Drawing on the literature on organizational change, technological change, and inertia, this paper explores how the moment that companies choose to initiate a technological change relative to other companies from the same regional and industrial context influences the company's performance. In particular, we test the excess inertia and excess momentum phenomena that refer to timely and untimely technological shifts in companies. A data set comprising about 1000 of the largest Russian companies, affiliated with 19 industries, located in most of the Russian regions, for 10 years starting from 2008, is used. Applying a multi-level approach of hierarchical linear modeling, we estimated the region environment effect and the industry effect on sales and productivity. The use of moderation effects of the correspondent technology adoption with the average lag or lead from the representative company in the industry or region, could help us demonstrate what digital technologies are probably associated with the excess inertia and the excess momentum phenomena on the industry and regional level. The results reveal that the industry effect is a major determinant of firm productivity, whereas sales are mainly influenced by the region effect. Our investigation also found that companies are more likely to exhibit excess inertia rather than excess momentum.

In a world of constant change, uncertainty, and complexity of the business environment, company-environment fit has a pivotal role in company success (both in terms of performance and longevity). Indeed, scholars claim that misalignment between a company and its environment may worsen company efficiency and performance, and lead to its potential demise (Pérez-Nordtvedt, Payne, Short, & Kedia, 2008; D.-N. Chen & Liang, 2011). Therefore, many researchers suggest that in the case of a significant shift within the external environment, a company needs to respond to the environmental demand through rethinking its external orientation and taking some real action to be better synchronized with its environment (Lam, 2005; Pérez-Nordtvedt et al., 2008). Company inertia is widely discussed in academic literature as one of main factors that complicate the implementation of necessary changes (Besson & Rowe, 2012; Colombo & Delmastro, 2002; Hannan & Freeman, 1984; Kelly & Amburgey, 1991; Sastry, 1997).

The transformational potential of new technologies, especially information technologies (IT) and digital technologies (DT), constitutes a challenge for contemporary companies (Martin & Leurent, 2017; Vial, 2019). Companies seeking to utilize IT and digital technologies and implement some organizational changes based on these technologies, undergo a digital transformation (Morakanyane, Grace, & O'Reilly, 2017; Nwankpa & Roumani, 2016; Sousa-Zomer, Neely, & Martinez, 2020; Vial, 2019a). According to a global survey of managers and executives conducted by Kane, Palmer, Phillips, Kiron and Buckley (2016) (Kane et al., 2016), 26% of companies already consider themselves to be digitally maturing, and 42% of companies regard themselves as digitally developing companies. As the majority of companies embrace digital technologies and rapidly transform their technological structures, almost one third (32%) of companies are in the early stages of digital development. That means that while some companies already recognize the positive impact of digital transformation on business outcomes which is documented in recent research (Chen, Jaw, & Wu, 2016; Gurumurthy, Camhi, & David, 2020; Sousa-Zomer et al., 2020), some companies are still struggling to initiate change in their technological structure.

A comprehensive analysis of technology-enabled transformation, run by Besson and Rowe (2012), revealed that an understanding of the circumstances under which companies undertake needed changes and overcome inertia successfully, is one of the research streams that can be considered as very promising. While there are some papers that address this issue (Hur, Cho, Lee, & Bickerton, 2019; Li, Su, Zhang, & Mao, 2018), we see some limitations here. First, digital transformation is a relatively new phenomenon and it is already seen as a multifaceted one, which is why it has received significant attention from scholars who discuss it from different theoretical angles (Morakanyane et al., 2017; Vial, 2019). Nevertheless, there is still a lack of empirical studies regarding this concept, and empirical papers are vital for a better understanding of the current state of digital transformation and for its further theoretical development. Second, most empirical papers employ either a qualitative research design or a cross-sectional research design, and, what is also important, use self-reported data ( Chen et al., 2016; Dalenogare, Benitez, Ayala, & Frank, 2018; Nwankpa & Roumani, 2016). However, the impact of digital technology as a general-purpose technology (as well as transformational process itself) cannot be tracked immediately (DeGeest & O'Boyle, 2014; Lam, 2005; Sabherwal et al., 2015), as longitudinal data is necessary to capture the effects of this phenomenon on business outcomes. With regard to self-reported data, it might be limited due to its being nonrepresentational, have a nonresponse-bias, and be prone to self-selection problems (Forman, 2005).

Thus, to close this gap, this paper seeks to profoundly explore the phenomenon of digital transformation and its effect on company performance, while taking into account different environmental conditions. Specifically, the objective of this research is to empirically investigate how the moment that companies choose to initiate a technological change, relative to other companies from the same regional and industrial context, influences a company's performance. Framing our research on the literature on organizational change, technological change, and inertia, and on research on the external environment effects on company performance, we test 1) which strategy – “first mover”, which means that a company reflects the external demand, or “follower”, which means that a company prefers to stay inert, choosing to compare itself with other companies from the same environment – a company implements in regard to digital technology adoption, and 2) how it affects organizational performance. If the “first mover” strategy fails, one may make a conclusion about excess momentum. Meanwhile, a failure in the “follower” strategy may point to the excess inertia phenomenon (Farrell & Saloner, 1985). With regard to the effect that technology adoption has on company performance, we specify and estimate a production function for two output variables, namely productivity and sales. We have chosen these variables as they are associated with the performance outcomes, which can be seen at different points in time, and they reflect different processes happening within a company (Banker, Chang, & Kao, 2002; Bresnahan, Brynjolfsson, & Hitt, 2002; Dalenogare et al., 2018; Gurumurthy et al., 2020; Piccoli & Lui, 2014).

Our research employs new data of about 1000 of the largest companies affiliated with different industries and located in most of the Russian regions, to be conducted over a period of 10 years, starting from 2008. In particular, we collected information on digital-technology adoption, corporate performance and the general characteristics of the companies, which may explain their diversity, in dynamics. A dataset for an empirical analysis of the digital transformation applied to the Russian case might be interesting for two reasons. First, Russia is a particularly heterogeneous country, consisting of 85 regions with different levels of economic development and geographical positions, as well as of institutional and regulatory quality (Russia Integrates: Deepening the Country's Integration in the Global Economy, 2019). Second, while Russia has occupied a mid-position in the IMD World Digital Competitiveness Ranking over the last five years, the digital divide between Russian regions is considerable (Korovkin, 2020).

The main distinction of the data refers to the method of its obtaining. Unlike the majority of studies in this field, we suggest merging publicly available information retrieved via text-mining tools, with official financial reports as published by companies (Sousa-Zomer et al., 2020). By doing so, we contribute to the growing body of research utilizing the text-mining approach to extract data stored in internet-based information sources (Pejic-Bach, Bertoncel, Meško, & Krstić, 2020; Shakina, Parshakov, & Alsufiev, 2021; Sousa-Zomer et al., 2020).

The text-mining tool, based on content analysis, utilizes a coding framework to identify the number of mentions of certain keywords associated with different digital technologies and company’ names. It is assumed that this number indicates the fact of voluntary and involuntary disclosure of digital technology adoption in a company. This approach indicates a departure from self-reported data mitigating most disadvantages associated with surveys. Moreover, it opens opportunities for longitudinal data covering reasonably long historical periods. Having this information in dynamics, both for corporate, industry, and regional levels, we make use of a set of proxy indicators to run a comparative statistical procedure and reveal whether the adoption of a certain digital technology took place before or after the benchmark, or didn't take place at all. This data transformation enables us to establish the timely and untimely technological shifts in companies. The untimely adoption of digital technologies is assumed to take place if excess inertia or excess momentum is registered. In other words – if the production function of the employed technologies demonstrates a negative impact of technological shifts on productivity and sales. We suppose that such an approach to data collection and processing, allows us to capture the transformational-related processes happening inside a company and estimate their outcomes with regard to different contexts, namely, industry and regional conditions.

The paper is organized as follows. First, we provide the theoretical background of our research and develop the hypothesis. Subsequently, we describe the research approach and data, which is followed by our findings. In the discussion section, we explore the contributions. A discussion of some limitations, as well as avenues for future research, concludes the paper.

