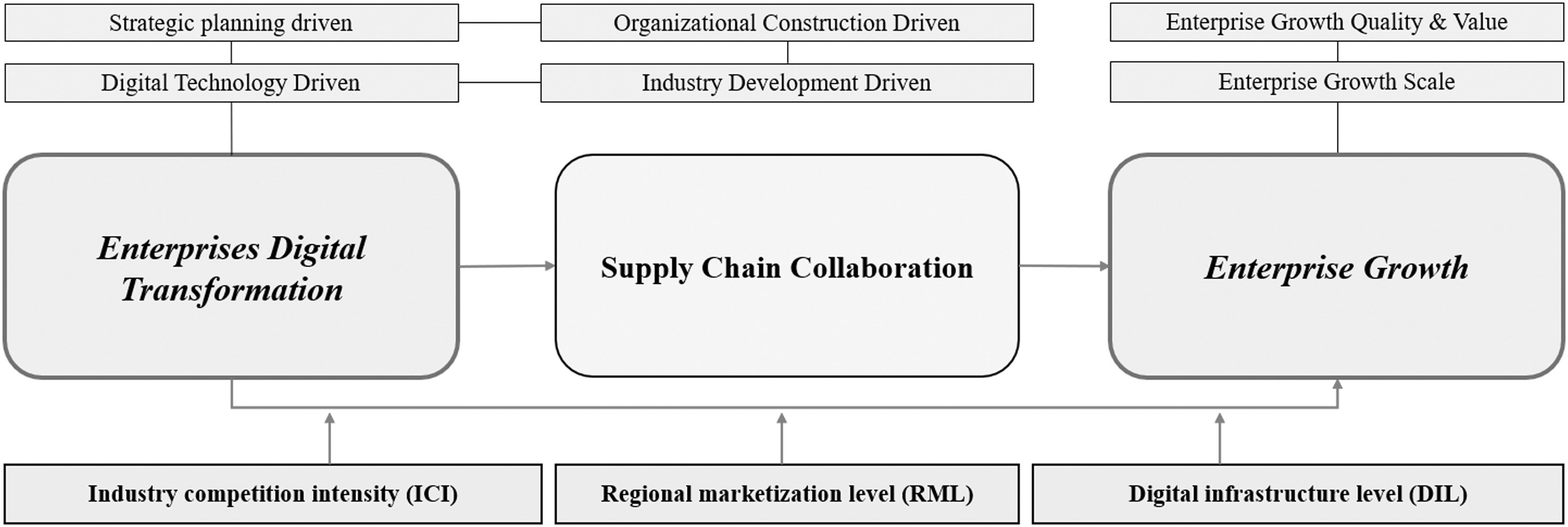

The rapid development of the new generation of digital technology has injected new vitality into the digital transformation (DT) and continued growth of enterprises. This paper selects data from China's A-share listed companies from 2010 to 2019 and uses transaction cost theory to empirically test the effect of enterprise digital transformation (EDT) on enterprise growth and its mechanism. Research has found that DT can significantly promote enterprise growth. The reduction of supply chain collaboration costs plays an important role as an intermediary mechanism in this process. At the same time, industry competition intensity, regional marketization level, and digital infrastructure level have played positive regulatory roles. In addition, when the enterprise's level of financing constraints is low and it is a manufacturing enterprise or state-owned enterprise, the promotion effect of EDT on enterprise growth is more significant. While expanding the research perspective and measurement methods of EDT, this paper integrates the strategic actions of EDT and the inter-enterprise collaboration costs of the supply chain into a unified theoretical framework, revealing a new theoretical mechanism for DT to promote enterprise growth. It also provides practical inspiration for relevant policy formulation and enterprise transformation and upgrading.

The deep integration of the new generation of digital technologies represented by big data, cloud computing, artificial intelligence (AI), and blockchain with the real economy is accelerating the transformation of the development momentum of the global economy from the industrial to the digital economy (Ni & Liu, 2021; Chen et al., 2022a). Data have become a new factor of production driving economic and social development alongside labor, land, and capital. Currently, as China undertakes economic structural adjustment and industrial upgrading, it is faced with a series of problems, such as rising production factor costs, an aging population structure, and natural resource and environmental constraints. The digital economy is considered an obvious means to deal with new challenges in economic and social development (Qi & Xiao, 2020) and the Chinese government is thus focused on its development. In various central documents, it has been repeatedly emphasized that China must seize historic opportunities for digital development, promote the upgrading and reconstruction of productivity and production relations, and lead the transformation of economic and social quality, efficiency, and power.

Overall, the digital economy is divided into two parts: digital industrialization and industrial digitalization. Digital transformation (DT) is an important component and the main source of the driving force for industrial digitalization. Enterprise digital transformation (EDT) is defined as the use of new-generation information technology by enterprises to promote technological changes in enterprises, transform and reconstruct enterprise business functions, operational processes, and organizational structures, and ultimately realize the overall digital upgrading and transformation of enterprises (Vial, 2019; Verhoef et al., 2021; Caputo et al., 2021). In the process of DT, data, as a new production factor, are combined with other production factors to improve traditional economic forms and give birth to new industries, business formats, and models.

First, in terms of the impact of DT on enterprises, EDT introduces advanced digital technology into all aspects of production management, operations management, R&D innovation, and marketing channel construction (Vial, 2019; Verhoef et al., 2021). Theoretically, doing so can optimize the allocation of the enterprise's internal and external resources, enhance its ability to pursue sustainable development, and ultimately enable it achieve scale growth and efficiency improvement and promote enterprise growth. However, existing research mainly focuses on the effect of DT on certain aspects of enterprises, such as total factor productivity (Zhao et al., 2021; Liu, 2022; Ding et al., 2024), growth rate of total assets (Ni & Liu, 2021), stock liquidity (Wu et al., 2021), innovation performance (Li et al., 2022a; Jin et al., 2022), business model innovation (Rachinger et al., 2019; Pérez-Moure et al., 2023a), and enterprise financial performance (Bai et al., 2022; Zareie et al., 2024). From a practical point of view, the effect of combining advanced digital technology and enterprise production and operations is comprehensive and extensive. It is difficult for a single indicator to reflect the overall effect of EDT on enterprise growth. For example, an increase in total factor productivity does not mean that an enterprise has greater operating scale and market value. Nor can the improvement of financial performance accurately reflect whether the company has achieved improvements in the quality and scale of enterprise growth. Therefore, it is necessary to clarify the effect of DT on enterprise growth from a more comprehensive and holistic perspective.

At the same time, in terms of the mechanism by which DT affects enterprises, previous studies have mainly focused on reducing operating costs (Zhao et al., 2021; Ni & Liu, 2021), improving innovation efficiency (Fernández-Portillo et al., 2022), optimizing human capital structure (Zhao et al., 2021), reducing operating risks (Ni & Liu, 2021), reducing financing constraints (Jin et al., 2022), and improving decision-making efficiency (Liu, 2022). These mechanisms explain how EDT promotes enterprise development by optimizing internal resource allocation and operational efficiency, but few studies have explored relevant mechanisms from the perspective of supply chain collaboration. However, with the continuous refinement of the industrial division of labor, the development of enterprises is increasingly dependent on the overall operating efficiency and competitiveness of the supply chain, and supply chain collaboration costs and efficiency have increasingly become key factors affecting enterprise development.

Therefore, research on EDT needs to answer the following questions: can DT promote enterprise growth? If so, does supply chain collaboration play an important role as an intermediary mechanism? How does the external environment of the enterprise have a moderating effect on this effect? What kind of heterogeneous effect does DT have under different characteristics of enterprises? The answers to these questions will deepen our understanding of the relationship between the digital economy and the supply chain, help enterprises better formulate DT plans, and provide a reference for government to guide the development of industrial digitalization.

In addition, because EDT is complex, comprehensive, and long-term (Vial, 2019; Verhoef et al., 2021), the question of how it can be quantitatively measured is currently a recognized research problem in the academic community. Using empirical paradigms to study the effect of DT on businesses has been fraught with difficulties due to the lack of generally accepted statistical data. Some scholars have made useful attempts at quantitative analysis, such as judging whether an enterprise has undergone DT through announcement information, and using “0–1″ variables to express it (He & Liu, 2019). However, this processing method cannot characterize the “intensity” of an enterprise's DT and may lead to distortion in the estimation of the effect of an enterprise's DT. With the rapidly increasing use of crawler technology and text analysis technology in economics research, some scholars have begun to use word frequency statistics of keywords related to digitization in enterprise annual reports to further measure the intensity of DT (Wu et al., 2021; Zhao et al., 2021). However, this measurement method, which relies entirely on keywords in enterprise annual reports, is characterized by high potential subjectivity and easily manipulated. At the same time, for enterprises of different types and stages of development, the connotations of DT represented by the same keywords may be significantly different. Therefore, it is necessary to construct a set of index systems to measure the degree of enterprises’ DT from a more objective and comprehensive perspective so as to promote DT-related research.

In response to the above research gaps and indicator measurement issues, we constructed a DT indicator system and an enterprise growth indicator system and empirically tests the effect of EDT on enterprise growth and its mechanism. We found that DT can significantly promote enterprise growth by reducing supply chain collaboration costs. At the same time, industry competition intensity, regional marketization level, and digital infrastructure level have played positive regulatory roles. In addition, when the enterprise's level of financing constraints is low and it is a manufacturing enterprise or state-owned enterprise (SOE), the promotion effect of EDT on enterprise growth is more significant.

This paper makes four principal contributions. The first concerns research perspective: we started from the comprehensive and holistic concept of enterprise growth and integrated EDT and enterprise growth into a unified theoretical analysis framework from the perspective of supply chain collaboration. The second concerns variable measurement: we constructed DT indicators from six dimensions to more objectively and comprehensively describe the degree of DT of enterprises. At the same time, we constructed indicators of enterprise growth from three dimensions to more comprehensively describe the growth level of enterprises. The third contribution concerns the research mechanism: we empirically tested the intermediary mechanism of supply chain collaboration in the process of DT's promotion of enterprise growth, which deepens our understanding of DT from the perspective of supply chain relationships and inter-enterprise operational collaboration, thereby breaking the status quo of limiting research perspectives within enterprises. Our fourth contribution concerns research depth: we empirically tested the moderating effects of “digital infrastructure” and “industry competition intensity” in the process of DT's promotion of enterprise growth, which furthers our understanding of the external factors that affect enterprises’ DT. We also compared the effects of and reasons for DT in SOEs and non-SOEs as well as manufacturing and non-manufacturing enterprises and enterprises with different levels of financing constraints, thereby analyzing the success conditions of EDT in more detail.

