Entrepreneurial competencies are capabilities that the business mind people possess to create a new business idea or improve the existing one. Though the direct effect of entrepreneurs’ competence on the performance of MSMEs was relatively researched, its mediating effect was not studied well. Therefore, the primary objective of this study was to investigate the mediating effect of the competence of entrepreneurs on the relationship between bank finance and performance of MSMEs and bridge the gaps in the literature. To meet the objectives, 411 MSMEs owner-managers were randomly selected. The Factor Analysis and Structural Equation Model (SEM) result revealed that the direct and mediating effect of entrepreneurs’ competency was not significant. However, bank finance has a significant positive effect on the performance of MSMEs. Moreover, the study revealed the significant mediating effect of behavioral finance on the relationship between bank finance and performance of MSMEs. For entire variables used in the model, the mediation pattern shown was competitive mediation for bank finance and behavioral finance though it was nonmediation for bank finance and entrepreneurs’ competency.

Though the limited access to finance unequivocally remained a constraint to Micro, Small, and Medium Enterprises (MSMEs), different data revealed that the sector accessed relatively a sufficient amount of funding. However, due to biased and irrational decision-making problems, accessed finance could not bring about vertical growth in the sector. Therefore, investigating the effect of mediating factors that played between the independent and dependent variables is necessary. In this study, the presumed mediating variables that played between bank finance and the performance of MSMEs are entrepreneurs’ competence and behavioral finance.

Entrepreneurial competence is “the capability of an entrepreneur in acquiring, using and developing a resource for business purpose in the specific context" (Mitchelmore & Rowley, 2010). In MSMEs, competencies are related to entrepreneurs/owner-managers (Kyndt & Baert, 2015; Mishra & Zachary, 2015; Boyatzis, 2008; Bird, 1995). Entrepreneur competency applies to individuals and groups that refer to value creation in private and public sectors (Bacigalupo, Kampylis, Punie, & Van den Brande, 2016). Though there is no consistency in the definitions and attributes of entrepreneurial competence in different studies, attributes like initiative, risk-taking, persuasive ability, and independence are commonly known attributes of entrepreneurs’ competency (Burgoyne, 1988; Draksler & Širec, 2018; Kyndt & Baert, 2015; Sánchez, 2013).

Entrepreneur competency helps owner-managers to address enterprise problems in a unique way that entrepreneurs with a high level of competencies can extract opportunities from problems (Man & Lau, 2000; Man, Lau, & Chan, 2002; Bird, 1995). Along with other factors, entrepreneurial competencies positively contribute to the performance of MSMEs (Bhutta & Ali Shah, 2015; Kyndt & Baert, 2015; Osman & Rahim, 2012; Toma, Dubrow, & Hartley, 2005).

In studying the effects of entrepreneurial competency and other determinant factors, understanding the general meaning of performance and its measurement is essential. The measurement of business performance, particularly in MSMEs, is difficult and controversial due to a variety of performance attributes. Some researchers advocated the strict use of financial indicators while others, especially in recent studies, emphasized the relevance of non-financial aspects. Financial measures are necessary but not sufficient to capture total organizational performance (Sefiani, 2013). As pointed by Leković and Marić (2015), financial performance measures of small business are not sufficient for real and objective expression of business results. Therefore, a self-reporting performance indicator criterion is necessary to measure the performances of MSMEs. Moreover, MSMEs do not usually keep the record of their performance that adds to the difficulty of gathering historical and objective data that shows their performance with a different dimension. Due to the complexities associated with obtaining historical data on financial performance, multiple dimensions are used (Haber & Reichel, 2005). Moreover, obtaining a well-recorded financial data is unlikely that performance is better to be considered from owners reporting perspective (Sefiani, 2013). Thus, the performance of MSMEs in this study is measured in terms of profit, additional jobs, Social budgets, and additional value-added products (Delmar, Davidsson, & Gartner, 2003; Santos & Brito, 2012; Sefiani, 2013).

Though the direct effect of entrepreneurs' competencies on the performance of MSMEs is relatively studied (Bendary & El Minyawi, 2015; Boyatzis, 2008; Kimeu, 2017; Bird, 1995), its mediating effect was not categorically documented. Since the performance of MSMEs is a function of different factors like financial services and government support, these factors could be suppressed or exhilarated by other mediating variables. For this study, therefore, we identified two independent, two mediating, and one dependent variable to investigate the direct and mediated effect of variables. Therefore, the prime objective of this study was to investigate the partial or complete mediating effects of entrepreneurs’ competencies and behavioral finance on the relationship between independent and dependent variables. Consequently, the mechanism through which the independent variables (banks finance and government support) affect the dependent variable (performance of MSMEs) through the mediating variables (entrepreneurs’ competence and behavioral finance) was explored. The specific objectives addressed by this study were;

- 1

To examine the effect of bank finance on the performance of MSMEs

- 2

To investigate the effect of bank finance on entrepreneurs competency

- 3

To study the effect of entrepreneurs competency on the performance of MSMEs

- 4

To examine the mediating effect of entrepreneurs competency on the relationship between banks finance and MSMEs performance

- 5

To examine the mediating effect of behavioral finance on the relationship between government support and the performance of MSMEs

To meet these objectives, the researcher examined a direct and mediating effect of variables used in the study. As discussed by Pearl (2001), the term direct effect was intended to quantify an influence that is not mediated by other variables in the model or more accurately, the dependent variable's sensitivity to changes in the independent variable while all other factors in the analysis are constant.