2Theoretical background2.1Organizational change and inertiaThe concept of organizational change is very broad and might be considered from a variety of perspectives (Colombo & Delmastro, 2002; Kelly & Amburgey, 1991; Quattrone & Hopper, 2001). Some researchers state that organizational form as well as organizational change are determined by different forces, among which, changes in the company environment, specifically, changes in social, political, technological and competitive environment, play significant roles (Hrebiniak & Joyce, 1985; Sastry, 1997). The idea of the fit between the company and its environment is discussed by a number of theories, including a structural inertia theory proposed by Hannan and Freeman (1984) or Tushman and Romanelli's (1985) theory of punctuated change. While these theories are originated in different fields (for example, structural inertia has its roots in the field of sociology, and theory of punctuated change - in strategic management), both of them claim that in the era of high-level volatility and uncertainty, a company cannot help but notice the changes in their environment and consider a response to them, punctuating two different modes of behavior – adaptive and inertia.

According to Hannan and Freeman (1984), the rationale behind this idea is twofold. On the one hand, effective organizational performance requires establishing organizational routines. As organizing implies routinizing, it results in the creation of organizational patterns, procedures, and practices that become very inflexible with time (Besson & Rowe, 2012). In this perspective, organizational change requires the constant overcoming of the accepted and established routines, that is organizational inertia, to realign the organization with its environment. On the other hand, the core organizational structures – the organizational strategy, legitimacy, technology, and marketing – are thought to contain a lot of sources of inertia. Any change of the core organizational structures requires a lot of effort from the company to reorganize its central processes, and as a result entails a great risk of failure (Hannan & Freeman, 1984).

Tushman and Romanelli (1985) view change as being similarly severely constrained by inertia. However, the theory of punctuated change differentiates the intensity of change under which the true inertia appears. In particular, during a stable period of organizational life, change is restricted to incremental adjustments that strengthen already-chosen strategic orientations. The research states that true inertia, which is defined as “resistance to all but incremental change, …impedes radical or discontinuous change…” (Tushman & Romanelli, 1985, p. 177), exists in a situation when a company needs to make a revolutionary shift in the strategic course to follow. Thus, it can be said that companies cannot change quickly or easily; it can also be said that companies are very selective and slow about their decisions to initiate any real changes, as the real transformation of the company is accompanied by inertia (Haveman, 1992).

Some important comments on inertia were added by Sastry (1997) in her causal model of the punctuated change theory. Sastry suggested that inertia should be considered as being interconnected with the organizational ability to change. According to the model, a high level of inertia is associated with a low organizational ability to change. Part of the explanation is related to the idea of creating a company's routines, as this formalisation of the internal processes and external relationship between the company and its environment hinders a manager's ability to notice and react to the need for a timely change. Moreover, long stable periods of organizational life weaken the organizational skills to scan environmental signals quickly and respond to them innovatively. That means that organizational ability to change actually declines. Unobvious consequences of this situation are the following. First, inertia increases constantly, and secondly, inertia is built up through the self-reinforcing mechanism, as routinization of some processes facilitates their further formalisation. However, what is interesting, high levels of inertia do not mean that a company cannot change: while inertia impedes change, it does not make it impossible.

Well timed organization changes are assumed to result in better financial performance as they are a means of adapting the company's fit to its environment (Burton, Lauridsen, & Obel, 2002; Haveman, 1992; Pérez-Nordtvedt et al., 2008). In this sense, the inertia should be defeated and change should be initiated. The moment when the level of external pressure (for example, manifested through environmental shift or a drop in performance, provoked by a misalignment between the company and the considered environment) exceeds the level of inertia should be recognized by companies and should be taken as a starting point for any changes (Sastry, 1997). Speaking about the moment when change takes place, one may think of two approaches to change – proactive and reactive; both of them reflect the idea of the temporal moment. Proactive and reactive reorientation also stress the importance of companies to use comparison as a mechanism to recognize, and the appropriate moment to introduce changes (Ancona, Goodman, Lawrence, & Tushman, 2001). Specifically, comparison allows companies to compare their position, structure, and progress, relative to other companies they compete with. While researchers claim that reactive reorientation is considered to be more risky than a proactive one, they also insist that resistance to change and to remain inert is an even more risky behavior for a company (Ancona et al., 2001). As such, although we can see that companies practice organizational change seldom and under very specific conditions (both external and internal) in order to increase their survival chances and benefit performance, they do resolve to initiate change. An interesting question arises about how the moment the company introduces change (before the rivals, which is proactive reorientation, or after them which is reactive reorientation) affects its outcomes.

2.2Technological adoption as a form of organizational change and a time factor for the technological adoption (excess momentum and excess inertia)Technology is an element of a company's external environment; it is also one of the key drivers of organizational change (Colombo & Delmastro, 2002; Tushman & Smith, 2002). Following the logic that companies should be aligned with their external environment and taking into account the fact that technology is part of the core structure of a company, companies may adopt technologies that are new for the company and experience some disruption as a result (Pérez-Nordtvedt et al., 2008). The technology-related shift may impact the current fit of the company with its environment and require strategic reorientation of the company. Depending on the appropriateness of the new strategic course, it may result in either improved performance or negative performance (Burton et al., 2002; Sastry, 1997). Thus, company decisions regarding technological adoption should be deliberated carefully.

Technology adoption behavior is closely tied to the time factor, which means that if the company decides to adopt a technology, then it needs to decide on when to adopt that technology – early or later (Hoppe, 2002; Milliou & Petrakis, 2011; (Suarez & Lanzolla, 2005)). Early technological adoption is associated with some benefits that a company may enjoy, for example, a technological leader may give an early adopter of such technology, a certain power over later movers and dictate to them the best way forward (Farrell & Saloner, 1985), giving them a better strategic and market position that results in profitability (Farrell & Saloner, 1985; Hoppe, 2000; (Suarez & Lanzolla, 2005)) and, more importantly, productivity (Milliou & Petrakis, 2011). However, the pioneering efforts might be challenged by high initial costs, flat sales, and operational losses if, for example, the adopted technology has not become an industry standard, or dominant design (Anderson & Tushman, 1990) at the moment of adoption (Farrell & Saloner, 1985; Hoppe, 2000; Milliou & Petrakis, 2011; (Suarez & Lanzolla, 2005) ).

As the consequences of technology adoption may be unexpected, the decision about whether the company should adopt a certain technology may be delayed. There are a lot of factors that may define the timing of adoption (see, for example, Hoppe, 2000). Structural inertia, which represents the internal resistance of a company to change, is viewed as an integral part of the adoption process. This is due to the fact that technological adoption reconfigures the technological background by embedding into it some new technology components (Lyytinen & Newman, 2008), and such a restructuring of an already established process is inhibited by inertia. Another important source of resistance lies in the nature of technologies whose adoption is being considered by a company. For instance, Tushman and Anderson (1986) distinguish competence-enhancing and competence-destroying technologies. Competence-enhancing technology is built upon the know-how embodied in the technology that is being replaced; thus, adoption of such technology is expected to have a greater cumulative effect. Competence-destroying technology, on the contrary, makes the knowledge required to grasp the technology being replaced as obsolete, so the company needs to invest more resources and effort in incorporating such a technology in the core structure of the company (Anderson & Tushman, 1990). This means that adoption behavior, regardless of the nature of adopted technology, will be accompanied by structural inertia; however, the degree of the inertia and the degree of effort required to overcome this inertia and to trigger changes, will vary in the case of adoption of both competence-enhancing technology and competence-destroying technology. That is why it seems logical that a company rarely adopts new technology as soon as it appears on the market, but waits until the technology demonstrates its value via the number of technology adoptions already undertaken by other companies (Hoppe, 2002; Lanzolla & Suarez, 2012).

In this sense, the practice of comparing (or benchmarking) how other companies which operate in the same environment behave with regard to technology adoption, may be beneficial in terms of gaging the usefulness of a new technology being adopted. If the company does not react to the technological changes in the environment that may be proxied through the technology adoption behavior of other companies or performs them too late, the company is likely to experience a drop in its performance. On the other hand, it is expected that a company that is able to overcome ‘excess inertia’ will benefit from changes and will carry them out (Farrell & Saloner, 1985). Furthermore, if a company sees that technological change is done by the industry leader, or by other powerful actors, or by “coalition” of some companies from the same environment, the company is ‘seeking synchronization of its organizational activities with those in the environment’ (Pérez-Nordtvedt et al., 2008). However, with respect to the time factor, it is unclear how the moment that companies choose to initiate a technological change relative to other companies from the same context, influences a company's performance.

