Whether firms should perform manufacturing activities on their own or buy them from an external provider is a strategic question that many managers from all firm areas have historically asked themselves. The present paper seeks to address this question by developing a theoretical framework which can help managers evaluate sourcing decisions. After discussing a make-or-buy literature review on 7 prestigious academic journals, the most relevant determinants and theories supported from the literature are identified and illustrated within this framework. The results are subsequently outlined, our research work concluding with a reflection on the extent to which this paper can improve the academic understanding of make-or-buy approaches. Our results suggest that practitioners should combine the resource-based view, strategic management and transaction cost economics theories in order to assess manufacturing location decisions.

Even though the dilemma faced by managers when it comes to choosing insourcing or outsourcing specific products or services was studied by many researchers in the past, they failed to consider hybrid and plural sourcings. Whereas hybrid sourcing refers to the procurement of the entire volume from a single mode that exhibits mixed governance, plural sourcing results from the simultaneous use of insourcing and outsourcing (Jacobides & Hitt, 2005; Park & Ro, 2011; Parmigiani, 2007; Puranam, Gulati, & Bhattacharya, 2013). Not only the historical and dichotomous make-or-buy perspective should be taken into account by decision makers, but also hybrid and plural sourcing views as well as the creation of strategic alliances. Furthermore, a distinction needs to be drawn within make-or-buy decisions manufacturing activities and those associated with research and development (R&D) (Brem & Elsner, 2018).

According to Doz, Prahalad, and Hamel (1990), joint ventures provide low-cost, fast access to new markets by sharing risks and borrowing expertise from local partners. Managers and decision makers want to know both which factors are likely to influence a firm's decision to buy a specific part or service rather than to produce it internally and how the relevant factors should be evaluated to ensure that the right decision will be made, thus avoiding future problems and extra costs. A number of researchers have argued that quite a few make-or-buy decisions have an instinctive nature or are based on an ad-hoc response – without a predetermined plan – when an obligation exists to reduce cost and/or improve the quality of a product or service (Moschuris, 2007). The staff from R&D and quality departments, in addition to those working for controlling and legal departments, should play a relevant role as well (Brem, Gerhard, & Voigt, 2014). After all, the consequences of make-or-buy decisions can determine the firm's future.

During the last few decades, academic research on make-or-buy has rapidly evolved favoring above all the outsourcing option. Indeed, the extremely fast growth experienced by the make-or-buy research field has hardly left any room for scholars to carry out a global, thorough assessment of the research activity undertaken to date. This article has as its aim not only to provide a more comprehensive historical literature review about make-or-buy decisions, but also to analyze the determinants triggering those decision within the framework of supply chain management. The goal sought with our work is threefold: examining the extant literature available – insofar as it reveals both past and current trends – identifying possible gaps; and offering potential research opportunities for future researchers. The analysis of the literature will identify the most relevant journals in this area, additionally highlighting the most important determinants, as well as the most commonly supported theories and trends in the make-or-buy literature.

2Literature review approachOur work process began with the systematic identification of renowned academic journals in the field of make-or-buy decisions – also referred to as insourcing or outsourcing decisions in the literature. A search for the keywords “make-or-buy” and “insourcing or outsourcing” in academic databases was performed, following a database search methodology similar to the one adopted by Durst and Edvardsson (2012); and Butkovic, Kauric, and Mikulic (2016). In particular, this review sought to screen the existing studies (published in the period comprised between 1982 and 2017) by means of three databases – ProQuest, Scopus and Web of Science – chosen because of their strong reputation when it comes to academic articles.

Articles and publications dealing with make-or-buy decisions were listed on a spreadsheet along with some basic information, namely: author; country of origin provenance; topic; and year of publication – with the possibility of including additional comments. Our electronic search was completed with a manual one, especially focused on tracing the papers cited in the bibliography of the previously selected articles.

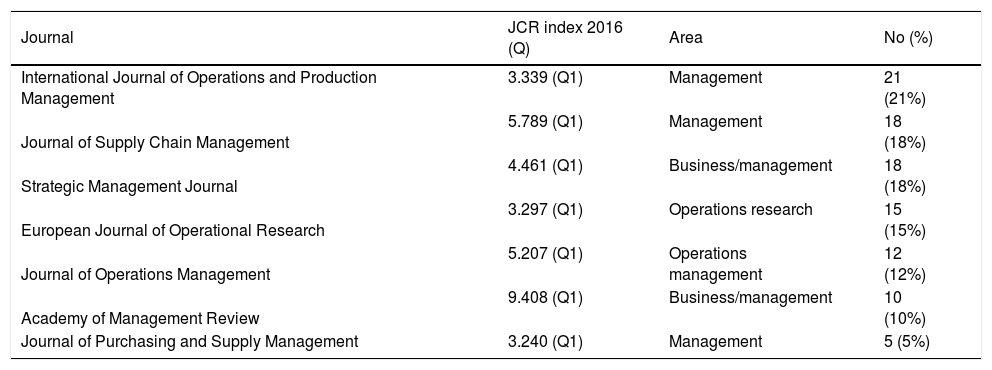

The journals which serve as the basis to analyze the literature revolving around make-or-buy decisions fulfill the requirement of appearing in the databases mentioned above and in the Journal Citation Report (JCR) database. The impact factor index of the reviewed journals is based on the data registered at the JCR published by Thomson Reuters in Q1-2016. The search for make-or-buy papers, which began without limiting their publication date, took place between January and February 2017.

The original sample of 123 articles was reduced to 99 articles, priority being give to articles based on empirical analysis and examinations of the topic over theoretical ones. Only articles from the journals listed in Table 1 were included. The aforesaid reduction meant eliminating articles which, by way of example, might have focused on marketing or physics rather than on our research topic. Working papers, reports and conference papers such as the Outsourcing Process and Theories from the POMS 18th Annual Conference held in Dallas (Perunović & Pedersen, 2007) and books like the Make vs. Buy revisited, reassesing your company's manufacturing strategy by the A.T. Kearney consulting Agency, were not considered (Monahan, Van den Bossche, & Tamayo, 2010). Previous literature review papers had also been exclusively based on the analysis of articles, leaving aside other sources, such as books or conferences (i.e. Gonzalez, Gasco, & Llopis, 2006). Thus, a total of 99 articles – listed in the Appendix (see Supplementary Materials1) – were finally analyzed.

Number of papers per journal.

| Journal | JCR index 2016 (Q) | Area | No (%) |

|---|---|---|---|

| International Journal of Operations and Production Management | 3.339 (Q1) | Management | 21 (21%) |

| Journal of Supply Chain Management | 5.789 (Q1) | Management | 18 (18%) |

| Strategic Management Journal | 4.461 (Q1) | Business/management | 18 (18%) |

| European Journal of Operational Research | 3.297 (Q1) | Operations research | 15 (15%) |

| Journal of Operations Management | 5.207 (Q1) | Operations management | 12 (12%) |

| Academy of Management Review | 9.408 (Q1) | Business/management | 10 (10%) |

| Journal of Purchasing and Supply Management | 3.240 (Q1) | Management | 5 (5%) |

