Investment and financing decisions are especially important in a family firm context, as family and business dynamics interact to produce unique behaviors that may affect these decisions. However, research on how the family nature of these firms shapes their investment and financing preferences is still lacking. To help fill this gap, this study aims to provide a robust picture of the literature to identify key questions that can help guide future research. Using a systematic approach based on bibliometrics and network analysis of 891 papers published in the Web of Science database between 1992 and 2023, we show the evolution of research in terms of publications and identify the most active and influential articles, authors, and journals. Using bibliographic coupling analysis, the paper reveals the thematic structure and trends of the research. This study provides valuable insights into the future by identifying knowledge gaps and offering guidance to both researchers and practitioners seeking to understand the specific needs and challenges faced by family firms in their investment and financing endeavors.

Family firms, which are those in which members of the same family are involved in ownership, leadership and/or management and are committed to perpetuating the business across generations (Chua et al., 1999), constitute an economically and culturally significant phenomenon. The overlapping connections between family and business foster emotional ties that are manifested in the firm's culture (Dyer, 2021) and permeate several key aspects of the business, such as its strategic orientation (Chrisman et al., 2005) and resource allocation (Chrisman et al., 2003; Schierstedt et al., 2020). In recent years, family firms have been found to exhibit certain characteristics with respect to their investment and financing decisions compared to non-family firms. However, scholars have yet to clarify the role of the family nature of the firm in shaping investment and financing preferences. In circumstances where the determinants of these decisions are not solely economic, it is crucial to know whether such processes follow their own logic (Motylska-Kuzma, 2017).

Studies show that family firms often approach decisions shaped by their long-term orientation, family dynamics, and governance and management structures (Chrisman et al., 2005; Berrone et al., 2012), which are influenced by both business and family needs (Gómez-Mejía et al., 2007). Family firms habitually have limited sources of external financial capital because they prefer to avoid sharing equity with non-family members (Sirmon & Hitt, 2003). Their primary organizational goal is often business sustainability to create value for future generations of the controlling family (Sharma & Sharma, 2019); therefore, they may sacrifice short-term economic objectives for the long-term survival of the firm (Gómez-Mejía et al., 2011). As suggested by Miroshnychenko et al. (2021), the transgenerational orientation of family firms may play a crucial role in promoting their sustainability and growth. This means that the transgenerational business vision could result in family firms with different cultures and strategies (Manzano-García et al., 2023). With a sense of unity and a shared vision among family members, the reputational and relational capital of these entities also play a pivotal role in shaping their strategic behavior (Gómez-Mejía et al., 2007; Berrone et al., 2012). These elements can be valuable assets that foster a collaborative environment where collective goals are pursued, and decision-making processes are informed by a common vision to ensure the sustained success and growth of the family firm. Indeed, emotional capital is recognized as the main reason that family firms often prioritize non-economic goals (Chrisman et al., 2005; Debicki et al., 2016).

It is important to understand the logic of the decision-making process, as all strategic decisions made in a firm have an impact on its investment and financing (hereinafter, I&F), and in the case of family firms, non-economic factors also come into play (Motylska-Kuzma, 2017). One of the key advantages of a shared vision within a family firm lies in the alignment of economic goals (Koropp et al., 2014). Family members with close familial ties are in a position to draw upon the family legacy and values in order to reach a consensus around investments in innovations and strategies with a view to achieving their aspirations (Sharma & Sharma, 2024). Financial decisions are more likely to be driven by a long-term perspective that considers the sustainability and legacy of the business (Sharma & Sharma, 2019). This shared commitment can lead to financial strategies that prioritize the continuity and prosperity of the family business over immediate gains (Gallo et al., 2004). Mutual trust and understanding among family members often result in a collaborative approach to assessing risks and rewards, fostering a more comprehensive evaluation of potential opportunities and threats that can contribute to effective risk management in I&F decisions (Koropp et al., 2013). This joint scrutiny enhances the quality of decision-making processes, potentially minimizing the adverse impacts of financial risks (Gallo et al., 2004; Miller & Le Breton Miller, 2005). However, it is imperative to acknowledge that while unity can be helpful, it may also present challenges that can hinder overall success. Group think, a phenomenon in which the desire for consensus hinders critical thinking and objective evaluation of alternatives, may become prevalent within a closely knit family (Zahra et al., 2008). This can lead to a reluctance to entertain dissenting opinions or alternative viewpoints, potentially overlooking viable investment opportunities or warning signs in I&F decisions. Moreover, the emotional ties within a family can complicate these decisions, as personal relationships can interfere with proposed decisions (Jaskiewicz et al., 2013). Nepotism, for instance, may lead to suboptimal staffing decisions, compromising the efficiency and competitiveness of the family firm (Gómez-Mejía et al., 2011; Schulze et al., 2003).

Academics have not yet uniquely defined the role of the family nature of a business in framing I&F preferences (Koropp et al., 2014). The specific characteristics of family firms may be an important factor when these firms consider alternatives. Hence, it is important to deepen the knowledge generated in this field, especially considering that family firms dominate between 70 and 90 percent of most global economies in number and in terms of the share of GDP (Sharma & Sharma, 2019). A systematic approach to a literature review makes it possible to understand the evidence generated thus far, discover new contributions, identify research trends, and deepen the knowledge structure within a field (Kraus et al., 2022). A literature review also stimulates debate on the future development of this emerging topic (Post et al., 2020). As suggested by Maseda et al. (2022), "each academic contribution is considered a piece of a puzzle that must be put together to show where the research on a subject currently stands, and what we know and do not know about it." In this regard, it should be noted that several previous studies have already undertaken the task of summarizing research on I&F in family firms and made valuable contributions to this body of research (see Table 1).

Summary of extant literature reviews on investment and financing in family firms.

| Author (year) | Source | Key contributions | Data base | Methodology | Period |

|---|---|---|---|---|---|

| Arteche-Bueno, Prado, & Fernandez (2019) | European Journal of Family Business | This article reports the recent evolution of the scientific research on the Private Equity focused on Family Firms and small and medium-sized enterprisesthe field between 1992 and 2018 and to identify and analyze the major thematic areas | Web of Science (252 papers) | Systematic Review. Bibliometric | 1990–2018 |

| Carbone, Cirillo, Saggese, & Sarto (2022) | Journal of Family Business Strategy | This study presents a systematic review of the current knowledge on initial public offerings (IPOs) in family firms. It uses an input-process-output model aligned with the different stages of an IPO. | Web of Science, Scopus and EBSCO (41 papers) | Systematic Review. Narrative approach | 1995 to 2020 |

| Hiebl (2017) | Journal of Family Business Management | Informed by upper echelons theory, this paper synthesize the knowledge on finance managers in family firms. | Web of Science and EBSCO (17 papers) | Content analysis | Until 2016 |

| Michiels & Molly (2017) | Family Business Review | This article provides an analysis and systematization of the literature on financing decisions in family firms. It helps to identify (theoretical) gaps and to present a framework for organizing (future) research in this field. | 64 selected finance and management journals (131 papers) | Systematic Review. Content analysis | 1977 to 2016 |

| Molly & Michiels (2022) | Journal of Economic Surveys | The review structures the theoretical thinking on dividend decisions in family firms and provides an overview of the current state of the literature. | Web of Science and EBSCO (47 papers) | Systematic Review. Content analysis | 2001 to 2020 |

| Motylska-Kuzma (2017) | Journal of Family Business Management | The paper examine the status, trends and potential future research areas in the field of financial decision-making in family firms. | EBSCO, Sage and Scopus (107 papers) | Systematic Review. Content analysis | 2000 to 2016 |

| Schickinger, Leitterstorf, & Kammerlander (2018) | Journal of Family Business Strategy | This study reviews the literature on private equity and family firms. It develops a framework for the categorization of the interaction and proposes an agenda for further research in the field. | EBSCO (50 papers) | Systematic Review. Content analysis | 1990 to 2017 |

