This study analyzes the effects of innovation and innovation characteristics on the survival of Small and Medium-sized Enterprises (SMEs) in the service industry. After analyzing around 22,300 innovative SMEs in Korea's service industry using Kaplan-Meier analysis, it is confirmed that the better the overall technological prowess (T-grade), the longer the survival period until delinquency (overdue payments for more than three months) and default. The technological innovation characteristics that significantly affect the survival period are derived using a time-dependent Cox model. Owner capability, productization capability, and profit prospects are found to positively affect the survival period of excellent SMEs, while R&D capability, technology superiority, and market status are found to have a negative effect. From an optimization perspective, if R&D capability is above an appropriate level, it can hinder the survival period of SMEs. Thus, it is interpreted that the more positive the market status, the more negative the survival period, because it accelerates the inflow of new competitors. Considering that owner capability, productization capability, and profit prospects are appraisal items based on business feasibility along with the technological prowess of SMEs, it is concluded that technology with business feasibility has a significantly positive effect on the survival period of innovative SMEs in the service industry.

SMEs play an important role in the national economy because of the economic benefits they bring (Radas & Božić, 2009). From a microeconomic perspective, SMEs have the advantage of immediately responding to environmental changes through a flexible structure and achieving an appropriate productivity level (Raymond, 2005). From a macroeconomic perspective, SMEs significantly contribute to job creation and have the advantage of minimizing distribution distortion (Ayyagari et al., 2007). In Korea, from 2015 to 2018, SMEs accounted for 83.17% of total employees and 48.80% of total sales. If this is limited to the service industry, the employees account for 90.37% and sales account for 56.93% of their respective totals; therefore, the proportion and role of SMEs in the service industry is significantly large in the national economy (Ministry of SMEs and Startups, 2021).

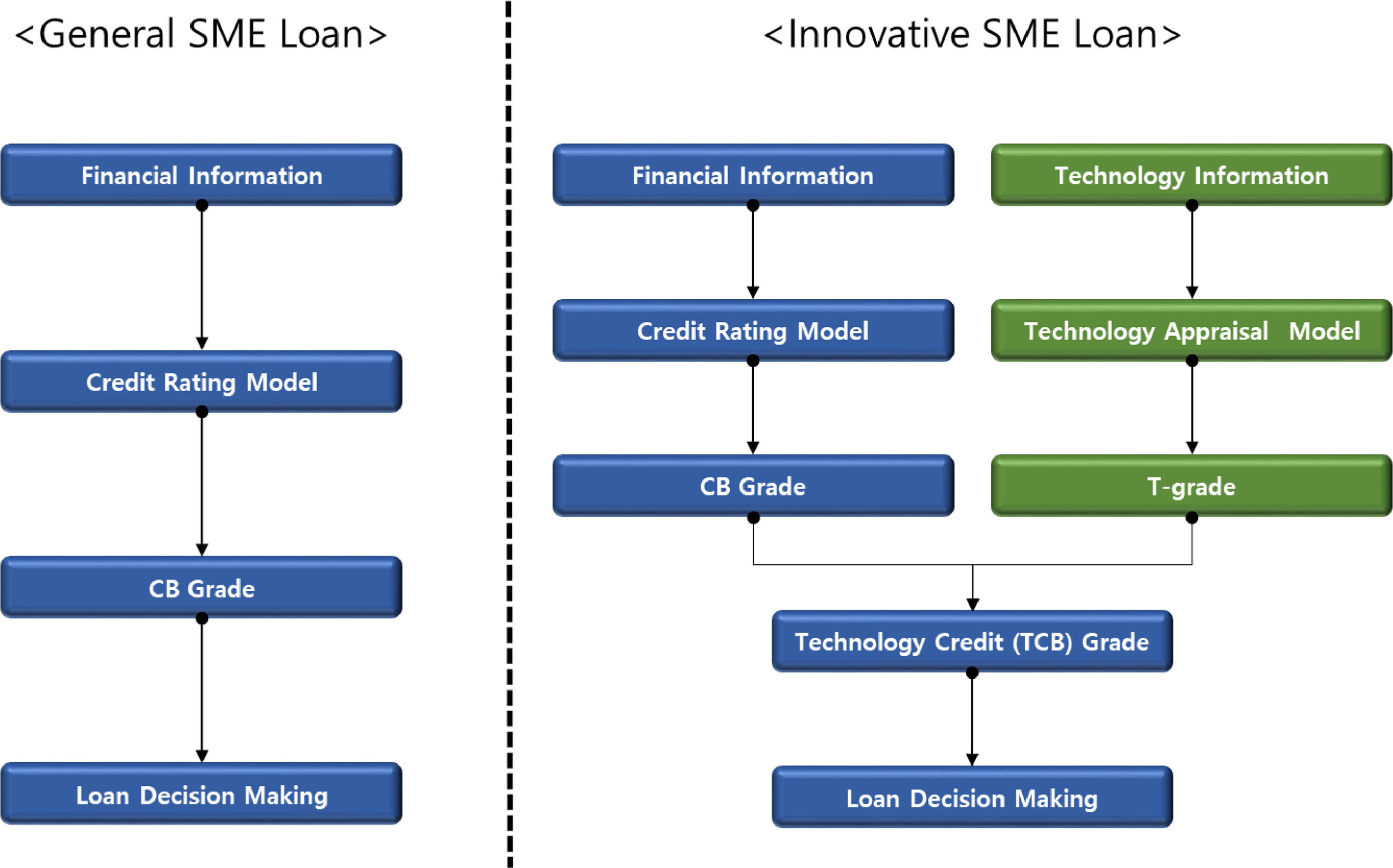

SMEs comprise a large proportion of the national economy, but obtaining loans through commercial banks is not easy because of information asymmetry (Niskanen & Niskanen, 2010), which threatens the survival of SMEs (Carter & Auken, 2006). To solve this problem, the Financial Services Commission of Korea introduced and implemented innovative SME loans that applied technology appraisals to SMEs borrowing from commercial and development banks. An innovative SME loan is a system that adds a T-grade, which appraises the overall technological prowess of SMEs, to the existing credit bureau (CB) grade used for loans. Moreover, it allows commercial banks to lend even if financial information is insufficient or the CB grade is not high but the technology is excellent (Lee & Yun, 2017). The T-grade, which appraises the overall technological prowess of SMEs, is assigned ten grades from T1 to T10. Companies from grades T1 to T4 are defined as technology-outstanding firms, while companies from T5 to T6 are defined as innovative SME loan-adequate firms (Lee & Kim, 2017). The Financial Services Commission of Korea encourages technology-outstanding firms to benefit from interest rates, limits, and maturity when borrowing from commercial banks (Financial Services Commission of Korea, 2015). These innovative SME loans enhance SMEs' access to financing and form a system that reflects mid-to-long-term perspectives based on a technological prowess. This system is called the T-grade of SMEs and is a credit rating model that predicts a company's insolvency in the next year based on past financial information (Kim, 2023) (See Fig. 1).

