Although environmental turbulence poses significant challenges for small and medium-sized enterprises (SMEs), it also offers opportunities for them to thrive and compete. Scholars generally acknowledge the effectiveness of dynamic capabilities (DCs) and artificial intelligence (AI) applications in responding quickly to market uncertainties; however, their impact on boosting firm performance during real-time environmental turbulence requires further investigation. To address this gap, this study examined the influence of environmental turbulence on SME innovation using AI applications and DCs and how new opportunities can be leveraged to maintain a competitive advantage. This study adopted a quantitative approach, and survey data were collected from 487 managers and owners of SMEs that implemented DCs and AI during real-time environmental turbulence. The results indicate that the elements of environmental turbulence influence SMEs’ implementation of both DCs and AI, acting as mediators between disruptive elements and enhancing firm performance during challenging times. The theoretical and practical implications of these findings are discussed in depth.

Small and medium-sized enterprises (SMEs) constitute the majority of global companies and play a major role in providing jobs and ensuring business development (Eggers, 2020). However, when a crisis occurs, such as COVID-19 pandemic, the survival of SMEs becomes even more challenging (Caballero-Morales, 2021). Environmental turbulence related to a crisis can be caused by (a) a sudden shift in demand, (b) the emergence of new technologies, or (c) an increase in competition (Bodlaj & Čater, 2019), all of which impact the survival of vulnerable SMEs. According to McKinsey (2020), SMEs are more susceptible to market uncertainty than larger companies because of (a) demand and liquidity challenges, (b) inflexible supply chains and operations, and (c) disproportionate SME representation in the sectors that tend to be hit hardest by crises. The large-scale failure of SMEs due to poor financial performance could put the global economy at risk (OECD, 2020); however, SMEs that recognize and act upon opportunities provided by the crisis increase their chances of survival. Firms with substantial investments in human capital and dynamic capabilities (DCs) can exploit opportunities and rearrange their resource base to be better positioned during a crisis (Dabić et al., 2023).

A firm's DCs are essential for taking advantage of the opportunities a changing business environment can offer. To gain an advantage, firms must identify and respond to trends by leveraging their innovative resources and establishing new strategies to exploit advanced technologies supported by artificial intelligence (AI). AI refers to a collection of technologies that provide machines with the ability to perceive, comprehend, respond, and learn, and these capabilities not only facilitate automation but also allow machines to display mechanical, analytical, intuitive, and empathetic intelligence (Chi et al., 2021). AI has altered the nature and scope of entrepreneurial activity in SMEs (Hansen & Bøgh, 2021). SMEs that use AI-assisted digital technology improve their competitive edge and efficiency (Chan et al., 2019). SMEs can leverage AI applications for predictive analytics to anticipate future trends, chatbots to improve customer engagement, process automation to streamline operations, and recommendation systems to enhance SMEs’ ability to make timely decisions. These AI applications help SMEs optimize logistics, reduce costs, and improve their overall business performance (Khurana et al., 2022). SMEs apply AI to track user behavior and provide guidance and recommendations to enhance consumer purchase choices and search results, enhance media communication, increase sales, lower expenses, and improve performance (Hansen & Bøgh, 2021). Hence, AI enables SMEs to exploit their competitive advantages, especially during environmental turbulence (Drydakis, 2022).

AI applications can stimulate new product and service development, promote innovation for targeting products and services to meet new market demands, improve infrastructure to reach more customers, and enable business growth. Nevertheless, many SMEs fail to adopt or implement technologies such as AI. This may be largely attributed to the skill gap that hinders managers and workers from identifying beneficial digital solutions for enhancing business operations and fostering innovation. Furthermore, a financing gap limits SMEs’ access to funds for intangible digital investments, which can result in less funding for innovation, while an infrastructure gap slows the deployment of up-to-date technologies, which further hinders SME performance. Addressing these gaps is crucial for SMEs to remain competitive. The recent environmental turbulence caused by COVID-19 has highlighted the urgent need for SMEs to innovate, adapt, and remain competitive (Drydakis, 2022). SMEs that have invested in advanced technologies and innovative business models have been better positioned to cope with weather crises, whereas those that have not struggled (Abed, 2022). Innovation in AI applications and DCs is critical for SMEs in times of crisis because it enables them to respond to new challenges and opportunities and find new ways to create value. Moreover, innovation can help SMEs increase their resilience and competitiveness in the face of future crises, enabling them to experience long-term survival and growth (Khurana et al., 2022).

Despite the importance of innovation for SMEs in times of crisis, there remains a significant gap in understanding the factors that drive innovation, specifically in AI applications, the proper deployment of DCs, and how they can be supported (Adam & Alarifi, 2021; Drydakis, 2022; Hassani & Mosconi, 2022). Many SMEs face barriers to innovation, such as a lack of resources, limited access to financing, and a risk-averse culture. Moreover, there is a need to understand how SMEs can effectively leverage different types of innovation, such as product, process, and business model innovation, to improve their performance and competitiveness (Drydakis, 2022).

At this point, some business units depend on a human workforce for their operations. However, business activities that use AI are more efficient. A previous study on AI applications examined only stable environments (Kumar & Kalse, 2021), and recent studies examining turbulent environments did not use a quantitative approach (Hansen & Bøgh, 2021; Sharma et al., 2022). Kumar and Kalse (2021) demonstrate the importance of validating the effect of AI on managing challenges that occur during a crisis and identifying opportunities to enhance performance. However, successful AI applications require the utilization of DCs during environmental turbulence to remain competitive and survive (Drydakis, 2022). SMEs must provide exceptional services to ensure customer satisfaction, brand loyalty, profitability, and growth (Drydakis, 2022), which requires innovative solutions such as AI. Nyamrunda and Freeman (2021) concluded that SMEs in different industries and sectors must employ different strategies to obtain the best DC outcomes. To ensure the optimal DC performance in uncertain business environments (Drydakis, 2022), owners and managers of a particular type of business must clearly understand their company's market stance rather than rely on one formula for success. In contrast, the findings of Bashir et al. (2023) on the effectiveness of DCs suggest that DC implementation does not guarantee a firm's success during environmental turbulence; however, this conclusion requires further investigation.

This study determines whether implementing DCs and AI applications enhances SME performance during environmental turbulence. DCs enable firms to identify and seize opportunities for innovation, which can lead to sustained competitive advantages, and AI can help SMEs gather and analyze customer data to identify emerging trends and develop new products and services that meet changing customer needs and be used to automate routine tasks and free up resources for strategic planning (Zahoor et al., 2022). Hence, this study examines the critical role of innovation in the survival and growth of SMEs in terms of DC deployment and AI applications during environmental turbulence. It also explores whether such firms can leverage DCs and AI applications to exploit the opportunities environmental turbulence provides. Most investigations have concentrated on how environmental turbulence leads to SME failure (Nyamrunda & Freeman, 2021) rather than on the opportunities it creates for SMEs to compete and survive (Weaven et al., 2021). Furthermore, this study provides updated information on how SMEs respond to crises in developing countries such as the United Arab Emirates (UAE), which is lacking in previous research (Rohrbeck et al., 2015).

The literature review employed in this research captures the influence of environmental turbulence on the mobilization of DCs and AI applications and their role in overcoming challenges and leveraging opportunities to boost performance. The methods are described, and the data are analyzed and interpreted. Finally, we discuss the study's drawbacks and suggest avenues for subsequent research.

Theoretical background and hypothesesDynamic capability theoryThe literature on effective business responses to acute market crises emphasizes improving managerial practices as a survival mechanism (Wang et al., 2020). The resource-based view (RBV) stresses a company's managerial strategies and the resources and knowledge that businesses can use to maintain profitability in highly competitive markets. Firms allocate strategic resources differently in ways that persist over time (Weaven et al., 2021). Thus, company managers gain a competitive edge by acquiring high-value resources that can be utilized in unique ways difficult for competitors to replicate (Masiello & Izzo, 2019). However, a firm's success is not only based on resource allocation but also includes strategic planning and implementation in response to political events, changing markets, and the overall health of the business sector (Bashir et al., 2023). The mere existence of certain resources is not sufficient to ensure that a company remains profitable or survives (Heredia et al., 2022). Due to their small size and resource limitations, SMEs face greater difficulties than large companies during economic downturns. Although knowledge resources are important during turbulent conditions, the RBV alone does not adequately account for an SME's competitive advantage in a crisis market (Garcia Martinez et al., 2019). To survive crises, SMEs must be able to reconfigure their assets into effective tools.

