The paper investigates the moderating effect of patriarchal attitudes by country and year on the relationship between gender diversity on boards and firm performance. The international sample analyzed is composed of 1,103 listed firms from 18 European countries for the period of 2005–2019. Using a two-step system GMM approach, the analysis shows how the generally positive relationship between gender diversity and economic performance (proxied by return on assets and Tobin's Q) is offset and even surpassed by the negative moderating effect of patriarchal attitudes. Furthermore, our work tests critical mass theory and finds confirmation in line with the results obtained for gender diversity. The main contributions of this work include its use of new specific proxies for gender culture by country, namely, patriarchal attitudes and the finding of how they affect the relationship between women's board participation and firm performance in a negative and consistent way.

In the last decade, the need to achieve gender equality has been extraordinarily advocated by social and regulatory pressures worldwide, with advanced economies and international organizations leading the process. As salient examples, we can mention the United Nations’ 2030 Agenda for Sustainable Development, whose 5th goal is to “Achieve gender equality and empower all women,” and the European Parliament resolution of 2017 on equality between women and men in the European Union from 2014–20151. One manifestation of this global social change is the possibility of women accessing power at the upper echelons under the same conditions as men, including access to higher posts of economic power.

The varied elements affecting the social evolution toward gender equality and the derivations from such a change for the business universe have drawn the attention of researchers and given rise to a growing number of theories, hypotheses, and findings. A broad research stream is devoted to gender equality in firms’ boards of directors because women's presence in leadership positions is a powerful driver of gender integration (Huffman et al., 2010). This is the view that the European Commission has taken in proposing a directive on “Improving the gender balance among non-executive directors of companies listed on stock exchanges and related measures,” which is expected to be approved shortly. Firms change as a result of external and internal pressures (Huffman et al. 2010); therefore, the desired objective of gender equality could be encouraged in firms by external social pressures through a firm's stakeholders (Amorelli & García-Sánchez, 2020), from mandatory regulation with different degrees of enforcement (Cabeza-García et al., 2019), and from a demonstrated beneficial influence of women board participation (in parity) on firm performance. A general research line examines the factors and conditions under which internal “pressure” can be developed or the relationship between women's board participation and firm performance (Bennouri et al., 2018; Hoobler et al., 2018; Jeong & Harrison, 2017; Post & Byron, 2015). Our work can be framed into this third line of research concerning firm performance as an internal pressure to improve women's board participation.

According to the empirical research conducted thus far on the link between women's participation on boards of directors and several measures of firm performance, it is not a straightforward relationship (Bennouri et al., 2018; Jeong & Harrison, 2017; Kirsch, 2017; Reguera-Alvarado et al., 2017). The challenge for research is to delimitate under what conditions the sign of this relationship changes and the factors inducing a significant link—whether positive or negative. In this setting, we are interested in a specific external form of pressure that one receives from firm human components from the culture present in society concerning gender attitudes. On this issue, Hoobler et al. (2018) suggest that the relevance of the climate or the culture at work or in the surrounding society supports several theories applied to explain board gender inequality, such as upper echelons theory, social identity theory and critical mass theory. More specifically, Post & Byron (2015) identify the role of two sociocultural elements in moderating this relationship, shareholder protection and gender parity by country, using the Global Gender Gap score.

Stereotypes or cultural gender roles in a society determine behavior norms expected from genders (Heilman, 2001) and act by biasing any subjective process of assessment; hence, patriarchal stereotypes hamper women's access to boards. The still scarce empirical evidence on this subject seems to support this reasoning. Thus, Wang et al. (2018) mention country culture (concerning uncertainty avoidance and gender egalitarianism) as a moderating factor of board gender differences in careers; Cabeza-García et al. (2019) analyze how legal mechanisms and cultural factors (proxied by two Hofstede dimensions: masculinity and power distance) affect the evolution of board gender proportions; and Diehl et al. (2020) develop a measure to capture how woman leaders perceive and experience gender biases and find a relationship with work dissatisfaction and turnover intention. Other references mention a lack of consideration of cultural differences as a limitation of their studies on how board gender diversity affects different aspects of firm performance (Atif et al., 2019; Nguyen et al., 2020).

This work is framed within a recent but growing stream on the identification of moderators within the general research on effects of board gender diversity on firm performance (Amorelli & García-Sánchez, 2021). Our moderator under study is patriarchal attitudes in a country, proxied by four different gender-attitude culture variables extracted from the World Values Survey Data and the Patriarchal Attitude Index we construct from these data. To our knowledge, these gender-attitude variables have not been used previously. In line with recent research, this work also tests critical mass theory (Amorelli & García Sánchez, 2020; Brahma et al., 2020).

For a large sample of 1,103 listed firms from 18 European countries for the period of 2005–2019, a significant negative moderating effect is found. That is, all types of patriarchal attitudes analyzed exert an offsetting effect on the baseline positive relationship between women's board participation and firm performance. The findings remain consistent for return on assets (ROA) and market performance (Tobin's Q) and support critical mass theory. Our results show robustness to the use of two alternative gender culture measures.

Within a theoretical framework built on a combination of economy, organization, and social psychology theories, this study offers two main contributions to research on gender board diversity. The first lies in this work's use of four very specific variables proxying for patriarchal attitudes and construction of the Patriarchal Attitude Index, representing a cultural factor with core relevance to the process involved in reaching gender equality in society in general and in the business contexts affecting the boards of directors in particular. As this work's second contribution, it provides consistent evidence of the negative significant effect of patriarchal attitudes on the role that women board members can play in improving firm performance. Finally, we contribute new evidence on critical mass theory for a broad sample of European countries.

The rest of this paper is structured as follows. Section two presents the theoretical framework addressing the proposed hypothesis. In the third section, we present the sample, research model, and methodology employed. Section four reports our main results and a discussion of our findings. Finally, the main conclusions and implications of this work are provided in Section five.

2Theoretical backgroundAs workplace gender equality is a social and ethical goal and women's presence in leadership positions noticeably contributes to gender integration throughout the firm (Dezsö & Ross, 2012; Huffman et al., 2010), socially desirable gender equality at the top of the corporate hierarchy has been widely analyzed. Strategic change and its derived firms’ performance have been studied as the effects of women's participation in upper echelons, such as boards of directors (Pham & Lo, 2023; Triana et al., 2014), CEOs (Hoobler et al., 2018), and top management teams (Carpenter et al., 2004). Of these three types of posts that a woman can occupy, the board has the central strategic role, as boards of directors influence the managerial team's strategic action (Deutsch, 2005; Kim et al., 2009) and take an active role in selecting new CEOs with previous experience to undertake the strategies preferred by the board (Westphal & Fredrickson, 2001).

The board of directors is the main management and representative committee of a company because its responsibilities include monitoring the CEO and other top managers to protect shareholder interests, formulating strategies advising the CEO and top managers on related administrative and managerial issues, and helping access critical resources for the firm (Johnson et al., 1996). Therefore, the board of directors’ responsibility for defining objectives and strategies, advising on policies, facilitating resources, and supervising and controlling top management (i.e., through hiring, firing, and executive pay) addresses the management of CEOs and top executives (Kim et al., 2009). This is why the board of directors has been the organ of a firm's power most frequently analyzed to check the effect of gender diversity in upper echelons on firm performance.

It is well established in the literature that the relationship between women's board representation and firm performance is mixed (Jeong & Harrison, 2017; Post & Byron, 2015) and that no single theory thoroughly explains this relationship, as far as theories on economics, organizations, and social psychology are concerned (Carter et al., 2010; Valls Martínez et al., 2022). A positive relationship suggests that women add firm value, which has been measured through accounting proxies such as ROA (Bennouri et al., 2018; Brahma et al., 2020; Liu et al., 2014; Terjesen et al., 2016) and through market values such as Tobin's Q (Brahma et al., 2020; Campbell & Minguez-Vera, 2008; Carter et al., 2003; Reguera-Alvarado et al., 2017; Terjesen et al., 2016). For example, Galbreath (2016) adds to this line that the positive relation between firm performance and board gender diversity could be indirect as women's influence on firms’ prosocial actions generates a more intense involvement in corporate social responsibility initiatives. A negative relationship has also been found, suggesting a negative influence of women directors on firm performance measured based on accounting (Adams & Ferreira, 2009; Yang et al., 2019) and market returns (Adams & Ferreira, 2009; Bennouri et al., 2018; Elsaid, 2014; Yang et al., 2019). Other empirical works have found no relationship between woman board representation and firm performance (Carter et al., 2010).