In this study, the survival period of SMEs is compared and analyzed according to the level of innovation in the era of Industry 4.0. It is particularly meaningful because the analysis is based on the service industry and uses empirical data. Furthermore, by deriving the innovation characteristics that affect the survival period of SMEs in the service industry, it is meaningful to define innovations that are important in the service industry.

Literature reviewStudies on the performance and survival of SMEs have used various methods and appear to have three main directions. The first is the estimation and comparison of the survival period of SMEs and the second is studying the impact of innovation on SME performance. The third research direction concerns the impact of innovation on SME survival.

Estimation and comparison of survival period of SMEsResearch on the estimation of SMEs survival period primarily compares the survival periods of SME types. Many studies have estimated the survival periods of start-up SMEs (Dunne et al., 1988; Mata & Portugal, 1994; Westhead & Birley, 1994) existing enterprises. They have also compared the survival periods of countries (Bartelsman et al., 2005; Zhang et al., 2018). The estimated survival period of start-up SMEs was found to be 13 years on average; three years after the start-up evaluations has been considered an important period for determining the survival of the company (Baldwin & Gorecki, 1991; Geroski, 1995). Research on the survival period of SMEs is based on the type of company, and success and failure factors are derived by analyzing the survival period of start-up SMEs.

The impact of innovation on the performance of SMEsResearch has also been conducted on the impact of innovation on SME performance. Research on SME performance has found that innovation has a positive relationship with financial performance (Qian & Li, 2003; Calvo, 2006; Soininen et al., 2012; O'Cass & Sok, 2014; Hou et al., 2019). Moreover, innovation also has a positive relationship with competitiveness (Madrid‐Guijarro et al., 2009), employment (Peters et al., 2014), and outperformance (Verhees & Meulenberg, 2004; Madrid‐Guijarro et al., 2013; Yıldız et al., 2014; Norman et al., 2016; Oura et al., 2016) of SMEs. However, conflicting research results have showed that innovation does not have a significantly positive effect on the performance of SMEs during a recession (DeDee & Vorhies, 1998; Hansen, 2014), and negatively affects the SME performance by increasing financial risk (Douglas & Shepherd, 2000; Baldwin & Gu, 2004). Recently, a study (Yu et al., 2021) has argued that excessive R&D expenditure should be controlled at an appropriate scale because it causes wastage of efficiency and resources, thereby undermining corporate competitiveness.

The impact of innovation on the survival of SMEsResearch on the impact of innovation on survival is based on the view that survival is the ultimate outcome (Kalleberg & Leicht, 1986; Miner, 1997; Danes et al., 2008), and has a value that takes priority over financial performance, especially for SMEs (Walker & Brown, 2004). The analysis revelated that innovation has co-existing positive (Calvo, 2006; Çakar & Ertürk, 2010; Rosenbusch et al., 2011; Adam & Alarifi, 2021) and negative effects on survival (Buddelmeyer et al., 2010; Cader & Leatherman, 2011). Particularly, studies have shown that if innovation is limited to R&D expenditure, it has a positive effect on survival (Jung et al., 2018), and that R&D expenditure has an inverted U-shaped relationship with survival; therefore, an approach to optimization is needed (Kim & Huh, 2015). Recent research has shown that innovation positively affects survival when accompanied by business feasibility and acts as an actual competitive factor, such as product competitiveness (Markey-Towler, 2016; Agostino et al., 2021; Rojek, 2021). Additionally, even when innovation is defined as marketing and strategy (Naidoo, 2010; Ulubeyli et al., 2018), organization (Dobson et al., 2013), or patents (Ortiz-Villajos, 2014), it has a positive relationship with the survival of SMEs. Most studies on the impact of innovation on the survival of SMEs have analyzed innovation from a single perspective. However, this study is meaningful because it subdivides the characteristics of innovation into technology, business feasibility, and marketability perspectives and analyzes the effect of each innovation characteristic on the survival period.

This study differs from previous research in the following ways. First, by limiting the analytical target to SMEs, it focuses on the effects of technological innovation characteristics on SMEs’ survival periods. This implies that SMEs need a tailored approach because they have a business model that is different from that of large enterprises (Cosenz & Bivona, 2021). Second, among SMEs, only those operating in the service industry are analyzed to refine the effect of technological innovation characteristics on the survival period in the service industry. Accordingly, the utilization of technological innovation characteristics in the service industry and interpretation of policy linkages are made possible. Third, previous research has defined technological innovation characteristics as a single variable, such as patents (Ortiz-Villajos, 2014; Kim & Huh, 2015) and R&D expenditure (Jung et al., 2018; Agostino et al., 2021), which limits the comprehensive interpretation of the analysis results. This study derives rich interpretations and insights into the analysis results using the technological innovation characteristics of innovative SME loans, appraised from the three perspectives of technology, business feasibility, and marketability.

MethodologyData and variablesThe database (DB) used in this study is an innovative SME loan DB from the Korea Credit Information Service. The Korea Credit Information Service is Korea's only public credit registry and each financial institution is obliged to transmit credit information generated during financial transactions to the public credit registry. Therefore, the DB used covers information related to all innovative SME loans in Korea and is free from selection bias.

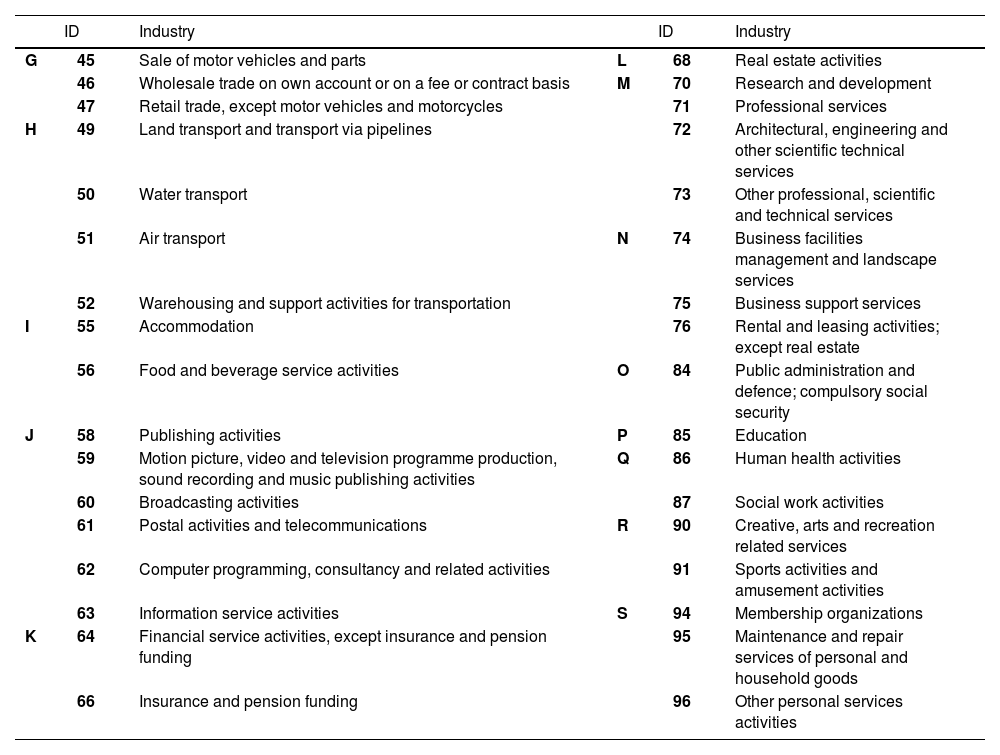

The SMEs to be analyzed are defined as companies that satisfy all of the Korean Standard of Industrial Classification (KSIC) sales standards, have less than 300 full-time workers, and possess less than 427 USD million in total assets. This follows the conservative definition under the Small and Medium Business Act (Ministry of SMEs and Startups, 2018) in Korea. SMEs in the service industry are based on KSIC G∼S (Korean Standard Statistical Classification, 2017), and the description of the sub-industry is detailed in Table A.1. Therefore, among the SMEs operating in the service industry, a T-grade is granted through innovative SME loans, and corporate business operators who could check the size, financial information, and number of employees are used for the analysis.