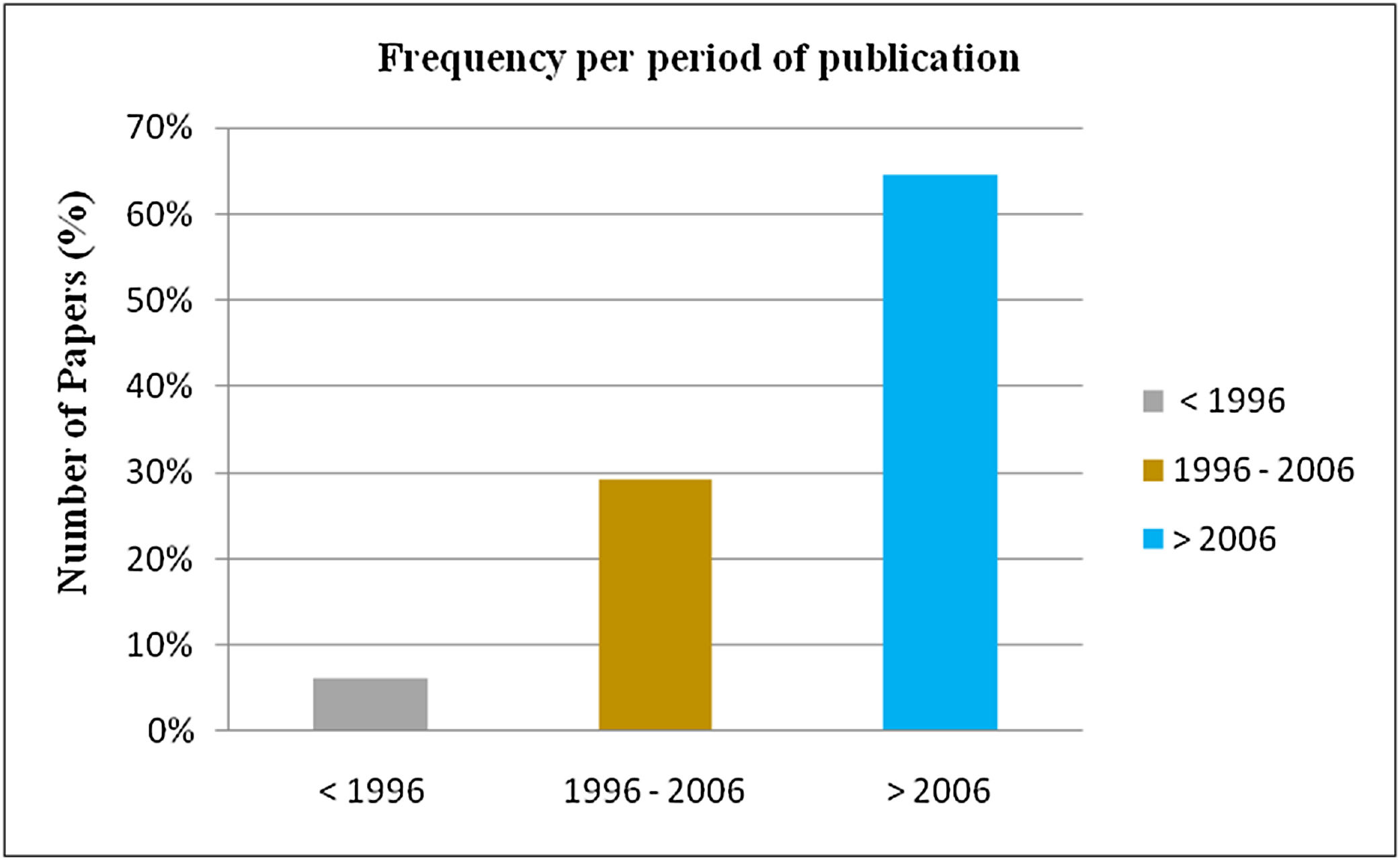

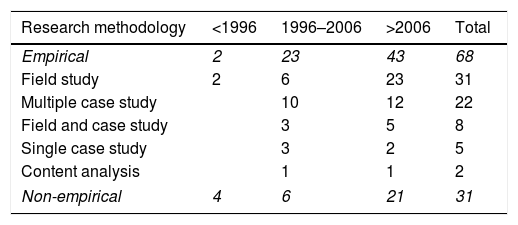

We analyzed 99 articles published during three decades, categorizing this period of time into three phases – shown in Fig. 1 – for the purpose of identify research trends over time. The first stage of our analysis, focused on papers published before 1996, revealed that only 6 articles (6% of the reviewed papers) were published in this period. The second stage of analysis dealt with articles published between 1996 and 2006 (29 articles, or 29% of those reviewed), and the third stage comprises articles published after 2006 (64 articles, or 65% of the total).

One of the relevant articles, authored by McIvor (2013), highlights the convenience of using the Transaction Cost Economics and Resource-Based View (TCE-RBV) theories to understand the manufacturing location decision. This author illustrated complementary and contradictory prescriptions of both theories, his article belonging to the third and most relevant stage for our research work (i.e. articles published after 2006). Fig. 1 illustrates a constant and steady growth in the publication of articles on make-or-buy decisions throughout the period under study. The preference for outsourcing may have influenced the outcomes of make-or-buy decisions too, the most outstanding aspect being the rising trend in the number of papers published after 2006.

Our findings reveal a considerable number of articles published in journals which combine the area of production with supply chain and strategic management (57 articles in all (21+18+18)). However, the relevance acquired by journals which deal not only with purchasing but also with management review (15 articles) should be taken into account as well. Table 1 lists the number of papers analyzed per journal, the International Journal of Operations and Production Management (IJOPM) appearing as the most prolific journal in relation to the make-or-buy subject, with 21 articles published (21% of those reviewed).

IJOPM is closely followed by Strategic Management Journal and the Journal of Supply Chain Management, both of them with 18 articles published, after which can be found the European Journal of Operational Research, with 15 articles published, and the Journal of Operations Management with 12 articles. Finally, the Academy of Management Review and the Journal of Purchasing and Supply Management published 10 and 5 of the articles examined, respectively.

3.2Research methods and relations3.2.1Research methodsThe papers were reviewed according to more than one dimension in this respect. After dividing them into empirical and non-empirical based on whether they applied some type of empirical method or not (Alavi, Carlson, & Brooke, 1989), we adopted the well-known empirical research categorizations (Van Horn, 1973) used in several research works with the aim to understanding the methods followed in the literature. The distinction between empirical strategies stems from the definition formulated by Yin (2017).

More specifically, while field studies answer such research questions as ‘who,’ ‘what,’ ‘where,’ ‘how many’ and ‘how much,’ case studies exclusively focus on ‘how’ and ‘why,’ obtaining data through direct observation, interviews or document analysis, amongst other procedures. The problem with this basically qualitative data collection method lies in the difficulty to generalize the results, derived from the limited number of organizations under study.

Instead, field studies analyze several organizations by means of quantitative methods and collect data through surveys, their drawback being that the information loses depth and richness in comparison with case studies (Gonzalez et al., 2006). We decided to follow the guidelines established by Seuring and Gold (2012) to identify articles which adopt a content analysis literature strategy. This is conducted by performing a descriptive assessment of the literature body according to specific analytical category patterns derived from a typical research process.

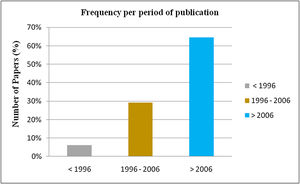

Table 2 illustrates the frequency with which the reviewed articles fell into empirical or non-empirical categories. 69% of the presented papers (or 68 articles) implemented an empirical research methodology, as opposed to 31% (or 31 articles) which showed a non-empirical approach. The studies undertaken by researchers until 1996 mostly had a non-empirical nature, the opposite trend becoming prevalent from then on. We can consequently attest that the research methodology utilized by scholars changed from theoretical to empirical during the last decades. Scholars began to observe reality directly, instead of trying to speculate from outside adopting a purely theoretical perspective. This increase in the number of articles based on empirical research methodologies probably revealed, as suggested by Brewer, Ashenbaum, and Carter (2013), an attempt to validate theories which already existed. An example of this validation and extension can be found in the TCE-RBV combined theoretical framework proposed by McIvor (2009).

Research methodology, relationships analyzed and subject category per period.

| Research methodology | <1996 | 1996–2006 | >2006 | Total |

|---|---|---|---|---|

| Empirical | 2 | 23 | 43 | 68 |

| Field study | 2 | 6 | 23 | 31 |

| Multiple case study | 10 | 12 | 22 | |

| Field and case study | 3 | 5 | 8 | |

| Single case study | 3 | 2 | 5 | |

| Content analysis | 1 | 1 | 2 | |

| Non-empirical | 4 | 6 | 21 | 31 |

| Relationship/level of analysis | <1996 | 1996–2006 | >2006 | Total |

|---|---|---|---|---|

| Empirical | 2 | 23 | 43 | 68 |

| Chain | 5 | 15 | 20 | |

| Firm | 8 | 11 | 19 | |

| Network | 1 | 8 | 8 | 17 |

| Dyadic | 1 | 2 | 9 | 12 |

| Non-empirical | 4 | 6 | 21 | 31 |

| Chain | 1 | 11 | 12 | |

| Firm | 3 | 2 | 1 | 6 |

| Network | 1 | 3 | 4 | |

| Dyadic | 1 | 2 | 6 | 9 |

| Subject/topic | <1996 | 1996–2006 | >2006 | Total |

|---|---|---|---|---|

| Outsourcing | 2 | 13 | 15 | |

| Risks | 7 | 5 | 12 | |

| Strategy | 1 | 5 | 4 | 10 |

| Performance | 2 | 8 | 10 | |

| Relationships | 1 | 1 | 8 | 10 |

| Theories | 1 | 5 | 4 | 10 |

| Plural sourcing | 1 | 5 | 6 | |

| Bargaining power | 1 | 1 | 4 | 6 |

| Make-or-Buy analysis | 1 | 2 | 2 | 5 |

| Resources/Capabilities | 1 | 2 | 2 | 5 |

| Supply Chain Management | 5 | 5 | ||

| Others | 1 | 4 | 5 | |

| Total | 6 | 29 | 64 | 99 |

As for empirical studies, they can be classified into five groups according to their importance, namely: (1) field studies; (2) multiple case studies; (3) studies with a mixed case and field methodology; (4) single case studies; and (5) content analysis studies. Within the group of field studies – the most abundant ones (31 articles, 46% of empirical papers) – surveys stand out as the most popular research method. Researchers additionally collect information from uncontrolled situations, without influencing the responses of their study's object. This method clearly seems to have prevailed over the rest after 2006. Similarly, Heide, Kumar, and Wathne (2014) designed specific questionnaires to collect data from key informants as a way of validating their hypothesis by their concurrent sourcing research.

