This study tests the impact of usage of Twitter as a microblogging service provider on shareholders’ returns and abnormal returns. In accordance with this purpose, two portfolios were created based on measurement of whether firms had a Twitter account and, if so, their number of followers and tweets and the increase in the number of followers. The returns from these portfolios indicate that better Twitter performance according to these metrics does not provide any significant increases in the abnormal returns of shareholders. Nevertheless, the market betas of greater than 1 observed in the related portfolios have revealed that these portfolios are more risky than alternative portfolios.

Social media is an important innovation that affects many disciplines as a channel through which consumers share their knowledge and ideas. There were 2.62 billion social media users worldwide in 2018, and this number is expected to grow steadily (Statista.com, 2019). In this context, it seems that social media can integrate into everyday life in many ways: while some sites help to connect people from different countries with similar interests, political views and activities, some are attractive to users due to common language, race, sex, religion or nationality (Boyd & Ellison, 2007). In addition, social media influences consumer behavior in many ways, such as information acquisition, awareness, opinions, attitudes, purchasing behavior, post-purchase communication and evaluation (Mangold & Faulds, 2009) – but it should also be noted that these effects are not limited to consumers.

Social media has changed the way people acquire knowledge. In particular, while microblogging services provide people and firms with a smooth and more efficient way of obtaining and distributing information, they also allow firms to more directly gain an understanding of public attitudes toward them (Liu, Wu, Li, & Li, 2015). In this context, it should be emphasized that social media plays an increasingly active role in the diffusion of marketing information by firms. Therefore, social media appears as a unique environment for the dissemination of a large amount of information about company activities, including marketing information. Social media provides exciting opportunities for communication with all the parties with which a company wants to have direct contact, from consumers to investors and other stakeholders interested in the firm: access to the company's information is easy, and the sharing and distribution of information is accelerating and becoming more democratic (Blankespoor, Miller, & White, 2014). Increasing transparency and accessibility also leads to an increase in customer communication, improved reputation and greater market value (Alexander & Gentry, 2014).

From a different point of view, the increasing use of social media seems to affect the capital market as well. While companies are using social media as a means of communicating with their investors, individual investors are increasingly using social media to share their knowledge and intuition about their expectations about corporations and stocks. Thus, social media appears to be an important channel for companies, allowing them to communicate with investors in a timely, cost-effective and intensive manner; and at the same time, it seems to be an important channel for investors, providing access to information not only from companies but also from each other (Bartov, Faurel & Mohanram et al., 2018). Given the impact of microblogging platforms on the information dissemination of firms, it is also possible that these platforms can contribute to the formation of effective markets. As is known from finance literature, dissemination can play a critical role in increasing the effectiveness of firm disclosures, especially in terms of information asymmetry (Blankespoor et al., 2014). In this respect, it is observed that in the course of the past ten years, the development of the internet has brought about significant changes in the collection, processing and interaction of information. The birth of internet-based social media makes data available on the information dissemination process which has never been acquired or recorded in the past. This allows for the process of information transition in stock markets, and for research into the possible impact of this process on asset pricing (Lin, Ren, Zhang, Zhang, & Shen, 2016). In line with that view, it is seen that some studies in related literature have focused on the impact of social media usage (such as Twitter usage) on shareholders’ returns, and have found that they are positively correlated (e.g. Cole, Daigle, & Van Ness, 2015).

The present study aims to test the effect of firms’ use of Twitter, as a microblogging service provider, on shareholders’ returns, and particularly on abnormal returns. In pursuing this aim, the study is based on the ground laid by Cole et al.’s (2015) study, which stated that tweeting and positive shareholder returns are correlated and concluded that firms’ use of Twitter to disseminate firm-based announcements helps to reduce information asymmetry, as would be expected based on Blankespoor et al. (2014). In other words, tweeting does not bring new information to the market, but company tweets increase information dissemination (Alexander & Gentry, 2014; Blankespoor et al., 2014). Hence, the effectiveness of companies’ use of Twitter can reduce information asymmetry for investors, and in this way information about the firm can be reflected in market prices accurately and quickly, which can increase market efficiency. If such efficiency occurs, neither technical analysis nor fundamental analysis will provide investors with the opportunity to earn greater returns than they can by holding a portfolio of randomly selected stocks (of at least comparable risk) (Malkiel, 2003).

The study demonstrates originality by being multidisciplinary, and because it is the first study in the literature in terms of aim, scope and sample size. In particular, the study investigates for the first time the abnormal returns of shareholders using portfolio returns created by grouping according to Twitter metrics. On the one hand, the findings of the study indicate that microblogging services have financial importance for information dissemination; on the other hand, they show the relationship between such dissemination and the returns, or abnormal returns, of shareholders. In this context, firstly, explanatory information about microblogging and microblogging measurement is introduced, followed by data and methodology. The fourth section outlines the findings obtained, and these findings are evaluated in the final section.

2Social media, microblogging and information disseminationSocial media, which aims to facilitate basic communication and content sharing, is a platform suited to many marketing activities, such as establishing relationships with customers, creating product information, and sharing promotional and campaign information. So, for many marketers, social media is now seen as a marketing tool. In this context, Constantinides (2014) stated that social media applications can be used for active and passive marketing and Mangold and Faulds (2009) suggested social media as a new element of the marketing mix. Armelini and Villanueva (2011) stated that more than 70% of globally active firms have a Facebook, Twitter or YouTube presence or their own company blog and consider social media as a component of their marketing mix. Within this framework, companies can use social media actively or passively to share large amounts of information about the company, helping them to find new customers; sell products; communicate with the customer; receive after-sales customer evaluations; and/or communicate information about the company's marketing purposes, current and new products, new campaigns, events in operation and new decisions of the company (investments, recruitment, etc.). This information sharing is regarded as communication activity that improves the relationship between the company and its stakeholders and increases returns to the company. Also, it is known that while social media is gaining importance in B2C marketing, it has still some handicaps in relation to B2B marketing. For instance, B2B marketers cannot determine how to effectively engage their fans or followers through social interaction (Swani, Milne, Brown, Assaf, & Donthu, 2017). B2B companies delayed their adaptation to social media because many such firms do not understand why they should use social media and have problems with how to determine the return on investment (Bodnar & Cohen, 2011). Although these problems still exist, B2B companies have started to use social media to communicate with their customers and suppliers, build relationships and trust, and identify prospective partners in terms of B2B selling (Michaelidou, Siamagka, & Christodoulides, 2011). In addition, social media has already been used by B2B firms in some fields such as product innovation, co-creation processes and brand awareness (Swani, Brown, & Milne, 2014; Müller, Pommeranz, Weisser, & Voigt, 2018). Müller et al. (2018) also state that B2B usage of social media has been increasing based on the increased requirement for information for industrial buying, the increased number of sources for industrial buying, the increased requirement for information regarding security, and increased usage of mobile devices in industrial buying. So, it is important for B2B companies to disseminate information on social media. In addition, the content of information posted on social media is a much more important factor than the amount of information in B2B markets.

