The study empirically investigates the relationship between corporate social responsibility (CSR) and organizational performance from the perspective of European multinational firms. Further, the study examines the effectiveness of corporate reputation as a moderator on CSR-organizational performance linkages. Final data comprised 340 responses collected from senior executives/managers working in European multinational firms. A two-stage approach was used to analyze the association: stage 1 involved theoretical model construction using the strategic paradigm of literature; in stage 2, hierarchical regression analysis was performed to examine the relevant relationships. Results have shown that CSR, when exercised towards external stakeholders, influences organizational performance. Moreover, this influence has been found to vary between well-established, reputable firms and business firms with weaker reputations.

CSR and its impact on organizational performance (OP) have received significant global research attention over the years (Jin & Drozdenko, 2010; López-Arceiz, Bellostas-Pérezgrueso, Moneva-Abadía, & Rivera-Torres, 2018; Miras Rodriguez, Carrasco Gallego, & Escobar Perez, 2014; Petrenko, Aime, Ridge, & Hill, 2016; Stanwick & Stanwick, 1998). However, several studies examining the direct relationship between CSR and organizational performance have provided inconclusive and ambiguous results (Margolis & Walsh, 2003; Mishra & Suar, 2010; Oeyono, Samy, & Bampton, 2011; Vogel, 2005.). While some studies reveal a positive relationship between CSR and OP (Abu Bakar & Ameer, 2011; Orlitzky, Schmidt, & Rynes, 2003; Van Beurden & Gössling, 2008), others have suggested that there is a negative relationship (Crisóstomo, Freire, & Vasconcellos, 2011; Malcolm, Khadijah, & Ahmad Marzuki, 2007). Some academic thought has established no relation between the two constructs at all (Aupperle, Carroll, & Hatfield, 1985). Although earlier research has offered meaningful insights into the direct association between CSR and OP, several studies suffer from some crucial limitations such as not considering the moderating variables which may have an effect on the CSR-OP relationship.

After reviewing the CSR literature spanning two and a half decades (1990-2015), Jamali and Karam (2018) revealed that 51% of studies were focused on the organizational level, 13% on the institutional level, and 9% on the individual level. The remaining 27% addressed two or more levels of analysis. It can be observed that fewer studies have been conducted on stakeholders’ perspectives such as those of employees, customers, and communities; therefore, more stakeholder-centric research in the CSR area is needed. Previous studies in different management domains have identified that the CSR towards the community, CSR towards the employee, and CSR towards customers are three main dimensions of CSR (Chaudhary, 2018; Farooq, Payaud, Merunka, & Valette-Florence, 2014; Nejati & Ghasemi, 2012). Organizational performance has also been found to be positively affected by these three dimensions (Berman, Wicks, Kotha, & Jones, 1999; Waddock & Graves, 1997).

The present study seeks to make a significant contribution to the CSR research domain by considering these three dimensions as independent variables so as to analyze their effect on organizational performance. This study also investigates the role of corporate reputation as a moderator in this relationship.

As a consequence of globalization, multinational firms have become increasingly concerned about their reputation as it relates to their social and environmental responsibilities, resulting in an influential trend towards CSR (Drucker, 1984; Perrini & Tencati, 2006; Porter & Kramer, 2002). Therefore, organizations are increasingly engaging in CSR activities to exercise and promote their environmental and social sustainability and accountability (Farache & Perks, 2010). As organizations consider CSR to be a set of sustainable practices within a multiple stakeholder framework, it is necessary to know its effect on overall organizational performance. However, in developed economies, very few efforts have been made to investigate CSR-OP links (Lindgreen, Swaen, & Johnston, 2009; Petrenko et al., 2016). The role of corporate reputation as a moderator between CSR and OP also remains unexplained, especially in the context of European firms where CSR is more active than in the US and other developed and developing economies (Welford, 2005).

A few studies have reported that CSR positively impacts organizational performance by enhancing corporate reputation among the various stakeholders (Fombrun, 1996; Greening & Turban, 2000). However, such studies fail to explain how corporate reputation moderates the relationship between CSR and organizational performance. Evidence has revealed that highly reputed firms were found to be best-practice organizations with regard to their reporting of sustainability information (Kim, 2011; Sotorrío & Sánchez, 2008). Conversely, Yoon, Canlı & Schwarz (2006) have remarked that firms with a poor reputation seem more interested in establishing a better reputation through CSR because it is believed that an organization’s socially responsible behavior positively enhances stakeholders’ perceptions.

Therefore, corporate reputation should be considered to be a moderator on the relationship between CSR and OP. This study argues that the relationship between CSR and a firm’s performance differs as per the firm’s reputation. Accordingly, this study tests the moderating influence of corporate reputation on the relationship between CSR and OP.