The reasons for explaining the potential effect of gender diversity on firm performance and the theories supporting those reasons can be classified into three main groups: those focused on board efficiency, board decision-making style (Atif et al., 2019), and board monitoring ability (Bennouri et al., 2018).

The first explanation is based on the human capital theory, which states that a person's stock of education, skills, and experience will be used to benefit the firm where they work (Carter et al., 2010; Terjesen et al., 2016). Thus, additional knowledge and experience would provide a better understanding of the market and of the diverse stakeholders of a firm (Carter et al., 2003; Post & Byron, 2015). The knowledge and skills contributed by women can materialize as creativity, innovation, and varied views (Miller & Triana, 2009; Reguera-Alvarado et al., 2017). Thus, with gender diversity on boards, complex issues are expected to be solved through more informed high-quality deliberations (Atif et al., 2019; Huang & Kisgen, 2013). This first group of reasons for efficiency is also alluded to as ‘board capital attributes’ and includes demographic attributes such as education, business skills, and nationality and relational capital such as tenure, media coverage, and multiple directorship (Bennouri et al., 2018).

The second group of reasons is based on stakeholder and resource dependence theories. In stakeholder theory, directors and managers are committed to fulfilling or accomplishing the firm's stakeholders’ expectations to obtain their approval (Elmagrhi et al., 2019). Resource dependence theory states the necessary engagement of the firm with external agents (stakeholders) to obtain resources and how those resources modify the firm's behavior and performance. According to these theories, gender diversity on boards affects a firm's decision-making style for several reasons. Stakeholder theory supports that women directors can increase pressure on firms to meet stakeholders’ expectations (Elmagrhi et al., 2019) by including new viewpoints and deliberative processes according to the different values identified by gender (Jeong & Harrison, 2017; Loyd et al., 2013; Post & Byron, 2015). Women as directors have been found to be more self-transcendent (a feature emerging from values such as benevolence and universalism) than self-enhanced (a feature emerging from values such as achievement and power) (Adams & Funk, 2012; Adams et al., 2011). Self-transcendence is explained by Bruckmüller & Branscombe (2010) as exhibiting interpersonal qualities of intuition and an awareness of others’ feelings. For example, women board directors have been found to focus more on corporate social responsibility (Romano et al., 2020; Shaukat et al., 2016; Valls Martínez et al., 2019). Consequently, diverse boards link firms with a greater variety of external agents. According to resource dependence theory, this variety and women's preference for greater accountability could help firms obtain more valuable and critical resources (Carter et al., 2010; Elmagrhi et al., 2019).

The third group of reasons is based on agency theory (Carter et al., 2010), that is, the relationship between groups linked by a principal-agent contract, and the conflicts derived from their different interests and priorities. This group of reasons concerns directors’ monitoring attributes, including independence, board chair representation, and participation in board committees (Bennouri et al., 2018). A diverse board of directors can play a relevant role in solving agency conflicts, as diversity reinforces its monitoring role owing to more independent contributions and better managerial accountability (Adams & Ferreira, 2009; Adams et al., 2011; Brahma et al., 2020). In addition, the identified significant difference between genders concerning risk aversion is expected to increase when a board of directors exerts its monitoring role, as women boards show a preference for safer corporate policies and more conservative investments (Datta et al., 2021).

In sum, women's traits can have a positive effect on firm performance through women board roles in advising, decision taking, and monitoring, forming reasons in favor of gender diversity in the upper echelons of business management. Given the contentious previous evidence, the conditions under which woman leaders are able to apply their knowledge and skills to improve a firm's financial performance seem to be key to advancing this line of research. Patriarchal attitudes precisely address such conditions. There are two cultural contexts to consider: the broader social context of woman life dimensions or the culture of the society in which a woman lives (Hoobler et al., 2018) and the local social context of the given workplace (Diehl et al., 2020). The first context, biased by patriarchal attitudes, is expected to influence the second strongly, although it is possible to moderate this influence through active gender management (Ng & Sears, 2017).

The broader context of patriarchal attitudes given by history, traditions, beliefs, values, education, and politics, will determine the behavioral patterns found in a society (Uribe-Bohorquez et al., 2019; Gyapong & Afrifa, 2019). These factors address what society considers right or wrong (Heilman, 2001). Depending on the given country, the interests and responsibilities of individuals, the experiences they may have, or the ways in which good decision making is to be carried out will be interpreted differently.

To determine the sociocultural factors related to gender that characterize countries, the model proposed by Hofstede (2011) has been repeatedly used. However, this model has several limitations, such as a lack of updated data and the fact that only one set of data is available for all periods. For this reason, the present work analyzes the impact of gender culture through an alternative source of information, the World Values Survey. This survey allows the user, through the survey's different waves, to obtain more recent information and data on different values for the period under study (Inglehart et al., 2020a; Inglehart et al., 2020b; Inglehart et al., 2020c). Cultural variables concerning gender are measured through patriarchal attitudes by country and year.

The local workplace context reveals how patriarchal values present in societies are reflected in business cultures. Four general elements of gender bias appear in business2 (Diehl et al., 2020): the “think manager—think male” pattern, the “glass ceiling” phenomenon, the “think crisis—think female” pattern, which has also been expressed as the “glass cliff” phenomenon, and the “queen bee syndrome.” (1) The “think manager—think male” pattern identified in the seventies (Schein, 1973) represents a general prejudice about how a manager should behave, with competitive and self-confident traits attributed to both men and managers according to stereotypes (Bruckmüller & Branscombe, 2010)3. This prejudice is offset by the presence of a woman CEO and by active firm processes encouraging women recruitment (Ng & Sears, 2017). (2) The “glass ceiling” phenomenon has been described as an invisible barrier that women face in accessing upper echelons of firms’ power (Heilman, 2001). An aspect of the gender bias contributing to the construction of the “think manager—think male” and “glass ceiling” trends is the differentiation of social roles, with work-family conflict being a determinant factor keeping women away from management and direction responsibilities. On the one hand, the more demanding family responsibilities attributed to women in patriarchal societies are perceived by employers, supervisors, and other directors on the board as hampering women's productivity at work. On the other hand, in patriarchal settings, women limit their own aspirations to avoid work-family conflict (Diehl et al., 2020). (3) Ryan & Haslam (2005) coined the term “glass cliff” to refer to a tendency for women to become board directors of failing businesses. Intuition and an awareness of others’ feelings are traits attributed to women according to stereotypes and are required in business crises (Bruckmüller & Branscombe, 2010). For instance, Hurley & Choudhary (2020) find support for glass cliff arguments in their work on the role of gender (CFOs and boards) in risk taking in US listed companies. The three elements form a coherent framework of gender inequality at the upper echelons of business power, as found by Bruckmüller & Branscombe (2010). In their experiments, stereotypes are found to be maintained in successful firms managed by men (“think manager—think male”), making certain posts inaccessible to women (“glass ceiling”); however, stereotypes about what constitutes a good leader change in the case of unsuccessful firms, which seem to require leader traits more closely reflecting female stereotypes (“think crisis—think female” and “glass cliff”). (4) Finally, a perverse effect of gender bias is the “queen bee syndrome,” whereby a woman in a power position distances herself from women colleagues, preventing her from defending women's equal treatment to avoid men colleagues’ criticism and rejection (Diehl et al., 2020). This syndrome takes place in countries with higher levels of competitiveness and ambition; that is, along with exhibiting traits associated with men, women managers may adopt masculine culture roles as a sign of adaptation (Uribe-Bohorquez et al., 2019).