In addition to the effects of sharing marketing-oriented information on social media, the financial effects on firms of this sharing are also discussed in the current literature (Chung, Animesh, Han, & Pinsonneault, 2015a; Kim, Koh, Cha, & Lee, 2015; Luo & Zhang, 2013; Yu, Duan, & Cao, 2013). These studies demonstrate that social media efforts contribute to firms’ market performance, firm value and stock performance. Furthermore, the consumer engagement and attention created by a firm's social media efforts also mediate the relationship between those social media efforts and firm performance (Chung, Animesh, Han, & Pinsonneault, 2015b). So, understanding the unique impact on and contribution to firms of social media marketing has undoubtedly led to an increase in the importance of social media for firms.

Social media platforms enable the creation of virtual customer environments in which online communities take shape around specific firms, brands or products. These platforms provide a unique environment for creating business value for companies (Culnan, McHugh, & Zubillaga, 2010). Blogs, microblogs, virtual social worlds, content communities, virtual games, and participatory projects are the first types of platforms that come to mind when thinking about social media (Kaplan & Haenlein, 2011). Microblogs are often short reviews sent to a common network, and are broadcast platforms used for the creation and consumption of content by user groups with different interests (Ramage, Dumais, & Liebling, 2010). The most popular microblogging site is Twitter. Twitter is a microblogging service where users send updates to an associated network from various devices, in existence since 2006. Posts, known as “tweets,” are text-based messages of up to 280 characters. Besides text, video, pictures and direct messages can be sent. Each Twitter user has a single page on which all of their updates are collected. For this reason, it is regarded as a microblog.

One use of microblogging platforms is that they allow the views and behaviors of the public to be understood directly by firms (Zhang, Fuehres, & Gloor, 2011). Microblogging service platforms allow companies to create official accounts that can be “followed” by other users. The number of followers of a company account indicates how many users have access to that company's notifications and published information. This number can be seen as a determinant of the ability of the firm to disseminate information (Liu et al., 2015). In this respect, Blankespoor et al. (2014) describe the emergence of a number of technologies that allow greater access to direct investors by providing additional communication channels to the firm, thus allowing them to reach direct investors on a fast, real-time basis without resorting to information intermediaries. They refer to these technologies as direct-access information technologies (or DAITs), and state that these direct-access information technologies include social networks such as Twitter as well as RSS channels and email alerts. According to Blankespoor et al. (2014), these new technologies have become a complementary component of firms’ communications and investor relations, as firms add to these traditional channels of diffusion by simultaneously using direct-access information technology in the form of Twitter posts, RSS channels and email alerts to keep investors informed. These technologies also reduce the time and energy that investors have to spend sorting through various news sources, because Twitter, for example, uses “push” technology that allows news to be disseminated in a shorter time to a wider range of investors, reducing information asymmetry (Mazboudi & Khalil, 2017).

The disclosure of marketing information encompasses announcements of information about a company's products, prices and distribution channels; a new market entry; marketing agreements; and interviews with marketing managers. Accordingly, marketing activities (advertising, channel management, branding, customer relationship management, etc.) help firms to form value-added marketing assets such as brand value and channel customer value. As a matter of fact, announcements about the marketing activities of firms concern both the marketing and finance managers and those analysts who follow these firms, in terms of the impact of such disclosures on market performance (Srinivasan & Siri, 2012). Given the impact of social media platforms on firms’ information dissemination, it is also possible that these platforms can contribute to the formation of effective markets. In the finance literature, a market in which security prices fully reflect all available information is called “efficient”, and it is assumed that all participants in an effective efficient capital market receive all available information without paying any price (Fama, 1970). According to this view, which can be explained by the efficient market hypothesis, security markets are highly influential (efficient) in reflecting information about individual stocks and the stock markets; it is assumed that news spreads very quickly with the emergence of information and that it impacts on just as quickly security prices (Malkiel, 2003). On the other hand, firms generally rely on information intermediaries such as the press in the dissemination of company-based information (Blankespoor et al., 2014; Miller, 2006); however, the media is more interested in companies with high visibility in order to attract the largest audience of readers (Blankespoor et al., 2014; Miller, 2006). As a result, most firms’ disclosures do not always reach the public broadly and effectively. For this reason, dissemination can play a critical role in increasing the effectiveness of firm disclosures, especially in terms of information asymmetry. As dissemination increases, information reaches a broader group of investors, and thus information asymmetry among investors reduces and liquidity increases (Blankespoor et al., 2014).

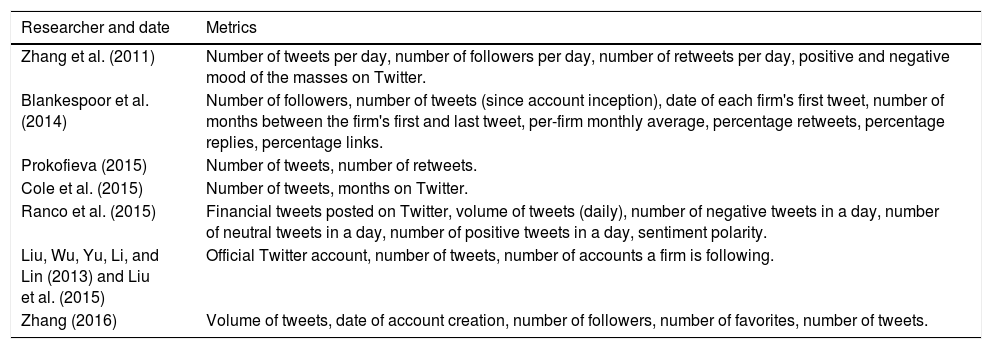

3Microblogging metricsCompanies use microblogs to communicate and to attract more customers, usually for marketing purposes (Kaplan & Haenlein, 2011). Tracking and measuring the activities of companies on such platforms has become an important requirement in measuring the effectiveness of their activities in terms of their marketing performance. So, a large number of performance measurement metrics have emerged. Berkowitz (2009), who used comments, downloads, share counts, clicks, likes, followers, and so on to measure social media performance, describes around a hundred metrics. The number of these metrics is increasing day by day with new social media applications and add-ons. On this basis, there are a number of metrics – such as number of tweets, number of followers, number of retweets, number of retweeters without followers, number of direct messages, and URL or hashtag tweet count (Bruns & Stieglitz, 2014; Neiger, Thackeray, Burton, Giraud-Carrier, & Fagen, 2013) – that are recommended and commonly used in the measurement of the performance of Twitter as a microblog. These metrics can change according to use purposes, time and method. The Twitter metrics used in some studies to measure the effect of information dissemination on financial performance are shown in Table 1.