Despite their relevance, these literature reviews focus on specific aspects of the topic and leave gaps in our overall understanding of the knowledge structure of research on I&F in family firms. For example, Motylska-Kuzma (2017) and Molly & Michiels (2022) focus on family firms' challenges in accessing finance when making financial decisions, while the reviews by Arteche-Bueno et al. (2019) and Schickinger et al. (2018) focus on private equity as an alternative source of finance for family firm investments. To understand the financing options used by family firms, Carbone et al. (2022) reviewed the literature on initial public offerings (IPOs), and Hiebl (2017) synthesized the role of financial managers in these firms. The fragmentation of these reviews is a limitation to a complete understanding of how these firms make I&F decisions. Hence, the present study seeks to provide answers to the following research questions (RQs):

RQ1. What is the trend in the number of publications on investment and financing in family firms?

RQ2. Which key players (e.g., publications, journals, and authors) are driving the evolution of research?

RQ3. What are the key research topics underpinning the development and growth of the field?

RQ4. What are the emerging research trends?

Specifically, the goal of this study is to offer a solid picture of the literature landscape, key issues, and directions for future research through a systematic analysis with the support of bibliometric and network analysis techniques. Using mathematical and statistical methods, bibliometrics can automate the process of selecting, collecting, and managing large databases to minimize omissions and errors, making it possible to present a complete image of the research on a given subject (Donthu et al., 2021). In addition, bibliometrics provides objective criteria for evaluating research performance and its evolution over time using quantitative metrics (Cobo et al., 2011). Scholars have therefore called for the use of bibliometric methods that synthesize a wide range of scientific publications to complement reviews based on extensive reading and fine-grained narrative reviews of selected publications (Bengoa et al., 2021). As a result, bibliometric research has experienced remarkable growth over the past two decades, with increasing acceptance in leading journals. For example, Mukherjee et al. (2022) found that 38 of the top 50 business journals listed by the Financial Times (2016; FT50) published bibliometric research in recent years, indicating that bibliometric research is valued by high-quality outlets. However, with the exception of the review conducted five years ago by Arteche-Bueno et al. (2019), there is a lack of systematic reviews supported by bibliometrics that reveal key bibliometric attributes and research themes on I&F decisions in family firms.

Our study aims to identify the leading publications, journals, and authors on this topic and to synthesize the theories, contexts, and methodologies applied over the past three decades from multiple perspectives. To this end, we develop a performance analysis to analyze the publication and citation trends and a bibliographic coupling analysis to identify the common references between the documents to assess their conceptual relatedness (Van Eck & Waltman, 2010). Next, we perform a keyword analysis to identify the most frequently author-selected keywords in the papers of each cluster. After mapping the knowledge domain of the field, we complemented our review with a comprehensive review of the documents. This review includes an interpretation of the bibliometric mappings. The comprehensive nature of the study provides an opportunity to understand the state of research in the field. This is essential for researchers and practitioners seeking to address the specific needs and challenges faced by family firms, particularly in I&F decisions.

The remaining sections are organized as follows. Section 2 begins with a discussion of the methodology and a structured overview of the sources of our literature review. Section 3 presents the results of the performance analysis and identifies the most influential journals, authors, and articles in the field. Section 4 identifies nine thematic clusters based on bibliography coupling and keyword analysis, which are briefly described in Section 5. Finally, Section 6 concludes with a brief overview of our findings, key considerations, limitations, and suggestions for future research.

2MethodologyBibliometrics is a type of systematic literature review that involves the application of quantitative and statistical measures and techniques, making it more objective and extensive than other types of reviews (Donthu et al., 2021; Mukherjee et al., 2022). Using mathematical algorithms, bibliometric analysis structures the process of selecting, ordering, and visualizing information, which allows for replication and minimizes bias (Cobo et al., 2011). The identification, selection, and analysis of existing publications in a field involves several steps, including the creation of a complete database of bibliographic references with information on citations and cited references (see Fig. 1 below).

The first step is the database search. We collected data from the Clarivate Analytics Web of Science (WoS) database using a protocol for searching, selecting, and uploading bibliographic references that allows the process to be reproducible. The WoS database covers a wide range of topics and is considered the "gold standard" by many international research rankings (Bengoa et al., 2021). In this study, we selected bibliographic references from the journals included in the Social Science Citation Index (SSCI) of the WoS database.

The second step involves the selection of search fields, research areas, keywords, and other research criteria (e.g., document type and language) in the WoS database. To identify bibliographic references in the WoS, previous literature reviews on similar topics were examined (Aparicio & Iturralde, 2023; Michiels & Molly, 2017; Motylska-Kuzma, 2017; Kumar et al., 2020; Maseda et al., 2022). Two search strings related to family firms and investment and financing activities were used. The use of asterisks allowed for different word endings. The two search strings were operationalized as [(“family firm*” OR “family business*” OR “family enterprise*” OR “family own*” OR “family SME*” OR “family control*” OR “family involvement” OR “family capital” OR “founder* firm*”)) AND (“firm*” OR “business*”] AND [“dividend*” OR “acquisition*” OR “cash-flow right*” OR “investment decision*” OR “capital structure*” OR “leverage” OR “liquidity” OR “debt” OR “equity” OR “financial decision” OR “earning* management” OR “voting right*”]. A summary of the filtering process used in our search strategy is provided in Fig. 1.

In the third step, the search process was performed, and the documents retrieved from the WoS database were stored. The last step refines the dataset by excluding repeated or irrelevant documents. We performed the data search in January 2024 in the WoS database with this combination of terms and restrictions, identifying a dataset of 891 bibliographic references that is included in Annex I. Microsoft Excel was used for data retrieval, data organization, and performance analysis.

To analyze our dataset of 891 articles, we conducted performance and bibliographic coupling analyses, which are complementary bibliometric-based methods that provide a general overview of a research field (Donthu et al., 2021). Performance analysis is an evaluative technique that provides bibliometric indicators of productivity and impact, offering a general perspective of a research field. In this analysis, citations are considered a measure of influence. The citations received by a document and the impact of the journal in which it is published are a measure of its impact, which signifies recognition by the citing publications of the relevance of the cited document (Hirsch, 2005). However, this method also has limitations, as it does not consider the quality of the citations received. Science mapping analysis is a relational technique used for the identification of key thematic areas of a research field. Specifically, in this study, in addition to performance analysis, we applied bibliographic coupling and author-selected keyword analysis using the freely available VOSviewer software, which is based on visualization of similarities (VOS). VOSviewer measures the degree of relationship (co-occurrence) between documents. Bibliographic coupling groups documents that cite the same source (Van Eck & Waltman, 2010). Put differently, two articles may discuss the same topic if they are bibliographically linked to each other (Kessler, 1963). Higher values of co-occurrence (i.e., the number of documents that are shared in their reference lists) indicate stronger links between them and, consequently, their conceptual relatedness. In this way, the thematic clusters derived from bibliographic coupling analysis are based on the citing publications. The visual representation of relationships among citing publications determines a map of the networks that shows how they relate to each other, using nodes and links. The size of a node indicates its importance, and the width of the links between nodes indicates how strongly they are connected. Nodes that are closely related to each other form clusters, shown in distinct colors. An advantage of bibliographic coupling is that it creates clusters of more recent documents based on the common references that are shared by the citing documents. Therefore, this method is considered suitable for identifying the latest development of themes and emerging trends in the literature (Boyack & Klavans, 2010; Vogel & Güttel, 2013; Donthu et al., 2021). Subsequently, a basic keyword analysis (Callon et al., 1983) was performed to identify the most common keywords included in the articles of each cluster since author-selected keywords constitute an adequate description of their content and help to reveal the topics of discussion in thematic clusters (Ding et al., 2001; Bhaskar et al., 2022). The flowchart in Fig. 1 illustrates the overall literature search and selection process.

