Using data about votes emitted by funds in meetings held by United States banks from 2003 to 2013, we apply a genetic algorithm to a set of financial variables in order to detect the determinants of the vote direction. Our findings indicate that there are three main explanatory factors: the market value of the firm, the shareholder activism measured as the total number of funds voting, and the temporal context, which reflects the influence of recent critical events affecting the banking industry, including bankruptcies, reputational failures, and mergers and acquisitions. As a result, considering that voting behavior has been empirically linked to reputational harms, these findings can be considered as a useful insight about the keys that should be taken into account in order to achieve an effective reputational risk management strategy.

The voting behavior disclosed by shareholders in corporate meetings is a key concern for researchers into the corporate governance field. Actually, many investigations have been carried out regarding the motivations of the vote direction (Choi, Fisch, & Kahan, 2008), as well as its effects (Becker, Bergstresser, & Subramanian, 2013; Fischer, Gramlich, Miller, & White, 2009), including its connection with shareholder wealth (DeAngelo & DeAngelo, 1989; Dodd & Warner, 1983; Mulherin & Poulsen, 1998) and corporate reputation (Bernile & Jarrell, 2009; Ertimur, Ferri, & Maber, 2012; Ferri & Maber, 2013).

Genetic algorithms are methods of inductive learning based on adaptive search techniques, which have the strength of using accumulative information regarding an unknown search space with the aim of redirecting successive searches into the most suitable subspaces, as an imitation of the biological evolution (Vafaie & De Jong, 1992). A candidate solution is characterized by means of a linear string similarly to a chromosome. A population advances toward better solutions, and a fitness function quantifies the suitability of each solution. As a consequence, this methodology has been successfully applied to the analysis of different scenarios, with the aim of discovering the most relevant features for the explanation of a certain phenomenon (Huang, Cai, & Xu, 2007; Rozsypal & Kubat, 2003; Yang & Honavar, 1998).

The recent developments into the quantitative finance field have resulted in the appearance of complex mathematical models for the explanation of different financial phenomena, which are frequently characterized by a lack of analytic representation. In this sense, several metaheuristic algorithms have demonstrated to be a suitable methodology for addressing these financial problems. In particular, genetic algorithms have been successfully applied to the analysis of different financial scenarios with promising results. Thus, genetic algorithms have been recently used in value-at-risk computing (Sharma, Thulasiram, & Thulasiraman, 2015), bankruptcy research (Davalos, Leng, Feroz, & Cao, 2014; Shin & Lee, 2002; Wu, Tzeng, Goo, & Fang, 2007), optimal insurance risk allocation (Ha, 2013), exchange rates prediction (Vasilakis, Theofilatos, Georgopoulos, Karathanasopoulos, & Likothanassis, 2013), financial failures forecasting (Chen, 2014), financial fraud detection (Hoogs, Kiehl, Lacomb, & Senturk, 2007), portfolio optimization (Chang, Yang, & Chang, 2009; Oh, Kim, & Min, 2005) and stock markets prediction (Ghoshal, Mukherjee, & Dhar, 2011; Karimi, Dastgir, & Shariati, 2014; Leigh, Purvis, & Ragusa, 2002).

The aim of this research is to address an empirical examination of the global vote direction observed in corporate meetings held by United States banks, applying a genetic algorithm over a large set of financial variables in order to identify the key determinants of the voting decisions.

2Literature reviewThe voting behavior disclosed by shareholders in corporate meeting has attracted increased attention from academics and practitioners in recent times. Thus, a direct relation between shareholder wealth and proxy contests has been demonstrated (DeAngelo & DeAngelo, 1989; Dodd & Warner, 1983; Mulherin & Poulsen, 1998), with palpable consequences observable throughout financial markets (Becker et al., 2013; Fischer et al., 2009). In addition, although there is a lack of consensus regarding the criteria that proxy advisors take into account in order to disclose their voting advise (Choi et al., 2008), they tend to acclaim a non-pro vote when a company with low results discloses high executive compensation (Ertimur, Ferri, & Oesch, 2013), with a demonstrated direct relation between the application of the Say on Pay policy and corporate performance (Cuñat, Gine, & Guadalupe, 2013), and some empirical findings on how corporate governance is linked to vote direction (Cai, Garner, & Walkling, 2009). Moreover, the damages derived from reputational risk have been explored through voting behavior, with voting pattern suggested as an adequate indicator for reputational harm (Bernile & Jarrell, 2009; Ertimur et al., 2012; Ferri & Maber, 2013).