The survival period of innovative SMEs in the service industry, which is a dependent variable, is calculated daily from the technology appraisal to the event occurrence date by defining delinquency and default as events. However, if an event did not occur, it was treated with right censoring, and until December 31, 2020, it was used as the survival period. No other censored cases are included in this study because they could not be traced. The definitions of delinquency and default are based on the credit rating information in the General Credit Information Management Regulations negotiated by Korean financial institutions, public institutions, and credit bureaus. Delinquency is defined as more than three months of overdue payment based on delinquency information, subrogation repayment, and payment information. Default is defined as a case in which registration is subject to transaction suspension. In the analysis, delinquency and default are distinct from a practical perspective, and the utility of the results is considered. In Korea, when a case of delinquency lasts for more than three months, a default is decided depending on whether the reason for the delinquency is lifted. Therefore, delinquency for more than three months is meaningful as a pre-signal for default. If the significant variables for delinquency and default are different, technological innovation characteristics can be used as information for early warning of default. However, if the significant variables for delinquency and default are similar, technological innovation characteristics are considered significant and robust factors in the survival period of SMEs.

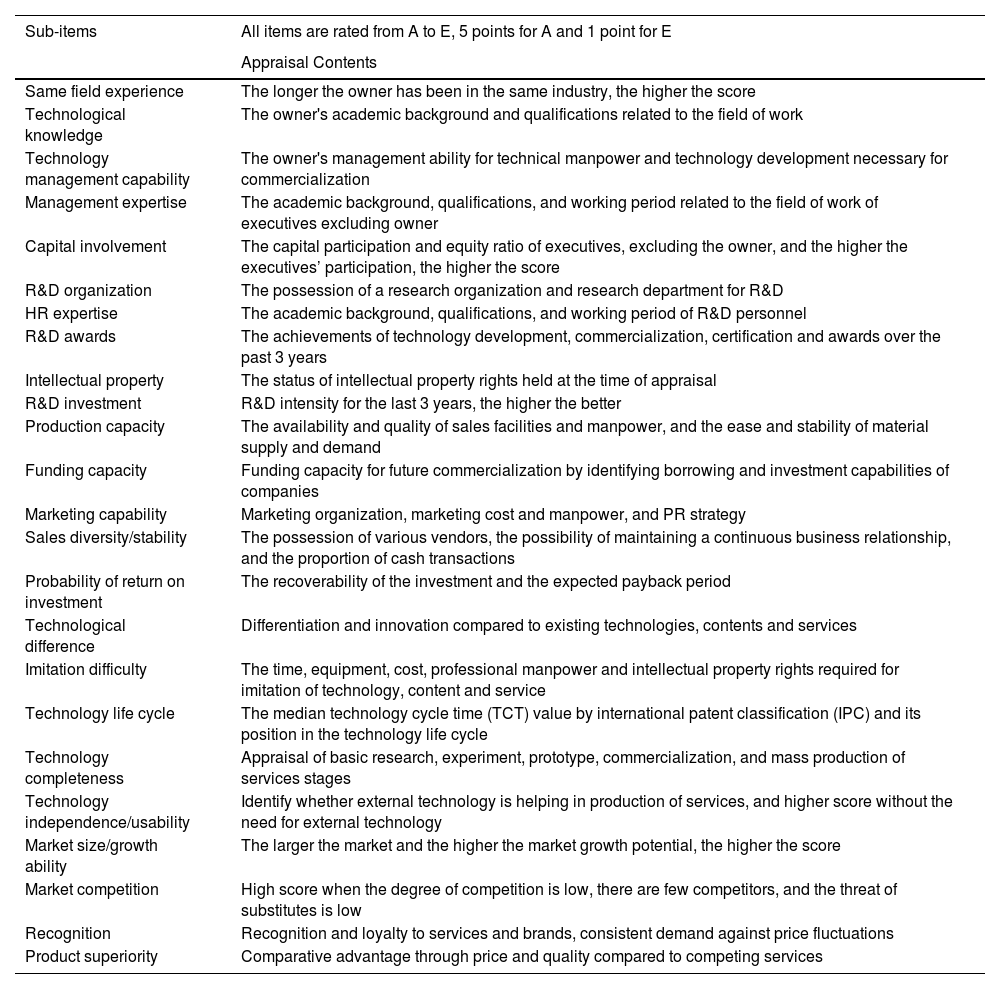

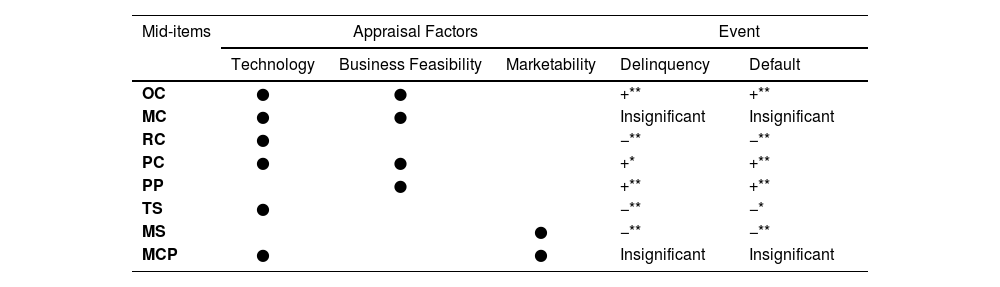

The technology appraisal items used for innovative SME loans are used as independent variables. As shown in Table 1, the appraisal items and composition of innovative SMEs in the service industry consist of two major items, eight mid-items, and 24 sub-items. Additionally, the appraisal is reflected in the three perspectives of technology, business feasibility, and marketability. Each item is appraised in five steps from A to E; the best A is converted to five points and the worst E is converted to one point. The following eight research hypotheses are established using the mid-items of the technology appraisal model used for innovative SME loans as technological innovation characteristics. The logical basis for the technological innovation characteristics used in each hypothesis can be found in previous studies on technological investment.

Technology appraisal items and factors.

Source: (Lee, 2020a)

Hypothesis 1 The owner capability positively affects the survival period of SMEs.

