This study investigates supply chain cooperative management problem. In this study, based on principal-agent, firstly we analyses cooperative management factors in supply chain including leading enterprise expected utilities, subsidiary enterprise expected incomes and leading enterprise agency cost, then the incentive contract model is constructed; Secondly the model is solved in the case of symmetric information and asymmetric information; At last, in order to make clear of the model, this paper does mathematical analysis of leading enterprise expected utilities, subsidiary enterprise expected incomes and leading enterprise agency cost. Some important conclusions are obtained: subsidiary enterprise ability, cost coefficient, absolute risk aversion factor and output variance has the same influence on leading enterprise expected utilities and subsidiary enterprise expected incomes; subsidiary enterprise ability, cost coefficient has the same influence on leading enterprise expected utilities, subsidiary enterprise expected incomes and leading enterprise agency cost; leading enterprise expected utilities and subsidiary enterprise expected incomes become bigger and bigger, but leading enterprise agency cost becomes smaller and smaller with absolute risk aversion factor and output variance decreased. etc. Leading enterprise can take on incentive measures (improving subsidiary enterprise ability, decreasing subsidiary enterprise cost coefficient.etc) to optimize supply chain management based on the common factors.

With the development of information and globalization, supply chain management has become an important factor affecting world’s economy development in a sustainable, healthy and rapid way. Studies of supply chain management are more complicated including theories and practices, especially cooperative supply chain management has become the focus in the recent 20 years. Supply chain is related to many industries which are different in departments, functions and operations, and the competition can be formed only by the cooperation between industries, what is more, supply chain activities cannot be achieved until resources of different industries are integrated. Not only it is the significance of supply chain coordination, but it is the way of eliminating the obstacles across industries. Therefore, the problem of cooperative supply chain management needs to be solved urgently. Based on the findings from existing literatures, we found that existing studies discuss the information technology and incentive theory.

Information technology is an important tool in dealing with supply chain management. To verify the importance of information, Prajogo and Olhager put forward supply chain management concept on the background of information, that was, the integration of logistics information resources could drive the integration of logistics resources, and information and information sharing had a significant impact on supply chain performance [1]; Barton and Thomas pointed out that supply chain management had become an increasingly important tool to improve the situation of manufacturing industry, and rapid reaction abilities, intelligent integration system and management capabilities were all the key to create a robust supply chain [2]; Lee emphasized the importance of information resources integration, its contents included: demand, inventory status, production plan, production time, promotion plan, demand forecast and transportation routes sharing [3]. Research also focused on Information tool, such as, Wamba and Chatfield discussed the application of RF technology in the logistics resources integration [4]. Meanwhile, a dynamic self-assessment of performance on supply chains operating in markets was put forward based on information simulation platform [5][6].

So we can conclude that the quantitative model in the above literatures is information-based.

Incentive theory is another important way of solving cooperative supply chain management problem due to the high cost with information technology. “Cooperation” is one key word of incentive theory, such as, Christopher thought it need cooperation for different supply chain parts in network times [7]; With the help of cooperative game theory, Nagarajan and Sos”ic’ analyzed the integration problem of supply chain, and proposed the theory of ‘vision’, which provided one new way for cooperative supply chain management [8].

“Trust” is another key word of incentive theory, such as, Handfield, Nichols and Sahay thought the trust mechanism is of great importance for supply chain management, holding that robust supply chain is needed to ensure the mutual trust and responsibilities among the system for a long time, and the sharing of information, risk and revenue was crucial [9][10].

“Agent” is also the key word of incentive theory, such as, on the background of global supply chain manufacture network, Jiao, You and Kumar set up a multi-agent (upstream and downstream enterprises involved in supply chain), multi-contracting negotiations (customer demand) model, which is helpful for dealing with spontaneous or semi-spontaneous problem in supply chain [11]; Brintrup established the supplier selection model of multi-agent, multi-target and multi-role at the aim of reducing transaction time and increasing corporate revenue [12]; From the perspective of customer needs, Akanle and Zhang put forward optimizing the configuration for supply chain, and they built a multi-agent model coordinating iterative bidding mechanism based on interactive algorithms, got the optimum based on genetic algorithm in the end [13]. Actually, the incentive theory in the above literatures is an important and new method in dealing with supply chain cooperative management problem.