The rest of this paper is organized as follows. First, a literature review of the concepts, effects, and mechanisms of EDT is presented, after which a theoretical analysis is conducted, and the research hypotheses of this paper are proposed. The third section explains the research design, key variables, and measurement methods used, while the fourth and fifth conduct empirical analysis and robustness testing followed by mechanism testing. After a heterogeneity analysis in the sixth section, a discussion section includes the research conclusions and policy implications as well as an explanation of the research limitations and suggestions for future research.

2Literature review2.1The concept of EDTThe DT of enterprises is closely related to the rapid development and wide application of the new generation of digital technology and is variously defined in the literature. EDT is defined as the use of a new generation of information technology to promote enterprise technological change; transform and reconstruct enterprise business functions, operating processes, and organizational models; and ultimately realize the digital upgrade of enterprise operation systems (Vial, 2019; Verhoef et al., 2021; Caputo et al., 2021; Paul et al., 2024). At the same time, EDT is considered to be a highly complex strategic change process as well as a process in which enterprises respond to dynamic changes in their business environments by changing their value creation processes using digital technologies (Warner & Wager, 2019; Hanelt et al., 2021; Broccardo et al., 2023). In addition, EDT is defined as a fundamental change process, achieved through the innovative use of digital technologies and the strategic leverage of key resources and capabilities, that is aimed at fundamentally improving the entity and redefining its value proposition for its stakeholders (Nambisan et al., 2019; Gong & Ribiere, 2021).

Based on the above definitions, the core characteristics of EDT can be summarized as follows. First, the new generation of digital technologies is its foundation and main driving factor, mainly represented by AI, blockchain, cloud computing, and big data (Vial, 2019; Li et al., 2022b). This is fundamentally because the new generation of digital technologies enhances the production, transmission range, and efficiency of data factors and promotes the integration and allocative efficiency of other production factors (Verhoef et al., 2021; Chen et al., 2022a). The second characteristic concerns integrating digital technologies with the improvement of existing products, services, and processes, that is, achieving the digital upgrade of the business system and the organization (Sebastian et al., 2017). This is essentially an incremental improvement in operating efficiency and has not yet involved a change in the business model. The third is that new value propositions are developed based on digital technology to build new value creation, delivery, and capture processes (Meng & Wang, 2023), creatively improve the digital form of products and services, innovate the construction of open innovation and value co-creation networks, and ultimately realize business model innovation and transformation (Rachinger et al., 2019; Broccardo et al., 2023). This is essentially a fundamental change in business strategy. The fourth concerns the systematization and complexity of DT, which requires enterprises to build corresponding dynamic capabilities and implement organizational changes. On the one hand, this concerns building dynamic capabilities to cope with rapid changes in the external environment (Warner & Wager, 2019; Li et al., 2022); on the other, it concerns implementing organizational changes to support the upgrading of business systems and transformation of business models (Lenka et al., 2017; Rachinger et al., 2019) and ultimately improve the market competitiveness and realize the growth of enterprises. These core characteristics provide a foundation for understanding EDT.

2.2The effect and mechanism of EDTThe rapid development of new-generation digital technologies, continuous changes in the competitive environment, and dynamic changes in consumer demands are the main external factors driving enterprises to carry out DT. The company's operating costs and operating efficiency, which constitute the internal factors of transformation, need to be continuously optimized (Nambisan et al., 2019). Driven by these internal and external factors, DT has become an inevitable choice for enterprises (Vial, 2019).

Research on the effect of EDT on enterprises has demonstrated that EDT optimizes business processes and management efficiency, helps empower enterprises to improve their total factor productivity and financial performance (Zeng et al., 2022; Ribeiro-Navarrete et al., 2021; Baiyere et al., 2020; Zhao et al., 2021), and promotes enterprise innovation, green innovation, and environmental innovation performance (Li et al., 2023; Ning et al., 2023; Gatell & Avella, 2024). Research on the effect of EDT mainly focuses on its effect on a single aspect of the enterprise, and few studies explore the effect of DT from the perspective of overall enterprise growth. However, in reality, the effect of the combination of advanced digital technology and enterprise production and operations is extensive and comprehensive. For example, an improvement in total factor productivity does not mean that an enterprise has greater scale and market value. Therefore, it is necessary to clarify the effect of DT on the overall growth of enterprises from a more comprehensive and holistic perspective, which is one of the research focuses of this paper.

Research on the mechanism of EDT has mainly focused on reducing operating costs, improving innovation efficiency, optimizing human capital structures, and reducing financing constraints (Zhao et al., 2021; Ni & Liu, 2021). These mechanisms explain how DT promotes enterprise development by optimizing internal resource allocation and operational efficiency. However, few studies have explored the relevant mechanisms from the perspective of inter-enterprise relationships in a supply chain, which is another research focus of this paper.

3Theoretical analysis and research hypotheses3.1EDT and enterprise growthWith the high level of application of digital technology in enterprises, EDT will activate the production, mining, dissemination, and utilization of data elements (Nambisan et al., 2019; Steiber et al., 2021; Wu et al., 2022). Under the influence of the penetration, synergy, and externality of digital technology, as well as the non-competition, circulation, sharing, and repeatability of data elements, the efficiency of each value chain link from R&D to marketing has been reshaped, and the production and operation efficiency of enterprises has been rapidly improved (Lenka et al., 2017; Li et al., 2022b). At the same time, empowered by digital technology and data elements, enterprises can further transform or reshape their organizational structures and business models (Pérez-Moure et al., 2023a), thus providing new possibilities for sustainable growth.

Firstly, EDT prioritizes promoting the digitization of enterprise products and services as well as that of production and operational processes. The first category refers specifically to the digitization of products and services. Enterprises integrate digital technology into products and services to achieve digital and intelligent upgrades of products and services (Vial, 2019; Verhoef et al., 2021; Bilbao-Ubillos et al., 2024), thereby enhancing the market competitiveness and customer experience of products and services and promoting enterprise growth. The second category refers to the digitization of production and operation processes. Enterprises use digital technologies, such as cloud computing and AI, to further digitize and intelligentize their production processes, reduce their reliance on labor, and completely change traditional large-scale production models. Doing so enables flexible production and a rapid response to markets, and meeting market demand more quickly and accurately (Baiyere et al., 2020) promotes enterprise growth.

Secondly, EDT further promotes the in-depth transformation of enterprises’ organizational systems, innovation models, and business models, providing more powerful support for improving enterprise market competitiveness and thus promoting enterprise growth. Specifically, as regards organizational system transformation, the DT of enterprises has promoted a networked, flat organizational structure, effecting traditional enterprise governance theory based on principal–agent costs and information asymmetry (Vial, 2019). Digital organization construction has changed the traditional hierarchical management system, optimized the upgrading of enterprises’ human capital structures, improved their decision-making efficiency and human capital advantages, and thus promoted their growth. As concerns the transformation of innovation models, DT makes enterprise innovation networks more open and collaborative, thus challenging the traditional closed innovation model (Hinings et al., 2018; Wu et al., 2022). Enterprises obtain more innovation resource support through open innovation networks, reduce innovation input costs, improve innovation output efficiency, and thus promote enterprise growth. Finally, as concerns business model transformation, digital technology has broken through the limitations of time and space, changed the traditional supply-side-oriented business model, and promoted the formation of user-demand-oriented business models (Rachinger et al., 2019; Kohtamäki et al., 2020; Pérez-Moure et al., 2023a) as well as business models that integrate productization and service-oriented development (Kamalaldin et al., 2020; Pérez-Moure et al., 2023a; 2023b). The upgrade of the business model enables enterprises to achieve greater business growth and profit space, expands their development scale and market value space, and thus promotes enterprise growth.

Based on the above analysis, this paper proposes:

Hypothesis 1 EDT can significantly promote the overall growth of the enterprise.

Transaction cost theory is a classical tool used to analyze the nature and governance models of enterprises and other organizations. Transaction costs refer to all kinds of costs related to a transaction generated by both parties before and after that transaction is completed. The level of transaction cost directly affects the effectiveness and economic efficiency of the market. Higher transaction costs may hinder the willingness of market participants to trade, limiting the efficient allocation of resources and economic growth. Reducing transaction costs is regarded as an important strategy to improve market efficiency and economic welfare (Coase, 1995; Williamson, 1979). The supply chain is an economic cooperation system composed of different stakeholders. As the supply and demand sides of products or business activities are separate, supply and demand contradictions will naturally occur in the supply chain, and there will inevitably be a large number of transaction costs. Therefore, it is necessary to continuously reduce the transaction costs between enterprises to continuously improve the operation efficiency of the supply chain (Wu and Yao, 2023) and support the sustainable growth of enterprises.

On the one hand, due to the separation of supply and demand, the upstream and downstream enterprises in the supply chain need to carry out repeated acts of coordination according to each other's spatial location, production quantity, production cycle, product quality, and transaction price (Li & Chen, 2004; Williamson, 1979). On the other hand, the operation process of the supply chain is constantly and dynamically changing, and all kinds of accidents and emergencies may occur during the performance of an agreement between two parties, such as urgent orders, equipment failures, insufficient storage resources, and logistics delays (Williamson, 1979; Wu & Yao, 2023; Sakas et al., 2023). On the whole, enterprises mainly face two kinds of transaction costs in the supply chain operation process: those generated in the coordination process of supply and demand and those generated in the warehousing and logistics process. Therefore, in this paper, the “supply and demand collaborative cost” and “logistics collaborative cost” of a supply chain are selected as the two proxy indicators of supply chain transaction costs to reflect the overall supply chain collaborative cost and efficiency.

3.2.1DT and supply chain supply and demand coordination costsDT can effectively improve the degree of data sharing and information symmetry between supply chain enterprises (Schmidt & Wagner, 2019). On the one hand, the application of digital technology allows enterprises to collect market information more comprehensively and accurately, accelerates the efficiency of information transmission between enterprises, and greatly improves the degree of information symmetry. An imbalance of supply and demand is caused by various types of information asymmetry during the operation of traditional supply chains, whereas the application of digital technology can unify the process of information collection, transmission, analysis, integration, and application (Nambisan et al., 2019; Steiber et al., 2021). DT provides information and data resource support for enterprises to optimize and adjust their supply chain resource allocations and greatly reduces various transaction costs caused by asymmetric supply and demand information, thereby promoting the growth of enterprises.