It is worth mentioning that highly reputed European firms, on average, present with a higher level of social behavior in comparison of U.S. firms (Sotorrío & Sánchez, 2008). Therefore, a sample of European firms could be helpful in demonstrating the moderating influence of corporate reputation on CSR-OP linkages. In the past, reputation was considered to be a moderator in other, different contexts such as consumer attitude and behavioral response, brand performance, customer satisfaction, and loyalty. (Boateng & Okoe, 2015; Helm & Tolsdorf, 2013). However, corporate reputation has never been tested empirically in terms of the CSR-OP relationship. Sufficient ground exists, therefore, to study the effect of this variable on the CSR-OP relationship. In this study, we analyze data from selected European multinational firms to establish the association between CSR and OP while considering corporate reputation as a moderator. With the help of strategic paradigm literature, we propose an inclusive model based on an association between CSR and OP. This study is thus vital for the analysis of the potentially complex relationship between CSR and OP, moderated by corporate reputation.

The present study contributes to the CSR literature by conceptually and empirically analyzing three CSR dimensions (CSR towards customer; CSR towards employee; CSR towards community) with relation to organizational performance, specifically in the context of European multinational firms. It also provides a theoretical perspective through stakeholder theory to explain why CSR impacts organizational performance. Firms can benefit from this study’s insights regarding how corporate reputation could moderate the relationship between CSR and OP. While other studies have examined the moderating influence of corporate reputation on the relationship between CSR and marketing variables (Boateng & Okoe, 2015; Helm & Tolsdorf, 2013), this study is the first to explore the moderating influence of corporate reputation on the relationship between CSR and OP.

The following sections provide the theoretical foundation and the hypotheses development process for all the selected variables, providing a background for the empirical analysis. Subsequently, the paper describes the methodology and the data collection method, as well as their analysis. This is followed by the results and the discussion of the findings with managerial implications. The last section presents the conclusion, along with the study’s limitations and suggestions for future research.

2Theoretical Foundation and Hypotheses Development2.1CSRCSR is a vital research domain in business ethics. Existing theories on CSR assume that business depends on society for existence, continuity, and growth. If businesses treat societies fairly, then societies are more likely to have a positive impression of businesses (Husillos, González, & Gil, 2011; Pedersen, 2010). CSR theories have been based on principles that emphasize doing the right thing to nurture a good society and environment (Hazlett, McAdam, & Murray, 2007; Zwetsloot, 2003). The CSR stakeholder theory provides the most compelling theoretical insights to conceptualize the term CSR and the present study also accepts this framework proposed by Freeman (1984). Freeman (1984) wrote in his book Strategic Management: A Stakeholder Approach that instead of having exclusively fiduciary duties towards stockholders, managers hold a fiduciary relationship with various stakeholders. According to Freeman (1984), stakeholders are groups that have a stake in or claim to the firm (customers, suppliers, employees, stockholders, and the surrounding community). Inspired by Freeman (1984), this study utilizes a three-dimensional structure of CSR, which mainly focuses on CSR directed towards the community (CSR1), employees (CSR2), and customers (CSR3). CSR1 is concerned with charity in communities, improvement in the quality of life, and financial support to the community (art, culture, education, health). CSR2 consists of the organization’s socially responsible activities for employee welfare. CSR3 comprises high-quality services, the flow of necessary information, complaint resolution, and satisfaction (Rettab, Brik, & Mellahi, 2009).

2.2CSR and Organizational PerformanceIt is very difficult to define the term organizational performance (OP) as organizations have many facets and frequently changing goals (Chow, Heaver, & Henriksson, 1994; Conde, Sampedro, Feliu, & Sánchez, 2013). Earlier studies have considered financial and non-financial performance to be elements of organizational performance (González & González, 2011; Waggoner, Neely, & Kennerley, 1999). Financial performance has been assessed through indicators such as sales growth, return on investment (ROI), return on asset (ROA), profit rate, return on sales, and earnings per share (EPS), whereas non-financial performance has been considered in terms of product quality, total quality management (TQM), marketing effectiveness, etc. In the literature, significant efforts have been made to analyze the relationship between CSR and OP (Pava & Krausz, 1996). Using meta-analysis, Orlitzky, Schmidt, and Rynes (2003) demonstrated a strong positive relationship between CSR and OP. The more a firm engages in CSR activities, the more likely it is to enjoy the resulting benefits, compared to those firms that do not engage in such activities. (Pava & Krausz, 1996).

As per a report by the Organization for Economic Co-operation and Development (OECD, 2011), an organization may derive a range of benefits by investing in CSR initiatives, such as (a) risk reduction; (b) organizational identification; (c) corporate reputation; (d) improved supplier network; (e) cost reduction; (f) increased total productivity and quality; (g) goodwill creation; (h) job performance; (h) customer loyalty; and (i) ethical culture. Hence, CSR is likely to provide more opportunities and mutual benefits to all stakeholders through consistent communication and a good corporate reputation. On the basis of previous research, we argue that CSR helps an organization to seize organizationally beneficial opportunities by creating a link between business and society.