Despite being a general concern, lately the focus has turned toward the banking industry and the investigation of the voting pattern in this specific sector has been addressed, with special attention to the effects of the Say on Pay policy (Yahr, 2013). That is a consequence of the relevant role in the germen of the financial crisis attributed to financial institutions, and also frequent reputational scandals affecting the banking industry contribute to explain this raising degree of interest (Fiordelisi, Soana, & Schwizer, 2013). Indeed, it has been pointed out that the banking activity is particularly sensitive to reputational issues (Allen & Santomero, 1997; Allen & Santomero, 2001; Bhattacharya & Thakor, 1993). As a matter of fact, corporate reputation has been referred as a strong competitive advantage for financial institutions (Xifra & Ordeix, 2009) and reputational risk has been identified as a severe threat for the banking business (Limentani & Tresoldi, 1998).

Actually, the banking industry has been traditionally considered a suitable scope for research purposes, due to the special characteristics of the banking products, as well as the role that banks play as financial intermediaries in an asymmetric information scenario (Allen & Santomero, 1997, 2001; Bhattacharya & Thakor, 1993). In fact, the United States banking industry is a particularly motivating focus for investigation, considering that the deregulation process that has been affecting this sector in recent times makes it an adequate choice for addressing the corporate consequences of environmental changes (Berger, Kashyap, Scalise, Gertler, & Friedman, 1995; Calomiris, 2000; Lounsbury, Hirsch, & Klinkerman, 1998; Marquis & Lounsbury, 2007).

3Method and dataFor the purpose of this research, we use the software WEKA, which is the short form for Waikato Environment for Knowledge Analysis, a famous solution deployed with Java technology by the University of Waikato and distributed as free software under the GNU General Public License, with remarkable applications for machine learning. The WEKA software includes a specific algorithm for genetic search, which is the simple genetic algorithm described in Goldberg (1989). This method estimates chromosomes considering certain parameters previously stablished, including learning rate and momentum. For each chromosome, a merit indicator is provided, as a measure of the classification error rate. In addition, a scaled fitness measure for each chromosome is also supplied (Larose, 2006). As a next step, the algorithm crosses over taking pairs of the best estimated chromosomes, and it also considers the presence of mutations affecting descendants (Ahmed & Zeeshan, 2014). Consequently, this technique results useful when it comes to build a subset of key attributes from a large dataset (Larose, 2014).

The data used in this study comprise votes emitted by the largest large cap funds and by socially responsible investing funds regarding managerial proposals about directors’ election and executive compensation presented in corporate meetings organized by companies in the United States banking sector from 2003 to 2013. These voting data are collected from official SEC N-PX fillings by the non-profit and non-partisan organization ProxyDemocracy, which has been recently referred as a suitable data provider for research purposes (Burns & Minnick, 2013). The final dataset is formed by 95,234 votes corresponding to 309 United States banks. In addition, we pick different accounting and financial indicators concerning the companies in our research from the Bankscope database, with the aim of discovering how these indicators affect the vote direction disclosed in corporate meetings. As a result, this is the list of the variables considered in this investigation (Table 1).

Description of the attributes.

| Number | Name | Description |

|---|---|---|

| Feature 1 | Year | This is a nominal variable with eleven values, one for each of the years contained in the sample. |

| Feature 2 | Vote direction | This is a dichotomous variable that can hold the class “sustain” or “not sustain”. For each bank and year in our sample, we count the pro votes and the non-pro votes regarding the corporate performance during that year. The non-pro votes include both abstains and against votes, since this is a common practice in the governance industry (Gregory-Smith & Main, 2013). If the pro votes overcome the non-pro votes, we give the class “sustain” for that bank and year. In other case, we assign the class “not sustain”. |

| Feature 3 | Total number of funds | We calculate the total number of funds disclosing at least one vote for each bank and year. |

| Feature 4 | Total assets | This variable shows the natural log of the total volume of assets for each bank and year. |

| Feature 5 | Age | We calculate the number of years lapsed since the date of the first corporate meeting of a given bank collected in ProxyDemocracy. |

| Feature 6 | Return on assets | For each bank and year, we compute this ratio by relating operating profit to total assets. |