The first technological innovation characteristic, owner capability (OC), comprises the owner's field experience, technological knowledge, and technology management capability (See Table 1). Previous studies have identified OC as an investment decision-making factor (MacMillan et al., 1987; Zacharakis & Meyer, 1998; Lee & Lee, 2009).

Hypothesis 2 The management capability positively affects the survival period of SMEs.

The second technological innovation characteristic, management capability (MC), consists of the management expertise and capital involvement of board members (See Table 1). In Lee and Lee (2009), OC and MC have been distinguished OC is the owner's own capability MC refers to the capability and participation of board members. Additionally, in Tyebjee and Bruno (1984) MC has been derived as a major decision-making factor in investment.

Hypothesis 3 R&D capability positively affects the survival period of SMEs.

The third technological innovation characteristic, R&D capability (RC), is composed of R&D organizations, HR expertise, R&D awards, intellectual property, and R&D investment. It is appraised as an item in terms of R&D-related infrastructure (See Table 1). MacMillan et al. (1987) have also selected RC as an important investment decision-making factor.

Hypothesis 4 The productization capability positively affects the survival period of SMEs.

The fourth technological innovation characteristic is productization capability (PC), which consists of production and funding capacities (See Table 1). Lee and Lee (2009) have identified the possession of production facilities for commercialization in the future and the corresponding funding capacity as investment determinants.

Hypothesis 5 The profit prospect positively affects the survival period of SMEs.

The fifth technological innovation characteristic, profit prospect (PP), consists of marketing capability, sales diversity/stability, and probability of return on investment, which directly and indirectly affect profits (See Table 1). Tyebjee and Bruno (1984) have derived PP as a major investment decision-making factor.

Hypothesis 6 Technology superiority positively affects the survival period of SMEs.

The sixth technological innovation characteristic is technology superiority (TS), which includes technological differences, imitation difficulty, technology life cycle, technology completeness, and technology independence/usability (See Table 1). While RC focuses on infrastructure, TS concerns the inherent superiority of technology. Referring to previous studies (MacMillan et al., 1987; Lee & Lee, 2009), this study uses RC and TS separately. Tyebjee and Bruno (1984) have derived TS as an important investment decision-making factor.

Hypothesis 7 The market status positively affects the survival period of SMEs.

The seventh technological innovation characteristic, market status (MS), is composed of market size/growth ability and market competition and represents the current external market conditions, expansion potential, and competition intensity (See Table 1). Previous studies (MacMillan et al., 1987; Zacharakis & Meyer, 1998) have classified the market status in which SMEs are active as an important factor in investment decision-making.

Hypothesis 8 Market competitiveness positively affects the survival period of SMEs.

The eighth technological innovation characteristic, market competitiveness (MCP), comprises recognition and product superiority (See Table 1). While MS focuses on the status of the external market, MCP focuses on SME competitiveness. This content is based on previous research (Tyebjee & Bruno, 1984). All technological innovation characteristics used in this study are consistent with previous studies on investment decision-making factors, and logical grounds for the hypotheses can be found.

T-grade, which indicates the overall technological prowess of SMEs, is derived by the weighted sum of two major items, each of which is the weighted sum of the mid-items composing the major items. Each mid-item is derived by the weighted sum of sub-items and is appraised from A to E. The detailed appraisal contents of the sub-items of innovative SMEs in the service industry are presented in Table A.2.

As control variables, those related to the size of SMEs and the CB grade are used with reference to previous studies (Lee, 2020b, 2021b). Variables related to the size of SMEs, work years, number of employees, and size of capital and liabilities are used. First, the work year is calculated on a yearly basis from the establishment date of the target company to the appraisal date. Second, for the number of employees, the 12-month average value of monthly employees corresponding to the technology appraisal year, is used, as provided by the National Pension Service. Third, the size of capital and liabilities is based on the financial statements corresponding to the year of technology appraisal, which are provided by credit bureaus. Capital and liabilities are based on USD millions and used in the analysis after log conversion. Fourth, the eighteen grade system (AAA ∼ D) of the Korea Financial Supervisory Service is used to obtain the CB grades of SMEs. When the CB grade is used as a continuous variable, there is a problem because the variable affecting the survival period of SMEs becomes too dependent on the CB grade. Therefore, to adjust the influence of the CB grade according to the level of the control variable, the high-CB SMEs cluster (AAA∼BBB0) and low-CB SMEs cluster (BBB−∼D) are used based on BBB0, which divides investment and speculation. The reference category forms the high-CB SMEs cluster.

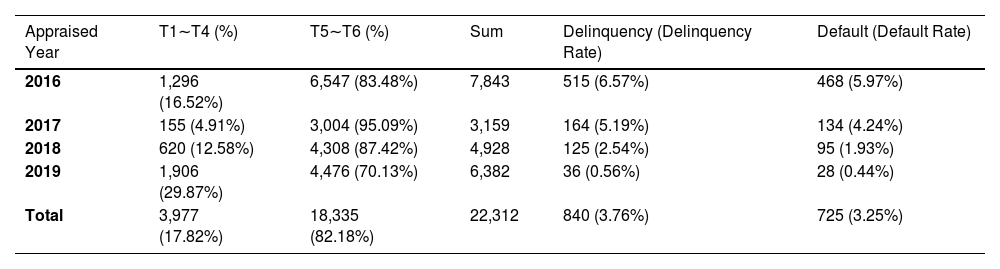

Prior to the survival analysis, we examine whether any bias induced from data imbalance exists by setting the technology appraisal date as the start date of the survival period. To confirm this, we examine whether there are concentrations of specific industries and T-grades, advantages/disadvantages in the delinquency, and default rates depending on the appraisal year. As shown in Fig. 2, the distribution of the appraised industries shows a similar distribution even when the appraisal year is changed. In the case of the T-grade, with the exception of 2017, technology-outstanding and innovative SME loan-adequate firms constituted a stable portion. The delinquency and default rates tend to decrease as the appraisal year is delayed, confirming that there is no distortion in the survival period caused by the concentration of technology-outstanding firms in the early appraisal year (See Table 2). The analysis target used in this study is the 22,312 companies that have been granted a T-grade through innovative SME loans as corporate business operators belonging to the service industry, which falls under the standard for SMEs.

T-grade cluster, delinquency and default rate by year.