A given variable is said to function as a mediator when it meets three conditions (Baron & Kenny, 1986). These conditions were "(a) variations in levels of the independent variable significantly account for variations in the presumed mediator, (b) variations in the mediator significantly account for variations in the dependent variable, and (C) where a previously significant relationship is no longer significant between independent and dependent variables.” However, Zhao, Lynch, and Chen (2010) vilified these three conditions and identified five mediation patterns that are consistent with mediation and non-mediation patterns: (1) Complementary mediation: there is both a mediated and a direct effect and it points in the same direction. (2) Competitive mediation: there are both mediated and direct effects and points in opposite directions. (3) Mediation indirectly only: there is a mediated effect, but no direct effect. (4) Non-mediation directly only: there is a direct effect, but no indirect effect. (5) Non-mediation no-effect: there is no direct or indirect effect.

Because the independent variable causes the dependent variable to vary, successful mediators measured with an error are most subject to overestimation bias (Kenny, 2018). To sidestep this, the researcher preferred multiple indicator approaches and estimate mediation paths by a latent variable of structural modeling methods (Baron & Kenny, 1986; Kenny, 2018). According to Zhao et al. (2010), researchers should not give up on a mediation hypothesis though they fail to find an effect to be mediated that tells us to continue our discussion in elaborating what is existed.

The remaining of this study is organized as follows: section 2 reviews prior researches related to entrepreneurs' competency, bank finance, behavioral finance, and government support. Moreover, section 3 presents the research methodology while sections 4,5, and 6 present hypotheses of the study, interpretation of results, and conclusion and future research direction respectively.

2Literature reviewResearchers in MSMEs sectors discussed a variety of factors that determine the performance. Some of these factors accentuated in this study are banks financial services, government support, entrepreneurs’ competencies, and behavioral finance (Camara & Tuesta, 2014; Mckinney, 2010; Mitchelmore & Rowley, 2010; Scott, 2008; Yazdanfar & Öhman, 2015; Mishra, 2015; Zhu, Wittmann, & Peng, 2012; Zhao et al., 2010; Pattnaik, 2007). Measuring these factors is difficult that observed variables must be identified to determine each latent variable. For every latent variable in the study, the associated observed variables were identified and confirmed through factor analysis. In the process of achieving research objectives, a literature review related to major variables was conducted.

2.1The effect of entrepreneurs competency on the performance of MSMEsAccording to Stebler (1997), there are two key meanings associated with the term competency: competency as behavior that an individual demonstrates; and competencies as the minimum standard of performance. Competency is also seen as an underlying characteristic of a person that results in effective action and/or superior performance in a job (Boyatzis, 1982). However, if competency is defined as a single construct, the tendency to believe that more effective people have the vital ingredients for success leads to the attribution of a halo effect (Boyatzis, 2008). Therefore, an integrated concept of emotional, social, and cognitive intelligence is used to offer a convenient framework for describing human characters.

Because it provides entrepreneurs with knowledge on the way they operate and encourages them to be conscious of the potential positive or negative impact of their own behavior, understanding business success through entrepreneurial competencies is important (Ahmad, Ramayah, Wilson, & Kummerow, 2010). In a study conducted by Man et al. (2002), there were ten areas of entrepreneurial competencies viz. opportunity, relationship, analytical, innovative, operational, human, strategic, commitment, learning, and personal strength competencies. Some of the attributes mentioned also include Persistence, self-knowledge, decisiveness, planning, independence, building networks, ability to persuade, and seeking opportunities (Kyndt & Baert, 2015). Moreover, risk-taking and initiation were also identified as entrepreneurs’ competency traits that contributed to the success of operators (Segal, Borgia, & Schoenfeld, 2005; Carland, Carland, Carland, & Pearce, 1995). Commonly used attributes to define entrepreneurs' competency were risk-taking, persuading, independence, and initiation (Burgoyne, 1988; Draksler & Širec, 2018; Kyndt & Baert, 2015; Man et al., 2002; Sánchez, 2013; Segal et al., 2005).

Having identified attributes of entrepreneurs’ competency, the next challenging task is its measurement. To measure entrepreneurial competency, researchers suggested different techniques. For example, Smith and Morse (2005) suggested a self-report assessment of respondents on their own level of competency or level of agreement with competency related statements. Due to the strong relationship between perceived and actual competencies, using self- assessment report of owner-managers is commendable (Gist, 1987).

