF | CA | |

|---|---|---|---|---|---|---|---|---|---|

| JP | 0.855 | 0.542 | 0.203 | 0.736 | |||||

| IT | 0.84 | 0.513 | 0.203 | 0.451*** | 0.716 | ||||

| CF | 0.856 | 0.597 | 0.143 | 0.261*** | 0.312*** | 0.773 | |||

| CR | 0.833 | 0.555 | 0.143 | 0.101 | 0.264*** | 0.378*** | 0.745 | ||

| AF | 0.803 | 0.505 | 0.145 | 0.381*** | 0.343*** | 0.328*** | 0.209** | 0.711 | |

| CA | 0.808 | 0.513 | 0.193 | 0.314*** | 0.439*** | 0.277*** | 0.249*** | 0.294*** | 0.716 |

Source: data processed.

In Fig. 4, indicators including Chi-Square/df = 1.241< 2, GFI =0.909 > 0.9, CFI = 0.977 > 0.95, RMSEA= 0.26 〈 0.03, PCLOSE = 1.000 〉 0.05, point out that the model is suitable as demonstrated in the literature (Hair et al., 2009; Hu & Bentler, 1999).

Table 6 indicates that audit fee has no relationship with quality of independent audit because of p-value of 0.476 > 0.05. All remain hypotheses are supported (P-value 〈 0.05, estimate values 〉 0).

Results of hypothesis test.

| Estimate | S.E. | C.R. | P | Label | |||

|---|---|---|---|---|---|---|---|

| RBA | <— | CA | 0.188 | 0.044 | 4.261 | *** | H1a Supported |

| RBA | <— | JP | 0.111 | 0.041 | 2.703 | 0.007 | H2a Supported |

| RBA | <— | IT | 0.143 | 0.046 | 3.086 | 0.002 | H3a Supported |

| RBA | <— | CF | 0.164 | 0.036 | 4.584 | *** | H4a Supported |

| RBA | <— | AF | 0.086 | 0.038 | 2.278 | 0.023 | H5a Supported |

| RBA | <— | CR | 0.199 | 0.037 | 5.324 | *** | H6a Supported |

| QIA | <— | CA | 0.112 | 0.044 | 2.542 | 0.011 | H1b Supported |

| QIA | <— | JP | 0.097 | 0.040 | 2.404 | 0.016 | H2b Supported |

| QIA | <— | IT | 0.118 | 0.045 | 2.600 | 0.009 | H3b Supported |

| QIA | <— | CF | 0.089 | 0.036 | 2.475 | 0.013 | H4b Supported |

| QIA | <— | AF | 0.026 | 0.036 | 0.713 | 0.476 | H5b Not Supported |

| QIA | <— | CR | 0.105 | 0.039 | 2.722 | 0.006 | H6b Supported |

| QIA | <— | RBA | 0.441 | 0.089 | 4.952 | *** | H7 Supported |

Source: data processed.

Auditing with RBA has become popular in developed countries but the topic is new in developing countries such as Vietnam. Therefore, this study was conducted to identify factors influencing RBA implementation and the quality of independent audit in Vietnam. The research results indicate that six factors have positive relationships with the level of applying the RBA and the quality of independent audit, including: capacity of auditor, job pressure on auditor; the support of IT; competitive capacity of audit firms; audit fees and client's risks. This result is similar to the findings discovered by previous studies such as Al-Khaddash, Al Nawas and Ramadan (2013), and Danescu and Chira (2014). However, it is important to note the impact of factors on the level of RBA application, and independent audit quality. Based on the Estimate coefficient in Table 6, the impact level of the factors on RBA application in the descending trend is arranged as follows: client's risks (0.199), capacity of auditor (0.188), competitive advantage of audit firms (0.164), the support of IT (0.143), job pressure on auditor (0.111), and audit fee (0.086). The gradual influence of the factors on audit quality is as follows: RBA (0.441), the support of IT (0.118), capacity of auditor (0.112), client's risks (0.105), job pressure on auditor (0.097), and competitive advantage of audit firms (0.089). With these results, some points need to be discussed:

In literature as well as practice, it has been showed that the capacity of auditors is one of decisive factors influencing on the audit quality (Boon et al., 2008; Do, 2015). Furthermore, performing an audit under RBA requires auditors to make more professional assessments of what is considered important and unimportant to related parties. In this way, auditors are highly qualified and develop more in-depth knowledge about clients (Curtis & Turley, 2007; Kutum et al., 2015). Accordingly, it is not surprising that the research findings also point that the auditor's capacity has the strongest impact on the audit quality.

The application of information technology to audit activities is an indispensable trend, while businesses increasingly rely on computer systems to record, trace, and process transactions. This is reason why information technology has the second strongest influence on RBA implementation as well as audit quality. This result is in line with findings from studies of Nazmi et al. (2017), Van Buuren et al. (2014), and Tarek et al. (2017).