DCs were developed to address the limitations of the RBV. DC is defined as “a firm's processes that integrate, reconfigure, gain and release resources to match and even create market change” (Eisenhardt & Martin, 2000, p.1107). DCs are part of the procedures that management routinely uses for a firm's operations, enabling it to tune its resource base (Teece, 2018). Collins (2021) categorized DCs into three areas: (a) assessment of an opportunity or threat, (b) utilization of resources to exploit an opportunity or respond to a threat value, and (c) acquisition and allocation of resources and modification of organizational procedures to meet changing market needs.

Weaven et al. (2021) consider the DC view to be important for studying SME behavior during an economic downturn, which can significantly impinge on business and infrastructure, damage the supply chain, increase unemployment, reduce customer demand, and raise costs. SMEs face greater resource constraints relative to large enterprises because they rely more on nearby and specialty markets and have few options for relocation (Cassetta et al., 2020). Consequently, under mutable and unstable conditions, an SME's ability to overcome difficulties and seize opportunities for growth is determined by the abilities of employees and managers (Khurana et al., 2022). This often involves reallocating resources from unproductive DCs to develop sustainable practices that align with existing needs.

Influence of market turbulence on AI applications and DCMarket turbulence (MT) is an element of environmental turbulence that reflects changing consumer needs. Previous research has recognized that MT affects a firm's capabilities and explored strategies that SMEs can adopt to overcome these negative effects (Dayan et al., 2019). SMEs have limited resources and view environmental instability as a threat (Weaven et al., 2021). Additionally, SMEs rely on their small size to maintain closeness with customers, which allows them to respond quickly to changing needs through direct interactions (Hassani & Mosconi, 2022). Bodlaj and Čater (2019) have emphasized that MT motivates firms to implement new digital technology and marketing strategies to differentiate themselves from others in the market and enhance their competitiveness. By using AI applications such as big data analytics, cloud computing, AI-enabled apps, intelligent decision systems, QR codes, chatbots, sales prioritization systems, cash flow forecasting, cyber security, and human resource service operations during MT, SMEs can enhance their competitiveness and outperform non-adopters in terms of sales revenue, profitability, and productivity (Sharma et al., 2022).

Katz et al. (2020) showed that in previous crises, MT influenced SMEs’ implementation of digital technology, including AI. The implementation addressed the challenges brought about by the crisis and the ability to identify potential opportunities to survive such challenging moments. MT occurs due to sudden shifts in customer demand, and according to Chamola et al. (2020), AI applications are harmonized with such changes as they can strengthen resilience, organize information, and aid decision-making during uncertain times, as well as enhance SMEs’ capacities via more accurate forecasting of market trends and consumer demands (Sharma et al., 2022). However, Drydakis (2022) has argued that only acquiring AI applications can lead to risk and misuse by SMEs, hindering significant improvements in performance and competitiveness. Kumar and Kalse (2021) demonstrated how difficult, costly, and time-consuming it is for SMEs to apply AI because of limited personnel and resources. Bodlaj and Čater (2019) argued that SMEs tend to respond to opportunities, customer queries, and changing needs more quickly than large organizations. Based on these findings, the following hypothesis is proposed:

H1a.MT has a positive influence on SMEs’ AI applications.

AI applications and DCs are harmonized to influence firms’ performance-enhancing capabilities (Drydakis, 2022). Haarhaus and Liening (2020) concluded that, with the occurrence of MT, strategic implementation of DCs enhances the ability of firms to identify new opportunities and avoid risks, enabling them to apply their skills to adapt to a changing business climate. Schilke et al. (2018) argued that DCs are especially useful during MT, in which a firm must strategically alter its approach to maneuver safely in a shifting business landscape. Vrontis et al. (2020) explained that DC exploitation should be viewed as an integrated method for exploiting new modes of competition such as AI (Kalubanga & Gudergan, 2022). Nyamrunda and Freeman (2021) maintained that a firm's DCs will improve its ability to compete by adapting to continuing changes in customer demands. The more verifiable the market information a firm obtains, the better the position it would be to seize the next opportunity (Vrontis et al., 2020); however, in a crisis, most SMEs still tend to restrict investment in DCs and avoid forming liaisons with others (Cuevas-Vargas et al., 2022). Shams et al. (2021) argue that DCs provide directions for acquiring, assimilating, and reconfiguring internal and external knowledge to respond to market shifts with agility and creativity. Based on these findings, the following hypothesis is proposed:

H1b.MT has a positive influence on SMEs’ DCs.

Influence of competitive intensity on AI applications and DCsCompetitive intensity (CI), another factor of environmental turbulence, increases the volatility of environmental turbulence and is a measure of the pressure from competitors a firm faces (Lyu et al., 2022). When competition is aggressive, a firm must struggle to maintain its advantage over other companies when marketing its products and services to the same consumer base. However, under such circumstances, firms can meet customer needs in several ways (Heredia et al., 2022). Given that CI can be viewed not only as a crisis but also as a new opportunity for SMEs, a product or service differentiation strategy may be successful. Firms must be innovative to quickly respond to customer needs by developing new products and enhanced services and leveraging existing opportunities to remain competitive (Heredia et al., 2022).

SMEs follow complex growth paths to bolster their performance during challenging moments to keep up with evolving technological innovations, such as AI (Drydakis, 2022). However, Hansen and Bøgh (2021) argued that SMEs are constrained by a lack of resources and limited awareness to implement AI. Drydakis (2022) illustrated that AI implementation requires awareness, skills, and capabilities rather than only considering whether the technology has been adopted. Kumar and Kalse (2021) found that in uncertain times, AI applications assist SMEs in recognizing changes in consumer behavior and enable them to capitalize on relevant opportunities to improve and create new products and services. Warner and Wäger (2019) argued that SMEs with AI applications can take advantage of limited resources to adapt to intense competition and remain financially healthy. Based on these findings, the following hypothesis is proposed:

H2a.CI has a positive influence on SMEs’ AI applications.

The literature lacks an in-depth understanding of the complex management processes that enable firms to successfully develop new products and services when facing intense competition (Lyu et al., 2022). Haarhaus and Liening (2020) reported that firms’ implementation of DCs during intense competition in volatile environments is widely regarded as more valuable, as it enhances firms’ speed and efficiency in responding to a crisis by exploiting revenue-enhancing opportunities. DCs positively affect competitiveness by facilitating innovation and tailoring resource allocation to meet the needs of dynamic situations. However, most studies have been conducted during stable economic periods, making the true effectiveness of DCs uncertain Adomako et al. (2022).

Tajvidi and Karami (2021) showed that although SMEs are vulnerable to economic downturns, they demonstrate resilience and high levels of adaptability and flexibility. Bashir et al. (2023) found that, during times of intense competition, SMEs implementing DCs are motivated to develop effective marketing strategies, giving them unique competitive advantages. When SMEs seize opportunities and act strategically in highly competitive environments, the advantages created are likely to produce superior financial performance, as they differentiate themselves from competitors. SMEs operate differently and are more susceptible to aggressive competition than large corporations. Consumers have many alternatives, and switching companies is easy (Ferreira et al., 2020). Businesses must constantly monitor market trends and customer needs to maintain loyalty. The effective implementation of DCs is a good way for a firm to remain competitive, especially in an unstable situation. Thus, the following hypothesis is proposed:

H2b.CI has a positive influence on SMEs’ DCs.

