The automotive industry is undergoing a profound transformation in its transition to production of electric vehicles. This paper seeks to examine the main transformations taking place in global value chains in the automotive industry as a result of this transition. The analysis follows a multiple case study methodology based on a theoretical approach that seeks to address the research question and purpose.

The main findings of this research focus on three dimensions of GVCs. First, this transition increases competition among assembly plants at the intra-group level for the awarding of new models. Second, it continues to reconfigure supply chains, threatening the viability of certain traditional providers of components and giving rise to new players – battery manufacturers – that may challenge the chain hierarchy. Third, the transition to electric vehicles has led to a reduction in employment volume in the chain as a whole. Because the transition is ongoing, it will continue to pose significant challenges for multiple actors involved in the automotive industry.

The transition to electric vehicles has major economic, social, and environmental implications (Mönnig et al., 2019; Galgóczi, 2020) and is essential for addressing both current and future energy and climate crises, given that road transport is among the activities that most contribute to climate change, accounting for some 16 % of global emissions (IEA, 2023). This process of transformation necessarily affects the overall automotive sector, which has been central in industrialized economies in terms of contributions to GDP, volume of employment, and significant interconnections with other sectors of activity (Mohammad & Shavarebi, 2019; López-Calle et al., 2020).

Over the last years, the automotive sector has been progressively moving toward the production of electric vehicles. In 2022, sales of electric vehicles exceeded 10 million units, representing a threefold increase in just two years. Over 26 million electric cars were on the road in 2022, or more than five times the total in 2018. Although electric vehicles still account for only 2.1 % of the global vehicle stock, data show that the process of electrification has been strongly accelerating (IEA, 2023). The most dynamic markets are mainly concentrated into three regions: China, Europe, and the United States (Sanguesa et al., 2021). In all three regions, public policies are being promoted to boost the electrification of the sector (Pichler et al., 2021; Wu et al., 2021). In addition, public institutions are also making efforts to accelerate the transition through increasingly stringent regulatory pressures on CO2 emissions (Szász et al., 2021).

This deeply relevant process of change in the automotive industry will furthermore bring about significant alterations across multiple dimensions of the sector's global value chains (GVCs). While still relatively incipient, the transition has generated over the past decade increasing interest within the academic literature. The primary avenues for research in the domain of electric vehicles are centered on the analysis of technical issues related to new vehicle components, especially those associated with the electric battery. Other work focuses on the dimensions of energy efficiency and reduction of emissions. As regards value chains, the focus is primarily on the importance of raw materials required to provision new vehicles, the sustainability of the supply chain, and the recycling of components (Soares et al., 2023; Yao et al., 2023; Barbosa et al., 2022; Pinto et al., 2021).

Nevertheless, a systematic approach to the impacts that this transition may have on the configuration of global value chains in the sector has been somewhat underdeveloped. This approach would include issues such as governance within GVCs, the entry of new actors into the industry, or the effects that the transition could have on production and employment. As Jacobides et al. (2016) highlights, in disruptive processes of transition, leading actors strive to define the industrial architecture that their sector will adopt, aiming to control how value is generated and captured. Part of the academic literature indicates that we are presently in a moment of significant uncertainty around which technologies will prove dominant, how different actors in the chain will reposition themselves, and the diverse trajectories that electrification may adopt in different manufacturers and regions (Pérez-Moure et al., 2023; Teece, 2018; Altenburg et al., 2016). In this paper, our interest lies in addressing the following research question:

RQ. How is the transition to electric vehicles impacting GVCs in the automotive industry?

The main contribution of this research is to answer our question by proposing a multilevel analysis focused on various dimensions of GVCs, incorporating pertinent elements from a multidisciplinary perspective including business management, governance of GVCs, and industrial design and organization. In order to answer the research question, we focus on how this transition may be impacting on three specific dimensions: competition among assembly plants for the allocation of new models; the exit of old and entry of new actors into the GVC and the subsequent impact on the governance of GVCs; and employment.

For this purpose, we will address some existing debates in academic literature. Regarding governance in the GVCs of the automotive sector, the debate on whether major suppliers may be challenging the leadership of carmakers has been revitalized with the entry of new actors linked to the production of key components for electric vehicles (Lampón & Muñoz-Dueñas, 2023; Bridge & Faigen, 2022). Likewise, there is also concern about how this electrification process affects the modular conception of the vehicle (Lampón, 2022). And related to this, there are also considerations about the impact the change in vehicle design can have on the competition among assembly plants and employment (López-Calle et al., 2020; Lefeuvre & Guga, 2019). All these issues are theoretically discussed in this research and will be analyzed through a case study of two particular GVCs.

The article is structured as follows. The second section offers a review of the literature focused on analyzing the transition to electric vehicles from the viewpoints of governance of GVCs, product architecture, and the productive model. Based on this review, we accurately outline the dimensions through which to answer our research question. The third section describes our research methodology, and the fourth section presents our analysis linked to the case study following the conceptual scheme derived from the literature review. The results of the research are presented in the fifth section. Finally, a discussion and some practical implications are provided in section six.

2Literature review: governance, industrial organization, and management of automotive GVCs in the transition to electrification2.1Governance of GVCs in the automotive industryGovernance within GVCs can be defined, as by Dallas et al. (2019: 667), “as the actions, institutions and norms that shape the conditions for inclusion, exclusion and mode of participation in a value chain, which in turn determine the terms and location of value addition, distribution and capture.” Taking a general perspective, authors such as Milberg and Winkler (2013), Rikap (2018), and Durand and Milberg (2020) emphasize the power deriving from the monopoly enjoyed by large transnational companies over technology and innovation, which allows them to strongly condition how chains are organized.

In the automotive industry, the traditional model of GVC governance is often represented as a pyramidal structure with the center of power at the top (i.e., with the carmaker); from here emanate the strategic and control decisions that then cascade through various levels of supply (Frigant, 2011; Frigant & Zumpe, 2014; Paz et al., 2022). This pyramidal model has been questioned by some who see certain (mainly first-level) providers increasing their hierarchical position after having developed strengths in key areas such as technology and in a high degree of market concentration, both of which improve their bargaining power against carmakers (Frigant, 2011; Sturgeon & Memedovic, 2011; Raj-Reichert, 2019). This questioning of the traditional model of governance has been exacerbated during the transition to the electric vehicle with the development of new key components and technologies, in particular the electric battery (Sanguesa et al., 2021: 382; IEA, 2022). While traditional component suppliers emerged due to outsourcing processes instigated by carmakers, the new range of components and technologies associated with electromobility are foreign to the sector, necessitating recourse to new suppliers and blurring the industry's erstwhile boundaries (Murmann & Schuler, 2023; Whittle et al., 2019; Szalavetz, 2022a).

In the electric vehicle, the battery pack is a key component (Küpper et al., 2020). Due to its inherent complexity, the technological skills, innovation, and knowledge available to suppliers of this component can afford them significant status within the framework of vehicle production chains. As Jetin (2020: 159) puts it, only those who develop battery production locally will have the opportunity to lead the electric vehicle market. Currently, the battery production sector worldwide follows an oligopolistic market structure, with a geographic concentration in Asia of the main suppliers (Geröcs & Pinkasz, 2019: 185). Major Chinese suppliers (such as Envision AESC, BYD, and CATL), Japanese suppliers (such as Panasonic), and Korean companies (SK Battery/SK Innovation, Samsung SDI, and Energy Solution LG) together account for the lion's share of the global market. These new players wield a high degree of control and decision-making power over these new technologies and have changed the asymmetrical dependence on traditional leading buyers in the automotive industry value chain (Lampón & Muñoz-Dueñas, 2023). Faced with this challenge, traditional carmakers are attempting to acquire skills and knowledge and to penetrate the battery sector through alliances with these new suppliers and the creation of jointly owned gigafactories (Bridge & Faigen, 2022).