Interestingly, the competitiveness of audit firms has the strong influence on the performance of RBA but has the weak audit quality. The reason behind the positive relationship is that audit firms have competitive advantages such as large-scale, reputation as well as trained and provided adequate guidance documents to implement RBA (Phua et al., 2011). As a result, they should have ability to apply RBA more competently and thoroughly than other audit firms.

Audit fee is also considered as positive factors affecting RBA implementation. This study contradicts the view of Bell, Landsman and Shackelford (2001), and Curtis and Turley (2007) that the audit implementation by RBA does not reduce but instead increases audit fee. This explains why in Vietnam, RBA is not performed by small audit firm. Audit fee has no relationship with audit quality that is in line with studies of Choi et al. (2006), Mawutor et al. (2019), but is opposition with studies of Defond and Zhang (2014), Tobi et al. (2016), and Abdul-et al. (2017).

Client's risk has the strongest impact on RBA application but insignificant audit quality. In Vietnam, the majority of clients are small and medium-sized with poor internal management and control systems. Therefore, in most cases, the risk assessment results of clients are high and thus substantive testing remains or even increases. In other words, customer risk does not change the audit procedures (Le & Nguyen, 2020).

The research results also find a significant influence of RBA application on the audit quality. However, for optimal audit quality, it is necessary to consider ways of implementing RBA with different clients. Kutum et al. (2015) state that narrowing or expanding RBA depends on assessing business risks of clients with different sizes. According to Andersen (2006), small audit firms often audit small-scale clients, and require less complex audit procedures. In contrast, large firms are more likely to audit large-scale clients with more business risks, which require more complexly procedures. Robson, Humphrey, Khalifa and Jones (2007) realize that RBA are a good method but changes and adjustments are needed when auditing small customers.

6ConclusionResults of the study indicate that in order to carry out an audit with quality and efficiency by RBA, auditors and audit firms in Vietnam need to consider the following suggestions:

Firstly, improving the auditor's capacity. Unsurprisingly, audit capacity has always been identified by many studies as a factor that has an important influence on RBA application as well as audit quality. Therefore, the recommendation is first made for the auditors themselves. Especially in a current integrated economy and technology, besides efforts to learn knowledge and professional qualifications, auditors must strive to improve foreign languages and information technology. On the other hand, the development of human resources is also greatly affected by the policies of audit firms in all stages: recruitment, training, management, and evaluation. Specifically, at the recruitment stage, policies must have a clear roadmap and focus on candidates with high levels of education and technology. At the training stage, it is necessary to provide programs regularly based on RBA commensurate with the modern information technology, and maintain the funding in both short and long term. Finally, KPIs performance measurement system is implemented at the stage of management and evaluation.

Secondly, applying RBA in information technology. Changes in procedures for processing, summarizing, and presenting information on financial statements in the context of information technology development require auditors to research and improve RBA. Moreover, audit firms need to invest in developing technology and equipping modern audit tools for auditors such as using high-tech audit software, sampling support software, analysis software, and security and storage software of customer data, etc. With the advantage of data processing speed, the software will help to improve the quality and efficiency of the audit, meet the requirements, and increase the trust level of clients.

Thirdly, enhancing competitiveness. Recognizing the importance of competitiveness for auditing activities, audit firms need to build a reasonable short-term and long-term business strategy, improve corporate governance capacity, gradually build brand, build corporate culture, and create reputation in the market. It is necessary to expand cooperation with foreign audit firms to gain experience and access advanced audit methods and technologies.

Fourthly, establishing a reasonable audit fee bracket. In order to enhance the openness, transparency and healthy business environment, it is necessary to have regulations on audit fee, which is publicized and quantified. From our viewpoint, the audit firms set the audit fee according to supply and demand relationship, but must ensure that it is calculated on the reasonable costs and professional ethics. At the same time, the registration of fee schedule with the Ministry of Finance, and VACPA help audit firms to manage and act as a basis for handling unfair competition.

Fifthly, adjusting RBA. According to Robson et al. (2007), and Khalifa et al. (2007), using RBA may not be beneficial for small-scale clients. Abdullatif and Al-Khadash (2010) conclude that business risk approach may be appropriate in principle, but the nature and weight of the risks evaluated have difference among environments. Similarly, a partial revision of RBA focus on clients of small and medium enterprises and the ability to tailor audits to the client's industry (Kutum et al., 2015). This study also shows that the competitiveness of different audit firms and the risk level of different customers also affect the implementation of RBA. From the above points, it can be seen that adjusting RBA is very necessary to suit the size of the audit firms and clients.

Finally, reducing job pressure. In audit activities, exposing to tangible and intangible pressures is unavoidable for auditors. However, the pressures can be controlled and reduced if auditors know how to arrange work in a scientific way, always upbeat and improve physical health. In addition, audit firms need to implement incentive and remuneration policies to increase motivation and satisfaction at workplace, create a friendly environment for auditors to exchange, learn, and share experiences.

FundingThis research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author contributionsLe and Nguyen conceived the study and were responsible for the design and development of the data analysis. All authors were responsible for data collection, analysis, and interpretation. Le and Nguyen wrote the first draft. Le edited the article.