Role of AI applications and DCs in SME performanceHansen and Bøgh (2021) found that SMEs could thrive by utilizing AI applications to cut costs and enhance decision-making, information accessibility, and communication, as well as achieve more flexibility and reactivity to MT. Drydakis (2022) concluded that SMEs that fail to respond to sudden shifts in customer demand and do not leverage DCs with AI applications because of a lack of resources, skills, and capabilities have a lower chance of survival. Sharma et al. (2022) found that SMEs that follow strategies aligned with changing customer demands during intense competition and can apply the latest digital technology can substantially increase their chances of survival. According to Hansen and Bøgh (2021), AI applications can aid SMEs in gaining market share, increasing overall productivity, developing new products and services, staying connected to customer demands, and retaining stability in changing markets. AI applications increase SMEs’ operational efficiency, inventory management, and personnel coordination, resulting in more competitive financial positions. According to Kumar and Kalse (2021), AI applications primarily enhance SMEs’ efficiency and significantly increase their competitiveness and financial advantage. Thus, the following hypothesis is proposed:

H3.AI applications have a positive influence on SME firm performance.

Most studies have reported that DCs positively influence competitiveness. Zahoor et al. (2022) showed that, by improving resource utilization, DCs allow firms to reconfigure their assets in line with a changing environment. Motta and Sharma (2020) found that DCs are essential for overcoming resource constraints and achieving sustainability during crises. By implementing DCs, SMEs can convert resources into competitive advantages (Fainshmidt et al., 2019) and enhance their competitiveness by increasing growth, sales, and profits (Sharma et al., 2022). Furthermore, Heredia et al. (2022) concluded that DCs enhance a firm's financial performance, competitiveness, and sustainability. However, researchers do not agree on the advantages that accrue from deploying DCs. Studies have emphasized the limitations of DCs in successfully promoting flexibility and concluded that not all firms need to initiate change through DCs (Teece, 2018). Wamba et al. (2017) posited that the value of DCs depends on the existing policies of the firm, as well as the context in which they are implemented. Wang et al. (2015) argued that MT and CI stimulate firms’ application of DCs. Irrespective of a firm's starting point, the more DCs available to it, the more proactive it will be in monitoring competition, the more aggressive it will be in acquiring data, and the better positioned it will be to respond to environmental turbulence (Heredia et al., 2022). Thus, the following hypothesis is proposed:

H4.DCs have a positive influence on SME performance.

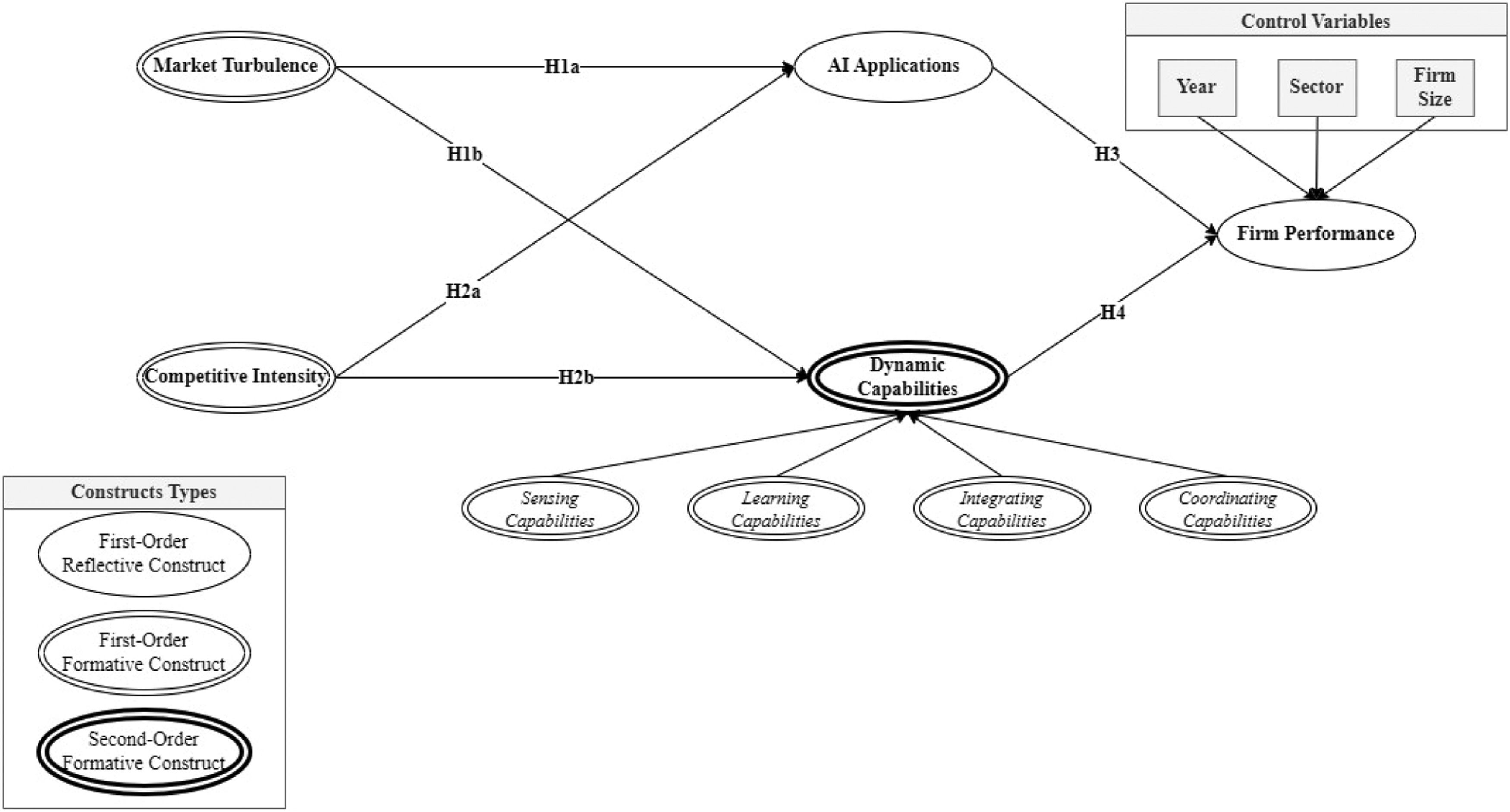

The hypotheses stating the relationships between the variables are presented in Fig. 1.

Research methodsStudy areaThis study was conducted in the UAE. Although the UAE comprises seven federal emirates, this study was conducted only on the emirates of Abu Dhabi, Dubai, and Sharjah, which are the largest in terms of population and GDP (UAE Government, 2022). The SMEs operating in trade, industries, and services were chosen for this study because they resemble the overall SME sectors in the UAE (UAE Government, 2020). The emirates selected for this study view SMEs as contributors to their economies, which have been hindered by the COVID-19 crisis.