2.2.1Technological change through the lens of IT and digital technology adoption and company performanceThe adoption of IT and digital technology has a potential to enhance company performance in two ways – in terms of productivity and profitability (Sabherwal et al., 2015; W. Chen & Srinivasan, 2019). However, it happens only when the use of technology follows technology adoption (Lanzolla & Suarez, 2012). In the short-term perspective, investments in IT and digital technology may not provide any visible effect, because technology adoption is a costly thing and it takes some time to deploy (Aral & Weill, 2007; Chen & Srinivasan, 2020; Galy & Sauceda, 2014). That is especially true for such complex IT systems (also called ‘sophisticated digital tools’ (Paunov & Planes-Satorra, 2019), p.27) as enterprise resource planning (ERP) systems or customer relationship management (CRM) systems. For example, Nicolaou (2004) found that firms' return on assets (ROA) significantly increased only four years after the company had installed ERP.

In the long-term perspective, companies that adopt technology related to a specific dimension of IT and digital asset (for example, IT and digital infrastructure, and informational systems), expect to observe greater profitability in terms of ROA and net margin Aral and Weill (2007). According to Aral and Weill (2007), improvement in profitability is achieved as a result of the effective integration of technology into a company structure, and the development of new competencies and practices related to this technology. A recent study by Galy and Sauceda (2014) also showed that the technological competence of a firm in using ERP system influenced net sales. An increase in productivity is usually explained in a way that IT and digital technology leverage workflow efficiency, labor efficiency, and resource utilization efficiency, that over time, results in greater output (Banker et al., 2002; Bresnahan et al., 2002; Dalenogare et al., 2018; Piccoli & Lui, 2014). For example, the results of later research by Espinoza, Kling, McGroarty, O'Mahony and Ziouvelou (2020) demonstrated that the effect of the Internet of Things (IoT), a rapidly developing digital technology, is relatively small; however, it is expected to grow due to the increasing number of IoT adoptions. Technology adoption could also trigger an innovation activity of a firm that then lead to better productivity (Sánchez-Sellero, Sánchez-Sellero, Sánchez-Sellero, & Cruz-González, 2015).

The relationship between information technologies, digital technologies, and company performance has been investigated by a number of researchers (see, for example, a meta-analysis of Sabherwal and Jeyaraj (2015), but most of the conducted studies estimate the impact of IT, rather than digital technologies, on company performance. To date, few papers analyze the impact of pure digital technologies on company performance (Dalenogare et al., 2018; W. Chen & Srinivasan, 2019). The studies reported mixed results; while a positive association between digital technology and company productivity was revealed, a significant decline in margin and sales growth was also observed (W. Chen & Srinivasan, 2019).

The study of Dalenogare et al. (2018) provides some interesting insights related to the adoption and use of digital technologies. In particular, Dalenogare et al. (2018) found that different digital technologies are correlated with different outcomes, which means that not all digital technologies will lead directly to a better financial result, as some of them may enhance non-financial metrics, such as improving product quality or decrease product launch time. Moreover, Dalenogare et al. (2018) detected that some technologies, that are considered as productivity-enhancing, were actually either insignificantly or negatively linked with company performance. One possible explanation for these findings could lie in a weak integration of these technologies into a company structure, and a lack of knowledge on how to use these technologies efficiently (Dalenogare et al., 2018; W. Chen & Srinivasan, 2019).

The inconsistency of the results and a small number of empirical studies, along with the fact that digital technologies have already begun to be classified as ‘general purpose technologies’ (Brynjolfsson, Rock, & Syverson, 2017), highlight the importance of conducting further research in this area. Furthermore, taking into account the fact that the number of digital technologies used in firms grows constantly (Andrews, Nicoletti, & Timiliotis, 2018), this study is focused on a specific set of digital technologies and digital tools that are associated with transforming potential (Hausberg, Liere-Netheler, Packmohr, Pakura, & Vogelsang, 2019), such as IoT, ERP, CRM, etc.

2.2.2Industry-level and region-level characteristics and performanceStrategic management literature has recognized that the fit of an organization with environmental conditions is an important antecedent of high company performance (Burton et al., 2002; Volberda, van der Weerdt, Verwaal, Stienstra, & Verdu, 2012). With respect to the environment, a company is part of a determined industry, and at the same time it is part of some specific geographical area (Fávero, Serra, dos Santos, & Brunaldi, 2018). The industry and geographical location form the two-level context for a company. Therefore, a company that is trying to find a fit with its environment can be closely aligned either to an industrial environment or to the geographical environment.

A number of authors have considered the effects of how much the company-level, industry-level, country- or regional-level, and time-level factors matter when explaining the differences in company profitability and productivity (Majumdar & Bhattacharjee, 2014; Rumelt, 1991; Short, Ketchen, Bennett, & du Toit, 2006, 2016). Empirical studies conducted within a limited number of industries and countries/regions, demonstrate that industry, country/region, and time factors are significant determinants of company profitability, although these factors account for a small share of variation (Hirsch & Schiefer, 2016; Zouaghi et al., 2016). For example, the study of Hirsch and Schiefer (2016), where the sample of companies was limited to the EU food industry, showed that only a 3.6% variation in ROA was explained by country effect, and the influence of industry effect and year effect was inconsiderable, with a contribution of 0.6% and 1.4%, respectively.

On the other hand, studies performed on less homogeneous samples of companies provide different results. For instance, the research of Short et al. (2006), based on a sample of 2802 corporations, in 348 industries over a period of 7 years, found a much stronger time effect compared to industry effect. Specifically, year-to-year changes in company performance over time, explained 46.67% of performance variance, measured via the ROA indicator; only 8.32% of the variance was between industries. Research carried out by Fávero et al. (2018), demonstrated that the country and industry-related factors were significant in explaining the real annual sales growth of 11,381 companies from 17 industries, in six Latin American countries. According to the obtained results, most of the variation results from differences between industries (77.2 percent), the variance between countries being at 6.7 percent.

Although literature based on what factors of a company's environment provide more value to company performance exists, it presents relevant gaps. First, most of the conducted research employs different proxies to measure the industry-level and country-level impact on company performance. To the best of our knowledge, technological characteristics of an industry and geographical location, as a part of the technological environment of a company, were not used to explain the differences in the performance variance of a company. Secondly, while there are some studies that are based on an extensive dataset, in terms of number of industries and companies, only few papers analyze a substantial number of countries/regions to capture the country or regional effect of company performance (Bamiatzi, Bozos, Cavusgil, & Hult, 2016; Chan, Makino, & Isobe, 2010; Goldszmidt, Brito, & de Vasconcelos, 2011). In this sense, this paper contributes to the understanding of how the moment that companies choose to initiate a technological change, relative to other companies from the same regional and industrial context, influences a company's performance.

2.3Hypotheses developmentAs indicated above, a technological change, as any organizational change, is a necessary process that enables companies to improve their fit with the environment and thereby increase their performance. However, literature has shown that a company's decision to initiate a technological shift is made with many factors in mind, namely, a company's ability to change, to implement different technology-related strategies, and to recognize industry-level and regional-level benchmarks towards technology adoption among rivals, but also the state and the nature of digital technologies. To understand this complex company-environment relationship, we propose three main hypotheses for this research that will be discussed below.

In a systematic literature review, Núñez-Merino, Maqueira-Marín, Moyano-Fuentes and Martínez-Jurado (2020) found that there are different approaches to how to view technologies in the process of their adoption. Specifically, some studies investigate what effect the isolated technology(ies) has on a company's performance; on the other hand, some studies consider these technologies jointly or as a toolset. As shown above, different IT and digital technologies have a different nature in terms of their contribution to company performance: some of them may directly contribute to better performance, while others may complement the organizational resources and enhance them, but do not demonstrate the visible results. Moreover, understanding that the concept of digital transformation implies the joint use of different technologies (Núñez-Merino et al., 2020), the following hypothesis is put forward: The adoption of digital technologies must be seen jointly affecting corporate performance. This hypothesis is tested by imposing the Cobb-Douglas functional form of variables, measuring digital technologies’ adoption.

Technological opportunities provided by the external environment can be a driver of company performance if the company can initiate a strategic change towards them (Short et al., 2006). That means that the company's characteristics play an essential role in explaining its performance. However, following studies on a decomposition of performance variation (see, for example, (Bamiatzi et al., 2016; Zouaghi et al., 2016), specificity of a company's environment (both industrial and regional) is also highlighted as a source of difference in performance. Hence, we hypothesize that technological shifts of a particular company, as a strategic response to environmental changes, bring higher performance. However, there is also a context-driven (industry and region-level) performance variation. To test this hypothesis, a multi-level estimator – hierarchical linear model (HLM) – is employed to find out the cross-level variation proportion of output variables and account for the nested structure of data.