Entrepreneurs’ competency has a significant effect on the performance of MSMEs (Gerli, Gubitta, & Tognazzo, 2011). In addition to the direct effect, entrepreneurs’ competence mediated the relationship between financial services and the performance of MSMEs. The relationship between financial services and MSMEs growth was partially mediated by entrepreneurs’ competency (Mohamad & Sidek, 2013). In addition, Sarwoko, Surachman, Armanu, and Hadiwidjojo (2013) found the mediating effect of entrepreneurs’ competence on the performance of MSMEs. In both of the studies, it was revealed that entrepreneur competency plays a significant role in determining the performance of MSMEs.

2.2The effect of bank finance on the performance of MSMEsIn addition to entrepreneurs’ competency, bank finance was one of the focus of this study. The pursuit of making financial services accessible to businesses at affordable costs is essential to the performance of enterprises. Ibor, Offiong, and Mendie (2017) found a positive and significant effect of bank financial services on the operation and growth of MSMEs. Easy access to financial services helps disadvantaged and vulnerable enterprises like MSMEs.

The bank financial services usually provided to MSMEs are loan, lease, and letter of credit (Camara & Tuesta, 2014). These mostly cited categories of bank financial services have a significant effect on the performance of MSMEs (Torre, Pería, & Schmukler, 2010). In analyzing the effect of bank financial service on the performance of MSMEs, this study focussed on loans, letters of credit, and lease. Among alternative sources of external finance to MSMEs, a bank loan is one of the channels that are sanctioned by banks with a variety of interest rates depending on the types of loans (Nguyen, Tripe, & Ngo, 2018). Different researches witnessed that the amount of loans given to enterprises has a significant effect to enhance the performance of MSMEs. Ayuba and Zubairu (2015) pointed out the significant impact of bank credit to the development of MSMEs. When we see these factors from the aggregate national level, banks finance is looking only from the traditional interest-bearing loan aspect while it could also take additional forms like a noninterest-bearing loan, factoring, leasing, and letter of credit (Torre et al., 2010).

A letter of credit is one of the financial services rendered by banks. Längerich (2009) defined a letter of credit as "a special method of payment used in businesses”. A letter of credit is a guarantee document issued by banks to guarantee the sellers of the product/service that the buyer will not default in paying the amount. Despite the use of the letter of credit as a guarantor, it is being used as a financing option to those enterprises that are short of cash. Through the application of technology, a number of banks and beneficiaries are using the paperless letter of credit (Kozolchyk, 1992). In either of the forms, the letter of credit facilities can help a lot in encouraging international trade. For local purchases and smaller financial needs, MSMEs owner-managers can also get benefits of the credit card issued by banks to buy goods/services with the amount more than the balance in the account.

Another form of financial services rendered by commercial banks is leasing. Though there is a huge potential to use leasing as a source of funds, there is a scarcity of literature especially in developing countries to understand the effect of leasing on the performance of MSMEs (Kraemer-Eis & Lang, 2012). Despite its importance to MSMEs, leasing has received little attention in the capital structure literature of MSMEs (Deloof, Lagaert, & Verschueren, 2007). Lease finance and corporate debt were considered substitutes in some literature that a negative relationship was found between debt and lease financing (Adedeji & Stapleton, 1996; Deloof et al., 2007). However, some empirical studies pointed out that leases and debt are complements (Ang & Peterson, 1984). Regardless of the types of financial services commercial banks are rendering, the empirical studies revealed that commercial bank financing has a significant positive effect on the performance of MSMEs (Ayuba & Zubairu, 2015; Ibor et al., 2017; Torre et al., 2010).

2.3The effect of behavioral finance on the performance of MSMEsBehavioral Finance is “the study of human interprets that explain why and how people make a seemingly irrational or illogical decision when they save and invest their money” (Belsky & Gilovich, 2010). To understand how MSMEs make their financing decisions, Briozzo and Vigier (2007) included behavioral factors as an explanatory variable that legitimizes the reflection of behavioral finance on performance determinants. Thus, behavioral factors are included in the study to examine how MSMEs owner-managers decide on their financial aspects (Briozzo & Vigier, 2007). In addition, Raveendra, Singh, Singh, and Kumar (2018) pointed out that behavioral components have a direct or indirect effect on the financial decisions of MSMEs. Moreover, Jude and Adamou (2018) pointed out that the choices of MSMEs to apply for bank loans is significantly influenced by operators’ behavior. There are persistent biases inspired by psychological factors that impact individuals' decision making (Ricciardi & Simon, 2000). According to Brealey, Myers, and Allen (2006)), the way financial decisions are made is blurred that needs due attention. Therefore, a focus on incorporating behavioral finance is essential that entrepreneurs are influenced by behavioral biases when they decide to invest the accessed funds (Zhang & Cueto, 2017). Recently, researchers are giving due attention to the behavioral biases of owner-managers due to its suppressing effect (Jude & Adamou, 2018; Raveendra et al., 2018; Ricciardi & Simon, 2000; Baker, Richard, & Wurgler, 2007).