To sum up, existing literatures mainly focus on resources configuration, supply chain cooperation, trust mechanism and agent model respectively; the problem is that how to coordinate leading enterprise and subsidiary enterprise overall. At present, the problem has not been resolved by related researches. In this paper, based on principal-agent, it analyzes the cooperative management problem in the supply chain, so the incentive contract model is constructed and solved in the case of symmetric information and asymmetric information; Some important conclusions can be obtained by the model. We organize this paper as following: In section 2, we present the incentive contract model, which forms the theoretical foundation of this study. In section 3, we solve the model, which provide the base for analysis. In section 4, we present the analytical model through which we can coordinate leading enterprise and subsidiary enterprise. Finally we conclude the whole study.

2Principal-agent model of cooperative supply chain managementThe origin and development of principal-agent theory provides scientific solution for the incentive problem of supply chain, and mechanism design is effective way of tackling with principal-agent problem, by looking for the common parameter related to both the principal and the agent in case of symmetric information and asymmetric information [14].

Leading enterprise and subsidiary enterprise are comprised of Stackelberg model, in which, leading enterprise is the principal (one leading enterprise assumed), subsidiary enterprise is the agent(one subsidiary enterprise assumed). Leading enterprise monitors the activities of subsidiary enterprise while paying agency cost. In the paper, the factors related to the model consist of leading enterprise expected utilities, subsidiary enterprise expected incomes and leading enterprise agency cost.

2.1Mathematical description of model(1) Subsidiary enterprise expected incomes(a) The sales modelSubsidiary enterprise provides products or service to the market in a certain level of effort, the sales of products or service (that is Q) are subjected to subsidiary enterprise ability, market prosperity and market random.

Where Q is the sales; A is subsidiary enterprise ability (A > 0); x is the effort, f(x) is the function, and f’ (x) > 0, that means marginal sales are positive, that also means the sales are positive with subsidiary enterprise ability; f” (x) ≤ 0, that means the rate of increasing in sales is decreasing; The constant B is market prosperity; θ is market ran, and θ ~ N(0, σ2)(σ2 is the output variance).If f(x) =xr1, where 0 < r1 < 1, equation f(x) = xr1, is consistent with the restrictions above. Supposing X = xr1, so Q = AX + B + θ.

And we can see the full linear relations in expression xr1 → X → Q, so Q = Af(x) + B + θ is simplified as Q = Ax + B + θ when f(x) = x.

(b) Subsidiary enterprise incomesSubsidiary enterprise generates sales in a certain level of effort, then leading enterprise needs to pay for subsidiary enterprise’s work:

Where is the price of products or service, (p - c) Q is the market returns, α is the fixed Income, β is the market gains share.

(c) Subsidiary enterprise cost and profitsSubsidiary enterprise’s direct cost is C(x) when providing products or service, and C’(x) > 0, C”(x) ≥ 0. If C(x) = mxr2, where m > 0, r2 > 1, and X = xr1, then C(x) = mXr3 (r3 = r2 / r1 > 1), and C(x) = mxr2 is consistent with the restrictions above. So C(x) = mXr3 is simplified as CX=bX22 when m=b2,r3=2, where b is cost coefficient.

In addition, subsidiary enterprise must pay risk cost when participating in collaborative incentive contract, and subsidiary enterprise’s certainty equivalent profits (I) reflect its actual income. Supposing the utilities u = -erz (Exponential distribution) for subsidiary enterprise, where random z is the income (that is different from S(Q)), r is absolute risk aversion factor, and r>0, and z ~ N(m, n2)

So subsidiary enterprise expected profits are

Because Eu=uI,−e−rmrn22=−e−rI random variable I1=α+βp−cAX+B+θ)−bx22 obeys Normal distribution.