Some metrics used to measure financial performance on Twitter.

| Researcher and date | Metrics |

|---|---|

| Zhang et al. (2011) | Number of tweets per day, number of followers per day, number of retweets per day, positive and negative mood of the masses on Twitter. |

| Blankespoor et al. (2014) | Number of followers, number of tweets (since account inception), date of each firm's first tweet, number of months between the firm's first and last tweet, per-firm monthly average, percentage retweets, percentage replies, percentage links. |

| Prokofieva (2015) | Number of tweets, number of retweets. |

| Cole et al. (2015) | Number of tweets, months on Twitter. |

| Ranco et al. (2015) | Financial tweets posted on Twitter, volume of tweets (daily), number of negative tweets in a day, number of neutral tweets in a day, number of positive tweets in a day, sentiment polarity. |

| Liu, Wu, Yu, Li, and Lin (2013) and Liu et al. (2015) | Official Twitter account, number of tweets, number of accounts a firm is following. |

| Zhang (2016) | Volume of tweets, date of account creation, number of followers, number of favorites, number of tweets. |

As mentioned earlier, the dissemination of information affects not only the relationship between customers and the firm but also relations with other stakeholders of the firm. For this reason, social media metrics can also be used to measure impacts on other stakeholders, market, firm value, firm reputation and share price, in addition to marketing performance. As can be seen from Table 1, the metrics used in financial research can vary according to time and method.

4Literature review: Twitter usage, information dissemination and their relationship to stock returnsIn recent years there have been many empirical studies contributing to an understanding of the relationship between microblogging and financial markets. These studies have used data mining or emotion/sensitivity analysis to analyze the relationship between microblog information and share price, and have showed that the microblogging network can estimate stock price with useful information (Lin et al., 2016). In this context, Fang and Peress (2009) state that the widespread dissemination of information affects stock returns, and find that stocks that are not in the media get higher returns than stocks that are highly publicized in the media. Blankespoor et al. (2014) study information dissemination and determine that companies which share links from press releases from Twitter accounts reduce information asymmetry and that, in keeping with reducing information asymmetry, abnormal bid-ask spreads are lower and information dissemination is positively associated with liquidity. Similarly, Prokofieva (2015) – who argues that by publishing their corporate information through Twitter, companies draw the attention of investors and reduce information asymmetry – states that there is a negative relationship between the difference between the pre-broadcast daily information spread average (which is expressed as abnormal spread) and the post-broadcast daily information spread average, and tweets posted by a firm during the announcement period. Prokofieva (2015) also finds that this relationship is stronger among firms with low visibility in the press. Paul (2015), whose hypothesis is that Twitter usage will lead to mispricing of assets in communications with investors, states that there is a negative relationship between the log of abnormal volume, product recalls and company-based notification tweets for monthly sales notifications. Paul (2015) finds a negative relationship between the absolute value of abnormal asset returns and firm-based tweets about monthly sales data, and suggests that Twitter only allows for lower information asymmetry, indicating that the given relationship is valid only for positive monthly sales. According to Mazboudi and Khalil's (2017) study, based on the assumption that social media is reducing information asymmetry, firms’ announcements about large-scale company acquisitions via Twitter alleviate the expected negative reaction in the market.

Aside from the effects of social media on information dissemination, some studies show findings on the effect of public opinion, media, and firms’ mood on the estimation of share price. According to Bollen, Mao, and Zeng (2011), while changes in the mood state of the public who share posts about the Dow Jones Industrial Average (DJIA) on Twitter increase the accuracy of forecasts about the DJIA, this leads to a decrease in the closing values of the index and in the estimation of the average absolute percent error. The forecasting model proposed by Bouktif and Awad (2013) for estimating stock movements, incorporating public mood on Twitter, has better results than alternative models where this variable does not exist. Tetlock (2007, 2011) states that a high level of pessimism in the media suggests a change in the price of a stock due to downward pressure. He also suggests that an unusually high or low level of pessimism predicts high market volatility. In addition, he points out that individual investors can overreact to old information and that this reaction can cause temporary movements in stock prices. Sul, Dennis, and Yuan (2014), who calculated the cumulative emotional value (positive or negative) of the information shared on Twitter by firms, find a relationship between emotional value and stock return. They also show that the emotional value of tweets by users with more followers than the average has a stronger influence on the same day's returns because of the rapid spread of sensation and the effect of this on stocks. On the other hand, the study states that the emotional value of tweets by users with lower-than-average numbers of followers has a stronger influence on future stock returns. A more interesting study by Bartov et al. (2018) is concerned with the return estimates of stocks that users make over Twitter. Bartov et al. (2018) determine that individual users accurately predicted their quarterly earnings from stocks on Twitter prior to sharing information about the company's earnings. This result shows the importance of evaluating aggregate opinion from individual tweets, especially in determining future expectations and value of the stock.

Some of the work in this area is focused on sentiment. Sprenger, Tumasjan, Sandner, and Welpe (2014) emphasize that there is a relationship between the tweet sentiment and the share of the stock, and the volume of messages and the volume of trade; this view is supported by Ranco, Aleksovski, Caldarelli, Grčar, & Mozetič (2015): there is causality between the sensitivity of stocks and Twitter volume, but there is a low correlation. When Twitter volume peaks, there is a significant relationship between Twitter sensitivity and abnormal return. Yu et al. (2013) also find that while both social and conventional media have a strong interaction effect on stock performance, overall, social media has a stronger relationship with firm stock performance than conventional media.