Behavioral finance has a strong negative effect on the performance of MSMEs that the behavioral factors restrict investors from making rational investment decisions. Therefore, the available finance could influence the behavior of entrepreneurs (MSMEs operators) that in turn affect the performance. Therefore, incorporating behavioral finance is essential that decision making is influenced by entrepreneurs’ behavioral aspects when they make investment decisions (Zhang & Cueto, 2017). To get better insights into the decision-making procedure, behavioral biases must be examined (Baker et al., 2007).

The study conducted by Baker, Kumar, and Singh (2018) in India revealed that MSME owner-managers were prone to behavioral biases expressed as self-attribution, overconfidence, and loss aversion biases. However, the study failed to find evidence on the presence of anchoring as the behavioral biases in owner-managers. In this study due focus was given to examine the effect of behavioral biases (self-attribution, overconfidence, loss aversion, and anchoring) on the performance of MSMEs. Research on entrepreneurs’ bias has expanded quickly since its beginning and has turned into a critical zone for business (Zhang & Cueto, 2017). Attributes that were chosen to measure behavioral finance were self-attribution, overconfidence, loss aversion, and anchoring (Baker et al., 2018; Baumeister & Vohs, 2007; Hvide, 2002; Kisgen, 2006; Luong & Ha, 2011; Ramiah, Zhao, Moosa, & Graham, 2016; Zhang & Cueto, 2017).

2.4The effect of government support on the performance of MSMEsAnother performance factor that was considered in this study is government support. Government support is very essential for the performance of MSMEs. With this regard, government support could be expressed from creating a conducive business environment to motivating the sector through the provision of different services like premises, marketing facilities, and others. The pace of MSMEs development depends on the level of government support (Scott, 2008; Smallbone & Welter, 2001; Zhu et al., 2012; Zindiye, Chiliya, & Masocha, 2012). The supports of the government in terms of tax relief, motivation (incentive), and appropriate supervisory structure have great importance to boost the performance of MSMEs (Mckinney, 2010; Scott, 2008; Mishra, 2015; Zhu et al., 2012; Sefiani, 2013; Pattnaik, 2007).

Though the direct interventions of the government could not be the only factor that influences MSME performance, it is one of the major factors (Smallbone & Welter, 2001). Enterprises need support from governments in many forms that include financial and non-financial supports. For example, in a report compiled by OECD (2004), it was pointed out that the motivation of the MSMEs sector could be deteriorated if the government support is missing in the public-private dialogue. A government can support entrepreneurs in establishing a platform that motivates MSMEs to co-innovate together (Mckinney, 2010). In addition, the government support to MSMEs can be expressed in creating a conducive ground for healthy competitions. According to a study conducted by Zhu et al. (2012), some of the government support areas that affect MSMEs performance as perceived by owner-managers were competition fairness, laws and regulations, and tax burdens.

Structure, as one of the attributes for government support, is an authoritative guideline for social behavior that includes systems, rules, and norms (Scott, 2008). The government can support MSMEs in creating these institutional structures and setup that is comfortable for MSMEs. Regardless of the economic conditions, government support plays a great role in the performance of MSMEs (Zindiye et al., 2012).