On the other hand, data elements will continue to be generated during the DT of enterprises and embedded into the supply chain cooperation and value creation process as production factors (Lenka et al., 2017; Meng & Wang, 2023), improving the overall operating efficiency of the supply chain. At the same time, DT can better unleash the cross-border penetration ability of digital technology among various production factors, reduce the cost of supply and demand collaboration between enterprises, improve the efficiency of supply chain collaboration, and thereby promote enterprise growth.

3.2.2DT and supply chain logistics collaboration costsWhile the continuous construction of transportation infrastructure continues to reduce social logistics costs, the widespread application of new-generation digital technology has greatly promoted the digital and intelligent upgrading of logistics systems (Li et al., 2023a). Through DT, enterprises can better connect with internal and external logistics systems, improve their ability to allocate tangible resources within the supply chain, and achieve continued reductions in warehousing and logistics costs. On the one hand, there is an objective distance between each node enterprise in the supply chain in time and space, so it involves a large number of cost issues such as material warehousing and transportation. By continuously optimizing supply chain management levels, enterprises continue to reduce warehousing and logistics costs while ensuring efficient connections between supply chain links (Li et al., 2022b). If the cost of warehousing and logistics is too high, it will not only affect the overall operating efficiency of the supply chain, but also significantly encroach on the company's profit margin. Therefore, logistics efficiency assurance and logistics cost control are core issues in supply chain management and even determine the overall competitiveness of the supply chain.

On the other hand, digital technology has unique advantages in promoting the digitalization and intelligence of warehousing and logistics systems. Enterprises can use digital technologies such as cloud computing and AI to optimize warehousing layouts and cargo management and even achieve fully intelligent unmanned warehousing (Govindan et al., 2018; Li et al., 2023b). By seamlessly connecting warehousing and transportation systems, enterprises can continuously optimize the circulation efficiency of raw materials, intermediate products, and finished products in the supply chain between enterprises.

In addition, through full-process management of supply chain warehousing and logistics systems, transaction costs between enterprises are reduced, and operational efficiency is improved. Enterprises can use digital technologies such as blockchain and big data to achieve full traceability from the production source to the sales terminal. Doing so not only ensures the safety of material flow and delivery through smart contracts, reducing the opportunistic tendencies of enterprises in each link of the supply chain (Govindan et al., 2018; Li et al., 2023b), but it also further reduces transaction costs among supply chain enterprises and improves logistics collaboration efficiency, thereby promoting enterprise growth.

Based on the above analysis, this paper proposes:

Hypothesis 2 EDT promotes enterprise growth by reducing supply chain collaboration costs.

Hypothesis 2.1 EDT promotes enterprise growth by reducing supply chain supply and demand collaboration costs.

Hypothesis 2.2 EDT promotes enterprise growth by reducing supply chain logistics collaboration costs.

Existing research shows that the intensity of market competition in which an enterprise operates is an important factor affecting enterprise decision-making and behavior (Carter et al., 2021). When the level of competitive incentives in the industry in which an enterprise is located is high, the survival and development of enterprises are often under greater pressure than when they are low. This situation forces companies to further improve their production efficiency and product competitiveness, optimize their supply chain resource allocation and warehousing and logistics systems, and continue to strengthen their collaborative efficiency with supply chain partners. In other words, the higher the intensity of competition in the market in which an enterprise is located, the more motivated that enterprise will be to take strategic change actions to improve its market competitiveness, introduce digital technology, and invest in the construction of digital supply chains. When the market competition intensity of an enterprise is low, the enterprise itself often has certain resource or monopoly advantages, and supply chain resources are relatively sufficient. Thus, there may be relatively weak pressure on the survival and development of enterprises and relatively low promotion of strategic changes in DT. Therefore, the stronger the market competition intensity of an enterprise, the more significant the promotion effect of EDT on enterprise growth may be.

3.3.2Regional marketization levelExisting research shows that the level of marketization is an important factor affecting the market transaction costs of enterprises (Wang et al., 2018). When the level of marketization in the region where an enterprise is located is higher, the efficiency of contract execution between enterprises is often higher, and the cost of breach of contract is relatively greater. Therefore, the probability that supply chain-related enterprises will behave opportunistically in the cooperation process is greatly reduced, and the external default risk faced by enterprises is relatively low. In other words, the lower the marketization level in the region where the enterprise is located, the greater the market risk the enterprise faces (Yuan et al., 2021) and the higher the risk of opportunistic behavior among market entities. Therefore, when the regional marketization level is low, enterprises may be more inclined to weaken the information asymmetry between enterprises and supply chain associates through DT so as to reduce supply chain transaction costs and ensure their own supply chain security. Therefore, the higher the marketization level of the region where an enterprise is located, the more significant the role of DT in promoting the growth of that enterprise may be.

3.3.3Digital infrastructure levelExisting research shows that the level of an enterprise's external digital infrastructure is an important factor affecting an enterprise's DT (Hinings et al., 2018; Li et al., 2022a). When the level of digital infrastructure outside an enterprise is higher, it often means that the enterprise can draw on more digital technologies and digital resources. The driving force for the DT of enterprises is relatively strong, and the cost of transformation is relatively low. This situation positively empowers the DT efficiency of enterprises and promotes their growth. At the same time, from the perspective of vertical relationships in the supply chain, companies can improve their capabilities to manage the supply chain system through DT and even connect more upstream and downstream companies by building a supply chain digital platform (Govindan et al., 2018). Doing so enhances the company's ability to control supply chain resources and promotes enterprise growth. In other words, when the level of digital infrastructure outside the enterprise is low, the cost of DT for the enterprise is relatively high. Therefore, the efficiency and extent of DT may be lower than they are for companies with better external digital infrastructure resources, and the promotion effect on enterprise growth is also relatively weak.

Based on the above analysis, this paper proposes:

Hypothesis 3 The promotion effect of EDT on enterprise growth is moderated by the enterprise's external environment.

Hypothesis 3.1 The promotion effect of EDT on enterprise growth is moderated by the intensity of industry competition.

Hypothesis 3.2 The promotion effect of EDT on enterprise growth is moderated by the level of regional marketization.

Hypothesis 3.3 The promotion effect of EDT on enterprise growth is moderated by the level of digital infrastructure.

Based on the above theoretical analysis, this paper focuses on research on the effect and mechanism of EDT on enterprise growth and proposes three sets of research hypotheses that await further empirical testing. The overall theoretical framework is shown in Fig. 1.

4Research design4.1Data sourcesTo meet its research needs, we selected the data of Shanghai and Shenzhen A-share listed companies in China from 2011 to 2019 as a research sample. On the one hand, the sample time interval was selected due to the rapid development of digital technology in China and because the DT of enterprises mainly occurred after 2010 (Chen et al., 2022b). On the other hand, this period excluded from consideration the abnormal business data and supply chain data caused by the novel coronavirus epidemic in 2020–2022. The financial data of the listed companies used were all taken from the CSMAR database, and the China Research Data Service Platform (CNRDS) database was also consulted when data were missing. In addition, in order to improve the validity of the data, the following processing steps were taken: (1) in view of the particularity of the financial industry, the data of enterprises belonging to the financial industry in the sample were excluded; (2) company data with abnormal data and serious missing data were eliminated; and (3) the company sample data of ST, *ST, and PT within the sample period were removed. After processing, a total of 13,610 observations remained for consideration.

Selection and adequacy of time span. The time span selected for this study is from 2011 to 2019, covering nearly a decade. During this period, the rapid development of China's economy, in particular, the rapid popularization of the application of information technology and the Internet, had a profound impact on the operation mode and growth path of enterprises. During this period, the Chinese government vigorously promoted the development of information construction and the digital economy. Moreover, the implementation of relevant policies provided a rich background of change and an experimental field for research, both of which increase the representativeness of the sample period and the timeliness of the research. In addition, a long time span enabled us to observe and analyze possible long-term effects and trend changes in the DT process. This is of great significance for understanding how DT affects enterprise growth, as it can effectively prevent the interference of short-term fluctuations on research results and improve the robustness of research conclusions.

Extensiveness and reliability of sample selection. As one of the most important stock markets in China, the A-share market of Shanghai and Shenzhen has listed companies covering all major industries and fields in China's economy, including manufacturing, information technology, and the service industry. A sample setting of this type is helpful to comprehensively capture the diversity and industry specificity of the impact of DT on the growth of enterprises in different industries and to enhance the universality and depth of research conclusions. At the same time, as important participants in economic activities, listed companies usually have more standardized management and better information disclosure systems, which not only ensures data accessibility and integrity, but also improves data accuracy and reliability. The financial statements, annual reports, and related announcements of listed companies have undergone strict audit and supervision, so the information extracted from these data has high reliability and validity.