In the workplace, invisible barriers affecting women take several forms because patriarchal culture affects how women are perceived, assigned to jobs, evaluated, and rewarded relative to men (Heilman, 2001; Huffman et al., 2010; Montgomery & Cowen, 2020). Thus, some authors have found that implicit gender biases emerge as a dislike of women's success, poorer evaluations, poorer performance ratings and less frequent rewards, leading to barriers to promotion (Diehl et al., 2020). In other words, women CEOs (as well as directors and managers) achieve less favorable personal career success outcomes, and Wang et al. (2018) found the important role played by cultural factors by country in moderating a considerable proportion of such career differences.

Returning to the three functions to be developed by boards of directors with an effect on firm performance—efficiency, decision-making style, and monitoring—we analyze how patriarchal attitudes interfere with the potential positive influences stated by human capital, stakeholder, resource dependence, and agency theories.

Patriarchal attitudes claim that women lack the “right” human capital for directorships (Carter et al., 2010). Specifically, one of our proxies for patriarchal attitudes is the proportion of people who agree or strongly agree with the idea “Men make better business executives than women do.” This idea has not been eradicated in any European country, and is equivalent to the pattern “think manager—think male” applicable to any power position in firms. With patriarchal attitudes biasing how women's knowledge, skills, experience, and performance are perceived and assessed (Heilman 2001; Huffman et al., 2010; Montgomery & Cowen, 2020), not only do they find it more challenging to access the board of directors but they also find it difficult to contribute these innovative and varied views coming from the diversity that should result in more informed high-quality deliberations (Atif et al., 2019; Huang & Kisgen, 2013). If women directors are treated as tokens (King et al., 2010) and their contributions are underestimated (Konrad et al., 2008), or they imitate patriarchal attitudes (queen bee syndrome) in their effort to avoid men colleagues’ criticism and rejection (Diehl et al., 2020), the potential effect of women directors’ differential human capital on board efficiency reasoned by human capital theory would be annulled.

As for the contribution to board decision-making, with patriarchal attitudes present in the workplace, the imitation of men's decision-making style (self-enhanced, oriented to achievement and power) (Adams & Funk, 2012; Adams et al., 2011) would not result in a better connection with stakeholders or a wide variety of external agents (Carter et al., 2003). Women on boards imitating their colleagues’ styles would not help the firm access additional critical resources (Elmagrhi et al., 2019). In contrast, women directors with a more self-transcendent style, oriented toward benevolence and universalism, would better connect with the firm's stakeholders. However, the patriarchal attitudes present in society would be biasing the perception that external agents have of the woman director (Heilman 2001), thus hampering the obtaining of additional critical resources for the firm. Therefore, even if women directors show a differential pro-stakeholder decision-making style, patriarchal attitudes would interfere with breaking the link between stakeholder theory and resource dependence theory.

Regarding the contribution to board monitoring ability, the first option, as in the previous two contributions of directors on boards, is that in the context of patriarchal attitudes in the workplace, women directors imitate the monitoring attributes of their men colleagues (queen bee syndrome) to avoid criticism and rejection (Diehl et al., 2020). In this case, the absence of diverse directors’ monitoring attributes does not benefit a firm's economic performance. On the contrary, diversity reinforces the board's monitoring role if women directors add more independent contributions, better managerial accountability (Adams & Ferreira, 2009; Adams et al., 2011; Brahma et al., 2020), or better control of excess risk (Datta et al., 2021). However, these potential reasons for better monitoring would disappear when women directors’ differential contributions are undervalued by their men colleagues and are not applied to the firm.

Regarding the three groups of decisions of boards of directors, the imitation of men directors’ traits by women directors in the context of strong patriarchal attitudes is explained by legitimacy (Deegan et al., 2002) and institutional theories (Grosvold & Brammer, 2011). According to legitimacy theory, a firm's reputation depends on its commitment to values in the surrounding society (Elmagrhi et al., 2019), and according to institutional theory, firms comply with pressures and expectations from formal and informal institutions (Scott, 1995). The evolution of societal boundaries and norms as well as regulations (Grosvold et al., 2007; Parboteeah et al., 2008) in respect to gender toward a non-patriarchal culture would make the imitation pattern unnecessary, but in the meantime, these theories support the queen bee syndrome as a way for women to fit in a masculine workplace.

The undervaluation of women's contributions to the board of directors by their colleagues and the firm's stakeholders can be explained through the behavioral theory of boards in a patriarchal culture. According to this theory, the functioning of the board of directors results from interactions inside and outside the boardroom, and decision-making and control mechanisms result from coalitions, bargaining, and cooperation (Van Ees et al., 2009). During interactions between women directors and their colleagues and stakeholders, patriarchal attitudes present in society and the immediate workplace exert their adverse or harmful influence. Several theories in the field of social psychology justify the moderating role of patriarchal cultures. These theories include expectation states theory, social dominance theory, system justification theory, and social identity theory (Uribe-Bohorquez et al., 2019). Concerning gender and status hierarchies in the workplace, expectation states theory predicts the influence of negative attributions (lower competence, less useful information, or experience) that colleagues and stakeholders can associate during negotiation with a woman counterpart, and the woman's legitimate expertise may not always annul this effect, resulting in women not being board members who are listened to (Konrad et al., 2008; Ridgeway, 2001). Social dominance theory explains how gender inequality in patriarchal societies perpetuates through institutional discrimination, aggregated individual discrimination, and behavioral asymmetry (Sidanius & Pratto, 2004). System justification theory states that the defense and justification of a gender inequality status quo serve to satisfy some underlying needs of patriarchal societies. However, this inequality can be disadvantageous to women (Jost et al., 2004). Social identity theory predicts ingroup favoritism by considering gender differences in status and legitimacy in patriarchal societies (Tajfel, 1979; Terjesen & Sealy, 2016).

Patriarchal attitudes work through the necessary interactions of women directors with stakeholders and other board members during the development of the three groups of board functions. Based on legitimacy and institutional theories, as well as the behavioral theory of boards and social psychological theories such as expectation states, social dominance, system justification, and social identity, we hypothesize a negative interference on the positive effect of gender diversity on firms’ economic performance predicted by human capital theory for board efficiency, stakeholder and resource dependence theories for board decision-making style, and agency theory for board monitoring ability. These phenomena result in an inefficient assignment of human capital, which, according to resource theory, results in poorer firm performance, all else being equal. Consistent with this reasoning, Post & Byron (2015) point out that the gender parity reached in every country is a determinant of the effect that gender diversity can have on firm outcomes. An extensive meta-analysis on the effects of women's business leadership on financial performance conducted by Hoobler et al. (2018) finds support for a more likely positive influence in cultures with more gender egalitarianism. We thus predict that a cultural gender bias toward patriarchal attitudes has a hampering effect on the relationship between gender diversity and firm performance.

H1: A context with patriarchal attitudes mitigates the positive association between gender diversity and economic performance.

Despite advances made in regulations over the past twenty years in many countries to encourage women to incorporate into corporate boards, imposed as recommendations in some cases and as legislative quotas of 30%-40% in others (Brahma et al., 2020), the percentages are still far from desirable levels and can be considered no more than tokens in many cases. This unequal evolution of the quotas imposed or recommended by regulation and the effective ones reached in practice suggests a divergence between formal and informal institutions (institutional theory) and different levels of legitimacy between the regulator's intention and that of the members of society in charge of the application of the rules (legitimacy theory). We hypothesize that this divergence comes from the patriarchal attitudes in the society where the firm is established and operates, affecting its upper echelons and stakeholders.

According to the Gender Equality Index of 2019 (EIGE, 2020), women constitute 28.8% of boards of the largest quoted companies, supervisory boards and boards of directors. This level constitutes a remarkable improvement from that of 2010, when the proportion was 11.9%, but progress has been heterogeneous, concentrating in countries with legislative or other mandatory actions. France is the only European Union Member State with more than 40% of each gender on combined boards; women account for more than a third (33%) of board members in only four Member States (Italy, Sweden, Finland, and Germany); in ten Member States the proportion ranges from 20% to 33%; and in 13 Member States women account for less than 20% of board representatives, with percentages being lower than 10% in Malta, Greece, and Estonia4.