2.3Stakeholder Theory of CSRThe stakeholder theory of CSR states that people who are affected by (or affect) a company's plans and actions tend to affiliate themselves with having participated considerably in the firm and its corporate social performance (Garriga & Melé, 2004; Pérez, López-Gutiérrez, García-De Los Salmones, & San-Martín, 2019). Earlier studies have cited five main stakeholders – shareholders, workers, customers, suppliers, and the community (Sturdivant, 1979). Some empirical research has also been done to determine best practices in corporate stakeholder relations (Bendheim, Waddock, & Graves, 1998; Agle, Mitchell, & Sonnefield, 1999; Mitchell, Agle, & Wood, 1997; Berman et al., 1999; Rowley, 1997; Ogden & Watson, 1999; Lee & Heo, 2009).

The stakeholder theory also became popular because the global economy is so tightly linked that decisions taken in one organization at one particular location can affect others at some other location and the ripple effects continue further from there. Accordingly, stakeholder theory is concerned with future generations taking sustainable development and society’s well-being into account, which further improves a firm’s reputation. Indeed, stakeholder theory relates to an organization’s ability to make ethical assertions on anyone affected by its decisions, whether it is a customer, employee, supplier, or an individual from the community. Once an appropriate set of stakeholders of an organization has been located, ethical implications result (Godos-Díez, Fernández-Gago, Cabeza-García, & Martínez-Campillo, 2014). According to this theory, the firm’s purpose is the maximization of profit on a collective bottom line, which is the total effect of a firm’s actions on all stakeholders. Hence, on the basis of stakeholder theory, it is contended that working towards socially responsible cooperation boosts an organization’s overall performance. As organizations’ central interest is the well-being of stakeholders, firms seek every possible opportunity in the competitive business world to augment organizational performance.

2.3.1CSR towards the community (CSR1)Community responsibility refers to the principle that a business organization must, apart from its primary purpose, engage in activities for the welfare of society (Henderson, 2007; Singh & Misra, 2020a). Such activities may include general community issues, rural development, agricultural activities, education, job training, conservation, environmental care, funding and promotion of art and culture, support for health, sport, unemployment, child care, and poverty eradication. There are several reasons that community responsibility is important when emphasizing the role of stakeholders in a discussion about CSR. Firstly, social activities directed towards social welfare and support focus on drawing stakeholders’ attention, enhancing the organization’s reputation, and positively influencing the stakeholders’ decisions in favor of the organization (Harjoto & Jo, 2011; Singh & Misra, 2020b). Kim (2014) also found that socially responsible activities help a company to manage external perception and maintain a good reputation. Secondly, CSR programs tend to focus on social initiatives at the local level, which helps enhance organizational performance in economic, social, and environmental terms (Garvin, McGee, Smoyer-Tomic, & Aubynn, 2009). Furthermore, such programs help to accommodate the local communities’ consent, which allows any company to operate (Singh & Misra, 2020c).

Over the last two decades, there has been a significant increase in firms’ efforts in terms of social causes (Walters, 2009). The major factor is, perhaps, that community responsibility has increased the organizational capacity and stakeholders’ cooperation directly through production facilities and the easier flow of supply chains and labor support, as well as indirectly through the political system (Wood & Kaufman, 2007). The literature on CSR asserts that business organizations perceive themselves as part of the community (Loza, 2004; Worthington, Ram, & Jones, 2006). It is not only the domestic corporations that place the community prominently in the CSR domain. Multinational firms also highlight the importance of community relations at local as well as global levels (De Chiara & Russo Spena, 2011).H1

There is a positive relationship between CSR towards community and organizational performance in the context of European multinational firms.

2.3.2CSR towards employees (CSR2)Many studies have considered CSR as a valuable strategic asset for the creation of a relationship with society (Esen, 2013; Fatma, Rahman, & Khan, 2015; von Weltzien Hoivik, 2011). However, despite its importance, the relationship of CSR with internal stakeholders has remained largely neglected (Morsing, 2006). In the marketing domain, some researchers have considered the influence of CSR on internal stakeholders (Balmer, Powell, Hildebrand, Sen, & Bhattacharya, 2011). They suggest that CSR can be categorized as internal and external, mainly based on the type of stakeholders with which CSR relates. Specifically, internal CSR relates to employee welfare and business ethics. When compared to other stakeholders, CSR towards employees may be expected to have a significant impact on job performance. Some existing theories on CSR and empirical research explain the connection between CSR practices and employee performance with significant insights into firm performance (Lee, Park, & Lee, 2013). Although these studies make a significant contribution to the literature, some limitations have been identified. For example, existing literature has mostly focused on employees’ perception towards CSR activities, rather than their participation in such activities (Ağan, Kuzey, Acar, & Açıkgöz, 2016; Choi & Yu, 2014). Also, the majority of work in this regard has been done through a cross-sectional research design that limits the researcher’s ability to infer causality (Chaudhary, 2018; Mensah, Agyapong, & Nuertey, 2017). Employees are internal stakeholders and often seek recognition within the firm; thus, they differ from external stakeholders. In light of these observations, this study hypothesizes:H2

There is a positive relationship between CSR towards employees and organizational performance in the context of European multinational firms.