The first features to highlight in the current configuration of GVCs reside in the power held by the parent companies of carmakers and the growing influence of battery suppliers (heretofore alien to the automotive sector, but whose technology can be acquired). The power of carmakers manifests in their ability to design and organize the industrial architecture and the productive model of the value chain.

2.2Product architecture in the automotive industryWithin the framework of fragmented and geographically decentralized production, articulated and coordinated through global value chains, the concept of product architecture carries weight in this impact analysis of the transition toward electric vehicles. Currently prevailing are two models of product architecture linked to distinct design requirements. In integral architecture, the design of each element of a product (here a vehicle) must be adjusted to fit with other elements. Thus the many product parts and interfaces for connection must adhere to a certain specificity, to suit the integral product as a whole. In a modular conception, on the other hand, the product design consists of diverse modules or subsystems that are structurally and functionally independent from each other. These can be combined in various ways to permit greater product variety, with the intention of sharing an increasing percentage of common parts (Baldwin & Clark, 2000; Jetin, 1999; Fujimoto, 2007; Doran et al., 2007; Gauss et al., 2019).

The design of the vehicle therefore determines how the production processes and the supply chain of components will be organized. The concept of chain architecture refers to all coherent relationships that must be maintained throughout product design, production processes, and the supply chain – i.e., the system of relationships between production centers (Takeishi & Fujimoto, 2003; Pashaei & Olhager, 2017). The form adopted by the chain architecture is strongly conditioned by the design of the product at both the conceptual and functional levels, so that significant design changes can have a considerable impact on the other dimensions comprising the chain architecture.

The major manufacturers in the automotive sector processes since the 1990s to develop processes of outsourcing and modularization, thereby shaping the industry's current configuration. This has conditioned how vehicles are designed and manufactured as well as how production processes are organized (Jacobides et al., 2016). The resultant production model has been characterized by the aggregation of parts and components that comprise a vehicle, these being introduced into the chain in a sequenced and synchronized manner in line with the model of logistics management based on the ‘Just in Time’ method (Fujimoto & Takeishi, 2001; Fredriksson, 2006; MacDuffie, 2013). First, the vehicles are designed on platforms – the basic support on which assembly occurs, incorporating elements such as the chassis, the engine supports, the steering box, and the rear and front suspension points (Lampón et al., 2017a). Since the early 2010s, a new generation of modular platforms began to be developed in the industry allowing the technical infrastructure on which the vehicle is assembled to adopt different dimensions, albeit from the same base of common components (Lampón et al., 2017b; CEPAL, 2019). Implementation of modular platforms in assembly phases provides versatile and multipurpose technical facilities within final-assembly plants, which are capable of producing a wide variety of models on relatively standardized yet flexible infrastructures.1 Thus, modularization favors the operational flexibility to transfer and share manufacturing resources within the production network of each carmaker (Lampón et al., 2017b; Lampón & Rivó-López, 2021), and this consequently fosters an intensification of competition for the allocation of new models among plants of the same carmaker.

The transition to electric vehicles has been deepening the modularization of production with the development of new modular electric vehicle platforms, or MEVPs (Lampón, 2022). Compared to the internal combustion vehicle, the electric vehicle is simpler in design, with fewer parts and components and a higher proportion of electrical (rather than electro-mechanical) elements. The propulsion system of an internal combustion vehicle (mid-range model) is made up of an estimated 1400 parts or pieces, and approximately one-third of the total value of the automotive supply chain is generated by industry linked to the propulsion system alone. In contrast, the propulsion systems of electric vehicles contain around 200 parts and components – a reduction of 86 % compared to the conventional vehicle (Casper & Sudin, 2021: 127; Krzywdzinski, 2021).

Finally, another feature to highlight in the configuration of automotive GVCs within the framework of this transition is the increased standardization and simplicity of the electric vehicle with respect to the combustion vehicle. This furthers the modular approach to production, as a greater range of simpler and technically similar models can be produced on a smaller number of platforms. Some ways in which all of this has affected the model of productive organization are explored below.

2.3Productive model in the automotive industryAs mentioned, recent decades have seen a deepening trend toward outsourcing and modularization in the automotive industry (Jacobides et al., 2016). From a descriptive point of view, global production chains in the automotive industry are made up of a carmaker's headquarters, the manufacturer's own production network of assembly plants, and a chain or network of suppliers providing parts and components to the final plant. Assembly factories generally attend to four final phases of the manufacturing process: stamping, ironwork, painting, and assembly. At the same time, a complex network of suppliers is configured around the final production factory, which is spatially and operationally stratified, like a ‘spider's web’ with different nodes or levels of supply. At the first level of supply (Tier 1) are manufacturers of systems, sub-systems, parts, and finished components – all generally complex in terms of manufacturing, and each requiring high levels of technology. At higher levels of supply (Tier 2, Tier 3, etc.) simpler and standardized parts are manufactured before circulating ‘upstream’ into the chain. In this way, through various companies situated at consecutive supply levels, large modules are formed and presented for assembly in the final plant (Pashaei & Olhager, 2019; Lampón & Rivó-López, 2021).

As previously indicated, global value chains in the automotive industry have traditionally been led by the carmakers, the headquarters of which concentrate power over decision-making in a vast range of areas associated with the company's model of productive organization and, by extension, the production chain. According to Boyer and Freyssenet (2000), each manufacturer seeks to develop a corporate strategy to obtain profitability based on three elements: product-policy (price and product design), productive organization (technology and production methods), and the labor relations framework (the volume of employment and working conditions).

The transition to electric vehicles involves changes to the production organization model within the sector, as electric vehicles are simpler and require a reduced number of components for manufacture compared to traditional vehicles (Küpper et al., 2020). Indeed, many components associated with the internal combustion vehicle totally or partially disappear, including the engine and gearbox, exhaust systems and noise mufflers, and alternators and fuel pumps and their sensors (Dombrowski et al., 2011). At the same time, new vehicle modules have emerged that include batteries and electric motors as well as adapted transmission systems, brakes, water pumps, and steering systems (Klug, 2014). This gives rise to a threat of extinction for certain suppliers (Schwabe, 2020) and presents challenges for carmakers in response to the entry of new players (Szalavetz, 2022b).

Furthermore, changes in product design associated with the transition to electric vehicles and the consequent deepening of modularization can impact the corporate strategy of carmakers when trying to maximize profitability. Specifically, a reduction in the number of platforms on which a greater variety of vehicles can be designed increases competition among assembly plants of the same group for the awarding of new models. In other words, as the number of platforms on which models from the same group can be manufactured is reduced, the plants that can potentially opt for that same range of models is increased, which boosts competition between plants of the same group and, therefore, contributes to lowering costs in the manufacturer's production network (Rísquez, 2023).

The model of productive organization associated with the manufacture of electric vehicles generates pressure to adjust employment, not only in the network of assembly plants within the group but in the chain as a whole. On one hand, this intensification of competitive pressure emanating from changes in product-policy and productive organization affects the assembly plants and, from there, suppliers in the supply chain. In their search for cost reduction, the assembly plants must in turn put pressure on suppliers to reduce the costs of intermediate components (López-Calle et al., 2020). On the other hand, this transition is expected to decrease the net employment volume, stemming from both the long-term reduction in electric vehicle production and the shortening of the supply chain (Lefeuvre & Guga, 2019: 175; Pardi, 2021).