Articles based on multiple case studies (22 in all) were our next focus of attention. After a complete absence of articles based on this methodology in the first period under examination – before 1996 – their relevance gradually increased during the following periods. Examples of such articles are provided by researchers such as Nordigarden, Rehme, Brege, Chicksand, and Walker (2014) who applied a multiple case study methodology and drew conclusions from qualitative data collected through in-depth interviews with wood manufacturing firms. Furthermore, Perunović, Christoffersen, and Mefford (2012) utilized a multiple-case study with 3 electronic manufacturers. Unlike single case studies, researchers are studying multiple cases to understand the differences and similarities between cases (Baxter & Jack, 2008).

Thirdly, articles based on the mixed field and case study methodology accounted for 12% (8 articles). Despite being more difficult to perform, such studies will enhance the overall understanding of make-or-buy approaches for both academics and practitioners. In this sense, Kistruck, Morris, Webb, and Stevens (2015) successfully resorted to this methodology using a sample of 929 new foreign market initiatives and 60 interviews with initiative leaders, senior managers and country managers in the field, their purpose being to determine the relevance of client heterogeneity when it comes to predicting make-or-buy decisions.

The fourth group comprised 5 articles (5% of all those analyzed) characterized by the use of a single case study as their information collection method. It becomes evident that, although no articles followed this methodology during the first period, its use has been steadily increasing over time. A single case study appears as the best choice when researchers want to study only one phenomenon (Yin, 2017). Similarly, Becker and Zirpoli (2003) adopted a case study methodology with the aim of integrating and coordinating specialist knowledge in the case of FIAT. Data sources such as interviews, documentation and observations are thus commonly used (Moses & Ahlström, 2009).

Finally, there were 2 articles based on a content analysis methodology (3% of all empirical articles). Priem and Butler (2001) tried to find out the extent to which the RBV can prove to be a useful perspective for strategic management research, whereas Gunasekaran and Ngai (2009) conducted a content analysis devoted to the supply chain literature. Table I in the Appendix (see Supplementary Materials) specifies the method used in each one of the articles analyzed.

3.2.2RelationsA subsequent categorization of research methods such as chain, firm, network or dyadic based on the research undertaken by Hooker, Giunipero, Joseph-Matthews, Yoon, and Brudvig (2008)’s research – and developed from verifiable and tested evidence (Bacharach, 1989) – was employed. Table 2 shows the frequency the examined articles focus on (1) Chain; (2) Firm; (3) Network; or (4) Dyadic relations.

Articles about the supply chain as such formed the Chain category, while those written from a purchaser's viewpoint fell into the Firm category. In turn, all the articles focused on factors associated with the make-or-buy network were labeled as belonging to the Network category. Finally, the Dyadic category comprises all the articles centered on relationships between 2 parties.

An examination of the data reveals that chain analysis stands out as the predominant category of analysis with a total of 32 empirical and non-empirical articles. The firm and the network category of analysis respectively accounted for 25% and 21% of all studies analyzed. As for the number of published articles situated at the dyadic level of analysis, it grew significantly after 2006 (until reaching 21% of the total), the reason for this lying in the number of articles which examine the relationship between the buyer and its principal provider. An example can be found in the paper authored by Azadegan, Dooley, Carter, and Carter (2008) who analyzed the extent to which principal provider performance impacts on buyer performance.

3.3Subjects/topicsThis section has as its aim to briefly highlight the most relevant subjects linked to the make-or-buy decision dealt with in the publications reviewed. A list of these topics appears in Table 2, which shows their presence by time periods together with the number of topics addressed by each article. Our categorization of the reviewed articles-based on the main topic examined in each article (relegating secondary topics outside the statistic) and adapted from Hooker et al. (2008) – resulted in 12 categories which are displayed in Table 2.

These are the 12 categories used in this study; (1) Outsourcing; (2) Risks; (3) Strategy; (4) Performance; (5) Relationships; (6) Theories/Concepts; (7) Plural sourcing; (8) Bargaining power; (9) Make-or-Buy analysis; (10) Resources/Capabilities; (11) Supply Chain Management; and (12) Other unclassifiable topics of minor relevance. The categories analyzed may fall upon several thematic areas and be combined with others in different papers. The topic dealt with in all the articles examined can be found in the Appendix (see Supplementary Materials).

The most commonly discussed topic is Outsourcing (15 papers), as can be seen in the paper authored by Laios and Moschuris (1999) which focuses on outsourcing decisions from an empirical point of view. Another approach to outsourcing comes from Marshall, Ambrose, McIvor, and Lamming (2015), who studied the influence of political and rational dynamics on this phenomenon. The second most important topic is Risks – represented with 12 articles. Outstandingly, Zsidisin (2003) analyzed managerial perceptions about supply risk, Handley and Benton (2012) investigating the influence of exchange hazards and power on opportunism in the context of outsourcing relationships. Based on a strategic outsourcing model (Holcomb & Hitt, 2007), managers can more accurately assess the impact of outsourcing on supply chain and firm performance (Park & Ro, 2011), considering possible hazards by means of a suitable, ad hoc risk assessment tool.

The topics ranking third, fourth, fifth and sixth in order of importance are Strategy, Performance, Relationships, and Theories – all four of them treated by 10 articles (9%) and connected with one another. Decision makers are faced with the challenge of finding the strategy best suited not only to achieving their organization's goal with the least possible risk but also to ensuring its best and most profitable performance. Strategy arises as the key factor determining a firm's vision and mission. By way of example, Boulaksil and Fransoo (2010) investigated the strategic implications of outsourcing on operations planning through a case study about the pharmaceutical industry.

The topic Performance has strategic relevance for researchers, insofar as firms require a mechanism to measure the profitability derived from their make-or-buy decisions. In particular, Park and Ro (2011) studied the impact of a firm's ‘make,’ ‘pseudo-make,’ or ‘buy’ strategy on product performance. Key performance indicators should be defined and used by practitioners for them to continuously measure ‘make-and-buy’ performance on a permanent basis.

The topic Relationships specifically focuses on outsourcing relationships between principals and external providers. Many of these articles support the relationship theories formulated by Klepper (1995) and Kern (1997). Whereas Mohr and Spekman (1994) explored the topic of relationships based on a field study, Boulaksil and Fransoo (2010) selected a multiple case study strategy.

Managers should become aware of intercultural differences prior to choosing their make-or-buy approaches (Handley & Angst, 2015). A better identification of the main attributes determining partnership success would enhance the position of managers when it comes to selecting, managing and developing an external provider (Mohr & Spekman, 1994). ‘Characteristics of partnership success’ stands out as one of the relevant categories mentioned by scholars supporting mainly social exchange theories, agency theories and cooperation strategies. Both lack of trust and lack of regular communication between both parties can negatively influence outsourcing relationships.

The category Theories/Concepts allowed us to bring together those articles which deal with conceptual papers. Categorized under this topic are the papers by Eisenhardt (1989), who sought to assess and review the agency theory, and the one written by Balakrishnan and Cheng (2005) which served to analyze and update the theory of constraints employed at the make-or-buy process. In addition to this, Eisenhardt (1989) highlighted the firm's concept as a nexus of contracts between principals and agents which can afford protection against opportunist threats. A prior evaluation of chances and risks should help decision makers avoid wrong approaches. Potential risks, outcome uncertainties and possible incentive-mechanisms should be considered and assessed too.