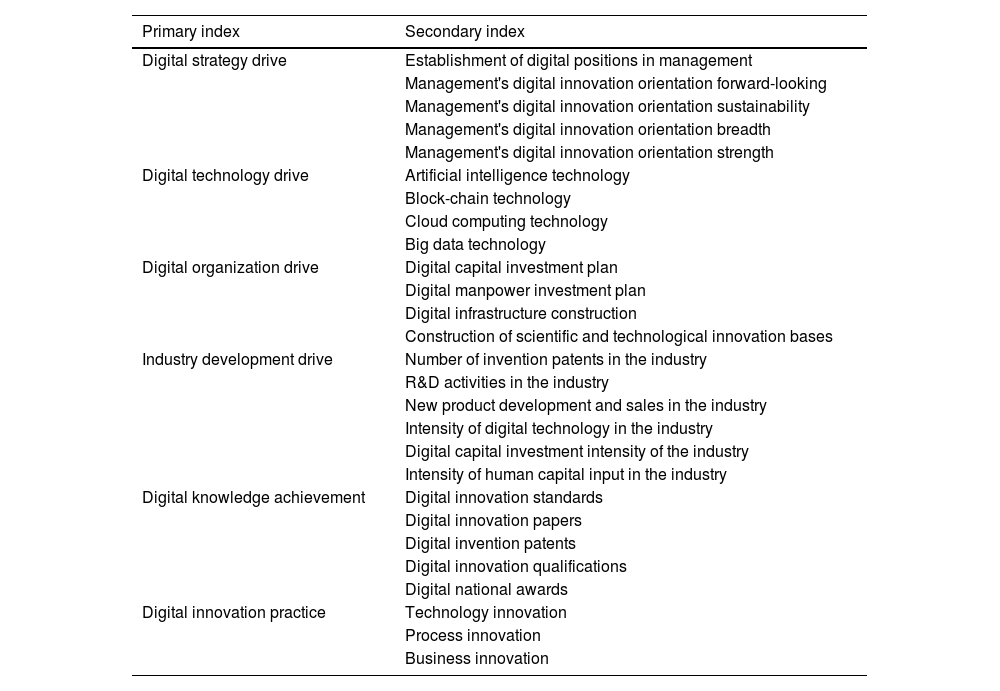

4.1.1Explanatory variableThe explanatory variable in this paper is the degree of enterprise digital transformation (EDT). Because EDT is a very complex strategic initiative (Hinings et al., 2018; Hanelt et al., 2021; Verhoef et al., 2021) that is comprehensively affected by various internal and external factors of the enterprise (Vial, 2019; Nambisan et al., 2019) and is a continuous process (Lenka et al., 2017; Rachinger et al., 2019; Warner & Wager, 2019; Gong & Ribiere, 2021), the academic community has not created a recognized and unified measurement index for it. To solve this problem and most accurately measure the degree of DT of enterprises, we used the annual reports of listed companies, China Statistical Yearbook, China City Statistical Yearbook, and websites of the State Intellectual Property Office and the Ministry of Science and Technology as data sources. Moreover, following the literature (Ribeiro-Navarrete et al., 2021; Yang et al., 2022; Tao et al., 2023; Li et al., 2023c) and integrating text analysis and financial analysis, we used the entropy weight method to construct a measurement system for EDT from six dimensions.

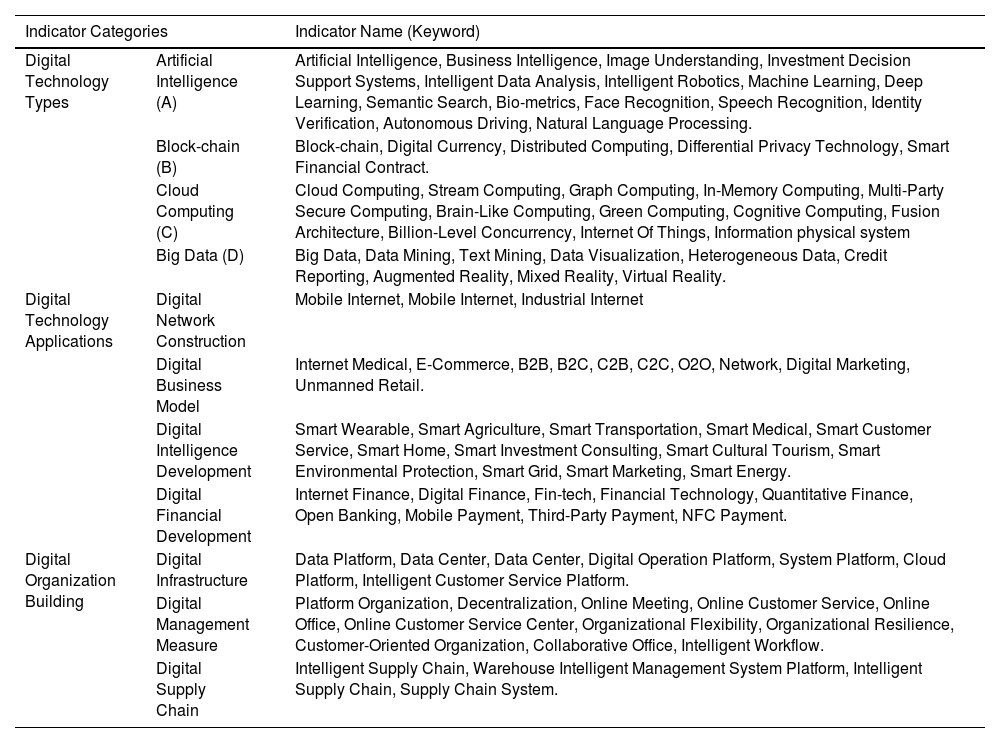

Specifically, it includes three driving factors, namely, digital strategy drive, digital technology drive, and digital organization drive at the company level, as well as the two result indicators of digital knowledge achievements and digital innovation practice. At the same time, industry development drive at the industry level is also included as one of the indicator dimensions to build a DT indicator system from multiple dimensions to measure the degree of DT of an enterprise as comprehensively and accurately as possible. Table 1 shows the dimensions and subdivisions of each indicator. For the robustness test, we use the text analysis method, which is most commonly applied in the literature, to measure the degree of EDT and conduct a benchmark regression test again as an alternative variable.

Enterprise digital transformation index system.

Note: The index design refers to the DT Research Database of Chinese listed companies.

The core explained variable in this paper is enterprise growth level (GROW). Based on Penrose's enterprise growth theory (Penrose, 2009), enterprise growth refers to the overall expansion trend displayed by an enterprise on the basis of continuously tapping the potential of internal and external resources, that is, the continuous transformation process of an enterprise from small to large and from weak to strong. Enterprise growth is a process in which an enterprise continuously optimizes the allocation of internal and external resources to achieve scale growth and efficiency growth. Enterprise growth is also a multi-dimensional concept that encompasses the improvement of production efficiency, profitability, revenue scale expansion, asset scale expansion, market value improvement, and so on. However, these multi-dimensional indicators can usually be summarized into three aspects: growth quality, growth scale, and growth value. Therefore, good enterprise growth measurement indicators should also be able to reflect the three core connotions. Hence, we select total factor productivity (TFP) to reflect the growth quality of enterprises (Grow_1), the growth rate of total assets (TAGR) to reflect the growth scale of enterprises (Grow_2), and Tobin's Q value (TQ) to reflect the growth value of enterprises (Grow_3). Then, we construct the comprehensive index of enterprise growth (GROW) using the principal component analysis method.

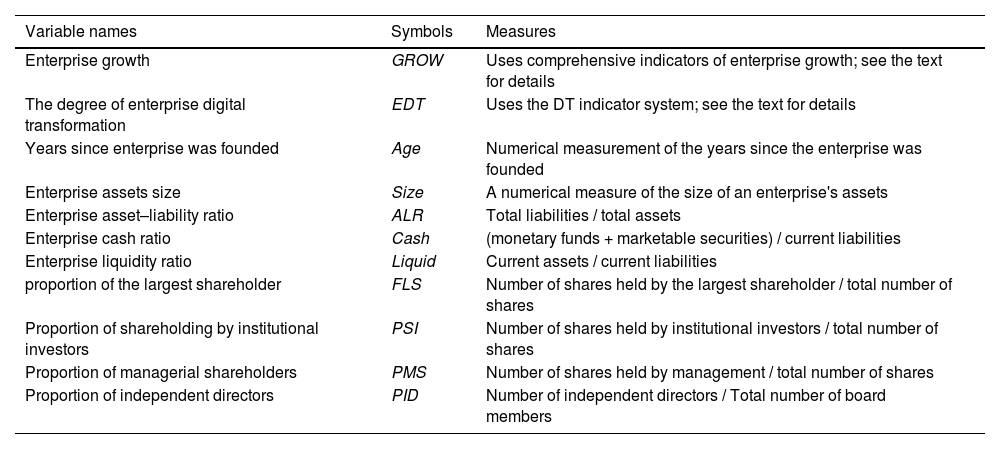

4.2.2Control variablesIn order to control for interference, we selected a series of control variables with reference to previous studies (Ribeiro-Navarrete et al., 2021; Yang et al., 2022; Tao et al., 2023). First, considering that DT may have a significant correlation with the existing asset structure and capital structure of the enterprise, enterprise history, scale, assets and cash, etc., we selected enterprise Age (Age), enterprise Size (Size), enterprise asset–liability ratio (ALR), enterprise Cash ratio (Cash), enterprise current ratio (Liquid), and other enterprise general characteristic variables for control. Then, considering that the DT of enterprises not only requires a large amount of investment in digital technology and talents, but also involves fundamental strategic decision-making and in-depth organizational changes, there may be an important relationship with the enterprise governance structure. Therefore, we selected enterprise governance characteristic variables, such as the shareholding ratio of the largest shareholder (FMS), the shareholding ratio of institutional investors (PSI), the shareholding ratio of the management (PMS) and the proportion of independent directors (PID), for control. Moreover, to exclude the influence of unobservable related factors as much as possible, we chose to control the fixed effects of Year (Year), industry (Ind), and region (Reg). The names, symbols, and measurement methods of variables in this paper are shown in Table 2.

Variable names, symbols, and measures.

Firstly, to examine the effect of EDT on enterprise growth, we followed previous studies (Ribeiro-Navarrete et al., 2021; Tao et al., 2023) to create Model (1).

Where, GROWit is the explained variable, representing the enterprise growth level of enterprise ‘i’ in year ‘t’; EDTit is the explanatory variable, representing the degree of DT of enterprise ‘i’ in year ‘t’; Controlsit is a series of enterprise-level control variables; and εitis a random disturbance term. In order to maximize the robustness of the research conclusions in this paper, we controlled for Year (Year) and industry (Ind) fixed effects. Coefficient β1 is the focus of regression analysis. If hypothesis 1 is true, then coefficient β1 should be significantly positive.

Secondly, referring to previous research (Yang et al., 2022), we used the interaction term model to test the chain mediation mechanism step by step and build the following mediation mechanism test Model (2).

Where,Mit is the intermediary mechanism variable, and the other variables are consistent with the settings in Model (1). Coefficient θj is the focus of regression analysis. If hypothesis 1 is true, then coefficient θj should be significantly positive.