In sum, the deepening of modular production generates a trend toward homogenization and standardization of conditions in the sector, intensifying competition among carmakers as well as among plants within each group. In that context, labor conditions have been established as the main adjustment variable in terms of competitiveness (Paz & Ruiz-Gálvez, 2020).

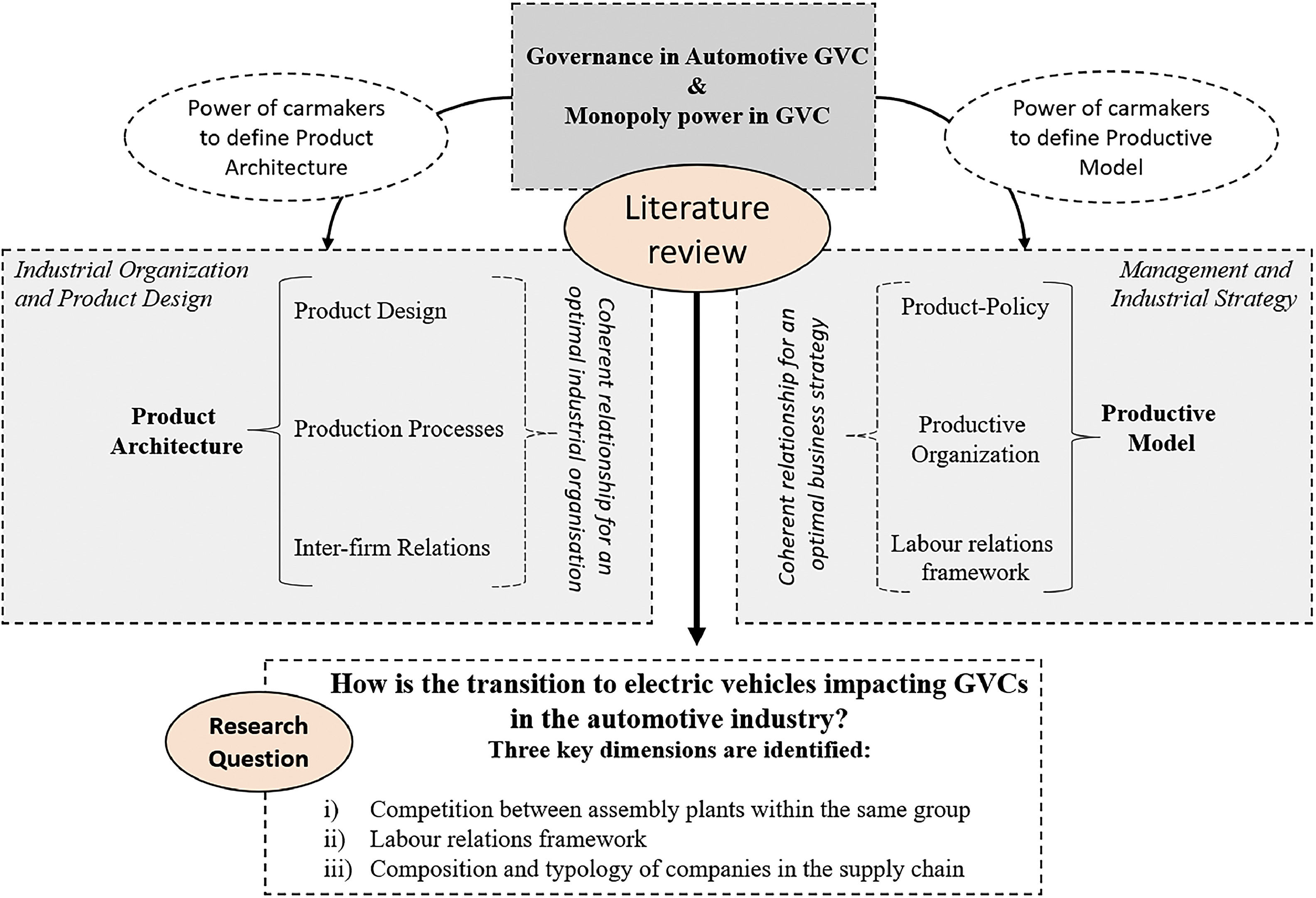

2.4Synthesis of the literature: some conjectures on the research questionBased on this review of the literature, we can identify which dimensions of the sector's GVCs are impacted by the transition to electric vehicles. We can also conjecture as to how these dimensions will change. Fig. 1 summarizes how the transition to electric vehicles affects GVCs in the automotive industry. Specifically, the carmakers possess the skills and ability to define the industrial architecture of the chains and the model of production organization, mainly through control over design and product-policy. According to the form that these elements adopt in the context of the transition to electric vehicles, certain implications are derived for intra-firm relations and for the labor relations framework. First, a simpler and more compact modular vehicle design intensifies competition between assembly plants of the same group for the awarding of new models. Second, this competitive pressure and the manufacture of a simpler vehicle have a negative impact on employment, for both the assembly plants and the enterprises that make up the supply chain. Third, both the volume of employment and the viability of some companies are threatened by the potential disappearance of suppliers dedicated to the production of components exclusive to the combustion vehicle.

3Research methodology3.1Multiple case studyTo answer our main research question, we have opted for a multiple case study methodology that allows us to identify specific elements characterizing the transition to electric vehicles by way of two assembly plants: Stellantis Galicia and VW Navarra. The multiple case study approach allows us to empirically corroborate similarities and differences and thus provide some analytical generalizations (Yin, 2009). We begin from an integrated multimodal approach that combines qualitative analysis techniques triangulated with statistical data obtained from various specialized sources. As suggested by Yin (2009), the approach to the research question and the focus of analysis on contemporary events favor this type of methodology, considered optimal in understanding ongoing phenomena (Goodrick, 2020).

The selection of these two plants is also pertinent, as both are leading factories in the Spanish automotive sector and represent a third of national production, employing almost 15,000 workers in their factories and generating jobs across the production sector for more than 20,000 people. VW Navarra has been a pioneer in the application of modular platforms, and its strategy toward electrification is currently leading the process in Spain. Stellantis, meanwhile, produces the most vehicles in Spain and is already among the plants assembling the greatest number of electric vehicles, although its strategy for electrification is distinct from that of the VW Group. Both cases are valuable in explaining the effects of this transformation process.