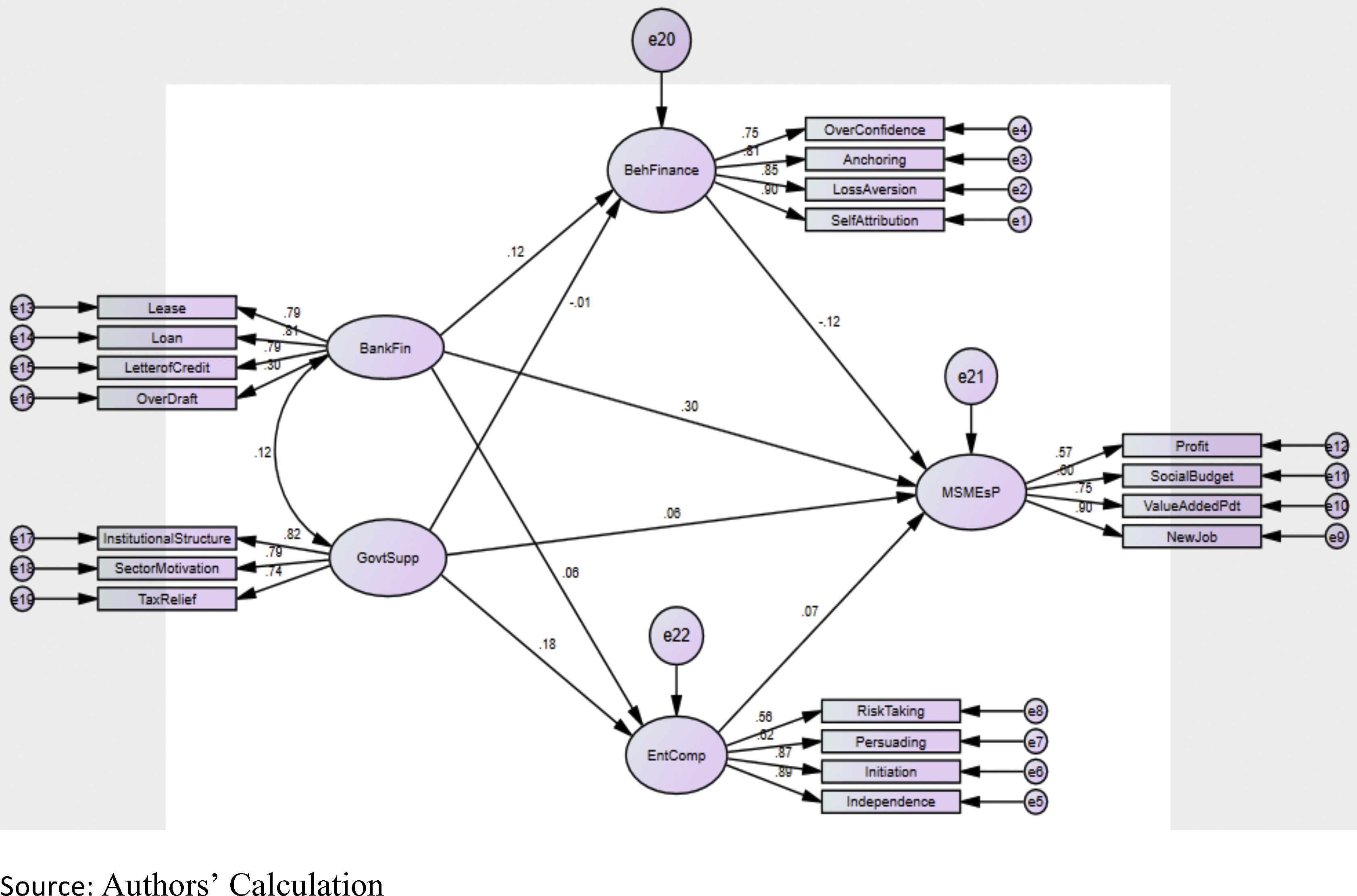

3Research methodologyThe study identified four latent variables from the reviewed literature to meet the objective. The variables of interest identified were Behavioral Finance, Entrepreneurs’ competency, Government support, and bank finance. For ease understanding of variables, sketching a conceptual framework is essential. Fig. 1 shows the hypothesized relationship of variables based on the background information. Based on the conceptual framework, the researcher formulated hypotheses.

To collect data, the researcher took lists of MSMEs in Ethiopia as a sample frame (Särndal, Swensson, & Wretma, 2003). To determine the sample size, the researcher used Slovin’s formula. Slovin (1960) suggested the formula when the population is large and known or nearly estimated. Accordingly, the researcher selected 400 MSMEs based on a 5% significance level. Including the contingency, the researcher distributed 413 questionnaires to owner-managers. Finally, the researcher was able to collect a total of 411 questionnaires and used them in the analysis. After completing the pre-analysis tasks, the researcher proceeded to address the research objectives through exploratory factor analysis, confirmatory factor analysis, and structural equation modeling.

To pledge the use of factor analysis, the researcher considered the Barlett Test of Sphericity (BTS) and Kaiser-Meyer-Olkin (KMO) test of appropriateness. The results of the BTS and KMO support the appropriateness of the data. The KMO was 0.741 that indicated the sample size adequacy considering the cutoff suggested by Meyer, Kaiser, Cerny, and Green (1977)). Furthermore, the Sphericity test by Bartlett was significant and the data were suitable for factor analysis (Tobias & Carlson, 1969; Meyer et al., 1977).

The factor analysis, with Principal Component Analysis method of extraction, was done. Moreover, the researcher used a rotation method of Varimax with Kaiser Normalization (Armstrong & Soelberg, 1968). Components with Eigenvalues greater than one were five obtained from the exploratory factor analysis, and this model accounts for 68.328 percent of the total variance. The minimum factor loading was decided to produce a clean matrix. Thus, those variables with factor loading lower than 0.30 were suppressed (Armstrong & Soelberg, 1968; Ferguson & Cox, 1993).