2.3.3CSR towards customers (CSR3)Several studies suggest that CSR can improve firm performance. However, only a few studies examine the CSR-customer relationship (Loussaïef, Cacho-Elizondo, Pettersen, & Tobiassen, 2014). Both institutional theory and stakeholder theory suggest that a company’s actions appeal to the multidimensional approach, which considers customers to also be part of an economy, being members of the community and of the country in which they operate as consumers. Daub and Ergenzinger (2005) proposed the term ‘generalized customer’ to refer to people who acted not only as customers but also as potential members of various stakeholder groups that an organization needs to acknowledge. CSR delivers benefits for organizations by increasing customer-corporate participation, which is affected mainly by the degree of customers’ perception of, or how they specifically conceive the organization to be. When a company engages in certain CSR practices, they generate a higher degree of identification in customers with that company and, in turn, the customers start supporting that company. Sen and Bhattacharya (2001) stated that CSR positively affects consumer evaluation and that this effect was partially mediated by customer-corporate identification. CSR plays an essential role in determining the degree of stakeholders’ identification with the organization, which in turn influences stakeholders’ behavior towards the organization. If a firm fails to treat its customers fairly, then customers’ trust in the firm is reduced. Conversely, if an organization treats its customers fairly and ensures a high level of satisfaction through employees and management, then customers’ trust in it is more likely to increase. This would help in improving overall identification with an organization and improve organizational performance. Hence, the authors propose:H3

There is a positive relationship between CSR towards customers and organizational performance in the context of European multinational firms.

2.4Moderating Role of Corporate ReputationCorporate reputation is based on a set of attributes assigned to a firm and is inferred from its past actions and ability to deliver improved business results over time. It also relates to a stakeholder’s faith in the firm’s performance. A firm can enhance its corporate reputation through financial soundness, high-quality products and services, superior management, and market competitiveness. Turban and Greening (1997) built on social identity theory and stated that CSR practices positively relate to corporate reputation, which helps in attracting talented potential employees. However, social involvement differs across industries – some organizations focus more on environmental responsibilities while others try to meet stakeholders’ expectations so that the reputational effect can be positive. Furthermore, stakeholders believing in carrying out business operations that exercise social responsibility would be more likely to associate themselves with such a firm’s social practices, and more importantly, will strategize and sustain these practices in the most profitable way to the firm, so they benefit from its reputation. To corroborate this assertion, Saeidi, Sofian, Saeidi, Saeidi, and Saaeidi, (2015), Zhu, Sun, and Leung (2014), and Roberts and Dowling (2002) considered corporate reputation to be a mediator when analyzing the association between CSR and firm performance and found a positive relationship between these two. However, there is a substantial difference in the extent to which organizations derive their reputation by exercising CSR. Some scholars posit that highly reputed organizations are more oriented towards CSR than others (Kim, 2011; Sotorrío & Sánchez, 2008). Also, some researchers reveal that badly reputed firms are more inclined to CSR as they believe that by exercising CSR initiatives, they will enhance stakeholders’ perceptions of the firm’s reputation (Yoon, Canlı, & Schwarz, 2006). Socially responsible behavior and stakeholders’ positive perceptions have been identified as being able to shape the reputation derived from CSR. This could be explained in terms of stakeholder theory, which states that external stakeholders identify an organization’s reputation with socially responsible behavior. If an organization’s reputation is congruent with its corporate social practices, it leads to better organizational performance. On the basis of the discussion above, the authors hypothesize:H4

Corporate reputation moderates the relationship between firm-level CSR toward community and organizational performance in such a way that the association will be stronger for well-established firms with a good reputation.

H5Corporate reputation moderates the relationship between firm-level CSR toward employee and organizational performance in such a way that the association will be stronger for well-established firms with a good reputation.

H6Corporate reputation moderates the relationship between firm-level CSR toward customers and organizational performance in such a way that the association will be stronger for well-established firms with a good reputation.

3Data and MethodologyThe data were collected from European multinational firms located in India. In the context of an emerging economy, India is experiencing rapid economic growth, and when CSR became a mandatory obligation for organizations in 2013, more firms began to engage in socially responsible practices. As a result of the strong regulatory environment and the huge stakeholder response to CSR, this makes India a good location to study the effect of CSR on organizational performance. More importantly, multinational firms’ CSR initiatives in India had not previously been extensively studied, and when such studies were done regarding multinational firms, the majority was conducted in developed countries. Therefore, studying European multinational firms operating specifically in India can be valuable for demonstrating the influence of CSR on organizational performance from the point of view of these firms.

The organizations were selected on the basis of three criteria. Firstly, the organization had to be actively engaged in socially responsible activities reflected in their sustainability reports and CSR disclosures. Secondly, as mentioned by Gounaris (2005), information gathered from varied sources containing heterogeneity in the responses usually leads to stronger relationships within the investigated constructs. Therefore, this criterion was applied with regard to the selected firms representing a diversity of industries. Thirdly, the respondents’ willingness to provide the requested data was an important criterion. Senior executives/managers were asked to participate in the study and to name one or more managers who were equal to or senior to them. An 18-item questionnaire on the relevant variables – CSR, corporate reputation, and organizational performance – was prepared and circulated to all the participants. To construct the questionnaire, a pilot study was conducted with 25 managers with extensive experience in the area of CSR. The questionnaire was modified as per their suggestions and feedback at this stage.