Technology evolves constantly (Anderson & Tushman, 1990). It is not known in advance what technology will be accepted as dominant by most companies in an industry, or when it will happen. That is why companies are always faced with the challenge of making a decision about technology adoption while under technology-related uncertainty, and realizing the risk of adopting an 'emerging standard' that will be subsequently replaced. Nonetheless, as time goes by, more information on a specific technology (for example, some empirical evidence on a technology efficiency, the level of its acceptance by the industry, and so on) becomes available (Lanzolla & Suarez, 2012). Only over time, may a company estimate what results the technology adoption delivered to the company. Taking into account a variety of digital technologies and their nature – we suggest individually testing the moderating effect of the moment of adoption for each of those technologies. Therefore, the following hypothesis has been formulated: The moment of adoption is technology-specific and may bring positive or negative results for two alternatives - the "first mover" and "follower" strategic responses. The identification strategy to estimate the effect of an optimal moment of DT adoption leans on moderation effects. We introduce in the model along with the factor of the DT adoption the moderation effect of the correspondent DT with the most probable moment of its adoption deducted by the median values on industry and regional levels. Thus, if the coefficient at the moderating variable is significant and negative - one may conclude about disadvantage brought by non-optimal moment chosen for its adoption, or advantage otherwise if the coefficient is positive. The overall effect points out whether excess momentum or inertia takes place.

3Research design and methodologyThe research problem, as stated in this paper, having deep theoretical roots and relevance for organizational and technological development, is, however, empirically understudied due to several reasons. First, there is a fundamental problem of measurement and data availability. The vast majority of empirical studies lean on self-reported data obtained via surveys or interviews ( Chen et al., 2016; Leonhardt & Hanelt, 2018; Nwankpa & Roumani, 2016) lacking objectivity, representativeness, external validity, and provides opportunities for generalization as a result. The technological and organizational changes are primarily internal, which may be somehow manifested in publicly available information employing voluntary and involuntary disclosure (Abdolmohammadi, 2005; Aksu & Kosedag, 2006; W. Chen & Srinivasan, 2019; Coluccia, Fontana, & Solimene, 2017; Kumar, 2013). The second important issue lies in certain complications of model specification. The experimental design and any exogenous origins of technological and organizational changes in this class of studies are usually not plausible, allowing causation claims. Moreover, a considerable diversity of contexts under which company's undertake such strategic decisions, bring substantial noise and distortion, even for a correlation analysis.

However, we are now witnessing a growing interest in the topic, which results in new research attempts to explore available empirics (Benitez-Amado & Walczuch, 2012; W. Chen & Srinivasan, 2019; Chen et al., 2016; Nwankpa & Roumani, 2016; Sousa-Zomer et al., 2020; Wu & Chen, 2014). The research design of our study has its foundations in papers by (W. Chen & Srinivasan, 2019; Sousa-Zomer et al., 2020) and seeks to examine data available in Internet-based information sources by employing text-mining tools, namely, content analysis (CA).

According to three hypotheses as put forward in this study, the research design implies the estimation of a multilevel model and leans on the following pillars:

- 1

Specification: To test whether the portfolio of digital technologies jointly affects corporate performance, we impose a relatively rigid functional form and specify the Cobb-Douglas function (formula 1) for two variables of output: sales and productivity (Cusolito, Lederman, & Peña, 2020; Hitt & Brynjolfsson, 1996). These variables have been chosen for the production function, driven by digital technologies (DT), due to the nature of the technological process associated with the digitalization. The proposed specification may be called DT-driven production function. As is mentioned in studies by (Banker et al., 2002; Bresnahan et al., 2002; Dalenogare et al., 2018; Piccoli & Lui, 2014), digitalization must enhance productivity, since it implies a reduced labor force to be employed for the same level of production. Meanwhile, a high intensity of digital technologies concentrated around an alternative sales channel would suggest higher sales if all other things being equal (Gurumurthy et al., 2020).

whereyj−theoutputvariable(productivity),

βo−theinterceptofthelinearspecification,

βj−coefficientsatthefactorsxij−DTadoption,

CV(CV′)− thevectorofcontrolvariables,

ej−errortermoftheinitialfunction,

uj−errortermofthetransformedfunction,

(2) Hierarchical linear model estimator: The research question, as stated in the paper, addresses the heterogeneity of effects across industries and territories with an implied diversity of contexts and strategic orientation of companies. This heterogeneity may be studied in different ways. Our econometric strategy, aimed at capturing the nested structure and non-independent nature of the data, is HLM (see for example – Sahaym & Nam, 2013; Erkan et al., 2016). We assume that each of the companies is nested according to its industry affiliation and type of activities. At the same time, it is located in a particular region which has a significant impact on economic conditions and resource provision, along with the infrastructure available. Hence, we seek to test the assumption of representative power of the mean value of parameters as obtained from the OLS estimator. With that, we would like to identify whether an intercept and coefficient at variables of interest carry a random component associated with two levels – industry and region. First, we assert that this method allows for a better theory-methodology-data fit, but also enables the estimating of the relative metric of variation associated with each level. Hence, the second hypothesis implies identifying the intraclass correlation analysis, to demonstrate the share of the variation of the variables of output brought by idiosyncratic and environmental factors. The theoretical construct is based on the assumption that the strategic response of a company depends on its environment, namely, how its rivals from the same industry or geographical proximity chose their technological shifts.

The cross-level variation would point out a potential significance and magnitude of the industrial and regional effect on the production function driven by digital technologies.

In this study, we estimate the random intercept with one fixed level-1 factor, which resembles a one-factor ANOVA as the overall mean and as the class effect (formula 2), and compute the intraclass correlation coefficient (ICC) (formula 3):

whereyij−theoutputvariable(sales/productivity),

βoj−therandomintercept,

βojandx1j−randomcoefficientforaoneofthefactors,

X−thevectorofvariablesofinterest(includingthemoderationeffects),

CV− thevectorofcontrolvariables,

eij,uij,ηij−errortermsofthecorrespondentlevels

(3) Moderation effects of "first mover" and "follower" strategies: The third hypothesis seeks to determine which technologies' adoption would benefit from each alternative strategy, and whether excess momentum or excess inertia is observed for companies exposed to examination in this empirical research. To carry out this statistical inference, the moment when a particular technology is adopted by most rivals (based on industrial and regional affiliation) has to be set up. Since this moment is identified, all companies which adopt this particular technology at any period prior to the moment of the general dissemination, would be considered to employ a "first mover" strategy. Alternatively, those companies which adopt this technology at any moment later, or don't make this technological shift, would be associated with the "follower" strategy. The moderation effect of the correspondent technology adoption with the average lag or lead from the representative company in the industry or region would, in turn, propose either the excess momentum or excess inertia phenomena.

3.1Data collectionSample. We collect longitudinal data on the 964 largest Russian companies (both public and private) for the years 2009–2017. The list of companies was formed on the basis of the RAEX-600 and RAEX-400 (the previous version of RAEX-600), independent rating, which is annually prepared by the highly esteemed RAEX rating agency (RA Expert) and the leading Expert magazine. RAEX 400 was introduced in 2004 and included 400 companies covering almost all industries. Since 2015, the list has included 600 companies. To create a sample, we took all the companies that were included in RAEX-400 and RAEX-600 at least once, for the period of 2009–2017. After a careful check of all companies comprising this rating, the final list of 964 companies was developed.

Data collection procedure and variables. This study employs automated content analysis which implies the precoding of narrative constructs to be found in the entire corpus of information associated with a company name published on the Internet. Specifically, we collect data on the number of mentions of specific digital innovations implemented in companies using open-accessed sources of information. Such an approach to data collection is considered confirmatory for two reasons. First, there are a number of studies that apply the same CA procedure (Parshakov & Shakina, 2020; Ritala, Huotari, Bocken, Albareda, & Puumalainen, 2018; Shakina et al., 2021). Second, content analysis as a research methodology was developed to be used, both for manifest and latent content (Drisko & Maschi, 2015; Franzosi, 2004; Gaur & Kumar, 2018). Even though scholars have criticized it for its oversimplification (Krippendorff, 1980) and the absence of a consistent coding framework (Abeysekera, 2006), it has been used in a wide range of research questions, especially in management and business studies.