Researchers considered different attributes to measure the performance of MSMEs (Delmar et al., 2003; Lingesiya, 2012; Santos & Brito, 2012; Sefiani, 2013). The exploratory factor analysis endorsed these attributes that all of them loaded in a single factor. These performance attributes were the value-added product, Profitability, social engagement, and growth in the number of employees. For other latent variables too, attributes were explored from literature and supported by the exploratory factor analysis. Hence, initiation, independence, persuading, and risk-taking were loaded under Entrepreneur competency (Kyndt & Baert, 2015; Mishra & Zachary, 2015; Boyatzis, 2008; Bird, 1995). In addition, the observed variables loaded under Bank Finance were loans, leases, and letters of credit (Camara & Tuesta, 2014; Yazdanfar & Öhman, 2015). In the same way, self-attribution, loss aversion, anchoring, and overconfidence were loaded under Behavioral Finance (Baker et al., 2018; Raveendra et al., 2018). Variables loaded under the government support were sector motivation, tax relief, and institutional structure (Mckinney, 2010; Scott, 2008; Mishra, 2015; Zhu et al., 2012; Sefiani, 2013; Pattnaik, 2007). Therefore, independent latent variables considered in this research were Bank Finance and government support. The mediating variables were behavioral finance and Entrepreneurs Competency (Baker et al., 2018; Civelek, Çemberci, Artar, & Uca, 2015; Mac an & Lucey, 2010). In addition, the dependent latent variable was MSME performance (Delmar et al., 2003; Santos & Brito, 2012; Sefiani, 2013). All observed variables were identified from literature and components were named based on related themes (Camara & Tuesta, 2014; Kyndt & Baert, 2015; Li, Huang, & Tsai, 2009; Mckinney, 2010; Santos & Brito, 2012; Scott, 2008; Segal et al., 2005; Zhu et al., 2012).

To analyze the impact of identified unobserved latent variables on the performance of MSMEs, Structural Equation Modeling has been applied (Ullman & Bentler, 2003). Structural equation models are often used to assess unobservable latent constructs that invoke a measurement model using one or more observed variables and imputes relationships between latent variables (Kaplan, 2007; Kline, 2015).

4Hypotheses of the studyBased on the literature reviewed, the researcher formulated and tested four research hypotheses in terms of direct and mediating effects. Thus, two of the hypotheses were tested in terms of mediation while two of them were tested in terms of direct effect.

- 1

Entrepreneur Competency mediates the relationship between Bank Finance and MSMEs performance

- 2

The Relationship between Government support and MSMEs Performance is mediated by Behavioral Finance

- 3

Bank Finance has a significant positive effect on MSMEs Performance

- 4

Behavioral Finance has a significant negative effect on the performance of MSMEs

In addition to its direct effect on the performance of MSMEs, entrepreneur competency was presumed to have a mediating effect on the relationship between bank finance and performance of MSMEs. Likewise, behavioral finance was hypothesized to have a mediating effect on the relationship between government support and performance. In addition to the mediating effects of entrepreneurs’ competence and behavioral finance, the direct effects of bank finance and behavioral finance on the performance of MSMEs were hypothesized to be significant.

5Interpretation of resultsThe results generated from factor analysis and structural equation modeling were presented and interpreted in this section. In the rotated component matrix, variables were loaded uniquely to distinctive factors that showed the existence of unidimensionality. Moreover, the exploratory factor analysis result showed that behavioral finance can be measured in terms of self-attribution, loss aversion, anchoring and overconfidence with a factor loading of 0.906, 0.880, 0.861, and 0.831 respectively. In the same approach, entrepreneur competency was measured in terms of initiation, independence, persuading, and risk-taking with the factor loading of 0.879, 0.878, 0.757, and 0.700 respectively. Lease, loan, letter of credit, and overdraft were loaded in bank finance component and their loadings were 0.860, 0.858, 0.845, and 0.396 respectively. Institutional framework, sector motivation, and tax relief were variables used to measure government support with a factor loading of 0.871, 0.854, and 0.844 respectively. Moreover, the dependent latent variable was measured in terms of new jobs created, additional value-added product, social budget, and profit with a factor loading of 0.835, 0.788, 0.759, and 0.738 respectively. Once the clean pattern matrix was generated, the researcher proceeded to analyze the effect of the independent variable as demonstrated in Table 1 and Fig. 1.

Unstandardized and standardized regression weights.

| Estimate | S.E. | C.R. | P | ||||

|---|---|---|---|---|---|---|---|

| Unstandardized | Standardized | ||||||

| BehFinance | <--- | BankFin | 0.124 | 0.120 | 0.059 | 2.105 | 0.035* |

| EntComp | <--- | BankFin | 0.070 | 0.064 | 0.063 | 1.124 | 0.261 |

| BehFinance | <--- | GovtSupp | −0.013 | −0.012 | 0.061 | −0.207 | 0.836 |

| EntComp | <--- | GovtSupp | 0.199 | 0.175 | 0.066 | 3.038 | 0.002* |

| MSMEsP | <--- | BankFin | 0.305 | 0.301 | 0.059 | 5.208 | P< 0.001 |

| MSMEsP | <--- | GovtSupp | 0.058 | 0.055 | 0.060 | 0.965 | 0.335 |

| MSMEsP | <--- | EntComp | 0.068 | 0.074 | 0.051 | 1.345 | 0.179 |

| MSMEsP | <--- | BehFinance | −0.117 | −0.119 | 0.053 | −2.216 | 0.027* |

The unstandardized coefficient of bank finance on behavioral finance was 0.124 that represented the partial effect of bank finance on behavioral finance, holding other path variables constant. The estimated positive sign implies that such effect is positive that behavioral finance would increase by 0.124 for every unit increase in bank finance. This coefficient value is significant at 5% level of significance. The conceptual interpretation is that behavioral finance (Biases in investment decision) is influenced by the availability of bank financial services.