Once the evaluation has been conducted, firms will be able to identify the most optimal contract for a particular case: outcome-based or behavior-based. Contracts should be designed as a monitoring instrument and an incentive-creating mechanism (Eisenhardt, 1989; Jensen & Meckling, 1976). For instance, firms choose and adopt both (1) incentives and (2) penalty plans, such as (1) 5% of purchased quantity as a bonus to principals for reaching an agreed sales target or (2) reducing the purchasing volume and charging extra costs to agents following a poor delivery or an inadequate quality performance. Such incentives and penalty methods should also form an integral part of the internal procedures applied within a firm or a firm group (vertical integration).

The seventh position in this ranking corresponds to 6 articles revolving around the topic of Plural sourcing which study how firms can make and buy at the same time. Traditionally, scholars investigated the make-or-buy decision on a dichotomous basis completely ignoring the concurrent sourcing approach (Parmigiani, 2007). A proper balance between vertical integration and strategic outsourcing will most probably have an influence on product portfolio, product success, and firm performance (Rothaermel, Hitt, & Jobe, 2006); hence why performance outcomes associated with the choice of governance mechanisms should be assessed as well (Heide et al., 2014).

Despite the high number of articles which refer to outsourcing in general, a total of 6 articles focus on Bargaining power in the relations between principals and external providers – single source or multiple source strategy? Obviously, a single source strategy increases the firm's dependence on its external provider and reduces its negotiation capacity. Being really able to maintain a credible threat to change external providers will endow firms with more bargaining power when it comes to negotiating better conditions and obtaining cost reductions from their providers (Aláez-Aller & Longás-García, 2009).

This privileged position may be restricted by previous contractual commitments, as a result of which changes in bargaining power can lead to governance inseparability (Argyres & Liebeskind, 1999). Furthermore, shifts in bargaining power are associated with the acquisition of sufficient knowledge and skills to eliminate dependence on one partner, especially in joint ventures (Inkpen & Beamish, 2007).

Five articles directly address the Make-or-Buy analysis as the main topic. Having to choose between manufacturing a product in-house or purchasing it from an external provider represents a central dilemma faced by many managers. It becomes crucial to resolve this dilemma in a structured manner and using the most appropriate tools (Cánez, Platts, & Probert, 2000). Setting in motion the right mechanisms (Moschuris, 2007) and taking advantage of the most relevant drivers will give decision-makers better insights to successfully address that make-or-buy dilemma (McNally & Griffin, 2004).

Resources/Capabilities stands out for being another popular topic, as shown by the five published articles belonging to this category. Resources are assets owned by an organization which can be physical, tangible, and human. In turn, capabilities are complex patterns related to skills when utilizing resources to achieve a desired product or service. Resources and capabilities are essential for an organization's competitive advantage. Articles within this domain have focused on arguing that capabilities serve as shift parameters from insourcing to outsourcing (Jain & Thietart, 2013) – and vice versa – when firms own better capabilities than their potential external providers (Argyres, 1996). Added to this, Peeters and Martin (2015) drew a distinction between the use of external knowledge for replication purposes (using knowledge itself) and the one which focuses on compounding (building on acquired knowledge by combining it with internally developed knowledge).

The articles based on Supply Chain Management accounted for 5% of the total (5 articles). The problem faced by managers consists in identifying which supply chain strategy best adapts to their firms’ goals. According to some researchers, the need for flexibility constitutes a key criterion for firms to rapidly meet their customers’ demands. Firms may improve flexibility throughout the chain by engaging in committed relationships with external providers (Stevenson & Spring, 2009). On the other hand, Atkins and Liang (2010) suggested that decentralization can be preferable for competitive supply chains because it increases the unit supply cost of direct competitors.

Finally, five articles dealt with Other issues, amongst them the one written by Leiblein and Miller (2003) which examines transaction-and firm-level influences along the vertical boundaries of the firm.

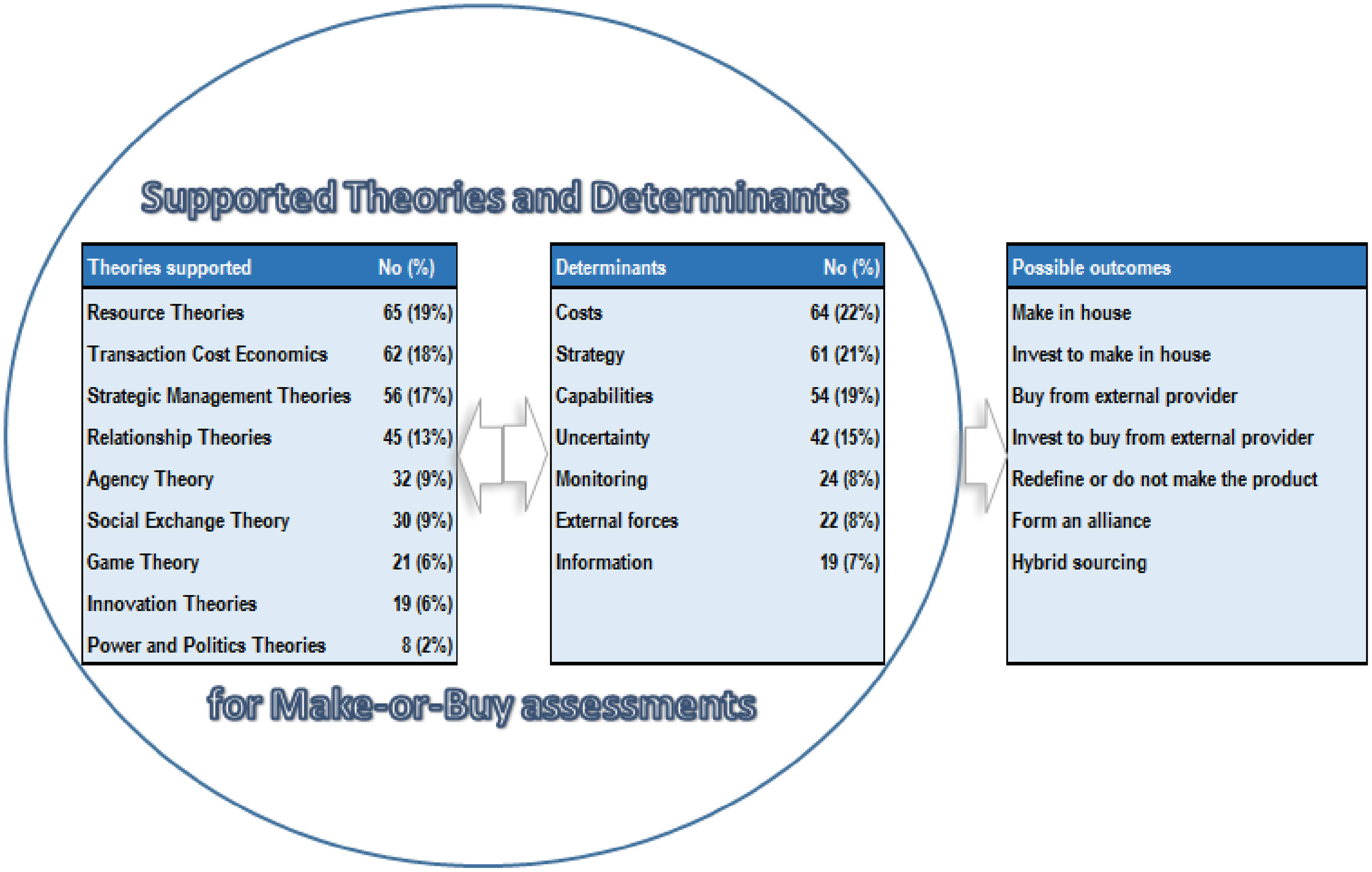

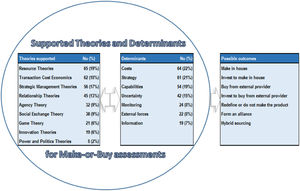

3.4Theoretical frameworkInput from Sections 3.4.1 and 3.4.2 was collected below seeking to build a comprehensive conceptual make-or-buy framework able to capture relevant determinants and theories which need to be taken into account in such decisions. Such a framework developed in accordance with the guidelines proposed by Miles and Huberman (1984) and its subsequent implementation by Cánez et al. (2000). The conceptual framework illustrates the importance and results of the theories and determinants identified on the examined articles. Furthermore, possible outcomes identified from the literature are listed in Fig. 2.