So subsidiary enterprise expected profits are

The variance of subsidiary enterprise profits are DI1 = (p - c)2 β2σ2, then subsidiary enterprise’s certainty equivalent profits are

Where r (p - c)2β2α2 / 2 is risk cost.

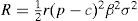

(2) Leading enterprise utilitiesLeading enterprise is risk neutral, and it pays more attention to the market prosperity. According to (a (b)(c) above, leading enterprise expected utilities is

(3) Leading enterprise agency costIn the case of asymmetric information, the principal cannot observe the agent’s effort. There are two additional kinds of agency cost compared with symmetric information: one is risk cost, another is incentive cost:

In the case of symmetric information, leading enterprise risk cost is 0; In the case of asymmetric information, leading enterprise risk cost is

Incentive cost refers to the difference between high expected revenue on the condition of symmetric information and low expected revenue on the condition of asymmetric information. That means subsidiary enterprise works harder in case of symmetric information than in case of asymmetric information. So leading enterprise expected utilities will decrease in case of asymmetric information. The difference (E (O1) between expected utilities in case of symmetric information and asymmetric information can be calculated based on the output function (E(O) = (p - c)(Ax + B)); the difference (E(C1)) between subsidiary enterprise cost in case of symmetric information and asymmetric information can be calculated based on the cost function (C=bx22); at last, leading enterprise agency cost is

2.2Establishment of models is the lowest income that subsidiary enterprise requires, and subsidiary enterprise will not participate in collaborative incentive contract when certainty equivalent profits are less than s. The contract prerequisite that subsidiary enterprise participate in collaborative incentive contract is

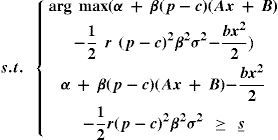

And cooperative supply chain management model including leading enterprise and subsidiary enterprise is

3Solution for cooperative supply chain management model3.1Symmetric informationLeading enterprise can monitor subsidiary enterprise in case of symmetric information, and leading enterprise will not motivate subsidiary enterprise. At the same time, leading enterprise must pay the least for subsidiary enterprise even if the latter wants the most. Based on the game relations, subsidiary enterprise will get the lowest in the end (s). So cooperative supply chain management model including leading enterprise and subsidiary enterprise is changed as

Do differentiation for x

SoIn case of symmetric information, market gains share β cannot be changed whether subsidiary enterprise works hard or not, and leading enterprises will not motivate subsidiary enterprise by gain market share, subsidiary enterprise will get the unchanged revenue in the end.

So

then3.2Asymmetric information(1) Leading enterprise expected utilities and subsidiary enterprise expected incomesIn the case of asymmetric information, subsidiary enterprise will try its best to increase s when (α, β) is given. And cooperative supply chain management model is reasonable.

Do differentiation for x

SoThen leading enterprise takes actions to increase its expected utilities when observing x

Do differentiation for β

SoActually, rational subsidiary enterprise will get at mostly, that is

So both subsidiary enterprise and leading enterprise will determine β, and market gain share β is known by leading enterprise and subsidiary enterprise.

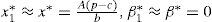

SoAnd β1=β2,β1=A2−Bb2A2,B=A2−2A2β1bSoEventually, leading enterprise expected utilities (α, β is know) are

And subsidiary enterprise expected incomes (α, β is know) are

Subsidiary enterprise expected profits must be s whether it works hard or not. Leading enterprise should motivate subsidiary enterprise by expected incomes instead of expected profits. This paper will discuss subsidiary enterprise expected incomes further.

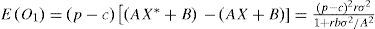

(2) Leading enterprise agency costThe optimal effort x* = A(p - c) / b and x = βA(p - c) / b are caculatied respectively in case of asymmetric information rand symmetric information.