The unstandardized coefficient of government support on entrepreneurs’ competency was 0.199 that represented the partial effect of government support on entrepreneurs’ Competency, holding other path variables constant. The estimated positive sign implies that such effect is positive that entrepreneurs’ competency would increase by 0.199 for every unit increase in government Support. This coefficient value is significant at 5% level of significance. The unstandardized coefficient of bank finance on MSMEs Performance was 0.305 that represented the partial effect of bank finance on MSMEs Performance holding other path variables constant. The estimated positive sign implies that such an effect is positive that MSMEs Performance would increase by 0.305 for every unit increase in bank finance. This coefficient value is significant at 1% level of significance. The unstandardized coefficient of behavioral finance on MSMEs Performance was -0.117 that represented the partial effect of behavioral finance on MSMEs Performance. The estimated negative sign implies that MSMEs Performance would decrease by 0.117 for every unit increase in behavioral finance. Similarly, this coefficient value is significant at 5% level of significance (Fig. 2).

Based on the standardized coefficient, the effect of bank finance on the performance of MSMEs was the most influencing path in the SEM model (0.301). The effect of government support on entrepreneurs’ competency (0.175) and the effect of bank finance on behavioral finance (0.120) were also significant paths. The most negative influencing path in the model was behavioral finance on MSME performance (-0.119).

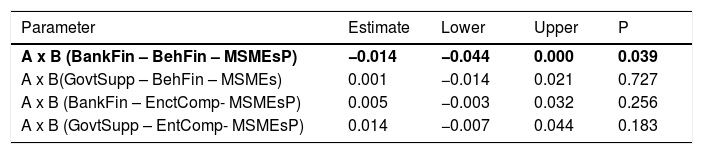

Entrepreneur competency (EntComp) and behavioral finance (BehFinance) were hypothesized to have a mediating effect on the relationship between Independent variables (bank finance and government support) and the dependent variable (MSMEs performance). Therefore, the paths: 1. Bank Finance to Behavioral Finance then to MSMEs Performance, 2. Government support to Behavioral Finance then to MSMEs Performance, 3. Bank finance to Entrepreneurs Competency then to MSMEs Performance, and 4. Government support to Entrepreneurs Competency then to MSMEs Performance were paths considered to examine direct and mediating effects.

To examine mediating effects, the researcher used the percentile bootstrap confidence interval. Bootstrapping is a method that is based on multiple replacement resampling and it is an increasingly popular way to test indirect effects (Bollen & Stine, 1990; Shrout & Bolger, 2002). In addition to its popularity, the researcher chose bootstrap because the percentile bootstrap confidence interval (CI) is essentially least vulnerable to the influence of outliers (Creedon & Hayes, 2015; Preacher & Hayes, 2004; Zhao et al., 2010). Thus, the researcher used a user-defined estimand based on a biased corrected percentile method to determine confidence intervals, P values, and standard errors. A confidence interval is calculated and checked to determine if there is zero in the interval. If zero is not in the interval, the researcher can rest assured that the indirect effect is different from zero (Kenny, 2018).

Based on the evidence obtained from Amos version 22 output, the researcher tested each hypothesis based on the direct and mediating effects of variables. Accordingly, hypotheses 1 and 2 were tested based on the indirect effects while hypotheses 3 and 4 were tested based on direct effects.

5.1Entrepreneur competency mediates the relationship between Bank Finance and MSMEs performanceThe evidence in Table 2 showed that -0.003 and 0.032 respectively were the lower and upper confidence intervals determined by user-defined estimates. In addition, the estimate and P value were respectively 0.005 and 0.256. The evidence showed that the P-value is not significant. Moreover, zero exists between the lower and upper confidence intervals that indicated the insignificant indirect effect of entrepreneur competency. Therefore, the evidence does not support the hypothesis. Thus, entrepreneurs’ competency has no significant mediating effect on the relationship between bank finance and MSME performance. This finding refuted the empirical investigation of Mohamad and Sidek (2013) and Sarwoko et al. (2013) that claimed the significant mediating effect of entrepreneurs’ competency. Though the result indicates an insignificant mediating effect of entrepreneurs’ competency, this result calls another research incorporating culture and other issues as a moderating variable for further clarity.

Estimates and confidence intervals based on user-defined estimands.

| Parameter | Estimate | Lower | Upper | P |

|---|---|---|---|---|

| A x B (BankFin – BehFin – MSMEsP) | −0.014 | −0.044 | 0.000 | 0.039 |

| A x B(GovtSupp – BehFin – MSMEs) | 0.001 | −0.014 | 0.021 | 0.727 |

| A x B (BankFin – EnctComp- MSMEsP) | 0.005 | −0.003 | 0.032 | 0.256 |

| A x B (GovtSupp – EntComp- MSMEsP) | 0.014 | −0.007 | 0.044 | 0.183 |

This hypothesis considered the path from government support to MSME performance through behavioral finance. The estimate, the lower confidence interval, upper confidence interval, and P-value were 0.001, -0.014, 0.021, and 0.727 respectively. The evidence showed that the p-value is not significant. Moreover, zero exists between the intervals. Therefore, the hypothesis is not supported. In other words, behavioral finance has no significant mediating effect on the relationship between government support and MSME performance.