3.4.1Theories utilized in the articles examinedThe articles under review were classified following the categorization in the Theoretical Foundations theory proposed by Dibbern, Goles, Hirschheim, and Jayatilaka (2004), who defined the Theoretical Foundations for outsourcing research in nine theories which are listed with our own analytical results in Fig. 2. The analysis determines whether the research supports (1) Resource theories; (2) Transaction Cost Economics (TCE); (3) Strategic Management theories; (4) Relationship theories; (5) Agency theory; (6) Social Exchange theory; (7) Game theory; (8) Innovation theories; (9) Power and Politics theories; or a combination of several of those theories. Each paper's categorization takes into account which theories are most relevant for it. Additionally, we have identified researchers supporting several theories in the same article.

- (1)

Resource Theories search for a competitive advantage; according to the RBV, the option ‘make’ prevails whenever the firm's resource position is high, the option ‘buy predominating in the opposite case.

- (2)

TCE, which plays a fundamental role in the make-or-buy decision, claims that the option ‘make’ should be taken if the potential for opportunism is high – the option ‘buy’ being preferable with a low potential for opportunism.

- (3)

From a Strategic Management Theories point of view, the adopted make-or-buy choice consists in the initiatives and the allocation of the resources needed to achieve the firm's long-term goals. A trend observed in the articles examined is the combination of several theories to resolve the make-or-buy dilemma. This option mainly received support from McIvor (2009), according to whom neither TCE nor RBV alone can explain and address the make-or-buy decision. Nearly half of the papers analyzed are structured around RBV, TCE and Strategic management theories to some extent, and partially support a combination of these three theories (54% (19%+18%+17%)).

Whereas RBV theory sees the relative capability of focal firms and exchange partners as an important factor for ‘make’ decisions, transaction-based perspectives explain different governance forms (Argyres, 1996; Holcomb & Hitt, 2007). In turn, strategic theories focus on firms’ strategic advantages and long-term plans to improve their operational performance. The integration of TCE, RBV and relevant concepts such as performance management or operations strategy have been highlighted by renowned researchers – most importantly, McIvor (2009) – and not only validated but also enlarged with performance attributes by Brewer et al. (2013). Even though the framework proposed by McIvor (2009) contains contradictory prescriptions stemming from RBV and TCE when it comes to outsourcing decisions, the integration of TCE and RBV theories is supported by a broad representation of the research community.

- (4)

The second most strongly supported – and recently favored – theory within the make-or-buy field after the combination of the aforementioned theories is the ‘relationship theory,’ which accounted for 13% of the reviewed papers. Relationship theories focus on the interactions between parties such as principals and agents which are adapted so that those parties can accomplish their individual objectives and reach successful partnerships. Relationship theories work between firms and exchange partners, as well as within the firm itself. While being compensated for choosing external providers based on price only leads to a decreasing joint action, McNally and Griffin (2004) suggest that being compensated for implementing close relationships leads to an increasing joint action.

Several notable trends were identified concerning the importance of using appropriate communication – particularly in terms of frequency, quality and mode – between firms. Parker and Russell (2004) suggested that a decrease in cooperation, trust, approachability, communication, fairness, helpfulness and poor communication between firms causes confusion, frustration, and annoyance, which is likely to result in a low performance of external providers. Collaboration and interdependence appear as essential ingredients in the management of supply chain performance that require establishing long-term cooperative relationships (Howard & Squire, 2007) with preferred external providers.

- (5)

The next most relevant topic – present in 9% of the papers – is the agency theory, which helps expose problems of divergent interests in outsourcing and suggests the convenience of ensuring an optimal contractual relationship between principals and agents to reduce the degree of uncertainty usually inherent to agents’ behavior. The agency theory reminds us that much of organizational life is based on incentives and self-interest (Eisenhardt, 1989), and outsourcing does not seem to be the most advisable choice when the output cannot be measured, an insufficient quality level exists, cost uncertainty is high, and agents show a hostile attitude (Balakrishnan, Mohan, & Seshadri, 2008).

- (6)

As for Social exchange theories, they support the reciprocity of benefits and costs through an exchange of activities between both parties (Emerson, 1972). This theory holds true for internal as well as for external exchanges. The principle underpinning the social exchange theory is the assumption of exchange reciprocity in terms of benefits and costs; 9% of the papers partially support this approach. It additionally deserves to be highlighted that this theory has proved to combine with the game theory in some research works.

- (7)

The game theory starts from the premise that every player under the same conditions makes rational and intelligent decisions seeking to maximize their respective profit (Dibbern et al., 2004; Fudenberg & Tirole, 1990). Thus, firms facing the fear of imitation could and should reduce the use of external sources (Giarratana & Mariani, 2014). As said above, the option of using the game theory in combination with the agency theory is backed by a number of researchers, support for the game theory accounting for 6% of all the articles under review. Proper relational contracts become of paramount importance to improve supply chain collaboration, ultimately seeking to safeguard firms’ interests and to prevent opportunistic behaviors on the part of future external providers. Informally promising future interactions to sustain collaboration sounds more feasible to external providers than to internal units, insofar as the provider can use its assets elsewhere (Brahm & Tarziján, 2016).

- (8)

Finally, innovation theories, together with power and politics theories respectively accounted for 6% and 2% of all the articles examined. Innovation theories see the make-or-buy decision as a way to adopt innovations and new technologies, spreading them throughout firms (Rogers, 1983). For instance, firms might be choosing to source out the development of a product due to the lack of in-house skills.

The previous question about the extent to which firms’ decisions to outsource or internalize R&D, production or specific processes or services affect their technological performance is one that managers often ask themselves.

Interestingly, Leiblein, Reuer, and Dalsace (2002) posed that a firm's technological performance is contingent upon the alignment between firms’ governance decisions and the significance of contractual hazards. Outsourcing has been aligned to reduce costs and improve flexibility. Firms can enhance their innovation performance in the near future by gaining access to external providers’ knowledge. However, a combination of knowledge with external providers might spill over the firm's own internal knowledge, especially in regions populated by organizations with a high absorptive capacity (Giarratana & Mariani, 2014). A ‘make’ decision will be preferred in such cases.

- (9)

A Power and Politics theories claim that government regulations and political instability are likely to determine the viability of a firm's strategy, accordingly having an impact on make-or-buy decisions too. Indeed, power and politics can play an important role when it comes to make-or-buy decisions (Lacity & Hirschheim, 1993), as shown by the fact that some very powerful firms and individuals even find themselves in a position to strongly influence regulations, politics and markets (Harland, Brenchley, & Walker, 2003). Firms may not have the capability to eliminate or mitigate many of the external political and regulatory risks, though.

Our classification of the articles under review was based on the definition of determinants for outsourcing proposed by Dibbern et al. (2004), the most representative determinants identified through the articles examined in the present paper being: (1) Costs; (2) Strategy; (3) Capabilities; (4) Uncertainty; (5) Monitoring; (6) External forces; (7) Information; and the combination of several of those determinants. The categorization of each paper takes into account which determinants are more relevant for it, which is why we have observed/paid attention to researchers proposing several determinants for the make-or-buy decision in the same article. Fig. 2 provides a summary of results.

- (1)

Costs include both the organization's relative performance efficiency and its transaction, agency and hidden costs. Cost reduction arises as the main driver for outsourcing – it accounts for 64 articles (22% of all the articles analyzed). This result matches those obtained by researchers such as Moschuris (2007), who suggested that cost saving constitutes the most important criterion when exploring make-or-buy decisions.

- (2)

Strategy comprises strategic significance analysis, strategic importance and fuzzy focus. The second most important factor for make-or-buy decisions is the strategy adopted by the firm itself (it is present in 21% of the papers). Firms may outsource non-core activities with the aim of focusing on core activities in-house, if the latter are defined as strategic and non-transferable for the firm (Miles & Snow, 1978).

- (3)

19% of the articles examined present capabilities as an important factor to address the make-or-buy dilemma. Capabilities embrace gaps in manufacturing capabilities, leverage internal technical capabilities, along with internal and vendor capabilities. The resource position of a firm can determine whether a product or service should be sourced in or out. Moreover, Quinn and Hilmer (1994) stated that the loss of critical internal skills can be avoided through a structured insourcing or outsourcing management.