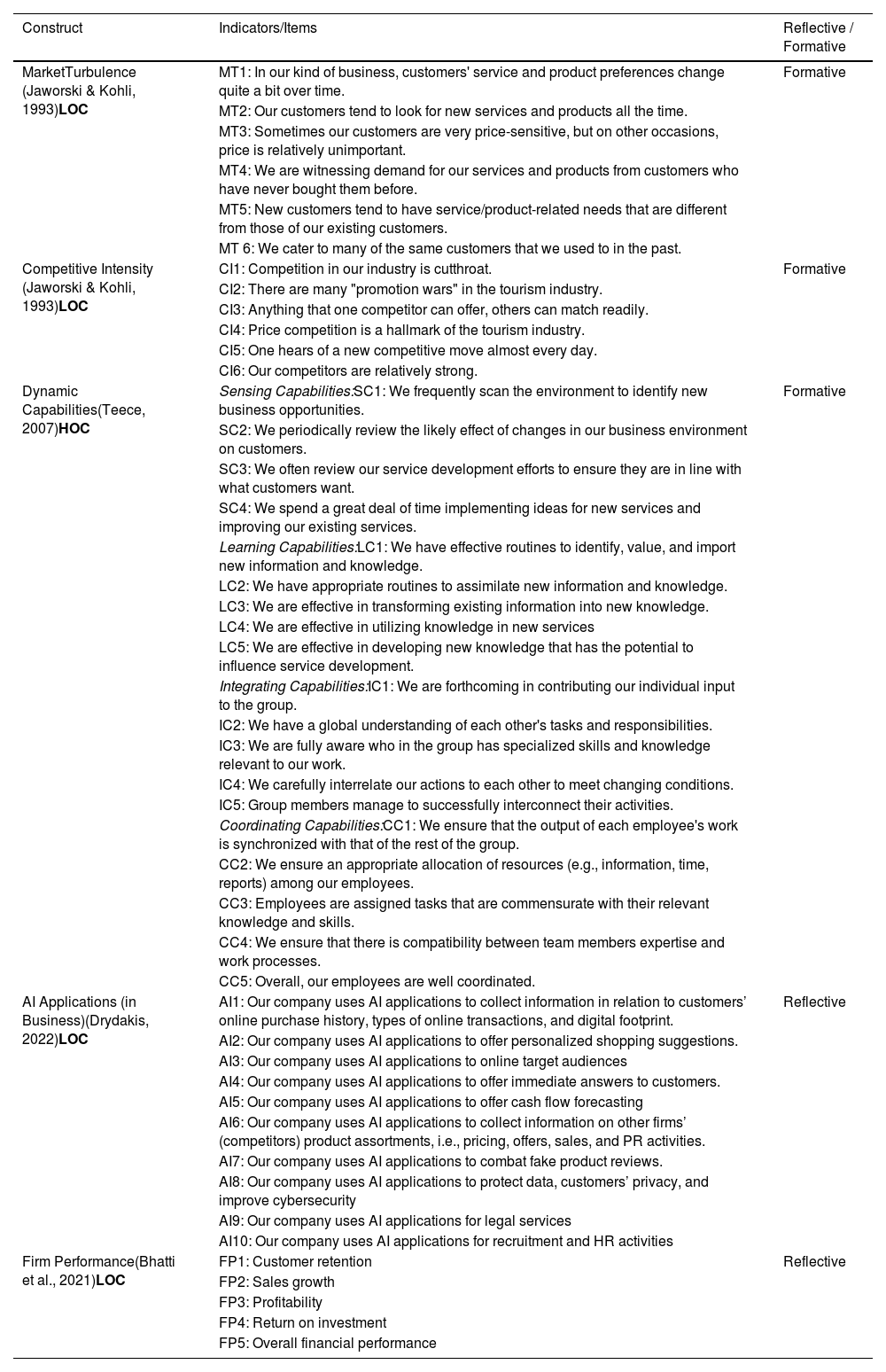

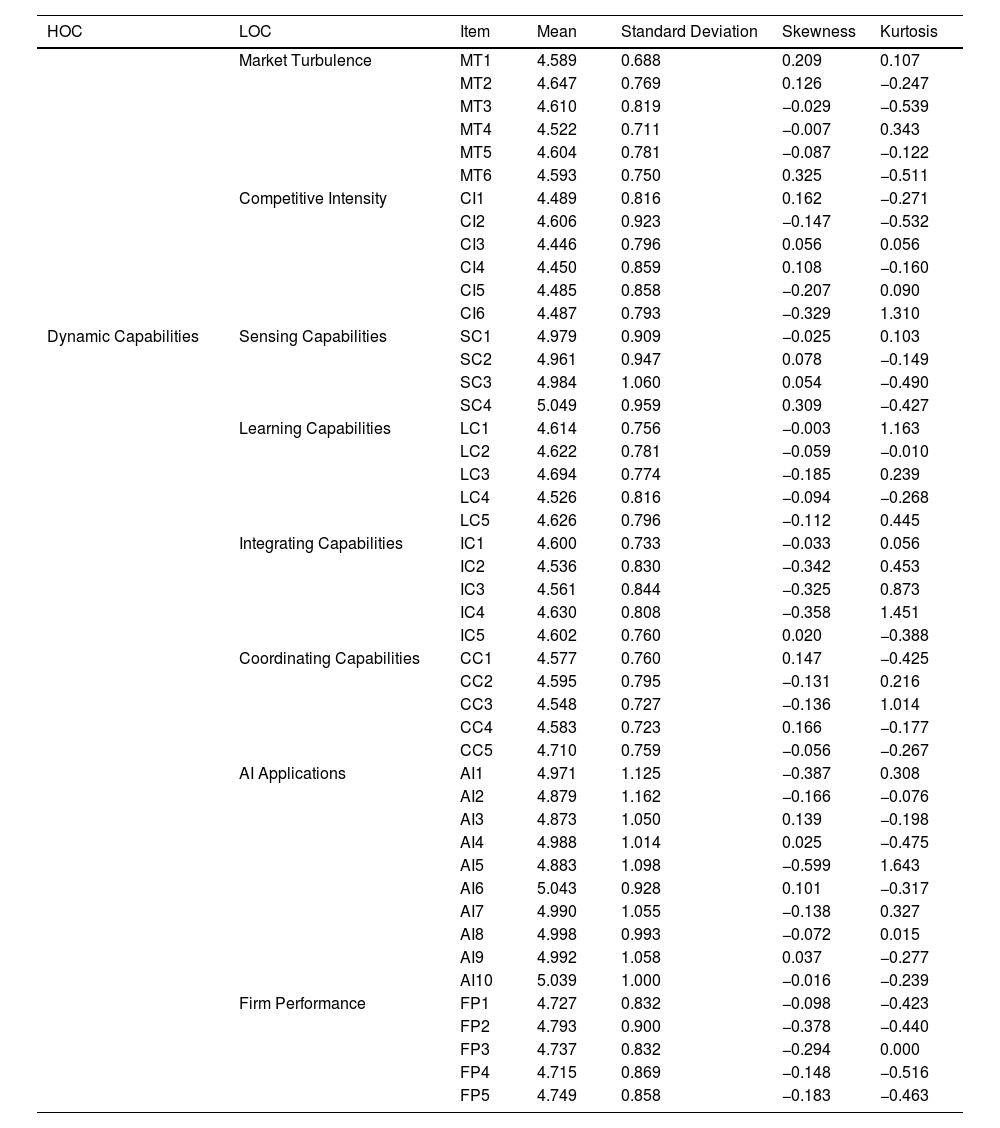

Development of measuresA questionnaire was designed to gather research and demographic data. The items and indicators used in this study are listed in Table 1. The measured latent variables included CI and MT, both independent variables, each with six items drawn from previous research (Jaworski & Kohli, 1993) as a first-order formative construct on a 6-point Likert scale. This was followed by the measurement of DCs, comprising four dimensions (sensing, learning, integrating, and coordinating capabilities) and 18 total items as a second-order formative construct measured on a 7-point Likert scale for sensing capabilities and a 6-point Likert scale for learning, integrating, and coordinating capabilities. All DC values were derived based on Teece (2007). AI applications comprising ten items were taken from Drydakis (2022) as a first-order construct on a 7-point Likert scale. The measurement of firm performance, pertinent to the financial performance, comprised five items and was derived from Bhatti et al. (2021) as a first-order reflective construct. The second section of the questionnaire focused on businesses’ demographic characteristics that served as control variables in the model: category/sector, establishment year, and company size (small/medium).