So the output difference for leading enterprise is

It will cost subsidiary enterprise by C=bx22 when leading enterprise gets the extra outputp−c2rσ21+rbσ2/A2

In case of asymmetric information and symmetric information, the cost difference for subsidiary enterprise is

So incentive cost for leading enterprise is

And risk cost is:

So leading enterprise agency cost is

4Analysis and discussion of modelIn order to make clear of the parameters relations, this paper does mathematical analysis of leading enterprise expected utilities, subsidiary enterprise expected incomes and leading enterprise agency cost (A, b, r, B, s, σ2 > 0).

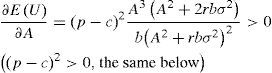

4.1Analysis of leading enterprise expected utilitiesIt indicates that leading enterprise expected utilities(E(U)) are positive with subsidiary enterprise ability(A).

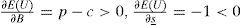

It indicates that leading enterprise expected utilities (E(U)) are negative with subsidiary enterprise cost coefficient (b).

It indicates that leading enterprise expected utilities (E(U)) are negative with subsidiary enterprise absolute risk aversion factor (r).

It indicates that leading enterprise expected utilities (E(U)) are positive with market prosperity (B); leading enterprise expected utilities (E(U)) are negative with the lowest requirement of subsidiary enterprise (s).

It indicates that leading enterprise expected utilities(E(U)) are negative with output variance(σ2).

To sum up, leading enterprise expected utilities (E(U)) are positive with subsidiary enterprise ability (A) and market prosperity(B); leading enterprise expected utilities (E(U)) are negative with subsidiary enterprise cost coefficient (b), subsidiary enterprise absolute risk aversion factor(r), the lowest requirement of subsidiary enterprise (s) and output variance(σ2).

4.2Discussion of subsidiary enterprise expected incomesSubsidiary enterprise expected incomes model ESQ=s_;+p−c2A22b1+rbσ2/A2 is similar with leading enterprise expected utilities modelEU=p−c2A22b1+rbσ2/A2+p−cB−s_;, both of which consist of expression (p - c)) A2/2b(1 + rbσ2 / A2), and based on the analysis above, we can get the results:

subsidiary enterprise expected incomes (E(s(Q))) are positive with subsidiary enterprise ability (A); Subsidiary enterprise expected incomes (E(s(Q))) are negative with subsidiary enterprise absolute risk aversion factor (r), subsidiary enterprise cost coefficient and output variance(σ2). Beacause ∂EsQ∂s_;=1>0, subsidiary enterprise expected incomes (E s(Q))) are positive with the lowest requirement of subsidiary enterprise (s).

To sum up, subsidiary enterprise ability (A), subsidiary enterprise absolute risk aversion factor (r), subsidiary enterprise cost coefficient (b)and output variance (σ2)(except the lowest requirement of subsidiary enterprise (s))have the same influence on leading enterprise expected utilities (E(U))and subsidiary enterprise expected incomes (E(s(Q)))

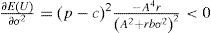

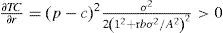

4.3Analysis of leading enterprise agency costIt indicates that leading enterprise agency cost (TC) are positive with subsidiary enterprise ability (A2)

It indicates that leading enterprise agency cost (TC) are negative with subsidiary enterprise cost coefficient (b).

It indicates that leading enterprise agency cost (TC) are positive with subsidiary enterprise absolute risk aversion factor (r).

It indicates that leading enterprise agency cost (TC) are positive with output variance (σ2).

To sum up, leading enterprise agency cost (TC) are positive with subsidiary enterprise ability (A2), subsidiary enterprise absolute risk aversion factor (r) and output variance (σ2); leading enterprise agency cost (TC) are negative with subsidiary enterprise cost coefficient (b).