The output of this text-mining would be primarily dependent on the quality of the initial coding procedure and the quality of the corpus of textual information (Parshakov & Shakina, 2020), which is why we have paid special attention to the validation of the coding framework. The coding framework, as employed in this study, follows several steps. At the first step, we produce a preliminary list of digital technologies and IT and digital-technology systems associated with digital transformation ((Digital, 2019);UN Secretary-General's Data Strategy 2020–22, 2020). Then a set of the chosen digital technologies and IT and digital-based systems has been confirmed with academic literature – namely, with recent papers by (Hausberg et al., 2019; Heilig, Lalla-Ruiz, & Voß, 2017; Ma, Tao, Zhang, Wang, & Zuo, 2019; Sebastian et al., 2017), to be sure that these technologies and systems are not just reflecting digital transformation, but could also be relevant for the vast majority of companies and they must be associated with significant organizational shifts as stated in our study (Hausberg et al., 2019). As a result, the following list of technologies and systems has been made to run a further examination:

-

Customer Relationship Management – CRM

-

Supplier Relationship Management – SRM

-

Human-Computer Interaction – HCI

-

Electronic Document Circulation – EDC (with examples - ORACLE, SAP, NAVISION)

-

Enterprise Resource Planning – ERP (with examples - ORACLE, SAP, NAVISION)

-

Internet of Things – IoT

In total, six IT and digital technologies and systems have been chosen for empirical analysis. They represent IT and digital technologies of different levels of sophistication: EDC (used for managing documents electronically); ERP, CRM, and SRM (software systems dedicated to different business processes); and HCI and IoT (which reflect different degrees of user involvement in his interaction with technology).

Based on the final list of technologies and systems, the coding framework has been elaborated by corresponding each technology and solution with a set of keywords in both the Russian and English language. The keywords have been incorporated in the CA algorithm to find the number of overall mentions of each of the keywords associated with a company name, for each year covered by our analysis. In other words, we programmed a search request that looks like “keyword + company title + specific year” (e.x. “internet of things Gazprom 2017″).

Apart from the consistent coding framework, the source of information should be reliable, and embracing all relevant channels of voluntary and involuntary disclosure (Dumay & Cai, 2014). Hence, for the study, we have addressed the corpus of the entire textual information associated with a company name on the Internet. This has been run via a software system that can search the Internet for particular information specified in a textual web search query – Microsoft Bing Application Programming Interface (API). It was introduced in May 2011 and has become the only major international search engine data source available for automatic offline processing for webometric research (Thelwall & Sud, 2012).

The Python script enabled the computing of the number of mentions for each of the keywords associated with the list of the digital technologies selected. Importantly, this information is longitudinal and provides panel structure of data sets, this condition being one of the most crucial for the study.

The data source used to collect data on company performance as well as general characteristics, such as industrial classification, location of a company ets, is Ruslana, provided by Bureau van Dijk. We use two measures of company performance, which are sales and productivity. Productivity is calculated for each firm and year as labor productivity (sales per employee, in logs) (Griffith, Huergo, Mairesse, & Peters, 2006).

Control variables. Previous studies (Kotha, Zheng, & George, 2011; Melville et al., 2004; Nwankpa & Roumani, 2016) found out that firm size and firm age might influence the technological development of a company. In particular, older firms have a time advantage to develop their technological capability (Kotha et al., 2011). At the same time, large companies usually possess more IT resources and are able to construct their own internal IT systems (Cho, 2006). We use the number of years since the company was established to measure its age, and number of employees to measure its size, obtaining these data from the Ruslana database provided by Bureau van Dijk.

4Data and empirical tests4.1Pretest data analysisAs mentioned earlier, the final data setting comprises the information on 1000 large companies, affiliated with different industries, located in most of the Russian regions, for ten years starting from 2008. Each of the unit of observation is described by a set of variables:

-

the performance indicators and other financial parameters;

-

general characteristics of a company's activities, affiliation to the industry, location;

-

and a set of indicators responsible for the digital technology' disclosure, which, according to our research design assumptions, refer to the correspondent technology adoption.

It is assumed, in line with the recent research by Sousa-Zomer et al. (2020), that the highest concentration of the mentions points out at the moment when the digital technology was adopted. Understanding the possible implications of this strict and arguable limitation, we run pretest analysis and several robustness checks to avoid coincidental or random results.