3Results of the performance analysisPerformance analysis is based on the scientific output and impact of a research topic according to several performance indicators, including the number of publications, citations, highly cited journals, and standardized citations (Cobo et al., 2011). In addition to providing quantitative data on scientific productivity, it shows the main players in the field. The performance analysis considered 891 articles from 199 journals written by 1804 authors, with a total citation count of 48,206 on January 15, 2024. This analysis provides information on the evolution of the field over time and its main contributors to answer the first two research questions (RQ1 and RQ2).

3.1Publication trendAccording to the WoS database, the first publication on the I&F decision of family firms was published in 1992. The publications tend to evolve in two phases. From 1992 to 2000, the number of publications was minimal. In contrast to the slow growth trend in that period, there has been a steady increase in scholarly production since 2000. This increase has become more pronounced in recent years. This upward trend is evidence of the interest generated by the subject in the research community. Fig. 2 displays the number of publications per year in the WoS database from 1992 to 2023, along with the most prevalent keywords, which serve as proxies for identifying the principal topics of the published papers.

3.2Influential journalsTo assess the influence of journals on I&F research in family firms, two different criteria for quality were considered: 1) the WoS index quartile ranking, where Q1 represents the most relevant group of journals and Q4 represents the least relevant, and 2) the journals listed in the Academic Journal Guide (AJG) published by the Chartered Association of Business Schools (CABS). The AJG is metrics based and has journal ratings based on peer review and editorial and expert judgments by scholarly associations. It is a reference guide among scholars in the Anglo-Saxon world (Nolan & Garavan, 2016). The results show that 86 % of the 199 journals that have published I&F articles on family firms are included in the AJG, which accounts for 92 % of the articles in the database. Nearly 55 % of the journals have three stars. They published more than 65 % of the articles. According to the WoS quartile classification, 98 % of the journals had a JCR impact, and more than 70 % of the articles were published in journals with Q1 and Q2 impacts. These data of publications in the most prestigious journals show the relevance of the topic in the scientific community (see Table 2).

Indicators of the quality and impact of scientific journals.

| AJG rating of the CABS | JCR quartile classification of the WoS | ||||||

|---|---|---|---|---|---|---|---|

| AJG rating | Total journals | % | Total articles | % | Journal quartile | Total articles | % |

| 4* | 15 | 8 % | 64 | 7 % | Q1 | 334 | 38 % |

| 4 | 23 | 12 % | 138 | 15 % | Q2 | 283 | 33 % |

| 3 | 54 | 27 % | 324 | 36 % | Q3 | 121 | 14 % |

| 2 | 51 | 28 % | 235 | 26 % | Q4 | 115 | 13 % |

| 1 | 20 | 11 % | 58 | 7 % | N/D | 17 | 2 % |

| Total | 170 | 85 % | 819 | 92 % | |||

Table 3 shows the top 20 most influential journals that have published at least 10 articles on I&F decisions in family firms. In terms of the number of articles published, the Family Business Review is the most influential journal with 43 publications, followed by the Journal of Corporate Finance and the Corporate Governance: An International Review with 37 and 36 publications, respectively. In terms of total citations and average citations per article, the Journal of Financial Economics is the most influential journal, with 7383 citations (527.36 average citations per article), followed by the Journal of Banking & Finance with 2324 total citations (105.64 average citations) and the Family Business Review with 3757 total citations (85.39 average citations per article).

Journals with 10 or more publications on I&F decisions in family firms.

| Journal | TP | TC | TC/TP | AJG rating | |

|---|---|---|---|---|---|

| 1 | Family Business Review | 44 | 3757 | 85.39 | 3 |

| 2 | Journal of Corporate Finance | 37 | 1921 | 51.92 | 4 |

| 3 | Corporate Governance-An International Review | 36 | 1796 | 49.89 | 3 |

| 4 | Journal of Family Business Strategy | 34 | 762 | 22.41 | 2 |

| 5 | Entrepreneurship Theory & Practice | 27 | 1801 | 66.70 | 4 |

| 6 | Journal of Banking & Finance | 22 | 2324 | 105.64 | 3 |

| 7 | Journal of Business Research | 19 | 919 | 48.37 | 3 |

| 8 | Journal of Small Business Management | 19 | 918 | 48.32 | 3 |

| 9 | Pacific-Basin Finance Journal | 19 | 461 | 24.26 | 2 |

| 10 | Small Business Economics | 18 | 580 | 32.22 | 3 |

| 11 | Journal of Business Finance & Accounting | 16 | 657 | 41.06 | 3 |

| 12 | Emerging Markets Finance and Trade | 15 | 157 | 10.47 | 2 |

| 13 | International Review of Financial Analysis | 15 | 311 | 20.73 | 3 |

| 14 | Journal of Financial Economics | 14 | 7383 | 527.36 | 4* |

| 15 | Management Decision | 13 | 141 | 10.85 | 2 |

| 16 | Emerging Markets Review | 13 | 182 | 14.00 | 2 |

| 17 | Review of Managerial Science | 13 | 270 | 20.77 | 2 |

| 18 | International Business Review | 11 | 364 | 33.09 | 3 |

| 19 | Asia Pacific Journal of Management | 10 | 207 | 20.70 | 3 |

| 20 | European Financial Management | 10 | 535 | 53.50 | 3 |

Note: TP = Total publications; TC = Total citations; C/P = Citations per publication; AJG Rating = Rating in the AJG Ranking.

Table 4 shows a dual view of the top 20 authors in the field of I&F decisions in family firms, ranked by the number of articles published in this field and the number of citations received, which represent their productivity and influence, respectively (Donthu et al., 2021). In terms of the number of publications, the most productive authors are Gómez-Mejía, with 12 articles, and Wright, De Massis, and Kellermans, with 10 articles each. In terms of the number of citations, the most influential authors are Lang (4356 citations in three articles) and Anderson and Reeb (3987 citations in five articles). As measured by the average number of citations per article, Cleassens and Djankow are the most influential authors. They have received 2.611 citations, with only one article coauthored with Lang (Claessens et al., 2000).