The data were collected between April 15 and August 2, 2019, in two phases. In phase one, the questionnaire on CSR with regard to stakeholders (CSR towards customers, employees, and community) was distributed. After two weeks, researchers distributed the questionnaire on corporate reputation and organizational performance. For both rounds, surveys were handed out personally, resulting in a high response rate.

A total of 400 questionnaires were distributed to senior executives/managers of European multinational firms located in India. During data entry, 35 questionnaires were found to be incomplete and 25 responses were treated as outliers as the standard deviation for all these responses was zero. Therefore, these responses were removed from the data, leaving 340 (85%) usable ones. SPSS data analysis tools were used to assess normality, outliers, and common method variance. Furthermore, to deal with the problem of non-response bias issues, an independent t-test was performed on the data after they were divided into two equal groups according to their time of completion (Armstrong & Overton, 1977). The results showed that there was no significant difference between these two groups, thus indicating that the sample was free from non-response bias. Participation in the survey was voluntary and the responses were collected in the participants’ free time during working hours. The respondents’ information confidentiality was ensured. The final sample included 52 firms with 15 from in manufacturing, 7 retail units, 10 belonging to the healthcare sector, and 20 from the service industry.

Out of 340 valid responses, 32.94% came from manufacturing firms, 20.58% from retail firms, 15.58% from healthcare firms, and 30.88% from service industry firms. The average age of the firms was 18 years in operation and the revenue size between $200 million and $240,000 million, with 75% of them between $200 million and $50,000 million.

SPSS 25.0 was used for descriptive statistics, Pearson’s correlation coefficients, and the hierarchical regression analysis. Amos version 23 was also used for the confirmatory factor analysis (CFA) which was employed to validate the factor structure of the CSR, CR, and OP constructs. For testing the study hypotheses, the hierarchical regression method suggested by Cohen and Cohen (1983) was used to identify the moderating effect of corporate reputation on the relationship between CSR and organizational performance.

3.1Measures and AnalysisCSR was measured by eleven items on a five-point Likert scale, where 1 = Strongly disagree and 5 = Strongly agree. All eleven items were adopted from Rettab, Brik, & Mellahi (2009), Maignan and Ferrell (2004), in which they measured CSR towards community responsibilities, employee responsibilities, and customer responsibilities. To measure corporate reputation, a 3-item scale established by Fombrun and Gardberg (2000) was used. Four items developed by Deshpandé, Farley, and Webster (1993); Jaworski and Kohli (1993); Samiee and Roth (1992) were used to measure organizational performance. The measured reliability for community responsibilities scale items was 0.81, for employee responsibilities (α=0.87), for customer responsibilities (α=0.90), for corporate reputation (α=0.86) and for organizational performance, (α=0.85) (See Table 2). The range of the scales’ reliabilities lay between 0.85 and 0.91, consistent with Maignan and Ferrell (2004). The hypothesized research model is shown in Fig. 1.

Summary statistics with correlation.

| Mean | SD | CR | CSR1 | CSR2 | CSR3 | CRa | OP | |

|---|---|---|---|---|---|---|---|---|

| CSR1 | 3.21 | 0.96 | 0.81 | 1 | ||||

| CSR2 | 3.51 | 1.09 | 0.87 | 0.40** | 1 | |||

| CSR3 | 3.08 | 1.33 | 0.90 | 0.33** | 0.12* | 1 | ||

| CRa | 4.20 | 0.87 | 0.86 | 0.20** | 0.05 | 0.02 | 1 | |

| OP | 3.55 | 0.96 | 0.85 | 0.38** | 0.06 | 0.24** | 0.51** | 1 |

Significance of Correlations: (* p<0.050), (** p<0.010). CR adenotes Corporate Reputation.

Confirmatory factor analysis was used through SPSS AMOS to test the validity of 18 items. The results obtained through confirmatory factor analysis were χ2 (125)=246.818 p<0.00; CMIN/DF=1.975, RMSEA=0.054, NFI=0.934, CFI=0.966, and GFI=0.927 respectively. Each factor loading was statistically significant at P<0.00 and values of factor loading were greater than the suggested value 0.5 (Fornell & Larcker, 1981).

Research has shown that firms’ size, age, and nature of industry influence their performance (see Saeidi et al., 2015; Galbreath & Shum, 2012; Liao, 2016; Orlitzky, Siegel, & Waldman, 2011; Lee, Faff, & Langfield-Smith, 2009). Therefore, this study has considered firm size, age, and industry nature as control variables. The details of control variables with firms’ characteristics are given in Table 1. The number of years of operation was used to measure the firm’s age, and the nature of the firm was measured by assigning the value of 1, 2, 3, and 4 to the manufacturing, healthcare, retail, and service sectors, respectively. The size was related to the firm’s revenue.