However, behavioral finance has a significant mediating effect on the relationship between Bank finance and MSME performance. The path from bank finance to MSME performance through behavioral finance showed significant p-value. The estimate, lower confidence interval, upper confidence interval, and p-value were determined -0.014, -0.044, 0.000, and 0.039 respectively. In addition, zero was not within the intervals that the indirect effect is different from zero. Hence, behavioral finance has a significant negative mediating effect on the relationship between bank finance and MSMEs performance while it has no significant mediating effect on the relationship between government support and MSMEs performance. The positive coefficient of the path from bank finance to behavioral finance indicates that the increase in fund availability would result in an increase in behavioral biases. In other words, operators would be prone to investment decision biases when finance is available. This finding concurs researches conducted by Statman (1995); Baker et al. (2018); Wingatewealthadvisors (2018), and Raveendra et al. (2018).

- 1

Bank Finance has a significant positive effect on MSMEs Performance

- 2

Behavioral Finance has a significant negative effect on the performance of MSMEs

Hypotheses 3 and 4 are tested based on the evidence presented in Table 1. The evidence showed that bank finance (BankFin) has a significant effect on the performance of MSMEs (MSMEsP) with a P-value of p<0.001. In the same way, it was shown that behavioral finance (BehFinance) has a significant negative effect on the performance of MSMEs with a p-value of 0.027. When Behavioral Finance (BehFinance) goes up by 1 standard deviation, the performance of MSMEs (MSMEsP) goes down by 0.119 standard deviations. Thus, the evidence revealed the significant positive effect of bank finance on the performance of MSMEs and the significant negative effect of behavioral finance on the performance of MSMEs. These results lead to acceptance of the research hypotheses 3 and 4.

The positive and significant effect of bank finance on performance refuted the findings of Abor (2007) that claimed the total negative effect of credits on the performance of MSMEs. However, this finding supported the findings of Ibor et al. (2017); Torre et al. (2010), and Längerich (2009). The significant negative effect of behavioral finance on the performance of MSMEs concurred the studies conducted by Ricciardi and Simon (2000) and Raveendra et al. (2018).

6Conclusion and future research directionResearchers frequently mentioned access to finance as one of the constraints to the growth of MSMEs. Usually, researchers failed to mention the concomitant problems occurred due to the available finance. The evidence in this study revealed that the prevalence of behavioral bias intensified with the availability of bank financial services. The total effect of commercial bank finance on the performance of MSMEs was absurdly less than the direct effect of the same due to the negative mediating effect of behavioral finance. Thus, the availability of finance increases the exposure of owner-managers to behavioral biases that again reduce their effectiveness. Unless stakeholders earnestly grapple a behavioral bias, it will create a serious problem in the performance of MSMEs as a whole. Though negatively mediated by behavioral finance, bank finance has a positive effect on the performance of MSMEs that pledge banks to keep on putting their fingerprint on MSMEs with critical follow-ups.

Entrepreneurs’ competency has no significant effect on the performance of MSMEs. Moreover, it has no significant mediating effect on the relationship between bank finance and the performance of MSMEs. However, the relationship between bank finance and MSMEs Performance significantly mediated by behavioral finance, and this mediation showed a negative effect. Refuting the idea of Baron and Kenny (1986), the researcher witnessed the direct effect, mediating effect, and no effect for variables used in the model with five mediation patters. Moreover, this result refuted the studies conducted by Mohamad and Sidek (2013), Sarwoko et al. (2013), and Zhang (2012). The evidence showed a direct effect of bank finance on the performance of MSMEs. It also revealed the mediating effect of behavioral finance between bank finance and performance. However, for government support and entrepreneurs' competency, the pattern shown was non-mediation, no effect. In other words, the direct effect of government support on the performance of MSMEs was not significant, and the mediating effect of entrepreneurs' competency between government support and the performance of MSMEs was insignificant.

This study contributed to the literature that MSMEs growth problem is not necessarily confined to limited access to finance. Rather, the availability of finance could exacerbate the prevalence of behavioral biases, which in turn affect the performance of enterprises negatively. In addition to the conceptual novelty, the study has employed Structural Equation Modeling to develop a causal model and analyze performance determinant factors to complement the methodological originality and extending the application of behavioral finance concepts beyond the security market.

The effect of entrepreneurs' competence on the performance of MSMEs found insignificant that contradicted most of the existing literature. Due to differences in moderating variables like culture and economic status, this study calls for future researches to incorporate moderating variables and investigate the effect of entrepreneurs’ competence on the performance of MSMEs.