Finally, some studies find that the presence of social media accounts and social media usage are associated with stock performance. For instance, Cole et al. (2015) state that the number of tweets per day and the number of months during which the company has posted any tweet are positively correlated with excess returns, and that in this context tweeting is related to positive returns of the shareholders, so tweeting and the experience of tweeting affect the market activity positively. Liu et al. (2015) show that companies with official Twitter accounts have a much higher level of comovement than those without, and the comovement of stocks increases when firms are divided into homogeneous groups according to metrics such as numbers of tweets or followers. In addition, they prove that firm-specific metrics can be used to predict the comovement of stock returns. Differently from the findings of the studies mentioned above, those of Cole et al. (2015) and Liu et al. (2015) draw attention to the importance of the different microblogging metrics used in an investigation which considers the impact of usage of Twitter as a microblogging service provider on shareholders’ returns or comovement of stocks.

5Data and methodologyThis study takes into consideration the stocks included in the Borsa İstanbul BIST 50 Index between November 1, 2016, and April 30, 2017 in order to investigate the impact of companies’ Twitter usage on the returns and abnormal returns of their shareholders. For this purpose, data on Twitter usage of the firms represented by the 28 stocks1 included in the BIST 50 Index during the relevant period was taken from the social media follow-up site www.boomsocial.com, which measures and analyzes the social media accounts of brands. Also, the metrics of total follower numbers, total tweet counts, and length of membership of Twitter frequently used in related literature are calculated for these companies, for the period of study.2 In addition to these metrics, a new metric in the form of follower increment numbers, which is thought to reflect the activity of Twitter in the relevant period, is also considered. For each calculated metric, the related firms are sorted from the highest (or longest) length of membership to the lowest (or shortest), the stocks of each firm are divided into two equal portfolios, and each portfolio is assumed to be held for the relevant period.

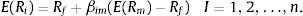

The stocks in the generated portfolios are weighted equally and rebalanced. The Capital Asset Pricing Model (CAPM) based on Sharpe (1964) and Lintner (1965) is used for risk–return evaluations for each portfolio: see Eq. (1):

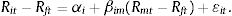

According to Eq. (1), E(Rm) is the expected return of the market portfolio; E(Ri) is the expected return of asset i (portfolio) and the expected return of any asset i (portfolio) consists of the sum of the risk-free interest rate, (Rf), and a risk premium (beta risk of asset i in market portfolio, (βim), times the price per unit of beta risk, (E(Rm)−Rf) (the market risk premium)). In the equation, (βim) shows the risk of covariance of asset i (portfolio) in portfolio M (Fama & French, 2003). On the other hand, the Sharpe–Lintner CAPM implies that the expected value of an asset's (portfolio) excess return (the asset's return minus the risk-free interest rate, (Rit)−(Rft)) is fully explained by the expected CAPM risk premium (βi (E(Rmt)−Rft)). This emphasizes the “Jensen's Alpha” that the constant term for each asset (portfolio) is zero in the time-series regression (Fama & French, 2004):

According to Jensen (1968), if the Sharpe–Lintner risk–return relationship in Eq. (2) holds, the constant term in the time-series regression of the “excess” return on asset i on the excess market return is zero for all assets i (Fama & French, 2003). Thus, this approach, based on Jensen (1968), estimates the time-series regression of the portfolio and uses the constant (Jensen's Alpha) to measure abnormal performance (Fama & French, 2003). In the analysis, the daily change rate of the BIST-KYD DIBS 91-day index is used as the risk-free interest rate (Rf) and the daily change rate of the Borsa İstanbul 100 return index is used as market portfolio return (Rm). All data used and reorganized within the scope of the study were obtained from the Borsa Istanbul Historic and Reference Data Platform.

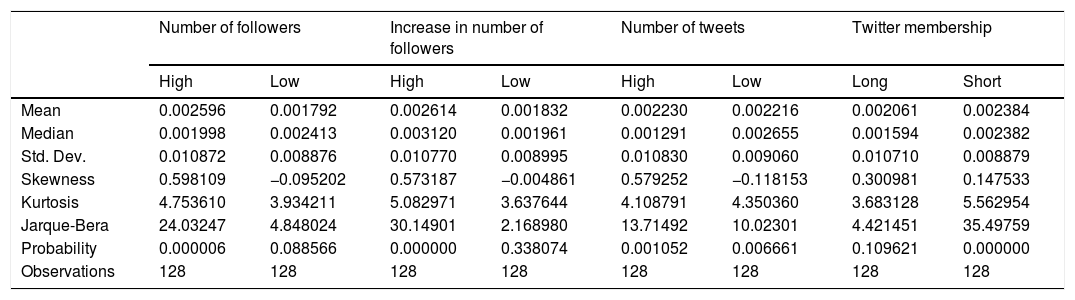

6Research findingsIn this study, which aims to investigate the effects of Twitter use of companies on their shareholders’ returns and abnormal returns, firstly, descriptive statistics for eight portfolios were generated according to the companies’ total number of followers on Twitter, the total increase in the number of followers, the number of tweets and membership duration metrics.

Looking at Table 2, it is noteworthy that the average returns of portfolios with higher-valued stocks and those with lower-valued stocks in related metrics have approximately similar values. In fact, this similarity between metric groups can be explained by the fact that the stocks in the portfolio, which are created according to each metric, consist mostly of the same stocks. However, when the metrics are examined individually it is observed that the average returns of portfolios with higher numbers of followers and an increase in the number of followers are positively different in comparison with those with lower numbers. While the consistency in values between the metric groups also appears in the standard deviation values, it is notable in examining individual metrics that this time an opposite relationship is captured. According to this, portfolios with higher metric values in all metrics appear to have larger standard deviations than those with lower values. Hence, the first findings show that portfolios with better Twitter performance, especially in terms of the metrics of number of followers and increase in the number of followers, may have larger returns, and portfolios with higher metric values for each metric group may be riskier. The return and risk evaluations for the given portfolio returns in Table 2 are also seen in Table 3 for excess returns, which indicates the return of portfolio over the risk-free rate.