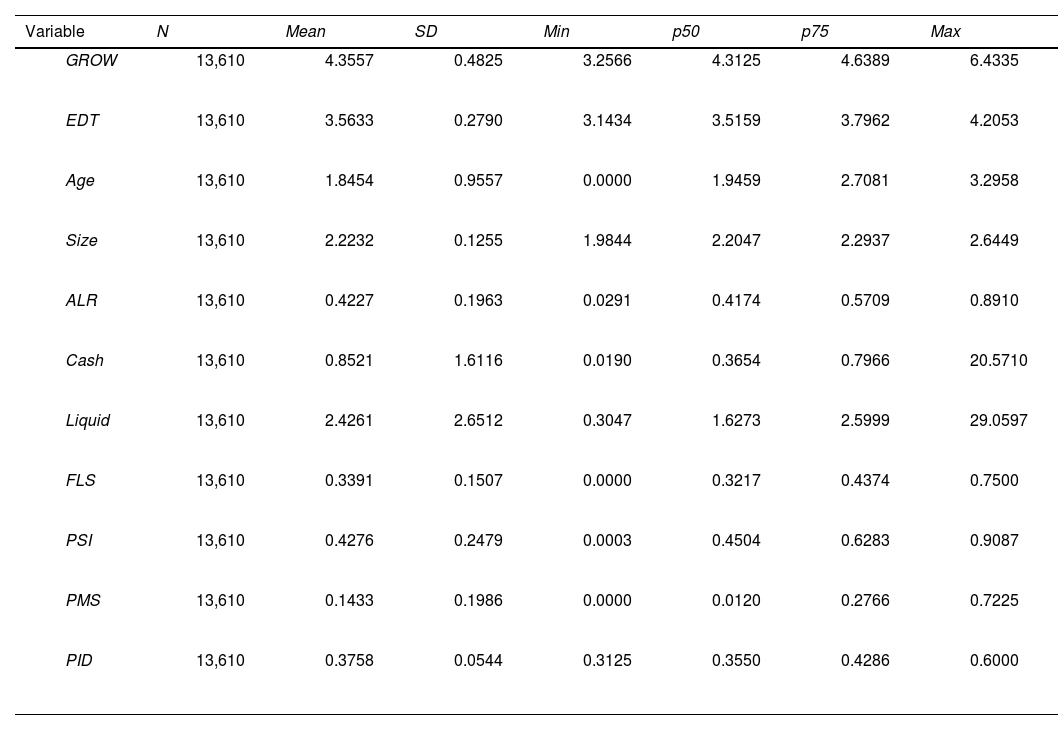

4.4Descriptive statisticsTable 3 reports the descriptive statistical results of the main variables. (1) There is a large dispersion in the development levels of enterprises, and the difference between the 75th percentile and the maximum value is significant, indicating that the branch enterprises have large room for growth. (2) The overall degree of DT of enterprises is low, indicating that it is at an early stage. (3) There are various differences in the control variables of enterprise characteristics. Among them, the standard deviations of cash and current ratios are larger, because the DT of enterprises involves large-scale investment and requires special attention. (4) Enterprise governance control variables focus on indicators related to equity checks and balances, reflecting the large differences in equity structures and governance structures of different companies.

Descriptive statistical results.

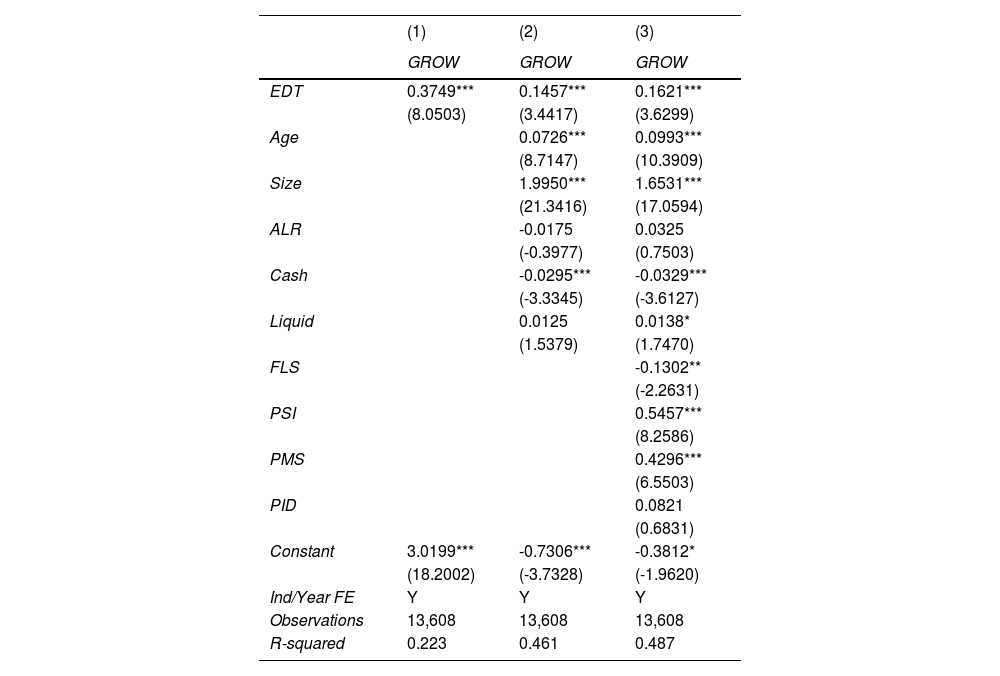

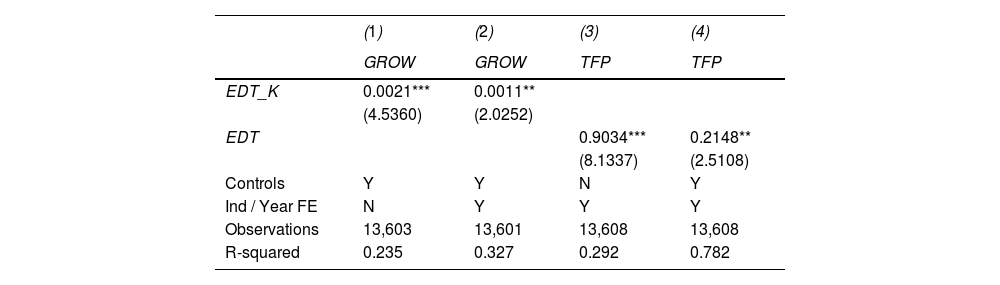

Table 4 reports the baseline regression results. Column (1) is the effect of EDT on enterprise growth without controlling for other variables. Column (2) adds controls for firm characteristic variables. Column (3) further adds controls for enterprise governance variables. The regression results show that the effect of EDT on enterprise growth is significantly positive at the 1 % level. Therefore, Hypothesis 1 is confirmed.

Benchmark regression results.

Note: Cluster robust standard error in parentheses; ***,**, * are significant at 1 %, 5 %, and 10 % levels, respectively. The following tables are the same.

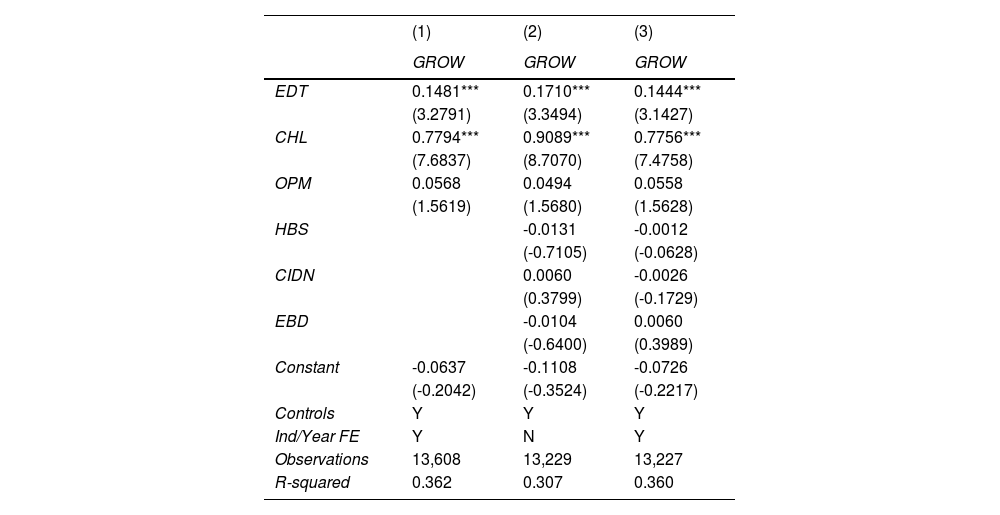

To avoid the endogeneity problem caused by the omission of dependent variables, we further increased the control of related variables. First of all, considering that the level of enterprise cash flow and profit margin may affect the investment of enterprises in DT, we added control variables such as enterprise cash holding level (CHL) and operating profit margin (OPM) to the benchmark regression model. Secondly, considering that the social network relationship between supply chain enterprises may have a significant effect on the cooperation between upstream and downstream enterprises and thus affect enterprise performance, we increased the control variables to include whether the enterprise holds bank shares (HBS), independent director network centrality (CIDN), and equity balance degree (EBD). The regression results in Table 5 show that after the relevant control variables are added, the effect of EDT on enterprise growth remains significantly positive at the level of 1 %. This shows that the basic conclusion of this paper is robust.

Considering the effect of missing variables.

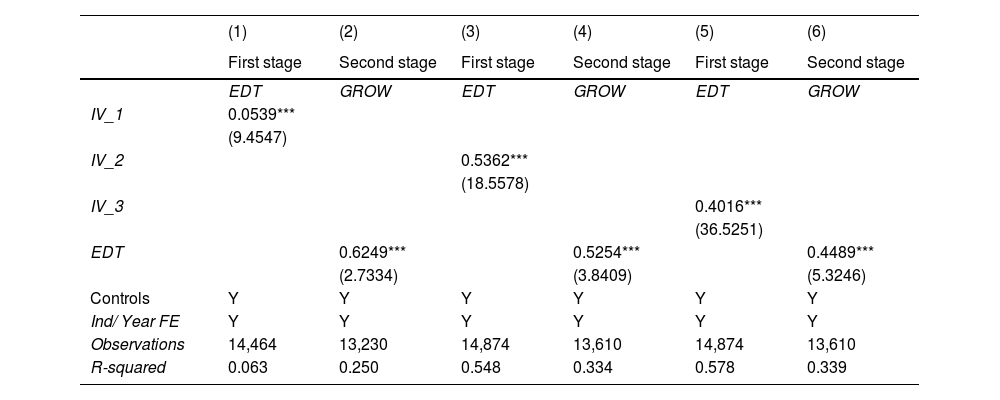

In this paper, there may be an endogenous problem caused by reverse causality; that is, well-developed enterprises are more inclined to carry out DT strategic actions, and DT may be the result of enterprise growth rather than its cause. Therefore, we tested for the presence of this problem by constructing three instrumental variables. Firstly, referring to previous studies (Yang et al., 2022; Tao et al., 2023; Li et al., 2023c), we used exogenous policy shocks to construct instrumental variables. Specifically, the process of the DT of enterprises is closely related to the development level of information infrastructures in the region and meets the correlation requirements of tool variable selection. At the same time, these infrastructures do not directly affect the enterprise growth of a single enterprise and meet the exogenous requirements of tool variable selection. In 2012, the Chinese government launched the “Broadband China Strategy,” and from 2014 to 2016, 120 cities were identified as pilot cities in three rounds for the promotion of information infrastructure construction to provide more basic technical resources for enterprise informatization and digital upgrading. Therefore, we selected the “Broadband China” policy as one of the instrumental variables (IV_1) and then conducted a regression test. Specifically, if the sample enterprise is located in a policy pilot city, the value after the selection year is 1; otherwise, it is 0. The regression results of the first stage presented in Column (1) of Table 6 show that the effect coefficient of instrumental variables is significantly positive at the level of 1 %, indicating that instrumental variables are significantly positively correlated with EDT. The regression results of the second stage presented in Column (2) show that the effect coefficient of EDT is significantly positive at the level of 1 %, indicating that EDT can significantly promote enterprise growth. Therefore, the basic conclusion of this paper is robust.