- (4)

Uncertainty, with a proportion of 15% of the total includes a variety of root sources, amongst which stand out sales, market or product uncertainty. Uncertainty involves endemic uncertainty, unexpected and undesirable outcomes too.

- (5)

Monitoring contains both the inability to control external providers and the loss of control over external providers (Monitoring and external forces accounted for 8% of the papers under analysis. Albeit possibly having little relevance for domestic outsourcing, Monitoring, auditing, surveillance and supporting costs can become much higher for offshore outsourcing. Monitoring costs should be taken into account prior to addressing the make-or-buy decision.

- (6)

As for External forces, they refer to those factors likely to affect the make-or-buy process which have to do with market prices for raw material supplies. These forces are additionally related to consumer demand for firms’ finished products, government regulations, and the strength of effective competition. External forces such as political instability, national or international regulations, or even natural catastrophes influence the manufacturing location decision. Firms can pursue a vertical integration strategy, incorporating additional plants into their business group or seeking partnerships and alliances with third parties that will allow them to enter new markets.

- (7)

Finally, information – the relevance of which amounts to 7% – plays a significant role in firms’ relationships. Information covers the dependence on information and the importance of having sustained innovative information available. Sustained innovation comes from sharing information with external providers on a regular basis. Bidirectional communication and mutual information sharing help avoid the emergence of asymmetric information between firms and their external providers. Asymmetric information, sometimes referred to as information failure, arises whenever one party possesses greater product or service knowledge than the other during an exchange process.

What should a small and medium-sized enterprise (SME) or a large enterprise know when they face make-or-buy decisions? After performing an in-depth analysis of the articles under examination, the following trends stood out:

- (1)

Combination of multiple theories: the make-or-buy decision can neither be explained nor resolved by one theory alone; a combination of multiple theories is needed which can complement each individual theory, contradicting deficits of addressing make-or-buy decisions based on only one theory. More than half of the papers analyzed support the combination of several theories to address the make-or-buy approach in some way or another. Whereas the RBV theory assigns importance to the relative capabilities of focal firms and exchange partners in ‘make’ decisions, the TCE theory explains different governance forms, and strategic theories focus on firms’ strategic advantages and long-term plans to improve their operational performance. The combination of those theories should be taken with caution in the light of some contradictions. The challenge for researchers lies in finding a correct balance between such theories in order to adapt them to address certain make-or-buy decisions. A conceptual framework was developed to help managers evaluate sourcing decisions. Unlike the results obtained by McIvor (2009), ours suggest not only considering the TCE and RBV theories to evaluate manufacturing location decisions but also take account of additional theories such as strategic and relationship theories.

- (2)

Risk mindset: the relevance according to the number of articles which discuss the possible hazards and threats of outsourcing makes it advisable to prioritize this topic and taking it into account. Practitioners and managers can more accurately assess the impact of outsourcing on supply chain and firm performance through a suitable risk assessment tool. The possible risks and chances involved in dealing with make-or-buy issues should be evaluated during the make-or-buy process, as required by the ISO 9001:2015 revision. Our results are in keeping with the evaluation of the potential for opportunism risks, implemented within the framework developed by McIvor (2009). We essentially suggest that firms should evaluate emergency plans, analyzing second source options in order to minimize risks.

- (3)

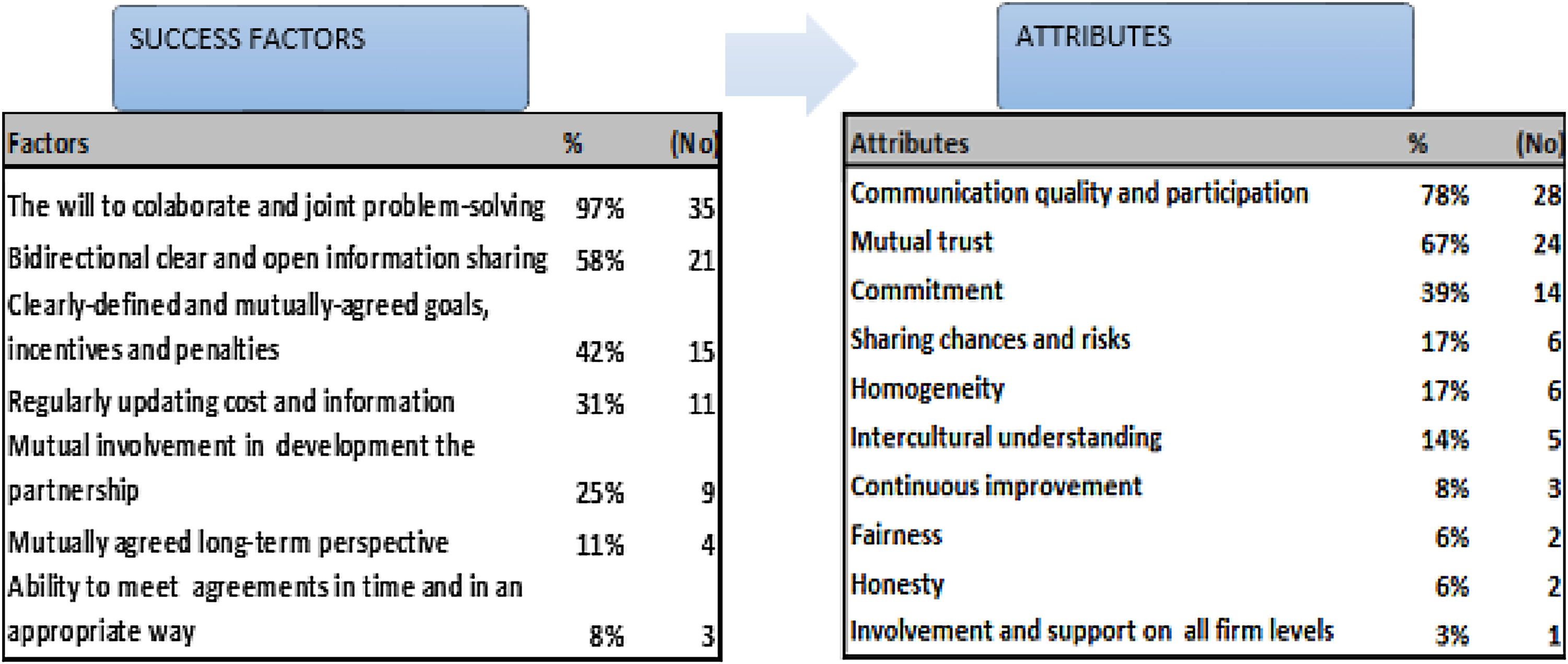

Relationship success factors: the importance of relationships and the characteristics of partnership success have been widely discussed by researchers who mainly support social exchange theories, agency theories and cooperation relationships. Our categorization of the articles under review was structured around the factors described by Lehtonen (2004), listing the supported success factors on a spreadsheet so that the factors most commonly supported in the literature examined could be validated.

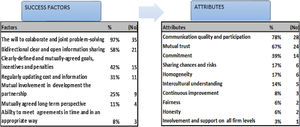

Our spreadsheet contained the attributes and success factors identified in the articles under review. Those attributes and success factors are summarized in Fig. 3. An identification of the most important partnership success characteristics would place practitioners in a better position to select, manage and develop external providers. Decision makers should be aware of intercultural communication techniques prior to addressing a make-or-buy approach. Which factors make a partnership successful?

Out of 99 papers analyzed, 36 partly mentioned one or several success factors or attributes, which were clustered following the factors proposed by Lehtonen (2004). It follows from the identified articles that the most frequent success factors of partnership are the relationships based on collaboration and the willingness to adopt a joint problem-solving strategy (97%), headed by the next significant ones being bidirectional clear and open information sharing with 58%. This result follows along the lines of collaboration with supplier factor implemented at the framework developed by Cánez et al. (2000). Clearly defined and mutually agreed goals, incentives and penalties accounted for 42% (or 15 papers). Regularly updating costs and information, and mutual involvement in the development of the partnership accounted for 31% and 25% respectively.