Although women in power positions serve as a sign of positive change toward equality for other women (Hoobler et al., 2018), the insightful work of Kanter (1977) suggests that the mere presence of women in such positions is not enough. The gender proportion within a work group determines an individual's experience as part of a minority (Hoobler et al., 2018). According to expectation states, social dominance, system justification, and social identity theories, in a work context of patriarchal attitudes, a woman would be attributed negative traits, which would affect her interactions with colleagues and stakeholders (behavioral theory of boards). This discrimination and asymmetry would tend to perpetuate, normalized as the status quo by the dominant group. In line with this reasoning, King et al. (2010) found that a woman accessing a post as a token to fill a ‘gender’ post may suffer social isolation and a psychological climate of gender inequity5 (pushing women to create the “queen bee syndrome”). Furthermore, King et al. (2010) find that the psychological experience of gender inequity has a negative effect on women's job satisfaction, affective commitment, and helping behaviors in parallel with their stress and turnover intentions.

An increasing proportion of women on boards acts against patriarchal attitudes within the board of directors and, subsequently, within the firm. The presence of two, three or more women on a board of around ten people first modifies the ingroup and outgroup of the only group of men directors (social identity theory). More active participation of women required when the proportion of men decreases would contribute to undermining the effects described by other social psychological theories (expectation states, social dominance, and system justification). The literature seems unanimous in supporting critical mass theory, which refers to positive change occurring in minority groups. Synthetically, Kristie (2011) summarizes this theory as follows: One female director on the board serves as a token, two form a presence, and three form a voice (Liu et al., 2014). Therefore, the effect of the presence of women directors on a board's decision-taking remarkably increases when the extent of this presence grows starting from a very small proportion (Torchia et al., 2011). For instance, for a sample of FTSE 100 firms, Brahma et al. (2020) find that gender diversity positively affects a firm's financial performance in an unequivocal and highly significant way when three or more women are part of a board of directors. Joecks et al. (2013) use a women presence of 30% (approximately 3 in absolute number as the average for the sample) or more to test critical mass theory and find a related improvement in firm performance after this critical mass is reached. Hence, women's perceptions of an inequitable gender climate in relation to tokenism would affect work outcomes. Critical mass theory suggests that the number of women on a board affects their representation, requiring at least three women to be present on a board to achieve a significant positive improvement in a firm's performance.

The question not previously addressed is whether a critical mass is able to annul or just counteract patriarchal attitudes inside the workplace. On the one hand, a significant proportion of women should indeed take part in negotiations and decision-making on the board, thus producing a substitution of expectations with negative attributions by the appreciation of women's real contribution and performance (Konrad et al., 2008), thus reducing the effect identified by expectation states theory. The reduction in disequilibrium between both groups (men and women) on the board plays a relevant role in undermining the effect of social identity theory, as well as the social dominance and the system justification theories. On the other hand, the positive effects of reaching a critical mass do not affect patriarchal attitudes external to the firm. Therefore, during the interactions of women directors with the firm's stakeholders, according to legitimacy and institutional theories, patriarchal attitudes are expected to hamper negotiations and the obtaining of critical resources, independent of the proportion of women on the firm's board. As a result, we hypothesize a partially positive effect of critical mass to offset the negative effect of patriarchal attitudes on the relationship between gender diversity and firm performance.

H1a: In firms with three or more women directors on their boards, a context with patriarchal attitudes mitigates the positive association between gender diversity and economic performance more lightly than in firms with less than three women board directors.

We use an international sample of 1,103 listed companies from 18 European countries6 (Austria, Cyprus, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Italy, the Netherlands, Norway, Poland, Portugal, Slovenia, Spain, Sweden, and the United Kingdom) for 2005 to 2019. Data for financial ratios and on board characteristics were obtained from Thomson Reuters Eikon. The required data on patriarchal attitudes were obtained from the World Values Survey, while gender development and inequality indices were extracted from the Human Development Report.

Panels A and B of Table 1 show the sample distribution indicating the mean values of gender diversity by country and year, respectively7. Panel A shows significant variation in women's representation in listed firms across countries, highlighting Cyprus, Greece, and Slovenia as the countries with higher proportions of women on boards. At the other extreme of the sample, Austria and Germany are the countries with lower proportions of women on boards.

Sample distribution.

Panel B shows the level of gender diversity by year. The progressive and remarkable increase in the percentage of women on boards during the period under study (191%) starts from the lowest mean value (5.4%) in 2005 and reaches the highest mean value of the period (15.8%) in 2019.

The total average by country or year (approximately 12%) is much higher than the proportion found in studies of previous periods (i.e., 3.28% obtained by Campbell & Mínguez-Vera (2008) and 6.93% found by Reguera-Alvarado et al. (2017)). However, our sample of listed firms presents a worse situation than that of the largest listed firms analyzed by EIGE (2020). The 10.67% value obtained for our sample for 2010 is lower than the EIGE's value of 12%, and it is worrying that the improvement gained in the following years up to the 15.83% level in 2019 is far from the 26.6% level reached by the largest listed firms.

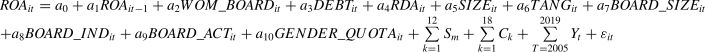

3.2Model and methodologyThe proposed model tests our hypothesis by examining the impact of board gender diversity on a firm's economic performance and the moderating effect of patriarchal attitudes on this relationship. In the model, a firm's economic performance is the dependent variable and is measured through ROA and Tobin's Q. Both ratios are extensively used as alternative measures of economic performance for listed firms (Bennouri et al., 2018; Brahma et al., 2020; Carter et al., 2010; Terjesen et al., 2016; Yang et al., 2019). However, Tobin's Q is a more complex measure. ROA takes only accounting data, relating the net income obtained every year with the assets used by the firm to produce those earnings. Tobin's Q takes accounting, and market data, relating the market's expected cash flows reflected in the firm's stock price (jointly with external financing) with the same total assets used. Therefore, Tobin's Q incorporates information on market participants’ expectations about future firm performance, which is an interesting source of the potential influence of external-to-the-firm patriarchal attitudes. The performance variable is lagged by one period to fit the methodology and avoid potential endogeneity. The proportion of women on a firm's board and patriarchal attitudes are the variables of interest. To explore each patriarchal attitude individually, we study the interaction between the proportion of women board members and four different proxies of patriarchal attitudes. Each model includes a patriarchal attitude as well as its interaction with the variable proxying for gender board diversity. In our baseline model, we measure board gender diversity from the proportion of women on a board of directors (WOM_BOARD), calculated as the ratio of the number of women to the total number of board members (Abad et al., 2017; Ahmadi et al., 2018; Li & Chen, 2018).

The moderating variables used in the model to test our hypothesis are based on the measures proposed by Davis & Williamson (2019) to explain levels of patriarchy in different countries. The use of different levels of patriarchal attitudes by country and year allows us to capture the evolution of the behavioral patterns attributed to sociocultural factors and to compare these factors to an international context. The four variables of patriarchal attitudes include the proportion of people who agree or strongly agree with the statement “Job scarce: Men should have more right to a job than women” (Men_job_right), the proportion of people who agree or strongly agree with the statement “Men make better business executives than women do” (Men_executives), the proportion of people who agree or strongly agree with the statement “Men make better political leaders than women do” (Men_politician), and the proportion of people who agree or strongly agree with the statement “University is more important for a boy than for a girl” (University_boy).

Our model includes two types of control variables. First, variables on firm characteristics are constructed with financial and accounting ratios. The second collection of control variables refers to board characteristics. Following previous studies (Botta, 2020; Brahma et al., 2020; Carpenter & Sanders, 2002; Nguyen et al., 2015; Uribe-Bohorquez et al., 2019; Kyaw et al., 2017), we set the control variables as follows. Financial characteristics include the leverage of the company (DEBT) calculated as the sum of short and long-term debt relative to total assets; research and development expenses (RDA) calculated as research and development expenses relative to total assets; the size of the firm (SIZE) calculated as the logarithm of total assets; and the tangibility of the firm (TANG) calculated as net property, plant, and equipment resources relative to total assets. Board characteristics considered in the model are as follows: board size (BOARD_SIZE) measured as the number of directors on a board; board independence (BOARD_IND) calculated as the proportion of nonexecutive board members of all members; and board activity (BOARD_ACT) measured as the number of annual board meetings. In addition, to analyze the effect of gender regulation by country, we have considered the gender quota law (GENDER_QUOTA), which is equal to 1 if the year after the country mandatorily applies the gender quotas in firms’ boardrooms, and 0 otherwise.