Sample characteristics.

| Variable | Groups | Percentage |

|---|---|---|

| Firm’s Characteristics: | ||

| Firms’ Size | ||

| Below $50000 million | 75 | |

| $50000 million to $ 100000 million | 15 | |

| More than $ 100000 million | 10 | |

| Firm Year | ||

| Up to 15 years | 37 | |

| More than 15 years | 63 | |

| Sector | ||

| Manufacturing | 29 | |

| Retail | 14 | |

| Healthcare | 19 | |

| Service | 38 | |

| Respondents’ Profile: | ||

| Job Profile | ||

| Owner/MD/GM/DGM | 13 | |

| Director/AGM/CFO/CMO | 21 | |

| Regional Manager/Branch Head | 30 | |

| Departmental Head | 36 | |

| Level of Academic Qualification | ||

| Ph.D. | 4 | |

| Masters | 52 | |

| Professional | 37 | |

| Bachelors | 7 | |

| Years of Experience | ||

| Below 10 years | 23 | |

| 10 – 20 years | 42 | |

| Above 20 years | 35 |

As shown in Table 2, mean scores for CSR1, CSR2, and CSR3 indicate that managers have favorable perceptions of sustainable activities conducted by business firms. Before estimating the hierarchical regression model, we measured the Pearson correlation coefficient for examining the independent variables’ association with the dependent variable. All three dimensions of CSR were found to show a very low to moderate correlation with each of them. Hence, a low correlation does not give rise to the multicollinearity problem. The dependent variable OP was found to have a significant correlation with CSR1 and CSR3, providing initial support to H1 and H3.

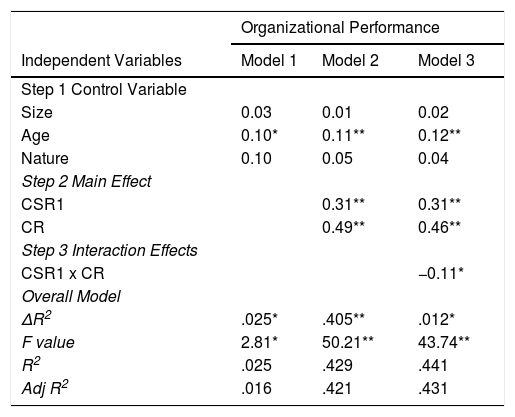

After correlation, the hierarchical regression model was run to analyze the relationship between CSR and organizational performance. In the first step, control variables (company size, age, and nature) were examined to control for their special effects statistically. Only age was found to have a significant association with the measures of organizational performance. Thus, it was shown that entering the Indian market earlier helps a firm to achieve better organizational performance through CSR. Surprisingly, all control variables together accounted for negligible variance in organizational performance (See R2 in model 1, Tables 3–5).

Impact of CSR1 on organizational performance.

| Organizational Performance | |||

|---|---|---|---|

| Independent Variables | Model 1 | Model 2 | Model 3 |

| Step 1 Control Variable | |||

| Size | 0.03 | 0.01 | 0.02 |

| Age | 0.10* | 0.11** | 0.12** |

| Nature | 0.10 | 0.05 | 0.04 |

| Step 2 Main Effect | |||

| CSR1 | 0.31** | 0.31** | |

| CR | 0.49** | 0.46** | |

| Step 3 Interaction Effects | |||

| CSR1 x CR | −0.11* | ||

| Overall Model | |||

| ΔR2 | .025* | .405** | .012* |

| F value | 2.81* | 50.21** | 43.74** |

| R2 | .025 | .429 | .441 |

| Adj R2 | .016 | .421 | .431 |

(* p<0.050), (** p<0.010) (All β values are standardized Coefficients).

Impact of CSR2 on organizational performance.

| Organizational Performance | |||

|---|---|---|---|

| Independent Variables | Model 1 | Model 2 | Model 3 |

| Step 1 Control Variable | |||

| Size | 0.03 | 0.03 | 0.03 |

| Age | 0.10* | 0.10* | 0.11* |

| Nature | 0.10 | 0.07 | 0.07 |

| Step 2 Main Effect | |||

| CSR2 | 0.03 | 0.03 | |

| CR | 0.55** | 0.55** | |

| Step 3 Interaction Effects | |||

| CSR2 x CR | −0.09* | ||

| Overall Model | |||

| ΔR2 | .025* | .312** | .008* |

| F value | 2.81* | 33.83** | 29.15** |

| R2 | .025 | .336 | .344 |

| Adj R2 | .016 | .326 | .333 |

(* p<0.050), (** p<0.010) (All β values are standardized Coefficients).

Impact of CSR3 on organizational performance.

| Organizational Performance | |||

|---|---|---|---|

| Independent Variables | Model 1 | Model 2 | Model 3 |

| Step 1 Control Variable | |||

| Size | 0.03 | 0.02 | 0.02 |

| Age | 0.11* | 0.12** | 0.13** |

| Nature | 0.10 | 0.05 | 0.05 |

| Step 2 Main Effect | |||

| CSR3 | 0.25** | 0.25** | |

| CR | 0.55** | 0.55** | |

| Step 3 Interaction Effects | |||

| CSR3 x CR | −0.09* | ||

| Overall Model | |||

| ΔR2 | .025* | .375** | .009* |

| F value | 2.81* | 44.39** | 38.24** |

| R2 | .025 | .399 | .408 |

| Adj R2 | .016 | .390 | .397 |

(* p<0.050), (** p<0.010) (All β values are standardized coefficients).