Indicators/items of research constructs.

| Construct | Indicators/Items | Reflective / Formative |

|---|---|---|

| MarketTurbulence (Jaworski & Kohli, 1993)LOC | MT1: In our kind of business, customers' service and product preferences change quite a bit over time. | Formative |

| MT2: Our customers tend to look for new services and products all the time. | ||

| MT3: Sometimes our customers are very price-sensitive, but on other occasions, price is relatively unimportant. | ||

| MT4: We are witnessing demand for our services and products from customers who have never bought them before. | ||

| MT5: New customers tend to have service/product-related needs that are different from those of our existing customers. | ||

| MT 6: We cater to many of the same customers that we used to in the past. | ||

| Competitive Intensity (Jaworski & Kohli, 1993)LOC | CI1: Competition in our industry is cutthroat. | Formative |

| CI2: There are many "promotion wars" in the tourism industry. | ||

| CI3: Anything that one competitor can offer, others can match readily. | ||

| CI4: Price competition is a hallmark of the tourism industry. | ||

| CI5: One hears of a new competitive move almost every day. | ||

| CI6: Our competitors are relatively strong. | ||

| Dynamic Capabilities(Teece, 2007)HOC | Sensing Capabilities:SC1: We frequently scan the environment to identify new business opportunities. | Formative |

| SC2: We periodically review the likely effect of changes in our business environment on customers. | ||

| SC3: We often review our service development efforts to ensure they are in line with what customers want. | ||

| SC4: We spend a great deal of time implementing ideas for new services and improving our existing services. | ||

| Learning Capabilities:LC1: We have effective routines to identify, value, and import new information and knowledge. | ||

| LC2: We have appropriate routines to assimilate new information and knowledge. | ||

| LC3: We are effective in transforming existing information into new knowledge. | ||

| LC4: We are effective in utilizing knowledge in new services | ||

| LC5: We are effective in developing new knowledge that has the potential to influence service development. | ||

| Integrating Capabilities:IC1: We are forthcoming in contributing our individual input to the group. | ||

| IC2: We have a global understanding of each other's tasks and responsibilities. | ||

| IC3: We are fully aware who in the group has specialized skills and knowledge relevant to our work. | ||

| IC4: We carefully interrelate our actions to each other to meet changing conditions. | ||

| IC5: Group members manage to successfully interconnect their activities. | ||

| Coordinating Capabilities:CC1: We ensure that the output of each employee's work is synchronized with that of the rest of the group. | ||

| CC2: We ensure an appropriate allocation of resources (e.g., information, time, reports) among our employees. | ||

| CC3: Employees are assigned tasks that are commensurate with their relevant knowledge and skills. | ||

| CC4: We ensure that there is compatibility between team members expertise and work processes. | ||

| CC5: Overall, our employees are well coordinated. | ||

| AI Applications (in Business)(Drydakis, 2022)LOC | AI1: Our company uses AI applications to collect information in relation to customers’ online purchase history, types of online transactions, and digital footprint. | Reflective |

| AI2: Our company uses AI applications to offer personalized shopping suggestions. | ||

| AI3: Our company uses AI applications to online target audiences | ||

| AI4: Our company uses AI applications to offer immediate answers to customers. | ||

| AI5: Our company uses AI applications to offer cash flow forecasting | ||

| AI6: Our company uses AI applications to collect information on other firms’ (competitors) product assortments, i.e., pricing, offers, sales, and PR activities. | ||

| AI7: Our company uses AI applications to combat fake product reviews. | ||

| AI8: Our company uses AI applications to protect data, customers’ privacy, and improve cybersecurity | ||

| AI9: Our company uses AI applications for legal services | ||

| AI10: Our company uses AI applications for recruitment and HR activities | ||

| Firm Performance(Bhatti et al., 2021)LOC | FP1: Customer retention | Reflective |

| FP2: Sales growth | ||

| FP3: Profitability | ||

| FP4: Return on investment | ||

| FP5: Overall financial performance |

Notes: HOC = higher-order constructs; LOC = lower-order constructs.

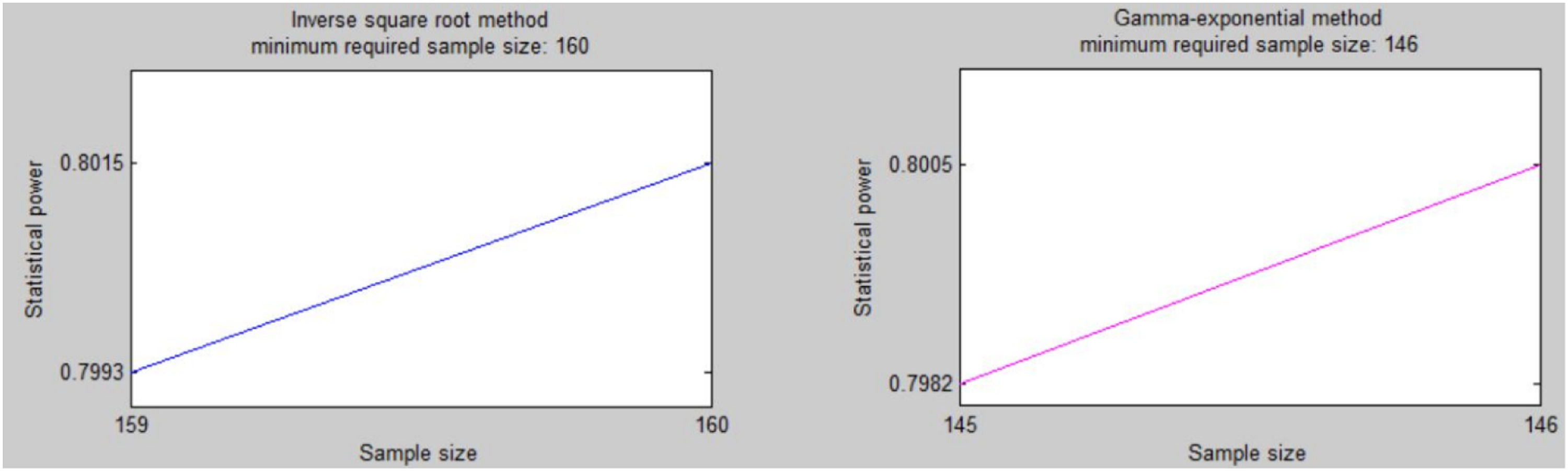

The UAE has 350,000 SMEs, with the majority located in the Emirates of Abu Dhabi, Dubai, and Sharjah (UAE Government, 2020). From this population, 1762 firms were selected as the target group, based on their usage of AI applications in areas such as sales and marketing, conversational commerce, customer service support, data analytics, sustainable development, credit evaluations, risk assessments, cybersecurity, legal services that improve quality optimization, operational efficiencies, and overall SME development, as identified based on information available online. The remaining SMEs were omitted because their information was unavailable and some had closed due to the pandemic. Probability sampling was used in this study. Owners and managers were randomly selected using a stratified procedure/sampling based on SME-defined categories in industry, trade, and services (Weaven et al., 2021). For SMEs operating in different sectors, stratified sampling ensures that the sample is representative of the overall population, accounts for differences between sectors, addresses potential biases in the sample selection process, and increases the accuracy and reliability of research findings (Zhao et al., 2019). Study respondents were approached during the peak period of the COVID-19 pandemic using a questionnaire written in English, and all participants provided informed consent. Of those approached, only 487 responded to the questionnaire. Inverse-square-root and gamma-exponential approaches were used to estimate the minimum sample size using partial least-squares structural equation modeling (PLS-SEM) (Kock & Hadaya, 2018). The ten-fold rule for determining a study's sample size can be inaccurate, whereas PLS-SEM has proven to be fundamental in determining sample size (Hair et al., 2022). For a statistical power of 80 %, the inverse square root and gamma exponential approaches yielded minimal sample sizes of 160 and 146, respectively. Therefore, the sample of survey respondents was an acceptable number considering what is required to reach a statistical power of 80 % (Fig. 2).

Control variables and endogeneityThe control variables included the establishment year, company size (Li & Rees, 2021), and SME category (Guo et al., 2018). The establishment year was used to determine whether business performance varied with company age. The number of employees in the business was used to indicate firm size (small or medium) in accordance with the definition of an SME (Abu Dhabi Chamber of Commerce, 2019). Finally, this study used several categories of SMEs to identify the various techniques they employed in each targeted category. By including control variables, endogeneity concerns were addressed to prevent erroneous results owing to company and industry heterogeneity (Guenther et al., 2023).