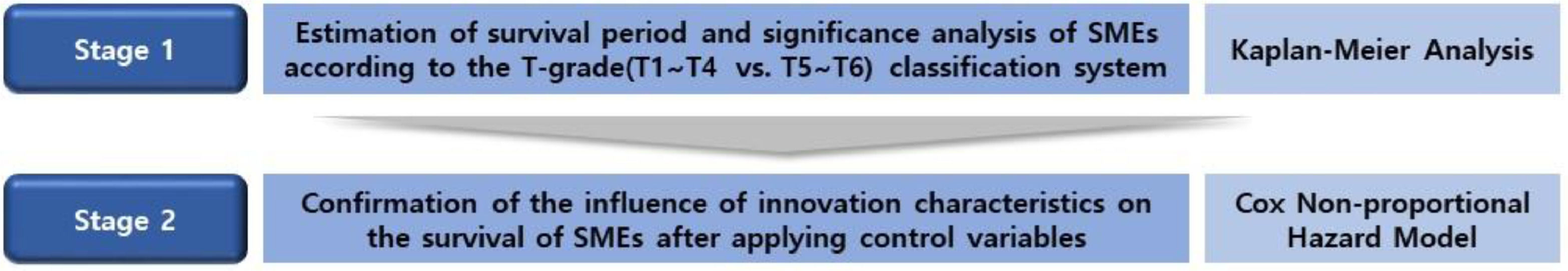

This study is divided into two stages (Fig. 3). In the first stage, the survival period of technology-outstanding firms and innovative SME loan-adequate firms is estimated according to the T-grade cluster. The significance of the difference between the estimated survival periods in the clusters is examined. Accordingly, the relationship between innovative SMEs’ overall technological prowess in the service industry and their estimated survival periods is also examined. In the second stage, the effect of the eight mid-items comprising the T-grade on the survival period of innovative SMEs in the service industry was examined when the size of the company and CB grade were controlled. Accordingly, the direction of the relationships among the mid-items, survival period, and significant technological innovation characteristics was selected, and policy implications were derived.

Kaplan-Meier analysis, a non-parametric method, was used to estimate the survival period. Kaplan-Meier analysis is a method for estimating the survival period for categorical independent variables. It estimates the probability of survival after a certain point using the time until delinquency and default. The method has the advantage of not requiring population assumptions (Kaplan & Meier, 1958). In this study, after estimating the survival period of T-grade clusters, technology-outstanding firms, and innovative SME loan-adequate firms, the significance of the differences between clusters was confirmed through a log-rank test using the same weights.

Cox regression, a semiparametric method, is applied to derive technological innovation characteristics that have a significant effect on the survival period. Cox regression was applied by dividing it into proportional hazard and non-proportional hazard models in accordance with the relationship between time and variables. If the hazard proportional assumption shows that the hazard ratio of a variable is constant over time is satisfied, the proportional hazard model is used; otherwise, the non-proportional hazard model is applied. Cox regression does not require assumptions regarding population, and continuous variables can be used as independent variables (Cox, 1972). In this study, the hazard proportional assumption for the independent variable was not satisfied; therefore, a time-dependent variable was created for the variable, and the Cox non-proportional hazard model was applied. This survival analysis is advantageous because it shows similar performances to the logit analysis in the case of model discriminant power and provides additional information on the process up to the occurrence of delinquency and default of SMEs (Gepp & Kumar, 2008).

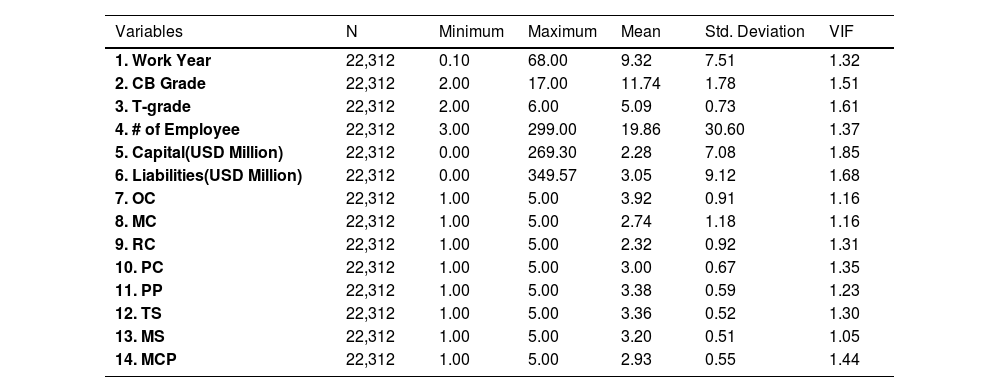

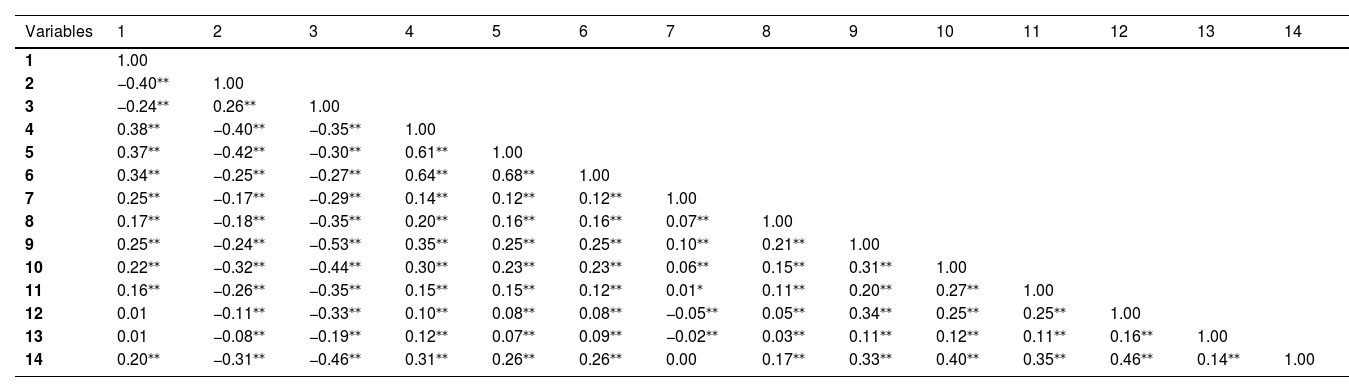

ResultsDescriptive statisticsFinally, 22,312 innovative service industry SMEs were included in the analysis. As shown in Table 3, the average work experience of the analyzed SMEs was 9.32 years, average CB grade was BB− to B+, and average T-grade was T5. The average number of employees, related to the size of the company, was 19.86, and average capital and liabilities were 2.28 (USD million) and 3.05 (USD million), respectively. Prior to the analysis, the Pearson correlation coefficient and Variance Inflation Factor (VIF) values were checked to confirm multicollinearity between variables. The correlation coefficient did not exceed 0.7 (See Table 4), and the VIF value was less than two (See Table 3), confirming that there is no multicollinearity problem between variables from a conservative point of view (Salmerón et al., 2018).

Descriptive statistics and VIF.

Correlation analysis

Note: *p < 0.05, **p<0.01.