Descriptive statistics of portfolio returns.

| Number of followers | Increase in number of followers | Number of tweets | Twitter membership | |||||

|---|---|---|---|---|---|---|---|---|

| High | Low | High | Low | High | Low | Long | Short | |

| Mean | 0.002596 | 0.001792 | 0.002614 | 0.001832 | 0.002230 | 0.002216 | 0.002061 | 0.002384 |

| Median | 0.001998 | 0.002413 | 0.003120 | 0.001961 | 0.001291 | 0.002655 | 0.001594 | 0.002382 |

| Std. Dev. | 0.010872 | 0.008876 | 0.010770 | 0.008995 | 0.010830 | 0.009060 | 0.010710 | 0.008879 |

| Skewness | 0.598109 | −0.095202 | 0.573187 | −0.004861 | 0.579252 | −0.118153 | 0.300981 | 0.147533 |

| Kurtosis | 4.753610 | 3.934211 | 5.082971 | 3.637644 | 4.108791 | 4.350360 | 3.683128 | 5.562954 |

| Jarque-Bera | 24.03247 | 4.848024 | 30.14901 | 2.168980 | 13.71492 | 10.02301 | 4.421451 | 35.49759 |

| Probability | 0.000006 | 0.088566 | 0.000000 | 0.338074 | 0.001052 | 0.006661 | 0.109621 | 0.000000 |

| Observations | 128 | 128 | 128 | 128 | 128 | 128 | 128 | 128 |

Descriptive statistics for portfolio excess returns.

| Number of followers | Number of followers | Increase in number of followers | Increase in number of followers | Number of tweets | Number of tweets | Twitter membership | Twitter membership | |

|---|---|---|---|---|---|---|---|---|

| High | Low | High | Low | High | Low | Long | Short | |

| Mean | 0.002239 | 0.001435 | 0.002257 | 0.001475 | 0.001873 | 0.001859 | 0.001704 | 0.002027 |

| Median | 0.001493 | 0.001974 | 0.002744 | 0.001823 | 0.000948 | 0.002115 | 0.001381 | 0.002139 |

| Std. Dev. | 0.010894 | 0.008904 | 0.010789 | 0.009027 | 0.010851 | 0.009089 | 0.010729 | 0.008911 |

| Skewness | 0.603536 | −0.089532 | 0.579134 | 0.000849 | 0.574767 | −0.100957 | 0.304705 | 0.152626 |

| Kurtosis | 4.796572 | 3.921422 | 5.135965 | 3.630381 | 4.107658 | 4.38858 | 3.715794 | 5.53807 |

| Jarque-Bera | 24.98504 | 4.699108 | 31.48764 | 2.119379 | 13.59111 | 10.50093 | 4.713287 | 34.85321 |

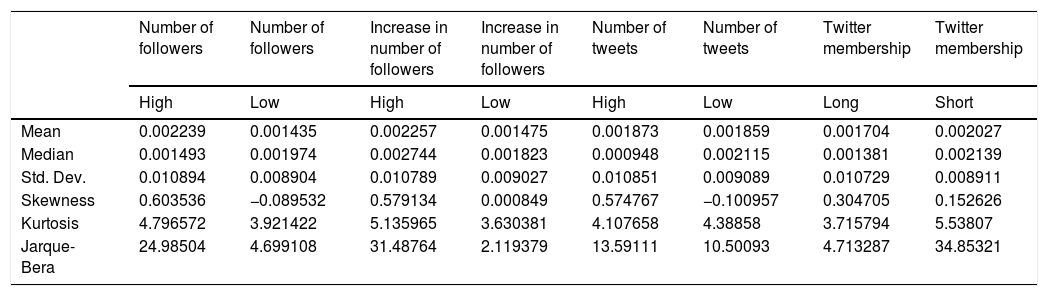

According to Table 3, the average excess returns of the portfolios with higher numbers of followers and an increase in the number of followers are different in a positive direction when compared with the portfolios with lower numbers; and in all metrics, portfolios with the higher related metric values have higher standard deviations than those with lower ones.