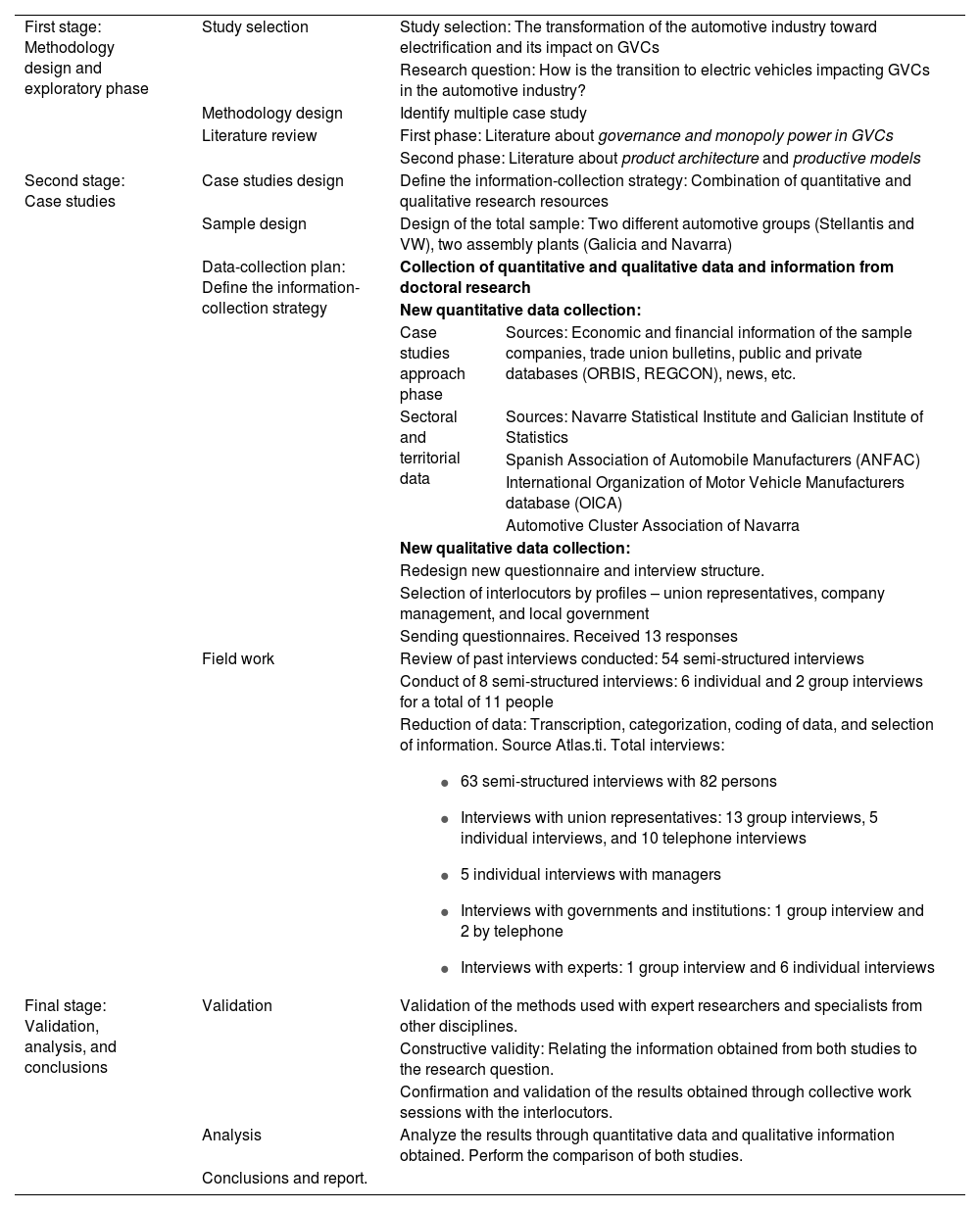

3.2Case study protocol and the collection of qualitative and quantitative dataThis research is a result of two doctoral investigations carried out within the framework of the same research group. After completion of their theses, the two authors have continued work on these case studies, adapting them to current problems. Both investigations have provided an excellent analytical foundation for our current research. For a better understanding of the complexity of this research, a summary can be found in Table 1.

Stages of research.

Source(s): Authors’ elaboration.

In the first phase, three fundamental tasks were undertaken. First, the possible lines of investigation arising from the doctoral research were proposed. We then delimited the research question and selected the multiple case study methodology. Next, we carried out the literature review in several phases, based on the two levels of the theoretical framework given in Fig. 1. Through prior work and this review, the key dimensions for focus of analysis were identified (see Fig. 1 inSection 2).

In the second phase, we approached the multiple case study through a methodology that combines qualitative data with quantitative data obtained from various statistical sources (Tashakkori & Teddlie, 2021). For this we compiled, classified, and processed information extracted from various statistical and documentary sources (academic literature and related works, official company documents, union bulletins, public and private databases, news reports), as explained in Table 1.

In parallel, we designed the structure of the interviews and questionnaires according to the people to be consulted and the interview format. Thanks to the union forces, we were able to gain access to the factories and thus carry out both the direct observation work and the interviews. We selected key informants with different profiles (union representatives, company managers, administration officials).

The sample design was planned with the key interlocutors, seeking to interview workers from different unions with different responsibilities and functions. An attempt was also made to select people of different ages. One of the main limitations was the difficulty in interviewing women, as female representation is scarce in the factories (we were able to interview only four). All those interviewed had previously been sent the questions and questionnaires.

For the initial research we undertook a total of six stays, three in Navarra (between 2015 and 2017) and three in Vigo, Galicia (between 2017 and 2019). During this period, we conducted 55 semi-structured interviews with 71 persons. More recently, in 2021 and 2022, in order to delve further into analysis of the most recent milestones in the transition to electric vehicles, we conducted another eight interviews – six individual and two in groups – for a total of eleven interviewees. Collation and comparison of information from the two studies afforded excellent triangulation of the research data (Yin, 2009)

In the final phase, we completed certain validation tasks and results analysis in order to arrive at our conclusions. This investigation remains open in response to ongoing changes still underway. A significant obstacle in the research has been the current uncertainty around the transition to electrification and changes in business strategies. This has compelled us to delve more deeply into interviews, search for new data, and select new interlocutors.

In summary, the literature review, our analysis of statistical and documentary sources, and the field work in two relevant territories have allowed us to analyze how the transition to electric vehicles has impacted the GVCs of the automotive industry. These elements allow a framework of general sectoral trends to be combined with our analysis of the two particular cases, thus enriching and reinforcing the argument and conclusions presented in the final section.

4Multiple case studyThrough our multiple case study, we have addressed the research question proposed in Section 1 following a structure derived from the literature review. In particular, we examine the impact of the transition to electric vehicles on two specific global value chains articulated around the assembly plants of Stellantis Galicia and VW Navarra. We focus analysis mainly on the three dimensions indicated in Section 2: i) competition between assembly plants; ii) the labor relations framework; and iii) the composition of the companies that comprise the supply chain.

4.1Changes to the global value chain serving the Stellantis Galicia plantThe Stellantis group emerged in 2021 as a result of the merger between the French group PSA and the Italian-American Fiat Chrysler Automobiles group, or FCA. The new Stellantis group is promoting an aggressive strategy of electrification of its vehicle fleet: in 2022, it presented its Dare Forward 2030 strategic plan with the goal of battery electric vehicles reaching 100 % of its sales in Europe and 50 % in the United States by the end of this decade (Stellantis, 2022). At the end of 2021, the group offered around 40 electrified models, many of them based on traditional combustion vehicles but designed on multi-energy modular platforms previously used by both PSA and FCA. In the short term, this group plans to significantly reduce the number of platforms on which it produces its entire fleet of electric models to only four: STLA Small, STLA Medium, STLA Large, and STLA Frame (Stellantis, 2021) Therefore, although prior to the merger between PSA and FCA each group had its own particular and differentiated fleet of models, the electrification process is set to increase the standardization and modularity of all models.

The Stellantis assembly plant located in Vigo (Galicia) is one of the group's most productive and profitable factories in Europe, with a high capacity: in 2023, the total output figure at the assembly plant in Vigo slightly exceeded half a million vehicles, marking a record in production. This is a ‘bi-flow’ assembly plant featuring one assembly line (M1) on the CMP multi-energy modular platform (where the Peugeot 301, Citroën C-Élysée, and Peugeot 2008 models are manufactured) and another (M2) on the EMP2 multi-energy modular platform manufacturing van-type vehicles (specifically the Citroën Grand C4 Spacetourer, Citroën Berlingo, Peugeot Rifter/Partner, Opel Combo, Toyota Proace City, and Fiat Dobló models). The Vigo factory produces electrified versions of all vehicles except the Peugeot 301, Citroën C-Élysée, and Citroën Grand C4 Spacetourer models.