Most influential authors in terms of number of publications and citations received.

| Top 20 authors in terms of number of publications | Top 20 authors in terms of citations received | |||||||

|---|---|---|---|---|---|---|---|---|

| Author | TP | TC | Author | TP | TC | C/P | ||

| 1 | Gomez-Mejia, LR | 12 | 2416 | 1 | Lang, LHP | 3 | 4356 | 1452.0 |

| 2 | De Massis, A | 10 | 658 | 2 | Anderson, RC | 5 | 3987 | 797.4 |

| 3 | Wright, M | 10 | 641 | 3 | Reeb, DM | 5 | 3987 | 797.4 |

| 4 | Kellermanns, FW | 10 | 448 | 4 | Claessens, S | 1 | 2611 | 2611.0 |

| 5 | Villalonga, B | 8 | 710 | 5 | Djankov, S | 1 | 2611 | 2611.0 |

| 6 | Voordeckers, W | 8 | 510 | 6 | Gomez-Mejia, LR | 12 | 2416 | 201.3 |

| 7 | Pindado, J | 8 | 343 | 7 | Dino, RN | 2 | 1879 | 939.5 |

| 8 | Wu, ZY | 8 | 299 | 8 | Lubatkin, MH | 2 | 1879 | 939.5 |

| 9 | Achleitner, AK | 7 | 395 | 9 | Schulze, WS | 2 | 1879 | 939.5 |

| 10 | Croci, E | 7 | 375 | 10 | Faccio, M | 1 | 1705 | 1705.0 |

| 11 | Requejo, I | 7 | 298 | 11 | Berrone, P | 3 | 1337 | 445.7 |

| 12 | Steijvers, T | 7 | 233 | 12 | Buchholtz, AK | 1 | 1306 | 1306.0 |

| 13 | Amit, R | 6 | 685 | 13 | Cruz, C | 2 | 1288 | 644.0 |

| 14 | Garcia-Meca, E | 6 | 283 | 14 | De Castro, J | 1 | 1196 | 1196.0 |

| 15 | Santana-Martin, DJ | 6 | 154 | 15 | Chen, X | 3 | 1084 | 361.3 |

| 16 | Block, JH | 6 | 71 | 16 | Cheng, Q | 3 | 1084 | 361.3 |

| 17 | Jara, M | 6 | 62 | 17 | Wolfenzon, D | 2 | 1027 | 513.5 |

| 18 | Anderson, RC | 5 | 3987 | 18 | Morck, R | 3 | 908 | 302.7 |

| 19 | Reeb, DM | 5 | 3987 | 19 | Yeung, B | 2 | 905 | 452.5 |

| 20 | Lybaert, N | 5 | 382 | 20 | Maury, B | 2 | 894 | 447.0 |

Note: TP = Total publications; TC = Total citations; C/P = Citations per publication.

This section shows the 10 most cited articles on the I&F decisions of family firms, which can be considered as an indicator of their influence. It should be noted, however, that an article can only be cited sometime after it is published, so a small number of citations does not necessarily imply less impact or contribution. Table 5 shows the papers in descending order by the number of citations received. The paper coauthored by Claessens, Djankov, and Lang is the most cited paper. It was published in the Journal of Financial Economics in 2000. This paper analyzes the differences in the ownership and control structures of East Asian firms and shows the significant concentration of control in the hands of business families (Claessens et al., 2000). Anderson and Reeb published the second most influential paper in the Journal of Finance in 2003 on corporate governance in family firms. The authors found that family firms outperform non-family firms by showing a relationship between founding family ownership and firm performance. The third most influential paper, published by Faccio and Lang in the Journal of Financial Economics in 2002, also focuses on the ownership and control structure of firms. For their study, the authors analyzed 5232 companies, predominantly family-owned and family-controlled firms, listed on the stock exchanges of 13 Western European countries. Table 5 shows the top 10 most influential articles were published in journals with an AJG rating of three stars or higher.

Most influential articles in terms of number of citations received.

| Title | Authors (year) | Journal | TC | AJG's ratings | |

|---|---|---|---|---|---|

| 1 | The separation of ownership and control in East Asian Corporations | Claessens, Djankov, & Lang (2000) | Journal of Financial Economics | 2611 | 4* |

| 2 | Founding-family ownership and firm performance: Evidence from the S&P 500 | Anderson & Reeb (2003) | Journal of Finance | 2551 | 4* |

| 3 | The ultimate ownership of Western European corporations | Faccio & Lang (2002) | Journal of Financial Economics | 1705 | 4* |

| 4 | Agency relationships in family firms: Theory and evidence | Schulze, Lubatkin, Dino, Buchholtz (2001) | Organization Science | 1306 | 3 |

| 5 | The Bind that Ties: Socioemotional Wealth Preservation in Family Firms | Gomez-Mejia, Cruz, Berrone, & De Castro (2011) | Academy of Management Annals | 1196 | 4 |

| 6 | Corporate governance, economic entrenchment, and growth | Morck, Wolfenzon, Yeung (2005) | Journal of Economic Literature | 863 | 4 |

| 7 | Founding family ownership and the agency cost of debt | Anderson, Mansi, & Reeb (2003) | Journal of Financial Economics | 783 | 4* |

| 8 | Are family firms more tax aggressive than non-family firms? | Chen, Chen, Cheng, & Shevlin (2010)) | Journal of Financial Economics | 758 | 4* |

| 9 | Exploring the agency consequences of ownership dispersion among the directors of private family firms | Schulze, Lubatkin, & Dino (2003) | Academy of Management Journal | 573 | 4* |

| 10 | Family ownership and firm performance: Empirical evidence from Western European corporations | Maury (2006) | Journal of Corporate Finance | 468 | 4 |

Note: TC = Total citations; AJG's ratings = Ratings in the Academic Journal Guide 2021.

Meaning of AJG Quality Rating: 4* (journals of distinction), 4 (journals that publish the most original and best-executed research), 3 (journals that publish original and well-executed research), 2 (journals that publish original research at an acceptable level), 1 (journals that publish research at a recognized but more modest level in their field).

Bibliographic coupling analysis is a bibliometric technique that adopts a prospective approach by generating clusters of citing documents that share a common set of cited references (Van Eck & Waltman, 2010). These clusters group the most recent documents, which facilitates the identification of emerging topics, new research areas, and trends in a field (Boyack & Klavans, 2010; Vogel & Güttel, 2013). Since the aim of this review is to show trends in an emerging research field such as I&F decisions in family firms, bibliographic coupling was considered the most suitable technique to answer RQ3 and RQ4.