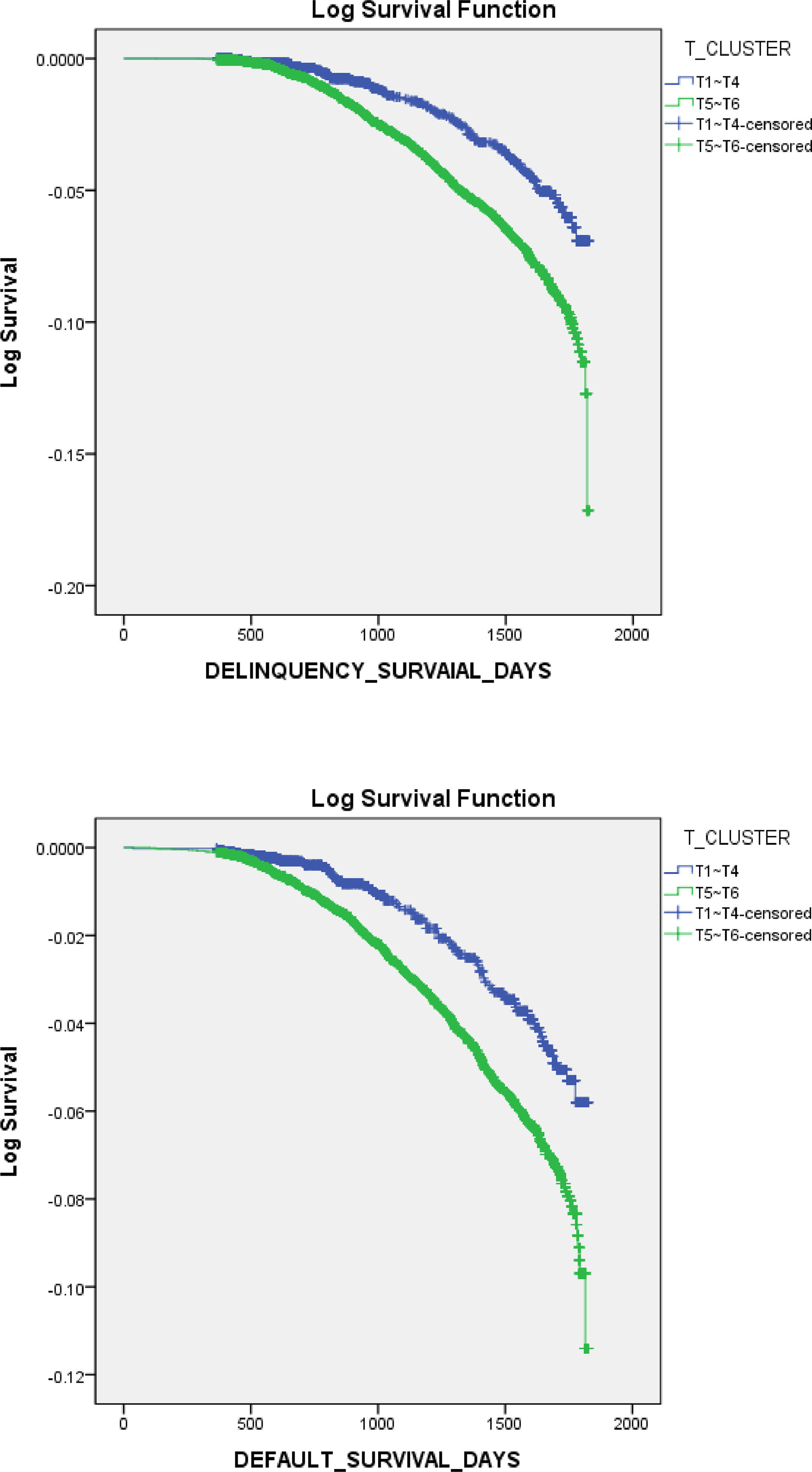

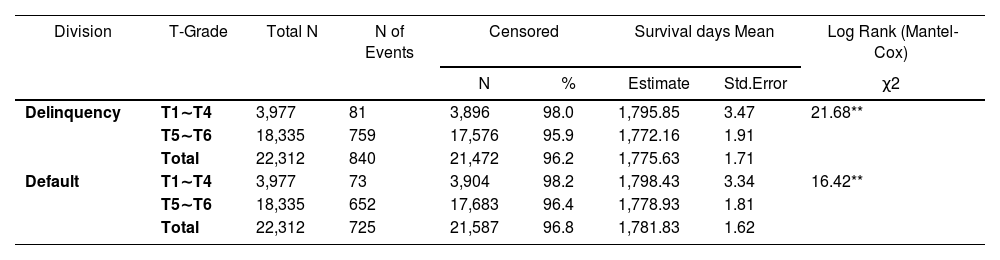

First, the significance of the difference in the survival periods based on the T-grade cluster of innovative SMEs in the service industry was confirmed using the Kaplan-Meier analysis. The T-grade cluster was used as a criterion for technology-outstanding firms (T1–T4) and innovative SME loan-adequate firms (T5–T6), as defined by the Financial Services Commission of Korea. The technology-outstanding firms benefit from innovative SME loans in terms of interest rates, limits, and maturity. The delinquency analysis revealed that the average survival period of technology-outstanding firms was 1,795.85 days, and standard deviation of the average survival period was 3.47 days. In the case of innovative loan-adequate SMEs, the average delinquency survival period was estimated to be 1,772.16 days and standard deviation of the average survival period was 1.91 days. The log-rank (Mantel-Cox) analysis of the differences between clusters confirmed that the estimated survival period of technology-outstanding firms was significantly longer (See Table 5 and Fig. 4). As a result of default analysis, the average survival period of technology outstanding firms was estimated to be 1,798.43 days, and standard deviation of the average survival period was 3.34 days. For innovative loan-adequate SMEs, the average survival period for default was estimated to be 1,778.93 days, and standard deviation of the average survival period was 1.81 days. The log-rank (Mantel-Cox) analysis of the differences between the clusters confirmed that the estimated survival period of technology-outstanding firms was significantly longer, similar to that in the case of delinquency (See Table 5 and Fig. 4). By estimating and comparing the survival period in the T-grade cluster, it was confirmed that the longer the survival period, the higher the overall technological prowess. Thus, the overall technological prowess has a significant effect on the survival period of innovative SMEs, even in the service industry. This result supports the claim from prior studies that overall technological prowess and survival have a positive relationship (Lee, 2021c, 2021d).

Estimation of survival period based on T-grade cluster and comparison of differences.

Note: *p < 0.05, **p<0.01.