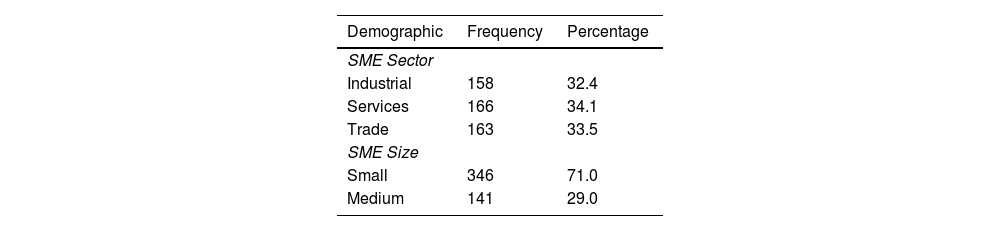

Data analysesDemographicsData were collected from the managers and owners of SMEs in Abu Dhabi, Dubai, and Sharjah (Table 2). Of the total SMEs, 32.4 % (158) were operating in the industrial sector, 34.1 % (166) in the service sector, and 33.5 % (163) in the trading sector. Regarding firm size, 71 % (346) were small firms (≤ 50 employees) and 29 % (171) were medium-sized firms (51–200 employees). As shown in Table 3, neither the skewness nor the kurtosis exceeded the range of −1 to +1, indicating data normality (Hair et al., 2022).

Descriptive analysis.

Notes: HOC = higher-order constructs; LOC = lower-order constructs.

The model assessment involved two main steps. First, the measurement model assessment for reflective and formative constructs required the use of PLS-SEM by SMART PLS version 3, given its suitability for formative constructs and complex models with a large number of items (Hair et al., 2022). Furthermore, it allows unrestricted computation of models composed of “reflective” and “formative” measurement models (do Valle & Assaker, 2016). The measurement models were analyzed to determine the correlations between the indicators and constructs to evaluate the PLS-SEM results. Reflective and formative constructs have different criteria. Second, after the measurement model criteria were met, the structural models were examined (Hair et al., 2022).

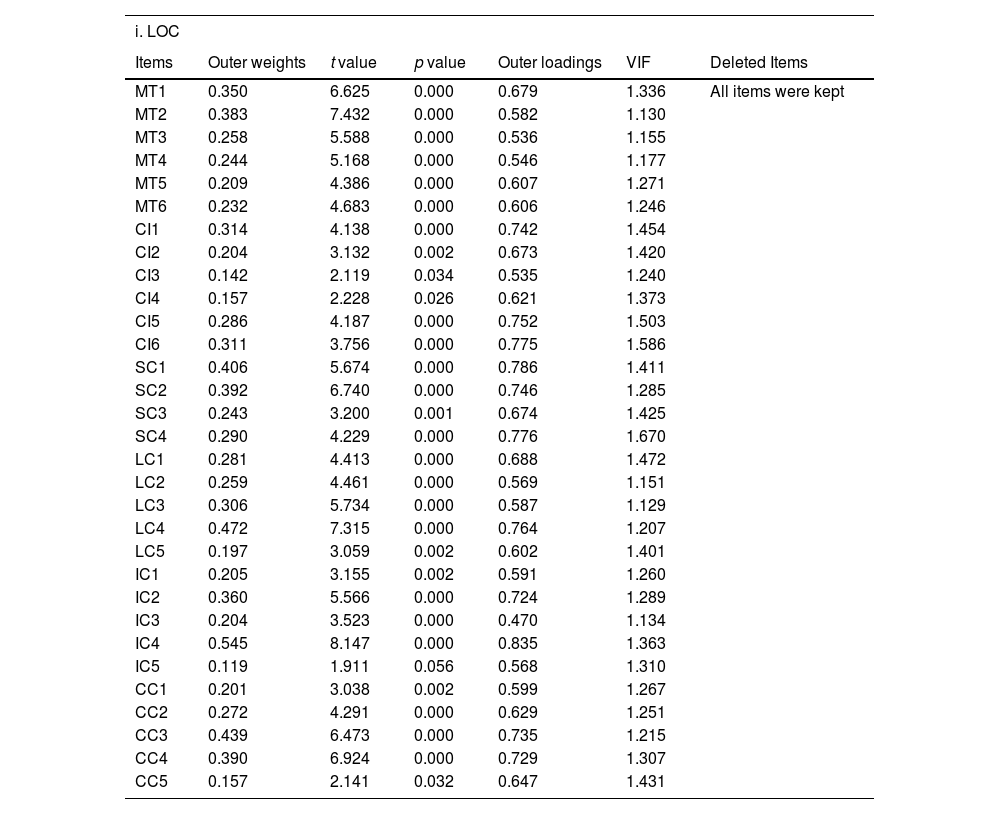

Assessing the formative and reflective measurement modelsThe measurement criteria differed between the formative and reflective models (Tables 4 and 5). For the formative model, a three-step process was used to evaluate the first- and second-order measurement models (Hair et al., 2022): (i) multicollinearity, (ii) construct validity (outer weights), and (iii) indicator reliability (outer loadings). The variance inflation factor (VIF) was used to determine collinearity between formative predictors. As suggested by Hair et al. (2022), VIF values should be lower than 5, and, ideally, lower at 3.3. The inner VIFs for the first- and second-order measurement models confirmed that this study did not suffer from multicollinearity. Then, using 10,000 bootstrap samples and estimating Mode B, the bias-corrected and accelerated (BCa) bootstrapping approach was used to examine the significance of the outer weights and outer loadings (Streukens & Leroi-Werelds, 2016). As Table 4 shows, all outer weights and loadings were significant, except for IC5; however, we did not remove them because their loadings were statistically significant (Hair et al., 2022).

Assessment of formative measurement model.

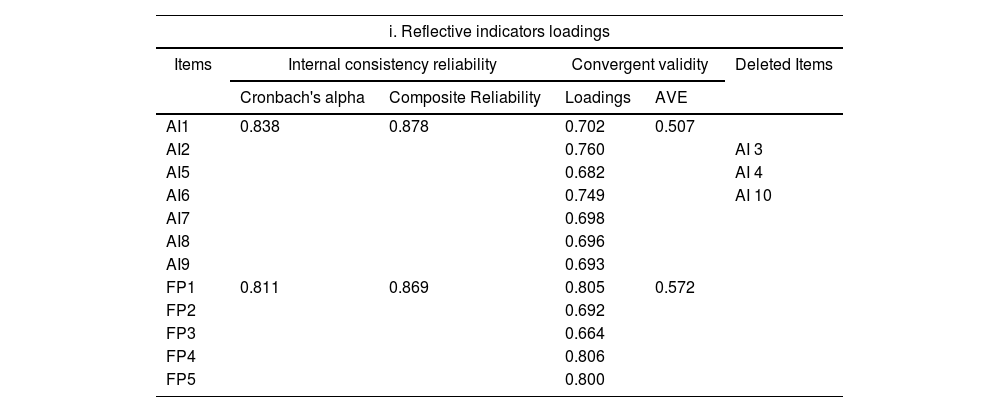

Assessment of the reflective measurement model.

Notes: AVE = average variance extracted.

After the first- and second-order formative measurement models were evaluated, a reflective measurement model was developed. Internal consistency and convergent and discriminant validity criteria were used to evaluate the quality of the measurement models (Hair et al., 2022). Convergent validity was assessed using outer loadings, and average variance was calculated (AVE). As suggested by Hair et al. (2022), although the outer loading must be > 0.708, items with loading values from 0.40 to 0.70 should be considered for deletion only if eliminating them increases the AVE or composite reliability (CR) beyond the proposed threshold value. All components with loadings < 0.708 were retained because their removal had no discernible effect on the constructs’ AVE and CR, except for AI3, AI4, and AI10, which were removed. As Table 5 shows, internal consistency reliability and convergent validity were confirmed because the AVE, CR, and Cronbach's α values were greater than the required thresholds of 0.5 (AVE) and 0.7 (CR and α) (Guenther et al., 2023). The square root of the AVE for each construct was higher than the correlation coefficients for that construct. Thus, discriminant validity was proven (Hair et al., 2022). Additionally, the heterotrait-monotrait (HTMT) values were below the 0.90 threshold (Henseler et al., 2015).