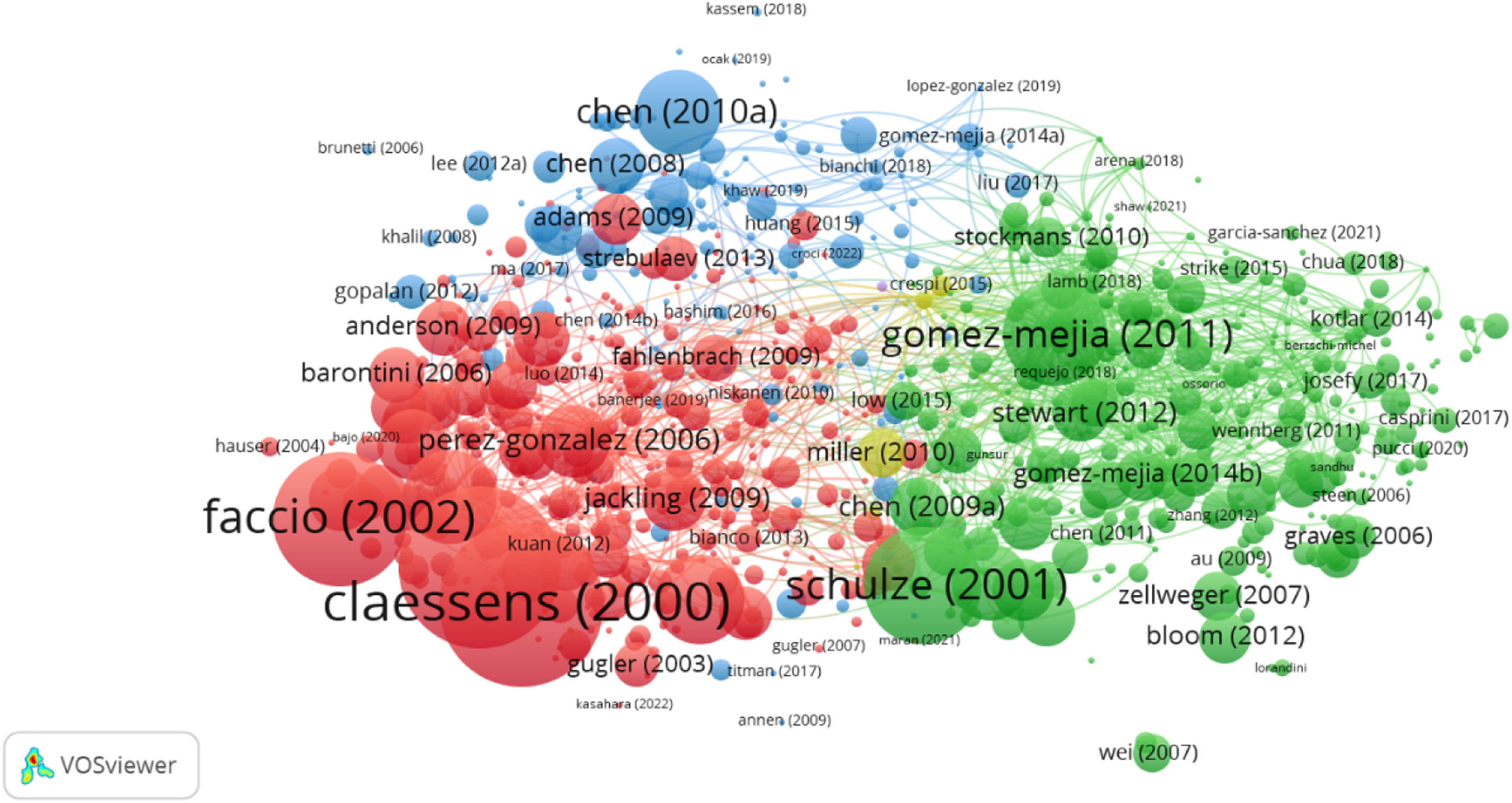

Fig. 3 shows the visual representation of the clusters obtained using VOSviewer. Through bibliographic analysis, the bibliometric networks of the 891 articles allowed us to identify three main clusters with 406, 332, and 138 articles. Some residual clusters, grouping a total of 15 articles, were discarded. Visualization of bibliographic coupling analysis through science maps helps illustrate the thematic associations.

Given the substantial number of articles grouped in the first two clusters, a new bibliographic coupling analysis was performed on them, resulting in four subclusters within each cluster. Thus, nine clusters were ultimately identified. The distribution of articles by cluster is presented below (Table 6).

4.2Keyword analysisThe final technique used in this study was a basic keyword analysis of author-selected keywords (Callon et al., 1983). This technique examines the most common terms indexed in the keyword section of the documents, just below the abstract. Author-selected keywords are chosen by the authors to encapsulate and describe the central theme of a publication; therefore, this technique is useful for identifying the main topics of a document (Ding et al., 2001). In fact, author-selected keywords are considered the basic elements of the representation of concepts, ideas, and knowledge from academic publications that contribute to the understanding of the field of study (Donthu et al., 2021). Given the potential of the keyword analysis for the identification of themes, we used this technique in a complementary way in each of the nine clusters generated by the bibliographic coupling analysis by more precisely identifying the research topics in each thematic cluster. To identify the most relevant keywords for each article, each keyword had to be used in at least three articles in each cluster.

Based on the advantages of bibliographic coupling analysis (Boyack & Klavans, 2010; Vogel & Güttel, 2013) and keyword analysis (Ding et al., 2001; Donthu et al., 2021), we used a combination of these two methods to identify the research themes of the clusters and to distinguish potential future research directions (Bhaskar et al., 2022). A more detailed analysis to facilitate interpretation and discussion of the results is presented below.

5Thematic clusters5.1Cluster 1. Family ownership and corporate governanceThis cluster comprises 102 documents with almost 11,644 citations. The main keywords describing the topic of this cluster are "corporate governance," "agency theory," "ownership structure," "firm performance," "firm value," and "board of directors." The most productive period in terms of publications in this cluster was 2006 to 2014. This was a period of expansion in research on family firms, which initially focused on analyzing the ownership structures and performance implications of large family firms compared to non-family firms. Regarding the theories used in the cluster, a large number of articles use agency theory to support their arguments.

Many articles analyze ownership and control in terms of agency relationships in the family firm context and their impact on various variables (Claessens et al., 2000; Oswald et al., 2009; Setia-Almaja et al., 2009; Gonzalez et al. 2014). The role of ownership concentration as a control agency mechanism, the problems between majority and minority shareholders and other agents involved in the firm, the internal and external mechanisms used to mitigate agency problems (Anderson et al., 2003; Attig et al., 2008; Boubakri et al., 2010; Gonzalez et al., 2014; Setia-Atmaja et al., 2009), and the influence of these mechanisms on the performance of family and non-family firms are also hot topics in this cluster. Most studies focus on publicly traded companies in Western countries, although there are a few exceptions that focus on the ownership structures of Asian family-owned firms (Claessens et al., 2000).

The relationship between family ownership and firm performance, or comparing the financial performance of family versus non-family firms, is also one of the most discussed topics. Several of these studies show that family firms outperform non-family firms (Anderson & Reeb, 2003; King & Santor, 2008; Maury, 2006; McConaughy et al., 2001). Risk taking in family firms is another topic in this cluster (Nguyen, 2011). Although theory suggests that family firms are less likely to take risks than non-family firms are, empirical research has not been able to confirm this prediction. (Anderson et al., 2023). Board characteristics, such as composition or size, and their role as an internal corporate governance mechanism are also the topic of papers integrating this cluster, analyzing their influence on the performance of family and non-family firms (Baran & Forst, 2015; Jackling & Johl, 2009; Setia-Atmaja et al., 2009). Overall, the results show that a higher percentage of family members on the board of directors and a smaller board size are associated with better firm performance. Ownership structure also appears to be more related to firm performance than board structure (Che & Langli, 2015). This cluster also includes papers that analyze the influence of gender diversity on the boards of family firms and its impact on firm performance (e.g., Minguez-Vera & Martin, 2011).

5.2Cluster 2. Pyramidal ownership and family firm groupsThis cluster consists of 87 articles, mostly published in the 2000s, with a total of 6085 citations. The most relevant keywords used to identify this cluster were "corporate governance," "firm performance," "ownership structure," "business groups," "pyramid," "voting rights," and "cash flow rights." Arguments based on agency theory and stewardship theory are the most common theoretical arguments used in this cluster.

The cluster addresses the issue of business groups and pyramidal structures and their impact on the performance of family firms. Through pyramidal structures and corporate groups or dual-class shares, family firms tend to have a more concentrated ownership structure and retain control over the business (Villalonga & Amit, 2010; Peng y Jiang, 2010; Sacristan-Navarro & Gómez-Anson, 2007). These mechanisms may cause large discrepancies between the ownership structure and control of firms, as these mechanisms achieve high voting rights with low cash flow rights (Almeida & Wolfenzon, 2006; Levy, 2009; Morck et al., 2005; Villalonga & Amit, 2009). Moreover, the separation between voting rights and cash flow rights can lead to conflicts of interest between controlling and minority shareholders. Therefore, a more balanced distribution of votes among large blockholders would be expected to have a positive effect on firm value (Maury & Pajuste, 2005). Relatedly, the most cited paper in this cluster is Faccio & Lang (2002), who analyze the effects of the separation of ownership and control in 5232 firms located in 13 Western European countries.