| Feature 7 | Operating income growth | For each bank and year, we calculate the inter-annual growth of the operating income. |

| Feature 8 | Leverage | For each bank and year, we compute this ratio by relating the book value of liabilities to the book value of equity. |

| Feature 9 | Dividend yield | For each bank and year, we relate the amount of dividends paid to the market capitalization. |

| Feature 10 | Operating margin | For each bank and year, we compute this ratio by relating the operating profit to the operating income. |

| Feature 11 | Tobin's q | For each bank and year, we relate the market value of assets to the book value of assets. The market value of assets is computed as the book value of assets plus the difference between the market value of equity and the book value of equity. This calculation of the Tobin's q ratio, and a variant that considers deferred taxes, is frequently used in academic research (Bebchuk & Cohen, 2002; Gompers, Ishii, & Metrick, 2003; Jiao, 2010; Kaplan & Zingales, 1997) as an alternative to a more formal calculation (Lindenberg & Ross, 1981), which is difficult to use in practice. There is empirical evidence supporting the similarity between the formal and the light definition of the Tobin's q (Chung & Pruitt, 1994) |

| Feature 12 | Price to earnings ratio | For each bank and year, we relate the market capitalization to the net profit. |

| Feature 13 | Market capitalization | For each bank and year, we compute the natural log of the market capitalization. |

| Feature 14 | Return on equity | For each bank and year, we calculate this ratio by relating the net profit to the book value of equity. |

Beyond the reported calculations, no additional data transformation is accomplished.

4Results and discussionAs a first step, we provide summary statistics for the numeric attributes of this research (Table 2).

Summary statistics for the numeric attributes.

| Attribute | Mean | Min | Max |

|---|---|---|---|

| Total number of funds | 7.369 | 1 | 121 |

| Total assets | 8.059 | 1.194 | 15.981 |

| Age | 3.856 | 1 | 10 |

| Return on assets | 0.013 | −0.353 | 0.689 |

| Operating income growth | 1.083 | −2.033 | 6.881 |

| Leverage | 0.863 | 0 | 1 |

| Dividend yield | 0.393 | 0 | 144.696 |

| Operating margin | 0.169 | −21.07 | 2.991 |

| Tobin's q | 1.058 | 0.128 | 7.806 |

| Price to earnings ratio | 16.474 | −2913.15 | 3184.739 |

| Market capitalization | 5.904 | 0.974 | 12.385 |

| Return on equity | 0.112 | −9.609 | 157.439 |

In order to apply the genetic search algorithm available in WEKA to our set of data, we begin by selecting the full training test mode with the following parameters: population size, 20; number of generations, 20; probability of crossover, 0.6; probability of mutation, 0.033. The results of this first experiment are reported in the following table (Table 3).

Results of the genetic search algorithm.

| Generation: 20 | ||

|---|---|---|

| Merit | Scaled | Subset |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.05858 | 0.00068 | 1 3 9 11 13 |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.09891 | 0.1037 | 1 3 11 13 |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.06323 | 0.01256 | 1 3 12 13 |

| 0.10111 | 0.10931 | 1 3 8 13 |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.09012 | 0.08125 | 1 3 14 |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.09891 | 0.1037 | 1 3 11 13 |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.05868 | 0.00093 | 1 3 4 5 8 12 13 |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.09839 | 0.10238 | 1 3 13 14 |

| 0.10821 | 0.12746 | 1 3 13 |

| 0.05831 | 0 | 1 3 12 13 14 |

Population size: 20; number of generations: 20; probability of crossover: 0.6; probability of mutation: 0.033.

This table shows the attributes subset in the third column. Each individual in the population represents one possible solution (one attributes subset). Those with a highest fitness (0.12746) correspond to a better solution (attributes: 1, 3, 13). Thus, the algorithm ends selecting the attributes “Year (1)”, “Total number of funds (3)” and “Market capitalization (13)”. To test the stability of the results, we carry out different experiments changing the initial parameters (Table 4).