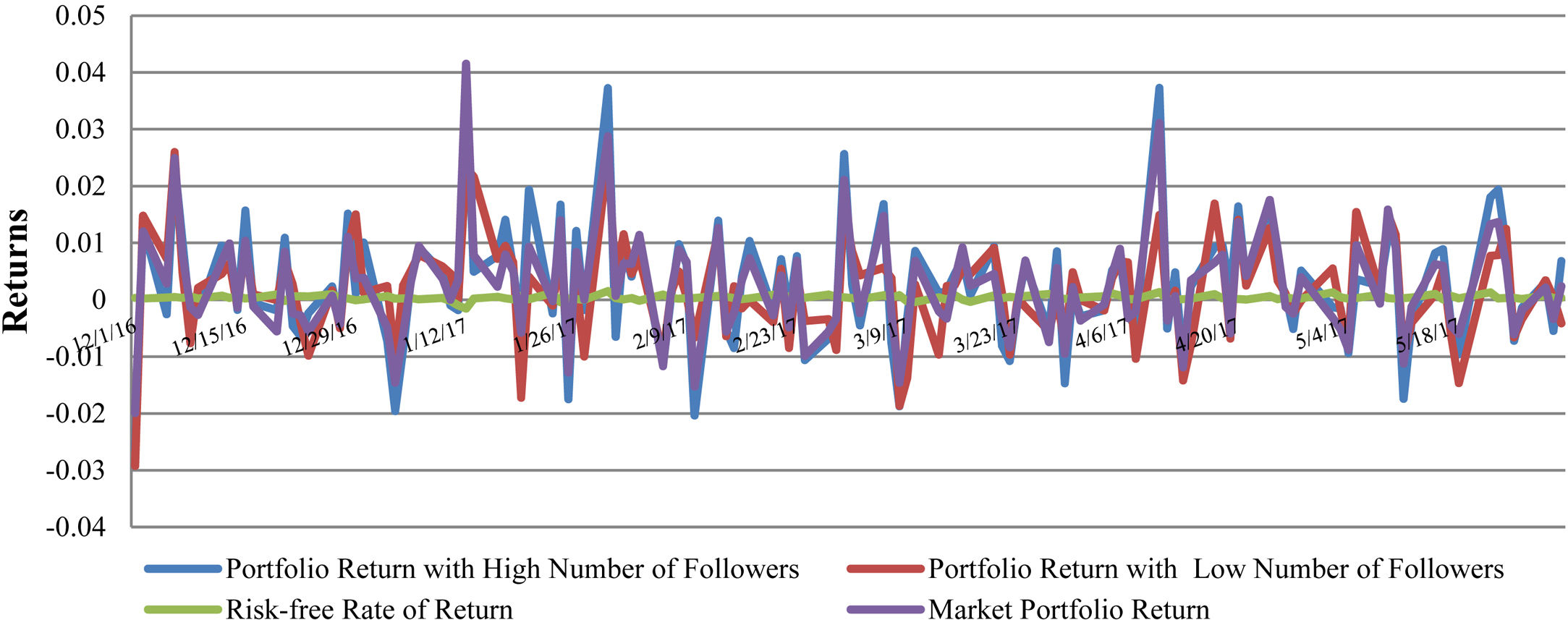

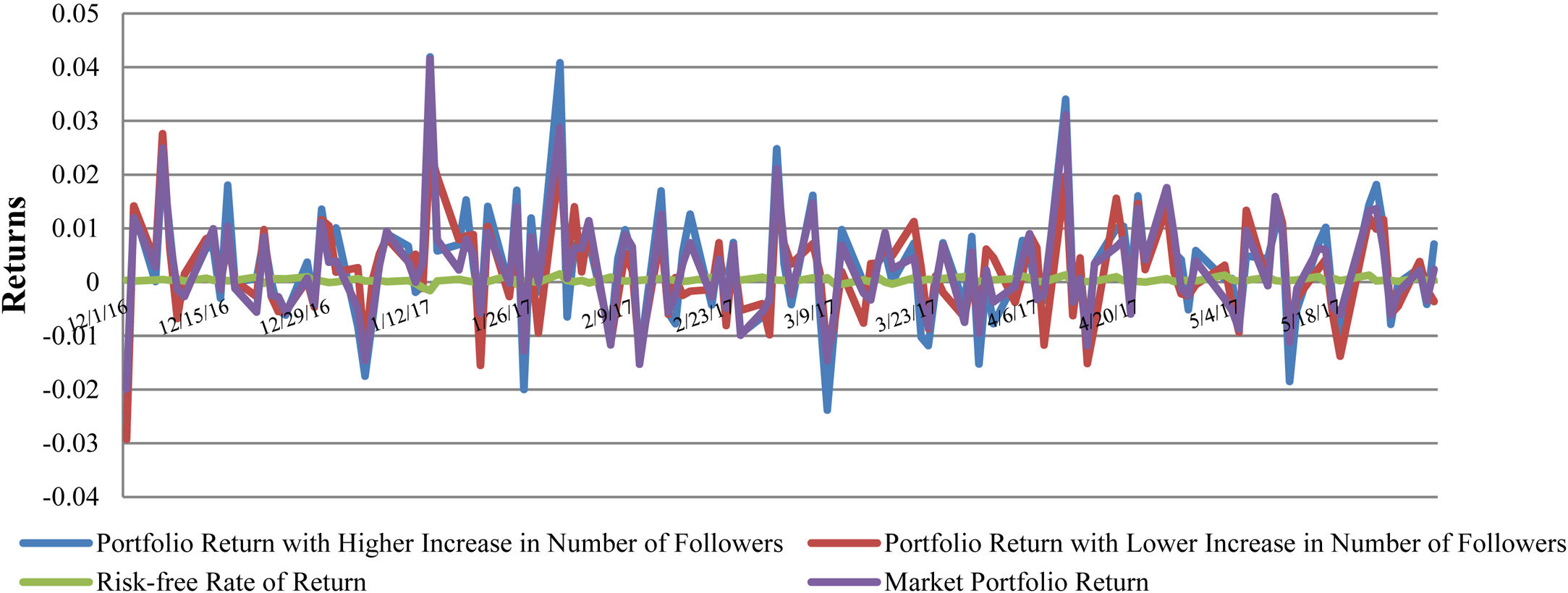

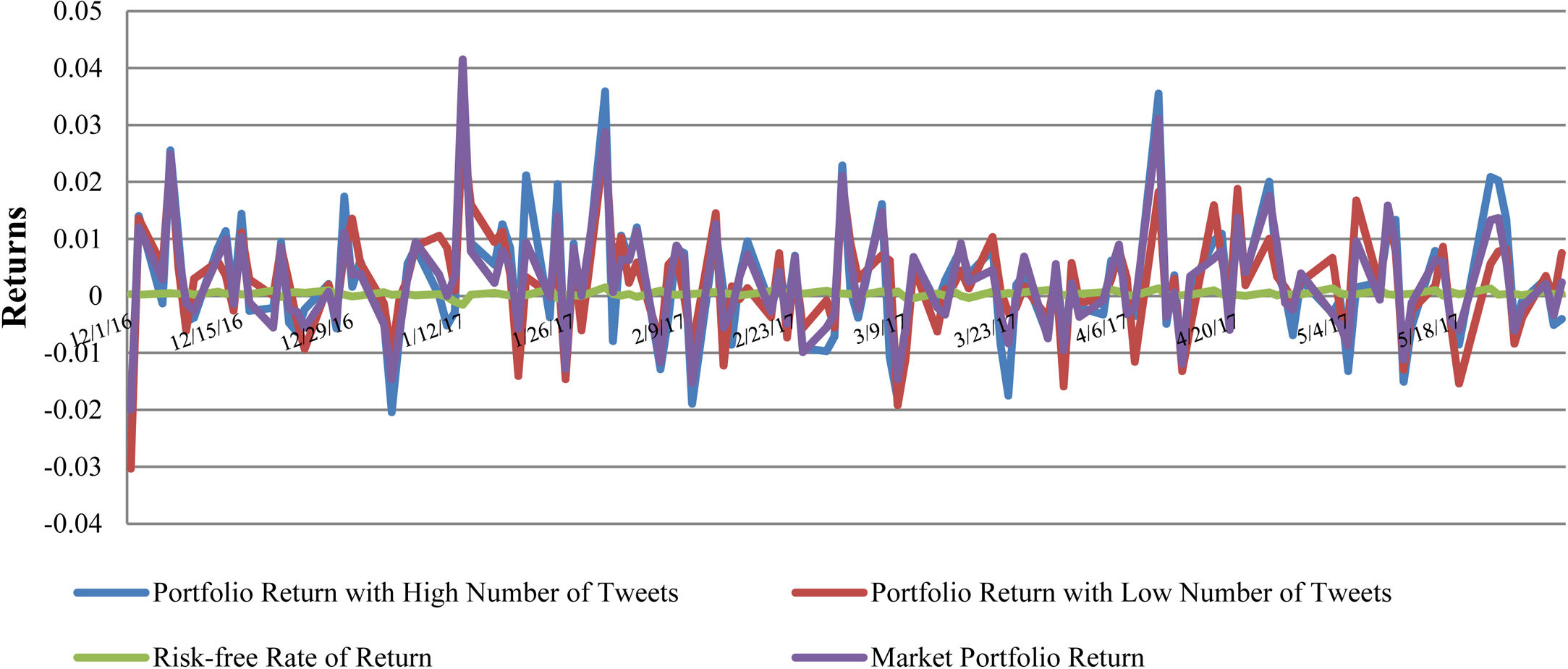

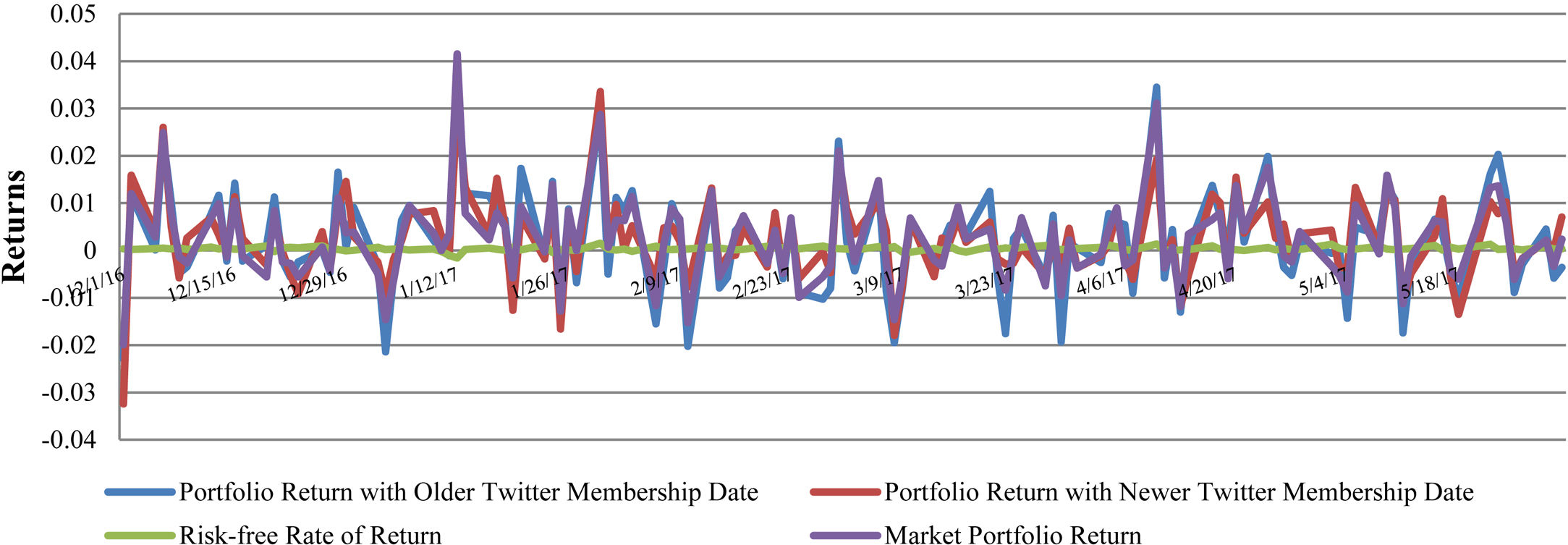

From another point of view, it is also important to show the given portfolio return series in the relevant period, since it is possible to clarify the relationships highlighted in Tables 2 and 3. In this regard, Graphs 1–4 show the movements of the given portfolio returns in the relevant period both against each other and against the market portfolio return and risk-free rate.

As can be seen from Graphs 1–4, the returns of portfolios in each metric group generally follow a process that is consistent between groups and against the return of the market portfolio. In the case of extreme increase and decline in the market portfolio return, it is often noted that portfolios, especially those with high metric values, are able