The Vigo plant competes with the group's other plants in Europe with high production capacities. Specifically, in the production of vehicles based on the CMP platform, Vigo competes mainly with plants in Figueruelas (Spain), Poissy (France), Trnava (Slovakia), and, more recently, Kenitra (Morocco). In the manufacture of vehicles designed on the EMP2 platform, the Vigo factory competes with plants in Mulhouse and Sochaux (France) and to a lesser extent with Rennes (France), all with considerably lower production capacities (Rísquez, 2023).

Following the purchase of Opel and Vauxhall by the PSA Group in 2017 (previously comprised of Peugeot, Citroën, and DS) and the subsequent merger with FCA in 2021, the competition that the Vigo plant faces within the Stellantis group will surely increase. Now it will be competing with plants that have already produced similar models of the previous brands, mainly in Italy but also in the United Kingdom. Additionally, over the short term, the design of all electric vehicles of all brands will be exclusively unified onto the four aforementioned platforms (STLA Small, Medium, Large, and Frame), diluting the degree of differentiation in technical-productive specialization among assembly plants when awarding new production. The increased number of Stellantis group plants located in Europe and the reduction in platforms for electric model design will thus intensify competition for new vehicles between assembly factories.

For this carmaker, one wonders at the possible ‘cannibalization’ dynamic that may occur among a wide range of similar models from distinct brands following successive mergers, especially for certain demand segments in the medium and medium-to-low ranges.2 Traditionally, the assembly plant in Vigo was geared to exclusive production of van-type models such as the Peugeot Partner and Rifter. More recently, the Stellantis group has been making investments in the Ellesmere Port assembly plant in the United Kingdom (previously belonging to General Motors) to specialize in the commercial and passenger van product profile, but for entirely electric models. In this sense, the ‘electrification’ of assembly plants once specialized in the production of combustion vehicles requires heavy investment in modernization and adaptation of industrial infrastructure, as well as in the provision of a workforce with the requirements and qualifications necessary to produce the new vehicle – especially in terms of safety in the proper handling of high-voltage components such as batteries.

This context of standardization and convergence in the productive specialization of plants (with potential overcapacity) coupled with the high investments that the group must make to transition to electric vehicles may lead to a process of production restructuring (that is, resizing the productive network of the group's assembly plants in Europe). As a result of this transition to the electric vehicle, the Galician assembly plant now faces greater threats of competition within the group.

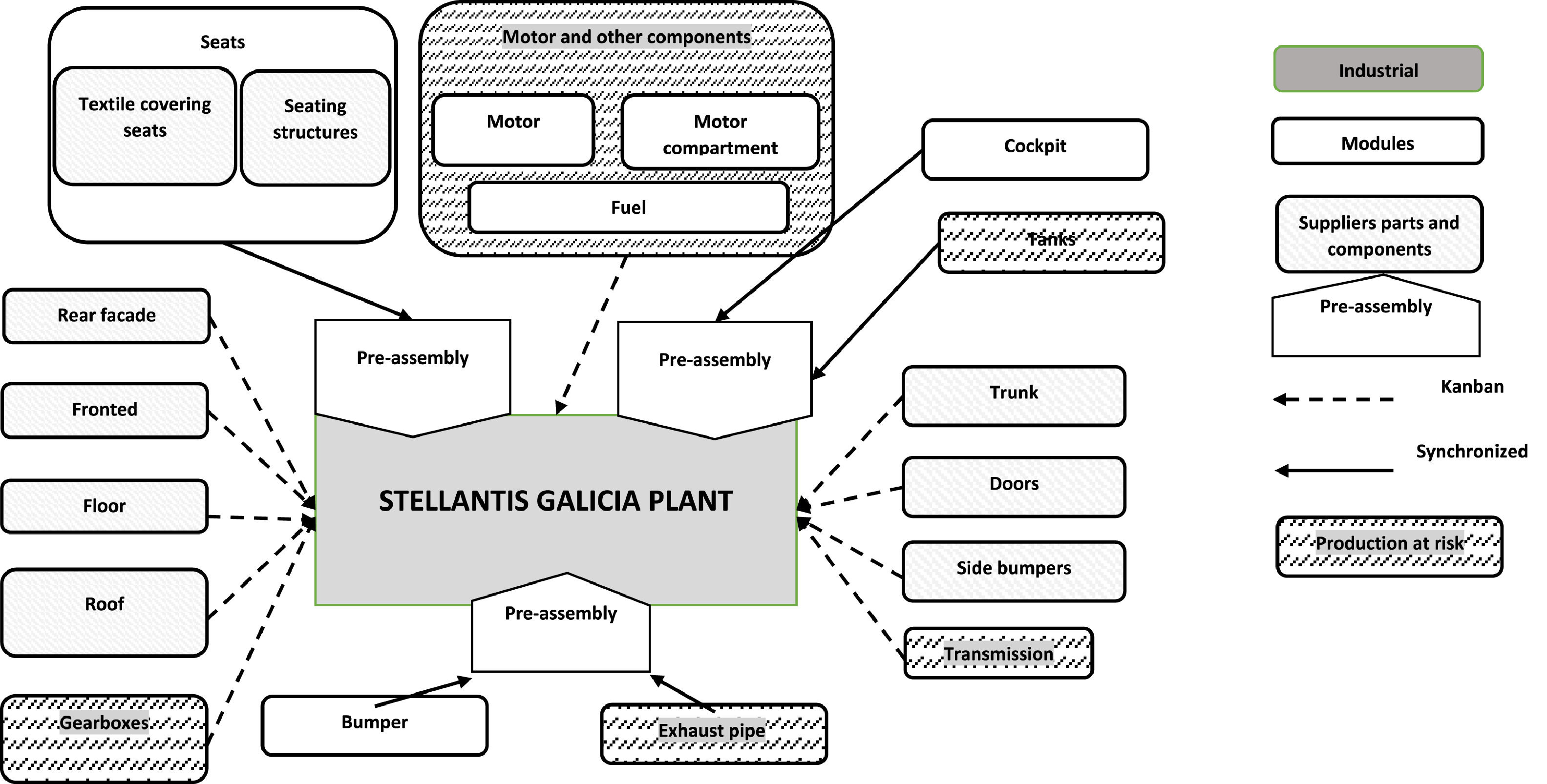

Beyond the assembly plant is the production supply chain for parts and components, a significant portion of which is located in proximity to the factory within the region of Galicia. This proximity of suppliers to the assembly plant has been a crucial factor in optimizing costs in the context of the ‘Just in Time’ system typical within the automotive industry. Fig. 2 in the Annex illustrates the production flows and companies that make up this supply chain, in this case for the manufacture of combustion models. In orange are those components and modules (and associated businesses) whose production in the context of electric vehicles would ostensibly disappear or else require adaptation or conversion.

Some components that together bring high added value to the vehicle (such as the engine, the transmission and gearboxes, the tanks and exhaust systems) are produced by large transnational companies located in Galicia and by other Stellantis group centers located in France. This group of companies will see production levels decrease as the transition to electric vehicles progresses, and these factories will face the challenge of readapting or reconverting their activity to the manufacture of relevant components. The battery – a new component that likewise represents high added value for the electric vehicle – has so far been supplied by manufacturers outside the European region. This is the case, for example, for batteries used in the Peugeot 2008-e model, provided by the Chinese company Contemporary Amperex Technology Co. Limited (CATL), or for batteries used in vans such as the Citroën e-Berlingo or the Peugeot Partner Tapee Electric, supplied by Lithium Energy Japan.