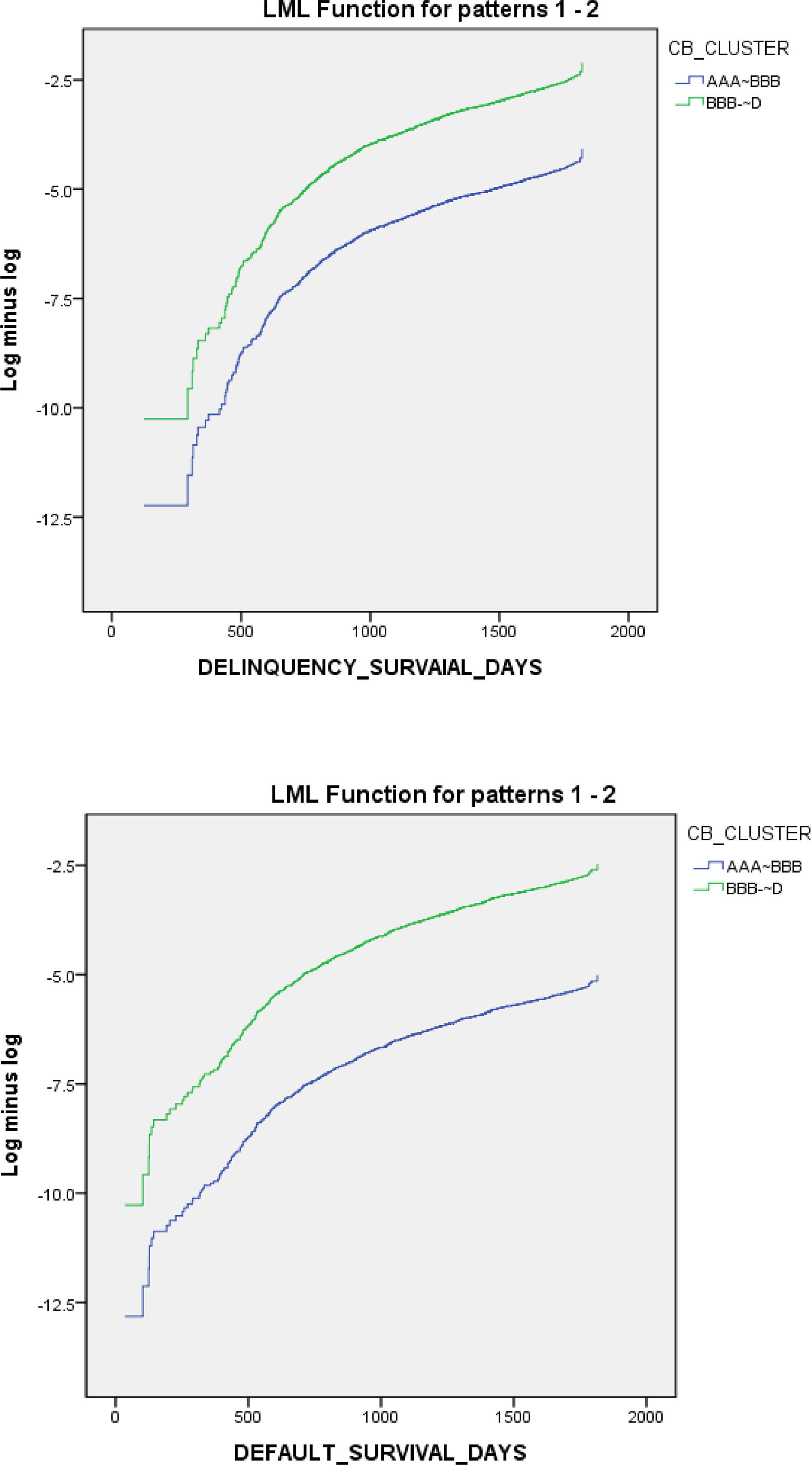

The Kaplan-Meier analysis of the T-grade cluster confirmed that the estimated survival period of technology-outstanding firms was significantly longer than that of innovative SME loan-adequate firms. Cox regression was used to analyze which mid-items among the technological innovation characteristics constituting T-grades had a significant effect on the estimated survival period. Prior to the analysis, the log-minus-log function (LML) graph was checked to confirm whether the proportional hazards were satisfied. If overlapping occurs in the LML graph, this means that the proportional hazards are violated, and there is no overlap in Fig. 5; thus, the proportional hazards are satisfied.

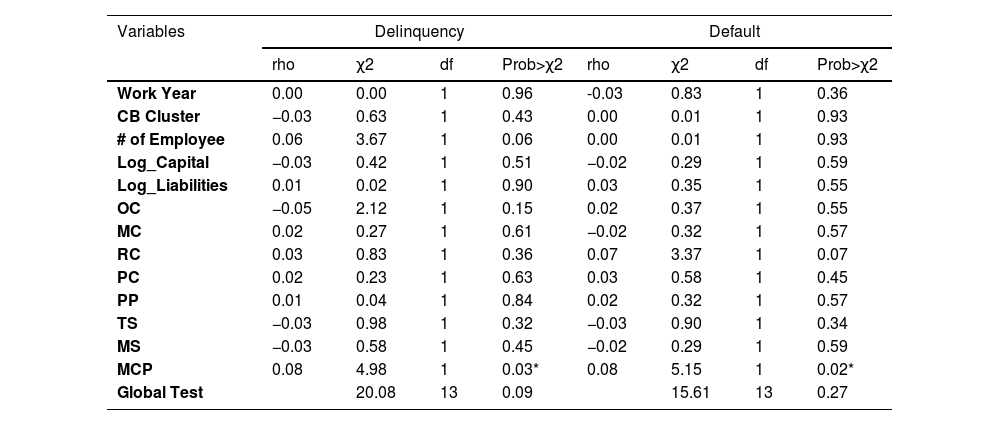

To ensure the robustness of the analysis, the Schoenfeld residual test was conducted to confirm whether the hazard ratio of the variable was constant over time. The test results confirmed that the MCP variable among technological innovation characteristics violated the hazard proportional assumption in both delinquency and default, and the other variables satisfied the hazard proportional assumption (See Table 6). Therefore, after converting the MCP variable into a time-dependent variable, an analysis was performed using the Cox non-proportional model. Policy implications are derived by applying the forward likelihood ratio (LR) method to classify significant and insignificant variables through the entry and exit of technological innovation characteristics that are significant in the survival period.

Schoenfeld residuals test for delinquency and default.

Note: *p < 0.05, **p < 0.01.

The delinquency analysis helped identify a total of eleven variables as technological innovation characteristics that had a significant effect on the survival period (See Table 7). The χ2 of the model was 385.94, which was confirmed as a significant model under the significance level of 0.01. Work year, number of employees, capital, liabilities, and CB clusters, used as control variables, were identified as significant variables. The work year, number of employees, capital, and survival period of innovative SMEs in the service industry showed a positive relationship, while the liabilities and survival period showed a negative one. In the CB cluster, the reference category, high-CB SMEs cluster (AAA∼BBB0), had a higher survival probability than the low-CB SMEs cluster (BBB−∼D).

Cox Non-proportional hazard model results for delinquency.

Note: *p < 0.05, **p < 0.01.

Among technological innovation characteristics, there exist the following six middle items: OC, RC, PC, PP, TS, and MS, all of which were derived as significant variables. OC, PC, PP, and survival period showed a positive relationship, while RC, TS, MS, and survival period showed a negative relationship. This indicates that the survival probability increases with OC, PC, and PP of innovative SMEs in the service industry. However, the higher the score for RC, TS, and MS, the lower the survival probability.