Considering reverse causation.

Secondly, we constructed the industry average level (IV_2) and city average level (IV_3), respectively, which are the other two instrumental variables of enterprises’ individual DT. On the one hand, the degree of DT of individual enterprises is related to the overall degree of DT of all enterprises in the industry and city in which they are located, which meets the correlation requirements of the selection of instrumental variables. On the other hand, the industry average and city average levels of enterprises’ DT are less correlated with the growth of a single enterprise, which meets the exogenous requirements of the selection of instrumental variables. Table 6 reports the regression results using the above instrumental variables. Columns (3) and (5) present the regression results of the first-stage instrumental variables on the EDT variables, respectively, and the influence coefficients are significantly positive at the level of 1 %. Columns (4) and (6), respectively, show that after the use of instrumental variables, the effect coefficients of EDT are significantly positive at the level of 1 %, further demonstrating that DT can significantly boost business growth. Therefore, the basic conclusion of this paper is robust.

5.3Robustness test5.3.1Replacement of explanatory variable measuresEDT is characterized by comprehensiveness, complexity, and continuity. Therefore, to enhance the credibility of the research conclusions, we considered the measurement methods used in the existing research literature (Zhao et al., 2021; Yuan et al., 2021). Thus, we selected the text analysis method to extract the keyword frequency of DT from enterprise annual reports and conducted a robustness test as an alternative indicator. Specifically, we used the proportion of the word frequency of digital keywords in the MD&A part of the enterprise annual report to the total word frequency as the proxy variable (EDT_K) of the enterprise's degree of DT. At the same time, we divided the keywords into categories (Table 7) and then repeated the regression for Model (1).

Keyword thesaurus of EDT.

However, it should be noted that the wording in enterprise annual reports is highly subjective and susceptible to human manipulation, so its explanatory power may be reduced. The regression results presented in Column (2) of Table 8 show that the effect of EDT on enterprise growth is significantly positive at the 5 % level. Therefore, the basic conclusion is robust.

5.3.2Replacing the explained variable measureWe used the total factor productivity (TFP) measured by the LP method as an alternative index of enterprise growth and then carried out the regression test. However, it should be noted that TFP is more of an indicator of enterprise operating efficiency and cannot accurately reflect other aspects of enterprise growth, such as the expansion of enterprise scale and improvement of enterprise value. Therefore, although TFP is an important indicator of enterprise growth, it cannot reflect the whole picture of enterprise success. The regression results presented in Column (4) of Table 8 show that the effect of EDT on TFP is significantly positive at the level of 5 %. Therefore, the conclusion of this paper is robust.

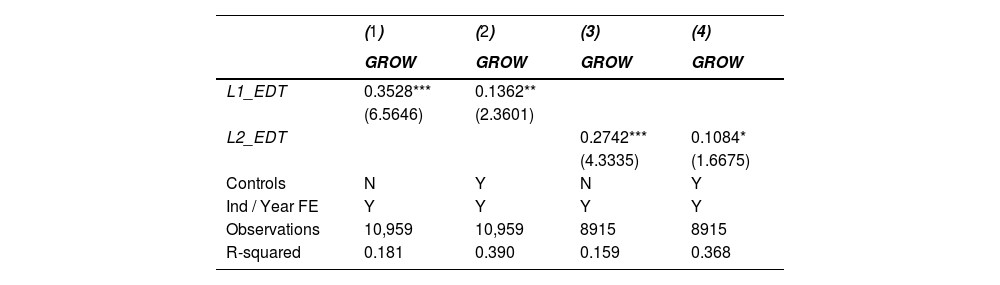

5.3.3The explanatory variable is laggedAs EDT is long-term system engineering, the effect of current DT may have a certain lag and obvious continuity. Therefore, we used a one-period lagged term (L1_EDT) and two-period lagged term (L2_EDT) of EDT as the core explanatory variables and repeated the regression. The regression results in Table 9 show that the promotion effect of EDT on enterprise growth is still significantly positive at the level of 1 %–10 %. At the same time, after the explanatory variable data are lagged, the sample size is significantly reduced, which may lead to a decline in the absolute value and significance of the effect factor. Therefore, the basic conclusions of this paper are robust.

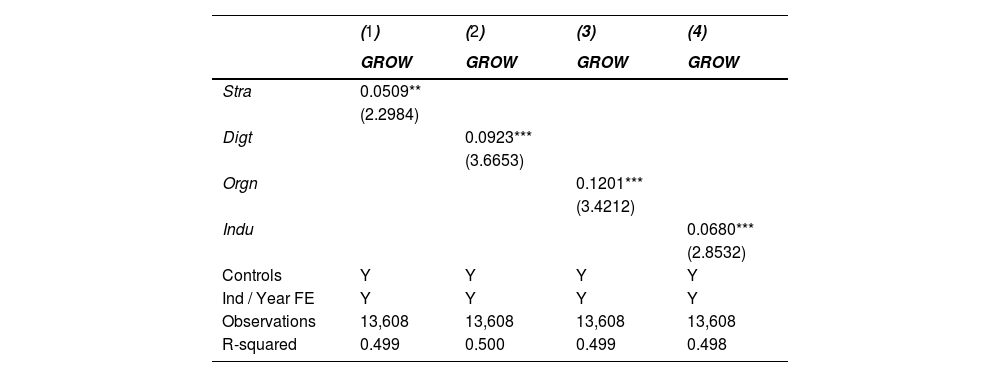

5.3.4The transformation drivers are subdividedIn order to further analyze the differential effect of the main drivers of EDT on enterprise growth and further confirm the robustness of our basic conclusions, we replaced the DT variables by four variables: digital strategy-driven (Stra), digital technology-driven (Digt), digital organization-driven (Orgn), and industry development-driven (Indu).

Table 10 reports the regression results as follows. (1) Within the enterprise, the promotion effect of being digital strategy-driven on enterprise growth is significantly positive at the level of 5 %. The promotion effects of being digital organization-driven and digital technology-driven on enterprise growth are significantly positive at the 1 % level. From the perspective of the impact coefficient, the influence of being digital organization-driven is more significant, which shows that in the process of EDT, digital organization construction is the underlying support for digital technology application and digital strategy landing. However, with the further development of DT, the leading role of digital strategy may become more obvious. (2) Outside the enterprise, the promotion effect of being industry development-driven on enterprise growth is significantly positive at the level of 1 %. This finding shows that DT is no longer the strategic change action of a single enterprise but is closely dependent on the overall development of the industry. With the accelerated penetration and diffusion of digital technology, in particular, as well as the continuous refinement of the industrial division of labor, the relationship between enterprises is deepening, and no enterprise can be immune. Determining how to achieve a more cost-effective and efficient DT with the help of the overall digital development trend of the industry is an important starting point for enterprises to win competitive advantages and achieve sustainable development.

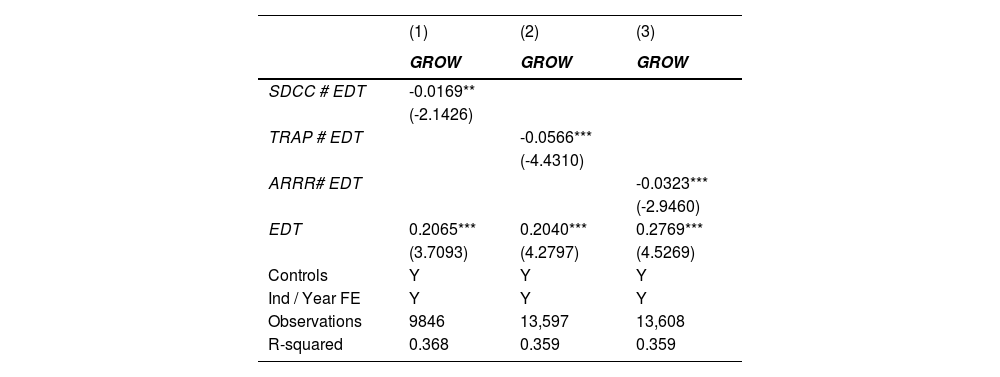

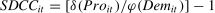

6Mechanism analysis6.1Intermediary mechanism test6.1.1Supply and demand coordination costs in the supply chainSince it is difficult to directly measure the supply–demand coordination cost between enterprises in the supply chain, we referred to the previous literature (Tao et al., 2023; Cachon et al., 2007) and measured the supply–demand coordination cost (SDCC) by the deviation of enterprise production fluctuation from demand fluctuation. The specific construction method of this index is as follows:

Where, δ(·) and φ(·) represent the standard deviation of variables, δ(Proit) represents the volatility of firm production, and φ(Demit) represents the volatility of firm demand. Proit,Costit and NYIit represent the production volume, operating cost, and year-end net inventory of enterprise “i” in year “t”, respectively. Demit represents the demand of enterprises, and enterprise cost (Costit) is used as the proxy variable. The greater the deviation between supply and demand in the supply chain, the lower the accuracy of supply and demand matching between enterprises in the supply chain, the higher the cost of supply and demand coordination between enterprises, and the lower the efficiency of supply and demand coordination. Considering that this index belongs to the data at the enterprise level, the one-period-lagged data were taken as the measurement index of the supply–demand coordination cost between enterprises to avoid endogeneity.