In the second step, CSR and corporate reputation (independent variables) were entered. In this model, CSR (all three dimensions) and corporate reputation together with control variables, accounted for an average of 38% of the variance in organizational performance (See Tables 3–5). Among all three CSR dimensions, CSR1 and CSR3 were found to have a significant influence on organizational performance (See Tables 3 and 5). Thus, Hypothesis 1 and Hypothesis 3 were supported. CSR2 does not have a significant direct influence on organizational performance (β=0.03, P>0.05); hence, Hypothesis 2 was not supported.

Finally, to examine the moderating role of corporate reputation, interaction term (CSRxCR) was computed. Model 3 shows the results for the moderating effect of corporate reputation on all three dimensions of CSR (See model 3 in Tables 3–5). The coefficient value for the interaction term was negative and significant and the addition of the interaction term led to a significant change in R2. Thus, the significance of the relationship between CSR and organizational performance was found to be affected by corporate reputation but not as per our prediction. Hence, Hypotheses 4, 5, and 6 were not supported. Further, to rule out the presence of multicollinearity, variance inflation factor (VIF) values were analyzed. In the regression model, since the VIF values of the variables were less than ten, the multicollinearity problem was eliminated.

5DiscussionThe present study analyzed the impact of managerial perceptions towards CSR on organizational performance while considering corporate reputation as a moderator. Hierarchical regression models 1, 2, and 3 explain the aforementioned relationship and the moderating effect of corporate reputation. Despite previous studies on organizational performance, financial viability, and financial determinants, there are consistent questions as to how a company’s sole objective is not profitability, but that it also may be concerned about social and environmental goals. In this context, organizations’ determination to act as responsible players in society should be crucial. Empirical results show that CSR towards community and customers significantly impacts organizational performance. CSR towards employees, however, did not result in any significant direct relationship with organizational performance. Unfortunately, managers’ views in the context of CSR towards employees do not lead to a gain in organizational performance. Thus, the present study provides mixed support to the hypotheses. An interesting result of the study and contrary to our prediction is the negative and significant interaction between CSR (its dimensions) and corporate reputation. To better visualize this interaction, the relationship between the two (CSR and corporate reputation) is plotted at high and low levels (see Figs. 2–4). The further discussion on all six proposed hypotheses is provided hereafter.

CSR was proposed to significantly impact organizational performance. Regression model 2 of Tables 3 and 5 provided support for this proposition. Furthermore, our findings support a previous study by Petrenko et al. (2016) but challenge the findings of Crisóstomo, Freire, and Vasconcellos (2011) and Malcolm, Khadijah, and Ahmad Marzuki (2007), where organizational CSR was reported to have a negative impact on firm performance. Pava and Krausz (1996) conducted a study on twenty-one cases and found strong support for a positive relationship between CSR and organizational performance. Additionally, some research has been conducted on European multinational firms with a global focus, while a few studies do not mention a mathematical model when examining this relationship (Margolis, Khadijah, & Ahmad Marzuki, 2008; Margolis & Walsh, 2003). Luo and Bhattacharya (2006) argued that to know the real effects of CSR on financial performance, the omitted moderators should be part of the study. On the basis of the aforementioned logical claims and methodological gap, this study used corporate reputation as a moderator to show why and how CSR has a significant impact on organizational performance.

Initially, it was assumed that customers, community, and employees respond equally to CSR initiatives as such programs address their fundamental concerns for social, psychological, and functional wellbeing (Lee & Heo, 2009). The positive and statistically significant effect of CSR towards the community (CSR1) and customers (CSR3) on organizational performance support our first and third hypotheses, respectively (β for CSR1=0.31, P<0.01; β for CSR3=0.25, P<0.01). These results are consistent with the previous empirical studies conducted by Ağan et al. (2016) and Bai and Chang (2015), which show a positive relationship between CSR efforts towards external stakeholders and firms’ performance.