Disclosure statementThe authors declare no conflict of interest.

| Item | Description | Sources |

|---|---|---|

| Capacity of auditor (CA) | ||

| CA1 | Professional auditors contribute to the efficiency of the audit process based on RBA. | Curtis and Turley (2007), Sardasht and Rashedi (2018), Moroney and Simnett (2009), Low (2004) |

| CA2 | Qualified auditors perform the RBA better than less qualified auditors. | |

| CA3 | Experienced auditors perform the RBA better than less experienced auditors. | |

| CA4 | Auditors have extensive knowledge of clients contribute to the efficiency of the audit process based on RBA. | |

| Job pressure on auditor (JP) | ||

| JP1 | The regulations of Government and Professional organizations pressure on auditors when conducting RBA. | Margheim et al. (2011); Umar et al. (2017); Interview experts |

| JP2 | The regulations of audit firm pressure on auditors when conducting RBA. | |

| JP3 | Demand of customers pressure on auditors when conducting RBA. | |

| JP4 | Expectations of users of audit results pressure on auditors when conducting RBA. | |

| JP5 | Audit time deadline pressure on auditors when conducting RBA. | |

| The support of information technology (IT) | ||

| IT1 | IT contributes in increasing the efficiency of RBA. | Bierstaker et al. (2001), Nazmi et al. (2017) |

| IT2 | The auditor design and implement appropriate control tests when using the computer in RBA. | |

| IT3 | The computer and its programs contribute in the method of selection of statistical sampling in RBA. | |

| IT4 | The computer and its programs contribute on using the analytical procedures in RBA. | |

| IT5 | The computer and its programs contribute in reducing the Inherent risk, control and Detection risk. | |

| IT6 | The auditor must be familiar with computer components and database related to RBA. | |

| Competitive ability of audit firms (CF) | ||

| CF1 | Large-scale audit firms perform the RBA better than small scale audit firm. | Phua et al. (2011), Berry et al. (1989), Lennox (1999), Shu (2000) |

| CF2 | The more reputation audit firm, the better it perform the RBA. | |

| CF3 | The larger market share audit firm, the better it perform the RBA. | |

| CF4 | The larger trademark audit firm, the better it perform RBA. | |

| Audit fee (AF) | ||

| AF1 | Performing the RBA leads to increased auditor fee` | Nazmi et al. (2017), Abdul-Rahman et al. (2017), Alaraji et al. (2017), Mawutor et al. (2019) |

| AF2 | The increase in audit fee encourages auditor more depth on RBA. | |

| AF3 | High audit fee leads to increase the quality of audit. | |

| AF4 | Reducing audit fee leads to reduced audit procedures. | |

| Client's risk (CR) | ||

| CR1 | The RBA is used more extensively when auditors assess the client's business risk is high. | Johnstone et al. (2004), Abdallah et al. (2015) |

| CR2 | The RBA is used more extensively when auditors assess inherent risk is high. | |

| CR3 | The RBA is used more extensively when auditors assess control risk is high. | |

| CR4 | The RBA is used more extensively when auditors assess IT system risk is high. | |

| The application of RBA (RBA) | ||

| RBA1 | To identify and assess client business risk | Allaham et al. (2017), Mawutor et al. (2019), Nazmi et al. (2017), Interview experts |

| RBA2 | To identify and assess the risks of material misstatement | |

| RBA3 | To response to assessed risks of material misstatement | |

| RBA4 | To give an opinion after handling to assessed risks of material misstatement | |

| Quality of independent audit (QIA) | ||

| QIA1 | Providing valuable audit reports | Alaraji et al. (2017) |

| QIA2 | Bringing satisfaction to customers | |

| QIA3 | Giving confidence for using the audit results | |

| QIA4 | Improving audit quality | |

| Component | ||||||

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | |

| JP2 | 0.763 | |||||

| JP5 | 0.755 | |||||

| JP3 | 0.726 | |||||

| JP1 | 0.716 | |||||

| JP4 | 0.700 | |||||

| IT3 | 0.754 | |||||

| IT6 | 0.722 | |||||

| IT1 | 0.721 | |||||

| IT5 | 0.696 | |||||

| IT2 | 0.665 | |||||

| CF1 | 0.819 | |||||

| CF4 | 0.763 | |||||

| CF2 | 0.743 | |||||

| CF3 | 0.740 | |||||

| CR2 | 0.802 | |||||

| CR3 | 0.743 | |||||

| CR4 | 0.718 | |||||

| CR1 | 0.706 | |||||

| AF4 | 0.736 | |||||

| AF1 | 0.729 | |||||

| AF3 | 0.705 | |||||

| AF2 | 0.662 | |||||

| CA1 | 0.766 | |||||

| CA2 | 0.752 | |||||

| CA4 | 0.679 | |||||

| CA3 | 0.661 | |||||

| KMO value of 0.866 | ||||||

| Cumulative percentage value of 54.718% | ||||||

Source: data processed.