At the same time, we used the change of accounts payable turnover days (TRAP) to characterize the supply–demand synergy efficiency between the focus firm and its upstream supply chain enterprises and the change of accounts receivable to revenue ratio (ARRR) to characterize the supply–demand synergy efficiency between the focus firm and its downstream supply chain enterprises. To a large extent, accounts receivable and accounts payable are generated by enterprises to avoid transaction risks in the process of cooperation with upstream and downstream enterprises, such as the delivery time cycle and quality of delivered products. First of all, the TRAP decreased, indicating that the focus enterprises made timely payments to upstream enterprises in the supply chain, and the credit purchase decreased, that is, the capital occupation of upstream enterprises decreased. This finding can largely reflect the reduction of transaction costs between focus enterprises and upstream enterprises, thus promoting the improvement of supply–demand coordination efficiency. Secondly, the ARRR decreased, indicating that the focus enterprises paid the downstream enterprises in the supply chain in a timely manner, that is, the capital occupation of the downstream enterprises decreased. This finding can largely reflect the reduction of supply and demand coordination costs between focus enterprises and downstream enterprises, thus promoting the improvement of supply and demand coordination efficiency.

The regression results presented in Table 11 in Columns (1)–(3) show that when three intermediary variables are used to represent the supply chain supply and demand collaboration costs of an enterprise, the coefficients of their interaction terms are all significantly negative at the 1 % level. This shows that EDT can significantly reduce the cost of supply and demand collaboration between enterprises in the supply chain, improve the efficiency of supply chain operation collaboration, and thus further promote enterprise growth. Therefore, hypothesis 2.1 is confirmed.

6.1.2Logistics coordination costs in the supply chainSince listed companies do not directly disclose the specific data of warehousing and logistics costs, we use the changes of inventory to revenue ratio (IRR) and inventory turnover days (ITD) to reflect the logistics coordination efficiency of a supply chain. The lower the IRR, the more quickly the input products can be put into production and the output products can be sold to the downstream enterprises or end market. DSIT refers to the number of days experienced by an enterprise from the beginning of acquiring inventory to the end of consumption and sales. The lower the ITD, the faster the inventory liquidation speed, and the higher the supply chain logistics coordination efficiency.

We also drew on the ideas of existing studies (Wu & Yao, 2023) and constructed warehousing logistics cost variables from the industry level through an input–output table. Considering that input–output table data from the sample period may be highly endogenous, we used the input–output table of 2010 to calculate the proportion of industrial warehousing and logistics costs (including warehousing costs and transportation costs) in intermediate inputs and construct the logistics collaborative cost index (WLC) of the industry.

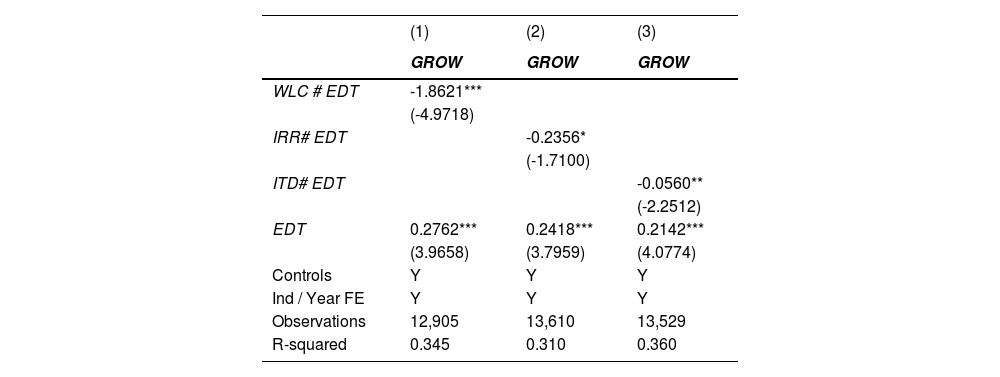

The regression results presented in Columns (1)–(3) of Table 12 show that when three intermediary variables are used to characterize the supply chain logistics collaboration cost of an enterprise, the coefficients of their interaction terms are all significantly negative at the 1 %–10 % level. This finding indicates that EDT can reduce logistics collaboration costs among enterprises in the supply chain and improve logistics collaboration efficiency, thereby further promoting enterprise growth. Therefore, hypothesis 2.2 is confirmed.

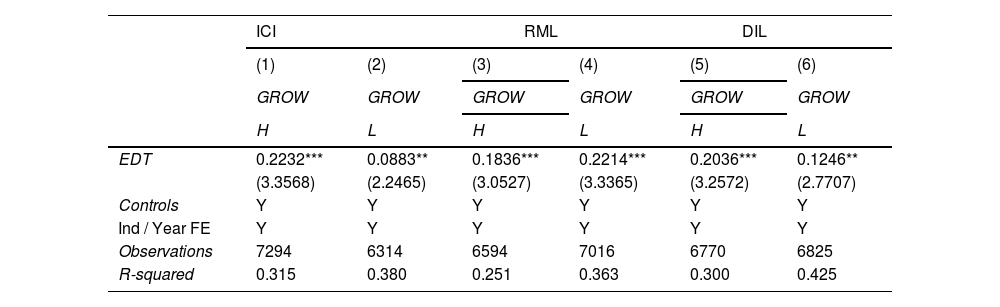

6.2Moderating effect test6.2.1Industry competition intensityThe intensity of industry competition has a significant effect on the operating efficiency and profit level of enterprises (Yuan et al., 2021). We used the Herfindahl index (HHI) to measure the industry competition intensity (ICI) faced by enterprises, and the samples were divided into higher and lower groups according to the median value for testing. The regression results presented in Columns (1)–(2) of Table 13 show that the significance level of EDT variables in the group with higher market competition intensity is more obvious than that in the group with lower market competition intensity. This finding shows that when enterprises are faced with a market environment of high market competition intensity, industry competition imposes greater survival and development pressure on them. This forced effect makes enterprises more inclined to strengthen the introduction of digital technology and digital talent training and achieve cost reduction and efficiency and R&D innovation through the continuous promotion of DT to promote enterprise growth. This finding indicates that the intensity of industry competition faced by enterprises plays a certain positive regulating role in the process of promoting enterprise growth through EDT. Therefore, hypothesis 3.1 is confirmed.

Moderating effect test.

We used the marketization index of the province where the enterprise is located to measure the regional marketization level (RML), and the sample was divided into higher and lower groups according to the median value for testing. The regression results presented in Columns (3)–(4) of Table 13 show that under the conditions of high or low regional marketization levels, the effect of DT on enterprise growth is significantly positive at the level of 1 %. Further from the absolute value of the variable coefficient, when the regional marketization level is low, the effect of EDT on enterprise growth is more significant. This finding shows that DT reduces transaction costs with upstream and downstream enterprises in the supply chain by strengthening investment in digital technology and improving the output of data elements, which enables the more efficient performance of supply chain collaboration and production and operation activities, thus promoting enterprise growth. Therefore, hypothesis 3.2 is confirmed.

6.2.3Digital infrastructure levelEDT needs the support of external digital infrastructure, and the more developed the infrastructure, the higher the support for EDT (Hinings et al., 2018; Vial, 2019; Guo et al., 2024). Following previous studies (Sestino et al., 2020; Hanelt et al., 2021), we comprehensively measured the digital infrastructure level (DIL) outside the enterprise based on such indicators as optical cable density, mobile switch capacity, Internet broadband access user scale, and mobile Internet user scale in the city where the enterprise is located and divided the sample into higher (H) and lower (L) groups for testing according to the median value of the sample. The regression results presented in Columns (5)–(6) of Table 13 show that when the level of external digital infrastructure is high, the effect of EDT on enterprise performance is significantly positive at the 1 % level. When the level of external digital infrastructure is low, the effect of DT on enterprise performance is significantly positive at the 5 % level. This finding indicates that the level of external digital infrastructure plays a positive regulating role. Therefore, hypothesis 3.3 is confirmed.

7Heterogeneity analysisWhen there are obvious differences in enterprises’ own characteristics and resource capacity levels, the effect of their DT on supply chain concentration should logically be quite different. We mainly analyzed heterogeneity from three aspects: the level of enterprise financing constraints, enterprise industry attributes, and the nature of property rights. Thus, we provide detailed support for the formulation and optimization of industrial policies as well as detailed evidence for the implications of enterprise practice.

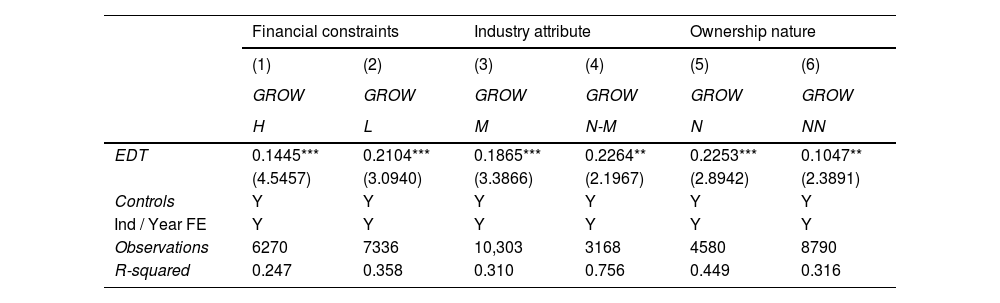

7.1Enterprise financial constraintsThe level of financial constraints is one of the key constraints for enterprise development (Nikolov et al., 2021). We measured the level of financial constraints of enterprises according to the WW index and divided them into high and low groups according to the median value of the sample for testing. The regression results presented in Columns (1)–(2) of Table 14 show that in the group with a low level of financing constraints, the promotion effect of EDT variables on enterprise growth is more significant. This finding shows that DT plays a more significant role in promoting the growth of enterprises with lower financing constraints, further indicating that enterprises with lower financing constraints have more disposable funds, strengthen their investments in digital technology and digital talents, and promote their growth by improving their degrees of DT.

Heterogeneity analysis.

Enterprises have different industrial attributes, and the complexity of the industrial chain they face is different, which largely determines the scope and effect of DT. Using the industry category of enterprises, we divided them into manufacturing and non-manufacturing groups for testing. The regression results presented in Columns (3)–(4) of Table 14 show that DT plays a more significant role in promoting the growth of manufacturing enterprises. This finding further indicates that the product production and process management of manufacturing enterprises are more complex. DT can improve the total factor productivity of manufacturing enterprises to a greater extent, expand the scope of business, reduce the transaction costs of supply chain, and realize increases in efficiency and business model reforms, thus promoting enterprise growth.