This implies not only a considerable loss of added value captured by the Stellantis group along the production chain but also the loss of control (technological, knowledge, etc.) over so crucial a component as the battery. However, the Stellantis group has recently located three battery manufacturing plants in Europe – in Douvrin (France), Kaiserslautern (Germany), and Térmoli (Italy) – by way of the Automotive Cells Company (ACC), a joint venture formed by Stellantis, Mercedes-Benz, and the French energy company Total Energies through its subsidiary SAFT, specialized in the production of batteries. Similar is the case of the electric motor previously supplied by Vitesco Technologies, a division of Germany's Continental. Here the Stellantis group is repositioning itself to join forces with the Japanese company Nidec to manufacture electric motors at the group's plant in Tremery (France), with additional plans locate an electric motor factory in Serbia. In short, the transition to the electric vehicle is altering the map of key players in the sector's global value chains, while large manufacturers such as the Stellantis group are seeking to reposition themselves by forging alliances with large transnational companies from other sectors of activity.

Lastly, this impact on the productive landscape resulting from the transition to electric vehicles in this chain will also affect employment. Reductions in the volume of employment are not only associated with the disappearance of certain companies currently dedicated to the manufacture of parts and components for combustion models; insofar as the electric vehicle features a simpler and more compact design and is comprised of significantly fewer of parts than the combustion vehicle, a smaller number of jobs will be required, not only in the suppliers but at the assembly factory itself. Through the information provided in the interviews, despite the plant achieving its production record in 2023, the employment volume (approximately 6000 workers) is currently at its lowest level in five years.

Likewise, as competition among assembly plants within the same group intensifies, there will also be increased pressure toward reducing the employment volume at the Vigo plant in order to bid for the awarding of new models. Indeed, Stellantis Vigo has normalized mechanisms of labor flexibility in recent years. By combining intensification of work with external flexibility tools such as Temporary Labor Force Adjustment Plans (known by the Spanish acronym ERTEs), the company has managed to align the workforce with changes in demand. Additionally, we observe a salary adjustment strategy that has both intensified through recent years and worsened in the current inflationary period.

At PSA (Stellantis), no one wants to work anymore; it's not like it used to be. Working conditions and labor exploitation have become the norm. They now employ all kinds of flexibility mechanisms that not only impact our workdays, but many days we are subjected to temporary layoffs (ERTEs) and do not work. When we do work, they intensify the pace of the job. They use ERTEs throughout the entire year. (Factory worker)

4.2Changes to the global value chain serving the VW Navarra plantThroughout its long history, the Volkswagen (VW group) assembly plant at Navarra has been distinguished by exclusive production of the VW POLO, setting it apart in terms of both intra-group competition and its designated strategy for profitability.3 VW Navarra has maintained a certain uniqueness within the automotive group; assembly of a single model at such volume and under a cost-reduction strategy permitted the plant to avoid some of most intense dynamics of intra-group competition in the allocation of new models. Although the assignment of every new POLO has always meant a moment of tension for the plant and for its local production environment, investments made in both the factory and the supplier park (quite extensive, in terms of capacities and accumulated knowledge) have been key to strengthening its position within the group.

This type of strategy and production model changed in 2017, when VW Navarra installed the MQB A00 platform, shared with B-segment models. This investment has allowed the factory (for the first time in its history) to assemble other models simultaneously: the T-Cross (from 2017) and the VW Taigo (from 2021), the latter exclusive to this plant, and with sales oriented to European markets. These changes in production imply a new corporate strategy from the prior focus on volume and cost reduction to one based on volume, diversity, and permanent cost reduction. However, according to data from the VW group itself, the assembly of these two new small SUV coupé models introduces the Navarra plant into a new market segment of fierce competition with other group plants, given that the segment is registering the highest rates of growth.

The trends toward modularization and standardization through the installation of MQB modular platforms have positioned the VW plant in new market segments and exposed it to aggressive competitive dynamics among plants of the same group, and this has shaped the product's architecture. Several key stakeholders confirm that the transformation processes are already incorporating changes in the design of the supply chain for electrification, and that the governance structure will undergo changes as a result.

The VW group has remained committed to its strategy of standardization and simplification of assembly processes. Through the SSP (Scalable Systems Platform) approach, it seeks to reduce the complexity of system and assembly times by 30 % and to unify the remaining installed platforms in production of electric cars exclusively by 2035. In short, the strategy toward the electric vehicle is based on the reduction of parts, greater simplification and homogenization of processes, and increased component technology, which will be decisive for battery consumption and life and for achieving a connected vehicle with greater autonomy.

This system implies a reduction in working hours per worker/car, now set at 10 assembly hours, which is 30 % lower than before. The new model is called Trinity and will be tested at the Wolfburg factory in Germany by introducing this new platform.

This simplification means that the rest of the plants must adapt quickly to these changes so that they can be assigned the other line and another platform. It's a race toward electrification that involves an increase in competitiveness between plants. That's why we must strive to be allocated more models. (Union representative of UGT, the majority union)

With a view to this transformation to electric, autonomous, and connected vehicles, adaptation of the Navarra plant to electric car production has entailed investments of €250 million, with one of its lines reserved for production of two models assigned for 2025. These are both small electric cars, translating to production of 60,000 fewer vehicles per year and the loss of approximately 500 jobs within the factory.

At VW Navarra, as in other group plants located on the Iberian Peninsula, specialization will be concentrated into small and mid-range cars, so major changes are not predicted in the segment positioning of these plants; but this will increase the competitive pressure among group plants in Iberia – SEAT Martorell, VW Navarra, and VW Lisboa.

This transformation has direct effects on the final assembly plant Navarra and its intra-group position, as well as a notable impact on suppliers. Due to reductions in assembly volume and decreases in components, along with the need for new parts and components described above, the impacts on the business environment and employment will be profound for many of these supplier companies (Del Río-Casasola et al., 2024).

Indeed, the number of supplier companies has already been reduced across recent decades, with much of production now concentrated into large multinational groups of parts and components companies. At the same time, outsourcing of logistical services by VW has been increasing. All of this has transformed the production environment of VW Navarra from an ‘industrial condominium’ (a pool of providers with their own spaces and autonomy, geographically close to the assembly company) to a ‘modular consortium’ where companies established within the factory premises (in what are known as islets) allocate all their work to the needs of the assembly plant. This light and flexible productive environment is however functional to the changes taking place with the arrival of the electric vehicle.