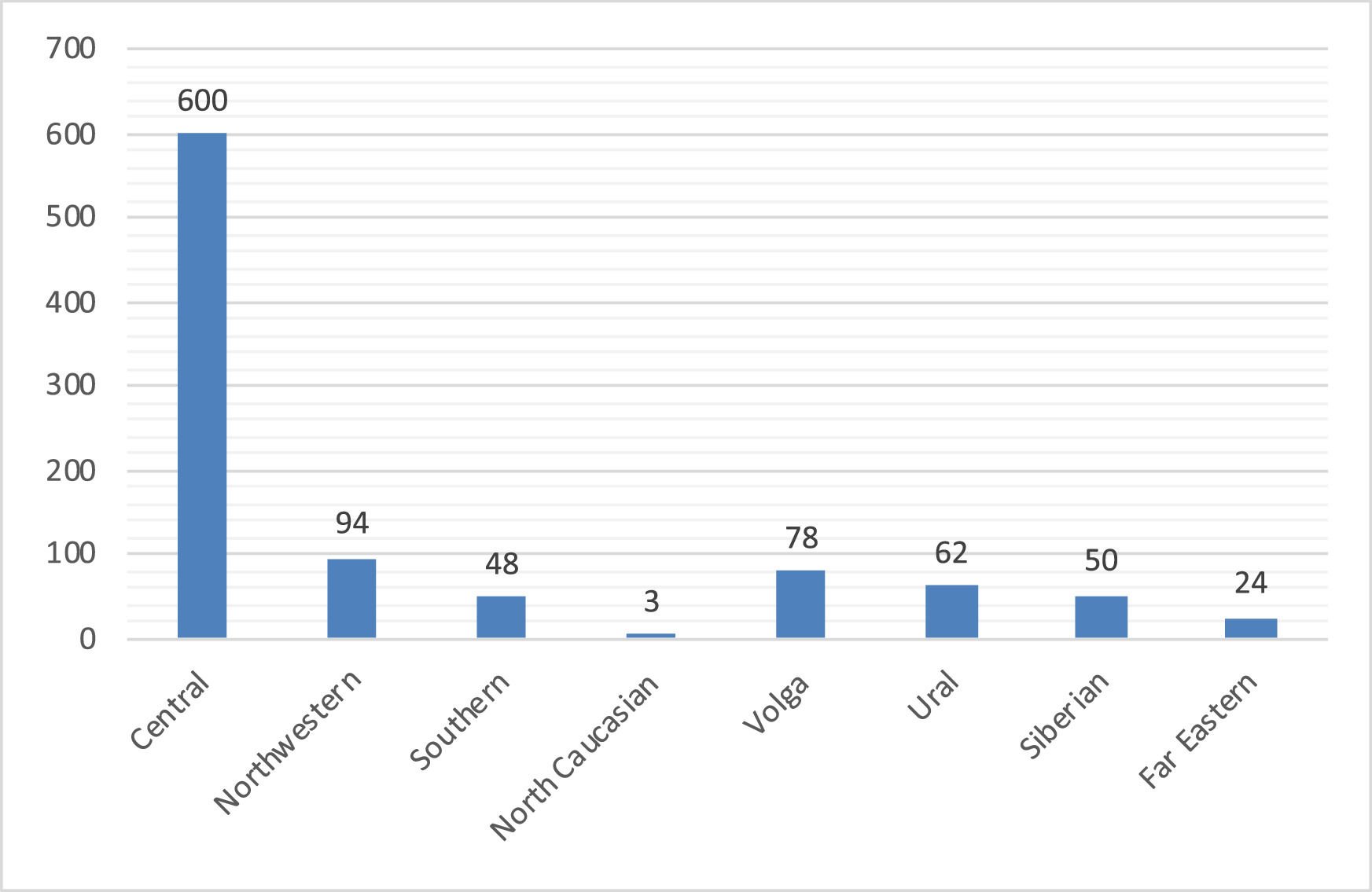

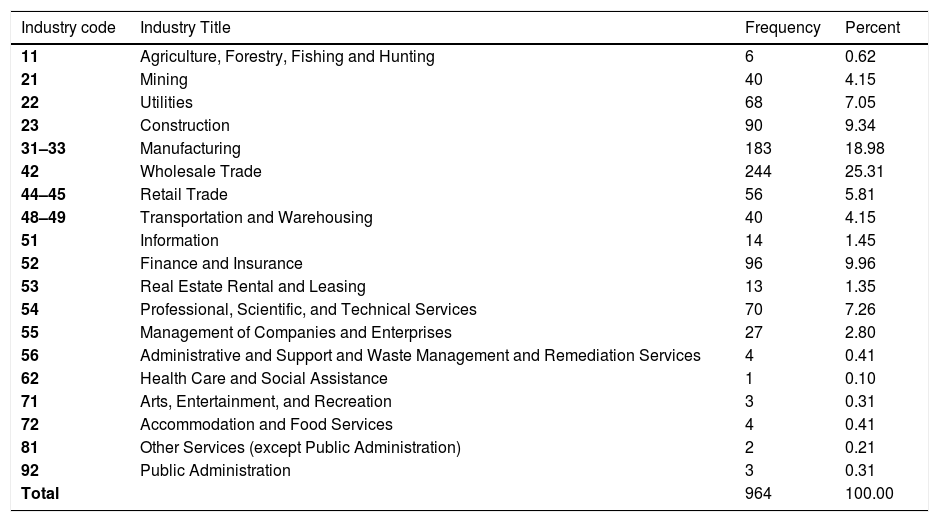

Tables 1 – 3 and Fig. 1 show the most general descriptive analysis outputs. The sample embraces companies affiliated with all industries and a variety of activities within these sectors. According to the NAICS code, companies represent 19 industries (Table 1). The largest sector is a wholesale trade, which accounts for approximately a quarter of all companies; manufacturing companies – the next largest sector – accounts for 18,98% of all companies of the sample. Companies involved in finance and insurance operations and construction businesses have approximately the same proportion and together account for around one fifth. Sectors that engage in providing professional, scientific, and technical service and utilities follow then, with 7,26% and 7,05%. The other 13 sectors exhibit an industry type of below 5%, namely retail trade, mining, transportation and warehousing, management of companies and enterprises, information, real estate rental and leasing, agriculture, forestry, fishing and hunting, administrative and support, and waste management and remediation services, accommodation and food services, arts, entertainment, and recreation, public administration, other services (except public administration), and health care and social assistance; the last 7 sectors represent less than 1% of companies.

Distribution of companies by industry type at the NAICS 2-digit level.

The geographical profile of the companies is diverse. Despite a clear bias towards central regions and capitals (Fig. 1), the rest of the distribution across the Russian federal districts is even and representative according to the intensity of the economic activities and business life.

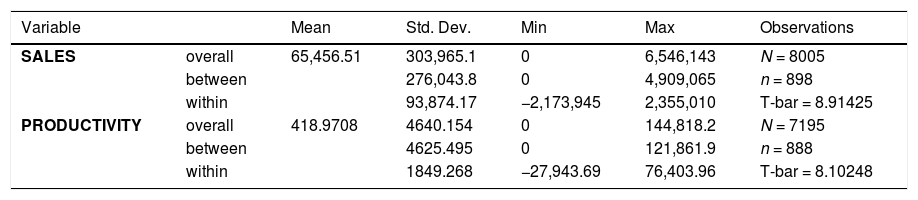

Tables 2 and 3 show the statistics of the main variables of interest and give an idea about the profiles of companies in this study. Both variables of output for DT-production function estimation are strictly positive. The productivity measure has been transformed for the Cobb-Douglass function estimation. The original distribution of both variables is far from normal. However, logarithmic smoothing for the linear transformation of the specification brings both of them very close to the normal distribution decreasing the possible heteroscedasticity of the estimated model. For both explained variables, we observe a low level of missing cases, making the panel sufficiently balanced.

Descriptive statistics of the explained variables (output of the DT-driven production function).

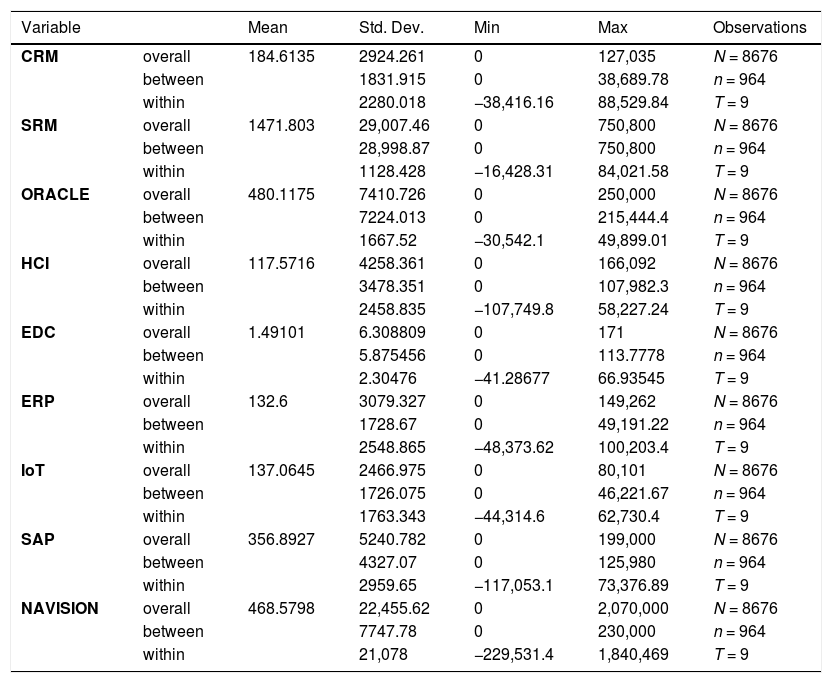

Descriptive statistics of the exploratory variables (number of mentions of the digital technologies - inputs of the DT-driven production function).

The descriptive statistics of the mentions for digital technologies based on confirmatory CA, according to the research design of the study, says that the mean values of all explored variables are homogeneous with the only exception for EDC. This technology is mentioned rarely. However, the internal between and within variation is plausible and does not bring any distortion for further analysis. All the exploratory variables have been logarithmically smoothed for the linear transformation of the Cobb-Douglas function. That approximated all distributions to bounded normality as its initial form was binominal with one of the picks in zero. It can be explained by the high number of companies with no mentions of particular digital technologies.

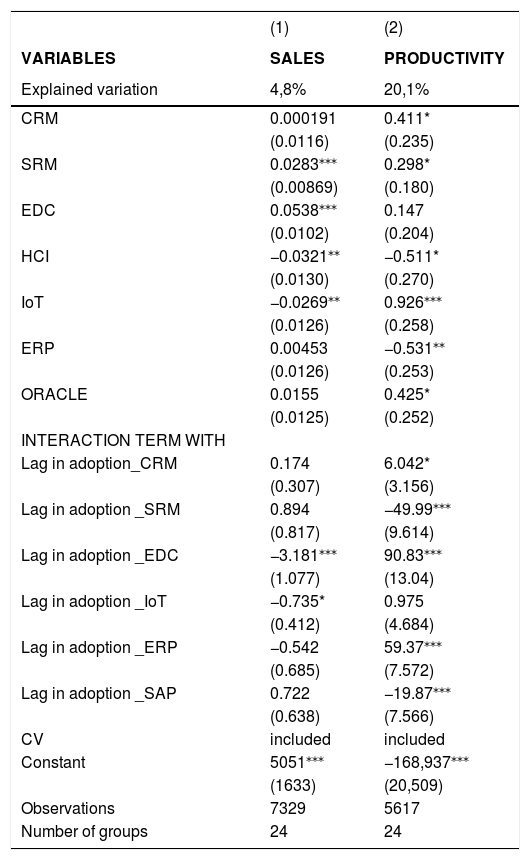

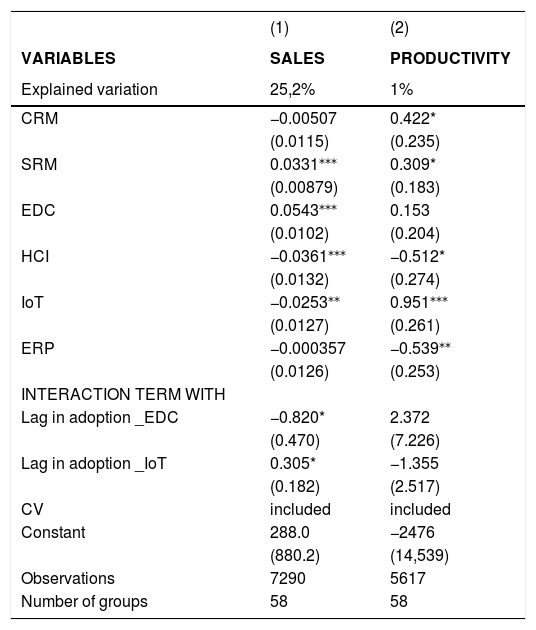

4.2Model estimation and interpretation of the resultsThe hypotheses testing demands the specification of the Cobb-Douglas production function. The HLM estimator for panel data fixed effect, can be applied for the linear transformation of the Cobb-Douglas (Formula 1.2). The estimation is run for two output variables – SALES and PRODUCTIVITY – controlling for all essential factors available for the analysis and introducing the moderation effects of each of the digital technology metrics and the lag in its adoption with the industrial and regional benchmark. All technologies and moderation terms are included in the model specification. Tables 4 and 5 report only those variables of interest, which were statistical significance at least in one of the specifications.