Finally, a mutually agreed long-term perspective and the ability to meet agreements in time and properly respectively represent 11% and 8% of the total (36). What are the attributes of partnership relationships? The attributes of partnership relations most commonly supported in the examined articles mainly revolved around such aspects as: communication quality and participation (78%), mutual trust (67%), commitment (39%), sharing chances and risks (17%), homogeneity (17%), intercultural understanding (14%), continuous improvement (8%), fairness (6%), honesty (6%) and involvement and support on all firm levels (3%). Looking for partners and external providers with such attributes can positively influence future outsourcing relations.

Firms’ achievements in the area of sustainable development are currently evaluated using the data provided by their Company Social Responsibility (CSR) report. Firms showing the best CSR reputation are the ones which ensure their active compliance with the spirit of the law, ethical standards and national and international norms. Managers and practitioners should evaluate which type of relationship best suits each external provider selected.

- (4)

Plural sourcing and Hybrid sourcing: in addition to the dichotomous make-or-buy approach, we observed an increase in the number of papers supporting the plural sourcing option literature after 2007. Hence, our decision to categorize the articles analyzed on a spreadsheet concerning the articles addressing Plural and Hybrid sourcing. Our analysis showed that researchers use a wide range of terms when referring to this topic. Examples are (1a) concurrent sourcing; (1b) plural sourcing; or (1c) parallel production; (2a) mixed sourcing; (2b); pseudo-make; or (2c) hybrid sourcing.

Unlike Heide et al. (2014), who argued that concurrent sourcing in itself suppresses external provider opportunism, Nordigarden et al. (2014) presented a variety of scenarios to solve production planning needs through the assessment of the ‘make,’ the ‘buy’ or a combination of both. In turn, Puranam et al. (2013) proposed an integrated framework to explain how complementarities and constraints encourage plural sourcing and identify the optimal mix of internal and external sourcing. Cassiman and Veugelers (1997) likewise confirmed the complementary nature of make and buy decisions as an evidence from Belgian manufacturing firms.

Internal and external sourcing can prove synergistic when used concurrently. Plural sourcing refers to the splitting up of the total volume procured by means of multiple modes, each of which may be a pure governance mode. Plural sourcing uses two mechanisms simultaneously. Instead, hybrid sourcing refers to the procurement of the entire volume from a single mode that exhibits mixed governance characteristics. Hybrid sourcing represents a procurement mode characterized by a degree of cooperation and coordination which is unusual in market relationships. As opposed to the Make-or-Buy controlling matrix proposed by Brem and Elsner (2018), our results suggest that not only the pure make or buy strategy should be assessed, plural and hybrid sourcings need to be considered as well.

- (5)

Structured, documented process and skilled personnel: we followed the same procedure as in Section 3. The articles analyzed were categorized with regard to the ones that resolved the make-or-buy process in a systematic and structured way and subsequently listed on a spreadsheet. By way of example, Moses and Ahlström (2009) as well as Baines, Kay, Adesola, and Higson (2005) were in favor of addressing the make-or-buy decision in a structured manner, and Cánez et al. (2000) proposed a framework to fill this gap in the literature. Another managerial implication is the consideration of product/subsystem aggregation schemes and make-or-buy controlling matrices to operationalize the make-or-buy framework, as pointed by Brem and Elsner (2018). They posited that complexity costs can be reduced by simplifying the decision-making level. This is in keeping with our preference for addressing the make-or-buy in a structured manner after the results obtained. It can be inferred from the articles under analysis that, if the approach during the make-or-buy decision process is neither structured nor standardized, manufacturing organizations are likely to lose competitiveness.

A wrong decision can influence the organization's future. The make-or-buy decision process should be structured, documented and conducted by a multi-disciplinary team. The staff involved in this process should be qualified and receive training periodically. Firms will require outsourcing managers and skilled personnel with experience in outsourcing relationships; which is why they should put in place processes to ensure the transfer of this know-how to new employees.

- (6)

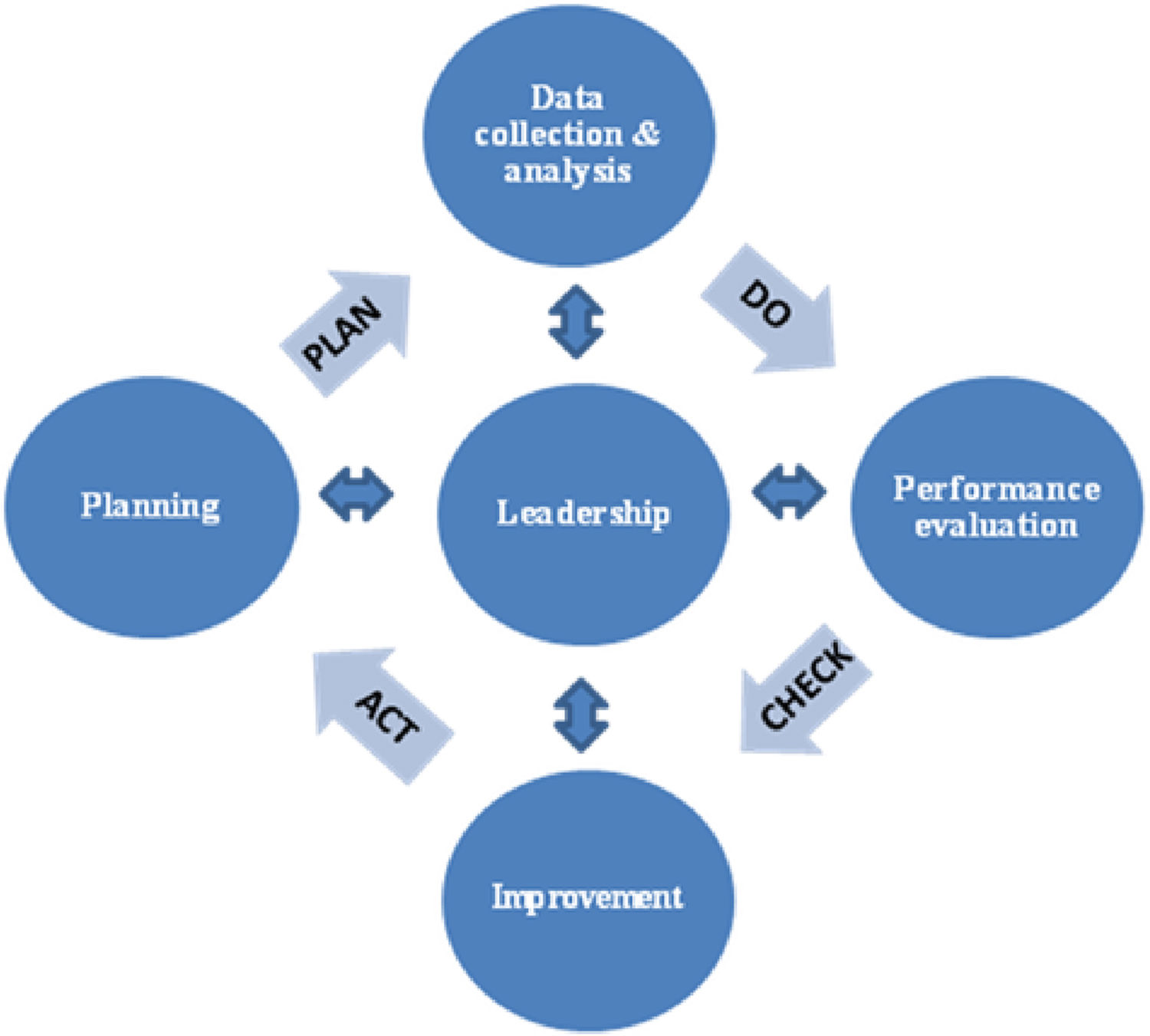

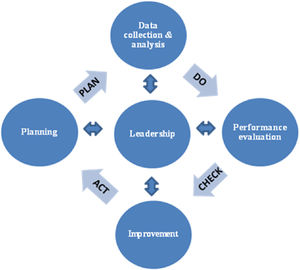

Stages in the make-or-buy decision process: the literature review made it possible for us to categorize the stages in the make-or-buy processes mostly following the models proposed by Baines et al. (2005), Cánez et al. (2000) and the process methodology standardized by the ISO 9001-2015 PDCA-Cycle (ISO, 2015). In contrast to their results, our suggestion is that practitioners should take the improvement stage into consideration for possible reevaluations. The information obtained from the articles examined with regard to addressed make-or-buy stages was listed on a spreadsheet. We additionally checked/realized that the terminology used by researchers varies to a large extent, which stresses the need to standardize all these terms in accordance with the ISO 9001 norm.