Common-method biasCommon method bias (CMB) can significantly impair the validity of findings when data are collected from the same source simultaneously (Pavlou & El Sawy, 2006). To reduce CMB, several a priori and post hoc steps were taken (Cegarra-Navarro et al., 2016). The questionnaire was initially tested by 50 respondents who were not included in the final group to identify ambiguities and misconceptions in the questionnaire's syntax or vocabulary and the use of positive and negative item phrasing (Hussain & Papastathopoulos, 2022). Second, respondents’ anonymity and confidentiality were maintained by omitting their personal information.

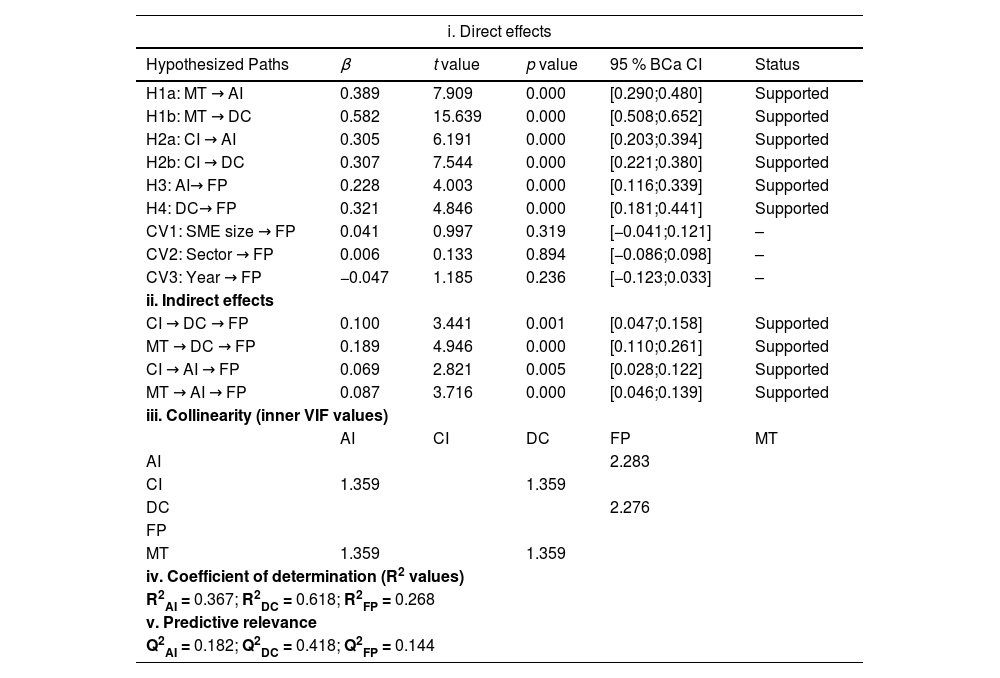

Assessing the structural modelWhen the measurement model was suitable, a structural model was evaluated as follows to assess the PLS-SEM findings. The coefficient of determination (R²), blindfolding-based cross-validated redundancy measure Q², and statistical significance and relevance of the path coefficients should all be addressed (Table 6). Collinearity must be examined before measuring structural relationships to ensure that it does not bias the regression findings evaluated by investigating the VIFs of the predictor constructs (Hair et al., 2022). The results showed that all VIFs were < 3.3, indicating that collinearity was not an issue. The significance of the path coefficients was determined for hypothesis testing considering the constructs’ positive effects and mediating roles. Using 10,000-sample bootstrapping, the structural model was confirmed to have significant relationships. For the structural model, the results support the hypothesis of a significant positive influence of MT on AI (β = 0.389, p < 0.001), MT on DC (β = 0.582, p < 0.001), CI on AI (β = 0.305, p < 0.001), CI on DC (β = 0.307, p < 0.001), AI on FP (β = 0.228, p < 0.001), and DC on FP (β = 0.321, p < 0.001). The path coefficients for all direct effects are supported. DC has an indirect effect between CI and FP (β = 0.100, p = 0.001) and MT and FP (β = 0.189, p < 0.001), while AI has an indirect effect on CI and FP (β = 0.069, p = 0.005), and MT and FP (β = 0.087, p < 0.001), revealing a dual mediation effect. Thus, all hypotheses of this study are supported. Regarding the control variables, SME size, sector, and establishment year did not significantly influence FP.

Assessment of SEM.

Notes: CV = control variable; BCa bootstrapping method was applied with 10,000 bootstrap samples (Streukens & Leroi-Werelds, 2016). Higher-order constructs were estimated by using the two-stage approach and mode B (Sarstedt et al., 2019).

Variance (R²) is explained and represented in each of the endogenous constructs and is, hence, a measure of the model's explanatory power (Streukens & Leroi-Werelds, 2016). R² is the in-sample predictive power ranging from 0 to 1, with higher values indicating greater explanatory power. R² values of 0.75, 0.50, and 0.25 can be considered substantial, moderate, and weak, respectively (Hair et al., 2022). The R² values were within this range, indicating substantial predictive power. The predictive accuracy of the PLS path model was assessed by calculating the Q² value (Ringle et al., 2020). This metric is based on the blindfolding process, which removes single points from the data matrix, imputes the removed points with the mean, and then estimates the model's parameters. Therefore, Q² is not considered a measure of out-of-sample prediction; instead, it combines aspects of out-of-sample prediction and in-sample explanatory power (Sarstedt et al., 2019). Hair et al. (2022) recommend blindfolding as a tool to identify a model's predictive performance; 5–10 read-out was deemed reliable and provided the sample size. AI, FP, and DC showed results below the threshold and were therefore predicted as eliminated datapoints.

Discussion and conclusionsResearch on environmental turbulence and innovation opportunities for SMEs has increased in recent years (Weaven et al., 2021). However, few studies have aimed to test the influence of environmental turbulence on SME innovation by utilizing digital technologies such as AI and leveraging firms’ capabilities, such as sensing, learning, integrating, and coordinating capabilities, as part of DCs to enhance firm performance during a crisis. Hence, this study is among the first to conduct a comprehensive quantitative investigation into the influence of environmental turbulence (MT and CI) on SME innovation, and how they leverage firms’ capabilities of sensing (to recognize, analyze, and seize opportunities), learning (to update current operational knowledge), coordinating (to integrate new knowledge into operational capabilities via the use of collaborative reasoning), and integrating (to alter operational capabilities by deploying tasks, resources, and activities), which are DCs, along with AI applications to exploit opportunities created from these turbulent factors.

According to Drydakis (2022), SMEs should utilize AI to support their business operations in areas such as (i) sales and marketing to improve customer targeting based on their habits, social media activities and profiles, online activities, and past transactions to develop more efficient interactions; (ii) conversational commerce such as chatbots or virtual assistants to facilitate online conversations between businesses and their customers; (iii) customer service support to help SMEs provide quick and efficient support to their customers; (iv) data analytics to analyze large amounts of data and gain insights into customer behavior, market trends, and business performance; (v) sustainable development to identify opportunities for sustainable development by analyzing environmental data and predicting trends; (vi) credit evaluation to assess the creditworthiness of potential borrowers; (vii) risk assessment to identify and manage risks more effectively by analyzing data from various sources; (viii) cybersecurity to protect SMEs’ digital assets from cyber threats; and (x) legal services to streamline legal processes and reduce legal costs by automating routine tasks. AI applications help improve SMEs’ quality optimization, operational efficiency, and overall development during environmental turbulence.