The output of the estimated HLM for excess momentum or excess inertia on industry level.

| (1) | (2) | |

|---|---|---|

| VARIABLES | SALES | PRODUCTIVITY |

| Explained variation | 4,8% | 20,1% |

| CRM | 0.000191 | 0.411* |

| (0.0116) | (0.235) | |

| SRM | 0.0283⁎⁎⁎ | 0.298* |

| (0.00869) | (0.180) | |

| EDC | 0.0538⁎⁎⁎ | 0.147 |

| (0.0102) | (0.204) | |

| HCI | −0.0321⁎⁎ | −0.511* |

| (0.0130) | (0.270) | |

| IoT | −0.0269⁎⁎ | 0.926⁎⁎⁎ |

| (0.0126) | (0.258) | |

| ERP | 0.00453 | −0.531⁎⁎ |

| (0.0126) | (0.253) | |

| ORACLE | 0.0155 | 0.425* |

| (0.0125) | (0.252) | |

| INTERACTION TERM WITH | ||

| Lag in adoption_CRM | 0.174 | 6.042* |

| (0.307) | (3.156) | |

| Lag in adoption _SRM | 0.894 | −49.99⁎⁎⁎ |

| (0.817) | (9.614) | |

| Lag in adoption _EDC | −3.181⁎⁎⁎ | 90.83⁎⁎⁎ |

| (1.077) | (13.04) | |

| Lag in adoption _IoT | −0.735* | 0.975 |

| (0.412) | (4.684) | |

| Lag in adoption _ERP | −0.542 | 59.37⁎⁎⁎ |

| (0.685) | (7.572) | |

| Lag in adoption _SAP | 0.722 | −19.87⁎⁎⁎ |

| (0.638) | (7.566) | |

| СV | included | included |

| Constant | 5051⁎⁎⁎ | −168,937⁎⁎⁎ |

| (1633) | (20,509) | |

| Observations | 7329 | 5617 |

| Number of groups | 24 | 24 |

Standard errors in parentheses.

The output of the estimated HLM for excess momentum or excess inertia on a regional level.

| (1) | (2) | |

|---|---|---|

| VARIABLES | SALES | PRODUCTIVITY |

| Explained variation | 25,2% | 1% |

| CRM | −0.00507 | 0.422* |

| (0.0115) | (0.235) | |

| SRM | 0.0331⁎⁎⁎ | 0.309* |

| (0.00879) | (0.183) | |

| EDC | 0.0543⁎⁎⁎ | 0.153 |

| (0.0102) | (0.204) | |

| HCI | −0.0361⁎⁎⁎ | −0.512* |

| (0.0132) | (0.274) | |

| IoT | −0.0253⁎⁎ | 0.951⁎⁎⁎ |

| (0.0127) | (0.261) | |

| ERP | −0.000357 | −0.539⁎⁎ |

| (0.0126) | (0.253) | |

| INTERACTION TERM WITH | ||

| Lag in adoption _EDC | −0.820* | 2.372 |

| (0.470) | (7.226) | |

| Lag in adoption _IoT | 0.305* | −1.355 |

| (0.182) | (2.517) | |

| СV | included | included |

| Constant | 288.0 | −2476 |

| (880.2) | (14,539) | |

| Observations | 7290 | 5617 |

| Number of groups | 58 | 58 |

Standard errors in parentheses.

As one can see for the reported results, with the interclass correlation control, the DT-driven production function is explained by almost 5% variation of sales and about 20% variation of productivity by industry. The opposite picture is drawn for the variation at the regional level. More than 25% would be explained for DT-driven sales and only 1% for productivity. One of the possible interpretations of these phenomena lies in the nature of the diversity of company's performance, which operate in the same industry but in different regions and, vice versa, different industries in the same region. Having said that, we may refer to the idea that sales are largely dependent on the purchasing power and overall economic status of the region.

Productivity is more grounded by the technological factors and should be considered less sensitive to the regional affiliation, if the respective technologies are accessible evenly across regions. We would argue that this is the case of digital technologies with insignificant variation in the infrastructural factors, which may reinforce or constrain the adoption and usage of those technologies by a particular company. Our findings provide clear evidence for idiosyncratic technological factors playing a more crucial role in sales within an industry and productivity within a region.

Table 4 shows two significant drivers for SALES – SRM and EDC adoption – and two technologies which may be currently seen as negative factors in terms of their payback – HCI and IoT. Both HCI and IoT are more specific than SRM and EDC, which makes them relevant only for some of the companies. This finding cannot be generalized and should be studied more. If we look at the DT-driven function for productivity, IoT appears to be a significant driver with a high magnitude. This evidence makes a clear distinction between the two specifications of the estimated production functions. For productivity, both CRM and SRM are revealed as technological drivers. Meanwhile, among all tested ERP systems, only ORACLE has found its positive influence on productivity.

The moderation effects of lags in the adoption of digital technologies compared to the industry benchmark have demonstrated the following results. Two negative moderations with EDC and IoT for sales evidence that excess inertia may take place for these digital technologies. Similar results are observed for SRM and SAP for the productivity-based function. Discovering these phenomena, we may argue that these technologies in the case of their too late adoption can bring an undesirable outcome and the "first mover" advantage takes place for those companies which can anticipate their implementation. CRM, EDC, and ERP demonstrate possible excess momentum for productivity. It indicates that the "follower" strategy may work better for these general digital technologies with the industry benchmark.

For HLM with the regional level random intercept, as demonstrated in Table 5, we have confirmed the same digital technologies being drivers and negative factors for sales and productivity. However, the magnitudes of the effects are slightly lower. The main difference of the DT-production function for the regional benchmark lies in the moderation effects. The only two significant factors for excess momentum and excess inertia are set up for IoT and EDC, respectively, for sales. EDC supports the results obtained for the industry benchmark. Meanwhile, IoT could be considered a new finding. The positive effect for the deferred adoption of IoT allows compensation for the average negative impact of this technology. The "follower" strategy demonstrates a highly significant positive outcome for IoT technology from a regional perspective.

To sum up, and coming back to the interpretation of the hypotheses testing, we can assert that the first hypothesis is confirmed since the multiplicative effects in the DT-driven production function are observed for the majority of the explored technologies. For the robustness check, the same factors have been tested for the linear case and we failed to find any statistical significance.

The second hypothesis has obtained discrepant results while being tested. Depending on the level of comparison and output variable, the DT-driven production function is more significantly explained by idiosyncratic or environmental factors. For sales, regional context appears to be more critical. For the productivity-based function, industry affiliation explains a substantial share of the variation. These findings may be important for a company's strategic response when a technological shift is undertaken.

The third hypothesis, which addresses excess momentum and excess inertia phenomena, has found empirical evidence for both of them. Considering two alternative strategies – "first mover" and "follower" when the adoption of digital technologies takes place, EDC and SRM are likely to demonstrate possible excess inertia for sales compared to the industry benchmark, while CRM and ERP have excess momentum for productivity. The evident case of excess momentum is unexpectedly discovered for IoT for sales in the regional context.