7.3Enterprise ownership natureChina has more SOEs, so it is necessary to consider the heterogeneity of regression conclusions when the property rights of enterprises are different. SOEs are often involved in important areas of economic system and national economy operation, their financing constraints are low, and they enjoy more tax incentives and policy support. The samples were divided according to the property rights of enterprises into SOEs and non-SOEs for testing. The regression results presented in Columns (5)–(6) of Table 14 show that DT has a more significant role in promoting the growth of SOEs than non-SOEs. This finding shows that SOEs often have a large scale and gain the support of various resources, through DT, to further improve R&D and production efficiency and strengthen their control of supply chain resources, thus further promoting their growth. However, non-SOEs as a whole are at an early stage of DT and need to invest a great deal in labor, talent, and material resources to carry out DT and upgrading; hence, the effect of DT on their growth is weaker than on SOEs.

8Conclusions and discussions8.1ConclusionsBased on the data of listed enterprises in China and transaction cost theory, we empirically tested the effect of DT on enterprise growth and its mechanism from the perspective of supply chain collaboration. At the same time, we empirically analyzed the regulatory effects and firm heterogeneity affecting the operation of this mechanism. The study made the following findings. (1) EDT can significantly promote enterprise growth. This conclusion still holds after a series of endogeneity and robustness tests. (2) In the process of EDT promoting enterprise performance improvement, supply chain transaction cost reduction and collaborative efficiency improvement play important intermediary mechanism roles. (3) The promotion effect of EDT on enterprise growth is positively regulated by industry competition intensity, regional marketization level, and digital infrastructure level. (4) When the enterprises are manufacturing enterprises or SOEs and their financing constraints are low, the DT of enterprises has a more obvious role in promoting their growth.

8.2Policy suggestionsBased on the above research conclusions, we make the following recommendations. At the policy level, the formulation and optimization of relevant industrial policies should be anchored by the DT of enterprises at the micro level and the improvement of supply chain synergy efficiency at the medium level to further promote the growth and sustainable development of enterprises. More detailed recommendations are outlined below.

- (1)

Increase support for the DT of enterprises and provide micro-support for the construction of a digital intelligent supply chain system. The mechanism analysis of this paper finds that the reduction of supply–demand matching costs between enterprises in the supply chain plays an important intermediary role in the process of promoting enterprise growth through EDT. With the advancement of the DT process of enterprises, both the production scale and sharing efficiency of data elements and the collaborative efficiency between enterprises in the supply chain will continue to improve. These improvements will gradually solve the problems of slow market response, low information sharing, and high operational risk in the supply chain, thus providing micro-support for the formation of a digital and intelligent supply chain system. Relevant policy departments and governments at all levels should take the industrial chain as the starting point, especially the key node enterprises in the industrial chain as the breakthrough point, and strengthen policy encouragement and support. Relevant government departments should encourage and support supply chain-leading enterprises to build or join a digital supply chain collaboration platform, open up supply chain upstream and downstream data sharing, improve the scope and efficiency of collaboration between enterprises, and promote joint R&D and value co-creation between enterprises as well as the overall digital level of the supply chain to empower enterprises to grow.

- (2)

Further strengthen the construction of digital technology infrastructure and at the same time improve the digital and intelligent level of traditional infrastructure. Our analysis of the mechanism of action in this paper found that the reduction of warehousing and logistics costs plays a key intermediary role in the process of promoting enterprise growth through EDT. The construction of warehousing and logistics systems often involves large-scale investment, and the requirements for traditional infrastructure, such as a new generation of digital infrastructure and transportation, are also high. Therefore, we suggest that relevant policy departments and governments at all levels should promote the reduction of warehousing and logistics costs as the core work of building a modern supply chain system. On the one hand, there is a need to strengthen the construction of a new generation of digital infrastructure, lay out and improve relevant infrastructure construction projects in a targeted and forward-looking manner, and reduce the costs related to the adoption of digital technology by enterprises. On the other hand, it is necessary to improve the intelligence level of traditional infrastructure and build smart transportation and smart logistics systems. Further, there is a need to strengthen the construction of supporting facilities, such as industrial parks, improve digital warehousing and logistics management systems (Sakas et al., 2023), empower enterprises to interact and collaborate with national and global supply chain partners, and promote the high-quality development of enterprises.

- (3)

Further improve the business environment and promote market competition. Our regulatory effect analysis found that a good business environment and market competition can help strengthen the role of DT in promoting the growth of enterprises. Therefore, the government should pay attention to the continuous optimization of the business environment and the fairness of market competition when formulating relevant policies. First, the legal framework and policy support should be strengthened to ensure that the legal rights and interests of enterprises in the process of DT are protected, and technological innovation and application should be encouraged. At the same time, the government needs to improve the digital level of public services and create a convenient environment for enterprises through efficient and transparent services. In addition, the market access policy should be optimized, the industry threshold should be lowered, monopolies should be broken, and healthy competition within the industry should be promoted, especially for small and medium-sized enterprises (SMEs), to create a fair competition environment. The government should also strengthen digital capability training for enterprises, especially SMEs, including digital skills training for employees, to enhance the digital application capability of enterprises. Finally, digital innovation and cooperation should be stimulated between enterprises, and enterprises and scientific research institutions should be encouraged to jointly develop new technologies and solutions and promote technological progress and industry innovation. Through these measures, the government can effectively promote the growth and development of enterprises, especially SMEs, and enhance the competitiveness and vitality of the overall economy.

- (4)

Policy departments should pay attention to the different characteristics of market players when formulating DT policies to achieve classification and precise policies. We find that when the levels of financing constraints, industry attributes, and property rights of enterprises are different, the effect of DT on the growth of enterprises is significantly different. Therefore, it is necessary to further strengthen the construction of digital finance and inclusive finance, continue to reduce the financing constraints of enterprises, and promote the growth of enterprises. At the same time, there is a need to further strengthen policy support for the service sector and non-SOEs to promote the high-quality and sustainable development of enterprises.

Based on the above research, the following conclusions can be drawn. At the enterprise level, DT should be expanded from the dimension of internal application change to the dimension of collaboration among supply chain enterprises in order to plan EDT strategy from a more macro perspective and further promote enterprise growth. This recommendation is outlined in more detail below.

- (1)

Build a new understanding of digital transformation strategy. Break through enterprises’ boundary thinking and connect the DT within an enterprise with the overall efficiency of the enterprise's supply chain. Powerful enterprises should not be satisfied with their own DT but should build digital supply chain platform ecosystems to drive the DT of SMEs, improve the accuracy and efficiency of supply and demand matching, and lead the continuous improvement of the efficiency of the entire supply chain.

- (2)

Strengthen supply chain coordination from the perspective of supply and demand matching. DT not only reduces and improves the supply and demand matching efficiency of the upstream and downstream of the enterprise's supply chain; it also further reduces transaction risks and improves capital turnover efficiency. Therefore, enterprises can take DT and supply chain collaboration as starting points and aim to reduce transaction risks, improve warehouse and capital turnover efficiency, and promote their own high-quality growth.

- (3)

Strengthen supply chain collaboration from the perspective of logistics efficiency. The application of digital technology in the field of logistics can greatly improve logistics and distribution efficiency, reduce costs, and shorten delivery times. Enterprises should optimize their warehousing and logistics networks by utilizing advanced digital technologies, including automated warehouse management systems, intelligent route planning, and real-time cargo tracking technologies, to ensure the transparency and traceability of logistics operations. In addition, by integrating information from the upstream and downstream of the supply chain through a digital platform, enterprises can achieve more efficient inventory management and demand forecasting, further improving the responsiveness and flexibility of the supply chain.

In addition to the above research process and findings, this paper may have the following research limitations. Our findings also suggest several research directions requiring further exploration.

- (1)

Measuring the degree of EDT. As EDT is a systematic strategic transformation process, involving a wide range and high degree of complexity, no recognized optimal measurement index has yet been formulated by scholars. Although this paper measures the degree of DT by constructing a DT index system and conducts a robustness test based on text analysis to accurately reflect the overall face of EDT to the greatest extent, means of precisely measuring EDT remain to be explored further.

- (2)

Selection and measurement of mediating variables. This paper attempts to integrate enterprise-level DT, supply chain collaboration, and enterprise growth into a unified theoretical framework. Since the inter-firm collaborative efficiency of a supply chain cannot be measured directly, the measurement of supply and demand matching and warehousing logistics costs in this paper can only describe part of the collaborative efficiency of a supply chain. Therefore, on the one hand, future research can further explore the measurement of supply chain collaborative costs, and on the other, it can further study the mechanism of value co-creation among enterprises and other cross-border actions in the supply chain.

- (3)

Exploration of dynamic research perspectives. This paper only studies the intermediary mechanism of supply chain transaction costs from a static perspective. However, in reality, the supply chain system experiences great dynamic change, and all links within it affect each other and interact with the enterprise, showing the development trend of the supply chain platform and ecology. Therefore, further attempts should be made to explore the effect of EDT on the evolution of the supply chain ecosystem from a dynamic perspective, and case studies can be carried out to provide new theoretical references for policy formulation and enterprise practice.

- (4)

Research on the expansion of the subdivision dimension. The index system of DT constructed in this paper comprises three dimensions, namely, digital strategy, digital organization, and digital technology, while the growth of enterprises has three sub-dimensions, namely, quality, scale, and market value. Subsequent studies can further deepen the impact of different dimensions of DT on different dimensions of enterprise growth and expand the exploration of theoretical mechanisms.

- (5)

International comparative studies. This paper conducts research based on Chinese practice and sample data. International comparative research based on the theoretical framework presented here would deepen the universality of the theoretical construction and the differences under different national backgrounds, thus deepening the research in this field.

Bin Li: Writing – review & editing, Writing – original draft, Visualization, Validation, Supervision, Software, Resources, Project administration, Methodology, Investigation, Funding acquisition, Formal analysis, Data curation, Conceptualization. Chuanjian Xu: Writing – review & editing, Software, Formal analysis, Data curation. Yacang Wang: Writing – review & editing, Writing – original draft, Formal analysis, Data curation, Conceptualization. Yang Zhao: Software, Validation, Writing – review & editing. Qin Zhou: Writing – review & editing, Writing – original draft, Supervision, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. Xiaodong Xing: Writing – original draft, Supervision, Project administration, Methodology, Investigation, Conceptualization.

This research was supported by the National Social Science Fund of China (Grant No. 23BJL002)