To summary, subsidiary enterprise ability (A), subsidiary enterprise absolute risk aversion factor (r), subsidiary enterprise cost coefficient (b) and output variance (σ2) have the influence on leading enterprise expected utilities (E(U)), subsidiary enterprise expected incomes (E(s(Q))) and leading enterprise agency cost (TC); subsidiary enterprise ability (A), subsidiary enterprise absolute risk aversion factor (r), subsidiary enterprise cost coefficient (b) and output variance (σ2) have the same influence on leading enterprise expected utilities (E(U)) and subsidiary enterprise expected incomes (E(s(Q))); subsidiary enterprise ability (A) and subsidiary enterprise cost coefficient (b) have the same influence on leading enterprise expected utilities (E(U)), subsidiary enterprise expected incomes (E(s(Q))) and leading enterprise agency cost (TC).

Leading enterprise can take on incentive measures to optimize supply chain based on the common factors.

5ConclusionsUnder asymmetric information, subsidiary enterprise has first-mover advantage of earning illegal profits with private information; and leading enterprise needs to pay agency cost when monitoring subsidiary enterprise, so subsidiary enterprise intends to earn extra profits; while leading enterprise cannot blindly suppress subsidiary enterprise in order to inhibit subsidiary enterprise of obtaining additional income.

Based on principal-agent, this paper analyses cooperative management problem in supply chain, so the incentive contract model is constructed and solved in the case of symmetric information and asymmetric information. Some important conclusions are obtained: leading enterprise expected utilities E(U), subsidiary enterprise expected incomes E(s(Q)) and leading enterprise agency cost TC are all affected by subsidiary enterprise ability A, cost coefficientb, absolute risk aversion factor r and output variance σ2;A,b, r and σ2 has the same influence on E(U) and E(s(Q)); A, b has the same influence on E(U), E(s(Q))and TC.

Leading enterprise can take on incentive measures to optimize supply chain management based on the common factors. So we should.

(1) Lmprove subsidiary enterprise abilitySubsidiary enterprise ability is related to institution, technology, service, scale, capital and culture, etc. So Leading enterprise should give enough support to subsidiary enterprise in above fields. Consequently, leading enterprise agency cost is increased, but leading enterprise expected utilities is improved as well as the healthy development of subsidiary enterprise.

(2) Reduce subsidiary enterprise cost coefficientSimilar with subsidiary enterprise ability, subsidiary enterprise cost coefficient is inversed with enterprise scale, staff ability, equipment technology. etc. So Leading enterprise may help subsidiary enterprise train staff, gain authentication and renovate equipment, etc. Consequently, leading enterprise agency cost is decreased, but both leading enterprise expected utilities and subsidiary enterprise expected incomes are increased, thus subsidiary enterprise tackling with market problems easily.

(3) Lower subsidiary enterprise absolute risk aversionSubsidiary enterprise absolute risk aversion indicates that small enterprise cannot meet with market risks well due to its insufficient capital and ability, thus unwilling deal with risk project. So Leading enterprise can give policy support for subsidiary enterprise, then subsidiary enterprise is motivated to provide products or service to the market in a high level of effort. Consequently, both leading enterprise expected utilities and subsidiary enterprise expected incomes are increased, while leading enterprise agency cost is decreased.

(4) Pay attention to market random factorsMarket random factors have the same meaning with uncertainties. Leading enterprise needs to keep steady policy, guarantee industry healthy development, and prevent vicious competitions, thus making the SCN (Supply Chain Network) robust.

Consequently, leading enterprise expected utilities as well as subsidiary enterprise expected incomes can be improved largely; Meanwhile, leading enterprise agency cost will be reduced substantially.

In short, based on the detailed analysis of supply chain cooperation problem, the research can provide the comprehensive methodology for cooperative supply chain management.

Of course, like all of the researches, this paper has certain limitations and deficiencies. To guarantee the computability of model, consequently, the cost function is simplified a, and the sales function is simplified as OX=bX22, and the sales function is simplified as Q = Ax + B + θ we should go further study on the hypothesis.

The study is supported by National Natural Science Foundation(71132008), the Fundamental Research Funds for the Central Universities (B12JB00280) and the Research, Development and Demonstration of Top-Design Decision Support System for Two-Oriented Integration (Z121100000312093), we appreciate the support very much.