to overcome these increases and declines. In the final evaluation, it is seen that portfolio returns in all metrics follow an average trend, and the returns of portfolios with high metric values have a more active trend than those with low metric values, supporting the findings in the descriptive statistics.

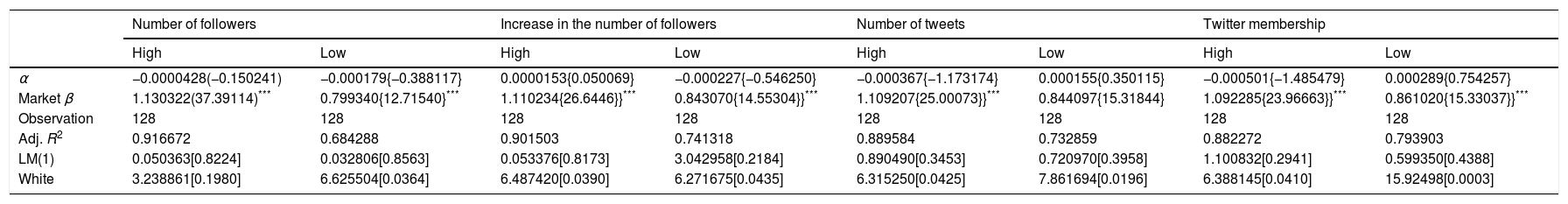

While both the descriptive statistics and the time series graphs allow a common assessment, investigating the contribution of related portfolios to shareholder returns over asset pricing models will, on the one hand, allow the strengthening of existing assessments and, on the other hand, reveal the effect of the use of Twitter by companies on shareholders’ abnormal returns. In this regard, Table 4 shows the results of regression analysis of portfolios, constructed from different metrics, based on the Sharpe (1964) and Lintner (1965) CAPM.