The use of pyramid ownership, which emerges as one of the most common mechanisms for maintaining control in family groups, is also analyzed in this cluster (Peng & Jiang, 2010). This mechanism is more common in small and underdeveloped financial markets, especially in countries with weak investor protection. In addition to contributing to the maintenance of family control, these structures mitigate financing constraints at the country level, which is favorable for firm expansion (Masulis et al., 2011). The composition of the board of directors is considered to be a key element when assessing corporate governance, especially in countries with weak investor protection, companies with large blockholders, and groups with pyramidal structures (Yeh and Woidtke, 2005).

5.3Cluster 3. Family ownership structure, cash holdings, and dividend policiesThis cluster consists of 79 publications with a total of 2582 citations. A considerable number of publications are concentrated around the year 2000. However, there were increases in the number of publications in 2012, 2015, and 2016. The keywords "corporate governance," "dividend policy," "ownership structure," "cash holding", "agency theory", and "shareholders" define the content of this cluster. This cluster focuses on analyzing how concentrated ownership structures affect the decision to hold cash and to pay dividends.

The relationship between excess voting rights and cash holdings is one of the main focuses of these studies. In this regard, Kuan et al. (2011) provide evidence of differences between family and non-family firms. Some studies conclude that family firms with excess voting rights tend to have more cash holdings, which are channeled into the firm rather than paid out to shareholders through dividends (Liu et al., 2015). Furthermore, family firms can reach optimal cash holdings faster and more efficiently than non-family firms (Lozano & Durán, 2017).

The literature on dividend policy is also present in this cluster. Some articles examine the relationship between the quality of corporate governance and dividends (Adjaoud & Ben-Amar, 2010), while others examine the relationship between the ownership and control structure and the dividend policy (Gugler, 2003). Some studies also examine whether family firms use dividend policy as a corporate governance mechanism to overcome agency problems, although the results are inconclusive. Whereas Pindado et al. (2012) and Isakov and Weisskopf (2015) found that family firms distribute higher and more stable payouts to reduce expropriation concerns of minority investors, Mulyani et al. (2016) found a significant negative association between family ownership and dividend payments.

5.4Cluster 4. The influence of the family factor on financing and investment decisionsThere are 134 publications, which were cited 4895 times, in this cluster. Although most of the articles in this cluster were published between 2011 and 2013, a significant increase in publications is observed in 2023, suggesting new research approaches. The keywords that define the content of the cluster are "capital structure," "investment," "product market competition," "corporate social responsibility," and "mergers and acquisitions (M&A)."

This cluster focuses on the relationships between strategic investment and financing decisions, mergers and acquisitions, and family ownership and control in large firms. The research question that articles published in this cluster seek to answer is whether family firms exhibit unique behavior in their business practices in general (Schulze et al., 2003) and in their investment and financing policies, in particular (Amore et al., 2011; Molly et al., 2010). Traditional capital structure theories, such as trade-off or pecking order theory, as well as stewardship and agency theory, and altruistic behavior among family members, are often used in these articles.

The results are inconclusive in terms of financial decisions and preferences regarding the use of financing sources. Some authors suggest that family firms prefer to use internal or family funds to finance their operations, limiting the use of debt to avoid default risks (Ampenberger et al., 2013). Others suggest a greater use of debt to finance their operations (Croci et al., 2011) and argue that family firms are more reluctant to use equity financing to maintain family control (Blanco Mazagatos et al., 2009; Gonzalez et al., 2013; Romano et al., 2001). As suggested by Koropp et al. (2013), financial decisions in family firms can be based on both economic and non-economic factors; therefore, their financial choices are heterogeneous and vary across family firms.

Another group of studies in this cluster focuses on the investment decisions of family firms and, more specifically, on their sensitivity to uncertainty, with conflicting results. According to Bianco et al. (2013), investments made by family firms are significantly more sensitive to uncertainty than those made by non-family firms. Risk aversion and some intrinsic characteristics of family firms, such as a high proportion of owners' wealth invested in the firm, a certain opacity in their behavior, and the degree to which control of the firm is kept within the family, are the main reasons for this. In contrast, according to Pindado et al. (2011), the investments of family firms are less sensitive to cash flow fluctuations, suggesting that this lower sensitivity could be mainly caused by the absence of deviations between cash flow and voting rights in family firms. Peruzzi (2017) contradicts these findings, suggesting that family firms are significantly associated with greater dependence between investment and cash flow.

Mergers and acquisitions (M&A) are another topic covered in this cluster. The main topics related to M&A analyze the relationship between the ownership structure and performance of acquiring firms (Ben-Amar and Andre, 2006), the relationship between family control and M&A transactions in different contexts—depending on the level of investor protection—(Franks et al., 2012), and the influence of family ownership and control on the decision to engage in M&A transactions, either as an acquiring firm or as an acquired firm (Almeida et al., 2011; Caprio et al., 2011). De Cesari et al. (2016) also study the impact of acquisitions on CEO compensation and CEO turnover in continental European family firms. In recent years, studies have analyzed the impact of socio-emotional wealth (SEW) on family firm acquisitions from perspectives including valuation, risk aversion, and the definition of nonfinancial goals. (Fuad et al., 2021; Haider et al., 2021; Schierstedt et al., 2020).

5.5Cluster 5. Value creationThis cluster consists of 116 articles, which were cited more than 7800 times, many of which were published around 2014. The cadence of publications per year has been constant since then. The main keywords that define this cluster are "succession," "agency theory," "SMEs (small or medium enterprises)," "private equity," "social capital," "entrepreneurship," and "socioemotional wealth." Beyond traditional financial theory, the articles in this cluster integrate other theories such as social capital as an internal and external mechanism to explain the behavior of family firms, many of which are SMEs.

This cluster focuses on issues related to the creation of value in family firms that may influence their performance and behavior. The papers attempt to show whether certain attributes and dynamics of family firms can benefit these firms. These attributes include emotional components (Astrachn & Jaskiewichz, 2008; Rutherford et al., 2008), entrepreneurial orientation (Campopiano et al., 2020; Deb & Wiklund 2017; Huybrechts et al., 2013), and social capital (Chua et al., 2011; Pucci et al., 2020; Rodriguez et al., 2009). The investment and financing of family firms appear to be of secondary importance in this cluster, as studies have shown that other elements contribute to the value of the business in addition to those. Moreover, all of this must be understood in a context where the field is beginning to shift toward the study of family SMEs. As Astrachan & Jaskiewicz (2008) point out, total firm value is not only financial as there are also other components and attributes that give value to firms.

Business succession, one of the most important challenges facing family-owned businesses, is also highlighted in this cluster. A lack of planning and preparation for the designated successor, in addition to financial and operational reasons, are crucial in this transition (Barbera, et al., 2015; Kimhi, 1997; Koropp et al., 2013). Differences between generations leading the firm or changing the CEO and how these events affect firm performance or leverage, among other effects, are also analyzed in this cluster (Galve-Gorriz & Salas-Fumas, 2011; Molly et al., 2010).

5.6Cluster 6. Socioemotional wealth approachThis cluster has a total of 3555 citations in 92 publications, the first of which were published in 2013. It is a growing cluster, as evidenced by the considerable number of studies published in the last 10 years on the influence of socioemotional aspects in the investing and financing decisions of family firms. The main keywords related to this cluster were "socioemotional wealth (SEW)," "corporate governance," "behavioral agency model," "corporate social responsibility," "R&D investment," and "family ownership."