Finally, we include a set of industry dummies (Sm) considering the 12 Fama and French factors, a set of country dummies (Ck), and a set of time dummy variables (Yt). In addition, to avoid outliers, we winsorize all continuous variables at the 1st and 99th percentiles. The baseline model, including the widely analyzed relationship between women's participation on boards and firms’ economic performance [1], has been extended to test the effect of patriarchal attitudes on this relationship [2].

We use a dynamic framework, since it could be considered the most appropriate for studying the impact of board gender diversity on a firm's economic performance (Nguyen et al., 2015; Pathan & Faff, 2013). Adams & Ferreira (2009), Wintoki et al. (2012), and Brahma et al. (2020) have identified and addressed endogeneity in the relationship between board structure (including gender diversity) and firm economic performance. Following Wintoki et al. (2012) and Brahma et al. (2020), we address potential endogeneity by using a well-developed dynamic panel generalized method of moments (GMM) estimator, in particular the two-step system GMM approach (Arellano & Bover, 1995; Blundell & Bond, 1998).

4Results4.1Descriptive resultsTable 2 reports the statistics of the variables of our sample. The mean value for firm performance is approximately 12.41% when considering the accounting economic ratio (ROA) and is 162.91% when market performance (Tobin's Q) is analyzed. For gender diversity on boards, we document a mean value of 12.21% of women8 on boards (WOM_BOARD) for the listed firms under study. Finally, regarding board characteristics, we report a mean size of 10 members9 (BOARD_SIZE); meanwhile, the proportion of independent members (BOARD_IND) is approximately 43%, and the mean number of yearly board meetings (BOARD_ACT) is approximately 910.

Descriptive statistics.

Notes. The variables’ definitions are shown in the Appendix.

Table 3 shows the mean values for patriarchal attitudes by country. The percentages range from the 5.94% of population that agrees with the idea that the university is more important for a boy than for a girl to the 13.54% that agrees that men are better politician than women. In addition, 10.20% of the population agrees that men are more entitled to a job, and 12% thinks that men are better at serving as executives than women. By country, we find maximum values in Hungary, Greece, and the Czech Republic, which show more patriarchal attitudes, and minimum mean values in Sweden, Denmark, and Norway. Following Davis & Williamson (2019), we create a Patriarchal Attitude Index. It is a comprehensive measure constructed by extracting the first principal component of the four questions through the principal component analysis technique and standardized with a mean of 0 and a standard deviation of 1. A low (high) score for this index means lower (higher) levels of patriarchal attitudes. The average values for the total sample under analysis show stronger patriarchal attitudes as we ascend the power pyramid, consistent with the existence of a glass ceiling (Diehl et al., 2020; Ng & Sears, 2017) and likely supported by a lack of previous referents of women leaders (European Parliament, 2017). The fact that the lowest percentages by country appear for views on university education is promising, because more gender equality among students will transfer to the future job market and should affect positions of power in business and politics. In contrast, it is worrying that any percentage of such a view exists in Europe, especially concerning attitudes on gender inequality in access to university studies or jobs, as they affect all women. The high levels of dispersion found across countries are also worrying because even regarding equal access to university studies, despite an average of 8%, the value is surprisingly close to 30% in Slovakia, approximately 20% in Romania, and higher than 10% in ten other countries. Social dominance and system justification theories explain the persistence of patriarchal values and the resistance and delay in adopting as society's norms (informal institutions) the regulation and guidelines issued by supranational (i.e., United Nations, European Commission) and national authorities (formal institutions).

Patriarchal attitudes by country.

Notes. The variables’ definitions are shown in the Appendix

The correlation matrix for the dependent and explanatory variables is reported in Table 4, indicating the validity of the inclusion of the studied variables in the model since they are far from highly correlated11. The negative correlation between firm performance and women's board participation found for both economic and market measures could indicate a lower performance derived from women participation (in line with previous evidence such as that from Adams & Ferreira (2009) and Yang et al. (2019)) or, alternatively, more participation from women in poorer performing firms according to the glass cliff effect (Bruckmüller & Branscombe, 2010; Hurley & Choudhary, 2020; Ryan & Haslam, 2005). We highlight the negative sign of the correlation between the patriarchal-attitude variables used and the proportion of women board members, in line with the transmission of patriarchal values from the broader social context—that is, from the culture of the society in the country where the woman lives (Hoobler et al., 2018), to the local social context of her workplace (Diehl et al., 2020).

Correlation matrix.

Notes. The variables’ definitions are shown in the Appendix. *p<.05.

We have checked that the baseline relationship between women's participation on boards and firms’ economic performance is positive for our sample and period (Table 5, column 1). The results obtained by applying model [2] proposed in Section 3.2, in which patriarchal attitudes are included, are shown in Table 5 (columns 2–6). We analyze the effect of patriarchal attitudes on the relationship between board gender diversity and economic performance proxied by ROA. Column 1 reports the results obtained from the regression including the indicator for board gender diversity, patriarchal attitudes exhibited by the statement "Jobs scarce: Men should have more right to a job than women," and the interaction between gender diversity and this patriarchal attitude. In columns 2, 3, and 4, the following patriarchal statements are respectively studied: “Men make better business executives than women do,” “Men make better political leaders than women do” and “University is more important for a boy than for a girl.” In the last column, we show the effect of the Patriarchal Attitude Index (PAI) on the relationship between ROA and board gender diversity.

ROA, board gender diversity, and patriarchal attitudes.

Notes. The variables’ definitions are shown in the Appendix. We report the estimated coefficients and associated standard errors in parentheses. ***p<.01. **p<.05. *p<.10.

The positive relationship found from the multivariate analysis of women board participation12 and a firm's economic performance is in line with most results provided by related research (Bennouri et al., 2018; Brahma et al., 2020; Liu et al., 2014; Terjesen et al., 2016). The results suggest a stronger effect of positive reasons for gender diversity, such as additional knowledge and experience contributing to board advisory abilities (Atif et al., 2019; Carter et al., 2003; Jeong & Harrison, 2017; Miller & Triana, 2009; Post & Byron, 2015; Reguera-Alvarado et al., 2017), in line with human capital theory (Terjesen et al., 2016), new viewpoints and improvements made to the decision-making role of boards (Adams & Funk, 2012; Adams et al., 2011; Bruckmüller & Branscombe, 2010; Jeong & Harrison, 2017; Loyd et al., 2013; Post & Byron, 2015), and better access to critical resources (Carter et al., 2003; Elmagrhi et al., 2019), in line with stakeholder and resource dependence theories, and independent standpoints, managerial accountability, and risk control contributing to board monitoring (Adams & Ferreira, 2009; Adams et al., 2011; Brahma et al., 2020; Datta et al., 2021), in line with agency theory (Carter et al., 2010).