The results show the positive effects of MT and CI on AI applications and DC utilization, both of which play positive mediating roles in enhancing firm performance to maintain competitiveness during crises. This study's findings are consistent with those of previous studies (Bodlaj & Čater, 2019) in that environmental turbulence elements (MT and CI) provide opportunities for SMEs to thrive and survive economic downturns if digital technologies are strategically implemented through the proper utilization of a firm's capabilities. Challenging the findings of Eggers (2020) that environmental turbulence threatens the survival of SMEs owing to their limited resources, the results of this study show that SMEs utilizing AI applications and leveraging sensing, learning, integrating, and coordinating capabilities are competitive, thereby enabling their survival. In addition, the findings are tangible, given that the context of this research relates to the COVID-19 crisis. Firm performance outputs were measured from the financial performance aspect to quantify financial health in terms of profitability, sales growth, return on investment, and customer retention.

In contrast to the findings of previous studies (Fainshmidt et al., 2019; Wang et al., 2015) that firms with DC have limited resources during environmental turbulence and are pressured to survive, this study found that SMEs that leverage DCs through sensing, learning, integrating, and coordinating capabilities are effective during real-time crises. The results also challenge those of Senivongse et al. (2019), who reported that DCs are only appropriate in stable as opposed to turbulent environments, as this study demonstrates that DCs are influenced by environmental turbulence elements, enhance firm performance, and play a mediating role between both.

This study indicates that SMEs are influenced by environmental turbulence to become more innovative in terms of utilizing capabilities and implementing AI despite a lack of resources. AI and DCs enable SMEs to adapt to unforeseen circumstances, implying that firms employ digital technologies to fulfill new needs, pivot their company operations quickly, increase efficiency, and mitigate business risks caused by crises (Garbellano & Da Veiga, 2019). Additionally, these technologies help SMEs identify new opportunities, capitalize on them, and adapt operational procedures in response to sudden and unexpected changes (Warner & Wäger, 2019). This also shows that irrespective of whether a crisis has occurred, SMEs should continuously adapt to changing environments and maintain their competitive edge over other businesses within each sector.

Theoretical implicationsThis study contributes substantially to the literature on the influence of environmental turbulence on SME innovation. First, it advances the findings on DC theory because it was conducted during the COVID-19 crisis and used quantitative empirical methods. This study's findings are robust, as they validate the effectiveness of DCs, which clarifies the arguments presented in previous research (Heredia et al., 2022). Unlike previous studies that tested DC effectiveness during real-time crises using qualitative exploratory methods (Weaven et al., 2021), this study extends the findings of DC theory based on a quantitative method, which indicates the effectiveness of DCs during uncertain times. Additionally, this study indicates that DCs are crucial for SMEs to ensure their competitiveness and market success. Thus, this study answers the call for validating DC outputs during crises (Heredia et al., 2022).

Second, the present research advances the findings on the influence and opportunities of environmental turbulence on SME innovation using the DC view theory, as previous studies have used environmental contingency theory (Tsai & Yang, 2014). Researchers have argued that environmental turbulence challenges SMEs’ survival (Eggers, 2020; Troise et al., 2022), whereas the findings of this study show that environmental turbulence drives SMEs and influences their innovativeness in terms of DC utilization and AI application.

Third, this study's data support the hypothesized connection between environmental turbulence elements (MT and CI) and both DCs and AI applications, between DC and AI applications and firm performance, and their mediating roles. Although scholars have found that AI applications enhance firms’ DCs (Drydakis, 2022; Parida et al., 2016), this study has contrasting findings because they were measured separately. A firm with DCs alone enhances its performance, and the results are similar for firms using AI applications; both (DC and AI) are influenced by environmental turbulence (Bashir et al., 2023). Environmental turbulence reinforces the firm's motivation to survive, driving it to innovate, leverage its existing capabilities and resources, and apply AI to cope with changes (Sultana et al., 2022).

Finally, this study's findings support previous literature showing that DCs enable a company to act rapidly when an opportunity or threat appears due to environmental turbulence and strategically reallocate resources to relevant areas (Bashir et al., 2023). However, DC use was not found to be influenced by environmental turbulence as it is an ongoing process for SMEs to enhance competitiveness. As the key to firms’ survival during economic instability, DCs facilitate agile responsiveness to environmental changes (Haarhaus & Liening, 2020). This quantitative study reveals the positive influence of the environmental turbulence elements of MT and CI on SMEs’ AI implementation and the key role AI plays in the survival of SMEs during a crisis, thus contributing to the literature on DC theory (Drydakis, 2022). Environmental turbulence positively influences AI applications, thereby promoting the profitability and performance of SMEs.

Managerial implicationsThis study's findings can assist SME managers, owners, and practitioners in understanding how environmental turbulence influences SMEs’ decisions regarding the utilization of DCs and AI to enhance firm performance during challenging times. Thus, these findings make significant practical contributions to the literature. First, the findings explain the influence of environmental turbulence on DC in the context of SMEs, which enables firm performance. This provides guidance for managers and owners to continuously scan the environment, understand changes, and identify the required capabilities and resources to cope and respond quickly and effectively during a crisis. This aligns with the research of Bodlaj and Čater (2019), who demonstrated the importance of environmental turbulence for SME innovation. Managers and owners must develop dynamic strategies to continuously meet changes in demand and thrive under competition. This can be achieved by taking advantage of DCs that are not only dependent on environmental turbulence but also part of a continuing program to grow and retain the customer base. These findings should motivate practitioners to develop a dynamic approach applicable to both stable and turbulent environments that can assist managers in evaluating current market conditions, enhancing their firm's knowledge base, leveraging AI applications to meet sudden changes in customer demand, and maintaining profitability when facing intense competition. Monitoring trends and potential disruptions in the business climate provides firms with the data necessary to spot impending changes and make timely modifications to planning. A constant finger on the market pulse enhances innovation and creativity and enables managers to respond and adapt quickly to inevitable future changes and retain customer loyalty.

Second, the results show the influence of environmental turbulence elements on AI applications, which also enhanced firm performance in harmony with DC leverage. Thus, managers should consider the necessity of AI applications and develop valid strategies (a) investing in new digital technologies and human resources for the use of AI and leveraging from the opportunities provided by an economic crisis; (b) responding to customer preferences and changing market circumstances effectively via the development of new capabilities, knowledge, and professional experience by applying new technologies within business models for the long-term; and (c) developing employee capabilities to manage AI applications (Dabić et al., 2023). In contrast, Weaven et al. (2021) highlighted that unsuccessful SMEs are generally unwilling to invest in digital technologies or develop their employees because of a lack of internal financial resources during a crisis, hindering their survival. By deploying digital technologies such as AI, SMEs can manage the overwhelming amount of complex and often ambiguous data that they deal with today, especially in times of crisis, and reduce costs.

The existing literature provides few practical insights into the use of AI applications during challenging times; thus, the findings of this study offer novel and practical advice on boosting performance through AI by improving business strategies, processes, capabilities, products, and services, and interfirm relationships in extended business networks to respond to sudden changes in demand and provide for on-the-spot market needs. Managers and owners who must develop action plans should constantly monitor the business environment for new trends and technologies and assess the status of competitor (Bashir et al., 2023).

Limitations and future researchThis study has several limitations that should be addressed in future research. First, this study combines all SME categories in the sample size, which may hinder the specification of how DC and AI applications are utilized per SME category, given that each SME category requires different strategies to fit the business activities pertinent to its sector to cope with sudden market changes. A comparative study of the DC and AI applications in each sector to identify the different strategies required by each sector during uncertain times would be interesting to conduct. Second, this study reflects SME performance during a real-time crisis; however, it would be fruitful to conduct a longitudinal study to compare SME performance during current and post-crisis stages to understand the influence of environmental turbulence on SMEs and whether SMEs can sustain their competitive edge after a crisis. Finally, the study was conducted in one geographic location and limited to three major cities, which hinders the generalization of the results. Therefore, a comparative study of SMEs in different geographic locations will provide more insight into the universal applicability of this study's findings.

CRediT authorship contribution statementMariam Hamad Al Dhaheri: Writing – original draft, Investigation, Conceptualization. Syed Zamberi Ahmad: Writing – review & editing, Writing – original draft, Supervision. Avraam Papastathopoulos: Methodology, Formal analysis, Data curation.

None.