Socioemotional wealth, a model that posits that firms make decisions depending on the reference point of the firm's dominant principals, was developed by Gomez-Mejia et al. (2007) as an extension of behavioral agency theory (Wiseman & Gomez-Mejia, 1998). According to the SEW approach, the members of the family (the principals) are motivated by both financial and nonfinancial goals, and their decisions depend on the reference point that dominates these decisions. In other words, family firms make decisions after balancing economic and socioemotional considerations of their strategies (Gómez-Mejía et al., 2010). Thus, investment decisions often involve both socioemotional wealth and economic considerations (Souder et al., 2017). If the family business prioritizes nonfinancial goals in decision-making, then this may conflict with financial goals and business strategies (Gómez-Mejía et al., 2011). In other words, financial and SEW perspectives may lead to incompatible acquisition decisions (Gómez-Mejía et al., 2018).

The articles in this cluster also analyze the extent to which the prioritization of nonfinancial goals and the maintenance of SEW may conflict with participation in new acquisitions or start-ups (Rossi et al., 2023; Strike et al., 2015), dividend reductions, or employee downsizing (Belling et al., 2022). Chirico et al. (2020) also suggest that family firms are less likely than non-family firms to exit (sell or liquidate) and to endure greater financial hardship to avoid losing SEW. However, some authors argue that CEOs of family firms who are close to retirement and who are more concerned about the legacy they are passing on to future generations are more willing to participate in new acquisitions despite the potential short-term risks (Strike et al., 2015).

Other studies in this cluster analyze the relationship between family involvement and investment in R&D, with conflicting results. Sciascia et al. (2015) find a negative relationship between family ownership and R&D intensity, which is attributed to the greater desire of family-owned firms to protect their SEW. However, family firms with family chairpersons invest more in R&D than do those without family chairpersons, according to Jiang et al. (2020).

Stewardship theory and the SEW approach have also been used to suggest that family firms are more likely to engage in corporate social responsibility (CSR) activities than non-family firms and also perform better (Lamb & Butler, 2018). The literature suggests that family ownership and control and family involvement in management promote higher levels of CSR commitment (Cordeiro et al., 2018). This may be because CSR provides benefits to shareholders beyond the direct financial returns from their investments (Faller & Knyphausen-Aufsess, 2018).

5.7Cluster 7. InternationalizationThis cluster contains 66 articles with approximately 3492 citations. “Internationalization," "family ownership," "female managers," and "choice of entry mode" are the main keywords used in this cluster. The largest scientific production corresponds to the year 2002, although there were fewer published in the following years. The articles address investment and financing decisions from an indirect perspective and do not represent the central axis of research on the internationalization of family firms.

The few articles that analyze the impact of financial characteristics on the internationalization process are oriented to detect differences between family and non-family firms. The results obtained by Marin et al. (2017) show that family ownership and having lower leverage have a positive impact on the outcomes of the internationalization process. Conversely, Dagnino et al. (2019) show that free cash flow and leverage have positive and negative effects, respectively, on family firms' international diversification.

The influence of family control and other characteristics of family firms on their internationalization is another issue addressed in this cluster (Ahsan et al., 2020; Boellis et al., 2016; Camino Ramón-Llorens et al., 2017). Fernandez and Nieto (2005) show that internationalization is negatively related to family ownership and positively related to corporate ownership (Fernandez and Nieto, 2006). Bhaumik et al. (2010) also suggest that family firms and firms with concentrated ownership (both common in emerging markets) are less likely to invest abroad. The results of the study by Graves & Thomas (2006) suggest that family firms lag non-family firms when expanding internationally due to low managerial expertise.

Some papers analyze the influence of family control on entry mode decisions (Mariotti et al., 2021; Sestu and Majocchi, 2020; Xu et al., 2020). Mariotti et al. (2021) show that the heterogeneity of family firms influences how these firms enter foreign markets, while Hollender et al. (2017) argue that international experience (firm resources) and product adaptation (firm capabilities) improve the performance of non-equity entry modes by mitigating the liabilities inherent to SMEs. According to several studies, heterogeneity in the level of family control of a firm and its influence on corporate governance may also affect the entry mode decisions of family firms (Chang et al., 2014). Cesinger et al. (2016) combined the internationalization model with the SEW approach to explain why the relevance of nonfinancial goals and the preservation of SEW may conflict with the internationalization process of family firms (Gomez-Mejia et al., 2011). Purkayastha et al. (2018) complemented the resource-based view of the firm with agency theory to examine the relationship between R&D intensity and firm internationalization, concluding that this relationship is reinforced by concentrated family firm ownership.

5.8Cluster 8. Financial decision-making in family SMEsThere are 51 papers, which have a total of 1597 citations, in this cluster. The largest number of papers was published in 2001, followed by several years with hardly any publications. Since 2008, there has been renewed interest in this topic. The theoretical basis of this cluster is based on the capital structure (Modigliani & Miller, 1958), the SEW approach and the agency, trade-off, and pecking order theories (Myers & Majluf, 1984). The main keywords that define the content of this cluster are "leverage," "capital structure," "board of directors," "private equity," "SMEs," and "financing decisions."

Many of the articles in this cluster focus on identifying whether there are differences in the financial decision-making process between family and non-family firms (López-Gracia & Sánchez-Andújar, 2007). Studies by Jansen et al. (2023) and Mazagatos et al. (2009) show that family firms prefer internal financing first, then debt financing, followed by family equity and finally external equity, with SEW considerations playing a significant role.

Ownership is identified as one of the factors influencing the financial structure of family firms, with conflicting results (Serrasqueiro et al., 2012). Some studies show that family firms are more indebted than non-family firms (Acedo-Ramirez et al., 2017; Camison et al., 2022; Gottardo & Moisello, 2014) and that they use more debt for financing (Diéguez-Soto and Lopez-Delgado, 2019). The same authors point out that family and lone founder involvement always determine a higher level of indebtedness than that of other firms (Diéguez-Soto et al., 2021). However, Hansen and Block (2021) find an overall slightly negative but significant relationship between family firm status and leverage. The heterogeneity of family firms may provide an explanation for these contradictory findings. According to Baixauli-Soler et al. (2021), family firms that are more focused on preserving SEW have lower debt levels, while Molly et al. (2019) find that family-centered goals have no direct relationship with the total debt ratio of family firms. The heterogeneity of family firms may also affect their debt maturity (Feito-Ruiz & Menendez-Requejo, 2022).

5.9Cluster 9. Accounting informationThe total number of publications identified in this cluster is 138, with 4978 citations. The first paper dates to 2002, although there were no new publications until 2008. A larger number of publications were published between 2014 and 2018. The keywords that define this cluster are "earnings management," "quality of financial information," "audit," "financial reporting," "corporate social responsibility," and "taxes."

Earnings management is the most explored topic in this cluster. Specifically, this cluster focuses on how corporate governance in general and boards in particular may affect earnings management. Board independence and CEO duality may have implications for earnings management (Chi et al., 2015). Therefore, the conclusion of Jaggi et al. (2009) is that firms should increase board independence to ensure high-quality financial reporting. Yang (2010) reaches a similar conclusion and recommends changes in the governance structures of these firms that are conducive to transparency and quality of financial reporting, thus avoiding the negative image that suggests that family firms expropriate the interests of minority shareholders. However, Cascino et al. (2010) find that family firms report higher quality financial information than non-family firms. Similarly, Chen et al. (2008) argue that family firms are more likely to report potential earnings contingencies due to fear of litigation or reputational costs. The fear of potential penalties and resulting reputational damage also makes family firms less tax aggressive than their non-family counterparts (Chen et al., 2010). According to Achleitner et al. (2014), family firms use earnings management practices strategically, avoiding practices that inhibit the long-term value of the firm and focusing on those that help families maintain transgenerational control (Achleitner et al., 2014).