For the effect of patriarchal attitudes on the above relationship, the coefficients indicate that the board gender diversity of firms in countries with stronger patriarchal attitudes has a significant and negative effect on economic performance for the four variables and the index. For instance, in column 2, at average values, the joint effect of coefficients 0.0592 and -0.6810 produces a result of close to zero and a negative effect. This joint effect on ROA is positive at the lowest levels of patriarchal attitude (+0.7%) but offsets and becomes negative as patriarchal attitudes grow stronger. Our results indicate that the gender culture present in patriarchal societies (Hoobler et al., 2018) is also present in the workplace (Diehl et al., 2020), as expected considering the necessary commitment of firms with values in the surrounding society, which is stated by legitimacy theory (Elmagrhi et al., 2019), and the compliance with society's expectations and pressures, which is explained by institutional theory with respect to informal institutions (Scott, 1995). The observed negative effect of patriarchal attitudes, which offsets or even turns negative the relationship between women's board participation and firm performance, supports our first hypothesis and suggests that invisible barriers facing women concerning how they are hired, assigned to jobs, assessed, and rewarded at work (Diehl et al., 2020; Heilman, 2001; Huffman et al., 2010; Montgomery & Cowen, 2020; Wang et al., 2018) would be present in countries with patriarchal attitudes and would reduce the potential positive effect of women's board participation on firm performance (Post & Byron, 2015). Whether women on boards try to fit in by imitating men's traits and styles to gain legitimacy in line with institutional and legitimacy theories or women's differential contributions are underestimated by colleagues and stakeholders, according to expectation states and social identity theories, the potential benefits of board gender diversity on firms’ economic performance would be annulled.

With the aim of providing robustness to our results, in Table 6, we use a market-based performance measure, Tobin's Q, as the dependent variable to replace the accounting proxy for economic performance (ROA) studied in the previous table. We show that board gender diversity has a positive effect on Tobin's Q significant at the 99% confidence level in almost all cases (except in the last column, in which the PAI is used). This result is in line with numerous previous empirical analyses (Brahma et al., 2020; Campbell & Mínguez-Vera, 2008; Carter et al., 2003; Reguera-Alvarado et al., 2017; Terjesen et al., 2016). However, when the interactions between women directors and patriarchal attitudes are analyzed, we find negative coefficients in all models, supporting our previous results. Thus, a higher proportion of women taking part in a firm's board also has a positive effect on a firm's economic performance when a market measure of performance is used, and again, if a firm is located in a country with strong patriarchal attitudes, the positive effect is offset and becomes a negative joint effect on performance. At the maximum values of the four patriarchal attitudes analyzed13, the deterioration of ROA with respect to its mean value is 19%, 12%, 3%, and 2%, whereas the deterioration of Tobin's Q with respect to its mean value is 29%, 18%, 39%, and 18%, respectively. The stronger effects on the market performance of the listed firms observed are consistent with the additional element present in market values (Bennouri et al., 2018) or how the market assesses women's board participation with the market being a part of society affected by patriarchal attitudes. This result is consistent with the moderation of this influence in the workplace of countries with high values of patriarchal attitudes through the firm-specific active gender management (Ng & Sears, 2017) likely induced by European regulations and guidelines. However, the moderation would not affect market-based measures, as the investors’ expectations would be biased by the strong patriarchal attitudes present in the society to which they belong. This trend of gender inequality in the perpetuation of patriarchal societies is mainly supported by social dominance theory.

Tobin's Q, board gender diversity, and patriarchal attitudes.

Notes. The variables’ definitions are shown in the Appendix. We report the estimated coefficients and associated standard errors in brackets. ***p<.01. **p<.05. *p<.10.

To analyze the effect of patriarchal attitudes in more detail, we substitute the proportion of women directors on a firm's board with a measure of reaching a benchmark in board gender diversity as a variable of interest to test a sub-hypothesis. Thus, we follow recent papers such as Joecks et al. (2013), Liu et al. (2014), and Brahma et al. (2020), which examine women's representation on a firm's board considering critical mass theory proposed by Kramer et al. (2006). Supporting the main assumptions of critical mass theory that “one is a token, two is a presence, and three is a voice” (Kristie, 2011), we create a dummy variable (Critical_mass) equal to one when three or more women are on a firm's board of directors.

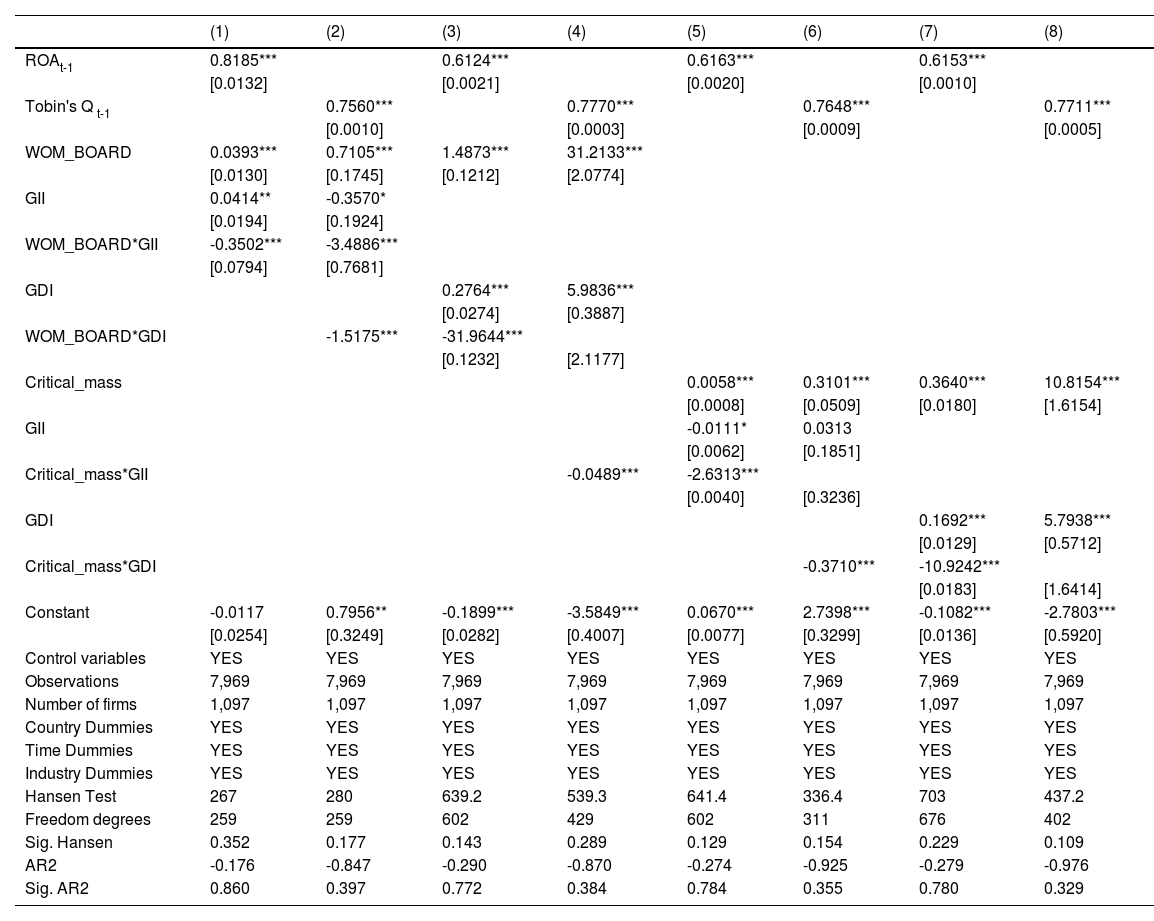

Tables 7 and 8 show the results of replicating the previous regressions (Tables 5 and 6) after replacing the gender diversity variable with the gender critical mass variable to consider the interactions between gender critical mass and patriarchal attitudes. Our results indicate that firms with three or more women on their boards show a significant and positive relationship with economic performance, in line with the lower influence of the negative attributes that colleagues can associate with women directors and a reduction of ingroup favoritism toward a decreasing proportion of men, according to expectation states and social identity theories, respectively. Supporting the results displayed in previous tables, the different proxies for patriarchal attitudes act as a powerful moderator of the relationship between a critical mass of women on boards and a firm's economic performance, offsetting the effect or turning it into a negative and stronger effect. At average levels, the contribution of women board participation to ROA is considerably stronger when a critical mass of at least three women on boards is reached, supporting our sub-hypothesis. This result is in line with the previous literature that has tested critical mass theory (Brahma et al., 2020; Joecks et al., 2013). Unfortunately, our results indicate that a critical mass of women on a board is not enough to protect a firm from the negative effect of patriarchal attitudes present in the firm's cultural environment, although at average values, the negative effect is generally weaker and the joint effect does not become negative in columns 3 and 5 of Table 7. These results are consistent with the lower effect of patriarchal attitudes in the work place, but a resilient negative effect derived from the second group of functions to be developed by boards of directors, in which interactions outside the boardroom (behavioral theory of boards) are required. In a patriarchal context, women directors would contact and negotiate with stakeholders with a biased perspective on their women counterparts, thus hampering the possibility of the firm accessing new critical resources. In this way, the stakeholders’ negative attributions of women directors, stated by expectation states theory, impede the woman director's commitment to the stakeholder's interests from translating into better access to critical resources, as both stakeholder and resource dependence theories predict.