Results for different values of parameters.

| NG | PS | PC | PM | SA |

|---|---|---|---|---|

| 20 | 20 | 0.6 | 0.033 | 1, 3, 13 |

| 50 | 20 | 0.6 | 0.033 | 1, 3, 13 |

| 100 | 20 | 0.6 | 0.033 | 1, 3, 13 |

| 500 | 20 | 0.6 | 0.033 | 1, 3, 13 |

| 1,000 | 20 | 0.6 | 0.033 | 1, 3, 13 |

| 5,000 | 20 | 0.6 | 0.033 | 1, 3, 13 |

| 100 | 20 | 0.6 | 0.033 | 1, 3, 13 |

| 100 | 40 | 0.6 | 0.033 | 1, 3, 13 |

| 100 | 60 | 0.6 | 0.033 | 1, 3, 13 |

| 100 | 80 | 0.6 | 0.033 | 1, 3, 13 |

| 100 | 20 | 0.2 | 0.033 | 1, 3, 13 |

| 100 | 20 | 0.4 | 0.033 | 1, 3, 13 |

| 100 | 20 | 0.6 | 0.033 | 1, 3, 13 |

| 100 | 20 | 0.8 | 0.033 | 1, 3, 13 |

| 100 | 20 | 0.6 | 0.011 | 1, 3, 13 |

| 100 | 20 | 0.6 | 0.033 | 1, 3, 13 |

| 100 | 20 | 0.6 | 0.055 | 1, 3, 13 |

| 100 | 20 | 0.6 | 0.077 | 1, 3, 13 |

NG, number of generations; PS, population size; PC, probability of crossover; PM, probability of mutation; SA, selected attributes. The values for the changing parameter in each experiment are presented in bold.

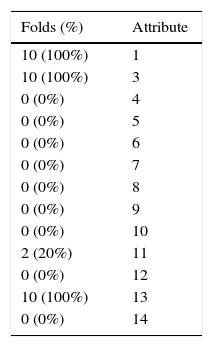

As we can see, the results are consistent throughout all the experiments, and the selected subset of attributes is always the same. Finally, using the initial parameters, we accomplish a final experiment using a 10-fold cross validation mode (Table 5).

Results for the 10-fold cross validation mode.

| Folds (%) | Attribute |

|---|---|

| 10 (100%) | 1 |

| 10 (100%) | 3 |

| 0 (0%) | 4 |

| 0 (0%) | 5 |

| 0 (0%) | 6 |

| 0 (0%) | 7 |

| 0 (0%) | 8 |

| 0 (0%) | 9 |

| 0 (0%) | 10 |

| 2 (20%) | 11 |

| 0 (0%) | 12 |

| 10 (100%) | 13 |

| 0 (0%) | 14 |

Population size: 20; number of generations: 20; probability of crossover: 0.6; probability of mutation: 0.033.

The results reinforce the previous conclusions and they show that the three main attributes still are “Year (1)”, “Total number of funds (3)” and “Market capitalization (13)”, since they appear in 100% of the cases. However, a fourth attribute shyly arises, and “Tobin's q (11)” is included in 20% of the folds.

Ultimately, all the consummated experiments point out the predominance of three attributes in explaining the direction of the aggregated voting behavior observed in corporate meetings. Thus, the market capitalization appears as one of these main explanatory factors, indicating that the market value of the firm influences the global vote direction. In addition, the total number of funds voting is also relevant, showing that the degree of activism disclosed by institutional investors is a key determinant of the whole support or rejection to managerial proposals. Moreover, the year appears as another significant feature, indicating that the moment at which the votes refer is relevant in explaining their direction. In order to understand this last influential relation, it must be taken into account that the time horizon considered in our sample covers some critical moments for the United States banking sector, including bankruptcies, severe reputational failures, and mergers and acquisitions. Thus, our results suggest that these critical events may have influenced the aggregated vote direction.

5ConclusionsUsing a sample of 309 companies from the United States banking industry, and collecting votes issued by the largest large cap funds and by socially responsible investing funds about managerial proposals presented in their corporate meetings during the 11-year period from 2003 to 2013, we investigate the determinants of the vote direction among an extensive set of financial variables by means of a genetic algorithm.

Our findings suggest that there are three main attributes that contribute to explain the global voting support or rejection. First, the market capitalization of the firm appears as a key explanatory factor, indicating that the corporate market value is an influential feature. Second, the number of funds voting also arises, suggesting that the shareholder activism is a key feature as well. Finally, the moment at which the votes refer is also important, suggesting that the critical events affecting the banking industry in recent times may have affected the aggregated vote direction.

Considering that voting behavior has been previously connected to reputational harm, our findings provide some interesting insights about key aspects that should be considered in order to build an effective reputational risk management strategy.