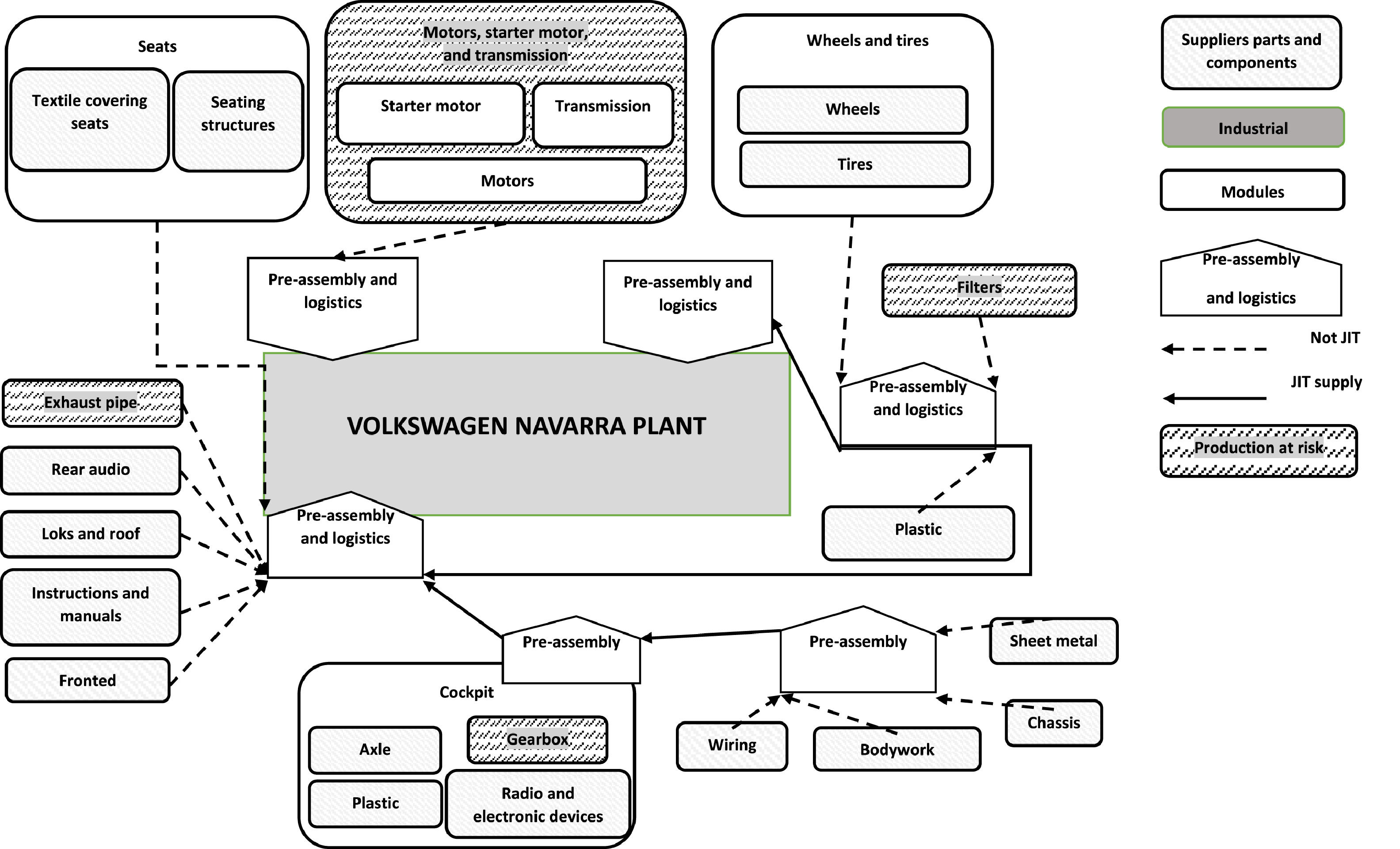

Among the biggest changes in the composition of these new vehicles is the absence of high added value parts and components such as gearboxes and combustion engines (made in Barcelona, Poland, the Czech Republic, and Germany) along with others of lower value (such as exhaust pipes or filters) manufactured nearer the supplier park (see Fig. 3 in the Annex).

At the same time, the arrival of new components like batteries and electric motors will mean major changes in the composition of the chain. The VW group has elected to build six battery gigafactories, and the Spanish city of Sagunto (in Valencia) will host one of these. All will be managed by POWER CO, a multinational 100 % owned by the VW group that uses Chinese technology for battery production. In this way, VW will enjoy absolute control while strengthening relations with China (among the most powerful electric car markets). This represents an element of strategic differentiation for the VW group with respect to others such as Stellantis or Mercedes. The group also appears to be following a similar control strategy for the production of electric motors, choosing to establish two key factories, one in Kassel (Germany) for European and American demand and another in Tianjin (China) for the Asian market. These facilities are estimated to have a production output of around 1.5 million engines in 2023.

As mentioned, the transition to the electric car implies three major changes in process: reduction in the volume of production; reduction and transformation of parts and components; and increases in the technological sophistication of processes. The sum of these three factors has important consequences for the workforce. At VW Navarra, it is estimated that approximately 500 fewer people will be needed, while due to the reduction in production volume, suppliers will lose 1500 workers. Competitive pressures and strong uncertainty around the assignment of new models is already becoming explicit in the negotiation of the new collective agreements by way of salary adjustments, despite current strong inflation.

So much uncertainty about electric vehicles weakens our (union) bargaining power when negotiating our salary conditions. If this is happening to us at VW, imagine what is happening in supplier companies. (Union delegate of CGT in VW Navarra)

While it is early to quantify in a comprehensive way all the changes resulting from this process of transition to electric vehicles, initial effects are already visible in product design (given the reduction of parts and components) and in increasingly standardized and lighter production processes, as well as in terms of the dimensions of the production environment surrounding VW Navarra. Vanishing small suppliers and concentration into large supplier groups anticipate the new economic, productive, and labor scenarios underway. Reduction in production, decreases in parts and components, and advances in the implementation of technology into processes will mean a reduction in the sector's workforce along all links of the chain. Uncertainty and strong competitive pressure are leading the plant to make significant labor adjustments as a mechanism to attract the arrival of new electric models (Del Río-Casasola et al., 2024).

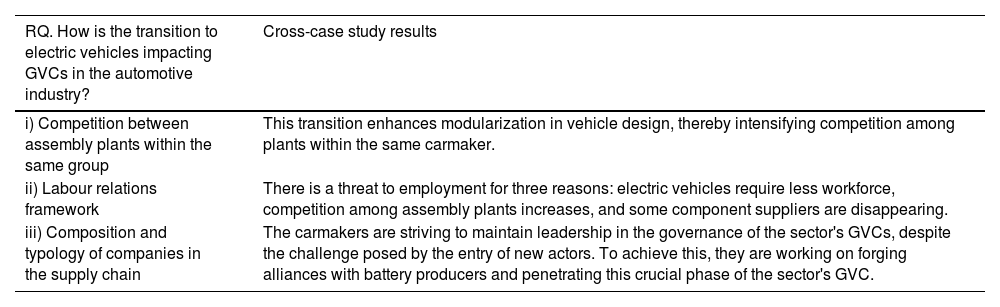

4.3Cross-case study resultsIn this section, the research proposal has been applied to analysis of two specific cases to contrast certain issues and debates outlined in the academic literature regarding the configuration of GVCs in the automotive industry, especially in the context of the transition to electric vehicles. Both Volkswagen and Stellantis are large carmakers promoting an aggressive strategy of electrification of their fleets and therefore represent two ideal case studies for analysis of the impacts of this transition on the sector's GVCs. A number of findings can be collected from this research, and they are summarized in Table 2.

Synthesis of cross-case study results.

Source(s): Authors’ elaboration.

In both of the cases analyzed, the electrification strategy promotes the design of new electric vehicle models on a smaller number of platforms. This potentially increases the number of assembly plants with which Stellantis Galicia and Volkswagen Navarra must compete for the awarding of future electric vehicle models. Therefore, progress in the modularization of production associated with the transition to electric vehicles leads to increased competition among assembly plants within the same corporate group.

This transition will lead to changes not only in the assembly plants but in the whole supply chain. Figs. 2 and 3 in the Annex identify the production of components whose viability is being threatened in the context of the transition to electric vehicles. Meanwhile, the battery as a strategic component of this new type of vehicle has raised the necessity of developing technological and production capacities. The multiple case study reveals how both Stellantis and Volkswagen are trying to reposition themselves within this GVC segment, weaving new alliances with other companies (energy and battery production) to penetrate this crucial sector and exert some control over the production capacity of this strategic component.