ROA, board gender critical mass, and patriarchal attitudes.

Notes. The variables’ definitions are shown in the Appendix. We report the estimated coefficients and associated standard errors in brackets. ***p<.01. **p<.05. *p<.10.

Tobin's Q, board gender critical mass, and patriarchal attitudes.

Notes. The variables’ definitions are shown in the Appendix. We report the estimated coefficients and associated standard errors in brackets. ***p<.01. **p<.05. *p<.10.

In contrast, in Table 8, a critical mass does not reduce the negative effect of patriarchal attitudes, and the joint effect is negative for the four variables at average values. Again, the results with Tobin's Q show stronger deterioration for the market-based ratio of economic performance (compared to the accounting-based ratio of economic performance) at the maximum values of the four patriarchal attitudes analyzed, indicating an additional effect of patriarchal values on this measure through investors’ expectations —that is, through the opinion of a wide group of members of the society unconnected with the firm's management and direction. These results also indicate a difference in gender culture between firms with a critical mass of women on the board and in the surrounding patriarchal societies.

4.3Robustness analysis4.3.1Gender inequality and gender development indicesTo test the robustness of the results presented in the previous sections, we use the Gender Inequality Index (GII) and Gender Development Index (GDI) to replace the patriarchal attitude variables as moderator factors of the relationship between economic performance and board gender diversity (considering the proportions of women on boards [the critical mass] shown in the first four columns [last four columns] of Table 9). Even though these two indices are not as specific in identifying patriarchal attitudes as our proxies, they gather some clear consequences of gender inequality and patriarchal attitudes, being much more adequate as robustness measures in our study than other general cultural measures such as the well-known Hofstede dimensions. The Gender Inequality Index measures several aspects of human development that have been found to be indicative of differences by gender, such as reproductive health (considering the maternal mortality ratio and adolescent birth rates), empowerment (calculated as the ratio of parliamentary seats occupied by women and the percentage of the adult population—distinguishing between men and women—with at least some secondary education), and economic status (calculated as the proportion of women and men participating in the labor force). A higher GII value indicates greater differences between men and women and therefore less gender equality. In addition, the GDI measures gender gaps considering the differences of three approaches: health, knowledge, and economic resources. The health approach is calculated as men and women life expectancy at birth; the knowledge or education dimension is captured by men's and women's expected years of schooling and men's and women's mean years of schooling for adults aged 25 and older. Finally, the economic dimension is measured from the estimated income earned by women and men. The index indicates whether women are less favored than men through these policies and how much improvement in human development by gender is needed. A higher GDI value denotes more gender gaps in human development.

Economic performance, gender diversity or critical mass, and gender inequality index or development index.

Notes. The variables’ definitions are shown in the Appendix. We report the estimated coefficients and associated standard errors in brackets. ***p<.01. **p<.05. *p<.10.

Despite the growing body of research evidence provided in the last decade concerning gender inequality in firms’ boards of directors, the relationship between women's presence in the upper echelons of business power and firms’ economic performance is still a contentious research issue.

Our work contributes to the research line that links women's participation in leadership positions in business and firms’ performance, which can be considered an internal source of pressure for gender equality at the upper echelons of business. Specifically, we analyze a critical moderator of this link: the presence of patriarchal attitudes. To construct a theoretical foundation on how and why patriarchal attitudes moderate the relationship between women's participation on boards and firms’ economic performance, we first build on theories that explain the potential positive contribution of women to the three groups of functions developed by boards of directors. These theories affect board groups of functions: human capital theory affect board efficiency, stakeholder and resource dependence theories affect board decision-making style, and agency theory affect board monitoring ability. We then identify two alternative options in the contribution of women to the three groups of board functions in the presence of patriarchal attitudes: imitation of men's traits and styles to avoid criticism and rejection in line with institutional and legitimacy theories, and undervaluation of women's contributions by their colleagues and stakeholders, according to the behavioral theory of boards in combination with expectation states, social dominance, system justification, and social identity theories, which are four complementary social psychological theories.

For an international sample of 1,103 listed firms from 18 European countries for the period of 2005–2019, our results show a positive relationship between gender diversity on boards and firm performance. The results remain for both accounting economic performance (ROA) and market performance (Tobin's Q). The effect of women's representation on boards of directors on firms’ performance seems to be addressed by a minimum representation of at least three women (a voice), in line with critical mass theory (Liu et al., 2014).

Echoing most of the research evidence, our results suggest that women directors produce better firm economic and market performance. According to the literature, reasons for a potential positive effect of gender diversity on boards over business economic performance are based on theories that support improvement at three action levels of board of directors: efficiency as an advisor, decision-making style, and monitoring ability. In essence, additional, new, and innovative pieces of knowledge and skills contributed by women to boards explain improvements in human capital at the advisory level; a self-transcendent style stressing ethics and risk aversion are the causes of more adequate stakeholder orientation in decision-making as a source of additional critical resources, and more independence and accountability result in better control or solving of agency conflicts as part of the role of women board members as monitors. However, in line with the contentious empirical evidence found in the literature, even if socially desirable, not only positive effects of women's presence on boards on firms’ performance can be expected from the second group of boards’ functions. For example, risk aversion can generate better financial conditions (with lower financial costs inducing higher profitability), but it can also result in less efficient capital allocation (with lower economic income due to lower NPV projects).

In terms of gender equality, if women directors produce better firm economic and market performance, firms themselves should tend to increase women's board participation, making mandatory rules and recommendations unnecessary, but this is not the case. The explanation of scarce available qualified women directors to hire can be discarded considering the lower salaries found for women (against the higher salaries expected for a shortage of highly qualified resources) (Huang & Kisgen, 2013). In the context of patriarchal attitudes generating gender inequality, the theoretical puzzle disappears, motivating us to study how gender contexts moderate the role of women board members in improving firms’ performance.

The gender context has been scarcely studied in this area of research, and available data are limited. In this study, we include four variables measuring patriarchal attitudes by country and year obtained from the World Values Survey and not previously used in research. They reflect the broad context (the culture of society) in which women live and work. As patriarchal attitudes are the origin of gender biases at work such as the “think manager—think male” view, “glass ceiling” view, “glass cliff” view, and “queen bee syndrome”, which result in a less efficient management of business, we interacted patriarchal-attitude variables ("Job scarce: Men should have more right to a job than women", “Men make better business executives than women do”, “Men make better political leaders than women do” and “University is more important for a boy than for a girl”) and the constructed Patriarchal Attitude Index to measure the effect on economic performance.

Our results show a consistent and significant moderating countereffect of all four proxies and the index for patriarchal attitudes on the baseline positive relationship between gender diversity on boards and firm performance (for both ROA and Tobin's Q). This is explained by the effect of patriarchal attitudes applied by the counterparts of women directors during interaction inside and outside the boardroom, as stated by the behavioral theory of boards. Inside the boardroom, interactions involve negotiating with men directors, whereas, outside it women directors interact with stakeholders. With patriarchal attitudes, both in the workplace and in the surrounding society, the moderating negative effect on firm performance can be explained in two ways. First, institutional and legitimacy theories justify a woman's imitation pattern of masculine traits and styles (queen bee syndrome) to avoid criticism and rejection, but also entry of differential women's contributions. Second, when women do not adopt defensive imitation of masculine patterns, expectation states and social identity theories explain the undervaluation of their differential contributions by counterparts with patriarchal values. When the market-based measure (Tobin's Q) is used, our results show a more intense effect of patriarchal attitudes owing to the incorporation of market expectations with respect to firm performance. This is consistent with the addition of negative attributions to women directors by external-to-the-firm members of a patriarchal society, as stated by the expectation states theory.