Some articles in the cluster analyze the impact of corporate social responsibility on financial considerations. For example, Liu et al. (2017) investigate how family involvement in a firm affects its engagement in earnings management, both directly and indirectly through its CSR activities. Other issues explored in this cluster include the relationships between CSR and the cost of capital (Wu et al., 2014), between CSR disclosure and asymmetric information (Martinez-Ferrero et al., 2018), between CSR and R&D performance evaluation (Ho et al., 2016), and between CSR and the risk of stock price crashes (Yang, et al., 2023). It is also observed that family firms are more willing to engage in social responsibility initiatives to achieve their nonfinancial goals (Shahzad et al., 2018).

6Discussion of findings and moving forwardThis article presents a bibliometric synthesis and review of the literature on I&F in family firms, identifying the progress made in recent years and some gaps around the thematic clusters identified earlier. Scholars have yet to comprehensively delineate the influence of the family nature of firms on their investment and financing propensities (Koropp et al., 2014), although the distinctive characteristics of family firms have been posited as key elements in the evaluation and selection of investment and financing strategies. Due to the qualitative nature of most of the previous reviews, it was not known how the research topics were structured or when the scientific community became interested in them. The use of a systematic methodology in the literature review facilitates the synthesis of existing research and stimulates discourse on its future development. By identifying these challenges, this study proposes several key research questions and directions to further a further research agenda that addresses the main motivation of this study and answers RQ4 on emerging trends in this area.

The analysis of the thematic groups resulting from the bibliographic coupling analysis shows an interest in the early years in the study of various aspects related to ownership, control, and external and internal mechanisms of corporate governance of family firms in comparison to non-family firms, rooted in financial theories. Most of these studies focus on publicly listed firms and use agency theory to show how agency problems derived from the relationship between shareholders and managers are transferred to agency problems between majority and minority shareholders in the case of family firms. Thus, the structure of ownership and control and the composition of the board of directors were the topics of greatest interest in the early years. In other words, agency relationships in general, family ownership, control, and governance in particular, and their influence on investment and divestment initiatives, M&As, and financing family firms were relevant topics of research. In recent years, there has been a growing emphasis on the "family factor" in examining how emotional and relational elements influence decision-making in family firms.

Our review shows that the family context can affect the I&F decisions of family firms. We agree with Michiels and Molly (2017), who point out the importance of using, in addition to traditional financing theories, a behavioral approach that allows a better understanding of the factors that determine I&F behavior and decisions in the family business. As studies show, the achievement of economic and noneconomic goals and family influence are aspects that cannot be ignored in family business research (e.g., Hernández-Perlines et al., 2023). In particular, the SEW perspective (Gómez-Mejía et al., 2007) seems to be a promising framework for studying investment and financing in family firms, as the preservation of the socio-emotional endowment is often an important goal for many family firms. The shared vision of family members, their strong ties and trust-based relationship networks, the importance of family and firm image and reputation, the transgenerational perspective of family ownership and its influence on the business determine that decision-making is affected by emotions and feelings, which influence their I&F actions (Gómez-Mejía et al., 2018). For example, future research could explore how family goals driven by family members' desire to maintain family legitimacy and socio-emotional endowment affect environmental performance. Examining the intersection of environmental, social, and governance (ESG) investing and family firm financial structure may be critical to understanding the impact of responsible investment practices and family firm approaches to sustainability practices (Sharma & Sharma, 2024). Future research may assist us in understanding the complex interaction between family dynamics, financial choices, and broader ESG considerations within family firms.

There is also significant research potential in understanding how family goals and values intersect with their I&F strategies in the future, providing valuable insights into their unique decision-making processes. For example, studies on the determinants of capital structure should examine financing decisions in family firms through the lens of both behavioral and financial theory, considering the influence of family firm heterogeneity. In this way, this study responds to the call to explore how institutional factors influence family firms’ configuration and their behavior and performance (Arteaga & Basco, 2023; Basco et al., 2023). This study may provide a roadmap for the future from which researchers could examine the influence of the generation running the firm and whether I&F behavior and decisions vary depending on which family members are present in the ownership, governance, or top management of the firm. Previous studies have concluded that financial literacy can influence the financial health and sustainable growth of these businesses (Diéguez-Soto et al., 2022). Future research could examine the role that financial literacy plays in the I&F decisions of family firms. This could be particularly important in determining the financial education these family members should receive to become family business CEOs, directors, or executives (Alcázar-Blanco et al., 2021). Examining the relationship between CEO diversity (i.e., gender, or generation) and leverage structure can also contribute to a better understanding of the role of diversity in shaping financial decisions.

Another compelling avenue of research is the study of family groups and the investment in and acquisition of firms. Researchers can examine the influence of family firm heterogeneity on firm value in the buy-sell period and explore differences in family firm bargaining capabilities, focusing on factors such as bargaining experience and managerial bargaining roles. Understanding the influence of family and board composition on the propensity of family firms to engage in M&As also provides an avenue for in-depth research. Future research could use an SEW approach to analyze how family control shapes firm acquisition activity. This would shed light on the emotional and nonfinancial aspects that influence strategic decisions in family firms. Such research could enrich our understanding of family firm dynamics and provide valuable insights. Future research could also explore the sensitivity of investments to changes in cash flow in the context of different family dynamics. The impact of corporate social responsibility practices on corporate reporting could also provide another perspective on the interaction of nonfinancial objectives, transparency, and reporting practices. This would improve our understanding of whether (and to what extent) emotional goals shape business decisions in family firms, which could provide important insights into the motivations underlying business practices. Since much of the related research has focused on publicly listed firms, there is also a gap in the literature regarding the perspective of small and medium-sized enterprises. An interesting avenue of research is to examine whether findings from I&F decisions in large and listed family firms are applicable to SMEs or whether there are differences in behavior.

In addition to the predominant use of quantitative methods in existing studies, we advocate the use of mixed methods analysis (incorporating both qualitative and quantitative approaches) due to the paramount importance of context in understanding this complex issue (Maseda et al., 2022). Researchers are strongly encouraged to consider the construction of longitudinal datasets to facilitate the comparison and analysis of the evolution of identified indicators over time. Going forward, it is imperative that research efforts adopt a perspective that acknowledges the inherent complexities associated with I&F decisions in family firms. In doing so, it seeks to gain a comprehensive understanding of their impact through a clear delineation of outcomes and outputs.

In summary, the primary objective of our review is to present a thorough overview of the current state of knowledge regarding I&F in family firms. The identified research gaps and suggested avenues for future exploration underscore the continuing interest in this field. Beyond clarifying the existing landscape, we expect our review to lay the groundwork for advancing the understanding of family firm I&F decisions. We look forward to further insights and a deeper understanding of this topic in future research.

FundingThis work was funded in part by the Consolidated Research Group of the Basque Government (Spain) under grant number IT1641–22. Financial support was also received from the Consolidated Research Group of the University of Vigo (Spain) under code OE7.

CRediT authorship contribution statementIñigo Cordoba: Writing – original draft, Formal analysis, Data curation, Conceptualization, Visualization. Txomin Iturralde: Writing – review & editing, Visualization, Methodology, Formal analysis, Data curation, Conceptualization, Investigation. Amaia Maseda: Writing – review & editing, Writing – original draft, Methodology, Formal analysis, Conceptualization, Investigation.

We highly appreciate the institutional support received from the Family Business Centre at the University of the Basque Country (UPV/EHU) and the Regional Government of Bizkaia (DFB/BFA), as well as the FESIDE Foundation. The feedback from the participants at the AEDEM Annual Congress held in Vigo (Spain) and the participants of the 6th International Family Business Research Forum held in Sharjah and Dubai, UAE, was also very much appreciated.