Finally, we observe how, in both cases, the transition to electric vehicles is representing a threat to employment. In the assembly plants, the job volume is decreasing because electric vehicles are simpler and require fewer workers for their manufacture. So far, assembly plants have maintained a production mix of electric and combustion vehicles, but as the transition progresses, the risk of job loss will increase. Furthermore, this adjustment in employment volume may be prompted by the intensification of competitive pressure at the assembly plants, as mentioned earlier. At the same time, the reduction of employment throughout the supply chain is also a significant threat, especially for those suppliers at risk of disappearing, or whose production is set to gradually decrease.

These are relevant results that corroborate certain of the conjectures noted in the literature review. They also allow us to sketch a prospective outline of the form that this transition will take in the various dimensions analyzed. Based on these findings, a series of relatively general considerations can be made; these are discussed below.

5Conclusions and theoretical discussionAs noted above, the transition to electric vehicles analyzed in this paper is both incipient and an ongoing process of change. Moreover, the organization of GVCs is complex, comprising multiple decentralized processes and numerous actors that must operate in a coordinated manner for proper economic performance. From this starting point, a literature review was carried out to identify a set of changes in different dimensions of GVCs in the automotive sector as a result of the transition to the electric vehicle. This literature review collected contributions on how combustion vehicle GVCs are organized, the main changes in product design, and the actors involved in the relevant GVCs in the context of the transition to electric vehicles. Subsequently, certain conjectures were outlined to address our main research question: How is the transition to electric vehicles impacting GVCs in the automotive industry?

Beyond the contributions offered by the theoretical-interpretative proposal and by the specific results of the multiple case study, more general findings can also be stated. We identified three key dimensions in which the current transformations are reflected: i) competition between assembly plants of the same group; ii) the labor relations framework; and iii) the companies that make up the supply chain. This transition process deepens trends that had already been developing in the sector, and it introduces significant changes to the configuration of the chains, as outlined below.

The transition to the electric vehicle has advanced the modularization of production in the automotive industry. Modularization implies further standardization and technical homogenization of the final product. This context intensifies competition between assembly plants for the awarding of new models by a group's parent company, as the plants now operate with relatively flexible production infrastructures in terms of product variety. Modularization and intensification of competition are therefore two processes that run in parallel and that assist carmakers in promoting the profitability they obtain from their network of production plants. This modularization process has already been pointed out by the literature (Lampón, 2022; Lampón & Rivó-López, 2021), as has its impact on the versatility of assembly plants and the intensification of competition for the allocation of new models (Rísquez, 2023; López-Calle et al., 2020). The present research contributes evidence in the same vein, concentrating on the domain of the electric vehicle.

Second, the transition to electric vehicles triggers significant changes in the configuration of supply chains. As some studies have indicated (Schwabe, 2020), these changes threaten specific suppliers oriented toward the manufacture of parts and components exclusive to the combustion vehicle, which will see their production volumes reduced and even their viability jeopardized their unless they refocus their activity. On the other hand, the incorporation of new components such as the electric battery affords entry to new actors and enables the generation of a new productive fabric and employment along the supply chains. Moreover, a dilemma has arisen for major companies in the sector around the control of technology, knowledge, and income derived from the design and production of electric batteries, and this may alter the governance framework in the sector's global value chains, heretofore strongly led by traditional carmakers.

Such debate had previously been documented in the literature for GVCs linked to combustion vehicles (Frigant, 2011; Raj-Reichert, 2019); now a similar debate has emerged in relation to the role played by battery suppliers for electric vehicles (Jacobides et al., 2016; Lampón & Muñoz-Dueñas, 2023). The possession of strategic assets (such as the electric battery) is a fundamental element for leadership within GVCs, as has also been pointed out in the literature (Rikap, 2018; Durand & Milberg, 2020). Based on our analysis of the case studies, carmakers are now entering the battery sector with the aim of integrating knowledge and production of that strategic component within the scope of their core competencies, which would enable them to maintain their leadership in GVCs. This reinforces the idea expressed by Jacobides et al. (2016) that, in contexts of disruptive transitions, leading actors seek to control essential aspects of the industrial architecture of their sector in order to strengthen their decision-making capacity over how value is generated and captured.

Finally, it should be emphasized that the transition to electric vehicles threatens the stability of employment volume in the GVCs of the automotive sector, and this threat is channeled through various avenues. In the case of assembly plants, the lower workload required for electric vehicle production and the intensification of competition between plants are observed to negatively impact employment levels. In the supply chain, risks are mainly linked to the disappearance and reduction of production in certain traditional suppliers. These conclusions align with others already suggested in the literature on this topic (Lefeuvre & Guga, 2019; Paz & Ruiz-Gálvez, 2020).

6Final considerations and practical implicationsThis original work contributes to increasing and integrating knowledge on how the transition to electric vehicles is currently impacting the configuration of GVCs in the automotive industry – a novel and complex reality that is both multidimensional and dynamic. Our findings on the disruptive role of technology reflect a new scenario in terms of the governance of supply chains, the impact of continued modularization on competitive dynamics, and adjustments to employment, all of which could be extrapolated to the analysis of other areas of industrial activity. This may be of interest for the study of sectors that exhibit similar industrial architectures, such as the electronic components or chemical sectors.

This process of change will certainly have a major impact on our economies and societies, as it affects a crucial and central sector of economic activity. The findings presented from this research may provide knowledge of special interest to the various actors who currently have the capacity to influence this transition.

From a business perspective, the race to control the design and production of electric batteries is essential for the governance of GVCs: carmakers that manage to reposition themselves successfully within this segment of the value chain will obtain a competitive advantage over those who do not. Likewise, the business success of carmakers will largely depend on their ability to develop in a coherent and comprehensive way the necessary multi-level changes in industrial organization and to adapt their model of production to electric vehicles. For the companies comprising the supply chains, reconversion toward the production of parts and components for new electric vehicles will present a critical challenge, especially for those specialized in the production of electro-mechanical parts that will tend toward obsolescence.

From the perspective of governance institutions, the transition to electric vehicles poses a challenge for the productive fabric and for employment, mainly in those regions whose economic activity depends heavily on the automobile sector. To face this challenge, it is necessary to develop a coordinated and coherent public policy agenda that contributes to accelerating this transition while protecting the affected parties. It will be further necessary to precisely identify which tools (fiscal policies, subsidies, financing policies, public purchasing, etc.) can encourage investment in order to accelerate this transition, as well as which other policies (advice to companies, employee training, search for new business niches, etc.) can improve the situation of both companies and populations negatively affected by this transition.

FundingThis study has been funded by the Ministry of Science and Innovation under the R + D + i project with the reference code PID2020–116040RB-I00, ‘Users, Business and Global Value Chain facing the new mobility Ecosystem: Challenges and Action Lines from Multiple Perspectives’.

Some manufacturers in the automotive industry have made significant advances in the past few years in terms of modularization. Examples include Volkswagen and its MQB modular platform, the Renault-Nissan alliance and its Common Module Family (CMF) platform, and the UKL platform of BMW, among others (Lampón et al. 2019).

As Schwabe (2020: 159) points out, among the predominant features in the automotive industry are market maturity and production overcapacity.

The ‘cost-plus’ strategy, specific and functional to high-volume productions, is based on setting prices according to the cost of production and the desired margin on sales. In this way, the company obtains its profit margin, also guaranteeing profits for the VW group while remaining at lower risk of losses (Bernal, 2008).