Regression analysis results.

| Number of followers | Increase in the number of followers | Number of tweets | Twitter membership | |||||

|---|---|---|---|---|---|---|---|---|

| High | Low | High | Low | High | Low | High | Low | |

| α | −0.0000428(−0.150241) | −0.000179{−0.388117} | 0.0000153{0.050069} | −0.000227{−0.546250} | −0.000367{−1.173174} | 0.000155{0.350115} | −0.000501{−1.485479} | 0.000289{0.754257} |

| Market β | 1.130322(37.39114)*** | 0.799340{12.71540}*** | 1.110234{26.6446}}*** | 0.843070{14.55304}}*** | 1.109207{25.00073}}*** | 0.844097{15.31844} | 1.092285{23.96663}}*** | 0.861020{15.33037}}*** |

| Observation | 128 | 128 | 128 | 128 | 128 | 128 | 128 | 128 |

| Adj. R2 | 0.916672 | 0.684288 | 0.901503 | 0.741318 | 0.889584 | 0.732859 | 0.882272 | 0.793903 |

| LM(1) | 0.050363[0.8224] | 0.032806[0.8563] | 0.053376[0.8173] | 3.042958[0.2184] | 0.890490[0.3453] | 0.720970[0.3958] | 1.100832[0.2941] | 0.599350[0.4388] |

| White | 3.238861[0.1980] | 6.625504[0.0364] | 6.487420[0.0390] | 6.271675[0.0435] | 6.315250[0.0425] | 7.861694[0.0196] | 6.388145[0.0410] | 15.92498[0.0003] |

Notes: (i) LM(1) is a Breusch–Godfrey Lagrange Multiplier test statistic which examines whether there is a first-degree autocorrelation in the regression error terms. The LM test statistic, calculated from auxiliary regression as n×R2, shows as χ2(1) distribution asymptotically. (ii) “White” is a White (1980) test statistic which examines whether there is heteroscedasticity in the regression error terms. The White test statistic, calculated from auxiliary regression as n×R2, shown as χ2(k−1) (k=the number of estimated coefficients in the auxiliary test regression) distribution asymptotically. (iii) Values in parentheses () show t-statistics, values in braces {} show t-statistics computed according to Heteroscedasticity Consistent Covariances (White, 1980) in case of detection of heteroscedasticity, and finally values in square brackets [] show p-values.

According to Table 4, CAPM regression results for the portfolios generated according to the given metrics have statistically insignificant alphas. This signals that better Twitter performance does not result in significant increases in shareholders’ abnormal returns. In particular, it is noteworthy that portfolios with high value in the metrics of number of followers, number of tweets and twitter membership have insignificant and negative alphas. In essence, this result coincides with the findings of the market betas, which are significantly higher than the 1 obtained in the portfolios. It is observed that portfolios with high values in each metric group are more risky than alternative portfolios with a market beta larger than 1. Therefore, it is found that portfolio returns with superior Twitter performance in related metrics are more sensitive to changes in market return (Fama & French, 2003).

7Discussion and conclusionFrom a more general view of the results obtained from the time series graphs and descriptive statistics, it can be concluded that performance advantages on Twitter in related metrics increase shareholder returns, consistent with Cole et al.’s (2015) study. Regression analysis results, on the other hand, point to the need to take into account different aspects of the subject in order to be able to make evaluations. Firstly, the period of the data is a limitation of this study. It is noteworthy that the sample period selected for the study involves the publishing dates of the 12-month Financial Reports of the Public Disclosure Platform (KAP) for 2016. As previously stated, the current study is based on a belief that, as suggested by Blankespoor et al. (2014), firms use Twitter to spread firm-based disclosures and this dissemination helps to reduce information asymmetry. Therefore, financial statement disclosures through dissemination via Twitter could be expected to result in an overreaction or underreaction to the relevant stock among investors. But, according to Barberis, Shleifer, and Vishny (1998), the findings for underreaction show that security prices underreact to news over the horizon at 1–12 months and the findings for overreaction indicate that security prices overreact to consistent patterns of news pointing in the same direction over the longer horizon of 3–5 years. So, in this view, it may seem that working with a larger sample period could allow for clearer evaluations of the dissemination effect of Twitter usage in terms of investigation of abnormal returns.

Secondly, Barberis et al. (1998) – referring to the evidence of Zarowin (1989), who finds that firms with consecutive bad earnings notifications are superior to firms with consecutive good earnings – suggest that stocks with consistent good-news records and quite high past returns are overvalued, and this would give investors the opportunity to earn abnormal returns; and that stocks with consistent bad-news records are undervalued and subsequently provide higher returns. Hence, the absence of abnormal returns based on the Sharpe (1964) and Lintner (1965) CAPM can be interpreted as a result of the fact that information on Twitter does not allow investors to obtain abnormal returns without causing any overreaction to them. However, it is important to note that tweeting does not bring any new information to the market, but rather that company tweets increase information dissemination (Alexander & Gentry, 2014; Blankespoor et al., 2014). As a matter of fact, confirming this finding, Bartov et al. (2018) state that for companies with strong information environments, the information provided by individual tweets has already been reported to the capital market via information channels such as media releases, press coverage and expert reports, and for this reason, the incremental increase in information content of the aggregate Twitter opinion may be low. In this context, Bartov et al. (2018) signal firm size as one of the measures combined into a proxy for the information environment, and state that small firms have poor information environments with less publicly available information. In this regard, in the current study, the stocks in the portfolios generated for each metric belong to large publicly traded companies and it is highly probable that the information on Twitter has reached investors through other channels or dissemination of that information has already been achieved. So, the fact that abnormal returns were not found in analyses of portfolios based on Twitter performance may indicate that Twitter does not actually play an active role in disseminating information for these companies.

Thirdly, in the current study, the sentiment contained in the information shared on Twitter is neglected. In this regard, Ranco et al. (2015), who categorize Twitter sentiment as positive, neutral and negative, find that there is a statistically significant dependence between Twitter sentiment and abnormal returns on Twitter volume peaks. Therefore, the inclusion of Twitter sentiment in the current study might have led to different findings in terms of abnormal returns. However, it should be noted that it is not clear whether the information generated and spread by individuals on social media platforms such as Twitter would be of value. Given the fact that these platforms are not fully regulated, it should not be overlooked that such information may be speculative, skeptical and perhaps manipulated (Bartov et al., 2018).

Lastly, in addition to Sharpe's (1964) and Lintner's (1965) CAPM, which is used in the present study to analyze the effects of Twitter usage on shareholder returns and shareholders’ abnormal returns, the use of the three-factor model of Fama and French (1993) and the four-factor models of Carhart (1997) would reinforce the validity of the analysis results in terms of the control of certain firm characteristics in the calculation of portfolio returns.

The authors thank to Borsa Istanbul Historic and Reference Data Platform for the data support.

Fourteen of these firms operate in B2B markets and fourteen in B2C markets. Therefore, half of the firms involved in the research post on Twitter for industrial consumers and the other half of the firms for final consumers. In addition to their target markets, all of the companies share their opinions to all stakeholders except their consumers.