The effect of a critical mass of women on boards does not prevent the negative influence of patriarchal attitudes, although this effect is reduced when ROA is used to measure firm performance. These results suggest an asymmetrical reduction in patriarchal attitudes, which would be faster in the workplace where critical mass has been reached, likely in response to regulations and guidelines issued by formal institutions. This higher proportion of women on boards is a cause and consequence of a reduction of negative attributions inside the firm with respect to them and of less power and ingroup favoritism of men as the only legitimate group, as explained by expectation states and social identity theories, respectively. In contrast, the proportion of women on the firm's board does not reduce the patriarchal attitudes in the surrounding society. This applies to stakeholders acting as counterparts of the woman director, with negative attributions to women derived from patriarchal attitudes (expectation states theory) hampering the acquisition of resources and thus damaging the firm performance. In the case of investors participating in the stock market, the worse effect obtained with Tobin's Q is consistent with a slower evolution of gender equality and the disappearance of patriarchal values in society because of the low pressure to follow guidelines or regulations on gender, and the trend of patriarchal values to perpetuate and self-justify the status quo, as stated by social dominance and system justification theories, respectively. Our results are robust to the use of two alternative measures of cultural gender bias, GII and GDI.

With this work, we extend the still scarce theoretical analysis and empirical evidence that considers cultural values in society with respect to gender inequality and the resulting effect on the slow evolution of gender equality in work contexts. The first contribution of this work is a theoretical framework built on a combination of economic, organizational, and social psychology theories to explain the effect of patriarchal values on the potential contribution of gender diversity on boards to firms’ economic performance. It is relevant as it explains why and how discrimination may occur and how it damages a firm's economic performance. The second contribution to the literature is a new standpoint to tackle gender diversity in the upper echelons of business. We do not focus our empirical tests on the result of discrimination but on the cause: patriarchal attitudes. Our work is the first to show a link between patriarchal attitudes and the effects of the role played by women board directors on firm performance. Thus, we help explain the persistence of inequities in the workplace found by other authors (King et al., 2010) despite remarkable progress made over the last decade. The third and main contribution is using the four variables of patriarchal attitudes extracted from the World Values Survey and the construction of a Patriarchal Attitudes Index. Tested individually, the four attitudes refer to socially desired views on gender inequality of students at university, of workers in general, of firm executives, and of politicians and show a significant and negative effect on the relationship between board gender diversity and firm performance. The variables used as proxies for patriarchal attitudes are much more precise and informative than other indices, such as the GII and GDI applied in the robustness section of this work or Hofstede's well-known, more general cultural factors. Apart from the specificity of our proxies, it is worth noting the broad number of countries with available information and periodic performance considered, which allowed us to capture evolution over time and international comparability. The fourth contribution is a test of critical mass theory for a broad sample of European countries under this new standpoint of discrimination cause which is the presence of certain levels of patriarchal attitudes. Finally, the fifth contribution is the test of the commonly used economic performance measures ROA and Tobin's Q under a theoretical framework that explains the difference in results between accounting- and market-based measures in combination with the new standpoint focused on the cause of gender inequality.

Closely related to our main contribution concerning the results obtained with patriarchal attitudes as the cause of gender inequality with negative effects on firms’ performance, we derive implications mainly for two groups: first, policymakers and regulators in the process of reducing or eliminating gender inequality, and second, men and women in leadership positions of firms in those countries with remarkable levels of patriarchal attitudes. In both cases, they must be aware that fighting gender inequality is not just a matter of regulation (even mandatory and under an enforcement setting, which is the best possible scenario). It is not enough to achieve a workplace free of patriarchal attitudes, because women directors develop part of their functions through interactions outside the boardroom, and because the firm performance strongly depends on its reputation and ability to comply with society's expectations. In the case of listed companies on the stock exchange, market prices will immediately reflect this ability to fit into its society. Other implications of our study concern researchers and academics interested in gender inequality in the workplace, investors, and other stakeholders of firms located in countries with patriarchal values, as they should consider this factor in their analyses of firms.

Let us make a final reflection on the patterns identified in our study for patriarchal attitudes. We find decreasing patriarchal attitudes as we descend the power pyramid (from politicians to executives, from executives to workers, and from workers to university students). This pattern is encouraging given that the natural evolution from one group to the next will promote a reduction in certain attitudes toward gender. Current students will be future workers, executives, and politicians, and some current workers will be future executives and politicians. However, we find more reasons for concern, as no country in our European sample is free of patriarchal attitudes, and some countries show strong gender unequal preferences in every category.

Important future research avenues include the identification of factors contributing to reduced patriarchal attitudes in social and institutional contexts from mere recommendations to mandatory laws accompanied by tough enforcement actions as well as in workplace contexts. Studies may also focus on the disentanglement of gender traits from patriarchal attitudes to efficiently allocate human resources according to real capacities and the effects of patriarchal attitudes on the roles of women board members as advisors, monitors, and facilitators of critical resources outside the firm.

This work was supported by Spanish Ministry of Science and Innovation (grant numbers PID2020-114797GB-I00 and PID2021-124950OB-I00). We wish to thank the editor and the anonymous reviewers for their constructive suggestions, to Nuria Suárez, Inmaculada Aguiar, as well as the participants of the 32th International Congress of ACEDE, the XXXVI International Conference ASEPELT, the VI Workshop of Financial Economy of ACEDE, and the 45th EAA Annual Congress.

https://www.europarl.europa.eu/doceo/document/TA-8-2017-0073_EN.html

In this context, the term “manager” must be read in a broad sense, referring to leadership positions of firms, including members of top management teams, CEOs, and board directors.

Other essential-for-business traits that stereotypes attribute to men are independence and aggressiveness (Heilman, 2001).

To address gender imbalances in boards of directors, some Member States have legislated gender quotas, including France (40%); Belgium, Italy, and Portugal (33%); and Germany and Austria (30%). A softer regulation is applied in eleven other Member States (Denmark, Ireland, Greece, Spain, Luxemburg, the Netherlands, Poland, Slovenia, Finland, Sweden, and the United Kingdom). For part of this group, legislated quotas are restricted to state-owned companies. Greece, Slovenia, and Spain have applied regulations without enforcement measures. Other Member States have instead encouraged companies to self-regulate. In the remaining eleven Member States (Bulgaria, the Czech Republic, Estonia, Croatia, Cyprus, Latvia, Lithuania, Hungary, Malta, Romania, and Slovakia), no substantial government action has been applied (EIGE, 2020).

This term refers to women's perceptions of unfair favoritism for men exhibited by the policies, procedures, and events of organizations (social identity theory).

The final observations from the 18 European countries are all listed companies on the stock exchange after excluding observations with missing information on firm boards and patriarchal attitudes.

Our sample could be affected by an availability bias due to a higher inclination of firms to provide data on gender diversity when they better comply with official guidelines and/or regulation.

Atif et al. (2019) document a higher value of 13% for a sample of large US listed firms, whereas Bennouri et al. (2018) obtain a value of 10.72% for a French sample of listed firms more heterogeneous in size. The proportion obtained by Schopohl et al. (2020) for a UK sample is considerably lower (7.8%), as it covers a longer past period.

Similar board size values are evidenced for other international samples, such as Campbell and Mínguez-Vera (2008) and Uribe-Bohorquez et al.’s (2019) values of 10.75 and 10.71, respectively. Similar board size values are also observed for UK boards (10.5) by Brahma et al (2020) and for US boards (9.7) by Atif et al. (2019).

For an international sample, Uribe-Bohorquez et al. (2019) find a proportion of independent members of 31% and 8.2 meetings per year for 2006–2015. The French sample analyzed by Bennouri et al. (2018) shows a proportion of independent members of 27% and 6.4 board meetings each year for 2001–2010. Schopohl et al. (2020) document the same proportion (43%) of independent members for a UK sample for 1999–2017.