The complete decision process is described as having 4 stages: (1) planning; (2) data collection and analysis; (3) performance evaluation; and (4) improvement. The project leader assigned for the make-or-buy decision, plans, coordinates and leads activities making sure that tasks are accomplished according to the milestones plan. Achieving the key milestone dates on time turns out to be essential for the multidisciplinary team involved in the process.

The overview is drawn/graphically represented in Fig. 4. Any organization making a make-or-buy decision should critically examine and carefully explain what they want to achieve through insourcing or outsourcing. The planning phase establishes the objectives sought with the make-or-buy process and the resources required (including the selection of a multi-disciplinary team) in accordance with the firm's strategy, additionally identifying and addressing both risks and opportunities. The data collection and analysis can be divided into three subcategories: (a) attribute generation; (b) attribute weighting; and (c) attribute rating. The highest score of the decision matrix indicates the best option in the analysis.

Determinants for outsourcing such as costs or capabilities – included within the criteria defined by Baines et al. (2005) – can be taken into account as a reference for attribute generation. During the performance evaluation, we estimate the results of possible actions resulting from the previous stage, performing a SWOT analysis and preparing a proposed action plan ranked in order of potential effectiveness. The improvement stage has as its aim to undertake proposed actions by allocating both a timescale and responsibilities, and to verify the firm's strategic position and, if necessary, improving it from the lessons learned.

- (7)

Automation as a complementary or substitute for offshore outsourcing: a number of certain risks linked with offshore outsourcing, amongst which stand out product recalls, long delivery times and complex relationships with external providers, make it advisable to consider the automation option. Managers deciding to outsource in offshore locations should be particularly aware of the fact that such a strategy entails risks and therefore they should adopt the necessary preventive actions.

Two main alternatives are available to managers: either (1) outsourcing locally where firms can have a higher degree of control and a better relationship with the external provider (Steven, Dong, & Corsi, 2014) or (2) insourcing the product or service through the development of an automated manufacturing process or a smart factory. The automation trend known as industry 4.0 creates what has come to be known as ‘smart factories’ – where firms can perform automated processes, reduce production costs, and improve quality failure rates. The search for automation is expected to grow, which means that the threat of automation will continue to increase. Opportunities exist for firms able to combine their services with a certain level that will give them more governance of/over the process. This ‘ownership of the process’ factor is also addressed in the framework designed by Cánez et al. (2000). They did not consider the smart factory insight, though.

- (8)

Main determinants for the make-or-buy process: the articles examined tend to show a prevalence of the factor cost as the major determinant for insourcing or outsourcing. This trend was empirically confirmed in the hotel sector by Espino-Rodríguez and Rodríguez Díaz (2017). Nevertheless, firms which still make their sourcing decisions based only on cost will eventually die (Welch & Nayak, 1992).

Cost, strategy and capabilities appear to be the most significant criteria, which suggests that firms usually resolve tactical make-or-buy issues seeking to achieve cost savings and strategic or operational advantages. Our results are in keeping with the framework of Brem and Elsner (2018), where the relevance of a firm's strategy ensure the identification of its core competencies. Uncertainty, external forces and monitoring play an important role for the outcomes of make-or-buy decisions. Finally, information deficits together with information asymmetry add to the administrative demands of organizing transactions and impact negatively on supply chain sourcing.

4.2Limitations and further researchNotwithstanding the above findings and contributions, this study faced a number of limitations and so do its outcomes. Firstly, a potential limitation of this study stems from the fact that our in-depth analysis focused exclusively on articles published in 7 prestigious journals. Secondly, using only the ProQuest, Scopus and Web of Science databases in the present study may have prevented us from covering all the articles in the field of ‘make-or-buy.’ Furthermore, our review is limited to research published in articles, leaving aside other sources such as books or conference reports. This limitation concerning the choice/selection of sources analyzed can hardly be avoided in any literature review. However, our findings seem to provide a valuable understanding of the current situation in this research field. The present study equally suggests a number of future research strands which may encourage more intensive research in this important area.

In our opinion, this article can prove useful for both researchers and decision makers, since both areas reflect new trends that will probably lead to future research and future implementation inside firms. Hopefully, the present paper will trigger a new approach to studying make-or-buy decisions, to which must be added that our results provide practical guidelines to adopt a sourcing strategy based on the relevance that corresponds to the various determinants for the firm.

There is clearly still plenty of room for growth and improvement within the make-or-buy literature. For instance, the academic literature has multiple studies focusing only on one link addressing the make-or-buy (focal firm to principals or focal firm to agents). A chance for future researchers also stems from the empirical validation of the proposed theoretical framework.

Basically, does the make-or-buy process require a make-or-buy specialist within firms? Does such a position exist? Has a training program been put in place? How is this knowledge transferred to the next generation? Aspects such as the proximity to markets, the macroeconomic and political situation, trade implications, profitability, technical differentiation, contract manufacturers’ capability, along with core or non-core activities strongly influence this decision.

Admittedly, the research questions listed below have already been investigated. Nevertheless, it is our conviction that a need exists to continue updating the dichotomous make-or-buy decision so that the scientific community can be helped with updated and new research insights. What considerations are borne in mind during the make-and-buy's decision process? To what extent does the make-and-buy impact on firms’ operational performance? Why are fixed and hidden costs ignored in make-and-buy decisions? How can organizations implement these structured decision-making models? As far as the make-and-buy is concerned, it does not suffice to consider the aforementioned theoretical models or explanations for the outsourcing phenomenon, we must do things differently the next time because we previously made quite a few mistakes that resulted in great failures.

5ConclusionThe research presented in this paper has important implications for theory and practice both regarding the supply chain as a whole and more precisely in terms of procurement management. Despite undoubtedly providing valuable results, the literature review carried out so far were based on a random selection of articles focused mainly on the TCE theory. This paper aims to analyze the determinants for the make-or-buy decision in supply chain management through the analysis of 7 prestigious academic journals. The most outstanding aspect identified is the upward trend in the number of papers published from 2006 onwards.

The growing popularity of outsourcing may also have some bearing on the outcomes of make-or-buy decisions. The articles assessed followed a variety of research methods, favoring empirical techniques to a greater extent than those of a purely theoretical nature. Within the empirical methods, the field study has been used more profusely for designing surveys for purchasers and decision makers involved in make-or-buy decisions.

A description is made about the theoretical framework for make-or-buy evaluation, its development being structured around the integration of the most widely supported theories and determinants in the literature under review. Our results thus seem to confirm the link between those theories and insights: (1) TCE; (2) resource theories; (3) strategic theories and the most relevant determinants; (1) costs; (2) capabilities; (3) strategy to address make-or-buy decisions. Our findings emphasize the importance of evaluating not only traditional pure sourcing – ‘make or buy’ – but also the combination of both ‘make and buy’ (plural sourcing), ‘hybrid sourcing’ and strategic alliances so that firms can design the manufacturing strategy which best fits their structure.

The make-or-buy assessment framework presented intends to deal with the trends identified in the literature by capturing relevant approaches considered in make-or-buy decisions. It has as its aim to provide a graphical representation of relevant dimensions which need to be studied when examining make-or-buy decisions. One of the main contributions made by the article consists in the preparation of a list with the trends identified in the literature together with the categorization of the most outstanding subjects found in the specific articles examined. An analysis of these trends should help clarify the topics which raise the most interest amongst researchers.

Our findings also highlight the importance of addressing make-or-buy decisions in a structured manner. A multi-disciplinary team should evaluate the possible risks and chances involved in dealing with make-or-buy issues through a suitable and adapted risk assessment tool. A four-stage model for the decision process which follows the trend observed in the literature reviewed has been suggested and adapted to the PDCA-Cycle (Plan, Do, Check, Act) according to the requirements of the ISO 9001:2015 norm.

Therefore, in a common manufacturing situation where multiple principals are depending on external providers and where hazardous behavior cannot be punished, it is perhaps better to rely on building up a “win-to-win” relationship regulated by “external provider agreements” with defined contracts that can influence multiple sources and long-term-relationships. Moreover, it becomes clear that cost reduction alone is not the most decisive factor for make-or-buy; aspects such as the risk of core capabilities, strategy, uncertainty, flexibility, capital requirements, financial returns, and level of skills and expertise need to be considered as well.