5Concluding discussionThere is a widespread opinion that in turbulent environments, a company needs to implement a “first mover” strategy, reacting quickly to external signals of change (Reeves & Deimler, 2011). Contrary to this, theory suggests that companies prefer an inert state as they comprehend changes happening around them over time and make their strategic decisions. These decisions may imply technological adoption, organizational shifts or any other response to external challenges. In the empirical literature, so called, excess inertia and excess momentum phenomena (Farrell & Saloner, 1985) have been provided support. Our research has undertaken a further exploration of the hypothesis of timely technological adoption which appears to be a pivotal condition for its effective implementation. In our paper, we examine digital technologies which are meant to become the most relevant economic shift.

The current study is based on the claim of Besson and Rowe (2012) who stand that additional attention should be drawn to the understanding of circumstances under which companies undertake organizational changes and overcome structural inertia successfully. To respond to this call, we have explored how the moment chosen for technological change – before or after its industry and regional rivals – impacts companies’ performance. By reconciling the technology adoption behavior of companies, regarding their industrial and region affiliation, with their performance results, we could demonstrate what digital technologies are probably associated with the excess inertia and excess momentum phenomenon on the industry and region-level. Our investigation revealed some new insights about the impact of digital technologies and the impact of the industry-effect and region-effect on corporate performance.

We found that seven out of the nine digital technologies (namely CRM, SRM, EDC, HCI, IoT, ERP, ORACLE) have a significant positive or negative impact on firms’ sales or productivity on the industry level. The same technologies, except ORACLE, act as the drivers and the inhibitors of corporate performance on the regional level. The positive effect of the adoption of CRM, SRM, and EDC on firm performance both on the industry and on the region level is supported by studies indicating that these technologies contribute to better management of information at two levels — of the company as a whole and of the company's particular business processes (Ali & Miller, 2017; Aral, Brynjolfsson, & Wu, 2006). At the same time, the negative effect of ERP adoption on firm productivity is contrary to previous studies, which have suggested that implementation and use of ERP technology enhance labor productivity (Aral et al., 2006; Engelstätter, 2009; Taştan & Gönel, 2020). It is somewhat surprising as ERP technology is seen as one that enhances productivity (Hausberg et al., 2019; Nicoletti, von Rueden, & Andrews, 2020). This inconsistency may be explained by the fact that relationship between technology adoption and firm performance could be more sophisticated and indirect (Haislip & Richardson, 2017; Ruivo, Oliveira, & Neto, 2014). However, it also could be a consequence of substantial time-lags in the realization of firm outcomes (Brynjolfsson, 1993). Taking into account that ORACLE adoption (one of the examples of ERP technology) demonstrates a result opposite to that of ERP adoption, future research should be undertaken to investigate the effect of ERP adoption on firm outcomes. Nevertheless, in general, it seems that we could observe that not all digital technologies are adopted intensively, nor are they adopted by all companies; this fact is in line with previous studies reporting that contemporary companies are at the different stages of digital transformation (Gurumurthy & Schatsky, 2019; Kane et al., 2016).

Taking into account a number of technologies adopted, our data suggest that companies focus more on the industry level than the regional level. That means that the technology environment among companies from the same industry plays a more significant role in the technology adoption than the technology environment formed by companies from the same region. Our data demonstrate that a significant share of productivity variation is explained by industrial factors. A possible explanation for this is that industrial affiliation stimulates the information exchange and knowledge dissemination much greater than the regional affiliation, therefore, companies from the same industry could adopt technology more effectively. This accords with the study of Wang and Lin (2008), who found that industrial rivals within a specific geographical cluster, due to competition, are not ready to cooperate and share knowledge and information. It seems that rivals located within different regions may interact more actively. However, it contradicts the literature on economic geography that suggests that knowledge dissemination is higher within a regional cluster (Tallman, Jenkins, & Henry, 2004).

With regard to the excess momentum and excess inertia, our analysis revealed that companies are more likely to exhibit excess inertia rather than excess momentum. Here, two interesting conclusions can be drawn. First, environmental conditions may change the company's reaction towards the adoption of a specific technology. For instance, on the regional level, IoT technology was adopted too quickly, while companies from the same industry prefer to implement a “follower” strategy with respect to this technology. The reason behind these results might lie in the fact that different technologies are at different stages of their development. When a technology is considered very promising (like, for example, IoT), even at an early stage of its development, some innovative companies or large companies could invest their IT budget in adopting this technology without expecting immediate payback or return on investment (Espinoza et al., 2020). However, such a time lag of benefit realization could slow down other companies in their decision to adopt this technology. Furthermore, the discrepant responses of companies regarding different technologies’ adoption are largely affected by their nature and potential complementarity or substitution. In this study, even following the inherent heterogeneity of technologies being exposed by our experiment, we meant to discover just an average effect. The further analysis may try to decompose this average effect depending on relevant characteristics of different groups of companies. Second, on the industry level, companies demonstrate more diverse strategic responses towards a greater number of technologies. This result may be explained by the fact that industry competition might be quite fierce, stimulating companies to overcome inertia and make a change (Barnett & Freeman, 2001; Colombo & Delmastro, 2002).

As for technology adoption and excess momentum and excess inertia phenomena together, our findings indicate that firms are interested in technology acquisition behavior — and by adopting advanced IT and digital technology, they undergo digital transformation. While our results depict the situation in Russia, present-day European firms, as well as firms from United States, take technology-enabled transformation (Digitalisation in Europe 2020-2021: Evidence from the EIB Investment Survey, 2021). What makes our results important is that Russia provides a specific context: first, it is a particularly heterogeneous country consisting of 85 regions with different levels of economic development and geographical positions, as well as of institutional and regulatory quality (Russia Integrates: Deepening the Country's Integration in the Global Economy, 2019); second, it is characterised by rather developed technological infrastructure (Russia - Country Commercial Guide. Information & Communication Technology, 2020; The Global Innovation Index 2020: Who Will Finance Innovation?, 2020), unlike many other countries (ICT Development Index, 2017). Even EU firms, for example, tend to perceive digital infrastructure as a major obstacle to the implementation of technologies (Digitalisation in Europe 2020-2021: Evidence from the EIB Investment Survey, 2021). Another important finding is that we could detect the empirical evidence of excess momentum and excess inertia phenomena, which could be interpreted as a manifestation of market orientation and specifically competitor orientation. It is possible to hypothesize that competitor-oriented firms are more likely to adopt technologies, and there are studies confirming the relationship between competitive orientation and technology adoption (Li, Chau, & Lai, 2010; Nuryyev et al., 2020). However, as this aspect was beyond the scope of this study, future research could be undertaken in order to address this issue.

Although our research provides some new empirical evidence on digital transformation, specifically, on the companies’ strategic responses to the technological environment, it has some limitations. First, the source of potential bias exists in the data collection method. We employed content analysis that calculated the number of mentions of a particular technology with respect to the company name on the Internet. In this sense, the corpus of textual information depends on available data and might be biased towards companies with a high level of voluntary or involuntary disclosure. This method is currently considered one of the most advanced since it allows the collection of vast panel data and captures comparative dynamic effects. Second, our analysis is performed on the largest Russian companies that have emerged in fast-growing industries. Such a rapid development of industries, along with the rapid development of technologies, can impact the way managers make their strategic decisions toward technology adoption. In other words, one may assume that Russian companies tend to the “first mover” strategy more than businesses under more stable economic conditions. Third, the empirical analysis is carried out on the data of large Russian companies, and this specific context imposed certain restrictions on the generalization of the findings. However, we would not think about the strict internal validity of the results, because this setting is rather representative of the Russian economy and leans upon similarities inherited by the majority of large enterprises. The choice of the large companies was motivated by the theoretical framework of organizational shifts which is originally developed for relatively big, internally diversified firms. Furthermore, digital innovations are adopted in an already globalized economy. This means that borders between companies from different countries are blurring. Still, the national and institutional context matters. Thus, with a certain amount of caution, the findings may be generalized. Meanwhile, further comparative experiments across countries and types of corporations (for instance, SMEs) are important, and are seen as a future development for the current study.

Understanding the current limitations and the fact that decisions on technology adoption are complex and nontrivial, more quantitative research can be made in assessing the different environmental conditions and the company response to them. It will be valuable to continue employing longitudinal and publicly available data and enhance them by adding objective primary information about companies’ use of different digital technologies, or their previous experiences in terms technology adoption, or their technological environment.

✰Funding:

This study comprises research findings from the Project No. 18-18-00270 supported by the Russian Science Foundation.

✰✰Confict of interest: The authors declare no conflict of interest.

★Availability of data and material: Not applicable.

★★Code availability: Not applicable.