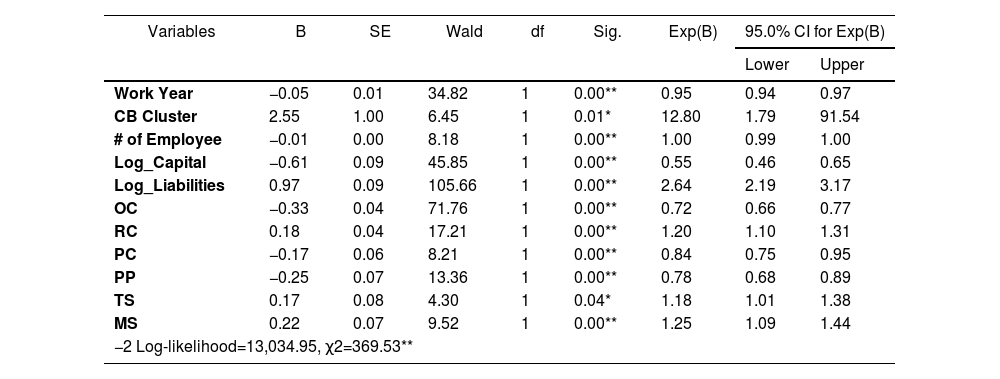

As a result of the default, it was found that a total of 11 variables had a significant effect on the survival period (See Table 8). The χ2 of the model was also 369.53, confirming it as a significant model under the significance level of 0.01. As with the analysis results for delinquency, the work year, number of employees, capital, liabilities, and CB cluster, used as control variables, were also confirmed as significant variables in the default model. Similarly, innovative SMEs in the service industry showed a positive relationship for work year, number of employees, capital, and survival period, and a negative relationship between liabilities and survival period. The CB cluster also showed that the high-CB SMEs cluster (AAA∼BBB0), which was the reference category, had a higher survival probability than the low-CB SMEs cluster (BBB−∼D).

Cox Non-proportional hazard model results for default.

Note: *p < 0.05, **p < 0.01.

Among the technological innovation characteristics, the following six items were identified as significant variables: OC, RC, PC, PP, TS, and MS. This variable was identified as a significant technological innovation characteristic in the delinquency model. The relationship between the variables and survival period also showed a positive trend between OC, PC, PP, and survival period, and showed negative trend between RC, TS, MS, and survival period. Therefore, even in the case of default, the survival probability increases as OC, PC, and PP scores of innovative SMEs in the service industry increase. However, RC, TS, and MS reconfirm that the higher the score, the lower the survival probability.

Discussion and conclusionDiscussionThe following conclusions are drawn from the analysis of the survival period of innovative SMEs in Korea's service industry. First, it was proven that the better the overall technological process (T-grade), the longer the survival period of innovative SMEs in the service industry. Second, by deriving technological innovation characteristics that significantly affect the survival period, we confirm that the six technological innovation characteristics are robust for both delinquency and default. Third, among these technological innovation characteristics, OC, PC, and PP have significantly positive relationships with the survival period, whereas RC, TS, and MS have significantly negative relationships with the survival period (See Table 9). Therefore, Hypotheses 1, 4, and 5 are supported. However, Hypotheses 3, 6, and 7 are statistically significant but rejected because they were confirmed to be in the opposite direction to the survival period. In the case of OC, leadership is inseparably related to the survival of SMEs, and this result supports prior research that shows its positive relationship with the survival period (Colombo & Grilli, 2005; Ganotakis, 2012; Boyer & Blazy, 2014). Considering that PC and PP are appraisal mid-items based on business feasibility, this supports prior research findings that when innovation improves actual competitiveness and productivity, there is a significantly positive effect on the survival period of a company (Çakar & Ertürk, 2010; Naidoo, 2010; Agostino et al., 2021; Lee, 2021a). The finding that RC and TS have a significantly negative relationship with the survival period of SMEs supports the idea that the R&D of a company has an inverted U-shape; therefore, it should be approached from an optimization perspective (Kim & Huh, 2015; Agostino et al., 2021; Lee, 2021a). This also supports the finding that a company's innovativeness threatens its survival (DeDee & Vorhies, 1998; Douglas & Shepherd, 2000; Baldwin & Gu, 2004; Buddelmeyer et al., 2010; Cader & Leatherman, 2011; Hansen, 2014). MS was found to have a significantly negative relationship with the survival period of SMEs, which supports the research finding that current market status accelerates the entry of new competitors and impedes the survival of existing companies (Mata et al., 1995; Honjo, 2000). Fourth, MC and MCP were confirmed as technological innovation characteristics that were not significantly related to delinquency and default (See Table 9). Therefore, Hypotheses 2 and 8 were rejected because they were not statistically significant. This appears to reflect the reality that it is difficult to secure competitive advantage through business model differentiation because of the nature of the service industry and the small number of human resources utilized by SMEs in the service industry.

Results of technology-related innovation characteristics affecting delinquency and default.

Note: *p < 0.05, **p < 0.01

The social implications of the results are as follows. First, innovation was confirmed to have significantly affect the survival of SMEs in the service industry. Therefore, it is necessary to institutionalize and activate support for SMEs through technology appraisals in the service industry. Second, unique and simple technological prowess (RC and TS) is not a sufficient condition for the survival of SMEs, and technological prowess accompanied by business feasibility (OC, PC, and PP) has a significantly positive effect on the survival period. This supports previous research (Markey-Towler, 2016; Rojek, 2021) that has a positive effect on a company's survival period when it acquires a relative advantage through product competitiveness based on business feasibility. Third, technological innovation characteristics are meaningful as additional information that differs from credit information, which predicts the survival of SMEs within one year. For example, in the case of a current good MS, from a mid-to long-term perspective, an increase in the inflow of new competitors may have a negative effect on the survival period of existing companies. This provides different insights from credit information, which can be practically used in the financial sector. Fourth, in terms of policy utilization, it is necessary to approach the technology-productization linkage project aimed at commercialization and pure technology-based research support project from a different perspective. Most technological appraisals are based on technological prowess, and inherent technological superiority and differentiation are classified as important appraisal items. However, in the application of these standards, it is necessary to consider both technology and business feasibility in policies to support and foster the commercialization of SMEs. Through these social implications, it is expected that new implications will be reflected in SMEs policies and applied to a more detailed policy design.

Research limitation and future research directionThis study drew meaningful results by analyzing the impact of technological innovation characteristics on the survival period of SMEs in the service industry. However, there are limitations to the application and interpretation of these results. First, this study analyzed approximately 22,300 innovative SMEs from Korea's service industry that were granted T-grades through innovative SME loans. As shown in Fig. 2, the sub-industries by year show a stable composition, but there are some differences from the composition of the service industry based on the 2015 economic census (Statistics Korea, 2015). In other words, because this study analyzed innovative SMEs that received loans in the service industry, bias inevitably occurs because of the selection of SMEs that are highly related to innovation. Therefore, because of the nature of the data in this study, the target was SMEs in the service industry based on a certain level of innovation and caution is needed in interpretation because there is a gap with the SMEs in the entire service industry. Second, this study uses technology appraisal information for innovative SME loans based on the resource-based view. Therefore, it is necessary to consider the interaction between internal resources and the external environment through the strategic selection of SMEs; accordingly, more diverse interpretations and implications can be drawn. Third, this study analyses the effect of technological innovation characteristics on the survival period of innovative SMEs in the service industry. Many studies have found that SME innovation has a significantly positive effect on financial performance. Therefore, by setting the dependent variable, and the survival period of SMEs, it is possible to determine whether a gazelle company is achieved or listed as a target variable. If we analyze the impact of technological innovation characteristics on SME performance, we can interpret and provide insights into the future-oriented perspective of technological prowess.

FundingThis research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Tables A.1 and A.2

Industry ID and Sub-Industry.

The detailed appraisal contents of sub-items.

Source: (Lee, 2021a)