This study’s unexpected result was the finding that the effect of CSR2 (CSR toward employees) on organizational performance was not statistically significant. We reasoned that firms would be able to benefit from their CSR initiatives towards employees, in terms of employee commitment and morale that may encourage a positive attitude towards work. To better understand this finding, we carefully read the CSR reports of the organizations in the sample and found that 29 out of the 52 firms did not declare any CSR commitment towards employees, and only employment quality goals were mentioned. Furthermore, these companies had established their own foundations for the CSR initiatives and, generally, they were for the external stakeholders. We conjecture that perhaps this study was unwittingly focused on the perceptions of senior managers who were more engaged in strategic management, and more concerned with the external stakeholders than internal ones. This could be a possible reason that CSR2 could not be a successful predictor for organizational performance. However, in earlier studies, it was found that if an organization does not concern itself with CSR toward employees, then it means that it is neglecting the effect of underlying variables such as corporate ethical values, organizational commitment, organizational citizenship behavior, and job performance (Barrena-Martínez, López-Fernández, & Romero-Fernández, 2017; Celma, Martinez-Garcia, & Raya, 2018; Trivellas, Rafailidis, Polychroniou, & Dekoulou, 2019). Previous literature suggests that the level of employee commitment decreases if they feel that their organization is not exercising appropriate ethical and responsible behavior towards them (Porter & Kramer, 2006; Velando Rodriguez, Crespo Franco, & Santos, 2006). Sun and Yu (2015) found that employees prefer to work more productively in socially responsible firms and are even willing to work for less when they find that their organization cares for them. Peloza (2006) argued that an organization’s social and economic objectives need not be separate and distinct, hence it is believed that understanding the relation between CSR and employees is as important as it is for other stakeholders because the success of an organization largely depends on its employees. This study’s result regarding the influence of CSR2 on organizational performance challenges the findings of Wang, Huang, Gao, Ansett, and Xu, (2015), and Lee, Park, & Lee (2013), where perceived CSR was reported to positively influence organizational performance on the part of employees.

After examining the direct relationship between managerial perception towards CSR (dimensions) and organizational performance, this study empirically analyzed the moderating effect of corporate reputation on the association. The objective was to learn how corporate reputation interacted with CSR (dimensions) to determine overall organizational performance. Results of hierarchical regression model 3, as seen in Tables 3,4, and 5, indicate that the impact of CSR (dimensions) on organizational performance was dependent on the organization’s reputation. In this study, CSR motives have been found to differ among well-established reputed firms, and business firms with weaker reputations. While emerging firms generally view CSR as a positive attribute, the study confirmed that reputed firms view CSR as pressurizing – especially in India where CSR has become a mandatory legal requirement (Aggarwal & Jha, 2019). Hence, the strength of the association between all three CSR dimensions and organizational performance differed by the degree to which stakeholders valued corporate reputation and believed in its importance to business performance. A negative but significant beta for interaction term (CSR x corporate reputation) specified that the influence of all three CSR dimensions on organizational performance was robust in the case of a low reputation score and vice versa (Figs. 2–4).

This is the first study of its kind to prove that well-reputed, multinational European firms located in India have a different perception towards CSR in the multi-stakeholder framework. This finding counteracts the results of Alshammari (2015), where companies with a good reputation among stakeholders reported a stronger influence of CSR on organizational performance.

This study provides several insights into the various aspects of CSR and associated practices in an organization. Empirical findings reveal that positive perceptions of organizations’ social engagement lead to improved organizational performance, especially on the part of the community and customers. These findings will be useful for motivating managers to meet community and customers’ expectations for each dimension beyond their firms’ positive external image. The present study also focuses on managerial concerns about CSR towards employees, which allows management to manage and serve employees better. Furthermore, this study’s findings could help decision-makers to design effective CSR policies and investment plans to enhance organizational performance.

Previous studies also mentioned the importance of such relevance in terms of aspects of developing economies when considering the effects of CSR on firms’ performance (Amini & Dal Bianco, 2017; Laskar & Maji, 2016). Also, these studies placed their focus on community and customers’ evaluation of a company’s social efforts, as well as on these stakeholders’ evaluation of the overall organizational performance. Thus, with regard to managerial implications, this study suggests that organizations should consider CSR as the most significant predictor of all micro and macro factors affecting overall organizational performance.

6ConclusionFollowing the empirical findings mentioned above, we conclude that managerial perceptions towards CSR and social efforts by a firm are significantly related to the organization’s reputation, core values, and overall organizational performance. Based on the theoretical perspective of a strategic literature review, six hypotheses were tested through a hierarchical regression model. Survey findings revealed that CSR directed towards community and customers significantly predicted organizational performance. Managerial perceptions of CSR toward employees were found to not have any significant direct relationship with organizational performance. One of the interesting results of the study and contrary to our prediction was the negative and significant interaction of CSR and corporate reputation on the relationship between CSR and organizational performance. This moderating result especially shows how important it is for well-reputed business firms to consider CSR as the main influencing factor on organizational commitment. These results are similar to those of earlier studies carried out mainly in developed nations, which found a positive association between CSR and organizational performance (Abu Bakar & Ameer, 2011; Orlitzky et al., 2003; Van Beurden & Gössling, 2008).

Although the findings provide meaningful implications, this study has some limitations which are important to consider when interpreting the study’s outputs. Firstly, the study was based on a cross-sectional research design that has limits between exposure and outcomes. It is suggested that future studies include longitudinal and experimental research to establish an actual cause and effect relationship. Secondly, the study examined 52 firms to establish CSR-organizational performance associations. Future research could include more firms to gain deeper insights into the nature of this relationship. Thirdly, in this study, the researchers preferred using the conventional hierarchical regression for analyzing the moderation effect; they acknowledge the need for future researchers to retest their theoretical model with a structural equation modeling (SEM) path model of relationships.

Declaration of Competing InterestThe authors report no competing interest.

Funding SourceNo funding received from any agency or organisation for this research work.